Unit - 2

Public Sector Economics

Part of the economy consisting of the public sector, governments of all levels and government-controlled businesses. Private companies, voluntary associations and households are not included.

The general definition of the public sector is not just a function, but the ownership or control of government, which includes, for example, the exercise of public authority or the implementation of public policy. When depicted as concentric circles, the core public services of central and local government agencies define the inner circle of the public sector. In this case, the distinction between the public and private sectors is relatively easy. It is clear in terms of employment relationships and the right to exercise public authority. The following circles include various quasi-government agencies that are outside the scope of direct accountability within the government. Examples range from social security funds to regional development agencies. The outer circle is occupied by state-owned enterprises and is usually defined by ownership of government or a majority stake. Since the 1980s, many developed countries have witnessed large-scale privatization of state-owned enterprises, whether partially or wholly (eg from airlines to the telecommunications sector), but public ownership continues. Extensive functionality. The field of local public transport.

The term public sector is also used for analytical purposes, especially in contrast to the private sector and the third or voluntary sector. This allows mapping of a range of national activities within a wider economy (and also allows comparison over space and time). In addition, it emphasizes unique patterns and operating procedures within the public sector.

Public sector economics welfare

Welfare: the health, happiness and fortunes of a person or group

A branch of economics that focuses on the optimal allocation of resources and goods and how this affects social welfare. Welfare economics analysis the total good and welfare that is achieved at a current state as well as how it is distributed. This relates to the activity of income distribution and how it affects the common good.

Definition of economic welfare: The level of prosperity and quality of living standards in an economy. Economic can be measured through a variety of factors such as GDP and other indicators which reflect welfare of the population.

Economic welfare is a general concept which doesn’t lend to easy definition. Basically, it refers to how well people are doing. Economic welfare is usually measured in terms of Real Income, Real GDP. An increase in Real Output and real income suggest people are better off and therefore there is an increase in economic welfare.

However, economic welfare will be concerned with more than just levels of income. For example, people’s living standards are also influenced by factors such as levels of congestion and pollution. These quality-of-life factors are important in determining economic welfare.

Externalities

Externalities are benefits (costs) received (borne) by neither the seller nor the buyer but by third parties.

Private benefits + external benefits = social benefits.

Private costs + external = social costs.

Since external benefits and costs are not perceived by buyers and sellers they are not captured in markets.

Therefore, markets may fall to allocate resources inefficiently.

Concepts of Externalities: Externalities occur when any activity by an individual or organization or any project activity affects other persons (or society) well-being and relevant costs and benefits are not reflected in market prices

In Economics, and externality is the cost or benefits that affects a party who did not choose to incur that costs or benefits.

Externalities are a loss or gain in the welfare of one party resulting from an activity of another party, without there being any compensation for the losing party.

Positive Externalities

A positive Externality arises say when any project or activity (say building a bridge) creates a positive benefit for the immediate society. Thus a positive externality would increase the utility of third parties at no cost to them. For example:

Govt Programmes: NREGA, Sarva Sikhshya Abhiyan, Bharat Nirman, Mid-day meals schemes

Millennium Development Goals by the United Nations (started in 2000)

Infrastructure Initiatives: Building a bridge or road.

A positive externality would increase the utility of third parties at no cost to them

Negative Externalities

Marginal social costs are greater than marginal private costs.

Pollution is a cost that may not be borne by sellers, but it is a cost nonetheless to society.

Private markets will overproduce (devotee too many resources) to the production of goods with negative externalities.

Damage to environment and Scarce resources etc

Water pollution by industries that adds effluent, which harms plants, animals and humans.

Noise pollution which may be mentally and psychologically disruptive.

Encouraging Positive Externalities

Increasing supply: Govt grants and subsidies to producers of the goods and services that generate external benefits will reduce costs of production and encourage more supply.

Increasing Demand: Demand for goods, which generates positive externalities, can be encouraged by reducing the price paid by consumers. For example subsidizing the tuition fees of university students will encourage more young people to go to university, which will generate a positive externality for future generations.

Labour Market

The nominal market in which worker find paying work, employers find willing workers, and wage rates are determined.

Labor markets may be local or national (even international) in their scope and are made up of smaller, interacting labor markets for different qualifications, skills, and geographical locations. They depend on exchange of information between employers and job seekers about wage rates, conditions of employment, level of competition, and job location.

Labour Market in India

Bonded Labour

The employees, when they need huge amounts of money to perform the social functions like the marriage of their children or to meet the expenses of hospitalization and medicines, approach the employer for granting loans.

The employers grant the loan for high rate of interest.

Employees fail to repay the loan and consequently they turn to be a Bounded Labour. The government of India has abolished the bonded labour.

Bounded labour work with the same employer for very low wages and the employer deducts some amount to clear the loan.

The employer of this type includes Landlords, Mine Owners, Bidi and Cigar manufacturers etc. The working conditions of bounded labours were untolerable- 12 to 18 hours a day working, no weekly holiday, low wages (even compared to minimum wages)

Child Labour

More dominant in third world countries like Asian countries. The reasons for the prevalence of child labour in our country are: Poverty, large family size, lack of care for children by both the parents and the government.

Growth of industry in the unorganized sector is another cause for the growth of child labour

Employment Conditions

They are mostly casual workers.

They are highly mobile.

They are paid very low wages.

Employee’s bargaining power is very low. They are given odd jobs.

Employment relations are not maintained with them.

Causes of employing child labour

Measures to reduce child labour

Key Takeaways:

The monetary system is defined as a set of policies, frameworks and institutions for the government to generate money in the economy. Such institutions include the Mint, the Central Bank, the Treasury, and other financial institutions. There are three common types of currency systems: commodity money, commodity-based money, and fiat money.

Fiat money is currently the most common type of currency system in the world. For example, the US dollar is fiat money.

Types of Monetary System

1. Commodity money

It is made up of precious metals or other commodities of intrinsic value. That is, the currency system physically uses the goods in terms of currency. This form of money retains its value as it melts. For example, gold and silver coins have been commonly used as a form of money throughout history.

2. Commodity-based money

This derives its value from the product, but you don't have to deal with it on a regular basis. The notebook has no specific value, but can be exchanged for a backed product. For example, the US dollar was used to bring its value to gold. This was known as the gold standard.

3. Fiat money

In this currency system, currencies that are legal tender according to government laws, that is, currencies whose value is guaranteed by the government.

Financial System

Developing Countries – India is the world's fifth largest economy in terms of nominal GDP. India's financial system refers to all institutions, structures, and services that provide financial facilities to the public.

It enables the trading and transfer of funds in a secure way. Democratic India has an independent pillar of the financial system, especially in the areas of banking, capital markets, equity markets, insurance, liability, claims, trading and investment.

It is important for the creation of wealth and the economic development of the country.

Characteristics, importance, and function of the Indian financial system

There are five main components:

1. Financial institution

There are two main types of financial institutions.

a. Banking or deposit handling institution

b. Non-banking or non-depositing institution

These have three additional categories:

2. Financial assets

These objectives are to provide convenient trading of securities in the commercial and financial markets, based on the requirements of credit seekers.

These are goods or products sold in the financial markets. Financial assets include:

3. Financial services

Financial services are also included in them:

Banking Services: The functions that banks perform, such as providing loans, accepting debits, distributing credit or debit cards, opening accounts, and granting checks, are some of these services.

Insurance Services: These include services such as providing insurance, selling insurance, and brokerage transactions.

Investment Services: These services include oversight and management of investments, assets and deposits,

Forex Services: These include foreign currency exchange, foreign exchange, and foreign money transfers.

4. Financial market

These are the markets where bonds, stocks, money, investments and assets are traded and exchanged between buyers.

There are four main types of financial markets:

a. Capital market

b. Financial market

It has two main types:

a) organized money market

b) Unorganized money market

c. Forex market

d. Credit Market

5. Money

This is an important exchange that can be used to purchase goods and services. It also can act as a store useful. It is evenly accepted everywhere.

Conclusion

The above article on Indian financial system raises awareness about Indian financial system. It helps you prepare for a competitive exam.

Key Takeaways

The Central Bank is the most important banking institution in the banking structure of every country. It is the ‘apex’ (highest) banking institution and is rightly treated as the ‘Lender of the money market’. It guides and regular the activities of all the banks in the country. The Central Bank acts as an agent, banker and adviser to the government in economic and financial matters. Their main objective is to regulate currency and credit system and to ensure economic stability and growth in the country. Today almost all the countries of the world have their own Central Banks.

Monetary aggregates are the measures of money stock in a country.

Central banks measure money aggregates and present them in the form of end-of-month national currency stock series. In the U.S, monetary aggregates are conventionally labelled as M 0, M 1, M 2, and M 3

The Reserve Bank of India, which is the Central Bank of our country, was established on 1st April, 1935 under the RBI Act, 1934.

Definition:

According to Prof. R. P. Kent, Central Bank is “An institution charged with the responsibility of managing the expansion and contraction of the volume of money in the interest of the general public welfare”.

Functions of Central Bank: The functions are divided into two parts:

A) Monetary Function B) Non-Monetary Function

A) Monetary Function:

1) Monopoly of notes issue: The main function of the Central Bank is the issue of notes. Central Bank has been authorized to print and issue currency notes. No bank other than the Central Bank enjoys the right of note issue. As the Central Bank is the only authority of note issue, its notes enjoy a distinctive prestige. There is uniformity in the issue of notes and over-issue can avoid. Moreover, it creates confidence among people.

In India, the Reserve Bank of India acts as the Central Bank which enjoys the monopoly of note issue. It has been authorized to print and issue all currency notes except one-rupee notes and coins. The RBI adopts what is known as minimum reserve system to print notes. As per 1957 Reserve Bank of India (amendment) Act, the RBI keeps a minimum reserve of Rs. 200crores in gold and foreign securities. Out of this, Rs. 115 crores must be in gold and Rs. 85 crores in foreign securities. The notes issued in excess of Rs. 200 crores are backed by the government rupee securities.

2) Banker to the Government: It acts as the banker, advisor and agent of the government.

1) As a banker to the government: As a banker of the government, it carries out all banking requirements of the government. It accepts deposits and makes payments of all government workers. It transfers funds from one place to another or from one use to another use for the government. It collects taxes on behalf of the government and advances loans to the government. It manages public debts, interest on loans, repayments of loan from international organizations etc. Central Bank advises the governme1nt on monetary problems and implemented the monetary policy of the nation. In India the Reserve Bank of India performs all these functions. Since, its operation is spread all over India. The RBI has appointed the State Bank of India as its sole agent for transaction government business.

2) As an advisor to the Government: The central bank has complete knowledge about the functioning of the economy and can therefore advice the government on various economic and monetary matters. It advices the government on various financial matters such as framing the budget, controlling inflation, foreign exchange policy, managing fiscal deficit, Monetary policy, etc.

3) Bankers Bank: The Central Bank is the apex body of the banking system. It supervises co-ordinates and controls the operations and activities of the commercial banks. It is the legal tradition that all commercial banks should keep a certain proportion of the demand and time deposits with the Central Bank of the country. This proportion is called cash reserve ratio (CRR).

The Reserve Bank of India also rediscount bill and provides financial assistance to commercial banks. The RBI grants loans to the scheduled banks for a period 90days against eligible bills. The RBI has been empowered to control the activities of all commercial banks under Reserve Bank of India Act 1934 and Banking Regulation Act, 1949.

4) Custodian of Nation’s Foreign Exchange / Determination of Exchange rate:

All foreign exchange reserve of the country is kept by the Central Bank of the country. It enables the Central Bank to exercise control over the foreign exchange. All foreign exchange transaction is done through the Central Bank. The Reserve Bank of India maintains the stability of the rate of exchange, section 40 of the RBI with this function.

It is obligatory for the RBI to buy and sell currencies of the members of the IMF. The Foreign Exchange Regulation Act (FERA) passed in 1947 to give wide powered to RBI to exercise control over foreign exchange. Over the years the act has been amended many times and currently, it is known as Foreign Exchange & Management Act (FEMA).

5) Lender of the last resort: The Central Bank helps the commercial banks when they face a financial crisis. When all the sources are closed, commercial banks can rely (depend) upon the Central Bank as the last resort (option) for securing financial assistance. That is why the Central Bank is called the Lender of the last resort. Sometimes cash reserve of the commercial banks gets exhausted. During such situations, Commercial banks can approach the Central Bank to come to their rescue. The Reserve Bank of India provides the necessary funds and relieves from their burden.

6) Clearing house facility: Central Bank provides clearing facility for the smooth functioning of commercial bank. It is a fact that there are large numbers of commercial banks opening in the economy. Each bank will have claims and counter claims over other. This is not possible for all commercial bank to meet personally to settle their claims. Central Bank solves this problem smoothly by debiting and crediting each bank concerned.

B) Non-Monetary Function:

1) Control & supervisory function: The Central Bank of India also takes the responsibility of supervising the activities for all commercial banks. It issues licenses to banking companies. It can take direct action against the erring commercial banks. It can suspend the activities of such commercial banks or may refuse to renew the license. In India the RBI controls, supervises the functions of all commercial banks.

The Reserve Bank of India Act, 1934 & Banking Regulation Act, 1949 have given RBI the power of supervision and control over commercial and co-operative bank.

2) Promotional & Development function:

a) To promote banking habits: The Central Bank has been playing a more responsible role towards the economic development of our country. Its functions are not confirmed to control of money market alone. In India, RBI exercises its power over commercial banks and puts them under pressure to open branches in the rural sector. This has contributed a lot towards rural banking and to cultivate banking habits among the poor people.

b) Agricultural finance: As a significant step towards rural credit, the RBI created various agencies and institutions for weaker sections under the various schemes for rural development. The arrival of NABARD in India has created a history in the field of rural finance.

c) Industrial finance: Central Bank takes several steps to meet the long-term requirements of the industrial finance. The financial institutions like IFCA, SFCA, ICICI, LIC, IDBI, IRCI, SIOBI, etc. play a vital role in boosting the growth in industrial sector in India.

d) Export-Import finance: RBI played a responsible role in the establishment of the Export-Import Bank (EXIM Bank) to provide finance towards export and import activities. The EXIM Bank was establishing in January, 1982 to provide refinance to the commercial banks and financial institutions against their export-import financing activities.

e) Encouraging small savings: To provide opportunities of investment and better returns for small savers, the RBI played an active role in the establishment of UNIT TRUST OF INDIA in 1963.

Meaning:

A commercial bank is an institution that operates for profit. It accepts deposits from the general public and extends loans to the households, the firms and the Government. The essential characteristics of commercial banking include

(1) Acceptance of deposits from the public.

(2) For the purpose of lending or investment.

(3) Withdrawal by means of an instrument whether a cheque, draft, order, etc.

Definition:

According to Cairns Cross, “A bank is an institution which deals in money and credit.”

According to Sayers, “Banks are institutions whose debts are usually referred to as ‘bank deposits’ and commonly accepted in final settlement of other people debts.”

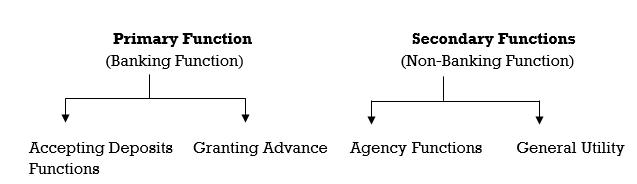

FUNCTIONS OF COMMERCIAL BANKS

Modern commercial banks perform a variety of functions and help the industrialists, businessmen and traders. They keep the wheels of commerce, trade and industry always revolving. Modern commercial banks perform mainly two types of functions i.e., primary or banking functions and secondary or subsidiary functions.

Functions of commercial bank

(A) Primary Functions:

The primary functions of a bank are also known as banking functions.

They are the main functions of a bank. They are as follows –

(I) Accepting Deposits: Accepting Deposits from the public is the most important function of a modern commercial bank offering various types of deposit accounts; banks mobilize the savings of the community. People who have surplus money deposit it with a bank for safety. The commercial banks protect the deposits and give interest on such deposits. There are four types of accounts:

(a) Saving Deposits Accounts: It is a deposit account which is operated by individuals for the purpose of saving a part of their income. Its main objective is to promote savings. It encourages saving habits among the salary earners and others. There is no restriction on the number and amount of deposits. But withdrawals are subject to certain restrictions. Banks pay a certain percentage of interest on this deposit. At present it is 4 % p.a. The money can be withdrawn either by cheque or withdrawal slip.

(b) Fixed Deposits Accounts: Fixed deposits are kept in a bank for fixed period varying from 30 days to several years. A certain sum of money is deposited for a fixed period. A higher rate of interest is paid. The rate may vary from bank-to-bank Withdrawals are not allowed before the maturity of period. In case of emergency, if the depositor wants to withdraw money before the maturity date, he will have to lose some interest. The depositor is given a fixed deposit receipt which he has to produce at the time of maturity. The deposit can be renewed for further period. Fixed deposit account is also known as time deposit.

(c) Current Deposits Accounts: These accounts are also known as demand deposits because the amount can be withdrawn on demand. This type of account is opened by businessmen who have a number of regular transactions with the bank, both deposits and withdrawals. There, is no restriction on the number and amount of deposits. There are also no restrictions on the withdrawals. Bank does not pay any rate of interest on such accounts. The bank provides overdraft facility to current account holder. Bank’s charge incidental commissions on such accounts. It facilitates the industrial progress.

(d) Recurring Deposits Account: Under this account, regular income earners deposit a certain amount of money at regular intervals for a certain period of time. For example, an individual can deposit, say Rs 500 every month for a certain period say, 2 years. Its main objective is to develop regular savings habits among the public. The period of deposit is minimum 6 months and maximum 10 years. The rate of interest is higher. At the end of the maturity period, the account holder can get substantial amount, which can be utilized for the purchase of consumer durables or some other investment such as land, machinery, etc.

(II) Granting Advances (Loans):

The second important function of a commercial bank is to extend loans and advances. The money which is received by banks by way of deposits is utilized for granting loans and advances to worthy borrowers. The profit earning capacity of a bank mainly depends upon the performance of the function. This function is also important in the context of economic development in general and development of trade, industry and commerce.

(a) Overdraft Facility: An overdraft facility is granted by the bank only to those persons who have their current accounts in the bank. To meet the temporary needs of the customer, the bank may permit the customer to overdraw the amount from the bank in excess of his balance. The bank may grant such advance on the personal security. The interest is charged only on the actual amount used. The overdraft is granted only occasionally and for short periods. A certain amount is sanctioned as overdrafts which can be withdrawn within a certain period of time say three months or so. It is sanctioned to traders, partnership firms and joint stock companies. The overdraft facility can be renewed from time to time.

(b) Cash Credit: It is a short-term credit given by the bank to any businessman to meet regular working capital needs. The bank opens a separate account in respect of cash credit. The borrower is allowed to draw from that account upto a certain ‘limit against a bond signed by securities or any other eligible securities. Interest is charged only on the actual amount withdrawn by the customer. It can be availed by current account holders as well as other businessmen. Most industrial concerns and business houses borrow money in this form.

(c) Loans: When a banker makes a lump-sum advance to the customers, it is called 'loan'. Interest is charged on the entire amount sanctioned irrespective of whether the complete amount is used or not by the customer. Loans are of various types i.e., Term loans, participation loans, personal loans, call loans, collateral loans etc.

a) Call Loans or Money at call: are loans repayable at short notice. They are called call loans, as they can be called back at any time. These loans are given to for a period of 7 to 15 days for investment in stock market. The rate of interest is the lowest.

b) Short term Loans: are provided by commercial bank for a period not more than two years. The rate of interest is higher. They are given to businessmen to satisfy their working capital requirement.

c) Medium term Loans: The loans are sanctioned for a period of two to five years period. The rate of interest charged for this type of loan is more than the short-term loans. Such loans are useful to industries to introduce innovations or for introduction of new method of production.

d) Long term Loans: Loans which are sanctioned for five years are known as long term loans. The rate of interest charged is higher than other loans. Such loans help businessmen to introduce permanent changes in the methods of production.

Discounting Bills of exchange: Another important function that the modern banks perform is the discounting of bills of exchange. Advances are made by discounting the bills of exchange. These advances are given for short periods only. When the holder of the bill is not in a position to wait till the maturity of the bill and requires the cash urgently, he sells the bill of exchange to the bank. The bank purchases the instrument at a discount. This type of business is very common in advanced countries.

(B) Secondary Functions:

Secondary functions are also known as non-banking functions or subsidiary functions or subsidiary functions. They are classified into two main categories

(a) Agency functions (b) General utility Functions

(A) Agency Functions: Bank also act as agents for their customers and in that capacity perform certain functions, which are known as agency functions. For these services, the bank charges certain commission from the customers. Some of the agency functions are as follows:

1) Collection: The commercial banks collect cheque, bills, draft interest, dividends on behalf of their customers and credit them into their accounts. This service is provided on the standing instructions from customers.

2) Payments: Banks also pay bills, insurance premium interest, loan installments, electricity bills, telephone bills, etc. on behalf of their customers as per their direction.

3) Purchase and Sale of Securities: Bank’s purchase or sell shares, bonds and securities of private companies on behalf of their clients.

4) Acts as Trustee: Banks acts as the trustee and the executor of the wills of their customers after their death.

5) E-Banking (Electronic Banking): A customer can operate his bank account through internet. Money can be transferred from one place to another for their customers. E-banking helps businessmen, traders, merchants in transacting business.

6) Dematerialization Account (De-mat Account): Some banks provide De-mat facility. De-mat account is useful to investors who deal in shares. The transactions related to buying and selling of shares are recorded in a separate De-mat account. Periodically statements regarding shares transactions are given to each investor.

B) General Utility Functions:

1) Safe Deposit Vault (Lockers): This facility is available to the general public to enable them to keep their valuables and securities like ornaments, jewels, documents, deeds, etc. There is a separate section in banks where lockers are provided in various sizes on payment of fixed rates.

2) Remittance of Funds: Banks remit money from one place to another or even from one country to another. Remittance of fund is done by telegraphic transfer, mail transfer, demand draft, etc.

3) Letter of credit: Commercial banks also issue letters of credit, to enable the traders to buy goods from foreign countries on credit. Through this letter of credit, the bank in one country authorizes another bank in foreign country to honour the draft or cheque of the person named in the document. The payment is limited to the amount shown in the letter and the amount is chargeable to the bank which issues the letter.

4) Referee: As a referee a bank authenticates the credit worthiness of its customers. This enables the customers to run their business smoothly and also obtain goods and services on credit.

5) Underwriter: Banks provide underwriting facility to the joint stock companies especially new business enterprises and also to the government in order to help them in raising funds. It guarantees the purchase of certain portion of shares if not sold in the market. Later they are free to sell these shares in the market whenever they want to do so. This is all done by the banks on a small commission from the company.

6) Dealings in Foreign Exchange: By keeping separate foreign exchange department, commercial banks offer services for converting one currency into another.

7) ATM facility (Automated Teller machine): Now-a-day banks also provide ATM facility to their customers. As a result, they can withdraw money at any time of the day, at their convenience, whenever they need it.

8) Collects statistics: The modern banks also collect statistics about money, banking, trade, commerce and publish them in form of pamphlets and handouts. This helps their customers in acquiring knowledge about the latest economic situation.

9) Travellers’ Cheques: Banks help customers by issuing internal or international travellers’ cheques. When people travel within the country or between countries traveller’s cheques are used as most convenient method of carrying funds.

MULTIPLE CREDIT CREATION (Credit creation by banks)

The banks are monetary institutions capable of expanding or contracting money through credit. In the words of Sayers, "Banks are not merely purveyors of money but also, in an important sense, manufacturers of money".

A bank can create money and multiply it too. It can convert a deposit of Rs. 1000 into Rs. 10,000 and Rs. 10,000 into 1, 00,000. No wonder, it looks like a magic. The process by which banks can multiply their deposits is called credit creation.

Though every bank can create credit on its own, multiple credit creation is possible when the entire banking system is involved in the process of credit creation.

Assumptions: The process of credit creation can be explained under the following assumptions:

(i) The bank should be prepared to lend on the basis of reserves. The required reserves are kept on the basis cash reserve ratio (CRR) fixed by the central bank. Let us suppose the cash reserve ratio is 10 percent. The remaining 90 percent would go into the process of credit creation.

(ii) The public should be willing to deposit their money in banks rather than hoarding.

(iii) There should be sufficient demand for bank loans.

(iv) People should accept the cheques in settlements of debts in place of cash.

(v) There are several banks operating in the economy.

Primary Deposits and Derivative Deposits:

It is important to learn the concepts of primary deposit and derivative deposit to understand the process of credit creation. Primary deposits are the original deposits held by people with the bank in the form of savings accounts, current accounts, fixed deposits etc. Suppose if Mr. P deposits Rs. 100 in his savings account, it becomes a primary deposit.

A banker knows by his experience that all the depositors do not withdraw all their deposits at the same time and diverts the major part of deposits into credit creation after keeping a part (say 10 percent) for meeting the requirements of cash reserve ratio.

Every one creates a deposit. Suppose a bank grants a loan of Rs. 90 to a borrower, he is supposed to maintain an account in which the loan is credited. Thus, the loan ultimately becomes a deposit. As this deposit is derived from primary deposit, it is called derivative deposit or secondary deposit. Thus, every loan creates a deposit.

Let us suppose bank X receives a primary deposit of Rs. 100 from a deposit holder. Bank X keeps cash reserves of 10 percent (i.e., Rs. 10) and lend the remaining amount Rs. 90 as a loan to Mr. A. Now the balance sheet of bank X appears as follows:

Balance Sheet of Bank X

Liabilities | Amount Rs. | Assets | Amount Rs. |

Deposits | 100 | Cash reserve | 10 |

|

| Loan to B | 90 |

| 100 |

| 100 |

Under double entry system, the amount Rs. 100 appears on both the sides. The deposit Rs. 100 is a liability to bank X since it is obliged to return the same to the deposit.

At the same time the cash reserves and loan are treated as assets of the bank and therefore they appear on the asset side.

Let us suppose Mr. A uses the loan Rs. 90 to pay off his creditor Mr. B by means of a cheque. Mr. B in turn deposits the cheque in his bank Y. As a result Rs. 90 becomes deposit for bank Y.

Bank Y will keep 10 percent of the deposit as cash reserves and the remaining amount is granted as a loan to Mr. C. Now the balance sheet of bank Y will appear as follows.

Balance Sheet of Bank Y

Liabilities | Amount Rs. | Assets | Amount Rs. |

Deposits | 90 | Cash reserve | 09 |

|

| Loan to C | 81 |

| 90 |

| 90 |

Mr. C who receives a loan of Rs. 90 will issue a cheque of Rs.90 to his creditor Mr. D. who in turn will deposit the cheque in his bank Z. Bank Z will follow the same procedure and expansion of credit will take place to extent of Rs. 72.90 by bank Z.

Now the balance sheet of bank Z will appear as follows:

Balance Sheet of Bank Z

Liabilities | Amount Rs. | Assets | Amount Rs. |

Deposits | 81 | Cash reserve | 8.10 |

|

| Loan to C | 72.90 |

| 81 |

| 81 |

The system of credit expansion continues in several banks till the original deposit Rs. 100 gets exhausted. Thus, the original deposit Rs.100 becomes additional deposits of Rs. 90,81,72.90,65.61 etc. If all these additional deposits are added, it will lend to a total of Rs.1000. The final position appears as follows:

The process of Multi Credit Expansion:

Banks | Primary Deposits (Rs.) | Cash Reserve (Rs.) | Loans (Rs.) |

X | 100 | 10 | 90 |

Y | 90 | 9 | 81 |

Z | 81 | 8.10 | 72.90 |

Total | 271 | 27.10 | 243.90 |

Key Takeaways:

Capital Market

Capital Markets are intended for long-term or backed trading. These markets lead a wealth of savers to those who can use them productively in the long run, such as when businesses and governments make long-term investments. A capital market is defined as a market that is funded over a period of one year or more. It is part of the financial system involved in raising funds by dealing with equities, fixed income and other long-term investments.

Debt Market

What is the Debt market?

This is a market for trading (that is, buying and selling) fixed income products. Bonds can be securities issued by central and state governments, local governments, and governments. Depends on an institution or a private organization such as a financial institution, bank or company. What are Bonds / Debts? Simply put, a bond / debt can be defined as a loan for which the investor is the lender. The bond issuer pays the investor's interest (at a given rate and schedule) in return for raising funds. The maturity date is the date on which the issuer must repay the principal to the investor. The bond market (bond market or credit market) is where participants can buy and sell new issuances, or debts, called markets. This is usually in the form of notes, invoices, and so on. The bond market is the market where debt products are traded. Debt products are assets that require a fixed payment to the holder, usually with interest. Examples of debt products include fixed income (government or corporate) and mortgages.

Key Takeaways:

Fiscal policy:

Meaning:

Fiscal policy is associated with increased government revenues and the generation of government spending. To generate income and bear spending, governments formulate policies called budgetary or fiscal policies. Therefore, fiscal policy is related to government spending and government revenue. Fiscal policy determines the size and pattern of government-to-economy and economy-to-government spending flows. So, broadly speaking, fiscal policy is

"That part of national economic policy, which is mainly related to the balance of the central government."

In other words, fiscal policy refers to government policy on taxation, public spending, and public borrowing.

Main objectives of India's fiscal policy

1. Effectively mobilize resources to ensure development:

An important purpose of fiscal policy is to ensure rapid economic growth and development. This goal of economic growth and development can be achieved by mobilizing resources in the right way. India's central and state governments have used fiscal policy to mobilize resources. Financial resources can be mobilized by: -

2. Taxation:

Through effective fiscal policy, the government aims to mobilize resources with both direct and indirect taxes.

3. Public savings:

Resources can be mobilized through public savings by reducing government spending and increasing the surplus of businesses in the public sector.

4. Personal savings:

Through effective financial measures, such as tax incentives, governments can source resources from the private sector and households. Financial resources can be mobilized through government bonds, government loans by issuing government bonds, loans from domestic and foreign stakeholders, and deficit finance.

5. Efficient allocation of limited financial resources:

Central and state governments have attempted to efficiently allocate available resources. These resources will be allocated to development activities, including spending on railroads and infrastructure. Non-development activities, on the other hand, include spending on defence, interest payments, subsidies and more. Socially desirable service. Therefore, India's fiscal policy is designed in a way that encourages the production of desirable commodities and discourages socially undesirable commodities.

6. Reducing income and wealth inequality:

Fiscal policy aims to achieve equity or social justice by reducing income inequality between different sectors of society. Direct taxes, such as income tax, are levied more on the wealthy than on the low-income. Indirect taxes are also high for semi-luxury and luxury items that are mainly consumed by the upper middle class and upper class. The government is investing a significant portion of its tax revenues in implementing poverty alleviation programs to improve the condition of the poor in society.

7. Price stability and inflation control:

One of the main goals of fiscal policy is to curb inflation and stabilize prices. This requires monetary action, and the government is constantly aiming to curb inflation by reducing budget deficits, introducing tax-saving schemes, and productive use of financial resources.

8. Job creation:

Responsible governments make every possible effort to increase employment in the country through effective fiscal measures. Investing in infrastructure has resulted in direct and indirect employment. Lowering taxes and tariffs on small industry (SSI) units encourages more investment and, as a result, creates more jobs. The Government of India is implementing various rural employment programs to solve problems in rural areas. Similarly, the self-employed system is adopted to provide employment to technically qualified people in urban areas.

9. Balanced regional development:

Another main purpose of fiscal policy is to bring about balanced regional development. From the government, there are various incentives to launch projects in the underdeveloped areas, such as cash subsidies, tax concessions, obligations in the form of tax exemptions, and loans at concession rates.

10. Reduce the balance of payments deficit:

Fiscal policy seeks to encourage exports through financial measures such as income tax exemption on export income, central customs exemption, sales tax and octroi exemption. Forex is also protected by providing financial benefits to import substitutions, such as imposing tariffs on industries and imported goods.

Foreign exchange obtained from exports and saved by import substitution helps solve the balance of payments problem. In this way, balance of payments disadvantages can be corrected by imposing tariffs on imports or subsidizing exports.

There are three sources from where the government makes money. The first two are sources of income and the last one is the sale of debt and capital assets.

1. Income or tax revenue:

This is a tax that the government collects in the form of corporate tax, personal income tax, customs duty, excise tax, etc.

2. Tax-exempt income:

These include interest on bonds held, dividends from PSUs, and grants. They are a source of income, meaning they do not have to be repaid and are less than tax revenue.

3. Receipt of capital:

These are government loans such as market loans, short-term loans, external commercial receipts, etc.

Monetary Policy

Monetary policy concerns the steps taken to regulate the money supply, costs, and credit availability in the economy. It also deals with the distribution of credit between users and between users, and deals with both bank lending and borrowing rates. In developed countries, monetary policy has been effectively used as an anti-circular policy to overcome depression and inflation. Various means of monetary policy are changes in the supply of currencies, fluctuations in banking and other interest rates, open market operations, selective credit management, and fluctuations in reserve requirements.

In India, following the recommendations of the Urgit Patel Commission report, the Reserve Bank has launched a disinflationary "glide path" targeting CPI inflation of less than 8% and CPI inflation of less than 6% by January 2015. Was officially announced. The agreement on the monetary policy framework between the Government and the Reserve Bank of India dated February 20, 2015 is a combination of the consumer price index (CPI-C) – in the medium term, (a) until January 2016. Less than 6%, (b) 4% (+/-) 2% after fiscal year 2016-17. Price stability is a necessary (if not sufficient) prerequisite for sustainable growth and financial stability. The relative emphasis assigned to price stability and growth goals in the implementation of monetary policy changes from time to time in response to the evolving macroeconomic environment. Financial stability is important for the smooth transmission of monetary policy, and therefore regulatory and monetary market policies, including macro-health policies, are often published with monetary policy under Part B of the Monetary Policy Statement14.

There are several direct and indirect means used to implement monetary policy.

Bank Rate: the speed at which the Federal Reserve Bank is prepared to get or redistribute bills of exchange or other cash equivalent. This rate is adjusted to match the MSF rate, so if the MSF rate changes because the policy repo rate changes, it'll change automatically.

Fiscal Policy tool Impact on Economy GOVERNMENT SPENDING Government spending includes the purchase of goods and services — for example, a fleet of new cars for government employees or missiles for national defence. Government spending is a fiscal policy tool because it has the power to raise or lower real GDP. By adjusting government spending, the government can influence economic output. In addition to the primary effect of government spending on the economy, this spending multiplies through the economy as it affects businesses who sell the goods and services bought by the government. Consumers then go on to spend the pay checks they earn from those businesses, stimulating real GDP even more. For example, when Larry's Limos receives a large order for more government vehicles, his sales increase, and he hires more employees who earn a pay check from the company. Once they cash their pay check, they spend this money on goods and services, and the effect of a single increase in government spending now leads to a much greater result — an effect that economists call the multiplier effect.

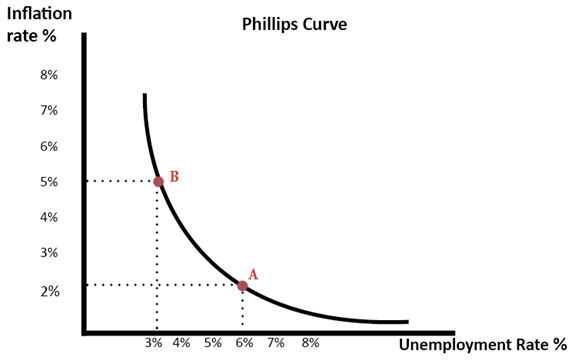

The Phillips curve is A. W. An economic concept developed by Philips, it states that inflation and unemployment are in a stable and opposite relationship. The theory is that inflation will occur with economic growth, which in turn will lead to more jobs and less unemployment. However, the original concept has been somewhat empirically disproved due to stagflation in the 1970s, when both inflation and unemployment were high.

Important point

The Phillips curve shows that inflation and unemployment are inversely related. Higher inflation leads to lower unemployment and vice versa. 3

The Phillips curve, a concept used to guide macroeconomic policy in the 20th century, was questioned by stagflation in the 1970s2.

Understanding the Phillips curve in the light of consumer and worker expectations shows that the relationship between inflation and unemployment may not hold in the long or short term. 2

Understand the Phillips curve

The concept behind the Phillips curve shows that changes in unemployment within the economy have a predictable impact on inflation. The inverse relationship between unemployment and inflation is represented by a downward concave curve that shows inflation on the Y-axis and unemployment on the X-axis. When inflation goes up, unemployment goes down, and vice versa. Alternatively, focusing on reducing unemployment will increase inflation and vice versa.

The belief in the 1960s was that fiscal stimulus would increase aggregate demand and begin to have the following effects: Labor demand will increase, then the pool of unemployed will decrease, and companies will raise wages to compete and attract smaller talent pools. Wage costs of businesses rise, and businesses pass those costs on to consumers in the form of rising prices.

With this belief system, many governments have adopted a "stop-go" strategy to set a target inflation rate, using fiscal and monetary policy to expand or contract the economy and achieve the target rate. However, the stable trade-off between inflation and unemployment collapsed in the 1970s with the rise of stagflation, questioning the validity of the Phillips curve.

Key Takeaways:

References:

1. Mankiw Gregory N. (2002), Principles of Economics, Thompson Asia

2. V. Mote, S. Paul, G. Gupta(2004), Managerial Economics, Tata McGraw Hill

3. Misra, S.K. and Puri (2009), Indian Economy, Himalaya

4. Pareek Saroj (2003), Textbook of Business Economics, Sunrise Publishers

5. M Chakravarty, Estimating, Costing Specifications & Valuation