Unit –III

Fiscal policy

Fiscal policy has several purposes, depending on the circumstances of the country.

The key objectives of fiscal policy are:

- Optimal allocation of economic resources. Its purpose is that fiscal policy should be structured to increase the efficiency of productive resources. To ensure this, governments should spend on those public works projects that give them maximum employment.

- Fiscal policy should aim for an equitable distribution of wealth and income. That means that fiscal policy needs to be designed to bring about reasonable income equality among different groups by shifting wealth from the rich to the poor.

- Another purpose of fiscal policy is to maintain price stability. It can have a big impact on fixed income classes while benefiting speculators and traders. Fiscal policy must be such that it maintains reasonably stable price levels, thereby benefiting all sectors of society.

- The most important purpose of fiscal policy is to achieve and maintain full employment. It automatically achieves most other purposes. Fiscal policy aimed at full employment envisions a tax system direction, not to increase revenue, but to be aware of the impact of certain types of taxes on consumption, savings and investment.

The issue is determining the amount and direction of government spending not only to provide specific services, but also to adapt public spending to the general patterns of total spending currently taking place in the economy.

These goals, especially price stability and full employment goals, are not always compatible. The purpose of fair distribution of income can be inconsistent with the purpose of economic efficiency and economic growth. Fiscal policy can be adjusted to transfer wealth from the rich to the poor through taxation with the aim of bringing about income redistribution. However, the transfer of income from the rich to the poor has a negative impact on savings and capital formation. Therefore, fairness and the purpose of growth are inconsistent.

Fiscal policy measures

- Fiscal policy tools are taxes, spending, public debt, and national budgets. They consist of changes in government revenues or tax rates to encourage or limit private spending on consumption and investment.

- Public spending includes regular government spending, capital spending on public works, relief spending, various types of subsidies, remittances and social security benefits.

- Government spending generates income, and taxes primarily reduce income. Managing public debt has also become an important tool in fiscal policy in most countries. It aims to influence total spending through changes in liquid asset holdings.

During inflation, fiscal policy aims to curb excessive total spending, while during recession it aims to make up for the lack of effective demand to lift the economy from the depths of the recession. The following considerations should be noted when adopting appropriate policy measures:

Opposite periodic budget policy:

A managed budget policy means changing spending at a constant tax rate, changing the tax rate at a constant spending, or a combination of the two. Budgetary control may be used to address depression and inflationary situations. Under this policy, deliberate attempts have been made to adjust revenues, expenditures and public debt to eliminate unemployment during recessions and achieve inflationary price stability.

Reverse circulation policy means an imbalanced budget. An imbalanced budget during depression means deficit spending. To make it more effective, the government may cover the deficit by borrowing from banks. During the period of inflation, the policy is to secure a budget surplus by reducing government spending.

The government can partially use the budget surplus to repay unpaid government debt. It is believed that the surplus budget has a deflationary effect on national income, and the deficit budget tends to increase. A deficit budget is desired during depression when income flow needs to be increased. Inflation, on the other hand, gives priority to surplus budgets when it is necessary to check for income overflows.

However, following a reverse-circular budget policy is not an easy task. Predicting a recession or inflation boom is a difficult task. Adjusting the budget for rapidly changing economic conditions is even more difficult, especially if the budget is a political decision to be made after significant delays and debates. Therefore, in order to be more effective as a weapon of reverse-circular fiscal policy, it is also necessary to focus on adjusting individual items of the budget.

Taxation policy:

The structure of tax rates needs to change according to the prevailing conditions in the economy. Taxes determine the size of disposable income in the hands of the general public and therefore the amount of the inflation-deflation gap. During depression, the tax system should be something that encourages personal consumption and investment. Meanwhile, during inflation, the tax system must reduce consumption and investment.

During depression, general reductions in corporate and income taxes are provided by Professor A H. Hansen, M. Kalecki, R.A. has been endorsed by economists such as. Musgrave because low corporate taxes encourage "venture capital" and thereby encourage more investment, while this leaves higher disposable income and induces more consumption for people.

However, some have raised serious questions about the potential stimulus effect of tax cuts on investment. It has been argued that even significant tax cuts will not change entrepreneurial decisions.

Mr. Calecki expressed the view that tax cuts to increase consumption and stimulate private investment are not a practical solution to the unemployment problem, as income taxes cannot be changed so often. The government will have to develop long-term fiscal policy.

During inflation, new taxes can be levied to wipe out surplus purchasing power. However, you need to be careful not to raise taxes enough to curb new investment and cause a recession. Expenditure tax and excise tax have the property of preventing inflation. During inflation, fiscal authorities should aim to impose taxes, such as reducing current excess demand for certain commodities, rather than aggregate demand.

Redistribution taxation is probably the best way to raise and stabilize the consumption function. Redistribution taxation means a progressive tax structure. This means that high-income groups are taxed at high rates and middle-income and low-income groups are taxed at low rates in order to increase personal consumption.

Public Debt:

A sound program of public borrowing and debt repayment is a powerful weapon in combating inflation and deflation. Government borrowings can take the form of borrowings from non-bank financial intermediaries, borrowings from commercial banking systems, withdrawals from central banks, or printing of new money.

Public borrowing by selling bonds and securities to reduce consumption and private investment.

Borrowing from the public through the sale of bonds and securities that reduce consumption and private investment is effectively anti-inflation. Borrowing from the banking system is effective during depression if the bank has excessive cash reserves.

Therefore, if we could lend unused cash in banks to the government, it would bring a net increase in the flow of national income. Withdrawals of balances from the Treasury are inflation in nature, but these balances can be so small that they are of little importance to the economic system. But printing new money is very inflationary.

During the war, when inflationary pressures increase, borrowing is needed. Therefore, during periods of inflation, public debt needs to be managed in ways that reduce the money supply and credit in the economy. The government will be successful in paying off debt through a budget surplus.

Conversely, during depression, taxes are reduced and public spending is increased. The deficit is covered by borrowings from national public, commercial or central banks. Otherwise, public borrowing of idle funds does not adversely affect consumption or investment. If you're short on budget, it's very difficult to pay off your debt.

In fact, you accumulate debt during depression and pay to redeem it during the period of expansion. As a result, financial authorities (central banks) need to aim for low bank interest rates in order to keep their debt burden low.

Public spending:

Public spending can be used to stimulate production, income and employment. Government spending forms a very important part of the total spending of the economy. Its reduction or expansion causes large fluctuations in total income. It can help coordinate consumption and investment to achieve full employment.

During inflation, the best policy is to reduce government spending to control inflation by giving up plans that are justified only during deflation. Expenditures will be reduced, but attempts are being made to increase public revenues to generate a budget surplus.

Certainly there are limits that may not reduce government spending beyond that (for example, due to political and military considerations), but governments can change spending to some extent to reduce inflationary pressures. ..

Public spending becomes more important during depression. There is a distinction between the concept of public spending during depression, the concept of pump priming and therefore the concept of "compensatory spending". Pump priming means that a certain amount of public spending will help the economy recover and gradually reach a satisfactory level of employment and production. This amount of spending is not specific. The idea is that small amounts of public spending may be a good starting point if personal spending is in short supply.

Compensatory spending, on the opposite hand, means public spending with a transparent view of compensating for the decline privately investment. The idea is that if private investment declines, public spending will increase and public compensation spending will continue as long as private spending is below normal. These spending has the synergistic effect of raising the level of income, output and employment.

Compensatory public spending can take the form of relief spending, subsidies, social insurance payments, public works, and so on

The mandatory requirements for compensatory public spending are:

(1) There must be the maximum leverage effect possible.

(2) It shouldn’t be cancelled.

(3) We must create economically and socially desirable assets. However, pump priming spending is less important in developed countries, where investment shortages are not only periodic, but also long-term.

Public works:

Expenditures for accumulating capital assets are called capital expenditures, and transfer payments are called ordinary expenditures. The government is encouraged to have a list of public works projects that may be picked up when there are signs of a recession.

Such a public investment program will ease the general morale of businessmen for investment. Primary employment in public works programs induces secondary and tertiary employment. As soon as the economy gets on the expansion track, such programs could be relaxed and completely abandoned so that public investment does not compete with private investment at any time.

Public works programs have some limitations and practical difficulties. It is unrealistic to expect public works to fill all investment gaps in the private sector of the economy. To be truly effective in facilitating investment during the Great Depression, utilities require the right time, the right funding, and the general approval of business and investment opportunities.

Public works programs cannot be easily adapted to the trade cycle, as many projects such as river dams take a long time to complete and many other projects such as schools and hospitals cannot be postponed. If you need these, you need to build them anyway.

Again, certain heavy projects that take a long time to complete and were started during the recession cannot be abandoned without a serious loss of goodwill to the government. Second, there are the issues of being able to know when the period of forecasting, inflation or deflation will begin, and quickly determining the exact nature of the program being implemented. Besides, there is a delay in getting them started. Again, because the project is in one area and the unemployed are in another, the debt burden is high and can lead to resource misallocation.

Some economists support a comprehensive program of social security measures such as pensions, subsidies, unemployment and insurance because of these restrictions on public works. These not only increase consumption during depression, but also stabilize it over the long term. If such a social security program is funded through progressive taxation, its purpose will be better served. The wise way is to coordinate social security measures and public works programs.

Built-in-Flexibility:

One of the practical difficulties of finance is to have enough flexibility to use financial tools quickly and effectively. For example, the tempo of business activity can change suddenly and appear in booms and slumps, but financial tools cannot be adjusted at once to handle such situations. To overcome these practical difficulties, we need to ensure the flexibility built into financial tools.

Flexibility is built into the fiscal system when changes in employment in the economy bring about significant compensatory changes in government revenues and expenditures. The unemployment insurance system has built-in flexibility on both the spending and taxing sides.

As employment increases, the cash spent on dolls is automatically reduced. Price support programs, certain excise taxes, especially those levied on luxury goods, also have some flexibility built in.

However, built-in flexibility may prove inadequate to deal with strong deflationary and inflationary pressures. Therefore, formal flexibility (or flexibility at the discretion of management) is required.

The official system of flexibility provides specific changes in the amount of taxation and government spending required by certain well-recognized issues in business activities. It requires administrative decisions about the necessary changes that must be implemented without delay.

Administrative discretion means delegating to the CEO the authority to order any changes he considers to be compatible with government spending and taxation. These measures are needed to complement the flexibility built into some schemes.

Built-in stabilizer:

The fact that both taxes and remittances change automatically as income levels change is the basis of our belief in the built-in stabilizer. The term "stabilizer" is used to act to counteract fluctuations in economic activity. These are called "built-in" because they work automatically when your income level changes.

A tax system that automatically increases the amount of tax collected by the government as national income increases may have a stable impact on the economic system. In this case, it has the effect of suppressing the expansion of disposable income. From a stabilization point of view, it means a slower rise in induced consumption.

If the tax system is such that not only the absolute amount of tax revenue but also the proportion of tax revenue increases as income increases, the impact on stabilization will be greater. This happens when the tax system is progressive, that is, when the effective tax rate rises as income levels rise.

Similarly, various forms of remittances work in a reverse cycle. Only such transfer payments have a stable effect, such as a decrease in the amount when income increases and an increase in the amount when income decreases.

For example, when employment decreases, payments to the unemployed automatically increase, which increases disposable income and vice versa. It would be too much to speculate that these stabilizers themselves can smooth income fluctuations, but most people effectively complement their discretionary actions aimed at stabilizing the economy.

Meaning:

In India, public debt refers to a portion of the total amount of federal debt, including market loans, special bearer bonds, government bonds, special loans and securities issued by reserve banks. It also includes unpaid external debt. However, the following borrowing items are not included.

- Slight savings,

- Fund,

- Other accounts, reserves and deposits.

Total federal debt, including public debt and these other debts, is commonly known as "government net debt."

Purpose:

In India, most government debt is held in long-term interest-bearing securities such as national savings certificates, local development bonds and capital development bonds. In industrialized nations like the United States, the term government debt or public debt refers to cumulative debt, although the government borrowed it to cover past deficits. In such countries, government debt has a very simple relationship with government deficits, and an increase in debt over a period of time (eg one year) is equal to the current budget deficit. However, in India, this term is used in a different sense.

States usually borrow from the public to meet three types of spending.

- To deal with the budget deficit

- To cover the costs of war and other unusual situations

- Fund development activities.

(A) Public debt to meet the budget deficit:

Whenever public spending exceeds public revenue, it is not always appropriate to make tax changes. You need to make sure that the transaction is casual or regular. If the budget deficit is accidental, it is appropriate to raise a loan to cover the deficit. But if the deficit is a regular feature each year, the state's proper policy is to increase its income or reduce its spending through taxation.

(B) Public debt to respond to emergencies such as war:

In many countries, existing public debt is largely due to war costs. This type of public debt has increased significantly, especially after World War II. Most of India's public debt came to cover the costs of the last war.

(C) Public debt for development purposes:

During British rule in India, public debt had to be raised to build railroads, irrigation projects and other construction. In the post-independence era, the government borrowed from the public to cover the cost of development work under a five-year plan and other projects. As a result, the amount of public debt is increasing day by day.

Burden of public debt:

When one country borrows money from another (or a foreigner), it incurs external debt. It all owes to others. When a country borrows money from another person, it has to pay interest on such debt along with the principal. This payment is made in foreign exchange (or gold). If the debtor does not have sufficient foreign exchange inventories (accumulated in the past), the debtor will be forced to export its goods to the creditor. In order for debtor countries to be able to export goods, it is necessary to generate sufficient export surplus by reducing domestic consumption.

Therefore, external debt reduces the potential for social consumption by subtracting the net amount from the resources available to people in debting countries to meet their current consumption needs. In the 1990s, many developing countries, such as Poland, Brazil and Mexico, faced serious financial difficulties after incurring large external debt. They reduce domestic consumption so that they can generate export surpluses (that is, to export more than imports) to repay external debt, that is, to pay interest and principal on past debt. I was forced to do it.

The external debt burden is measured by the debt repayment ratio, which reverts to the obligation to repay the principal and interest on the external debt for a particular year. This is expressed as a percentage of the export (that is, the current receipt) of goods and services. That year in India it was 24% in 1999. External debt puts a strain on society because it represents a decline in the country's consumer potential. It causes an inward shift in the productivity curve of society.

Three problems:

When we shift our attention from external debt to internal debt, we find that the story is different. It causes three problems:

- Distortion effect on incentives due to additional tax burden,

- To divert the limited capital of society from the productive private sector to the unproductive capital sector.

- Shows the economic growth rate.

Let's take a brief look at these three issues.

1. Loss of efficiency and welfare due to taxation:

When the government borrows money from its own people, the government must pay interest on such debt. Interest is paid by imposing taxes on people. Incentives for work and savings can be adversely affected if people need to pay more taxes just because the government has to pay interest on debt. If the same individual was a taxpayer and a bondholder at the same time, it could be a happy coincidence.

But even in this case, the distorted impact of taxes on the inevitable incentives is unavoidable. If the government imposes additional taxes on Mr. X to pay interest, he may have less work and less savings. Either (or both) of the results should be considered a distortion from efficiency and well-being. In addition, if most bondholders are rich and most taxpayers are modest people, paying off debt redistributes income (welfare) from the poor to the rich.

2. Capital displacement (crowding out) effect:

Second, when the government sells bonds and borrows money from the public, the limited capital of society is diverted from the productive private sector to the unproductive public sector. A capital shortage in the private sector will push up interest rates.

In fact, while selling bonds, the government is competing for borrowed money in the financial markets, pushing up interest rates for all borrowers. Due to the large deficit in recent years, many economists are interested in competition for funds. Higher interest rates are also discouraging borrowing for private investment, an effect known as crowding out.

This, in turn, leads to lower economic growth. Therefore, a decline in living standards is inevitable. This seems to be the most serious consequence of large public debt. Paul Samuelson said: "Perhaps the foremost serious consequence of huge amounts of debt is that it replaces capital from the country's wealth stock. As a result, economic growth slows and future living standards decline."

3. Public Debt and Growth:

By diverting the limited capital of society from the productive private sector to the unproductive public sector, debt acts as a slowing factor for growth. Therefore, the economy grows much faster in the absence of public debt than in the absence of debt.

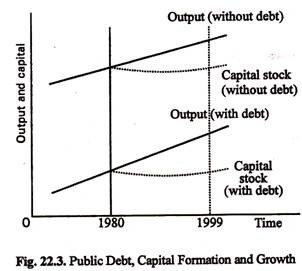

Considering all the implications of government debt on the economy, we can see that large amounts of public debt can have a negative impact on long-term economic growth. Figure 22.3 shows the relationship between growth and debt. Suppose the economy runs debt-free for a long time. In that case, the capital stock and potential GDP follow the virtual path shown by the solid line in the figure.

Now let's say the government has increased its huge deficit and debt. More and more capital is being replaced over time as debt accumulates, as shown by the dashed capital line at the bottom of Figure 22.3. As the government imposes additional taxes on people to pay interest on debt, there is greater inefficiency and distortion, which further reduces production.

More seriously, rising external debt lowers national income and increases the proportion of GNP that must be secured each year to repay external debt. Considering all the effects of public debt together, production and consumption will grow more slowly than without big government debt and deficits, as shown by comparing the upper lines in Figure 22.3..

Huge government debt tends to reduce potential GDP growth by replacing private capital, increasing tax inefficiencies and forcing the country to repay the external portion of debt. "

Conclusion:

There is no doubt among some people that interest payments on national debt repayments are a depletion of the country's limited economic resources. Using them to pay interest on debt is a pure waste of our resources.

This argument is wrong because interest payments on debt do not interfere with the use of economic resources at all, even if they are held domestically. Of course, it is true that if our debt is held by a foreigner, we will suffer a loss of resources.

For domestically held (internal) debt, the internal payment of debt includes the transfer of income from Indian taxpayers to contemporary Indian bondholders. In most cases, taxpayers and bondholders are different entities, so large amounts of national debt inevitably have an income redistribution effect. However, internal debt does not include the actual use of the country's economic resources.

Public Debt Limits:

There should be no clear final limit on internal debt, but there should be a clear limit on external debt. In addition, the internal debt cap should be set by the annual growth rate of GNP per capita.

Valuation of debt (optional):

How does national debt put a burden on taxpayers and future generations?

One of the most obvious and important burdens on government bonds is the interest that must be paid to borrow and maintain debt of this size. The interest burden on government bonds accumulates as additional debt is incurred each year. The debt has not been repaid, so interest must be paid annually.

The increased burden of debt repayment, or the cost of interest to maintain the debt, will be passed on to future generations who will have to pay interest on the current debt. But at the same time, many of the people who pay interest are Indians who own government bonds.

Should we pay off the debt?

First of all, raising the amount needed to repay debt through taxes and other income can be a huge, perhaps impossible burden, even for years. Second, as debt repayments increase tax burdens, average taxpayers become poorer and government bond holders become richer with newly redeemed funds, resulting in significant income redistribution.

In addition, some of the debt is external or foreign-affiliated. Under normal circumstances, this is not a serious concern, but it does mean a significant outflow of rupees from India during periods of accelerated repayment. Finally, a set of surplus budgets will be needed to repay public debt.

However, as Keynes pointed out, surplus budgets have a diminishing impact on the economy. Economic activity will decline while debt is being repaid. In short, the opportunity cost of cutting government bonds will slow down economic activity.

What is Public Debt Management?

Public debt management is the process of establishing and implementing strategies to ensure that governments do so.

Financing needs and their obligations to pay are met at the lowest possible cost in the medium to long term. Consistent with the degree of cautious risk 12. It is important that public debt management is also clearly linked

A macroeconomic framework to ensure that public debt growth is sustainable. The complexity of public debt management depends largely on the size and structure of the economy. Domestic securities market, government structure promoting public debt, economic resilience

Not only absorb shocks (natural disasters, global financial crises, etc.), but also the country's international

Domestic borrowing history.

Comparable and accurate information for timely notification to government policy makers and financial markets. To be Governments can manage and manage public debt because they can organize, measure, and evaluate public debt. Effectively provide early detection of vulnerabilities and sustainability risks outside the country,

A government that has the potential to understand the phenomenon of public debt from various perspectives.

Four Key Concepts of Public Debt Management

Public debt management consists of designing credit contracts with medium- to long-term plans. Four important concepts must be included (ISSAI 5422): 13 Governance

- Debt structure by currency, holder, rate, terms, commodities and contractors entity

- Contract risk assessment

- Careful management practices Monitoring and reporting

- Process recording, control, and monitoring.

The first three concepts relate to governance issues and the fourth concept is monitoring report.

Key Concept 1: Debt structure by currency, holder, rate, terms and commodities

Contractor entity

Key Concept 2: Debt Contract Risk Assessment

Risk assessment is the process by which situations or events occur that can interfere with the debt specified in the debt.

Not only does it define that the contract is fulfilled, but it also defines the probability that those situations or events will occur.

Common risks of bond management are market risk, rollover risk, liquidity risk, and unattainable risk.

Desirable financial revenue targets (tax and non-tax revenue), credit risk, settlement risk, natural disaster risk,

Country risk and operational risk. Operational risk is related to:

- The functions and responsibilities of the staff in charge of debt management are not clear

- Lack of expertise and training

- Lack of written procedures or instructions

- Documenting risk

- Risk of fraud.

These operational risks are primarily related to the internal control of government agencies responsible for public debt.

Key Concept 3: Careful management practices

Careful management practices should include:

- Legal framework

- A framework for comparing risk and cost

- Defined contingent liability or liability

- Strategies that demonstrate debt management measures are associated with a robust macroeconomic framework.

Key Concept 4: Process Recording, Control, and Monitoring

Achieving sound debt management practices requires reliable and accurate information about external debt.

To measure and assess the risks that governments may face and to make informed decisions. In summary, public debt management is important for several reasons.

- To ensure that the level and rate of public debt growth is sustainable in a wide range of situations

- Reduce public borrowing costs, reduce the impact of deficit finance, contribute to debt and finance sustainability

- . Avoid economic crises due to unstructured external debt

Conclusion

In most Pacific island countries, public debt levels are unsustainable and action is needed to ensure this. Debts are properly disclosed and managed. SAI has an important role to play by encouraging the government has a solid debt management strategy, sound risk management practices and appropriate a report to disclose the level of public debt. As a result of this joint audit, participating SAIs have made some recommendations aimed at strengthening. Governance, including monitoring and reporting of government public debt. From a regional perspective, PASAI We has identified two recommendations that SAI can consider with interested parties.

In each country, region, and region to improve public debt management in each country:

- Debt Management and Financial Analysis System (DMFAS) and Commonwealth Secretariat Debt management solution systems exist to help countries manage their external and domestic citizen’s debt. Pacific countries should consider using one of these systems to manage their debt. For them Countries using any of these systems will need to seek further assistance to make them fully available. Take advantage of available features.

- It is necessary to clearly define the main roles and responsibilities of the institution responsible for public debt management. This will improve coordination between all these institutions and improve public debt.

Taxation is compulsory taxation by the government on individuals or groups. Taxes serve other purposes, but are levied in almost every country in the world, primarily to increase income from government spending.

This article concerns general taxation, its principles, objectives, and its effects. Specifically, the nature and purpose of taxation, whether taxes need to be categorized directly or indirectly, the history of taxation, tax standards and standards, and shifts and incidences (who bears the ultimate burden). Explain the economic impact of taxation, including) when the burden is passed from an individual or group to another person for whom the burden is deemed legally responsible. For more information on the role of taxation in fiscal policy, see Government Economic Policy. In addition, see International Trade for tariffs.

In the modern economy, taxes are the government's most important source of income. Taxes are a compulsory levy and differ from other sources of income in that they are not rewarded. That is, they are not usually paid in exchange for certain things, such as certain public services, the sale of public property, or the issuance of public debt. .. Taxes are likely to be levied for the well-being of the taxpayer as a whole, but the liability of individual taxpayers is independent of the particular interests received. However, there are important exceptions. For example, payroll tax is usually levied on labor income to fund retirement benefits, medical expenses, and other social security programs. All of these can benefit taxpayers. Payroll taxes are sometimes referred to as "contributions" (as in the United States) because there may be a link between taxes paid and benefits received. Nevertheless, payments are generally obligatory and links to profits are sometimes very weak. Another example of taxes related to benefits received is to use taxes on vehicle fuel to fund the construction and maintenance of roads and highways that can only be serviced by consuming taxable vehicle fuel.

Purpose of taxation

During the 19th century, the general idea was that taxes should serve primarily to fund the government. Once and today, governments have used taxation for more than just financial purposes. One useful way to look at the purpose of taxation due to American economist Richard A. Musgrave is to distinguish between the purposes of resource allocation, income redistribution, and financial stability, unless there is a strong reason for interference, such as the need to reduce pollution. Allocation is further promoted if the original purpose, the resource tax system, does not interfere with the allocation determined in the market. The second purpose, income redistribution, is to reduce inequality in the distribution of income and wealth. The purpose of stabilization is to maintain high employment and price stability, implemented through taxation, government spending policy, monetary policy and debt management.

Conflicts can arise between these three purposes. For example, resource allocation may require changes in tax levels and / or composition, but these changes can have a significant impact on low-income households, so redistribution. The goal is confusing.

Tax class

Direct tax and indirect tax

In the financial literature, taxes are categorized in different ways by who pays, who bears the ultimate burden, how much the burden can be shifted, and various other criteria. An example of the former type is income tax and an example of the latter is sales tax. and it is not clear which category a particular tax, such as corporate income tax or property tax, should fall into. Direct taxes are generally said to be taxes that taxpayers cannot transfer to others, but indirect taxes can.

Direct tax

Direct taxes are primarily taxes on natural persons (such as individuals) and are usually based on the taxpayer's solvency as measured by income, consumption, or net worth. Below is a description of the main types of direct tax.

Personal income tax is usually levied on the total net income of the taxpayer (which may be an individual, a couple, or a family member) in excess of the prescribed minimum amount. It is also generally adjusted for situations that affect solvency, such as family status, number and age of children, and financial burden from illness. Taxes are often levied at gradual rates. In other words, as income goes up, so does the tax rate. Personal exemptions for taxpayers and their families can create a range of income that is subject to a zero tax rate.

Taxes on net worth are levied on the total net worth of an individual, that is, the value of the asset minus the liability. As with income tax, you can take into account the taxpayer's personal circumstances.

Personal or direct taxes on consumption (also known as spending tax or spending tax) are basically levied on all income that is not devoted to savings. In contrast to indirect taxes such as sales tax, direct sales tax can be adjusted to suit the individual's ability to pay, taking into account marital status, age, number of dependents, and so on. Although long appealing to theorists, this form of tax is only used in two countries, India and Sri Lanka. Both instances failed in a short amount of time. By the end of the 20th century, "flat tax", which achieves the same economic effect as direct sales tax by exempting most income from capital, became popular with tax professionals. Many countries have only one tax rate of income tax, but no country has a flat tax based tax.

Taxes at the time of death take two forms: inheritance tax (taxable is a bequest received by the heir) and inheritance tax (subject to total property left by the deceased). Inheritance tax may take into account the taxpayer's personal circumstances, such as the relationship between the taxpayer and the donor before receiving the bequest and net worth. However, inheritance tax is generally graded according to the size of the property, and some countries offer tax-exempt remittances to spouses, taking into account the number of heirs involved. To prevent inheritance tax from being circumvented by the exchange of property before death, the tax system may include a tax on gifts that exceed certain thresholds made between living people (gift tax). See). Taxes on transfers usually do not generate a lot of income just because you can easily avoid paying large taxes through asset planning.

Indirect tax

Indirect taxes are levied on transactions involving the production and consumption of goods and services, or imports and exports. Examples include general and selective sales tax, value added tax (VAT), taxes on all aspects of manufacturing or production, taxes on legal transactions, customs duties or import taxes.

General sales tax is a tax that applies to a significant portion of consumer spending. You can apply the same tax rate to all taxable items, or you can apply different tax rates to different items (such as food and clothing). One-step taxes can be collected at the retail level, as in US states, or at the pre-retail (manufacturing or wholesale) level, as they occur in some developing countries. Multi-level taxes are applied at each stage of the production-distribution process. VAT, which became popular in the second half of the 20th century, is generally collected by allowing taxpayers to deduct purchase tax deductions from their sales responsibilities. VAT has replaced sales tax. This is a tax at each stage of the production and distribution chain, there is no tax reduction paid at the previous stage. The cumulative effect of sales tax, commonly known as the tax cascade, distorts economic decisions.

Generally applicable to a wide range of products, sales tax may exempt low-income households from necessities to reduce the tax burden. By comparison, excise tax is only levied on certain goods or services. Excise and tariffs are levied on almost everything from essentials such as bread, meat and salt to essentials such as tobacco, wine, liquor, coffee and tea, and luxury items such as jewelry and fur in some countries. .. Product groups such as alcoholic beverages, tobacco products and automotive fuels generate most of the excise tax revenue in most countries. Centuries ago, taxes on durable consumer goods were applied to luxury goods such as pianos, saddle hoses, carriages and pool tables. Today, the main luxury tax is on automobiles. This is primarily because registration requirements make it easier to manage taxes. In some countries, gambling is taxed, state-owned lottery tickets have the same effect as excise tax, and the government's "take" is effectively a tax on gambling.

Some excise taxes and customs duties are specific. That is, it is taxed based on the number, weight, length, quantity, or other specific characteristics of the taxable goods or services. Other excise taxes, such as sales tax, are ad valorem taxes and are levied on the value of the goods measured at the price. Legal transactions are taxed on the issuance of shares, the sale (or transfer) of homes and land, and transactions on the stock exchange. For administrative reasons, it often takes the form of stamp duty. That is, legal or commercial documents are stamped to indicate tax payments. Many tax analysts consider stamp duty to be a nuisance tax. They are most often found in developing countries and often interfere with the transactions to which they apply.

Proportional taxation, progressive tax, regressive tax

Taxes can be distinguished by their impact on income and wealth distribution. Proportional taxation imposes the same relative burden on all taxpayers. That is, when tax obligations and income increase at the same rate. Therefore, progressive taxation is considered to reduce income distribution inequality, while regressive taxation has the effect of increasing these inequality.

Taxes that are generally considered progressive tax include personal income tax and inheritance tax. However, nominally progressive income tax may be lower in the high-income category. This is especially true if the taxpayer can reduce the tax base by declaring a deduction or excluding certain income factors from taxable income. Proportional tax rates that apply to the low-income category will also be more gradual if an individual exemption is declared.

Income measured during a particular year does not necessarily provide the best measure of tax capacity. For example, a temporary increase in income may be saved, and during a temporary decrease in income, taxpayers may choose to raise funds for consumption by reducing their savings. Therefore, when taxation is compared to "permanent income", it is less regressive (or more regressive) than when compared to annual income.

Sales tax and excise tax (excluding luxury goods) tend to go backwards as the proportion of personal income consumed or spent on certain goods decreases as the level of personal income rises. The poll tax (also known as the poll tax), which is levied as a fixed amount per person, is clearly regressive.

Due to the uncertainties in the ability of firms to shift tax costs, it is difficult to classify corporate income tax and taxes on firms into progressive, regressive, or proportional taxes (see shifts and rates below). This difficulty in deciding who will bear the tax depends largely on whether national or local taxes (that is, state or state taxes) are being considered.

When considering the economic impact of taxation, it is important to distinguish between several concepts of tax rates. These are usually marginal tax rates, but they can also be average tax rates. The marginal income tax rate indicates the percentage of incremental income that is levied when your income increases by $ 1. Therefore, if your tax liability increases by 45 cents when your income increases by $ 1, the marginal tax rate will be 45%. Income tax law usually includes a gradual marginal tax rate, that is, a tax rate that increases as income rises. Careful analysis of marginal tax rates requires consideration of provisions other than the formal statutory tax rate structure.

For example, if a particular tax credit (tax credit) drops by 20 cents for every dollar of income increase, the marginal tax rate is 20 percentage points higher than indicated by the statutory tax rate. The marginal tax rate is a good way to assess the incentive effect of taxation because it shows how after-tax income changes in response to changes in pre-tax income. It is even more difficult to know the marginal effective tax rate that applies to income from business and capital, as it may depend on considerations such as depreciation structure, interest deductions, and inflation adjustment provisions. The basic economic theorem states that the marginal effective tax rate for capital income is zero under consumption tax.

The average income tax rate is the percentage of total income paid for taxation. The average tax rate pattern is related to the valuation of taxable distribution capital. Under progressive income tax, the average income tax rate rises with income. The average income tax rate generally rises with income.

Average income tax rates generally increase with income due to the provision of personal deductions for taxpayers and dependents and the gradual marginal tax rate. Income incentives, primarily received by high-income households, can overwhelm these effects and create regressiveness, as indicated by the average tax rate that declines as incomes rise.

While views on what is appropriate in tax policy influence the choice and structure of tax law, historical taxation patterns can be explained primarily by administrative considerations. For example, import duties were one of the earliest taxes because imported products are easier to tax than domestic production. Similarly, simple sales tax (which is levied on total sales) is long before the invention of the economically superior but administratively more stringent VAT (which allows deduction of taxes paid at the time of purchase). It was shaking. It's easier to identify and therefore tax real estate than other assets. In addition, the introduction of poll tax (polling tax) is even easier. Therefore, it is not surprising that the first direct taxation was poll tax and land tax.

Taxation has a long history, but it played a relatively small role in the ancient world. Sales tax was levied in Greece and Rome. Tariffs (taxes on imported goods) were often significantly more important than domestic sales tax as long as income was generated. Property taxes are temporarily levied as a means of raising additional funding during the war. For a long time, these taxes were limited to real estate, but later extended to other assets. Real estate transactions were also taxed. In Greece, free citizens have different tax obligations than slaves, and Roman tax law distinguishes between citizens and residents of conquered territories.

Early Roman tax forms included sales tax, customs duties, and certain "direct" taxes. The main of these were branches paid by citizens and usually collected as poll tax. Later, when additional income was needed, the basis of this tax was extended to real estate holdings. During the time of Julius Caesar, a 1% sales tax was introduced (centesima rerumvenalium). The state relied on poll and land taxes for income. The latter, like Persia and Egypt, initially consisted of fixed debt, regardless of the return from the land, but then the land tax was changed to achieve land fertility and a certain response. I did. It will be collected as an in-kind tax (one tithing). It is worth noting that the inheritance tax in Rome was 5% and later 10% relatively early. However, relatives of the deceased were exempt. For a long time, tax collection was left to the intermediary, or "tax collector," who contracted to collect taxes for a portion of their income. Delegated to civil servants under the Caesar collection

In the Middle Ages, many of these ancient taxes, especially direct taxation, were superseded by various mandatory services and "aid" systems (most of which corresponded to gifts). . In the city, the concept of tax obligations for all residents has been developed. In the late Middle Ages, some German and Italian cities introduced some direct taxes: a head tax for the poor and net worth tax, or occasionally a gross income tax for the rich. (Income tax was managed by self-assessment and oath in front of the Citizens' Committee.) Taxes on land and homes gradually increased.

Taxes have been a major subject of political controversy throughout history, even before they accounted for a significant portion of national income. A well-known example is the American colonial rebellion against Britain when colonists refused to pay taxes imposed by a silent parliament. Therefore, there is a slogan "No taxation without representation". Another example was the French Revolution of 1789, where the unfair distribution of tax burdens was a major factor.

Taxes have affected far more taxes than they have affected the revolution. Many taxes, especially income tax (first introduced in the United Kingdom in 1799) and sales or purchase taxes (Germany, 1918; United Kingdom, 1940), began as "temporary" war measures. Similarly, income tax withholding methods began as a wartime innovation in France, the United States, and the United Kingdom. World War II converted the income taxes of many countries from upper class taxes to large amounts of taxes.

There is little need to mention the role that taxation plays in the influential peacetime politics of powerful and organized pressure groups. The debate over tax reform, especially in the area of income tax, has always been a problem in the domestic politics of many countries.

Modern trends

Recent tax developments can be summarized by the following general statement, but considerable country differences need to be taken into account: the sovereign authority to collect taxes in a more or less arbitrary way: Lost and lost taxing power Now generally resident in parliamentary bodies. Most tax levels have risen significantly, and the ratio of tax revenue to national income has also risen. Today's taxes are collected on money, not goods. Tax agriculture (collection of taxes by external contractors) will be abolished and instead civil servants will assess and collect taxes. (On the other hand, many developing country banks have recently been entrusted with tax collection as a means of overcoming the inefficiencies of government agencies. In addition, some countries have outsourced the management of customs duties.)

In addition, the dependence on tariffs and excise taxes is decreasing. Many countries are increasingly dependent on sales tax and other general sales taxes. An important development in the second half of the 20th century was to replace sales tax with VAT. Privileges to do business and taxes on real estate have remained an important source of income for the community, but have lost ground. The absolute and relative weights of direct personal taxation are increasing in most developed countries, and VAT and payroll taxes are receiving increasing attention. At the end of the 20th century, the expansion of e-commerce created serious challenges in managing VAT, income tax, and sales tax. Revenue Agency issues include buyer and seller anonymity, the possibility of doing business from offshore tax havens, the fact that tax authorities cannot monitor the flow of digitized products and intellectual property, and the fact that untraceable funds It was aggravated by a series of flows.

Income tax (individual and corporate), payroll tax, sales tax, and property tax (in some countries) provide the largest income in modern taxation. Income tax is no longer a "rich" tax. It is now paid by the general public, and in some countries taxes on net worth are added. The emphasis on the principle of tax-bearing power and therefore the redistribution of wealth seems to possess led to gradual tax rates and high maximum marginal tax rates, but for greater concern about the economic distortions and impediments caused by the high It was replaced. Tax rate. Significant fiscal centralization took place throughout most of the 20th century, as reflected in the types of taxes imposed by the central government. They currently manage the most important taxes (from a revenue-generating perspective): income and corporate taxes, payroll taxes, and VAT. However, during the last decade of the 20th century, many countries became more decentralized, resulting in the transfer of taxation rights to local governments. Allowing subordinate governments to share tax revenues with the central government does not promote such autonomy.

For example, developed countries usually rely more on personal income tax and less on corporate income tax than developing countries. In developing countries, the reliance on income tax, especially corporate income tax, generally increases as income levels rise. In addition, a relatively high percentage of total tax revenue in developed countries is due to domestic sales tax, especially VAT (rather than simple sales tax). The social security tax, which is generally collected as a payroll tax, is much more important for developed countries and wealthier developers.

A country rather than the poorest, reflecting the almost lack of social security systems in the poorest countries. In fact, in many developed countries, payroll tax is comparable to or exceeds personal income tax as a source of income. Vital trends and their consequences, especially the aging of the global workforce and the need for public pension financing, can raise payroll taxes to increasingly steep levels. In some countries, pension offerings are being privatized. For example, replace payroll tax with compulsory contributions to your personal account.

Taxes generally represent a much higher percentage of national product in developed countries than in developing countries. Similarly, the products of more countries are directed to government use through taxation in developing countries with higher incomes than in developing countries with lower incomes.

Taxation principle

In The Wealth of Nations (Volume 5, Chapter 2), he set four general norms.

- All state themes should contribute as much as possible to government support in proportion to their capabilities. In other words, in proportion to the income each enjoys under the protection of the state ...

- The taxes that each individual is obliged to pay must be certain, not arbitrary. The time of payment, the method of payment, and the amount paid must all be clear and obvious to the contributor and everyone else. ...

- All taxes should be levied at that time or in the manner most likely to be most convenient for the contributor to pay. ...

- All taxes should be devised to be out of people's pockets and as low as possible, in addition to what it brings to the country's public finances. ...

These principles hold surprising relevance, although they need to be reinterpreted from time to time. From the beginning, we can draw some key views on what is fair in the distribution of tax burdens between taxpayers. These are: (1) The belief that taxes should be based on the solvency of the individual, known as the principle of tax-bearing power, and (2) the benefit principle, the idea that there should be some equivalence between the contents of the individual. And the benefits received from subsequent government activities. The fourth of Smith's criteria can be interpreted as being rooted in the fact that many economists focus on a tax system that does not interfere with market decision-making, and that the need to avoid complexity and corruption is more apparent.

Distribution of tax burden

Various principles, political pressures, and goals can guide a government's tax policy. The following is a discussion of some of the key principles that can shape tax decisions.

Horizontal fairness

The principle of horizontal equity assumes that persons in the same or similar position (for tax purposes) are subject to the same tax obligations. In practice, this principle of equality is often ignored, intentionally or unintentionally. Intentional breaches are usually motivated by politics rather than sound economic policy (eg, tax incentives given to farmers, homeowners, or members of the general middle class, interest on government securities. Exclusion). .

Principle of tax-bearing power

The principle of tax-bearing power requires that all relevant personal characteristics be taken into account and distributed among individuals according to their ability to bear the total tax burden. The most appropriate taxes from this perspective are personal taxes (income tax, net worth tax, sales tax, inheritance tax). Historically, there was a common consensus that income was the best indicator of solvency. However, there was significant disagreement with this view, including the number of 17th-century British philosophers John Locke and Thomas Hobbes, as well as current tax experts. Early opponents believed that fairness should be measured by what was used (that is, consumption), not what was earned (that is, income). Modern proponents of sales tax emphasize the neutrality of sales tax on savings (income tax distinguishes savings), the simplicity of sales tax, and the superiority of consumption as a measure of an individual's ability to pay for life.

Wealth is a good measure of solvency, as some theorists say that assets mean some degree of satisfaction (power) and taxability, even if they do not generate concrete income (as in the case of art collections). I believe in providing.

The principle of tax-bearing power is also generally interpreted as requiring direct personal tax to have a progressive tax structure, but there is no way to show that a certain degree of progressiveness is correct. Some tax theorists say that such taxes are supplemented by direct income transfer or negative income tax (or refundable credits), as a significant portion of the population does not pay certain direct taxes such as income tax or inheritance tax. We believe that a satisfactory redistribution can only be achieved if it is done). Others argue that income transfers and negative income taxes create negative incentives. Instead, they favor public spending on low-income households (eg health and education) as a better way to reach distribution goals.

Indirect taxes such as VAT, excise tax, sales tax and sales tax can meet the criteria for solvency, but their scope is limited. For example, exempt food and other necessities, or distinguish tax rates according to "urgency." Needed. Such policies are generally not very effective. In addition, they distort consumer purchasing patterns, and their complexity often makes it difficult to get started.

Throughout most of the 20th century, there was a general opinion that the distribution of tax burdens between individuals should reduce the income inequality that naturally arises from the market economy. This view was completely contrary to the liberal view of the 19th century that income distribution should remain the same. However, by the end of the 20th century, many governments will use taxes for redistribution purposes, recognizing that trying to use taxes to reduce inequality can result in costly distortions. I have partially returned to the view that it should not be.

Benefit principle

Under the Benefit Principle, taxes are considered to perform a function similar to the price of private transactions. This helps the government decide what activities to do and who will pay for them. If this principle can be implemented, the allocation of resources through the public sector will directly meet the needs of consumers.

In fact, it is difficult to implement the benefit principle in most public services, as citizens generally do not tend to pay for publicly provided services such as police. The Benefit Principle is best used to finance roads and highways through taxation of vehicle fuel and road user tolls (tolls). The payroll tax used to raise social security may also reflect the link between benefits and "contributions", but contributions are in the accounts held for individual contributors. This link is generally weak because it doesn't fit.

Economic efficiency

The requirement that the tax system be efficient arises from the nature of the market economy. There are many examples of the opposite, but economists generally believe that markets do a pretty good job of making economic decisions about choices such as consumption, production and financing. Therefore, they feel that the tax system should generally refrain from interfering with the allocation of economic resources in the market. In short, taxation should minimize interference with individual decisions. You must not discriminate in favor of or against a particular consumer spending, a particular means of production, a particular organizational structure, or a particular industry. Of course, this does not mean that key social and economic goals may not take precedence over these considerations. For example, it may be desirable to tax pollution as a means of protecting the environment.

Economists have developed techniques to measure the "overburden" that occurs when taxes distort economic decision making. The basic idea is that if a tax impact costs $ 2 to produce a product for only $ 1.80, you will have an overburden of 20 cents. A more neutral tax system will have less distortion. Therefore, an important post-war development in taxation theory is the development of optimal taxation, the decision of tax policy to minimize overburden. Being dealing with a highly stylized mathematical description of the economic system, this theory goes beyond the important insight that supply and demand do less damage if supply and demand are less sensitive to such distortions. , Does not provide a prescription that can be easily applied to the policy. Attempts have also been made to incorporate distribution considerations into this theory. They face the challenge of not having a scientifically correct income distribution.