Unit -I

Nature and scope of macroeconomics

Introduction:

The term "macro" was first used in economics by Ragnar Frisch in 1933. However, it originated in the 16th and 17th century mercantilists as a methodological approach to economic problems. They were interested in the entire economic system. In the 18th century,

Physiocrats adopted it in the table economy, demonstrating a "wealth cycle" (ie, net production) among the three classes represented by the peasant, landowner, and barren classes.

Malthus, Sismondi and Marx in the 19th century dealt with macroeconomic issues. Walras, Wicksell and Fisher contributed modernly to the development of pre-Keynes macroeconomic analysis.

Certain economists such as Kassel, Marshall, Pigovian, Robertson, Hayek, and Hortley developed the Quantity Theory of Money and General Price Theory in the decade following World War I. But Keynes, who eventually developed the general theory of income, output, and employment in the wake of the Great Depression, has credit.

Economics is a science that deals with the production, Exchange and consumption of various goods in the economic system. It is a scarce resource that can lessen the abundance of human welfare. The central focus of Economics lies in the choice between resource scarcity and its alternative uses. The word "economics" is derived from two the Greek words oikos (House) and nemein (to manage) mean to manage the household budget "using the limited funds possible.

Scope of Macro Economics

Economics is the subject of dealing with every situation happening all over the world. This subject is used in many stances in our lives. For example, your mom does all the work in your home. From doing all the housework to maintaining a budget for rations to meeting all your needs. Thus, it is one subject that deals with the daily work of our lives. There are two major categories on the same subject: microeconomics and macroeconomics. One deals with individual units of the economy, such as consumers and households. But the latter deals with the whole economy. It deals with research on national income and output. This understanding of science is vast and of varying lengths. However, for simplicity, this article will only focus on the scope and need for macroeconomics.

Microeconomics:

As mentioned above, microeconomics is a branch of economics that deals with individual units of the economy. It includes research areas on individual units such as consumers and homes. The subject deals with issues related to determining the price of goods. These direct or indirect factors affect the supply and demand of goods and the procurement of individual satiety levels. The main purpose of microeconomics is to maximize profits and minimize costs incurred. It is used for future generations to be available and balanced.

Macroeconomics

The term macroeconomics was coined by Ragnar Frisch in 1933. However, the approach to economic problems began in the 16th and 17th centuries. As a result, this originated from mercantilists. It is the field of science that deals with the whole economy or the whole, including macro factors. The hope of macroeconomics does not involve studying individual units of the economy. But the whole economy studies the whole economy and the average. National income, total employment, total savings and investment, aggregate supply and demand, and general price levels.

The subject of macroeconomics revolves around income and employment decisions.

Controlling the cycle of inflation and deflation was only possible by choosing current economic policies. These policies were developed at the macro level. Research on individual units has also become impossible. In addition, government participation through financial and fiscal measures in the economy is increasing. Therefore, the use of macro analysis is irrefutable.

Now we know that macroeconomics is a specialty of economics. Focus on the economy through the sum of the individual units and determine if it will have a significant impact on the country as a whole. All prominent policies and measures are based on this concept. For example, per capita income determines national income. This is nothing but the average of the total income of the people of the whole country.

Scope of Macroeconomics:

Governments, financial institutions and researchers analyze the general problems of the people and the economic well-being of the people.

It mainly covers the foundations of macroeconomic theory and measure theory, which is macroeconomic policy. Here, macroeconomic theories include theories of economic growth and development, national income, money, international trade, employment, and general price levels. In contrast, macroeconomic policy covers fiscal and monetary policy.

Research on issues such as India's unemployment, general price levels and balance of payments (BOP) issues is part of macroeconomic research as it is relevant to the economy as a whole.

Macroeconomic Theories:

The government is understood to be the national regulator. Consider various aspects that are important and have a direct impact on the lives of citizens. There are six theories within the scope of macroeconomics.

Theory of Economic Growth and Development:

Economic growth is also under the study of macroeconomics. Economic resources and capabilities are assessed based on the scope of macroeconomics. It plans to increase levels of national income, output, and environmental levels. They have a direct impact on the economic development of the economy.

Money theory:

Macroeconomics assesses the impact of reserve banks on the economy, capital inflows and outflows, and its impact on employment rates. Frequent changes in the value of money caused by inflation and deflation have many negative effects on the country's economy. They can be exacerbated by monetary policy, fiscal policy, and direct control of the economy as a whole.

National Income Theory:

This includes various topics related to measuring national income, such as revenue, spending, and budget. As a macroeconomic study, it is essential to assess the overall performance of the economy in terms of national income. At the beginning of the Great Depression of the 1930s, it was essential to investigate the triggers of general overproduction and general unemployment.

This led to the creation of data on national income. Helps predict the level of economic activity. It also helps to understand the income distribution among different classes of citizens.

International Trade Theory:

This is a research area focused on the import and export of products or services. Simply put, it points to the economic impact of cross-border commerce and tariffs.

Employment theory:

This macroeconomic scope helps determine the level of unemployment. It also determines the conditions that lead to such unemployment. Therefore, this affects production supply, consumer demand, consumption, and spending behavior.

General Price level theory:

The most important of these are research on commodity prices and how inflation or deflation fluctuates a particular price rate.

Macroeconomic policy:

The RBI and the Government of India are working together to imply macroeconomic policies for national improvement and development.

It falls into two sections:

Fiscal policy:

It refers to how spending fills deficit income and describes itself as a form of budgeting under macroeconomics.

Financial policy:

The Reserve Bank is working with the government to establish monetary policy. These policies are measures taken to maintain the stability and growth of a country's economy by regulating various interest rates.

Importance of macroeconomics:

Macroeconomics is an important concept that considers the whole country and works for the welfare of the economy.

1. Business cycle analysis

Timing of economic fluctuations helps prevent or prepare for financial crises and long-term negative situations.

2. Formulation of economic policy

The fiscal and monetary policy system relies entirely on the widespread analysis of macroeconomic conditions in the country.

3. Reduce the effects of inflation and deflation

Macroeconomics is primarily aimed at helping governments and financial institutions prepare for economic stability in a country.

4. Promote material welfare

This stream of economics provides a broader perspective on social or national issues. Those who want to contribute to the welfare of society need to study macroeconomics.

5. Regulate the economic system

It continues to guarantee or check the proper functioning and actual position of the country's economy.

6. Solve economic problems

Macroeconomic theory and problem analysis help economists and governments understand the causes and possible solutions to such macro-level problems.

7. Economic development

By utilizing macroeconomic data to respond to various economic conditions, the door to national growth will be opened.

Problems related to macroeconomics

Economists need to analyze the following issues while studying macroeconomics.

1. Issues related to government policy

Business activities also bring social costs such as deforestation and land degradation. To regulate this social cost, the government has clear laws and laws in place. These regulations act as barriers for corporate organizations.

2. Problems related to macroeconomic trends in the economy

The economic situation of a country has immeasurable impact on the activities of all organizations, directly or indirectly. The various economic patterns or variables that affect the industry include gross domestic product (GDP), employment rates and conditions, revenue incentives, banks, and pricing policies.

3. Problems related to foreign trade

Many organizations trade (export or import goods) in the international market. They are sensitive to economic fluctuations, exchange rates, prices, and many other factors in other countries. Therefore, such changes can affect the economic situation of the country. This can also affect your business organization.

Conclusion

Macroeconomics is the basis of many economic policies. It lays the foundation for the regional decision-making mechanism of the country. However, policies backed by this concept usually have a dual impact on society as a whole and on individual citizens. It requires an observing, logical and incredible approach.

Difference between Microeconomics and Macroeconomics:

The differences between microeconomics and macroeconomics can be seen in the following points. Microeconomics is the study of the economic activity of individuals and small groups of individuals. This includes specific households, specific companies, specific industries, specific products, and individual prices.

Macroeconomics is also derived from Macross, which means "big" in Greek. The purpose of microeconomics on the demand side is to maximize utility, while on the supply side it is to minimize profits at the lowest cost. On the other hand, the main objectives of macroeconomics are full employment, price stability, economic growth and a good balance of payments.

The basis of microeconomics is a price mechanism that works with the help of the power of supply and demand. These forces help determine the equilibrium price of the market. On the other hand, the basis of macroeconomics is national income, output, and employment, which are determined by aggregate demand and aggregate supply.

Microeconomics is based on various assumptions about the rational behavior of individuals. In addition, the phrase "ceteris paribus" is used to describe economic law. Macroeconomics, on the other hand, makes assumptions based on variables such as the total output of the economy, the extent to which its resources are used, the size of national income, and general price levels.

Microeconomics is based on partial equilibrium analysis that helps explain the equilibrium conditions of individuals, businesses, industries, and factors. Macroeconomics, on the other hand, is based on general equilibrium analysis, which is an extensive study of many economic variables, their interrelationships and their interdependencies, to understand the workings of the entire economic system.

In microeconomics, equilibrium studies are analyzed at specific times. But it does not explain the time element. Therefore, microeconomics is considered static analysis. Macroeconomics, on the other hand, is based on time lags, rate of change, past and expected values of variables. This rough division between microeconomics and macroeconomics is not rigorous, as parts affect the whole and whole influences the parts.

Dependence of Microeconomics on Macroeconomics:

For example, when aggregate demand increases during the prosperous period, so does the demand for individual products. If this increase in demand is due to lower interest rates, then "the demand for different types of capital goods will increase, which will lead to an increase in the demand for certain types of labor required by the capital goods industry. If the supply of such a labor force is inflexible, its wage rate will rise.

Wage rates can be raised by increasing profits from increased demand for capital goods.

Similarly, the overall size of income, output, employment, cost, etc. in an economy affects the composition of individual income, output, employment, and cost of individual companies and industries. To give another example, when total production declines during a recession, capital goods production is lower than consumer goods production. In the capital goods industry, profit and wage employment declines more rapidly than in the consumer goods industry.

Reliance of macroeconomics on microeconomic theory:

On the other hand, macroeconomic theory also relies on microeconomic analysis. The total is made up of parts. National income is the sum of personal, household, corporate and industrial incomes. Total savings, total investment and total consumption are the result of individual industry, business, household and individual savings, and investment and consumption decisions.

A typical price level is the average of all prices for individual goods and services. Similarly, the economic output is the sum of the outputs of all individual production units.

Let's look at some concrete examples of this macro dependence on microeconomics. When the economy concentrates all its resources on the production of agricultural products only, the total production of the economy decreases because other parts of the economy are ignored.

The total level of output, income and employment in the economy also depends on income distribution. If there is an unequal distribution of income and the income is concentrated in the hands of a few rich people, it tends to reduce the demand for consumer goods.

Profit, investment and output will decline, unemployment will widen and the economy will eventually face a recession. Therefore, both macro and micro approaches to economic problems are interrelated and interdependent.

Macro dynamics:

Economic dynamics, on the other hand, is the study of changes in acceleration or deceleration. It is an analysis of the process of change that continues over time.

The economy can change over time in two ways.

(A) Without changing the pattern

(B) By changing the pattern.

Economic dynamics are associated with the latter type of change. When there are changes in population, capital, production technology, the form of business organizations, and people's tastes, the economy takes different patterns in any or all of them, and the economic system changes its direction.

In the attached figure, given the initial value of the economy, D was moving along path AB, but suddenly at A the index changed pattern and the direction of equilibrium changed towards C. Proceed to D again. But in C, the pattern and orientation change to E. Therefore, economic dynamics investigates the path from one equilibrium position to another, that is, the path from A to C and from C to E.

Therefore, economic dynamics is related to time lag, rate of change, past and expected values of variables. In a dynamic economy, data changes and the economic system take time to adjust accordingly. . It can be seen as a" movie "of the progressive overall economic function. "

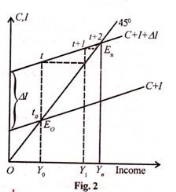

In Figure 2, C + 1 is the aggregate demand function and the 45 ° line is the aggregate supply function. Starting from a period when the income equilibrium level is OY0, the investment increases by ∆I, and in the period t, the income increases by the amount of increased investment (t0 to t). The increase in investment is indicated by the new aggregate demand function C + I + ∆I.

However, in period t, consumption is delayed and is the same as income at E0. In period t + I, consumption increases and new investment increases even higher income up to OY1.

This process of income propagation continues until the aggregate demand function C + I + ∆I crosses the line of aggregate supply function 45 ° at En in the nth period, and the new equilibrium level is determined by OYn. Curve step t0 to En shows the macrodynamic equilibrium path.

What is saved each year is consumed as regularly as it is I spent every year and almost at the same time. But that is consumed by another person. That part of him the income that rich people spend each year is almost always consumed by an idle guest that part he consumes every year immediately for savings, profits employed as capital and consumed at the same manners but by other people ", Adam Smith

Measuring National Income

- Added value and total production.

- Three ways to measure GDP:

- Total production (total value added by all companies).

- Total spending on final products.

- Total income (sum of wages and profits)

- GDP vs. GNP.

- GDP vs. NNP.

Components of GNP

Indirect taxes have been eliminated and solid subsidies. In addition, NNP generates national income at base prices. After this, the national income ,Retained earnings, corporate tax, social security ,Contribution and household income.Government we will also send money to your household. In addition, we earn personal income. In the case of income tax when deducted, you get an individual's disposable income.

Is GDP a good measure of welfare?

- Consumer surplus;

- Externalities (positive and negative).

- Non-market exchanges (housework, underground Economy);

- Depreciation of capital (physical, human and environment);

- Inflation, changes in quality.

- Exchange rate, PPP

- Inequality.

- Keep up with Jones.

- Happiness.

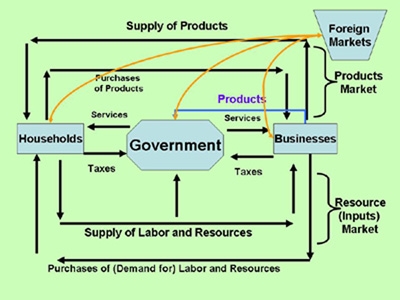

Injections and Withdrawals

- In equilibrium, planned spending should be equal to actual spending. Economy. Pre-expenditure must be equal to post-expenditure.

- Expenditure is the sum of its components.

Y≡ C + I + G + NX

- Consumption C , investment I government expenditure G , NX is a net export (export minus imports).

- Injections into the income cycle must be equal drawer:

S + T + M ≡ I + G + X

- S is savings, T is taxes, M is imports, I is investments, G is Government spending, and X is export Injections and Withdrawals

Circular flow of Income

Aggregate Expenditure

Important assumptions

• Prices and wages are fixed in the short term

• Changes in resources and total spending during unemployment

• It is reflected in changes in output and income.

• But in the long run, wages and prices are flexible.

• Therefore, the change in total spending

• It leads to price level changes, but not output.

• We will only look at short-term fluctuations, not long-term fluctuations growth.

Income generation

• Consumption depends on income.

• Suppose 40% of each pound of income is spent on Consumer Goods: C = 0.4Y

• Companies spend £ 20 on investment goods: I = 20

• National income is 100.

• This is in equilibrium. Withdrawal = Savings = 20 = Injection = Investment = 20

• Planned total demand = total revenue Unbalance

Solving for equilibrium

• Planned spending = income level of income

• Planned spending = C + I = 0.4Y + I

• Setting this equal to income Y gives:

Y = 0.4Y + I, so

Y = I / (1-0.4) = 5I

• The multiplier is 10 = 1 / 0.1 = 1 / marginal propensity to save.

Adjustment Process

• How much income increases when autonomous Increased spending is determined by the multiplier (Richard Kahn, 1931).

• Companies that produce investment goods as I increase Run out of their stock.

• This will increase production over the next period (Equal demand in the previous period).

• Earn extra income and use it for consumers Being a commodity, retailers' inventory is reduced, which triggers them To order more from the manufacturer

Complete the photo

• Two other withdrawals: taxation and imports.

• Initially, government spending and exports were treated as given.

• Taxation and imports depend on the level of income.The government receives 30% of its income as tax, Imports make up 10% of spending.

• Income = Expenditure

• Y = 0.8 * 0.7 * Y + I + G + X-0.1 * Y

• Y = (I + G + X) / (1-0.56 + 0.1)

• Y = (I + G + X) /0.54

Grumpy hive

Still, a huge number of them made them prosperous.Millions of people are trying to supply Mutual desires and vanities. "With greatness. Those who will be resurrectedbGolden age, must be free,nI'm honest about acorns. " Bernard Mandeville (1705)

Paradox of thrift

• At any level if the consumer decides to save more what will happen to my income and income?

• As people save more at the first income level as consumption decreases, so does demand manufacture.

• Therefore, increased savings have reduced production!

• This may only be true in the short term and interest rates are fixed.

• Therefore, savings may be good in the long run, it causes a recession in the short term.

Overview

• GDP can be defined in three different ways: production, spending, or income.

• GDP measurements are incomplete, costly and time consuming. Many economic activity such as housework and housework is not measured underground economy. Therefore, GDP is an incomplete indicator standard of living.

• However, the year-to-year changes in GDP the state of the business cycle.

• In equilibrium, planned spending must be equal to actual spending economy.

• Increased personal frugality can lead to decreased, all other things being equal with total output, and therefore with total savings.

Three views of national income and their relationships. The concept is as follows:

- Gross National Product (GNP)

- Net Gross National Product

- Net Gross National Product at Factor Cost.

The concept of national income

- Gross National Product (GNP):

This is the sum of all final goods and services produced in the economy in a year. In W.C.'s words, Peterson, "Gross National Product may be defined as the current market value of all goods and services produced by the economy during the period of income." There are two ways to avoid double counting when estimating GNP.

- One is to exclude all intermediate goods and count only final goods and services. Final goods and services directly meet consumer needs, and intermediate goods are intended to be exhausted in the production process itself.

- The second way to avoid double calculation is to calculate the "value added" of each production sector in the economy. The value added in a production process over a period of time is calculated by subtracting the input value from the total value of the products leaving the process. The sum of the values added by all processes will give us the value of GNP.

GNP calculated in this way excludes the value of the import because the cost is automatically deducted from the production value of the industry using the value of the import. To get Gross National Product, you need to deduct depreciation from the total "value added". The "added value" method and the "final product" method give the same result. The former considers the flow of production through each process while the "final product" method counts the quantity of goods delivered at the end of a particular period and appropriates the goods still in transit at the beginning and end. Adjust to. Of the period The "added value" method follows normal corporate accounting procedures because all companies record the value of their products and the value of the materials used. The "final product" method suffers from many difficulties in that it requires the actual production of consumer goods and producers' goods to be split.

2. Net Gross Domestic Product:

Subtracting renewal, repair, and obsolescence depreciation from GNP gives you gross national product at market prices. Therefore:

GNP at MP – Depreciation = NNP at Market Price

Depreciation is the loss of value that a country's fixed capital (buildings, machinery, equipment, etc.) inventory suffers from wear and tear. The issue of valuing the depreciation of capital stock is one of the most annoying issues in the field of national accounts. The convention was to accept business records as a measure of depreciation without having to re-estimate in terms of current replacement costs. Therefore, a purely domestic product means the market value of all final goods and services after depreciation. The big advantage of the NNP concept is that it reveals a net increase in total production, in addition to current consumption and current alternative investments. This means a long-term improvement in the physical productivity of capital. The concept of NNP has the great advantage of showing a net increase in total products. It emphasizes the long-term importance of maintaining the productivity of the economy. Therefore, it is very useful for researching economic growth.

3. Net national income at factor cost:

When a factor of production is produced, the factor of production is paid in form or wage, interest and profit on rent. NNI is the sum of all income payments made to the factor of production. The sum of goods and services for the year is produced by the cooperation of the factors of production, so their monetary value is also distributed to the factors of production.

Therefore, national income can also be regarded as the total or income received by the person who provides the factor of production or the services and resources used for production. These payments take the form of wages, rent, interest and profits.

Therefore, the main components of national income at factor cost are:

- All wages, salaries, and supplementary income earned by employees for the productive services provided, and

- Interest paid to individuals plus

- Net rent for all individuals. Including attribution payments such as rent for private housing

- Income of individual businesses such as farmers, partnerships, professionals such as lawyers, net income of corporations including dividend payments, undistributed income and net income of all types of businesses including corporate tax Minus

- Transfer payments, that is, income payments that do not provide productive services in return. In other words, these are not payments for the production of goods or services, but state or similar public payments from one individual to another, such as interest paid on national debt, social security payments (such as unemployment allowances and old ones). Represents the transfer of income through a target institution (age pension), etc

These remittance payments must be deducted from the total national income determined by adding the total payments made to the factor of production. In addition to the concept of net national income, it is useful to have ideas for certain other income concepts needed for a particular purpose.

The most important of these are:

Personal income:

Tax authorities need ideas about the income that assessors actually receive from a variety of sources. They need an estimate of personal income so that they can shape their tax policy. Personal income is the sum of the incomes that everyone receives from all sources of income. It consists of wages and salaries, interest rents, and dividends received by individuals, including business entities (such as clubs and churches treated as a group .It also includes mixed incomes of self-employed people such as farmers, shopkeepers and barristers, and all remittances received from public institutions by people such as pensions, unemployment allowances and family allowances.

Therefore, personal income is equal to national income minus undistributed profits of companies and public enterprises minus remittances received by individuals. The difference between "national income" and personal income is that remittances excluded from "national income" are included in personal income.

The steps involved in calculating personal income are displayed as follows:

- National income

- Small corporate profit

- Employers' contribution to social insurance is small

- Plus government. Money transfer

- Plus business transfer payment

- Plus net interest paid by the government

- Plus interest paid by consumers

- Plus dividend

- Employees' contribution to social insurance is small

- Equal to personal income

- Disposable income:

Personal income as defined above is not income that a person has the full command to spend, save, or give in any way he or she likes. Income tax and national insurance premiums are mandatory payments and must be deducted in order to obtain what is called personal disposable income.

This income also includes fixed commitments such as contributions such as pensions and installment payments for employment purchases to further reduce individual disposable income.

Therefore, disposable personal income is obtained by deducting personal tax from personal income. These personal taxes are in the form of income tax, wealth tax, expenditure tax and occupational tax. Disposable income consists of personal spending and personal savings.

Disposable income = personal income – personal tax = personal consumption + personal savings.

The concept of disposable income is especially useful in estimating the expected demand for goods and services for personal use by individuals. In times of national emergencies and shortages, this concept helps predict the gap between available supplies and expected demand for goods and services.

Gross National Product (GDP), Gross National Product (GNP), Net Gross National Product (NNI), Adjusted Gross National Product, etc., in economics to estimate gross national product and production in a country or region. A variety of high indicators are used. (NNIs are tuned for natural resource depletion – also known as NNIs for factor cost). Both are of particular interest in counting the total amount of goods and services produced within the economy and in various sectors. Boundaries are usually defined by geography or citizenship, also as the country's total income, and limit the goods and services that are counted. For example, some measures count only the goods and services that are exchanged for money, excluding the bartered goods, while others try to include them by imposing monetary value on the bartered goods. There is also National accounts

A large amount of data collection and calculation is required to reach the total production figures of goods and services in a large area such as a country. Although several attempts were made to estimate national accounts by the 17th century, [2] systematic maintenance of national accounts, including these figures, began in the United States and some European countries in the 1930s. It was. The driving force behind its key statistical efforts is the rise of Clutch plague and Keynesian economics, which defines the government's greater role in economic management and provides accurate information to the government to advance its intervention in the economy. I needed to. Provide as much information as possible.

In order to count goods and services, we need to assign value to them. The value that national income and output measurements assign to a good or service is its market value, the price you get when you buy or sell. The actual utility of the product (its value in use) is not measured – assume that the value in use differs from its market value.

Three strategies are used to obtain the market value of all products and services produced: product (or production) method, expenditure method, and income method. The Product Law examines the economy by industry. The total output of the economy is the sum of the output of all industries. However, because the output of one industry may be used by another industry and become part of the output of that second industry, the value of each industry's output should not be counted twice. Use added value instead. In other words, the difference in value between what it produces and what it incorporates. The total value produced by the economy is the sum of the values added by all industries.

Spending methods are based on the idea that all products are purchased by someone or some organization. Therefore, we sum the total amount that people and organizations spend to buy things. This amount should be equal to all the values generated. Individual spending, corporate spending, and government spending are usually calculated separately and summed up to total spending. In addition, it is necessary to introduce an amendment period in consideration of imports and exports outside the boundary.Their total revenue must be the total value of the product, as they are only paid for the market value of their product. Wages, owners' income, and corporate profits are the main subdivisions of income.

How to measure national income

Output

The output approach focuses on finding the total output of a country by directly finding the total value of all goods and services produced by the country.

Due to the complexity of multiple stages in the production of a good or service, only the ultimate value of the good or service is included in the total production. This avoids a problem called "double counting" where the total value of goods is included several times in a country's production by repeatedly counting at several stages of production. In the meat production example, the value of goods from a farm could be $ 10, then $ 30 from a butcher, and $ 60 from a supermarket. The value that should be included in the final national production should be $ 60, not the sum of all these numbers, $ 100. The added values at each stage of production compared to the previous stage are $ 10, $ 20, and $ 30, respectively. The sum of them provides another way to calculate the value of the final output.

The main formulas are:

- GDP (Gross Domestic Product) at market price = production value in a particular year's economy minus intermediate consumption

- GDP at Factor Cost = GDP at Market Price-Depreciation + NFIA (Net Factor Revenue from Overseas)-Net Indirect Tax (GNP)

- NDP at Factor Cost = Employee Compensation + Net Interest + Rental and Loyalty Income + Income and Unincorporated NDP Profit at Factor Cost

Spending

The spending approach is basically an output accounting method. It focuses on finding the country's total production by finding the total amount spent. This is acceptable to economists, as the sum of all commodities, as well as income, is equal to the total amount spent on the commodities. The basic formula for domestic output is to take all the various fields in which money is spent in the region and combine them to obtain the total output.

{\ displaystyle \ mathrm {GDP} = C + G + I + \ left (\ mathrm {X} -M \ right)} {\ mathrm {GDP}} = C + G + I + \ left ({\ mathrm { X}} -M \ right)

Where:

C = consumption household expenditure / consumption expenditure personal

I = total private sector investment

G = Government consumption and total investment expenditure

X = total export of goods and services

M = Total import of goods and services

Note: (X-M) is often described as XN or NX, both representing "net exports".

The name of the measure consists of either the word "Gross" or "Net", the word "National" or "Domestic", or the word "Product", "Income", or "Expenditure". Will be done. ". All of these terms can be explained individually."Gloss" means the entire product, regardless of its subsequent use. That is, the depletion or obsolescence of a country's fixed capital assets. The "net" indicates the amount of product that is actually available for consumption or new investment.

"Domestic" means that the boundaries are geographical. That is, it counts all goods and services produced within the border, regardless of who they are.

"Nationality" means that boundaries are defined by citizenship (nationality). We count all goods and services produced by the people of the country (or the companies they own), regardless of where their production physically takes place.

The production of French-owned cotton factories in Senegal is counted as part of Senegal's national figures, but as part of France's national figures.

"Product," "Income," and "Expenditure" refer to the three counting methods described earlier: the product, income, and expenditure approach. However, these terms are used loosely.

"Product" is a general term and is often used when one of the three approaches is actually used. The word "product" may be used, followed by additional symbols or phrases to indicate the methodology. So, for example, you get structures such as "Gross Domestic Product", "GDP (Income)", and "GDP (I)".

"Income" here is the income approach was used.

"Expenditure" specifically means that the spending approach was used.

Note that in theory, all three counting methods give the same final number. However, in reality, there are subtle differences from the three methods for several reasons, such as inventory level changes and statistical errors. For example, one problem is that an in-stock item has been produced (and therefore included in the product) but not yet sold (and therefore not yet included in the expenditure). Similar timing issues are due to the value (product) of the product produced and the factors that produced it, especially when the input is purchased with credit and wages are often collected after a period of time. Of production that can cause slight discrepancies between (income)

Gross domestic product (GDP) and gross national product(GNP)

GDP

Gross Domestic Product (GDP) is the sum of the monetary or market value of all finished products and services produced within a border over a particular period of time. It serves as a comprehensive scorecard for the economic health of a particular country as a broad measure of overall domestic production.

For example, in the United States, the government publishes annual GDP estimates for each accounting quarter and calendar year. The individual datasets included in this report are effectively provided, so the data is adjusted for price fluctuations, minus inflation. In the United States, the Bureau of Economic Analysis (BEA) of the US Department of Commerce uses data identified through surveys of retailers, manufacturers, and builders to look at trade flows and calculate GDP.

Important points

- Gross Domestic Product (GDP) is the monetary value of all finished products and services manufactured domestically during a particular period of time.

- GDP provides a snapshot of a country's economy and is used to estimate the size and growth rate of the economy.

- GDP can be calculated in three ways using spending, production, or income. It can be tailored to inflation and population to provide deeper insights.

Despite the limitations of GDP, GDP is an important tool for policy makers, investors and businesses to make strategic decisions.

GNP

Gross National Product (GNP) is an estimate of the sum of all final products and services produced in a particular period by means of production owned by a resident of the country. GNP is usually calculated from the sum of consumer spending, private domestic investment, government spending, net exports, and income earned by residents from foreign investment minus income earned by foreign residents in the domestic economy. I will. Net exports represent the difference between what a country exports minus imports of goods and services. 1

GNP is associated with another important economic indicator called Gross Domestic Product (GDP). This takes into account all production produced within the border, regardless of the owner of the means of production. GNP starts with GDP, adds the investment income of the resident from the overseas investment, and deducts the investment income of the foreign resident obtained in Japan. (For related materials, see "About GDP and GNP") 1

Important points

- GNP measures the production of residents of a country, regardless of the location of the actual underlying economic activity.

- Income from foreign investment by national residents is included in GNP and does not include foreign investment within national borders. This is in contrast to GDP, which measures economic output and income based on location rather than nationality. 1

- GNP and GDP can have different values, and the significant differences between countries' GNP and GDP may indicate significant integration into the global economy.

As an example, the table below shows some of the US GDP and GNP, and NNI data.

NDP: Net domestic product, like NNP, is defined as "gross domestic product (GDP) minus capital depreciation"

GDP per capita: Gross domestic product per capita is the average value of per capita production and is also the average income.

National income and welfare

GDP per capita (per capita) is often used as a measure of human welfare. Countries with high GDP are more likely to score high on other welfare indicators such as life expectancy.

GDP measurements usually exclude unpaid economic activity, most importantly domestic work such as childcare. This leads to distortion. For example, the income of a paid nanny contributes to GDP, but the time unpaid parents spend caring for their children does not, even if they both have the same economic activity.

GDP does not consider the inputs used to generate the output. For example, if everyone worked twice as long, GDP could double, but this does not necessarily mean that workers are better because they have less leisure time. Similarly, the environmental impact of economic activity is not measured in GDP calculations.

Comparison of GDP from one country to another can be distorted by fluctuations in exchange rates. Measuring national income at purchasing power parity may overcome this problem at the risk of overestimating basic commodities and services such as subsistence agriculture.

GDP does not measure factors that affect quality of life, such as environmental quality (different from input) or security from crime. This leads to distortion-for example, spending on cleaning oil spills is included in GDP, but the negative impact of spills on well-being (for example, loss of clean beaches) is not measured.

GDP is not the median (midpoint) wealth, but the average (average) wealth. In countries with a biased income distribution, wealth is concentrated in the hands of a small part of the population, so the majority of the population has a relatively low level of income, while per capita GDP is relatively high. It is likely to be high. See Gini coefficient.

For this reason, other welfare indicators such as the Human Development Index (HDI), Sustainable Economic Welfare Index (ISEW), Genuine Progress Indicator (GPI), Gross National Happiness (GNH), and Sustainable National Income (SNI). Is used.

Macroeconomics consist of two types of equilibrium. The short term in macroeconomic analysis is the period during which wages and other prices do not respond to changes in economic conditions. In certain markets, prices (including wages) may not adjust fast enough to keep these markets in equilibrium as economic conditions change. A sticky price is a price that is slow to adjust to an equilibrium level and creates a period of persistent shortfall or surplus. Wage and price stickiness is preventing the economy from achieving its natural employment levels and potential GDP. In contrast, the long term of macroeconomic analysis is a period of flexible wages and prices. In the long run, employment will move to natural levels and real GDP will move to potential levels.

We will start with a discussion of long-term macroeconomic equilibrium. Because this type of equilibrium allows us to see the macro economy after full market adjustments have been achieved. In the short term, in contrast, price and wage stickiness hinders complete adjustment. The reasons for these deviations from potential output levels and their impact on the macroeconomy are discussed in the Short-term Macroeconomic Equilibrium section.

In the long run

As explained in the previous chapter, the natural level of employment occurs when real wages are adjusted so that the amount of labor required is equal to the amount of labor supplied. When the economy achieves natural levels of employment, it achieves potential production levels. We can see that real GDP will eventually move to potential, as all wages and prices are expected to be flexible in the long run.

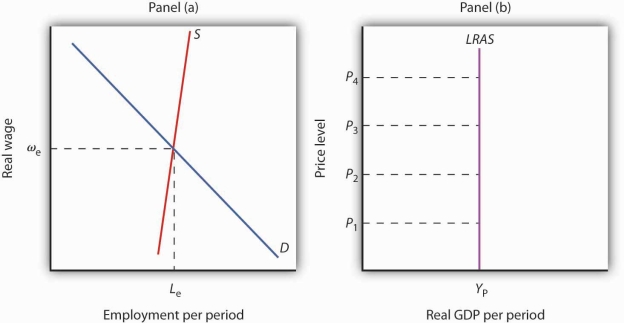

Long-term aggregate supply

The long-term aggregate supply (LRAS) curve associates the level of production produced by an entity with the long-term price level. In Figure 22.5, “Natural Rate of Unemployment and Long-Term Aggregate Supply” panel (b), the long-term aggregate supply curve is a vertical line at the potential production level of the economy. Only one real wage will bring employment to a natural level. In Figure 22.5 “Natural rate of unemployment and long-term aggregate supply” panel (a), only the real wages of ωe produce the natural rate of unemployment Le. However, the economy can achieve this real wage in any of an infinitely large set of combinations of nominal wages and price levels. For example, suppose the equilibrium real wage (the ratio of wages to price levels) is 1.5. You can do that with nominal wage level 1.5 and price level 1.0, nominal wage level 1.65 and price level 1.1, nominal wage level 3.0 and price level 2.0, and more.

When the economy reaches natural employment levels at the intersection of the labor supply and demand curves, as shown in panel (a), potential output is achieved by vertical long-term aggregate supply, as shown in panel (b). Curve LRAS at YP.

Panel (b) shows price levels in the range P1 through P4. Higher price levels require higher nominal wages to generate real wages for ωe, and flexible nominal wages will achieve that in the long run.

Therefore, in the long run, the economy can achieve natural employment levels and potential output at any price level. This conclusion shows a long-term aggregate supply curve. Since there is only one output level at any price level, the long-term aggregate supply curve is a vertical line at the potential output level of the economic YP.

In the short term, one factor of production is fixed, usually capital. However, the fixed factor does not stop the ability of the curve to shift outwards. As the curve shifts to the right, production increases and GDP decreases at certain prices. Examples of events that cause the curve to shift to the right in the short term include lower wage rates, increased physical capital stock, and technological advances.

In the long run, only asset, employment and automation affect the aggregate supply curve. This is because at this point it is assumed that everything in the economy is being used optimally. Long-run curves are often considered static because they shift the slowest. The long-term aggregate supply curve is vertical, demonstrating the economist's belief that changes in aggregate demand only bring about temporary changes in the economy's total output. Examples of events that shift the long-term curve to the right include population growth, physical capital stock growth, and technological advances.

Reason for shift

The short-term total supply curve is affected by production costs such as taxes, subsidies, labor prices (wages) and raw material prices. All of these factors shift the short-term curve. If there are changes in the quality and quantity of workforce and capital, those changes affect both short-term and long-term supply curves. The long-term aggregate supply curve is affected by events that change the potential output of the economy.

Changes in short-term aggregate supply increase real GDP while lowering the price level of goods or services. In the long run, prices will stabilize and the price levels of goods and services will rise as they change.

The business cycle is a cycle of fluctuations centered on the long-term natural growth rate of gross domestic product (GDP). It explains the expansion and contraction of economic activity that the economy experiences over time.

The business cycle is completed through one boom and one contraction in sequence. The time it takes to complete this sequence is called the length of the business cycle. The boom is characterized by periods of rapid economic growth, but periods of relatively stagnant economic growth are depressed. These are measured in terms of inflation-adjusted real GDP growth

Business cycle stage

In the figure above, the straight line in the middle is the stable growth line. The business cycle moves across the line. The following is a detailed description of each stage of the business cycle.

- Extension

The first stage of the business cycle is expansion. At this stage, positive economic indicators such as employment, income, output, wages, profits, demand and supply of goods and services are increasing. Debtors generally pay off their debts on time, the money supply is fast and the investment is high. This process will continue as long as the economic situation favors expansion.

- Peak

The economy then reaches end , the next phase of the business cycle. You have reached the growth limit. Economic indicators are the best, no further growth. Prices have peaked. This stage marks a reversal of economic growth trends.

- Recession

The recession follows the peak phase. At this stage, the demand for goods and services begins to decline rapidly and steadily. Producers continue to produce without immediately noticing a decline in demand, creating an oversupply situation in the market. Prices tend to go down. As a result, all positive economic indicators such as income, output and wages begin to decline

- Depression

There is a corresponding increase in the unemployment rate. This stage is called a recession because economic growth continues to decline, which is below a stable growth line.

- Trough

During the recession, the economic growth rate will be negative. Factor prices, as well as supply and demand for goods and services, will fall further until they reach their lowest points. The economy eventually reaches the valley. It is a negative saturation point for the economy. The income and expenditure of the people are greatly depleted

- Recovery

After this stage, the economy is in a recovery stage. At this stage, there is a recovery from the valley and the economy begins to recover from negative growth. Demand begins to recover due to lower prices, and as a result, supply begins to react. The economy shows a positive attitude towards investment and employment, and production begins to increase.

Employment has begun to increase, and lending is also showing positive signs due to the accumulation of cash balances with bankers. Recovery will continue until the economy returns to stable growth levels. It completes one complete business cycle of boom and contraction. Extreme values are peaks and valleys.

Explanation by economist

John Maynard Keynes describes the occurrence of a business cycle as a result of fluctuations in aggregate demand. This puts the economy in a short-term equilibrium that is different from the full employment equilibrium. The Keynesian model does not necessarily show a regular business cycle, but it does mean a periodic response to a shock through a multiplier. The degree of these fluctuations depends on the level of investment, which determines the level of total production.

On the contrary, economists such as Finn E. Kidland and Edward C. Prescott, who belong to the Chicago School, disagree with Keynesian theory. They believe that fluctuations in economic growth are not the result of financial shocks, but the result of technology shocks such as innovation.