Unit - 4

Project Commissioning

Profit planning is the set of actions taken to achieve a targeted profit level. These actions involve the development of an interlocking set of budgets that roll up into a master budget. After planning profit successfully, an organization needs to control profit. Profit control involves measuring the gap between the estimated level and actual level of profit achieved by an organization. If there is any deviation, the necessary actions are taken by the organization.

Profit planning is a vital part of any business plan structure for a small or medium business. The goals of small business owners include ensuring that the business makes profits year-over-year, and that it is sustained over a period of time for growth. The business plan includes a forecast that tries to anticipate the business growth and determine the revenue that could be generated in that particular year. Here’s a look at the basics of profit planning for your business:

1. Evaluate your business operations: Profit planning and forecasting enables a comparison between projected costs and spends, and the actual costs that your business is incurring. This can help your team decide on improving cost efficiency and closing up the gaps. It also enables better decision-making like which resources to invest in or cut costs from. Proper profit planning will ensure that the business does not spend more than is necessary or end up not investing enough in resources that are required.

2. Forecast marketing strategies: Marketing is one of the highest areas of expense for small businesses because marketing efforts are directly related to getting leads for the business. The company’s marketing efforts are categorized into various areas, and each of these need to be evaluated for the employees and resources required to fulfill them. If the marketing costs are not estimated properly, it could affect profits, and the company will unnecessarily spend more on marketing. Profit planning helps avoid this scenario.

3. Anticipate financial planning: Planning funds to allocate across departments and procedures needs to begin well in advance. Profit planning anticipates the company’s financial ability to make the maximum use of resources, with efficiency in costs and finally high profitmaking potential.

4. Carve out hiring requirements: After the entire financial projection is made and the business plan structure is ready, the company needs to evaluate if they have enough staff to carry out all the operations. Profit planning also estimates the number of personnel required, vis-à-vis the work they generate which has a bearing on the company’s revenue and profits. Planning costs for hiring requirements is also an important part of this. Profit planning is a crucial business activity that prepares the company for the coming year, helps spread out company resources efficiently and motivates the major stakeholders of the company to strive towards year-on-year growth. Profit planning needs to be an activity that is carried out every year. After the end of the year, there also needs to be an audit that compares the projection to the actual profits. This can guarantee that the company is prepared and has a well-thought-out strategy to improve every time and maximize profits and performance

Net Profit

Net Profit is a measure of profitability of a company usually referred to as “the bottom line of the income statement. It refers to the profit that remains after deducting expenses from gross profit. These expenses include all operating expenses, non-operating expenses, taxes and preferred stock dividends of a business. Therefore, net profit is an important component of trading and profit and loss account of a business. The trading account represents the results from the manufacturing activities of a business. That is, the activities that involve manufacturing, purchasing and the ones that help in bringing goods to the point of sale. Thus, purchases are one of the constituents of such activities. The other constituents of the activities directly related to the production are direct expenses. These expenses include carriage inwards, freight inwards, wages, factory lighting, coal, water and fuel, royalty on production, etc

On the other hand, the profit and loss account represent the Gross Profit on the credit side. The operating profit is calculated to calculate Net Profit. Then, operating Profit is ascertained as the difference between Gross Profit and sum of following expenses:

Selling and Marketing Expenses

General and Administrative Expenses

Foreign Exchange Losses/Gains

Other Operating Income

Marginal cost

Marginal cost is the cost of one additional unit of output. The concept is used to determine the optimum production quantity for a company, where it costs the least amount to produce additional units. If a company operates within this "sweet spot," it can maximize its profits. The term marginal cost implies the additional cost involved in producing an extra unit of output, which can be reckoned by total variable cost assigned to one unit. It can be calculated as:

Marginal Cost = Direct Material + Direct Labor + Direct Expenses + Variable Overheads

Characteristics

Classification into Fixed and Variable Cost: Costs are bifurcated, on the basis of variability into fixed cost and variable costs. In the same way, semi variable cost is separated.

Valuation of Stock: While valuing the finished goods and work in progress, only variable cost is taken into account. However, the variable selling and distribution overheads are not included in the valuation of inventory.

Determination of Price: The prices are determined on the basis of marginal cost and marginal contribution.

Profitability: The ascertainment of departmental and product’s profitability is based on the contribution margin.

Facts Concerning Marginal Costing

Cost Ascertainment: The basis for ascertaining cost in marginal costing is the nature of cost, which gives an idea of the cost behavior, that has a great impact on the profitability of the firm.

Special technique: It is not a unique method of costing, like contract costing, process costing, batch costing. But, marginal costing is a different type of technique, used by the managers for the purpose of decision making. It provides a basis for understanding cost data so as to gauge the profitability of various products, processes and cost centers.

Decision Making: It has a great role to play, in the field of decision making, as the changes in the level of activity pose a serious problem to the management of the undertaking.

Distinction between Marginal Costing and Absorption Costing

Marginal costing is a method where the variable costs are considered as the product cost and the fixed costs are considered as the costs of the period.

Absorption costing, on the other hand, is a method that considers both fixed costs and variable costs as product costs. This costing method is important particularly for reporting purposes. Reporting purpose includes both financial reporting and tax

The key differences between them –

Marginal costing doesn’t take fixed costs into account under product costing or inventory valuation. Absorption costing, on the other hand, takes both fixed costs and variable costs into account.

Marginal costing can be classified as fixed costs and variable costs. Absorption costing can be classified as production, distribution, and selling & administration.

The purpose of marginal costing is to show forth the contribution of the product cost. The purpose of absorption costing is to provide a fair and an accurate picture of the profits.

Marginal costing can be expressed as contribution per unit. Absorption costing can be expressed as net profit per unit.

Marginal costing is a method of costing and it isn’t a conventional way of looking at costing method. Absorption costing, on the other hand, is used for financial and tax reporting and it is the most conventional method of costing.

Basis for comparison | Marginal costing | Absorption costing |

Meaning | Marginal costing is a technique that assumes only variable costs as product costs. | Absorption costing is a technique that assumes both fixed costs and variables costs as product costs. |

What it’s all about | Variable cost is considered as product cost and fixed cost is assumed as cost for the period. | Both fixed cost and variable cost are considered in product cost |

Nature of overheads | Fixed costs and variable costs. | Overheads in the case of absorption costing are quite different – production, distribution, and selling & administration |

How profit is calculated? | By using profit volume ratio (P/V ratio) | Fixed costs are considered in product costs; that’s why profit gets reduced. |

Determines | The cost of the next time | The cost of each unit |

Opening and closing stock | Since the emphasis is on the next unit, change in opening/closing stocks doesn’t affect the cost per unit. | Since the emphasis is on each unit, change in opening/closing stocks affects the cost per unit. |

Most important aspects | Contribution per unit. | Net profit per unit |

Purpose | To show forth the emphasis of contribution in product cost. | To show forth the accuracy and fair treatment of product cost. |

How it is presented | It is presented by outlining the total contribution. | It is presented in the most conventional way for the purpose of financial and tax reporting. |

Break-even Analysis, Cost-Volume-Profit Analysis

Breakeven analysis

Breakeven is a financial tool which helps the company to determine after which stage they will be profitable. Breakeven point is where the company neither make money nor losses money, but covers all the cost incurred.

Breakeven is useful in studying the relationship between cost and revenue. It is a point at which total cost and total revenue are equal. It is no gain no loss situation, though opportunity costs have been paid and capital has received the risk-adjusted, expected return.

Components of breakeven analysis

Fixed costs

Fixed costs are also called overhead costs. These fixed costs occur after taking the decision to start an economic activity and these costs are directly related to the level of production, but not the quantity of production. Fixed costs include interest, taxes, salaries, rent, depreciation costs, labour costs, energy costs etc. Irrespective of the production these costs are fixed in nature. In case of no production also the costs must be incurred.

Variable costs

Variable costs are directly proportional to the quantity of production. The costs will increase or decrease in direct relation to the production volume. These costs include cost of raw material, packaging cost, fuel and other costs that are directly related to the production.

Formula

Break even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

Where:

- Fixed costs are costs that do not change with varying output (e.g., salary, rent, building machinery).

- Sales price per unit is the selling price (unit selling price) per unit.

- Variable cost per unit is the variable costs incurred to create a unit.

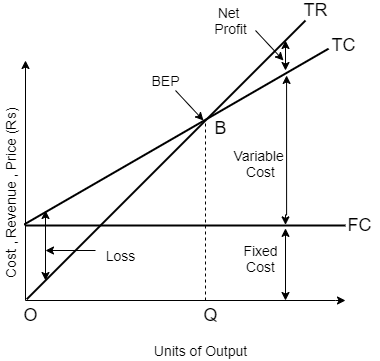

It is also known as “cost –volume-profit analysis”. In the above figure, TR is total revenue curve is straight line from the origin, as every unit of output contributes to revenue. TC is total cost curve is fixed and variable cost which starts from vertical axis and rises linearly. B is the breakeven point at OQ level of output where all the cost has incurred.

Benefits of Break-even analysis

- Catch missing expenses: In a new business, it happens that few expenses are missed. With the help of break-even analysis, to reach break even point all the financial commitments are reviewed.

- Set revenue targets: Once the break-even analysis is complete, the company knows how much to be sold to be profitable. This will help to set more concrete sales goals.

- Make smarter decisions: break even analysis helps in making good decision based on the facts to become successful

- Better Pricing: Finding the break-even point will help in pricing the products better. This tool is highly used for providing the best price of a product that can lead to maximum profit without increasing the existing price.

- Cover fixed costs: Doing a break-even analysis helps in covering all fixed cost incurred.

For an example:

Variable costs per unit: Rs. 400

Sale price per unit: Rs. 600

Desired profits: Rs. 4,00,000

Total fixed costs: Rs. 10,00,000

Solution

Break even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

= 10,00,000/ (600 – 400)

Break Even Point = Rs. 10,00,000/ Rs. 200 = 5000 units

Next, this number of units can be shown in rupees by multiplying the 5,000 units with the selling price of Rs. 600 per unit.

We get Break Even Sales at 5000 units x Rs. 600 = Rs. 30,00,000.

Cost volume analysis

The cost-volume-profit (CVP) analysis helps management in finding out the relationship of costs and revenues to profit. The aim of an undertaking is to earn profit. Profit depends upon a large number of factors, the most important of which are the cost of manufacture and the volume of sales effected. Both these factors are interdependent-volume of sales depends upon the volume production, which in turn is related to costs. Cost, again, is the resultant of the operation of a number of varying factors. Such factors affecting cost are:

(i) Volume of production;

(ii) Product-mix;

(iii) Internal efficiency;

(iv) Methods of production; and

(v) Size of plant; etc.

Analysis of cost-volume-profit involves consideration of the interplay of the following factors:

(i) Volume of sales;

(ii) Selling price;

(iii) Product mix of sales;

(iv) Variable costs per unit; and

(v) Total fixed costs.

Uses

1. C.V.P. Analysis helps in forecasting costs and profits as a result of change in volume.

2. It helps fixing a sales volume level to earn or cover a given revenue, return on capital employed, or rate of dividend.

3. It assists determination of effect of change in volume due to plant expansion or acceptance of an order, with or without increase in costs or in other words a quantum of profit to be obtained can be determined with change in volume of sales.

4. C.V.P. Analysis helps in determining relative profitability of each product, line, project or profit plan.

5. Through cost volume-profit analysis inter-firm comparison of profitability can be done intelligently.

6. It helps in determining cash requirements at a desired volume of output, with the help of cash breakeven charts.

7. Break-even analysis emphasizes the importance of capacity utilization for achieving economy.

8. From break-even analysis during severe recession, the comparative effects of a shut down or continued operation at a loss is indicated.

9. The effect on total cost of a change in the fixed over-head is more clearly demonstrated through break-even analysis and cost- volume-profit charts.

10. The conditions of a business such as profit potentialities, requirements of capital, financial stability and incidence of fixed and variable costs can be gauged from a study of the position of the breakeven point and the angle of incidence in the break-even chart.

Key takeaways

- The cost-volume-profit (CVP) analysis helps management in finding out the relationship of costs and revenues to profit

- Marginal costing is a method where the variable costs are considered as the product cost and the fixed costs are considered as the costs of the period.

Various decision-making problems

1. Lack of support from top management: Many a times, the cost accounting system is introduced without the support of the top management in all the functional areas. Even managing director or chairman often introduces such system without consulting the departmental heads. This results in opposition from the various managers as they consider it is an interference on their activities.

2. Resistance from the existing staff: The existing financial accounting staff may offer resistance to the cost accounting system because of a feeling of their being declared redundant under the new system.

3. Non-cooperation at other levels of organization: The foreman, supervisors and other staff may also resent the additional paper work and may not co-operate in providing the basic data which is absolutely essential for the success of the system.

4. Shortage of trained staff: There may be shortage of cost accountants to handle the work of cost analysis, cost control and cost reduction. The work of the costing department cannot be handled with the availability of trained staff.

5. Heavy costs: The costing system will involve heavy costs unless it has been suitably designed to suit specific requirements.

Standard Costing and Variance Analysis

Standard costing

Meaning of Standard Costing:

It is a method of costing by which standard costs are employed. According to ICMA, London, Standard Costing is ―the preparation and use of standard costs, their comparison with actual cost and the analysis of variances to their causes and points of incidence‖.

According to Wheldon, it is a method of ascertaining the costs whereby statistics are prepared to show:

(i) The standard cost;

(ii) The actual cost;

(iii) The difference between these costs which is termed the variance.

W. Bigg expresses:

Standard Costing discloses the cost of deviations from standards and clarifies these as to their causes, so that management is immediately informed of the sphere of operations in which remedial action is necessary.

Thus, from the above, it becomes clear that Standard Costing involves:

(i) Ascertainment and use of Standard Costs;

(ii) Recording the actual costs;

(iii) Comparison of actual costs with standard costs in order to find out the variance;

(iv) Analysis of variance; and

(v) After analyzing the variance, appropriate action may be taken where necessary

Features of standard costing

- Determination of standard costs of various elements of costs such as standard cost of direct material, direct labour and various overheads.

- Comparison of standard costs and actual costs of production.

- Finding differences (variances) between actual costs and standard costs. These variances may be favorable as well as unfavorable or adverse.

- Analyzing the variances to find the cause of variances.

- Remedial steps are suggested so that unfavorable variances may not be repeated in the future.

- Reporting these variances to top management for remedial action.

Advantages of Standard Costing:

The following advantages may be derived from Standard Costing:

(i) Standard Costing serves as a guide to the management in several management functions while formulating prices and production policies etc.

(ii) More effective cost control is possible under standard costing if the same is reviewed and analyzed at regular intervals for improvements and immediate action can be taken if deviations from standards are found out which, ultimately, leads to cost reduction.

(iii) Analysis of variance and its measurement helps to detect inefficiencies and mistakes which enable the management to investigate the reasons.

(iv) Since standard costs are predetermined costs, they are very useful for planning and budgeting. It also helps to estimate the effect of changes in Cost-Price-Volume relationship which also helps the management for decision-making in future.

(v) As standard is fixed for each product, its components, materials, process operation etc. it improves the overall production efficiency which also ultimately reduces cost and thereby increases profit.

(vi) Once the Standard Costing System is implemented it will lead to saving cost since most of the costing work can be eliminated.

(vii) Delegation of authority and responsibility becomes effective by setting up standards for each cost centre as the supervisors or executives of each cost centre will know the standard which they have to maintain.

(viii) This system also helps to prepare Profit and Loss Account promptly for short period in order to know the trend of the business which helps the management to take decisions promptly.

(ix) Standard costing also is used for inventory valuation purposes. Stock can be valued at standard cost which can reduce the fluctuation of profit for different methods of valuation for the same.

(x) Efficiency of labour is promoted.

(xi) This system creates cost-consciousness among all employees, executives and top management which increase efficiency and productivity as well.

Variance analysis

The primary object of standard costing is to reveal the difference between actual cost and standard cost. A ‘variance’ in standard costing refers to the divergence of actual cost from standard cost. Variances of different cost items provide the key to cost control. They indicate whether and to what extent standards set have been achieved. This enables management to correct adverse tendencies.

After standard costs have been established, the next step is to ascertain the actual cost under each element and compare them with the standard cost. The difference between these two is termed as cost variance. Cost variance is the difference between a standard cost and the comparable actual cost incurred during a given period.

Variance analysis can be defined as “the analysis of performance by means of variances”. It is the process of computing the amount of and isolating the cause of variances between actual costs and standard costs.

Variance analysis involves:

(a) Computation of individual variances, and

(b) Determination of the cause(s) of each variance.

Actual cost which is higher than the standard costs would be a sign of inefficiency and the difference would be termed as unfavourable or adverse. A variance that reduces profit is adverse or unfavourable. A variance that increases profit is favourable. Variance are computed under each element of cost for which standards have been established. Each variance is analyzed to ascertain the causes so that the management can exercise proper control. The cause is affixed to the variance, for example, materials price variance will show that the variance arose due to change in the price of materials. Some of the variances are controllable while others are not. The purpose of such classification is that proper emphasis can be placed on the controllable variance. This follows the principle of management by exception.

Variances occurring in a period may be compared with variances on the same account expressed as a percentage of the standard costs and compared with the percentage for the previous month. Comparison may be made between the standard and actual or between basic standard and current standard.

As already stated, the origin and causes of the variances need to be traced by analyzing the total variances into their components parts in order to determine and isolate the causes giving rise to each variance.

Equal emphasis should be laid on favourable and unfavourable variances. An unfavourable variance points out the inefficiency in use or waste of materials, labour, and resources. A favourable variance may be due to improvement in efficiency or production of substandard products or an incorrect standard. An unfavourable variance may be off-set by a favourable variance; hence the need for analysis and appropriate action.

A detailed probe into the variances, particularly the controllable variance, helps the management to ascertain:

(a) The amount of variance;

(b)Its occurrence;

(c) The factors responsible for it;

(d) The executive responsible for the variance;

(e) Corrective action which should be taken to obviate or reduce the variance.

Favourable and Unfavourable Variance: If the actual cost is less than standard cost, the difference is known as a favourable variance, credit variance or positive variance denoted by (F) or Cr. - it increases the profit. On the other hand, if actual cost exceeds, standard costs, the divergence is known as an unfavourable variance, debit variance, negative variance or adverse variance denoted by (A) or Dr. - it reduces the profit.

Controllable and Uncontrollable Variance: When the variance with respect to any cost item reflects the degree of efficiency of an individual or department, i.e., a particular individual or departmental head is responsible for the variance, the variance is known as a controllable variance. Obviously, such a variance is amenable to control by suitable action. An uncontrollable variance is one which is not amenable to control by individual or departmental action. Such a variance is caused by external factors like change in market conditions, fluctuations in demand and supply, etc. No particular individual within the organization can be held responsible for it.

When variances are reported, attention of the management is particularly drawn towards controllable variances. If a variance has been caused by multiple factors, the part of cost variance relevant to each factor should be determined.

Revision Variance: This is amount by which a budget is revised but which is not incorporated in the standard cost rate as a matter of policy. The standard costs may be affected by wage rate changes after wage accords, fiscal policy etc. The standard costs are not disturbed to account for these uncontrollable factors and to avoid the amount of labour and cost involved in revision, the basic standard costs are allowed to stand. It is essential to isolate the variance arising out of non-revision in order to analyses the other variances correctly.

Method Variance: It is the difference between the standard cost of the product manufactured or operation performed by the normal methods and the cost of operation by alternative method. Standards usually take into account the best method applicable, and any deviation will result in an unfavourable variance. Hence such deviations should be as few as possible.

Key takeaways

- Standard Costing discloses the cost of deviations from standards and clarifies these as to their causes, so that management is immediately informed of the sphere of operations in which remedial action is necessary.

- A ‘variance’ in standard costing refers to the divergence of actual cost from standard cost.

Pricing strategies: Pareto Analysis. Target costing, Life Cycle Costing

Pricing strategies: Pareto Analysis.

Pareto analysis is a decision-making tool used to compare and fix problems strategically. It uses the Pareto principle, which is also known as the 80/20 rule – named after Italian economist Vilfredo Pareto. He found that many phenomena or trends follow the 80/20 rule.

For example, in Pareto’s first works, he found that 80% of income in Italy went to 20% of the population. The Pareto principle can be seen all around the world in many different settings, within businesses, and beyond.

For example:

• 80% of bus delays stem from 20% of the possible causes of delay.

• 80% of service complaints arise from 20% of the services you offer.

• 80% of software crashes come from 20% of the potential computer virus types.

• 20% of your products amount to 80% of your revenues.

The 80/20 rule can be used to strategically select the problems in a company to fix that will result in the most impact. It can help stimulate creative thought and organized thinking around business innovation or problem-solving. One important note is that the 80/20 rule is purely a convenient rule of thumb, not an exact ratio or law.

Steps to Create a Pareto Diagram (80/20 Rule Diagram)

1. Identify a list of problems

Ideally, the list is gathered through feedback from employees, clients, or customers. Common examples include anonymous complaint/feedback forms, customer surveys, or employee organizational recommendations.

2. Identify the cause of each problem

Why did the problem occur? Make sure to think about the root cause, which might be hidden under the surface.

3. Score each problem

Assign a number to each problem based on the negative impact associated with it. The scoring system will depend on the type of problem trying to be solved. For example, for a cellular company, did a customer complaint make them leave the carrier, change their plan (negatively), or not change anything?

4. Group the problems together

Group all of the similar problems together and calculate the collective scores. The problem with the highest score will most likely be the one you should try to resolve first and provide the highest return.

Benefits of Pareto Analysis

Pareto analysis offers several benefits, depending on what specific type of project it is being used for. It helps identify problems and prioritize task completion.

Pareto analysis can help improve efficiency, profitability, and much more. Ultimately, it optimizes the overall organization’s performance by coordinating the highest return activities to pursue.

Limitations of Pareto Analysis

Like all business analysis techniques, Pareto analysis comes with limitations. The most prevalent is the ease of overlooking small complications during the analysis, which can add up over time. Also, it does not factor in the severity of a defect or problem, only the quantity.

It is essential to use other types of research to make the most educated decision in problem-solving. Alternative types of problem-solving analytical tools that can be used in parallel to Pareto analysis include hazard analysis, fault tree analysis, and functional failure mode and effect analysis.

Target costing, Life Cycle Costing

Target costing

Target costing is a cost management technique. Target cost is the difference between target sales minus target margin. It is, thus, the difference between estimated selling price of a proposed product with specified functionality and quality and the target margin.

Target costing is a pricing method used by firms. It is defined as “a cost management tool for reducing the overall cost of a product over its entire life-cycle with the help of production, engineering, research and design”.

“Target costing is a structural approach to determine the cost at which a proposed product with specified function and quality must be produced, to generate a desired level of profitability at its anticipated selling price.”

Target costing is a cost management technique which is very much helpful to any organization in an increasingly competitive situation. It is helpful in reducing the product life cycle cost also.

In the context of pricing in competitive world, it is always used to reduce cost through its continuous improvements and replacement of technologies and processes. Generally, cost of any product is calculated on the analysis of the best structure of the leading competitor in the country.

On the basis of market price, the basis of target cost is fixed. A target price is the estimated price of a product, which shall be payable by a potential customer. This estimate is based on the understanding of customer. Target price can be found out by deducting target income per unit from its target price.

Thus, Target cost per unit = Target Price – Target operating income per unit.

Target income is that income which a company aims to earn. Target cost per unit is the estimated long run cost of a product and the company tries to achieve its target income, when the product is sold out on target price. In target cost calculations, all future fixed and variable cost are included, because in long run, the company must cover all its costs.

Features

1. It is viewed as an integral part of the design and introduction of new products.

2. A target selling price is determined using various sales forecasting techniques.

3. The target selling price is the establishment of target production volumes, given the relationship between price and volume.

4. Target costing process is to determine, cost reduction targets.

5. A fair degree of judgement is needed where the allowable cost and the target cost differ.

Target Costing Phases – Planning, Development and Production

Target costing is a market driven methodology.

There are the three phases of this methodology as under:

(i) Planning –

The products of all competitors are to be analyzed with regard to price, sales, quality, technology, and service etc., and after that target cost is to be determined and then market share of one product is to be finalized.

(ii) Development –

Cost structure of the organization is to be finalized after examining and studying various cost reductions measures and Activity based costing and then a suitable design has to be developed.

(iii) Production –

Production target are fixed and efforts are made to achieve it at the lowest cost without affecting the quality, technology design and its production techniques etc.

Lifecycle costing

The technique used to estimate the total life cycle cost of a procurement is called life cycle costing. In other words, life cycle costing is a procurement process which considers overall total cost, i.e., sum of acquisition and life cycle ownership cost of an item.

Life cycle costing is also termed as whole life costing. It is a technique to determine the total cost of ownership. The approach is structured one which addresses all elements of cost. It can be used to produce a spend profile of the product or service over its anticipated life-span.

Life cycle is the cycle of competitive degeneration. It starts with the invention of a new product and ends at which the customer support and withdraws it. The time taken from the invention of the product till to its degeneration is known as product life cycle.

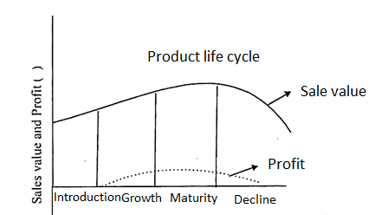

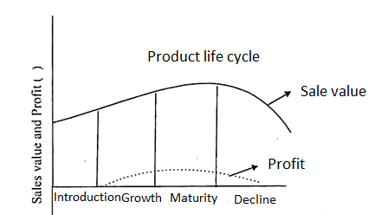

Life cycle consists of four phases as –

(1) Introduction,

(2) Growth,

(3) Maturity, and

(4) Decline.

It can be shown as under:

Thus, life cycle is a system that traces the actual costs attributable to each product from its initial stage to its final resource and support in the market. It attempts accumulation of costs that occur over the entire life cycle of a product.

It focuses attention on total cost including design and development, operation, acquisition, servicing, maintenance etc. In service cost, marketing, distribution, administration and after sales service costs etc. are included.

Key takeaways

- Target costing is a cost management technique. Target cost is the difference between target sales minus target margin

- Life cycle is the cycle of competitive degeneration. It starts with the invention of a new product and ends at which the customer support and withdraws it.

Costing of service sector

Service sector companies provide their customers with services or intangible products. The activities of service sector may be used for both: (i) Provision of services to outside customers (ii) Provision of services internally (i.e., captive consumption). T

Like manufacturing sector companies in the service sector, generally adopt one out of the following two basic costing methods to assign costs to services. These are:

1. Job costing method: In job costing method the cost of a particular service is obtained by assigning costs to a distinct identifiable service. In service sector like Accounting firm, Advertising campaigns etc. job costing method is used. For assigning indirect costs (overheads) models such as Activity Based Costing may be used.

2. Process costing method: In process costing system the cost of a service is obtained by assigning costs to masses of similar unit and then computing unit cost on an average basis. Retail banking, Postal delivery, Credit card etc. uses process costing method.

3. Hybrid costing method: Many companies uses a method of costing which is neither job costing nor process costing method. They in fact uses a hybrid costing method which combines elements of both job costing and process costing methods.

Just-in-time approach

Just-in-time (JIT) manufacturing, also known as just-in-time production or the Toyota Production System (TPS), was first developed and perfected within the Toyota manufacturing plants by Taiichi Ohno, is a methodology aimed primarily at reducing cycle times of various activities within production system as well as response times from suppliers and to customers. JIT is a common inventory management technique and type of lean methodology designed to increase efficiency, cut costs and decrease waste by receiving goods only as they are needed. Its origin and development were in Japan, largely in the 1960s and 1970s.

JIT is seen as a more cost efficient method of maintaining stock levels. Its purpose is to minimize the amount of goods you hold at any one time without compromising the production volumes. And this has numerous advantages such as less space needed, with a faster turnaround of stock; we don't need as much warehouse or storage space to store goods. Less stock levels also means lesser investment.

Many other companies also have been using similar concepts although with different names. Motorola used the concept of short-cycle-manufacturing (SCM), IBM used the concepts of continuous-flow manufacturing (CFM) and demand-flow manufacturing (DFM).

In recent times, JIT has been replaced with the newer concepts of Lean-Manufacturing which also has come from Toyota. Although it started from Toyota, but today it is much more widely adopted across companies worldwide. Some of the leading companies where they use JIT is Dell, HP, McDonalds to name a few.

JIT is closely associated with other concepts such as TQM, Kanban and Continuous Process Improvement etc. JIT aims at producing the exact quantities of items for the exact demand by maintaining just the exact amount of inventory both on the raw material side as well as on the finished good side.

To achieve this kind of lean management, it requires extremely careful planning to manage the entire supply chain including raw material procurement to finished good delivery to the end customer. And such planning in turn needs the use of sophisticated technology and software solutions.

Some of the advantages of JIT:

- JIT aims at keeping the stock holding to bare minimum leading to much lower inventory cost and much lower storage and warehouse cost.

- Minimum inventory at all stages of supply chain means lesser expiry and lesser wastage for the organization

- Lower inventory means lower investment for the same level of production. This reduces working capital investment to a greater extent. This in turn leads to better ROI and profitability for the organization

- JIT manufacturing aims at producing items based on the demand. Hence all items produced will be sold. So, no obsolete items in the finished goods section. It helps the organization to adapt well to any changes in product specification from the market without the fear of having any kind of waste and obsolete stocks.

- To achieve JIT production, there is a need for very close communication between all the parties involved in the entire supply chain. This communication technique is often referred as “Kanban”.

- In JIT, immense focus is on quality of the final product and companies work to achieve “first time right” for all goods.

Disadvantages of JIT:

- JIT production can be very sensitive to any kind of error. Since bare minimum inventory levels are maintained, there is no room for any kind of error.

- JIT production will not be able to adapt well to sudden increase in volume of demand from the market, since the inventory levels are maintained at much lower level.

- Just in time manufacturing is a philosophy which is achieved only when all the parties involved in the whole supply chain will work in great tandem and coordination. JIT may fail sometime if any of the suppliers will fail to fulfil their obligations and respond to the requirements in a timely manner.

- JIT focuses on lean inventory; hence there is not much buffer in stock levels. For any reason, if there is any kind of failure that happens in the supply chain, that can lead to sudden down time in production leading to huge losses for the organization.

Material Requirement Planning

Material Requirements Planning (MRP) refers to the process that translates master schedule requirements for finished goods into time-phased requirements for raw materials, components, parts, and sub-assemblies.

While the master schedule designates the quantity and need dates of the end items, material requirements planning generates a production plan that indicates the timing and quantities of all materials required to produce those end items.

Functions of MRP

Having a systematized method of planning your materials will keep your production planning, inventory control, and purchasing departments aligned and keep materials moving through the facility.

Although an MRP system cannot run a production facility on its own, it allows manufacturers to maintain a steady flow of materials through the supply chain and permits planners to focus their attention on problematic areas. Some of the functions of an MRP system include:

- Inventory Management - The main function of an MRP system is to ensure that materials are available when they are needed. This can also help ensure that you do not have too much or too little materials on hand. Inventory management is essential as too much material will incur additional storage costs while holding too little inventory can lead to delays and unhappy customers.

- Cost Reduction - Cost is reduced significantly for manufacturing facilities using an MRP system. First, by reducing the time that planners would spend on manually determining the quantities and timing of each material or component. Second, through inventory management, MRP will ensure that you do not lose money by storing unnecessary materials or by constantly having to rush in material orders to meet deadlines.

- Production Optimization - Although the main goal of MRP is to manage materials it serves as an important tool to improve production processes. When materials are flowing smoothly within the production facility, you can save time, decrease costs, and increase the overall throughput. Employees and equipment will be able to work at a more consistent and faster rate if they don’t have to stop to retrieve or wait for materials.

Enterprise Resource Planning

Enterprise resource planning (ERP) is a system of integrated software applications that standardizes, streamlines and integrates business processes across finance, human resources, procurement, distribution, and other departments. Typically, ERP systems operate on an integrated software platform using common data definitions operating on a single database.

ERPs were originally designed for manufacturing companies but have since expanded to service industries, higher education, hospitality, health care, financial services, and government. Each industry has its own ERP peculiarities. For example, government ERP uses contract lifecycle management (CLM) rather than traditional purchasing and follows government accounting rules rather than GAAP. Banks have back-office settlement processes to reconcile checks, credit cards, debit cards, and other instruments.

Key features of ERP systems

Enterprise-wide integration. Business processes are integrated end to end across departments and business units. For example, a new order automatically initiates a credit check, queries product availability, and updates the distribution schedule. Once the order is shipped, the invoice is sent.

Real-time (or near real-time) operations. Since the processes in the example above occur within a few seconds of order receipt, problems are identified quickly, giving the seller more time to correct the situation.

A common database. A common database enables data to be defined once for the enterprise with every department using the same definition. Some ERP systems split the physical database to improve performance.

Consistent look and feel. Early ERP vendors realized that software with a consistent user interface reduces training costs and appears more professional. When other software is acquired by an ERP vendor, common look and feel is sometimes abandoned in favor of speed to market. As new releases enter the market, most ERP vendors restore the consistent user interface.

Total Quality Management and Theory of constraints.

Total quality management (TQM) is a term that originated in the 1950s and is today used mainly in Japan. It is the equivalent of what other countries or organizations may call a company-wide quality management system, enterprise quality management system, or integrated quality management system, to name a few.

The term ‘total’ means the entire organization—all teams, departments and functions—is involved in quality management. The ‘system’ refers to the managerial and technological methods to achieve quality requirements and business objectives throughout an entire organization. Although it may go by various names, Juran believes ‘enterprise excellence’ to be a more appropriate name for TQM.

Juran’s Enterprise Excellence Management System has long been expressed as a company-wide business excellence and/or enterprise quality system. It embodies organizational beliefs and habits set forth in policies and processes to develop a culture capable or designing and delivering products and services that will exceed customer, regulatory, business and societal needs.

Key Principles of TQM

Total quality management has a number of key principles which—when implemented together—can move any organization towards business excellence.

Customer focus

Central to all successful TQM systems is an understanding that quality is determined by the customer. No matter what measures you introduce to improve the quality of your products and services, the only way of knowing if they have been successful is customer feedback, whether in the form of reviews, return rates, or satisfaction surveys.

Employee involvement

Every person in an organization—from entry-level workers to management—has a responsibility for the quality of products and services. However, employees can only be invested if they feel empowered to make their own decisions, something that depends on management creating the right workplace environment.

Centred on process

A TQM system will fail without a clear focus on processes and process-led thinking. A process fault is ultimately the cause of most problems, which is why effective monitoring of every single step is an essential part of assessing, maintaining and improving quality.

Integrated system

An organization should have an integrated system that allows for effective total quality management. This may be a bespoke system, or one based on a quality standard such as ISO 9001, but it should be understood and applied across all functions and departments.

Strategic & systematic approach

Critical to quality management is the existence of a strategic plan that outlines how an organization intends to achieve its mission and business goals. It goes without saying that quality should be a core component of such a plan.

Decision-making based on facts

Business performance can only be assessed using the available facts, such as sales data, revenue figures, and customer retention rates. The opinions of customers, employers and suppliers should never be used to inform decisions.

Communication

Effective communication is essential when an organization is implementing significant changes for the sake of business improvement. Every member of staff should be made aware of the strategy, the timescales involved, and the reasons for implementing it.

Continuous improvement

Applying the principles of DMAIC and Lean Six Sigma will instill an organization with a culture of continuous improvement, driving all employees to constantly seek new ways to be more competitive and deliver high-quality products for all stakeholders.

Theory of constraints

The Theory of Constraints is a methodology for identifying the most important limiting factor (i.e., constraint) that stands in the way of achieving a goal and then systematically improving that constraint until it is no longer the limiting factor. In manufacturing, the constraint is often referred to as a bottleneck.

The Theory of Constraints takes a scientific approach to improvement. It hypothesizes that every complex system, including manufacturing processes, consists of multiple linked activities, one of which acts as a constraint upon the entire system (i.e., the constraint activity is the “weakest link in the chain”).

So, what is the ultimate goal of most manufacturing companies? To make a profit – both in the short term and in the long term. The Theory of Constraints provides a powerful set of tools for helping to achieve that goal, including:

- The Five Focusing Steps: a methodology for identifying and eliminating constraints

- The Thinking Processes: tools for analyzing and resolving problems

- Throughput Accounting: a method for measuring performance and guiding management decisions

Dr. Eliyahu Goldratt conceived the Theory of Constraints (TOC), and introduced it to a wide audience through his bestselling 1984 novel, “The Goal”. Since then, TOC has continued to evolve and develop, and today it is a significant factor within the world of management best practices.

One of the appealing characteristics of the Theory of Constraints is that it inherently prioritizes improvement activities. The top priority is always the current constraint. In environments where there is an urgent need to improve, TOC offers a highly focused methodology for creating rapid improvement.

A successful Theory of Constraints implementation will have the following benefits:

- Increased Profit: the primary goal of TOC for most companies

- Fast Improvement: a result of focusing all attention on one critical area – the system constraint

- Improved Capacity: optimizing the constraint enables more product to be manufactured

- Reduced Lead Times: optimizing the constraint results in smoother and faster product flow

- Reduced Inventory: eliminating bottlenecks means there will be less work-in-process

Key takeaways

- JIT is a common inventory management technique and type of lean methodology designed to increase efficiency, cut costs and decrease waste by receiving goods only as they are needed

- Total quality management (TQM) is a term that originated in the 1950s and is today used mainly in Japan.

- Material Requirements Planning (MRP) refers to the process that translates master schedule requirements for finished goods into time-phased requirements for raw materials, components, parts, and sub-assemblies.

References:

- Cost Accounting a Managerial Emphasis, Prentice Hall of India, New Delhi

- Charles T. Horngren and George Foster, Advanced Management Accounting

- Robert S Kaplan Anthony A. Alkinson, Management and Cost Accounting

- Ashish K. Bhattacharya, Principles and Practices of Cost Accounting A. H. Wheeler publisher

- D. Vohra, Quantitative Techniques in Management, Tata McGraw Hill Book Co. Ltd.

Unit - 4

Project Commissioning

Profit planning is the set of actions taken to achieve a targeted profit level. These actions involve the development of an interlocking set of budgets that roll up into a master budget. After planning profit successfully, an organization needs to control profit. Profit control involves measuring the gap between the estimated level and actual level of profit achieved by an organization. If there is any deviation, the necessary actions are taken by the organization.

Profit planning is a vital part of any business plan structure for a small or medium business. The goals of small business owners include ensuring that the business makes profits year-over-year, and that it is sustained over a period of time for growth. The business plan includes a forecast that tries to anticipate the business growth and determine the revenue that could be generated in that particular year. Here’s a look at the basics of profit planning for your business:

1. Evaluate your business operations: Profit planning and forecasting enables a comparison between projected costs and spends, and the actual costs that your business is incurring. This can help your team decide on improving cost efficiency and closing up the gaps. It also enables better decision-making like which resources to invest in or cut costs from. Proper profit planning will ensure that the business does not spend more than is necessary or end up not investing enough in resources that are required.

2. Forecast marketing strategies: Marketing is one of the highest areas of expense for small businesses because marketing efforts are directly related to getting leads for the business. The company’s marketing efforts are categorized into various areas, and each of these need to be evaluated for the employees and resources required to fulfill them. If the marketing costs are not estimated properly, it could affect profits, and the company will unnecessarily spend more on marketing. Profit planning helps avoid this scenario.

3. Anticipate financial planning: Planning funds to allocate across departments and procedures needs to begin well in advance. Profit planning anticipates the company’s financial ability to make the maximum use of resources, with efficiency in costs and finally high profitmaking potential.

4. Carve out hiring requirements: After the entire financial projection is made and the business plan structure is ready, the company needs to evaluate if they have enough staff to carry out all the operations. Profit planning also estimates the number of personnel required, vis-à-vis the work they generate which has a bearing on the company’s revenue and profits. Planning costs for hiring requirements is also an important part of this. Profit planning is a crucial business activity that prepares the company for the coming year, helps spread out company resources efficiently and motivates the major stakeholders of the company to strive towards year-on-year growth. Profit planning needs to be an activity that is carried out every year. After the end of the year, there also needs to be an audit that compares the projection to the actual profits. This can guarantee that the company is prepared and has a well-thought-out strategy to improve every time and maximize profits and performance

Net Profit

Net Profit is a measure of profitability of a company usually referred to as “the bottom line of the income statement. It refers to the profit that remains after deducting expenses from gross profit. These expenses include all operating expenses, non-operating expenses, taxes and preferred stock dividends of a business. Therefore, net profit is an important component of trading and profit and loss account of a business. The trading account represents the results from the manufacturing activities of a business. That is, the activities that involve manufacturing, purchasing and the ones that help in bringing goods to the point of sale. Thus, purchases are one of the constituents of such activities. The other constituents of the activities directly related to the production are direct expenses. These expenses include carriage inwards, freight inwards, wages, factory lighting, coal, water and fuel, royalty on production, etc

On the other hand, the profit and loss account represent the Gross Profit on the credit side. The operating profit is calculated to calculate Net Profit. Then, operating Profit is ascertained as the difference between Gross Profit and sum of following expenses:

Selling and Marketing Expenses

General and Administrative Expenses

Foreign Exchange Losses/Gains

Other Operating Income

Marginal cost

Marginal cost is the cost of one additional unit of output. The concept is used to determine the optimum production quantity for a company, where it costs the least amount to produce additional units. If a company operates within this "sweet spot," it can maximize its profits. The term marginal cost implies the additional cost involved in producing an extra unit of output, which can be reckoned by total variable cost assigned to one unit. It can be calculated as:

Marginal Cost = Direct Material + Direct Labor + Direct Expenses + Variable Overheads

Characteristics

Classification into Fixed and Variable Cost: Costs are bifurcated, on the basis of variability into fixed cost and variable costs. In the same way, semi variable cost is separated.

Valuation of Stock: While valuing the finished goods and work in progress, only variable cost is taken into account. However, the variable selling and distribution overheads are not included in the valuation of inventory.

Determination of Price: The prices are determined on the basis of marginal cost and marginal contribution.

Profitability: The ascertainment of departmental and product’s profitability is based on the contribution margin.

Facts Concerning Marginal Costing

Cost Ascertainment: The basis for ascertaining cost in marginal costing is the nature of cost, which gives an idea of the cost behavior, that has a great impact on the profitability of the firm.

Special technique: It is not a unique method of costing, like contract costing, process costing, batch costing. But, marginal costing is a different type of technique, used by the managers for the purpose of decision making. It provides a basis for understanding cost data so as to gauge the profitability of various products, processes and cost centers.

Decision Making: It has a great role to play, in the field of decision making, as the changes in the level of activity pose a serious problem to the management of the undertaking.

Distinction between Marginal Costing and Absorption Costing

Marginal costing is a method where the variable costs are considered as the product cost and the fixed costs are considered as the costs of the period.

Absorption costing, on the other hand, is a method that considers both fixed costs and variable costs as product costs. This costing method is important particularly for reporting purposes. Reporting purpose includes both financial reporting and tax

The key differences between them –

Marginal costing doesn’t take fixed costs into account under product costing or inventory valuation. Absorption costing, on the other hand, takes both fixed costs and variable costs into account.

Marginal costing can be classified as fixed costs and variable costs. Absorption costing can be classified as production, distribution, and selling & administration.

The purpose of marginal costing is to show forth the contribution of the product cost. The purpose of absorption costing is to provide a fair and an accurate picture of the profits.

Marginal costing can be expressed as contribution per unit. Absorption costing can be expressed as net profit per unit.

Marginal costing is a method of costing and it isn’t a conventional way of looking at costing method. Absorption costing, on the other hand, is used for financial and tax reporting and it is the most conventional method of costing.

Basis for comparison | Marginal costing | Absorption costing |

Meaning | Marginal costing is a technique that assumes only variable costs as product costs. | Absorption costing is a technique that assumes both fixed costs and variables costs as product costs. |

What it’s all about | Variable cost is considered as product cost and fixed cost is assumed as cost for the period. | Both fixed cost and variable cost are considered in product cost |

Nature of overheads | Fixed costs and variable costs. | Overheads in the case of absorption costing are quite different – production, distribution, and selling & administration |

How profit is calculated? | By using profit volume ratio (P/V ratio) | Fixed costs are considered in product costs; that’s why profit gets reduced. |

Determines | The cost of the next time | The cost of each unit |

Opening and closing stock | Since the emphasis is on the next unit, change in opening/closing stocks doesn’t affect the cost per unit. | Since the emphasis is on each unit, change in opening/closing stocks affects the cost per unit. |

Most important aspects | Contribution per unit. | Net profit per unit |

Purpose | To show forth the emphasis of contribution in product cost. | To show forth the accuracy and fair treatment of product cost. |

How it is presented | It is presented by outlining the total contribution. | It is presented in the most conventional way for the purpose of financial and tax reporting. |

Break-even Analysis, Cost-Volume-Profit Analysis

Breakeven analysis

Breakeven is a financial tool which helps the company to determine after which stage they will be profitable. Breakeven point is where the company neither make money nor losses money, but covers all the cost incurred.

Breakeven is useful in studying the relationship between cost and revenue. It is a point at which total cost and total revenue are equal. It is no gain no loss situation, though opportunity costs have been paid and capital has received the risk-adjusted, expected return.

Components of breakeven analysis

Fixed costs

Fixed costs are also called overhead costs. These fixed costs occur after taking the decision to start an economic activity and these costs are directly related to the level of production, but not the quantity of production. Fixed costs include interest, taxes, salaries, rent, depreciation costs, labour costs, energy costs etc. Irrespective of the production these costs are fixed in nature. In case of no production also the costs must be incurred.

Variable costs

Variable costs are directly proportional to the quantity of production. The costs will increase or decrease in direct relation to the production volume. These costs include cost of raw material, packaging cost, fuel and other costs that are directly related to the production.

Formula

Break even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

Where:

- Fixed costs are costs that do not change with varying output (e.g., salary, rent, building machinery).

- Sales price per unit is the selling price (unit selling price) per unit.

- Variable cost per unit is the variable costs incurred to create a unit.

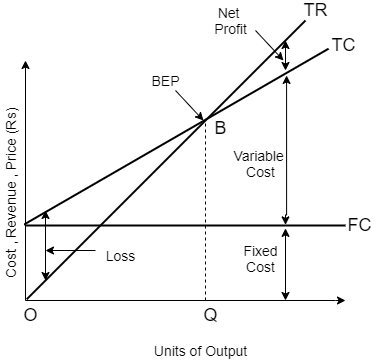

It is also known as “cost –volume-profit analysis”. In the above figure, TR is total revenue curve is straight line from the origin, as every unit of output contributes to revenue. TC is total cost curve is fixed and variable cost which starts from vertical axis and rises linearly. B is the breakeven point at OQ level of output where all the cost has incurred.

Benefits of Break-even analysis

- Catch missing expenses: In a new business, it happens that few expenses are missed. With the help of break-even analysis, to reach break even point all the financial commitments are reviewed.

- Set revenue targets: Once the break-even analysis is complete, the company knows how much to be sold to be profitable. This will help to set more concrete sales goals.

- Make smarter decisions: break even analysis helps in making good decision based on the facts to become successful

- Better Pricing: Finding the break-even point will help in pricing the products better. This tool is highly used for providing the best price of a product that can lead to maximum profit without increasing the existing price.

- Cover fixed costs: Doing a break-even analysis helps in covering all fixed cost incurred.

For an example:

Variable costs per unit: Rs. 400

Sale price per unit: Rs. 600

Desired profits: Rs. 4,00,000

Total fixed costs: Rs. 10,00,000

Solution

Break even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

= 10,00,000/ (600 – 400)

Break Even Point = Rs. 10,00,000/ Rs. 200 = 5000 units

Next, this number of units can be shown in rupees by multiplying the 5,000 units with the selling price of Rs. 600 per unit.

We get Break Even Sales at 5000 units x Rs. 600 = Rs. 30,00,000.

Cost volume analysis

The cost-volume-profit (CVP) analysis helps management in finding out the relationship of costs and revenues to profit. The aim of an undertaking is to earn profit. Profit depends upon a large number of factors, the most important of which are the cost of manufacture and the volume of sales effected. Both these factors are interdependent-volume of sales depends upon the volume production, which in turn is related to costs. Cost, again, is the resultant of the operation of a number of varying factors. Such factors affecting cost are:

(i) Volume of production;

(ii) Product-mix;

(iii) Internal efficiency;

(iv) Methods of production; and

(v) Size of plant; etc.

Analysis of cost-volume-profit involves consideration of the interplay of the following factors:

(i) Volume of sales;

(ii) Selling price;

(iii) Product mix of sales;

(iv) Variable costs per unit; and

(v) Total fixed costs.

Uses

1. C.V.P. Analysis helps in forecasting costs and profits as a result of change in volume.

2. It helps fixing a sales volume level to earn or cover a given revenue, return on capital employed, or rate of dividend.

3. It assists determination of effect of change in volume due to plant expansion or acceptance of an order, with or without increase in costs or in other words a quantum of profit to be obtained can be determined with change in volume of sales.

4. C.V.P. Analysis helps in determining relative profitability of each product, line, project or profit plan.

5. Through cost volume-profit analysis inter-firm comparison of profitability can be done intelligently.

6. It helps in determining cash requirements at a desired volume of output, with the help of cash breakeven charts.

7. Break-even analysis emphasizes the importance of capacity utilization for achieving economy.

8. From break-even analysis during severe recession, the comparative effects of a shut down or continued operation at a loss is indicated.

9. The effect on total cost of a change in the fixed over-head is more clearly demonstrated through break-even analysis and cost- volume-profit charts.

10. The conditions of a business such as profit potentialities, requirements of capital, financial stability and incidence of fixed and variable costs can be gauged from a study of the position of the breakeven point and the angle of incidence in the break-even chart.

Key takeaways

- The cost-volume-profit (CVP) analysis helps management in finding out the relationship of costs and revenues to profit

- Marginal costing is a method where the variable costs are considered as the product cost and the fixed costs are considered as the costs of the period.

Various decision-making problems

1. Lack of support from top management: Many a times, the cost accounting system is introduced without the support of the top management in all the functional areas. Even managing director or chairman often introduces such system without consulting the departmental heads. This results in opposition from the various managers as they consider it is an interference on their activities.

2. Resistance from the existing staff: The existing financial accounting staff may offer resistance to the cost accounting system because of a feeling of their being declared redundant under the new system.

3. Non-cooperation at other levels of organization: The foreman, supervisors and other staff may also resent the additional paper work and may not co-operate in providing the basic data which is absolutely essential for the success of the system.

4. Shortage of trained staff: There may be shortage of cost accountants to handle the work of cost analysis, cost control and cost reduction. The work of the costing department cannot be handled with the availability of trained staff.

5. Heavy costs: The costing system will involve heavy costs unless it has been suitably designed to suit specific requirements.

Standard Costing and Variance Analysis

Standard costing

Meaning of Standard Costing:

It is a method of costing by which standard costs are employed. According to ICMA, London, Standard Costing is ―the preparation and use of standard costs, their comparison with actual cost and the analysis of variances to their causes and points of incidence‖.

According to Wheldon, it is a method of ascertaining the costs whereby statistics are prepared to show:

(i) The standard cost;

(ii) The actual cost;

(iii) The difference between these costs which is termed the variance.

W. Bigg expresses:

Standard Costing discloses the cost of deviations from standards and clarifies these as to their causes, so that management is immediately informed of the sphere of operations in which remedial action is necessary.

Thus, from the above, it becomes clear that Standard Costing involves:

(i) Ascertainment and use of Standard Costs;

(ii) Recording the actual costs;

(iii) Comparison of actual costs with standard costs in order to find out the variance;

(iv) Analysis of variance; and

(v) After analyzing the variance, appropriate action may be taken where necessary

Features of standard costing

- Determination of standard costs of various elements of costs such as standard cost of direct material, direct labour and various overheads.

- Comparison of standard costs and actual costs of production.

- Finding differences (variances) between actual costs and standard costs. These variances may be favorable as well as unfavorable or adverse.

- Analyzing the variances to find the cause of variances.

- Remedial steps are suggested so that unfavorable variances may not be repeated in the future.

- Reporting these variances to top management for remedial action.

Advantages of Standard Costing:

The following advantages may be derived from Standard Costing:

(i) Standard Costing serves as a guide to the management in several management functions while formulating prices and production policies etc.

(ii) More effective cost control is possible under standard costing if the same is reviewed and analyzed at regular intervals for improvements and immediate action can be taken if deviations from standards are found out which, ultimately, leads to cost reduction.

(iii) Analysis of variance and its measurement helps to detect inefficiencies and mistakes which enable the management to investigate the reasons.

(iv) Since standard costs are predetermined costs, they are very useful for planning and budgeting. It also helps to estimate the effect of changes in Cost-Price-Volume relationship which also helps the management for decision-making in future.

(v) As standard is fixed for each product, its components, materials, process operation etc. it improves the overall production efficiency which also ultimately reduces cost and thereby increases profit.

(vi) Once the Standard Costing System is implemented it will lead to saving cost since most of the costing work can be eliminated.

(vii) Delegation of authority and responsibility becomes effective by setting up standards for each cost centre as the supervisors or executives of each cost centre will know the standard which they have to maintain.

(viii) This system also helps to prepare Profit and Loss Account promptly for short period in order to know the trend of the business which helps the management to take decisions promptly.

(ix) Standard costing also is used for inventory valuation purposes. Stock can be valued at standard cost which can reduce the fluctuation of profit for different methods of valuation for the same.

(x) Efficiency of labour is promoted.

(xi) This system creates cost-consciousness among all employees, executives and top management which increase efficiency and productivity as well.

Variance analysis

The primary object of standard costing is to reveal the difference between actual cost and standard cost. A ‘variance’ in standard costing refers to the divergence of actual cost from standard cost. Variances of different cost items provide the key to cost control. They indicate whether and to what extent standards set have been achieved. This enables management to correct adverse tendencies.

After standard costs have been established, the next step is to ascertain the actual cost under each element and compare them with the standard cost. The difference between these two is termed as cost variance. Cost variance is the difference between a standard cost and the comparable actual cost incurred during a given period.

Variance analysis can be defined as “the analysis of performance by means of variances”. It is the process of computing the amount of and isolating the cause of variances between actual costs and standard costs.

Variance analysis involves:

(a) Computation of individual variances, and

(b) Determination of the cause(s) of each variance.

Actual cost which is higher than the standard costs would be a sign of inefficiency and the difference would be termed as unfavourable or adverse. A variance that reduces profit is adverse or unfavourable. A variance that increases profit is favourable. Variance are computed under each element of cost for which standards have been established. Each variance is analyzed to ascertain the causes so that the management can exercise proper control. The cause is affixed to the variance, for example, materials price variance will show that the variance arose due to change in the price of materials. Some of the variances are controllable while others are not. The purpose of such classification is that proper emphasis can be placed on the controllable variance. This follows the principle of management by exception.

Variances occurring in a period may be compared with variances on the same account expressed as a percentage of the standard costs and compared with the percentage for the previous month. Comparison may be made between the standard and actual or between basic standard and current standard.

As already stated, the origin and causes of the variances need to be traced by analyzing the total variances into their components parts in order to determine and isolate the causes giving rise to each variance.

Equal emphasis should be laid on favourable and unfavourable variances. An unfavourable variance points out the inefficiency in use or waste of materials, labour, and resources. A favourable variance may be due to improvement in efficiency or production of substandard products or an incorrect standard. An unfavourable variance may be off-set by a favourable variance; hence the need for analysis and appropriate action.

A detailed probe into the variances, particularly the controllable variance, helps the management to ascertain:

(a) The amount of variance;

(b)Its occurrence;

(c) The factors responsible for it;

(d) The executive responsible for the variance;

(e) Corrective action which should be taken to obviate or reduce the variance.

Favourable and Unfavourable Variance: If the actual cost is less than standard cost, the difference is known as a favourable variance, credit variance or positive variance denoted by (F) or Cr. - it increases the profit. On the other hand, if actual cost exceeds, standard costs, the divergence is known as an unfavourable variance, debit variance, negative variance or adverse variance denoted by (A) or Dr. - it reduces the profit.

Controllable and Uncontrollable Variance: When the variance with respect to any cost item reflects the degree of efficiency of an individual or department, i.e., a particular individual or departmental head is responsible for the variance, the variance is known as a controllable variance. Obviously, such a variance is amenable to control by suitable action. An uncontrollable variance is one which is not amenable to control by individual or departmental action. Such a variance is caused by external factors like change in market conditions, fluctuations in demand and supply, etc. No particular individual within the organization can be held responsible for it.

When variances are reported, attention of the management is particularly drawn towards controllable variances. If a variance has been caused by multiple factors, the part of cost variance relevant to each factor should be determined.

Revision Variance: This is amount by which a budget is revised but which is not incorporated in the standard cost rate as a matter of policy. The standard costs may be affected by wage rate changes after wage accords, fiscal policy etc. The standard costs are not disturbed to account for these uncontrollable factors and to avoid the amount of labour and cost involved in revision, the basic standard costs are allowed to stand. It is essential to isolate the variance arising out of non-revision in order to analyses the other variances correctly.

Method Variance: It is the difference between the standard cost of the product manufactured or operation performed by the normal methods and the cost of operation by alternative method. Standards usually take into account the best method applicable, and any deviation will result in an unfavourable variance. Hence such deviations should be as few as possible.

Key takeaways

- Standard Costing discloses the cost of deviations from standards and clarifies these as to their causes, so that management is immediately informed of the sphere of operations in which remedial action is necessary.

- A ‘variance’ in standard costing refers to the divergence of actual cost from standard cost.