Unit - 5

Energy Economics

The payback period refers to the time required to earn back the amount invested in an asset from net cash flows.

An investment with shorter payback period is better since the investor’s initial outlay is at risk for shorter period.

The calculation used to derive the payback period is called payback method.

Example:

If a company invests $300,000 in new production line which produces positive cash flow of $100,000 per year, then the payback period is 3 years.

The formula is:

Payback period = Cash outlay ÷ net cash inflow.

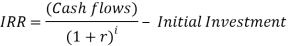

The internal rate of return (IRR) is a discounting cash flow technique which gives a rate of return earned by a project. The internal rate of return is the discounting rate where the total of initial cash outlay and discounted cash inflows are equal to zero. In other words, it is the discounting rate at which Net present value is equal to zero.

How is the Internal Rate of Return computed?

For the computation of the internal rate of return, we use the same formula as NPV. To derive the IRR, an analyst has to rely on trial-and-error method and cannot use analytical methods. With automation, various software (like Microsoft Excel) is also available to calculate IRR. In Excel, there is a financial function that uses cash flows at regular intervals for calculation.

Where

Cash flows = Cash flows in the time period

r = Discount rate

i = Time period

The rate at which the cost of investment and the present value of future cash flows match will be considered as the ideal rate of return. A project that can achieve this is a profitable project. In other words, at this rate the cash outflows and the present value of inflows are equal, making the project attractive.

How is IRR used for capital budgeting?

If the same costs apply for different projects, then the project with the highest IRR will be selected. If an organization needs to choose between multiple investment options wherein the cost of investment remains constant, then IRR will be used to rank the projects and select the most profitable one. Ideally, the IRR higher than the cost of capital is selected.

In real life scenarios, since the investment in any project will be huge and will have a long-term effect, an organization uses a combination of various techniques of capital budgeting like NPV, IRR and payback period to select the best project.

Illustration

Let us say a company has an option to replace its machinery.

The cost and return are as follows:

Initial investment = Rs.5,00,000

Incremental increase per year = Rs.2,00,000

Replacement value = Rs.45,270

Life of asset = 3 years

If we assume IRR to be 13%, the computation will be as follows.

Year | Cash flows | Discounted cash flows | Computation |

0 | -5,00,000 | -500000 | (5,00,000 * 1) |

1 | 2,00,000 | 176991 | 2,00,000 * (1/1.13)1 |

2 | 2,00,000 | 156229 | 2,00,000 * (1/1.13)2 |

3 | 2,00,000 | 138610 | 2,00,000 * (1/1.13)3 |

4 | 45,270 | 27765 | 45,270 * (1/1.13)4 |

The total of the column Discounted Cash Flows approximately sums up to zero making the NPV equal to Zero. Hence, this discounted rate is the best rate. As can be seen from the above, using the rate of 13%, the cash flows, both positive and negative become minimum.

Hence, it is the best rate of return on investment. The cost of capital of the company is 10%. Since the IRR is higher than the cost of capital, the project can be selected.

If the company has another opportunity to invest the money in a project that gives a 12% return, the company will still go in for the machinery replacement since it gives the highest IRR.

When an organization takes decision regarding the expansion of business and investment then in such cases the organization makes use of NPV method.

Net Present Value Method is a popular capital budgeting technique that takes into consideration the time value of money.

It uses net present value as a base to accept or reject the proposed investment in projects say purchase of new equipment, purchase of inventory, expansion of existing plant and so on.

Net Present Value:

It is difference between the present value of cash inflows and the present value of cash outflows which occurs as a result of undertaking an investment project.

There are three possibilities of net present value:

Positive NPV:

If present value of cash inflows is greater than the present value of cash outflows, then the net present value is positive, and the investment proposal is acceptable.

Zero NPV

If present value of cash inflows is equal to the present value of cash outflows, then the net present value is said to be zero and the investment proposal is acceptable.

Negative NPV

If present value of cash inflows is less than the present value of cash outflows, then the net present value is negative, and the investment proposal is rejected.

Example 1 – cash inflow project:

The management of Fine Electronics Company is considering in purchasing an equipment to be attached with the main manufacturing machine. The equipment will cost $6,000 and will increase annual cash inflow by $2,200. The useful life of the equipment is 6 years. After 6 years it will have no salvage value. The management wants a 20% return on all investments.

Required:

- Compute net present value (NPV) of this investment project.

- Should the equipment be purchased according to NPV analysis?

Solution:

Computation of net present value:

Initial cost - $ 6,000

Life of the project 6 years

Annual cash inflow $ 2,200

Salvage value 0

Required rate of return 20%

Item | Year(s) | Amount of cash flow | 20% Factor | Present value of cash flow |

Annual cash inflow | 1-6 | 2,200 | 3.326 | $7317 |

Initial investment | Now | (6000) | 1000 | (6000) |

NPV |

|

|

| $1317 |

Yes, the equipment should be purchased because the net present value is positive ($1,317). Having a positive net present value means the project promises a rate of return that is higher than the minimum rate of return required by management is 20%

Life Cycle Costing is a method of economic analysis for all costs related to building, operating, and maintaining an energy conservation measure (ECM) project over a defined period of time. Assumed escalation rates are used to account for increases in utility costs over time. Future costs are expressed in present day dollars by applying a discount rate that reflects the value of money invested elsewhere. All costs and savings can then be directly compared and fully-informed decisions can be made.

LCC is a method consisting of estimating the total cost of a product, taking into account the whole life cycle of the product as well as the direct and external costs. Actually, estimating the cost of a product along with its life cycle or the life cycle environmental resources consumption and releases to the environment can refer to the same conceptual framework. The goals and scope have to be properly defined and data inventory including allocation issues must be considered. There is no need to consider impact assessment through characterization models in the case of LCC, as all estimates are in the same currency unit. However, it is possible to define concepts of risk cost that would be aligned to midpoint and endpoint impacts. Finally, the interpretation stage is also relevant in the case of LCC. There are several challenges in combining LCA with LCC, such as harmonizing the goals and the scope; where the goals of the interested public may be different, LCC is often undertaken for a particular actor. Therefore, the context in which the combination of both assessments is relevant must be stated. Such context may be concerned with public decisions in which the environmental impact of a new product must be complemented by its costs to the whole community, including owner cost, user cost and external cost. Fair information to consumers is another relevant context.

Another challenge is avoiding double counting or inconsistent assessment. For instance, economic allocation in the case of E-LCA requires the use of cost allocation factors, whereas external costs in the case of LCC requires internalizing the environmental impacts. Fully adapting both requirements along with the life cycle is challenging.

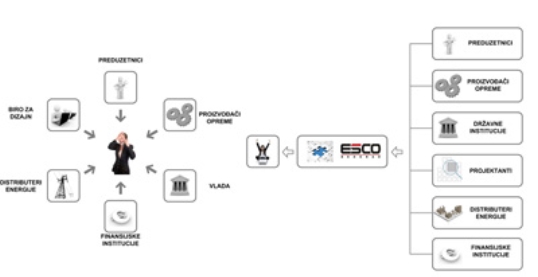

ESCO is a company that provides integrated energy services to its customers, provides performance and savings guarantees, and its remuneration is directly tied to the energy savings achieved. Therefore, an ESCO risks its payments on the performance of equipment and services implemented.

The typical ESCO project includes the following elements:

- Investment grade energy audit,

- Identification of possible energy saving and efficiency improving actions,

- Comprehensive engineering and project design and specifications,

- Guarantee of the results by proper contract clauses (EPC),

- Code compliance verification and guarantee,

- Procurement and installation of equipment,

- Project management and commissioning,

- Facility and equipment operation & maintenance for the contract period,

- Purchase of fuel & electricity (to provide heat, comfort, light, etc.),

- Monitoring and verifications of the savings results, and

- Project financing.

While the ESCO shall ensure all the above actions, the ESCO is not necessarily responsible for all of them. Some actions can be subcontracted; however, the ESCO has to ensure the results and project implementation. Some experts have compared the role of the ESCO to the architect in new property development: the architect has to define the project, select the engineering firm, supervise the building construction, obtain the permits, etc.

The financing of the project is ensured through two main types of contracts: Guaranteed Savings and Shared Savings. In the shared saving contract, the ESCO assumes the performance and credit risk; in the guaranteed savings contract, the client assumes the credit risk, while the ESCO assumes the risk for the savings.

ESCOs generally act as project developers for a wide range of tasks and assume the technical and performance risk associated with the project. Typically, they offer the following services:

- Develop, design and finance energy efficiency projects,

- Install and maintain the energy efficient equipment involved,

- Measure, monitor and verify the projects energy savings and

- Assume the risk that the project will save the amount of energy guaranteed

References:

1. Witte L.C., Schmidt P.S. And Brown D.R., Industrial Energy Management and Utilization, Hemisphere Publ., Washington,1988.

2. Callaghan P.W., Design and Management for Energy Conservation, Pergamon Press, Oxford, 1981.

3. Murphy W.R. And McKay G., Energy Management, Butterworths, London,1987.