UNIT 5

Monopolistic Competition

In Monopolistic competition there are large numbers of buyers and sellers which do not sell homogenous product unlike perfect competition. This is more realistic in the real world. Monopolistic competition occurs when an industry in which many firms selling products that are similar but not identical.

Monopolistic competitions try to differentiate its product. Thus, it is closely related to business strategy of brand differentiation. In monopolistic competition heavy advertising and marketing is common among firms.

Monopolistic competition combines element of both monopoly and perfect competition. All firms in monopolistic competition relatively have low market power and they are all market makers.

Monopolistic competitive market

2. Many firms – there are many firms in each product group. A product group is a "collection of similar products". Under monopolistic market, each firm has a small market share. This gives each firm a freedom to set price and each firm action have negligible impact on the market. A firm can cut the price to increase sale without any fear. As its action will not prompt retaliatory responses from competitors.

3. Freedom of entry and exit - Like perfect competition, under monopolistic competition the firms can freely enter or exit. When the existing firms makes super-normal profits, then new firms will enter. The entry of new firms leads to increase the supply of goods and services and this would reduce the price and thus the existing firms will be left only with normal profits. Similarly, if the existing firms are incurring losses, some of the firms will exit. This will reduce the supply which result decrease in price and the existing firms will be left only with normal profit.

4. Independent decision making – under monopolistic market, each firm can independently set the terms and conditions of exchange for its product. The firm does not consider how their decision will have impact on competitors. In other words, each firm feels free to set prices and prompting heightened competition.

5. Market power – under monopolistic competition, the firms have low degree of market power. Market power means that the firm has control over the terms and conditions of exchange for its product. All firms under monopolistic competition are price makers. A firm can raise the prices of products and services without losing all its customers base. The firm can also lower prices without any effect on the competitors. Since the firm have relatively low market power, there is no barrier to entry.

Under monopolistic competition a firm can some extent independently control the supply and price of the product. The demand curve is stable and slightly downward slope

A monopolistic competitor creates output at which the marginal cost is equal to marginal revenue. The price is greater than marginal cost.

short run

In short run, the firm attains its equilibrium where marginal revenue equals marginal cost and the price is set according to its demand curve. Thus, when MR=MC, profits are maximized

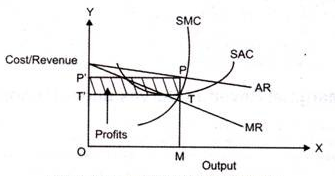

In the above fig,

AR is the average revenue curve,

MR represents the marginal revenue curve,

SAC curve represents the short run average cost curve,

SMC signifies the short run marginal cost.

In the above figure we can see that at output OM, MR intersects SMC. Here, price is OP’ (which is equal to MP). Thus, P is the point on AR curve, which is price. PT is the supper normal profit per unit output, is the difference between the average revenue and average cost.

Long run

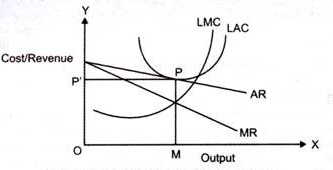

In the long run due to the possibility of new firms entering the industry the price under monopolistic competition becomes equal to long-run average cost giving only normal profits. So, no firm under monopolistic competition can make excess profit or loss in the long run.

When the new firm start supplying, the price would fall. Thus, the AR curve shifts from right to left and supernormal profits are replaced with normal profits. The long run equilibrium is achieved when average revenue is equal to average cost.

In the above fig we can see that, at pointP, AR curve touches the average cost curve (LAC) as a tangent. P is the equilibrium at price MP and output OM.

At MP average cost is equal to average revenue. Therefore, in long run, the profit is normal. The conditions (MR=MC and AR=AC) result in attaining equilibrium in long run.

Product differentiation is the process of distinguishing a product or service from others to make it more attractive to a target market. It involves making unique position in the market by offering unique benefit to the target group. This is referred as unique selling position that makes the product stand out from the crowd.

Differentiation does not mean changing the product, but it implies creating a new advertising campaign or by changing its packaging.

Importance of product differentiation

With the increase in competition the demand is divided among the different firm in the market. Thus, it is important to make the customer understand what different the firm is offering.

Product Differentiation Types & Factors

There are three types of product differentiation as follows

For ex – mineral water brands

2. Vertical differentiation – the products are differentiated in terms of quality refers to vertical differentiation. Here it is possible to say which product is better than the other. Comparison can be easily done.

For ex – Duracell batteries are chosen by the customers because they feel it last long

3. Mixed differentiation – the products are differentiated based on numerous characteristics is known as mixed differentiation.

For ex – choosing the product from Amazon than visiting a store, because customer doesn’t want to leave the house

A product can be differentiated based on:

Advantages

Selling cost plays a key role in monopolistic competition and oligopoly. To promote sales the firm has to spend on advertising and publicity under these market forms. The producer not only decides about price and output, it also keeps in mind how to maximize profit.

The expenditure which is done by the company refers to selling cost. Selling cost includes salary, rent, advertisements, etc.

Definition

According to Edward H. Chamberlin, “Those costs which are made to adopt the product to the demand are costs of production; those made to adopt the demand to product are costs of selling.”

Selling costs are costs incurred in order to alter the position or shape of the demand curve for the product.” E.H. Chamberlin “Selling costs may be defined as costs necessary to persuade a buyer to buy one product rather than another or to pay from one seller rather than another.” Meyers Assumption

Selling cost is based on two assumptions

Major components of selling cost

2. Commission - commission are paid out of profit to the middleman. The middleman helps in marketing and promotion of the product. For example, it can be advertising agency who advertise and promote the product.

3. Rent - Another component of the selling cost is rent. It means high expenditure if the venue is located in the central location than any other location. Central location is assumed to pull more customers.

4. Advertising and promotion - advertisement is one of the big expenditure of any company. Advertising can be done through newspaper, radio, magazine, billboards, celebrity endorsements, etc. Promotions refer to the publicity that is done through pamphlets, offers, discounts, collaborations, etc.

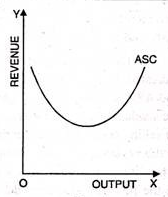

Average selling cost-

Average selling cost is the cost per unit of a product. The curve of selling cost is U shape. The average selling cost initially falls and later it start rising. It means proportionate increase in sale is more than the increase in selling costs in the beginning. But after a point proportionate increase in sale is less than the selling cost. ASC curve will never touch X axis or it will never be zero.

Features

2. Monopolistic competition – in Monopolistic competition there are large numbers of buyers and sellers which do not sell homogenous product unlike perfect competition. This is more realistic in the real world.

Features

Key differences between Perfect Competition vs Monopolistic Competition

2. Standardised product offered in perfect competition. On the other hand, in monopolistic competition product differentiation is there.

3. In perfect competition, the price for the whole industry is determined by the demand and supply forces and every firm sell its product at the price. Whereas in monopolistic competition, every firm offer products at its own price. They are the price setter,

4. In perfect competition, entry and exit are easy as compared to monopolistic competition.

5. In perfect competition, average revenue and marginal revenue coincide with each other. Whereas average revenue is greater than marginal revenue in monopolistic competition. It means to increase sales the firm has to lower down its price

6. Perfect competition does not exist in reality. It is an imaginary situation. While Monopolistic competition exists practically.

| Perfect competition | Monopolistic competition |

Number of sellers/ buyers | Many sellers and buyers | Many sellers and buyers |

Types of goods and services | Homogeneous | Differentiated |

Price | Price taker | Price setter |

Is marketing important | Not important | Yes very important |

Entry barrier | Zero entry barrier | Low entry barrier |

Situation | Unrealistic, imaginary | Real, realistic |

Demand curve slope | Horizontal, perfectly elastic | Downward sloping, relatively elastic |

A relation between Average Revenue (AR) and Marginal Revenue (MR) | Average Revenue = Marginal Revenue | Average Revenue > Marginal Revenue. |

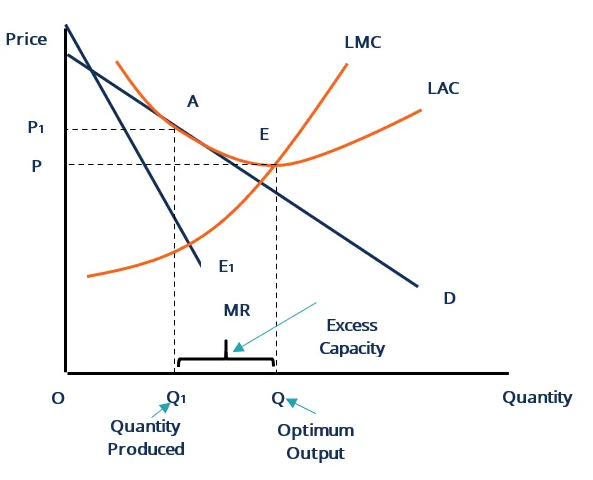

Excess capacity is also known as unutilised capacity. This occurs when the firm produces output less than the optimum capacity. This happens when the demand falls down. During recession the demand declines and the firm has to reduce the capacity to decrease the cost.

During excess capacity, the firm tend to decline the price of the product to move and cover the fixed cost. Under monopolistic competition, excess capacity is more defined due to the nature of the market structure.

Where:

Under monopolistic competition, demand curve slope downwards and it cannot be diverging to the LAC at its minimum point. Equilibrium are reached at E, when LMC = LAC at the minimum point.

Under monopolistic competition, firms face excess capacity, as the firm will not get any incentive to produce optimum output at higher long run marginal cost ie greater than marginal revenue.

The firm under monopolistic competition gets equilibrium at point E1,where quantity produced is OQ1and at point A demand curve is tangent to LAC. OQ is the optimum output produced where LMC curve intercepts the LAC curve at its lowest point as shown in the figure. Beyond OQ1 , the firm start making losses as LMC is greater than MR. Thus, excess capacity is created as represented by Q1Q. In long run under monopolistic competition prices are higher and output is lower.

Causes of excess capacity

2. Entry of new firms in the industry - In short run firms earn abnormal profit whic attract new entrants. As the new firm enter the market, the existing firm reduce to earning normal profits. Due to sharing of market demand, each firm produces less than its optimum capacity.

Benefits of excess capacity

Under monopolistic competition, the excess capacity is caused by product differentiation that leads to product variety and quality. This is beneficial to consumer. Excess capacity increases customer satisfaction as Consumers do not prefer homogenous products

The term oligopoly has been derived from Greek words, ‘oligoi’ means few and ‘poly’ means control. Oligopoly refers to a market structure in which few sellers control the market. These sellers deal with either homogenous or differentiated products.

Oligopoly is also called ‘competition among the few’. Under oligopoly, the industry is dominated by few sellers in the market, every seller influence, the behavior of other firm.

In oligopoly there are small numbers of firms in the market. As per the norms, oligopoly consist of 3 -5 dominant firms. The firms can compete with each other or collaborate to earn more profits. Here the buyers are more than the sellers. Some of the examples are automobiles, cement, steel, aluminum, etc.

Characteristics

The main reasons for indeterminate price and output under oligopoly are as follows:

2. Intermediate demand curve - due to different behaviour patterns of organizations, the demand curve is unknown under oligopoly. Every firm observe the action of the rivals and make strategies accordingly. Under oligopoly, the demand curve is not stable and changes as per the action of rivals. According to Baumol, “the firm’s attempts to outguess one another are then likely to lead to interplay of anticipated strategies and counter strategies which is tangled beyond hope of direct analysis.”

3. Non profit motive – non profit motive implies, organisation not only aims at maximising profit, it also competes for non profit motive. Under oligopoly, these motives lead to indeterminate price and output. For ex, to promote sales firm uses advertisement and other tools.

- a French economist Augustin Cournot was the first to develop a formal duopoly model in 1838.

- This model is implied when firm produces homogenous goods, they compete simultaneously on market share and output, they expect any changes the firm make, in response the rivals not to change their output.

- Cournot uses the example of mineral spring water. Both the firm operates at zero marginal cost. The demand curve face constant negative slope. Each seller acts on the assumption that his competitor will not react to his decision to change his and price.

- The model conclude that each firm supplies one-third of the market and charges the same price. While one-third of the market remains unsupplied.

- The model is criticised that the assumption zero cost of production is totally unrealistic

2. Chamberlin’s duopoly model

3. Bertrand’s Duopoly Model

4. Stakelberg’s duopoly

5. Sweezy’s Kinked Demand Model:

Price leadership occurs when a firm leading in a given industry and can effectively determines the price of goods and services for the entire market. This type of firm is referred as price leaders.

Price leadership is “situation in which a market leader sets the price of a product or services and competitors feel compelled to match that price”

A dominant company sets the price and other firms with little choice have to follow its leads and adjust the price to match the price of the leading firm to hold their market share. Large firms commonly use price leadership as a strategy.

Effective leadership works under following conditions

Types of price leadership

There are three types of price leadership which includes barometric, collusive, and dominant.

2. Dominant –

3. Barometric –

4. Collusive

Advantages

Disadvantages

Collusion occurs when the rival firms agree to work together. They together set high price in order to make greater profits. Collusion refers to making higher profit in the expense of the consumer and reduces the competition in the market. Collusion is an agreement to seek higher price.

Definition

According to Samuelson, “Collusion denotes a situation in which two or more firms jointly set that prices or output, divide the market among them, or make other business decisions.”

In the words of Thomas J. Webster, “Collusion represents a formal agreement among firms in an oligopolistic industry to restrict competition to increase industry profits.”

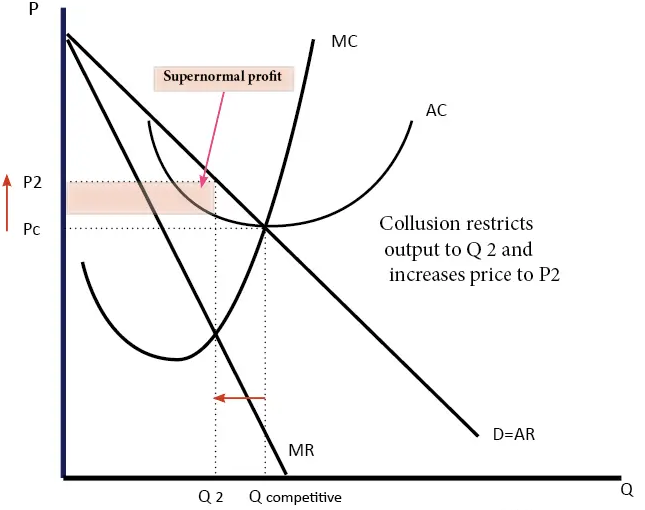

In the above figure we can see that when the industry is competitive quantity Q is given at price P1. As the firm collude, the price increase to P2 and quantity reduced to Q2. Thus, the firm earns super normal profit.

Types of collusion

Formal collusion – A formal agreement made between the firms to stick to high prices. This involves the creation of a cartel. The most famous cartel agreement is OPEC. OPEC control over the world petroleum market. It is also referred as two or more firms within the same industry formally agree to control the market. Such formal agreement is kept highly secret.

Tacit collusion – It is also referred as implicit collusion. This happens when two or more firms within the same industry informally agree to control the market.

Price leadership - Price leadership occurs when a firm leading in a given industry and can effectively determines the price of goods and services for the entire market. This type of firm is referred as price leaders. Price leadership is “situation in which a market leader sets the price of a product or services and competitors feel compelled to match that price”

Problems of collusion

Collusion is regulated by the government as it is seen bad for consumers and economic welfare. Collusion can lead to

In oligopolistic market, the competitors change the prices/quantity of output and thus firm cannot have a fixed demand curve. The price remains inflexible for a long time. American economist Sweezy in 1939 came up with the kinked demand curve to explain the behaviour of oligopolistic organizations.

A kinked demand curve occurs when the demand curve is not a straight line but due to higher and lower prices, it has a different elasticity ie elastic and inelastic.

Assumption of kinked demand curve model

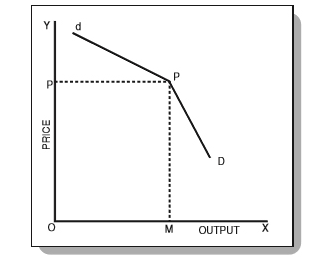

The following figure shows a kinked demand curve dD with a kink at point P.

From the above fig, we can see that at price P, the firm produces and sell output at OM. the upper segment dP of the demand curve dD is elastic as the price rises the demand falls. The lower segment PD of the demand curve dD is relatively inelastic as the price falls, demand for the product increases.

This model suggest that prices are rigid and with the increase or decrease in price the firm will face different affects. The kink in the demand curve is due to the behaviour of rival firms to the increase or decrease in price

Impact of price rise

Impact of price cut

Example of kinked demand curve

The market of petrol is homogenous and consumers are price sensitive. If one petrol pump increases the price, consumer will shift to other petrol station. If one petrol station will cut the price, the other station will also follow and cut the price.