Unit - 2

General Principles of Contracts Management

The nature/essential/general principles elements of valid contract are-

Figure1: Essential elements of valid contract

- Offer and its acceptance

According to section 2 (A) of the Indian Contract Act,1872 “When one person signifies to another his willingness to do or to abstain from doing anything, with a view to obtaining the assent of that other to such act or abstinence, he is said to make a proposal’’. The person who makes an offer is called ‘’Offeror’’ or ‘’Promisor’’ and the person to whom the offer has been made is called Offeree or Promisee. For example, Mr. A owns several cars. He enters into an agreement with Mr. B to sell one of his cars. He tell Mr. B, Will you buy my car at Rs. 2,00,000/- This is not a valid offer as Mr. A did not specify the car he is talking about. Here, the offer is ambigious.

According to section 2(b) of Indian Contract Act,1872, when a person to whom an proposal has been made, signifies his assent thereto. In the case of Lalman Shukla v Gauri Dutt (1913), the defendant’s boy went missing, accordingly, his servant-Plaintiff was sent to search for the boy, in the meantime a missing poster was released by the defendant, promising to pay a certain sum, to the person who finds the boy. The servant, unaware of such an offer succeeded to find the boy. Once he discovered that such an offer existed he asked for the consideration, but the same was denied. The court ruled in favour of the Defendant, by holding that Plaintiff was ignorant of offer and thus the performance of the promise does not amount to acceptance.

2. Free consent of both parties:

According to section 10 of the contract act, a contract is valid if it was entered into by free consent of the parties. Section 14 of the contract act defined free consent as consent not given under coercion, undue influence, fraud, misrepresentation and mistake. Chickam Amiraju v. Chickam Sheshamma In case, the Husband gives a threat that he will commit suicide if they did not execute a release deed in favour of his brother to his wife and son. The wife and son executed the release deed under the threat given by the husband. It was held that threat to commit suicide amounts to coercion under section 16 of the Act. Section 17 of the Act lays down the list of Act which amounts to fraud. There is the slightest difference between fraud and misrepresentation, in the first case the person making the statement does not believe that such statement is true and in later one, the person making such statement belives that such statement is true.

3. Mutual and lawful consideration for agreement

Section 2(d) of Indian Contract Act,1872 defines consideration as ‘’When, at the desire of the promisor, the promisee or any other person has done or abstained from doing, or does or abstains from doing, or promises to do or to abstain from doing, something, such act or abstinence or promise is called a consideration for the promise;’’ In Currie v Misa court defines consideration as ‘a valuable in sense of the law it may consist either some right, interest, profit or benefit accruing to one party, or some forbearance, detriment, loss or responsibility given, suffered or undertaken by the other part. If the proposal is not supported with any money such proposal will be nudumpactum (a bare promise) and is not enforceable by law.

4. Intention to create legal relationship

Intention to create a legal relationship is one of the most fundamental aspects of the law. It is defined as the intention to enter a legally binding agreement or contract, it implies that the parties acknowledge and accept legal consequence in case of a breach of a contract. Intention to create legal relations consists of readiness of a party to accept the legal consequences of having entered into an agreement. For example, A agrees to meet his friend B at 9:00 p.m. It is the moral and social duty of A to meet this agreement and it does not create any legal obligation on B neither there is any legal relationship between A and B.

5. Parties should be competent to contract

According Sec .11, every person is competent to contract who

- Is of the age of majority according to the law to which he's subject

- Is of sound mind

- Is not qualified from contracting by any law to which he's subject.

Thus Sec. 11 declares following persons to be incompetent to contract:

- Minors

- Persons of unsound mind

- Persons disqualified by any law to which they're subject.

In Mohori Bibee v. Damodar Ghose, In this case, Damodar Ghose the defendant was a minor and the sole owner of his property. His legally appointed guardian was his mother. a moneylender Mr Brahmo Dutt, through his agent KedarNath, lent the defendant at 12% interest per year a sum of Rs 20,000. By way of mortgaging the property, the loan was taken by the defendant. On the day on which the deal was made, Damodar Ghose's mother notified the appellant that Damodar was a minor, and anyone who enters an agreement with him would do so at his own risk. KedarNath claimed that Damodar Ghose had lied about minority on the date of the execution of the deed.

6. Object should be lawful

According to section 10, consideration and object of the contract should be lawful and is an essential element of a contract. Accordingly, Section 23 defines unlawful consideration. Unlawful consideration and object is one which is either,

- Forbidden by law; or

- Is of such a nature, that if permitted, then it would defeat the provisions of law; or

- The purpose of the contract is fraudulent; or

- Involves or implies giving injury or damage to someone or to someone’s property; or

- The court considers it as immoral or against public policy.

For example, if A forces B to sign a contract for buying a car from C by kidnapping C's daughter. This is not a lawful object. Hence, the contract will be void.

7. Contract shouldn't are declared as void under Contract Act or the other law

Apart from conditions u/s 10, contract act specifically declared a few classes of contract as void. Section 26 to 30 deals with such contracts. There are those contacts which have been expressly declared void by the Contract Act.

- Agreements restricting a marriage (section 26)

- Agreements restricting trade (section 27)

- Agreements in restraint of proceedings (section 28)

- Agreements void due to uncertainty (section 29)

- Agreement of wager are void(section 30)

In the day-to-day life of every person, Contracts play a very important role. Contracts or agreements between various parties are governed by the Indian Contract Act. Above-given conditions must be fulfilled by the parties for the formation of a contract. Therefore it is important to have the all essential elements which are mentioned above in a contract. Only if there are all the main elements in an agreement then it would legally constitute a valid contract.

8. Possibility of performance:

Agreement must be capable of performance. If agreement is not capable of performance, it is void. In order to make an agreement valid, the terms of the agreement must be clear, certain and capable of performance. An agreement to do an impossible act is void. For example, A enters into an agreement with B to bring back C to life who is already dead. This agreement is void.

9. Legal Formalities:

According to Indian Contract Act1872, a contract can be both in oral and in writing. Contract involving movable property can be made orally but contract involving immovable property must always be in writing. However, it is advisable that the contract must always be in writing because it will be easier to prove in the court if any dispute arises between the parties in future. Contract must be signed and attested by witness and registered if required by the law. For example, X entered into an oral agreement with Y to sell his bike. This is a valid agreement.

Contract Formation & Law

The Indian Contract Act, 1872 defines the term “Contract” under its section 2 (h) as “An agreement enforceable by law”. In other words, we will say that a contract is anything that's an agreement and enforceable by the law of the land. This definition has two major elements in it viz – “agreement” and “enforceable by law”. So as to know a contract in the light of The Indian Contract Act, 1872 we need to define and explain these two pivots within the definition of a contract. For example, marriage contract, business contact etc.

Figure: Concept of contract

Privacy of contract

The doctrine of privity of a contract is a common law principle which implies that only parties to a contract are allowed to sue each other to enforce their rights and liabilities and no stranger is allowed to confer obligations upon any person who is not a party to contract even though contract the contract have been entered into for his benefit. The rule of privity is basically based on the ‘interest theory’ which implies that the only person having an interest in the contract is entitled as per law to protect his rights. For example, If Ramesh makes a promise to deliver goods to Arun. Then in this case, if Ramesh breaches the contract then only Arun has a right to prosecute him and no other person can prosecute him.

Essentials of Privity of contract

- A contract has been entered into between two parties:- The most important essential is that there has been a contract between 2 or more parties.

- Parties must be competent and there should be a valid consideration:- Competency of parties and the existence of consideration are pre-requisites for application of this doctrine.

- There has been a breach of contract by one party:- Breach of contract by one Party is the essential requirement for the application of the doctrine of privity of contract.

- Only parties to contract can sue each other:- Now after the breach, only Parties to a contract are entitled to sue against each other for non-performance Of contract.

Exceptions to the Doctrine of Privity of contract

As a general rule only parties to contract are entitled to sue each other, but now with the passage of time exceptions to this general rule have come, allowing even strangers to contract to prosecute. These exceptions are

- A beneficiary under a contract:-

If a contract has been entered into between 2 persons for the benefit of a third person not being a party, then in the event of failure by any party to perform his part, the third party can enforce his right against the others. For eg. In a contract between Alex and James, beneficial right in respect of some property may be created in favour of Robin and in that case, Robin can enforce his claim on the basis of this right. This concept of a beneficiary under a contract has been highlighted in the case of Muhammad Khan v. Husaini Begum.

2. Conduct, Acknowledgement or Admission:

There can also be situation in which although there may be no privity of contract between the two parties, but if one of them by his conduct or acknowledgment recognizes the right of the other, he may be liable on the basis of law of estoppel ( Narayani Devi v. Tagore Commercial Corporation Ltd). For eg., If A enters into a contract with B that A will pay Rs 5000 every month to B during his lifetime and after that to his Son C. A also acknowledges this transaction in the presence of C. Now if A defaults C can sue to him, although not being directly a party to contract.

3. Provision for maintenance or marriage under family arrangement:

These type of provisions is treated as an exception to the doctrine of privity of contract for protecting the rights of family members who not likely to get a specific share and also to give maximum effect to the will of the testator. For eg., If A gives his Property in equal portions to his 3 sons with a condition that after his death all 3 of them will give Rs 10,000 each to C, the daughter of A. Now C can prosecute if any one of them fails to obey this.

Various types of contract and their features

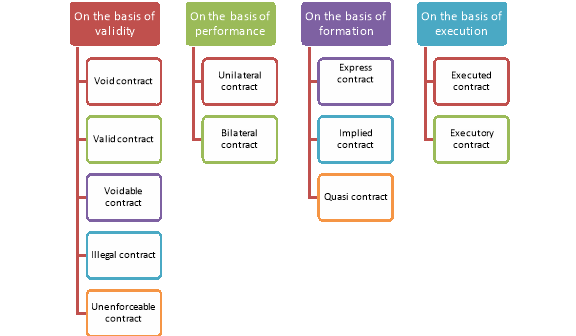

Contact is classified on the basis of validity, performance, execution and formation. Such classifications are discussed below-

Figure: Classification of contract

1. On the idea of validity

a) Valid contract: An agreement which has all the essential elements of a contract is named a legitimate contract. A legitimate contract are often enforced by law. For example, marriage contract between adult person.

b) Void contract [Section 2(g)]: A void contract may be a contract which ceases to be enforceable by law. A contract when originally entered into could also be valid and binding on the parties. It's going to subsequently become void. -- There are many judgments which have stated that where any crime has been converted into a "Source of Profit" or if any act to be done under any contract is against "Public Policy" under any contract— than that contract itself can't be enforced under the law. Example: Mr A agrees to write a book with a publisher. After few days, A dies in an accident. Here the contract becomes void due to the impossibility of performance of the contract.

c) Voidable contract [Section 2(i)]: An agreement which is enforceable by law at the option of 1 or more of the parties thereto, but not at the option of other or others, is a voidable contract. If the essential element of free consent is missing in a contract, the law confers right on the aggrieved party either to reject the contract or to accept it. However, the contract continues to be good and enforceable unless it's repudiated by the aggrieved party. For example, Contract with minor, unsound minded person etc.

d) Illegal contract: A contract is against the law if it's forbidden by law; or is of such nature that, if permitted, would defeat the provisions of any law or is fraudulent; or involves or implies injury to an individual or property of another, or court regards it as immoral or against public policy. These agreements are punishable by law. These are void-ab-initio. “All illegal agreements are void agreements but all void agreements aren't illegal. For example, A agrees to sell narcotics to B. Although this contract has all the essential elements of a valid contract, it is still illegal.

e) Unenforceable contract: Where a contract is good in substance but due to some technical defect can't be enforced by law is termed unenforceable contract. These contracts are neither void nor voidable. For example, A agrees to sell to B 100kgs of rice for 10,000/-. But there was a huge flood in the states and all the rice crops were destroyed. Now, this contract is unenforceable and can not be enforced against either party.

2. On the idea of formation

a) Express contract: Where the terms of the contract are expressly prescribed in words (written or spoken) at the time of formation, the contract is claimed to be express contract. For example, A says to B ‘will you purchase my bike for Rs.20,000?” B says to A “Yes”.

b) Implied contract: An implied contract is one which is inferred from the acts or conduct of the parties or from the circumstances of the cases. Where a proposal or acceptance is formed otherwise than in words, promise is claimed to be implied. For example, A stops a taxi by waving his hand and takes his seat. There is an implied contract that A will pay the prescribed fare.

c) Quasi contract: A contract is made by law. Thus, quasi contracts are strictly not contracts as there's no intention of parties to enter into a contract. It's legal obligation which is imposed on a celebration who is required to perform it. A contract is predicated on the principle that an individual shall not be allowed to complement himself at the expense of another. For example, If Mr A leaves his goods at Mr B’s shop by mistake, then it is for Mr. B to return the goods or to compensate for the price.

3. On the idea of Performance

a) Unilateral contract: A agreement is one during which just one party has got to perform his obligation at the time of the formation of the contract, the opposite party having fulfilled his obligation at the time of the contract or before the contract comes into existence. Example: Anuj promises to pay Rs. 1000 to anyone who finds his lost cellphone. B finds and returns it to Anuj. From the time B found the cellphone, the contract came into existence. Now Anuj has to perform his promise, i.e. the payment of Rs. 1,000.

b) Bilateral contract: A contract is one during which the requirement on both the parties to the contract is outstanding at the time of the formation of the contract. Bilateral contracts also are referred to as contracts with executory consideration. Example: A promises to sell his car to Bj for Rs. 1 lakh and agrees to deliver the car on the receipt of the payment by the end of the week. The contract is bilateral as both the parties have exchanged a promise to be performed within a stipulated time.

4. On the bases of execution

a) Executed contract: An executed contract is one during which both the parties have performed their respective obligation. Example: A contracts to buy a car from B by paying cash, B instantly delivers his car.

b) Executory contract: An executory contract is one where one or both the parties to the contract have still to perform their obligations in future. Thus, a contract which is partially performed or wholly unperformed is termed as executory contract. Example: A sells his car to B for Rs. 2 lakh. If A is still to deliver the car and B is yet to pay the price, it is an executory contract.

5. Other Contracts

Besides the above said classification, there are other kinds of contract also. Contingent Contract is one such type. For example, Insurance contract.

Valid & Voidable Contracts

Valid contact is an agreement that is legally binding and enforceable. It must qualify all the essentials of a contract. For example, marriage contact between two matured person.

Voidable contracts are defined in section 2(i) of the Act: “An agreement which is enforceable by law at the option of one or more of the parties thereto, but not at the option of the other or others, is a voidable contract.” For example: Suppose a person A agrees to pay a sum of Rs. 10,0000 to a person B for an antique chair. This contract would be valid, the only problem is that person B is a minor and can’t legally enter a contract. So this contract is a valid contract from the point of view of A and a “voidable” contract from the point of view of B. As and when B becomes a major, he may or may not agree to the terms. Thus this is a voidable contract.

A voidable contract is a Valid Contract. In a voidable contract, at least one of the parties has to be bound to the terms of the contract. The other party is not bound and may choose to repudiate or accept the terms of the contract. If they so choose to repudiate the contract, the contract becomes void. Otherwise, a voidable contract is a valid contract.

Prime and sub-contracts

A prime contractor is the primary contractor on a project. This individual or firm is responsible for the entire project. It must complete the project on time and under budget. A subcontractor is hired by the prime contractor or project owner to complete a certain task.A subcontract is a contract between a firm which is being employed to do a job and another firm which agrees to do part of that job.

KEY TAKEAWAYS

- The Indian Contract Act, 1872 Defines the Term “Contract” Under Its Section 2 (H) As “An Agreement Enforceable by Law”.

A joint venture involves two or more businesses pooling their resources and expertise to achieve a particular goal. The risks and rewards of the enterprise are also shared. For example, Hindustan Aeronautics Ltd, Vistara, Tata Global Beverages, BrahMos Aerospace etc.

A successful joint venture can offer:

- Access to new markets and distribution networks

- Increased capacity

- Sharing of risks and costs with a partner

- Access to greater resources, including specialised staff, technology and finance

Problems are likely to arise if:

- The objectives of the venture are not 100 per cent clear and communicated to everyone involved

- The partners have different objectives for the joint venture

- There is an imbalance in levels of expertise, investment or assets brought into the venture by the different partners

- Different cultures and management styles result in poor integration and cooperation

- The partners don't provide sufficient leadership and support in the early stages

A consortium is a group made up of two or more individuals, companies, or governments that work together to achieving a common objective. Entities that participate in a consortium pool resources but are otherwise only responsible for the obligations that are set out in the consortium's agreement. Examples of for-profit consortiums are Airbus Industrie GIE, composed of the companies British Aerospace, Aérospatiale, Construcciones Aeronáuticas SA, and Hulu, composed of Comcast, Time Warner, the Walt Disney Company, and 21st Century Fox.

Advantages of consortium:

- Easy to establish as there are no formal procedures that must be followed. Most consortiums are formed in writing by the execution of a consortium agreement. In addition, no capital is required to create the consortium.

- Members of the consortium can change their contractual agreement at any time to suit changed circumstances.

- The consortium can be set to expire on a given date or on the occurrence of certain events without any formal requirements.

- The consortium is not directly subject to taxation; however, the individual members are.

- Some of the members of a consortium may choose to be ‘undisclosed’ in dealings with third parties.

- The cost of running a consortium is usually lower to that of a joint venture.

Disadvantages of consortium:

- It is difficult for consortium members to restrict or limit its liability. Members may even become liable to third parties for the non-performance of other members of the consortium or the debts of such members in undertaking a common project.

- Third parties will often find it difficult to enter into contract with a non-legal entity like a consortium. Because it is a non-legal entity funding is also difficult.

KEY TAKEAWAYS

- A joint venture involves two or more businesses pooling their resources and expertise to achieve a particular goal. The risks and rewards of the enterprise are also shared.

Complex contracts are like regular contracts—oral or written agreements between two or more parties that are legally binding—but with the added complexity of competing priorities such as financial targets, support capabilities, and delivery schedules. Such complex terminologies are-

Tenders

The term “tender” is often used interchangeably to the term bid. However, “Bid” is increasingly being used by the offerer (the supply side) and the term “tender” used on the procurement side (the buyer).

Request for Proposals (REP)

A request for proposal (RFP) is a document that solicits proposal, often made through a bidding process, by an agency or company interested in procurement of a commodity, service, or valuable asset, to potential suppliers to submit business proposals. It is submitted early in the procurement cycle, either at the preliminary study, or procurement stage.In principle, an RFP:

- Informs suppliers that an organization is looking to procure and encourages them to make their best effort.

- Requires the company to specify what it proposes to purchase. If the requirements analysis has been prepared properly, it can be incorporated quite easily into the Request document.

- Alerts suppliers that the selection process is competitive.

- Allows for wide distribution and response.

- Ensures that suppliers respond factually to the identified requirements.

- Is generally expected to follow a structured evaluation and selection procedure, so that an organization can demonstrate impartiality - a crucial factor in public sector procurements.

Bids & Proposals

Bid is an approach to a client in order to gain significant new or repeat business. Bids, by their nature, involve staff from across the whole breadth of one or more organisations. The Bid Manager needs to be able to interact with many types of specialists – from technical to legal, finance, HR and senior management, and will need to know their roles, responsibilities, and what they can and cannot be asked to deliver. The term “bid” or “bidding” can also relate to the documented Offer submitted in response to a request or invitation to tender. The ‘bid’ will then be evaluated against a set of criteria that are described in the request or invitation to tender.

In procurement of goods or services, the bid and proposal (B&P) are a firm's plan (proposal) and proposed cost (bid) for fulfilling the conditions outlined in a request for proposal (RFP) or other information gathering or supplier contact activity. The development of a bid and proposal takes place early in the procurement process, and the resulting proposal will be subject to review by the purchaser and negotiation between the two parties. Developing a bid and proposal takes place before a contract vehicle is in place, meaning that firms undertake the costly tasks of proposal-writing and cost estimation before they are awarded a contract. Often in official use of these two terms a "bid" supposes the limits or scope of work is similar and usually the lowest "bid" is awarded work, especially in government contracts. Proposals mean the entity is fully aware the details and scope of work may vary and the work is awarded to the best "plan" and NOT the cheapest, lowest price. Quality and quantity are more of a consideration when proposals are taken seriously as opposed to the lowest "bid".

Bid Evaluation

Bid evaluation is the process that takes place after the tender submission deadline. It involves the opening and examining of the bids to identify the preferred supplier(s) for the project. Negotiations may then be entered into with one or more suppliers, and the successful supplier awarded the contract. Generally, bid evaluation will be carried out in accordance with evaluation criteria or a selection methodology specified in the invitation to tender. Criteria or other factors that were not included in the invitation to tender should not be used to evaluate bids, and ideally, the same evaluators should evaluate all bids.

The bid evaluation process into four basic stages including-

(1) Preliminary examination for responsiveness to formal qualification requirements

(2) Evaluation for compliance with technical requirements

(3) Price/financial evaluation and

(4) Post qualification/due diligence.

Key Takeaways

- Complex contracts are like regular contracts—oral or written agreements between two or more parties that are legally binding—but with the added complexity of competing priorities such as financial targets, support capabilities, and delivery schedules.

The general conditions and specifications of contract are discussed below-

1. Extent of work. - This contract provides for the manufacture, supply, delivery erection of all materials and finishing in all respects of all works required in connection with the construction of tank.

2. Limits of the Contract. - The contract works shall be deemed to be completed when they have such successfully withstood one whole rainy season and not less than 12 months after the works enumerated under item I above are completed and handed over to the Government.

3. General Arrangement. - The Contractor shall provide all labour and materials required for erection f bench marks and level pegs etc., in order to see out the work and shall be held responsible for its correctness and it shall be incumbent on the contractor to dismantle, remove and rebuilt at his own expenses any work not correctly set out.

4. Reinstatement of Roads, provision of temporary bridges. - The contractor shall include in his rates for all work required to be done on the diversion of public or a private road, disturbed by the construction of the work to the entire satisfaction of the Engineer-in-Charge, the authorities concerned and the private owners.

He shall also defray all charges that may be made by the authorities concerned who may themselves construct a service road, if the one built by the contractor is not found satisfactory. The contractor shall also provide at his own cost all temporary bridges across trenches or excavations at the place considered necessary by the Engineer-in-Charge.

5. Arrangement of work. - The contractor shall provide such pegs or plates and give such assistance in checking the setting out of the work as may be required by the Engineer-in-Charge both before and during the execution of the contract work.

The contractor must work in collaboration with other contractors who may be employed from time to time execute a part of the work or supply and erect materials in conjunction with the original works.

6. Erection or checking of working. - As each part of the collection of materials and construction of the work is completed, it will be checked over by the Engineer-in-Charge or his authorised representative. The contractor or his agent shall ascertain from the Engineer-in-Charge representative from time to time what part he wishes to check and pass over but such passing shall in no way relieve the contractor from any of his responsibilities.

7. Tests. - During the progress of the work and after its completion the contractor shall carry out such tests as in the opinion of Engineer-in-Charge are necessary to determine that the materials supplied comply with the conditions of these specifications whether under test conditions or in ordinary use. The tests carried out shall include those tabulated in Schedule 'E'.

8. Detailed drawings. - The detailed drawings for the works to be executed shall be supplied to the contractor at the time the work is ordered to be taken in hand. In case the contractor finds it difficult to proceed with any work for want of More details, he should apply to the Engineer-in-Charge, who will supply the necessary information. No work shall be carried out by the contractor for which full details have not been supplied to him or written instructions are not given. No excuse for delay in execution of the work will be entertained for any delay in supplying detailed drawings.

9. Date of completion. - The date of completion shall be from the date of orders to start work as detailed under Schedule 'F'.

10. Payment of work. - The payment for the work done shall be made in the manner set out in the general conditions and specifications hereto annexed and at the rates stated in Schedule 'G'. As regards work done in quantities, it shall be determined by the actual measurements of the work approved by the Engineer-in-Charge or his authorised representative.

A supplementary Schedule 'H' (hereto annexed) must also be filled in by the contractors at the time of tendering for use as may be found applicable in regulating payment in the event of alterations in the description of the works specified and also for use in extra works and in deduction and day work when ordered and for the supply of materials if ordered as extras.

The prices given for the materials enumerated in the supplementary must include the charges for the delivery at the site of the work.

This supplementary schedule must not be taken as altering or interfering with the contract rates given in the Schedule 'G' annexed hereto and the prices stated in supplementary schedule must agree with the prices set forth in Schedule 'G' aforesaid.

11. Alteration to the tender. - The contractor must tender in general with the requirements of these specifications of modifications but such alterations or modifications as may be provided must clearly set forth embody with end from part of the contract.

12. Samples. - As the work proceeds, the contractor shall submit samples of materials required for the execution of the work for the approval of the Engineer-in-Charge. A list of such samples as are required in the first instance is given in Schedule 'D'. An work done with materials not approved before hand shall have to be dismantled and removed.

13. Octroi or royalty. - All octroi and royalty for any plant of materials required for the work will be paid by the contractor.

14. Want of knowledge. - The contractor must read carefully these specifications and terms of contract and in case of any obscurity must apply to the Executive Engineer for its elucidation. No excuse for want of knowledge, for non-compliance with any part of portion of these conditions and specifications or terms of contract can be considered.

15. Supply of T & P. - The contractor shall provide himself with all tools and plants for the proper execution of the work. He shall also provide steam rollers of at least 8 tons capacity for the proper consolidation of earthwork and power pumps for boiling water out of foundations, and necessary trolly lines, wagons and other accessories necessary for works.

16. Method of tendering. - The contractor must fill in Schedule 'G' and the supplementary Schedule 'H' item by item in several columns and must state the total of cost in words as well as in figures, Schedule "g" and the supplementary Schedule "H" must be signed a principal of the contractor or a duly accredited agent of contractor on his behalf.

17. Examination of site plans and Specifications. - Every tenderer must make himself thoroughly conversant with the site, plans specifications requirement of work difficulties likely to arises as to the character and amount of all necessary class of labour and materials, which will be required to carry out the ultimate work and as to all circumstances and conditions that may effect the cost of works.

No information derive for any ambiguity in the maps, plans, specifications, etc. will relieve the successful tender form carrying out the terms of his contract and specifications, each bidder by his bid certifies that he has examined the local conditions, has read each an every clause of the contract and agrees that if he is awarded the contract he will make no claim against the Government, based upon ignorance of locations conditions or misunderstanding of contract provisions. He must provide rates to contingencies likely to arise at the site for completion of the works.

18. Firm tenders. - Firm prices in Rupees (Indian coin) shall be quoted.

19. Fencing and Watching. - The contractor shall be responsible for fencing off in sufficient manner all excavation work and material so as to prevent accidents by night as well as by day. He shall also be responsible if or lighting up in proper and sufficient manner at night the portion of works which is open or under execution and he shall always maintain a sufficient number of watchmen on duty when his staff is not actually working. Whole quarry stone or excavating rock by blasting he shall take precautions to prevent labour or public men within the danger zone of a radius not less than 100ft.

20. Damages by rains or floods. - The contractor shall so stock the materials to be used in the execution of the work and protect the work in progress and they may not be exposed to any risk of damages by rains or floods. If in any case damages occur, the contractor shall be responsible for them and shall replace the same at his own cost.

21. Water supply - The contractor shall make his own arrangements for the supply for pure water for drinking of his staff and labourers and also for the execution of the work.

22. Measurements. - All measurement connected with the work shall be taken geometrically or nett. The measurement of earthwork of bund shall be measured for bank section. The measurements given in Schedule 'G' or in the supplementary Schedule 'H' attached to the tender shall be held to mean the finished sizes of the respective item of the work after any dressing or cutting required has been executed.

23. Tools and plant. - The contractor should provide himself necessary and requisite tools and plants such as trolly lines, crossings turn-tables, trapping wagons, necessary pumps an engine’s steam road rollers G.l. Pipes etc. and on no account will the department undertake any responsibility whatsoever for the supply of the same or any other stores required for completion of work.

24. Special penalty. - For each and every day after expiry of completion period stated in clause 9, the Government shall be at liberty to and shall deduct from the payment of contractor the sum considered necessary as liquidated damages for the loss on account of delay of each day over and above the penalties specified under the clauses of the contract agreement.

Critical /“Red Flag” conditions

A red flag is a warning or indicator, suggesting that there is a potential problem or threat with a company's stock, financial statements, or news reports. Red flags may be any undesirable characteristic that stands out to an analyst or investor. Red flags tend to vary. There are many different methods used to pick stocks and investments, and therefore, many different types of red flags. So a red flag for one investor may not be one for another.

Contract award & Notice to Proceed

Contract Award is the time at which the advertised project is awarded to the lowest responsible bidder. Criteria for the award of contracts must take into account the experience of the bidders, their technical and financial capacity, as well as price, quality and quantity of the offers. The criteria are set out in advance in the bidding documents.

On the other hand, notice to Proceed is formal notification given to the Contractor that officially begins the project. The monitoring of the number of contract working days begins on this date. It is a letter from the owner or director of a company or business to a contractor. This notice will inform the contractor of the date that he can start work, as outlined in a previous contract. The date mentioned in the notice to proceed will be the official start of the contract.

Variations & Changes in Contracts

A contract variation is a subsequent change to an original contract. The parties to the original contract may agree the change at the time of the variation, or a future variation could have been provided for by the parties at the time of the original contract through the identification of trigger points or processes resulting in change.

Key Takeaways

- A red flag is a warning or indicator, suggesting that there is a potential problem or threat with a company's stock, financial statements, or news reports. Red flags may be any undesirable characteristic that stands out to an analyst or investor. Red flags tend to vary.

Cost escalation can be defined as changes in the cost or price of specific goods or services in a given economy over a period. This is similar to the concepts of inflation and deflation except that escalation is specific to an item or class of items (not as general in nature), it is often not primarily driven by changes in the money supply, and it tends to be less sustained. While escalation includes general inflation related to the money supply, it is also driven by changes in technology, practices, and particularly supply-demand imbalances that are specific to a good or service in a given economy. For example, while general inflation (e.g., consumer price index) in the US was less than 5% in the 2003-2007 time period, steel prices increased (escalated) by over 50% because of supply-demand imbalance. Cost escalation may contribute to a project cost overrun but it is not synonymous with it.

Suspensions & Terminations

The termination of contact is taken place in the following ways-

- Cancellation For Default - This is used by a customer when the vendor has failed to abide by the terms of the contract. Depending on how the contract is worded, the termination can be triggered by a failure to adhere to delivery dates, or a failure to provide items with the level of quality required. Whatever the cause the customer should be able to provide evidence to substantiate the cancellation notice. Depending on the contract the vendor may have a period in which to address the issues, or if they disagree with the reasons provided by the customer, they can take their case to a mediator.

2. Cancellation By Mutual Consent - In many cases the contract is terminated by mutual consent without any instances that trigger a cause. Sometimes the vendor stops production of a part used by the customer and therefore the contract can no longer be fulfilled. In other cases, the customer may no longer produce finished goods that require parts fulfilled by the contract.

3. Cancellation For Convenience - Vendors have found that customers have cancelled contracts for convenience due to the fact that they are in financial difficulties and do not want to be tied to a contract. If this termination occurs the vendor should not suffer any financial loss because of the actions of the customer.

An extension of time (EOT) is a provision in most standard forms of contract, for an amendment of the scheduled Practical Completion date due to unforeseen circumstances and it is usually requested by the main Contractor.

The term ‘force majeure’ has been defined in Black’s Law Dictionary, as ‘an event or effect that can be neither anticipated nor controlled. It is a contractual provision allocating the risk of loss if performance becomes impossible or impracticable, especially as a result of an event that the parties could not have anticipated or controlled.’ While force majeure has neither been defined nor specifically dealt with, in Indian statutes, some reference can be found in Section 32 of the Indian Contract Act, 1872 (the "Contract Act") envisages that if a contract is contingent on the happening of an event which event becomes impossible, then the contract becomes void. From a contractual perspective, a force majeure clause provides temporary reprieve to a party from performing its obligations under a contract upon occurrence of a force majeure event.

When a breach of contract occurs, liquidated damages and/or penalty is payable. While the terms, penalty and liquidated damages might sound similar, there is a clear line of distinction between them. According to Section 74 of the Indian Contract Act, 1872, if the parties fix the damages, the Court will not allow more. However, it may award a lesser amount, depending on the case. Hence, the suffering party gets reasonable compensation but no penalty. There is an exception to Section 74 which states that if a party enters into a contract with the State or Central government for the performance of an act in the interest of the general public, then a breach of such a contract makes the party liable to pay the entire amount mentioned in the contract.

Here are some other remedies available to suffering parties:

1] Rescission of Contract

Rescission means revocation, cancellation, or repeal of a law, order, or agreement. If one party breaches the contract, then the other party can treat the contract as rescinded. Also, he is discharged of all obligations under the contract. Further, he can claim compensation for damages, if any.

2] Quantum Meruit

Quantum Meruit means a reasonable sum of money paid to a person for services rendered when the amount is not specified in a legally enforceable contract. In such cases, the law infers a promise to pay since the service rendered indicates an understanding between both parties. Quantum Meruit covers a case where the party who provides the service has completed part, but not all of the work that he was bound to do and seeks compensation for the value of the work done. There are two important conditions that must be met for this rule to be applied:

- Contract is discharged

- The claim is brought by the party who has not defaulted.

In simple words, Quantum Meruit allows compensating a party for the value of work done or services rendered. While damages are compensatory in nature, Quantum Meruit is restitutory since it is a reasonable compensation awarded on the implication of a contract to remunerate.

3] Suit for Specific Performance

There are cases where damages are not an adequate remedy upon the breach of a contract. In such cases, the Court may, in its discretion on a suit for specific performance, instruct the defaulting party to perform the promise as per the terms of the contract.

4] Suit for Injunction

If a party has promised not to do something vide a contract but is negating these terms, then the Court can issue an injunction order to restrain the party from doing what he has promised not to do.

Insurance is defined as a contract between insurer (insurance company) and insured (client) where the insurance company agrees to repay the money to the client in case of damage to his life/property due to the third party. Insurance are marine insurance, life insurance and general insurance.

Functions of an insurance Company

1] Provides Reliability

The main function of insurance is that eliminates the uncertainty of an unexpected and sudden financial loss. This is one of the biggest worries of a business. Instead of this uncertainty, it provides the certainty of regular payment i.e. the premium to be paid.

2] Protection

Insurance does not reduce the risk of loss or damage that a company may suffer. But it provides a protection against such loss that a company may suffer. So at least the organisation does not suffer financial losses that debilitate their daily functioning.

3] Pooling of Risk

In insurance, all the policyholders pool their risks together. They all pay their premiums and if one of them suffers financial losses, then the payout comes from this fund. So the risk is shared between all of them.

4] Legal Requirements

In a lot of cases getting some form of insurance is actually required by the law of the land. Like for example when goods are in freight, or when you open a public space getting fire insurance may be a mandatory requirement. So an insurance company will help us fulfil these requirements.

5] Capital Formation

The pooled premiums of the policyholders help create a capital for the insurance company. This capital can then be invested in productive purposes that generate income for the company.

Principles of Insurance

There are certain principles that are important to ensure the validity of the contract. The principles of general insurance are

1] Utmost Good Faith

A contract of insurance must be made based on utmost good faith. It is important that the insured disclose all relevant facts to the insurance company. Any facts that would increase his premium amount, or would cause any prudent insurer to reconsider the policy must be disclosed.

If it is later discovered that some such fact was hidden by the insured, the insurer will be within his rights to void the insurance policy.

2] Insurable Interest

This means that the insurer must have some pecuniary interest in the subject matter of the insurance. This means that the insurer need not necessarily be the owner of the insured property but he must have some vested interest in it. If the property is damaged the insurer must suffer from some financial losses.

3] Indemnity

Insurances like fire and marine insurance are contracts of indemnity. Here the insurer undertakes the responsibility of compensating the insured against any possible damage or loss that he may or may not suffer. Life insurance is not a contract of indemnity.

4] Subrogation

This principle says that once the compensation has been paid, the right of ownership of the property will shift from the insured to the insurer. So the insured will not be able to make a profit from the damaged property or sell it.

5] Contribution

This principle applies if there are more than one insurers. In such a case, the insurer can ask the other insurers to contribute their share of the compensation. If the insured claims full insurance from one insurer he losses his right to claim any amount from the other insurers.

6] Proximate Cause

This principle states that the property is insured only against the incidents that are mentioned in the policy. In case the loss is due to more than one such peril, the one that is most effective in causing the damage is the cause to be considered.

Taxation

Tax is a mandatory fee or financial charge levied by any government on an individual or an organization to collect revenue for public works providing the best facilities and infrastructure. It is of two types-

Direct Tax

- The definition of direct tax is hidden in its name which implies that this tax is paid directly to the government by the taxpayer

- The general examples of this type of tax in India are Income Tax and Wealth Tax.

- From the government’s perspective, estimating tax earnings from direct taxes is relatively easy as it bears a direct correlation to the income or wealth of the registered taxpayers.

Indirect Tax

- Indirect taxes are slightly different from direct taxes and the collection method is also a bit different. These taxes are consumption-based that are applied to goods or services when they are bought and sold.

- The indirect tax payment is received by the government from the seller of goods/services.

- The seller, in turn, passes the tax on to the end-user i.e. buyer of the good/service.

- Thus the name indirect tax as the end-user of the good/service does not pay the tax directly to the government.

- Some general examples of indirect tax include sales tax, Goods and Services Tax (GST), Value Added Tax (VAT), etc.

Key Takeaways

- Insurance is defined as a contract between insurer (insurance company) and insured (client) where the insurance company agrees to repay the money to the client in case of damage to his life/property due to the third party. Insurance are marine insurance, life insurance and general insurance.

Performance of a contract is the fulfilment of the contractual obligations by the parties. It is one of the methods to discharge a contract.

Obligation of parties to contracts (Section 37)

The parties to a contract must either perform, or offer to perform, their respective promises, unless such performance is dispensed with or excused under the provisions of this Act, or of any other law. Promises bind the representatives of the promisors in case of the death of such promisors before performance, unless a contrary intention appears from the contract.

Effect of refusal to accept offer of performance (Section 38)

Where a promisor has made an offer of performance to the promisee, and the offer has not been accepted, the promisor is not responsible for non-performance, nor does he thereby lose his rights under the contract. Every such offer must fulfil the following conditions:

(1) it must be unconditional;

(2) it must be made at a proper time and place, and under such circumstances that the person to whom it is made may have a reasonable opportunity of ascertaining that the person by whom it is made is able and willing there and then to do the whole of what he is bound by his promise to do;

(3) if the offer is an offer to deliver anything to the promisee, the promisee must have a reasonable opportunity of seeing that the thing offered is the thing which the promisor is bound by his promise to deliver. An offer to one of several joint promisees has the same legal consequences as an offer to all of them.

Effect of refusal of party to perform promise wholly (Section 39)

When a party to a contract has refused to perform, or disabled himself from performing, his promise in its entirety, the promisee may put an end to the contract, unless he has signified, by words or conduct, his acquiescence in its continuance.

Person by whom promise is to be performed (Section 40)

If it appears from the nature of the case that it was the intention of the parties to any contract that any promise contained in it should be performed by the promisor himself, such promise must be performed by the promisor. In other cases, the promisor or his representatives may employ a competent person to perform it.

A non-performance which is excused due to an impediment does not give the aggrieved party the right to claim specific performance or to claim damages. The excuses for non-performance of contract are

- Supervening events

- Impossibility

- Impracticability

- Frustration of purpose

- Failure of conditions

- Anticipatory repudiation

- Later agreements between the parties (such as modification, rescission, and accord and satisfaction)

- Waiver.

Key Takeaways

- Performance of a contract is the fulfilment of the contractual obligations by the parties.

Every contract is a set of reciprocal promises. Most often at one end of these is the obligation on one of the parties to do or get done a certain thing on a specified date or in a specified time period. Failure to adhere to the prescribed time may or may not be fatal to the entire contract depending on whether time is of essence in the contract. Construction contracts being extremely dynamic in nature and dependent on several unforeseeable and unpredictable circumstances, delay in completing the works is not unusual. However, disputes arising from such delays are also not scarce. The issue of delay in construction contracts has time and again come before our courts of law, giving rise to varied legal positions.

Does delay make a construction contract voidable?

Section 55 of the Indian Contract Act, 1872 says that When a party to a contract promises to do a certain thing at or before a specified time, or certain things at or before specified times, and fails to do any such thing at or before the specified time, the contract, or so much of it as has not been performed, becomes voidable at the option of the promisee, provided the intention of the parties was that time should be of the essence of the contract. Thus the question, in the context of construction contracts, narrows down to whether time is generally intended by the parties to be of essence.

Most construction contracts will have an agreed upon date of completion or handover. However, it's been ruled by the courts in a number of cases that this is not by itself imply that time is of essence in the contract. It was held in Bangalore Development Authority Vs. Syndicate Bank by the Hon'ble Supreme Court that in a contract involving construction, time is not the essence of the contract but the same was qualified by the words "unless specified". This was quoted with approval by the Punjab State Consumer Disputes Commission in the case of Karam Jeet Singh vs Emaar Mgf Land Private Limited.

Even in cases where there was express stipulation to the effect that time is of essence, courts have held that delays may not give rise to voidability of the contract. A general proposition as to this effect was laid down by the Supreme Court in the case of Hind Construction Contractors vs The State of Maharashtra. The court while quoting Halsbury's Laws of England in regard to building and engineering contracts held that “even where the parties have expressly provided that time of the essence of the contract such a stipulation will have to be read along with other provisions of the contract and such other provisions may, on construction of the contract, exclude the inference that the completion of the work by a particular date was intended to be fundamental; for instance, if the contract were to include clause providing for extension of time in certain contingencies or for payment of fine or penalty for every day or week the work undertaken remains unfinished on the expiry of the time provided in the contract such clause would be construed as rendering ineffective the express provision relating to the time being of the essence of contract.”

Thus to render a construction contract voidable on account of delay, two conditions need to be satisfied:

i) There must be express stipulation to the effect that time is of essence in the contract.

Ii) Other contractual provisions as well as the conduct of the parties should reflect their intention to make time to be of essence.

Does delay give rise to the right to claim compensation?

Every contract is to be performed on or within the time prescribed. If no time has been prescribed, performance has to be done in a reasonable time. Therefore, delays in performance always have legal consequences. S.55 of the Contract Act further says that if from the intention of the parties it is clear that time is not of essence of the contract, the party affected by the delay is only entitled to compensation for any loss occurring to him as a result of the delay. Therefore, even in construction contracts where time is not intended to be of essence, delays are not always excusable. Section 73 of the Contract Act provides that the party who suffers from the breach is entitled to compensation for any loss or damage caused to him thereby. The right to compensation as well as its quantum will however depend on who is at fault for the delay. In case where the contractor fails to complete the work on time owing to faults on his part the employer is entitled to claim damages and vice-versa.

Damages or compensation is payable only for losses which naturally arose in the usual course of things from such breach, or which the parties knew, when they made the contract, to be likely to result from the breach of it and not for indirect or remote losses. Claims on account of mere breach without any damage or actual loss due to the delay are not sustainable.

In addition to this, the affected party may, according to the terms of the contract, be also be entitled to claim as part of the contract price ‘other costs’ from the party at fault, such as claims for loss of profit on account of delay, additional charges incurred due to change in market conditions and prices, overhead charges on machinery etc provided they stand the test of proximity laid down under Section 73. The costs are payable only to the extent that the same have some nexus with the nature of the delay caused which attracts the costs and the amount claimed falls within the definition of the expression costs and not otherwise.

Bid shopping

Bid shopping means any effort by a general contractor after bid submission to obtain a lower price from a subcontractor that such contractor has previously solicited bids from with respect to the project for which such bid was submitted, including using one subcontractor's bid to coerce lower bids from other subcontractors, but excluding the substitution of a contractor. "Bid shopping" occurs when a general contractor discloses the bid price of one subcontractor (or suppliers) to its competitors in an attempt to obtain a lower bid than the one on which the general contractor based its bid to the owner. Put another way, bid shopping occurs when a general contractor uses the lowest bid received to pressure other subcontractors to submit even lower bids.

Bid fixing

Bid fixing also known as bid rigging is an illegal practice in which competing parties collude to determine the winner of a bidding process. Bid rigging is a form of anticompetitive collusion and is an act of market manipulation; when bidders coordinate, it undermines the bidding process and can result in a rigged price that is higher than what might have resulted from free market competitive bidding. Bid rigging can be harmful to consumers and taxpayers, who may be forced to bear the cost of higher prices and procurement costs.

Cartels

Cartel includes an association of producers, sellers, distributors, traders or service providers who, by agreement amongst themselves, limit, control or attempt to control the production, distribution, sale or price of, or, trade in goods or provision of services. The three common components of a cartel are:

- An agreement.

- Between competitors.

- To restrict competition.

A cartel is an organization created from a formal agreement between a group of producers of a good or service to regulate supply in order to regulate or manipulate prices. In other words, a cartel is a collection of otherwise independent businesses or countries that act together as if they were a single producer and thus can fix prices for the goods they produce and the services they render, without competition.

Contract Document is the written documents that defines the basis of contract consisting of both parties’ roles, responsibilities, and detailed description of the work or service such as drawings, specifications, procedures, any other conditions, as well as the commercial information including the prices agreement, payment conditions, etc. The Contract Document should include sufficient information to be able to complete the work or service. In other words, Contract Documentation means

(i) the acceptance of a Tender by the Council in whole or in part and comprises the Tender as so accepted and the acceptance in writing by the Council, and any executed contract thereafter;

(ii) these Terms and Conditions

(iii) any Specification, Drawings, Schedule(s);

(iv) any special terms agreed to in writing by the Council; and

(v) any Orders placed by the Council for the procurement of any Works, Goods, or Services following any Council quotation;

(vi) any Key Performance Indicators or Service Level Agreements required by the Council; and

(vii) any other documents produced supplied or referred to by the Council as part of the Contract.

Contract Notices

A notice of contract is defined as the knowledge of information of specific facts or of a certain state of affairs and the formal papers that provide this information. Notice is given directly to the involved party. There is both implied notice and express notice, which are different.

A reverse auction is a type of auction in which sellers bid for the prices at which they are willing to sell their goods and services. In a regular auction, a seller puts up an item and buyers place bids until the close of the auction, at which time the item goes to the highest bidder. In a reverse auction, the buyer puts up a request for a required good or service. Sellers then place bids for the amount they are willing to be paid for the good or service, and at the end of the auction the seller with the lowest amount wins.

BOOT (build, own, operate, transfer) is a public-private partnership (PPP) project model in which a private organization conducts a large development project under contract to a public-sector partner, such as a government agency. A BOOT project is often seen as a way to develop a large public infrastructure project with private funding.

In the Build-Own-Operate (BOO) type and its other variants such as Design-Build-Finance-Operate (DBFO), the private sector builds, owns and operates a facility, and sells the product/service to its users or beneficiaries. This is the most common form of private participation in the power sector in many countries (examples are numerous). For a BOO power project, the Government (or a power distribution company) may or may not have a long-term power purchase agreement (commonly known as off-take agreement) at an agreed price from the project operator. Many BOO projects have also been implemented in the transport sector. Examples include, Kutch and Pipavav Railways in India (joint venture BOO projects); Xiamen Airport Cargo Terminal in China and Sukhothai Airport in Thailand; and in the port sector, Wuhan Yangluo Container Port in China and Balikapapan Coal Terminal in Indonesia.

Public-private partnerships involve collaboration between a government agency and a private-sector company that can be used to finance, build, and operate projects, such as public transportation networks, parks, and convention centers. Financing a project through a public-private partnership can allow a project to be completed sooner or make it a possibility in the first place. Public-private partnerships often involve concessions of tax or other operating revenue, protection from liability, or partial ownership rights over nominally public services and property to private sector, for-profit entities.Public-private partnerships typically have contract periods of 25 to 30 years or longer. Financing comes partly from the private sector but requires payments from the public sector and/or users over the project's lifetime. The private partner participates in designing, completing, implementing, and funding the project, while the public partner focuses on defining and monitoring compliance with the objectives. Risks are distributed between the public and private partners through a process of negotiation, ideally though not always according to the ability of each to assess, control, and cope with them.

INCOTERMS (International Commercial Terms) are an internationally recognised set of trade term definitions developed by the International Chamber of Commerce (ICC). The terms define the trade contract responsibilities and liabilities between a buyer and a seller. They cover who is responsible for paying freight costs, insuring goods in transit and covering any import/export duties, for example. They are invaluable as, once importer and exporter have agreed on an INCOTERM, they can trade without discussing responsibilities for the costs and risks covered by the term.

Commonly used international commercial terms

- EXW - Ex Works

The seller makes the goods available at his or her premises. The buyer is responsible for uploading. This applies to any mode of transport, but should only be used for domestic transactions, because the seller has only to 'provide the buyer'… assistance in obtaining any export licence, or other official authorisation. The seller also has no obligation to load the goods. In addition the buyer has limited obligations to provide the seller with proof of export. For international trade, FCA, below, is more appropriate.

2. FCA - Free Carrier

The seller must 'deliver the goods to the carrier ... Nominated by the buyer ... At the named place'. This term is suited for international sales with minimum obligations for the seller. Its advantage over EXW is that the seller is responsible for any export licensing and Customs export clearance, which eases the problem of proof of export, and the seller must load the goods (which is usually the case).

3. CPT Carriage Paid To

The seller pays for carriage. This term is used for all kinds of shipments. Risk is transferred from the seller to the buyer upon handing over of the goods to the first carrier at the place of shipment in the country of export.

4. CIP - Carriage and Insurance Paid

The seller must 'deliver to the first carrier at the named place'. It’s strongly recommended that the parties define the place of delivery (in the seller's country) as well as the place of destination (in the buyer's country) due to the fact that risk passes to the buyer at the named place of delivery in the seller's country.' When CPT or CIP terms are used, the seller fulfils their obligation to deliver when it hands the goods over to the carrier, and not when the goods reach the place of destination.' So these are ' shipment contracts' not ' arrival contracts'. Therefore, it is strongly recommended that the place of delivery, in the seller's country, is identified as precisely as possible in the contract.

5. DAT - Delivered at Terminal

The seller pays for carriage to a nominated ‘terminal’ or ‘point’, except for costs related to import clearance. The seller also assumes all risks up to the point that the goods are unloaded at the terminal. DAP would be inappropriate in these circumstances as the seller has only to place the goods 'ready for unloading'.

6. DAP - Delivered at Place

This is appropriate to both domestic and international sales. The seller delivers when 'the goods are placed at the disposal of the buyer ready for unloading by the buyer at the named place'. All import Customs formalities and costs are the responsibility of the buyer.

7. DDP - Delivered Duty Paid

This applies to any mode of transport. The seller must deliver the goods to the buyer, cleared for import, and not unloaded at the named place of destination.

Key Takeaways

- Incoterms (international commercial terms) are an internationally recognised set of trade term definitions developed by the international chamber of commerce (icc). The terms define the trade contract responsibilities and liabilities between a buyer and a seller.

1. Balfour vs Balfour

Where parties to contract do not intend to create binding agreement, the agreement cannot be enforced. The case of balfour vs balfour is a well known illustration of a domestic agreement. In this case a husband (Mr. Balfour) was working in ceylone. During the holidays, he and his wife (Mrs. Balfour) went to England to enjoy the leave. When Mr. Balfour was to return to ceylone, his wife was advised to remain in England, due to ill health. Mr. Balfour agreed to send a sum of $930 per month for probable expense of maintenance. For some time he sent the amount but afterwards differences arose between them which resulted in their separation and the allowance fell into arrears. Mrs. Balfour suit for recovery was dismissed by Lord Atkin on the ground that parties did not intend that it will be attended by legal consequences.

2. Carlill vs. Carbolic Smoke Ball Co

A General offer may be accepted by any person from among the public who has the knowledge of it. The performance of conditions of offer will amount to acceptance. The case of Carllil vs. Carbolic Smoke Ball Co. Is an illustration of a contract arising out of a general offer. As per the facts of the case, the company issued an advertisement in a newspaper about its product, “the smoke ball” a preventive medicine against influenza. In the advertisement, the company offered to pay a sum of $ 1,000 as compensation to anyone who contacted influenza or a cold after having used the smoke ball according to the printed directions. The advertisement also contained that a sum of $ 1,000 had been deposited with the Alliance bank to show the sincerity of the company. A lady, Mrs. Carllil relying on the advertisement purchased and used the smoke balls as per directions but still contacted influenza. She sued the company to claim the compensation of $ 1,000. Held, it was a general offer and Mrs. Carllil had accepted it by her act, by performing the conditions for acceptance. She was therefore entitled to get the claim.

References:

1. B.S. Patil, Legal Aspects of Building and Engineering Contracts, 1974.

2. The National Building Code, BIS, 2017

3. RERA Act, 2017

4. Meena Rao (2006), Fundamental concepts in Law of Contract, 3rd Edn. Professional Offset

5. Neelima Chandiramani (2000), The Law of Contract: An Outline, 2nd Edn. Avinash Publications Mumbai

6. Avtar singh (2002), Law of Contract, Eastern Book Co.

7. Dutt (1994), Indian Contract Act, Eastern Law House

8. Anson W.R. (1979), Law of Contract, Oxford University Press