UNIT II

Economic Trend

Defination of Economic Trends

Before we dive deeper into the meaning of economic trends, let's first understand the individual parts. The first word, economy, refers to economy. The economy consists of all financial transactions between businesses and consumers in a region or country. In general, when an economy is mentioned, it is heading for a particular country. For example, we hear about the US economy in the news every day.

The second part of the phrase, the trend, can be thought of as a pattern. In most cases, trends are formed and interpreted from datasets. For example, if someone plots a stock price at 4 o'clock every day for 3 weeks, the dots will create a pattern or trend and the chart will show 15 dots. The graph on the left shows these points. The graph on the right shows what happens when the dots are connected.

In this example, this stock price is on the rise. This can be interpreted as the price increases as the vertical axis shows, as the days go by, as shown on the horizontal axis.

The combination of these two words gives economic trends, which are indicators of the financial situation of a region or country. In most cases, the US economy is part of the news. We, like any other economy, experience good times and bad times. What economic trends define your good times and bad times?

Example

Now that we have a general understanding of economic trends, let's look at some of the most important and popular ones that help us define the types of economic conditions we are experiencing. The first is the unemployment rate. The unemployment rate measures the percentage of the unemployed workforce. This tendency personally affects most of us. We may have experienced this directly. We collect data from many individuals every month and publish the unemployment rate based on that data. This percentage will affect the next economic trend, the Consumer Confidence Index.

Income

Income is an opportunity for consumption and savings that a company has acquired within a specified time frame and is usually expressed financially. However, for households and individuals, "income is that the sum of all wages, salaries, profits, interest payments, rent, and other sorts of income received during a specific period."

In the field of public economics, the term may refer to the accumulation of both monetary and non-monetary consumption capacity, the former (monetary) being used as a substitute for total income.

National income:

Concept of national income

National income is the sum of all final goods and services produced by a country in a particular year. The growth of national income helps us to know the progress of the country.

In other words, the total amount of income generated by a country from economic activity in a year is known as national income. This includes payments made to all resources in the form of wages, interest, rent and profits.

From a modern point of view, national income is defined as "the net production of goods and services that flows annually from the country's production system in the hands of the end consumer."

National accounts are the method or method used to measure the economic activity of the entire national economy.

NIA is primarily intended for the following purposes:

Policy development: Helps you compare past and future estimates and predict future growth rates. For example, if a country's GDP is Rs. 103 Raku, 3 rupees higher than last year, it has a growth rate of 3 percent.

Effective decision making: Estimate the contribution of each sector of the economy. This helps companies plan production.

International Economic Comparison: Useful for development level comparisons

It provides useful insights into how well the economy is working and where money is being generated and spent. You can compare the standard of living and its growth rate in different countries.

There are various terms related to measuring national income.

National income concept (theory):

1) GNP (Gross National Product)

2) GDP (Gross Domestic Product)

3) NNP (Gross National Product)

4) NI (National Income)

5) PI (Personal Income)

6) DPI (Disposable Personal Income)

Next, let's understand the meaning of each.

1) GDP (Gross Domestic Product):

Gross domestic product is the monetary value of all goods and services produced within a country's geographical boundaries over a particular period of time.

Note: GDP is domestic only.

GNP (Gross National Product): GNP is the monetary value of goods and services produced by a country during a particular period of time.

Plus (+)

Total amount of goods and services produced by foreign nationals

minus(-)

Income received by foreigners in Japan.

Note: GNP is calculated based on the market price of the product. Indirect taxes and subsidies, if any, are included. If income is GDP, GNP is equal to GDP

The income earned and received by citizens of a country within the boundaries of a foreign country is the same as the income received by foreigners in that country.

2) NNP (NET NATIONAL PRODUCT):

This is GNP minus depreciation. NNP = GNP – Depreciation

Note: Depreciation is the consumption of capital stock

NI (national income):

National income is also known as gross national product at factor cost.

Therefore,

NI = NNP minus (total indirect tax + subsidy)

Note: Both indirect taxes and subsidies will be deducted from NNP.

3) PI (Personal Income):

This is the actual income earned by people after deducting various taxes. PI = National Income – (Corporate Tax + Payments Made for Social Security)

Plus (+)

Government transfer payment PLUS (+)

Business transfer payment PLUS (+)

Net interest paid by the government

DPI (Disposable Personal Income):

This is personal income minus direct tax.

DPI = PI – Direct tax

4) GNP (Gross National Product)

This is the sum of all final goods and services produced in the economy in a year. In W.C.'s words, Peterson, "Gross National Product may be defined as the current market value of all goods and services produced by the economy during the period of income." There are two ways to avoid double counting when estimating GNP.

1) One is to exclude all intermediate goods and count only final goods and services. Final goods and services directly meet consumer needs, and intermediate goods are intended to be exhausted in the production process itself.

2) The second way to avoid double calculation is to calculate the "value added" of each production sector in the economy. The value added in a production process over a period of time is calculated by subtracting the input value from the total value of the products leaving the process. The sum of the values added by all processes will give us the value of GNP.

GNP calculated in this way excludes the value of the import because the cost is automatically deducted from the production value of the industry using the value of the import. To get Gross National Product, you need to deduct depreciation from the total "value added". The "added value" method and the "final product" method give the same result. The former considers the flow of production through each process while the "final product" method counts the quantity of goods delivered at the end of a particular period and appropriates the goods still in transit at the beginning and end. Adjust to. Of the period the "added value" method follows normal corporate accounting procedures because all companies record the value of their products and the value of the materials used. The "final product" method suffers from many difficulties in that it requires the actual production of consumer goods and producers' goods to be split.

SAVINGS:

Savings are income received by households and are not used or paid by the government as taxes. Savings are withdrawals (or leaks) from the cyclical flow of income.

1) Savings are unused disposable income.

2) There are many ways to save money, from bank accounts and building-and-loan accounts to pension and stock market savings.

3) Savings rate is the percentage of disposable income saved, not spending. If a person's annual income is 25,000 rupees, of which 2500 rupees are saved, the savings rate is 10%.

4) High savings rates (other factors remain the same) reduce consumption and totals Savings and investment flow most likely to change economic activity.

Y = Consumption (C) + Savings (S)

Consumer Y = C + S

Producer O = C + I

What are the factors that influence how much income people save?

b. Expectations for future income and employment security / everything leads to consumer confidence.

c. Credit Availability – Borrowing to cover extra spending counts as savings.

d. Taxation of savings. Tax-effective savings schemes and vocational pension tax cuts may encourage people to clean up much of their disposable income.

e. Need to save to pay off debt – Example: Real estate owners stick to the negative equity that homes are less valuable than families who need to reduce their mortgage or credit card debt.

f. Need to accumulate mortgage deposits, pay school and college tuition, and save for retirement under a vocational pension plan.

g. Availability of savings institutions such as banks and our trust in them. The UK government guarantees deposits in British banks, but in 2013 in other countries, including Cyprus, large depositors were hit by unexpected taxes as part of Cyprus' emergency relief.

The importance of savings for the economy

Rent: Rs 1,300

Car payment: 450 rupees

Student loan payments: Rs 450

Credit card payments: Rs 300

Grocery: Rs 250

Utility: Rs 75

Mobile Phone: Rs 75

Gas: Rs 100

Total Expense: Rs 3,000

John spends 3,000 rupees out of his monthly income of 3,200 rupees, so he can save 200 rupees. If John's cost is higher than his income, he's not saving. He lives from salary to salary. If he is fired, an emergency occurs, or the company is closed within two weeks, there is little backup for him.

In banking terms, a savings account is a time deposit. That is, the bank will notify the account holder before withdrawing funds, or

Penalty for withdrawals before the specified date. Interest rates on savings accounts vary by institution, but are generally lower than interest rates on long-term deposits such as CDs and money market accounts. Interest is usually compounded monthly. In banking terms, a savings account is a time deposit. That is, the bank can require the account holder to be notified before withdrawing funds, or can penalize the withdrawal prior to the specified date. Interest rates on savings accounts vary by institution, but are generally lower than interest rates on long-term deposits such as CDs and money market accounts. Interest is usually compounded monthly. A lot of money it spends almost nothing, its economy can suffer. Called the frugal paradox, it is an economic theory developed by John Maynard Keynes that states that the more people save, the less spending and less stimulating the economy.

It is important to note that interest rates paid to savings accounts can fall below inflation. That is, despite the interest earned, the account can actually lose purchasing power over time.

Source of savings

There are three types of sources of savings.

The household sector is the largest contributor to domestic savings. It is important because it reflects how savings are efficiently converted into investments by the role of financial sector mediators in the process. These sectors include the following savings:

(A) Household (family),

(B) Collages, non-profit organizations such as hospitals, and

(C) Non-corporate business unit.

Household savings are of three ways:

(A) Physical assets:

Physical assets include housing, machinery, furniture, fixtures and real estate

(B) Financial assets:

It takes the form of currencies, bank deposits, stocks and corporate bonds, government claims, mutual funds, national savings certificates, life insurance funds, and reserves and pension funds.

(C) Unaccounted savings in the household sector:

Unaccounted savings in the household sector are always maintained in the form of very scarce information on gold, silver and durable goods. However, based on estimates, the percentage of these assets will be in the range of 3-10 percent of GNP at any given year.

Government Savings:

Government savings come from the surplus of public enterprises and other public financial institutions. Government savings formed 7.4% of the economy's GDP in 2008-09 and increased to 8.2% in 2009-2010. Since then, government savings have been steadily declining, reaching 7.9% in 2010-11.

The most important factors that cause this trend are:

(A) Deterioration of overall tax GDP ratio, and

(B) Increased over time losses from public utilities such as state power and water departments, state road transport corporations, and railroads.

Private sector savings:

The private sector accounted for 9.4% of total savings in 2007-08. However, this dropped to 7.4% in 2008-09. However, it has been on an upward trend since then, reaching 8.24 percent in 2009-10.

In developed countries, the corporate sector has contributed significantly to national savings, despite the development of secondary and tertiary industries in the economy and the significant increase in manufacturing, but not in India.

This is due to the following factors:

(A) Significant increase in the use of loan capital in the Indian industry and a decrease in the share of profits in elemental income.

(B) An important position of the unincorporated private sector in India's manufacturing and commerce, reflected in household savings rather than "private sector savings". And

(C) A taxation policy that prevents the accumulation of undistributed profits in companies and companies in combination with the low profitability syndrome.

INDIA GROSS SAVINGS RATE (1951 - 2018);

India's Gross Savings Rate was measured at 30.5 % in Mar 2018, compared with 30.3 % in the previous year. India Gross Savings Rate is updated yearly, available from Mar 1951 to Mar 2018, with an average rate of 18.5 %. The data reached an all-time high of 37.8 % in Mar 2008 and a record low of 7.9 % in Mar 1954. CEIC calculates Gross Domestic Savings Rate from annual Gross Domestic Savings and annual Nominal GDP. Central Statistics Office provides Gross Domestic Savings in local currency and Nominal GDP in local currency based on SNA 2008, at 2011-2012 prices. Gross Domestic Savings Rate is annual frequency, ending in March of each year. In the latest reports, India's GDP expanded 5.0 % in Jun 2019. India's Nominal GDP reached 703.7 USD bn in Jun 2019. Its GDP deflator (implicit price deflator) increased 2.8 % in Jun 2019. India's GDP Per Capita reached 2,041.1 USD in Mar 2019.

INVESTMENT”

Investing is allocating money (or another resource such as time) in the hope of some future profit. For example, there are two investments in durable consumer goods such as real estate for the service industry and factories for the development of manufactured products. A common type of microeconomic production in the modern economy. Investment in R & D is primarily based on consumer goods innovation.

Investment and economic growth:

Economic growth can be driven through the use of sound investment at the business level. If a company builds or acquires new production equipment to increase the total production of goods on-site, the increase in production can increase gross domestic product (GDP). This allows you to increase production and grow your economy based on your previous capital investment.

Indian industry comprises of : public and private sector enterprises-

Economic division between the public and private sectors:

The current economic structure of the Indian economy is known as the mixed economy, where both the public and private sectors coexist. All the different types of industries are divided into these two sectors. From the beginning, most of the country's industry was within the private sector.

However, after independence, especially after the introduction of economic plans and subsequent industrial policy resolutions, the importance of the public sector was recognized in 1948 and 1956. Therefore, some distinct categories

The industry was gradually reserved for the public sector due to its expansion and development.

Thus, the size and activity of the public sector gained momentum as the amount of spending planned for public sector development under the country's various five-year plans increased. Therefore, in a mixed economy like India, some industries are owned and controlled by the country through the public sector and the rest are owned and controlled by the country's private sector.

In India, only industries that are essential to the rapid development of the economy and are reluctant to invest in the private sector due to low rates of return or high risk are reserved for the public sector.

In India, the area of public sector activity was very limited to limited areas such as electricity, irrigation, roads, railroads, ports, telecommunications, and some sector businesses during independence. However, after independence, the field of activity in the public sector expanded rapidly. Two industrial policy resolutions, adopted in 1948 and 1956, respectively, divided the country's industry into different categories.

Therefore, some industries were completely assigned to the public sector and some industrial sectors were left entirely to the private sector. This division of territory between the public and private sectors has secured both durable and non-durable consumer goods, while heavy, basic and strategic industries have been reserved for the public sector. Reveals that the entire group of consumer durables industry producing remained open for the private sector.

The entire agricultural sector, the country's largest sector, remains in the private sector. Again, infrastructure areas such as rail, air transport, ports, electricity, telecommunications, banks, insurance and financial companies are reserved for the public sector.

The logic behind securing heavy and basic industries such as steel, heavy electric plants and heavy industries in the public sector and the fast-growing consumer goods industry in the private sector is very simple

R.K. Hazari attempted to analyze the logic behind such a government strategy, arguing that the government's industrial programs adopted after 1955 were completed according to two hypotheses:

(A) Private investment activities in relatively simple commodities are generally done by shutting out imports and also. Home, and as a result boost profits. And

(B) Public investment is indifferent to profits, has a long gestation period, has a low or zero rate of return, has high exchange requirements, is complex in technology, and has similarly complex basic and strategic adjustment issues. It is done in the field.

The first hypothesis here is that private investment is a form of "induced investment" and can be facilitated by adopting protection policies against various import substitutions. The argument in support of the second hypothesis was that the flow of investment in industries that are low-profit and require large investments is in the form of "autonomous investment" and therefore can be made by the state.

Relative roles of the public and private sectors in the Indian economy:

In countries like India, both the public and private sectors play a very effective relative role. The 1948 and 1956 industrial policy resolutions specifically provided for the reservation of spheres for both the public and private sectors, taking into account their relative role in the country's economy.

Industrial policy in 1948 laid the foundation for a mixed economy by classifying India's industry into four major categories, involving both the public and private sectors. The 1956 Industrial Policy Resolution then categorized Indian industry into three schedules: the state-owned sector, gradually the state-owned sector and the private sector.

Following this policy of 1956, the state promoted private sector industry by securing infrastructure facilities such as electricity, transportation and other services and providing non-discriminatory treatment to both public and private owners. Promoted and encouraged.

In addition, the Philosophy and Action Plan for the Promotion of the Public Sector was incorporated into the 1948 and 1956 Industrial Policy Resolutions. The 1956 Industrial Policy Resolution states that "all of the nature of basic and strategically important or utility services, as well as the adoption of social patterns of society as national goals, the need for planned development. Industries must be in the public sector. Other industries that are essential and require investment on a current state-only scale.

The situation can be provided and must also be in the public sector. Therefore, the state must take direct responsibility for the future development of industry over a wider area. Therefore, the 1948 and 1956 industrial policy resolutions articulate the relative roles of both the public and private sectors in countries like India.

While analyzing the role of the public sector in the Indian economy, Mrs. Indira Gandhi, then Prime Minister of India, made the right observation: Of social benefit or strategic value, rather than providing a commercial surplus to fund further economic development, primarily considering profits. "

The 1977 Industrial Policy Statement also referred to the role of the public sector, thereby stipulating the expansion of the role of the public sector, especially with respect to strategic goods of a fundamental nature. The public sector was also encouraged to develop auxiliary industries and transfer technical and management expertise to the small and domestic industry sectors.

Given the growing problem of public sector corporate illness, industrial policy in 1980 regained confidence in the public sector, despite the recent decline in confidence in the public sector. confirmed. Therefore, this policy has introduced a time-limited program to restore the efficiency of public sector operations through an effective management system.

Again, the 1980 Industrial Policy attempted to integrate the industrial development of the private sector by promoting the concept of economic federalism, installing several nuclear plants in each district identified as the industrial rear district, As many accessories as possible and as small as possible cottage unit.

The new industrial policy of 1991 radically liberalized the industrial policy itself and drastically deregulated both the public and private sector industries in line with the liberalization movement introduced in the 1980s. The new industrial policy of 1991 recognizes the relative roles of both the public and private sectors of the economy and frees both of the two industrial sectors from the spider web of unnecessary bureaucratic control, India. Introduced liberalization measures to integrate the economy with the world economy. Freed indigenous private enterprises from the restrictions of MRTP law in order to achieve sustainable growth of productivity and employment and also to achieve international competitiveness.

In addition, the new policy has also prepared to reduce the burden on the most public sector enterprises in its expansion program. Public sector policies have helped them rebuild potentially viable units. In addition, priorities for future public sector enterprise growth will also be rescheduled to include products with critical infrastructure, mineral and oil exploration and development, technological development and strategic considerations.

Thus, it was found that the various industrial policies developed by the government since 1948 take into account the relative roles of both the public and private sectors in the Indian economy.

Therefore, these policies have made serious attempts to develop both the public and private sectors simultaneously and sustainably.

Relative role of Indian public sector:

The public sector has occupied a worthless place to achieve systematic and systematic development in developing countries like India. In a country like India, which suffers from multifaceted problems, the private sector is not in a position to make the necessary efforts to develop different sectors at the same time.

Therefore, in order to provide the support needed for a country's development strategy, the public sector provides the minimum impetus needed to guide the economy on a path of self-sustaining growth. Thus, it is now well recognized that the public sector plays an active role in national industrial development by laying a sound foundation for the industrial structure in the early stages of development.

Below are some of the important relative roles of the public sector in the economic development of countries like India.

(A) Promote economic development at a rapid pace by bridging the gaps in the industrial structure.

(B) Promote appropriate infrastructure for economic growth.

(C) Conducting economic activity in strategically important areas of development where the private sector can distort the spirit of national goals.

(D) Check monopoly and concentration of power in the hands of a few people.

(E) Promote balanced regional development and diversify natural resources and other infrastructure facilities in these underdeveloped regions of the country.

(F) Close the gap in income and wealth distribution by bridging the gap between the rich and the poor.

(G) Create and enhance ample employment opportunities in various sectors by making large investments.

(H) Achieve independence with various technologies according to requirements.

(I) Eliminate dependence on foreign aid and technology.

(J) Enforce social control and regulation through various financial institutions.

(K) Manage delicate sectors such as distribution systems and rationally allocate rare imported goods. And

(L) Reduce balance of payments pressure by promoting exports and reducing imports.

Relative role of Indian private sector:

India, a mixed economy, assigns great importance to the country's private sector to achieve rapid economic development. The government has fixed specific roles in the private sector in the areas of industry, trade and services.

India's most dominant sector, agriculture and other related activities such as dairy, livestock and poultry, is completely under the control of the private sector. In this way, the private sector manages the entire agricultural sector, thereby playing an important role in providing the entire food supply to millions of people.

In addition, the majority of the industrial sector engages in non-strategic and light sector, various consumer goods and non-durable consumer goods, electronic and electrical products, automobiles, textiles, chemicals, foods, light industrial products. Etc. are produced. It is also under the control of the private sector. Private sector players play an active role in the development and expansion of the aforementioned industrial groups. Moreover, the development of small-scale and cottage industries is also the responsibility of the private sector.

Finally, the private sector also plays a relative role in the development of the country's tertiary industry. Private sectors manage the entire service sector and provide different types of services to the general public.

The entire country's wholesale and retail trade is also managed by the private sector in the most rational way. In addition, most of the transportation, especially road transportation, is also managed by the private sector.

With the progress of liberalization of the Indian economy in recent years, the private sector has been assigned far greater responsibility in various areas of economic activity.

Key takeaways:

Trade balance:

This is the difference between the amount of exports and imports of important goods (called visible goods or goods) during the year.

Examples of visible items are clothing, shoes, machines, and so on. Obviously, the two transactions that determine a BOT are the export and import of goods.

It does not include imports and exports of services (invisible items such as shipping, insurance, banking, dividend and interest payments, tourist spending, etc.).

The difference in value between exports and imports is called the trade balance or trade balance. Keep in mind that exporting means sending goods abroad to earn forex, and importing means buying goods from abroad and paying forex. Exports are considered income and imports are considered expenditure. It contains only visible items and does not consider service exchanges.

Surplus or shortage BOT:

The trade balance can be in the black, in the red, or in equilibrium. If the export value of a visible item is greater than the import value of a visible item, the trade balance is said to be positive or favorable. Therefore, BOT is in the black. If the export value is less than the import value, the trade balance is said to be negative, negative or disadvantageous.

The BOT is then called in red. A bot is said to be in equilibrium or equilibrium if its export value is equal to its import value. Rows (1) and (5) of the table in Section 10.1 show the country's trade balance as a fictitious example. The country exported 55 billion rupees of goods and imported 80 billion rupees of imported goods. The trade balance of 250 rupees was in the red.

Trade Balance = Table Rows (1) and (5) = 550-800 = Rs -250

Even if a country's trade balance is in the red, it can be offset by other account items, especially the capital account. The trade balance (commodity) provides a substantive description of the payments that result from international transactions, but does not reflect the full picture of all payments payable to a country and the payments payable to a country. To do so, you need a balance in your Pa5 Tnent account. To be on the safe side, the balance of items displayed in your BOP account is called a BOT.

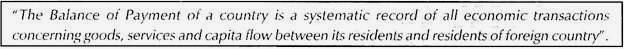

Balance of Payments:

Meaning of balance of payments:

Like companies, these are needed to present the balance sheet and cash flow at the end of the year. This is the same way we wanted to get a snapshot of the country's balance of accounts for the country's foreign currency. Through a statement named Balance of Payments. The trade balance shows the difference in value between imports and exports, and the balance of payments shows the combined effect of different other balances of trade and trade balances on different accounts from countries in other worlds.

In addition to imports and exports, we also take into account receivables or payables for:

(1) Freight fare,

(2) Port charges,

(3) Expenditures for foreign visits for tours, education, medical care, business, etc.

(4) Purchase of marine fuel and preparation for crew,

(5) Maintenance of overseas embassies,

(6) Remittance of foreigners, repayment of external debt and interest,

(7) Remittance of profits of foreign companies and development subsidies.

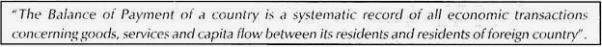

In the words of Kindleberger (1973):

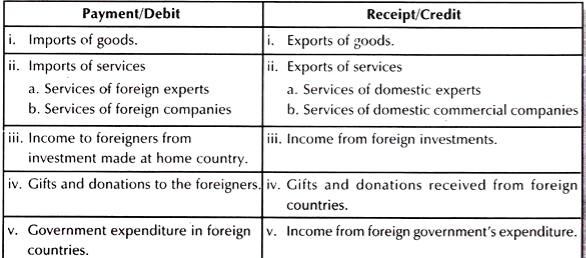

Balance of Payments Account Types:

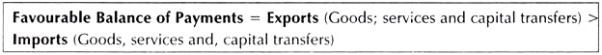

The balance of payments is the difference between exports (of goods, services and capital transfers) minus imports (of goods, services and capital transfers). This shows that the balance of payments is a wider period and the trade balance is part of it. The balance of payments is further categorized as favorable and unfavorable.

1. Preferred balance of payments:

In addition to excesses of exported goods and services, imported goods and services and capital transferred abroad beyond the transfer of capital from abroad are known as the balance of payments.

It can also be expressed as:

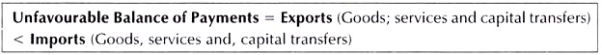

2. Unfavorable balance of payments:

An excess balance of payments that exceeds the transfer of capital abroad, that is, the transfer of capital to other parts of the world, in addition to the goods and services exported, in addition to the goods and services imported, is known as the unfavorable balance of payments. I am.

It can also be expressed as:

Balance of Payments Form or Account:

There are two types of balance of payments or accounts:

1. Current account

2. Capital account

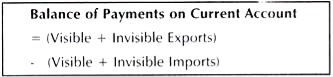

1. Checking account:

The balance of payments for checking deposits is a short-term statement of the actual balance of payments. This includes the import and export of both important goods and services. Checking items are actually traded.

It can also be expressed as:

Current balance components or items:

The components of the checking account are important for calculating the net position of the current account balance. These components are broadly divided into visible and hidden items.

1. Import / export of visible items or goods:

All visible and important commodities that are imported and exported make up the items of the current account balance. Records of these goods are available at national ports.

2. Invisible items or non-essential goods or services:

Inflows and outflows of non-significant goods or services from abroad in the country cannot be recorded, nor can be seen or touched.

Below is a list of some items related to the category.

(I) Transportation and travel services:

Transportation support is also required to move goods between countries. Whenever foreign tourists, businessmen, students, etc. (to take advantage of health, education and entertainment) use domestic transportation and travel facilities, they can be called exports from a BOP perspective. ..

Similarly, when a country's citizens use the facilities of a foreign transport, it is called an import. The difference between the value of the shipment received and the value of the shipment used forms part of the balance of payments in the balance of payments statement.

(II) Professional services:

The services of foreign professionals are used domestically, just as the services of domestic professionals are used in other countries. The value of services received from overseas is called imports, and the value of services provided overseas by domestic citizens is called exports. The difference between exporting and importing services forms part of the balance of payments of the current account.

(III) Investment income and investment costs:

Rent, interest, profits and dividends are also invisible items of the balance of payments. Receiving income from abroad is called receiving in foreign currency. Similarly, the income earned by a foreigner from that country is known as payment in foreign currency. Differences between foreign income receipts and payments of foreign expenses also form part of the balance of payments of the current account.

(IV) Donations and gifts:

Donations and gifts are uncompensated transactions, or unilateral transactions. Therefore, the receipt of the same thing from abroad by the natives of a country is called receipt, and the giving to another country is called payment. Differences between donations, receiving and donating gifts from abroad, and gifts to other countries also form part of the balance of payments.

(V) Services provided by commercial businesses:

Related trading and commerce companies, such as shipping companies, banks and insurance companies, are involved in the provision and reception of services with other countries in the country and around the world. Differences between imports and exports of exchanges of services such as delivery, banking and insurance form part of the balance of payments balance of payments.

(Vi) Government transactions:

In general, governments provide services from embassies, High Commissioners' Offices, and other foreign delegations to maintain harmonious relationships and to fund relationships with offices. I'm spending. Such spending is called payment.

Similarly, certain domestic countries earn foreign currency from the governments of other countries for their domestic offices, which are known as receipts. The difference between paying and receiving such services forms part of the balance of payments of the current account.

(Vii) Others:

Miscellaneous and invisible items such as fees, advertisements, royalties, patent fees, rent, membership fees, etc. are provided overseas and paid from overseas. Meanwhile, the country receives or uses these items and pays to other parts of the world. The difference between receiving and paying for these invisible services forms part of the balance of payments of checking accounts.

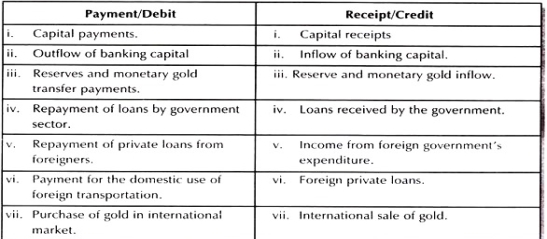

2. Capital account:

All kinds of short-term and long-term international capital transfers, gold and billion metal transfers, personal and government account receipts and payments, institutional and private loans, interest, profits, grants and more are part of the capital account Form Since the capital account is related to financial transfers, it has no direct impact on national income, output or employment.

Capital account components:

The main items or components of the capital account are:

(I) Gold movement:

Central banks in each country buy and sell gold domestically and internationally. This means the import and export of gold by the central bank that pays and receives the gold. The amount of gold purchased is reflected in the "debit" and the sale of gold is reflected in the "credit".

(Ii) Reserve, gold coins, SDR:

Government foreign currency assets, central bank gold reserves, IMF SDRs and other similar capital transactions are included in the "credit items" and payments for these transactions are

(Ii) Reserve, gold coins, SDR:

Government foreign currency assets, central bank gold reserves, IMF SDRs and other similar capital transactions are included in the "credit items" and payments for these transactions are reflected in the "debit items".

(Iii) Bank capital movements:

The inflow of bank capital other than the central bank is reflected in the "credit item", and the outflow of bank capital other than the central bank is reflected in the "debit item".

(Iv) Private foreign loan flow:

The country's private sector received foreign loans from abroad. Receipts for these external debts are included in the "credit items". The country's private sector also pays foreign loans abroad. Repayments of these foreign loans are included in the "debit items".

(V) Official capital transactions:

The national public sector receives foreign loans from the International Monetary Fund. The receipt of these loans is included in the "credit item" and the public sector also pays the loan to the International Monetary Fund, which is included in the "debit item".

(Vi) Others:

In addition to the above items, the central bank receives other types of government capital. These types of receipts are also included on the "credit side" and the central bank pays for these government capitals included on the "debit side".

Items of Current Account:

Items of Capital Account:

What is money?

Money can be defined as what is generally accepted by people in society or the community for the payment of purchased goods and services or the payment of debt. Another very good, but a simple definition of money is the exchange in a region or defined area. Money is a concept that we all understand, but it is difficult to define exactly.

Money serves as a medium for exchange. Most definitions of money

Start with "money function". "Money is money." According to Professor Walker, "Money seems to be money."

That is, the term money should be used to include everything that performs the function of money. That is, the medium of exchange, the measurement of value, the unit of account, and so on. Since general acceptance is a fundamental property of money, money is defined as "what people generally accept in the exchange of goods or services or the repayment of debt."

Money supply

In the real world, the money supply has different definitions: M1 and M2. Money is categorized by its liquidity. The most liquid item is in M1.

M1: Includes currencies (coins coined by the US Treasury and banknotes issued by the Federal Reserve), checkable deposits, and traveler checks (issued by commercial banks and savings and loan associations).

M1 does not include currencies and checkable deposits belonging to the federal government, the Federal Reserve System, or other financial institutions.

M1 = Currency + Checkable Deposit + Traveller's Check

M2: In addition to all the components of M1, near money is included, including items such as:

a) Time deposits: Interest deposits with a value of less than $ 100,000 and a designated maturity.

b) Savings deposits: Deposits that earn maximum value and certain non-maturity interest.

c) Money Market Accounts: Savings deposits investing in short-term financial instruments pay higher than interest on savings accounts.

d) Overnight repo contract: A contract by a financial institution to sell short-term securities to a customer and a contract to buy back securities within 24 hours.

e) Overnight Eurodollar Deposit: A 24-hour dollar-denominated deposit held by a financial institution outside the United States.

M2 = M1 + All near money (fixed deposits, savings deposits, money market accounts, overnight repo contracts, overnight euro dollar deposits, etc.).

The modern banking system was developed from the early partial reserve banks.

Goldsmiths had vaults for gold and precious metals, which they often kept for a fee for consumers and merchants. They issued receipts for these deposits. After that, receipts were used as money instead of gold, and goldsmiths.

Note that much of the saved gold was never redeemed. The goldsmith realized that he could lend money by issuing a receipt to a borrower who agreed to repay the money and interest. The actual gold in the vault has become only a small part of the receipts held by the borrower and owner of the gold. Fractional reserve banking is important because banks can generate money by lending more than their original reserves.

Creation of money:

Individual banks are not allowed to print their money. However, banks can make money by making checkable deposits that are part of the money supply.

Suppose the Federal Reserve prints $ 100 and decides to deposit it in Bank X. Bank X reserves a portion of $ 100, for example 10%, which is the required reserve (the specific amount that the bank must hold as reserve for all deposits). The remaining 90%, $ 90, will be in excess reserve. Bank X can lend that $ 90 to Customer A. Customer A deposits in his account at Bank Y. In this step, the original $ 100 remains in the system and customer A can be added.

$ 90. Bank Y secures 10% and lends the rest. This process continues

Until you can no longer create a new excess reserve.

The money multiplier is a number that multiplies the change in the monetary base to find the resulting change in the amount of money.

Change in quantity of money = Change in money multiplier X monetary base.

The money multiplier is determined by the required reserve requirement (r) and currency outflow (c). c: The increase in currencies held outside the bank shows the portion of the currency that people hold as cash for their expansion after borrowing from the bank. r is the required reserve requirement determined by the Federal Reserve System. The bank must hold the r portion of the total deposit as a necessary reserve.

RR: Required reserve = total deposit x r

ER: Excessive preparation = actual preparation-necessary preparation

The maximum new loan amount of a bank is the same as the excess reserve held by the bank.

The modern banking system was developed from the early partial reserve banks.

Functions of Money:

They issued receipts for these deposits. Later, receipts were used as money instead of gold, and goldsmiths realized that much of the gold they had stored was never redeemed. The goldsmith realized that he could lend money by issuing a receipt to a borrower who agreed to repay the money and interest. The actual gold in the vault has become only a small part of the receipts held by the borrower and owner of the gold. Fractional reserve banking is important because banks can generate money by lending more than their original reserves.

Creation of money:

Individual banks are not allowed to print their money. However, banks can make money by making checkable deposits that are part of the money supply.

Suppose the Federal Reserve prints $ 100 and decides to deposit it in Bank X. Bank X reserves a portion of $ 100, for example 10%, which is the required reserve (the specific amount that the bank must hold as reserve for all deposits). The remaining 90%, $ 90, will be in excess reserve. Bank X can lend that $ 90 to Customer A. Customer A deposits in his account at Bank Y. In this step, the original $ 100 remains in the system and customer A can be added.

$ 90. Bank Y secures 10% and lends the rest. This process continues until you can no longer create a new excess reserve.

The money multiplier is a number that multiplies the change in the monetary base to find the resulting change in the amount of money.

Change in quantity of money = Change in money multiplier X monetary base.

The money multiplier is determined by the required reserve requirement (r) and currency outflow (c). c: The increase in currencies held outside the bank shows the portion of the currency that people hold as cash for their expansion after borrowing from the bank. r is the required reserve requirement determined by the Federal Reserve System. The bank must hold the r portion of the total deposit as a necessary reserve.

RR: Required reserve = total deposit x r

ER: Excessive preparation = actual preparation-necessary preparation

The maximum new loan amount of a bank is the same as the excess reserve held by the bank.

Money function:

Generally speaking, the main function of money in the economic system is "to facilitate the exchange of goods and services and to help facilitate trade." Its basic feature is general receptivity. The function of money is reflected in the following well-known renku.

"Money is a matter of function 4. The medium of exchange and the measurement of value are the main functions because they are the most important, but the post-paid standard and the preservation of value are secondary functions because they are derived from the main functions

Money is a matter of function 4, medium, means, standards, stores.

Money in the modern economy performs important functions classified by Kinley as:

(A) Key functions, also called basic and unique functions, such as exchange media and value measurement.

(B) Secondary functions such as deferred payment criteria, value preservation, and value transfer.

(C) Accidental functions such as income distribution, utility measurement and maximization.

Main functions:

The main features include the most important money features that need to be performed in all countries.

1. Money is a medium of exchange: This is arguably the most prominent feature of money. Money solves all problems related to bartering or bartering systems. The barter system was used long ago when money was not invented. In bartering, a product was directly exchanged for another product. This system had many drawbacks. Because the only way to get what you want was to have something in exchange for what you want with someone. For example, suppose John wants an onion and goes to Janet, who has the onion. And because he didn't have the money to pay Janet to collect the onions, he had to find what Janet needed to exchange for onions. This system was very difficult to implement in the sense that it could not be exchanged without a match of desires. But money came to solve this problem.

2. Money is a measuring tool: As you can see, distances are measured using units of measure such as kilometres so that you can compare distances from one location to another. Therefore, it goes without saying that it is very difficult to compare the distances from one place to another without kilometres. Money plays a similar role in the evaluation of goods and services. Money plays a similar role in evaluating goods and services and comparing them to other goods and services. Thanks to the money, it's no longer difficult to be effective, for example, replacing a bag of beans with a cow. Today, money has allowed us to exchange bean bags for the right ones.

2. Secondary function:

These refer to money features that complement key features. These functions are also called "derivatives" because they are derived from linear functions.

1. Post-paid criteria: When we say deferred payment, it means debt settlement at a later date. With money, it's very easy to defer payment from now until a later date. For example, if you buy an item with credit, you promise to pay for the item you purchased at a later date. You can't do this without money. Thanks to the money, we were able to record the debt and pay it at a later date. Money also allows contracts to be signed now and executed in the future.

2. Money allows us to save now for future use: Without money, it is very difficult to store goods, especially fresh foods such as tomatoes, onions, fruits and vegetables, for future use. For example, tomato farmers cannot store tomatoes for future use. However, by selling produce for money, farmers can now save for later use.

3. Credit Foundation: Money facilitates mortgages. Borrowers can spend money to get goods and services when they need them most. For example, newlyweds need a lot of money to complete their home at one time. They don't have to wait 10 years, for example, to save enough money to buy expensive items such as cars, refrigerators and TVs.

Accidental function:

Moreover, Professor Kinley, the primary and secondary function of money, focuses on the accidental function of money. Money facilitates the distribution of national income among the various elements of production. Land, labor, capital and organizations all cooperate in production activities, and products are the result of joint efforts belonging to all of them.

Some of the accidental functions of money in economics are: (I) Distribution of national income (ii) Maximization of satisfaction (iii) Foundation of credit creation (iv) Capital productivity (v) Option bearers and (vi) Guarantee solvency.

(I) Distribution of national income:

Money helps to optimally distribute national income among the various elements of production (land, labour, capital, businesses).

The country's total production is jointly produced by these factors. Therefore, the output needs to be distributed among them. Money helps distribute domestic products in the form of rent, wages, interest and profits. These are represented by money.

(II) Maximizing satisfaction:

Money helps consumers and producers maximize satisfaction. Consumers derive maximum satisfaction by equalizing the price of each product (expressed in money) to its marginal utility (satisfaction). Similarly, producers maximize satisfaction (profit) by equalizing the marginal productivity of an element with the price of such element.

(III) Basics of credit creation:

Money as a store of value has encouraged people to save in the form of demand deposits with banks. Such demand deposits are used by commercial banks to generate credit. ‘

(IV) Capital productivity:

Money is the most liquid asset and can be used for any purpose, increasing capital productivity. The liquidity of money makes it easy to move capital from less productive uses to more productive uses.

(V) Optional bearer:

Money provides purchasing power in the hands of the person (owner) who owns it, and he has many options for using it. Owners can change their spending decisions at any time and from place to place, depending on urgency, intensity, and priority.

(VI) Guarantee of solvency:

Money acts as a guarantee of the solvency of an individual or institution. If an individual has enough money (more than his debt), he cannot declare bankruptcy or bankruptcy. For this reason, individuals and businesses have large amounts of money to meet unexpected needs.

Recently, another feature was added. Money is completely fluid. Liquidity means convertibility to cash. Therefore, the ability to quickly convert an asset into money without losing its value is called the liquidity of the asset. Modern economists focus on the liquidity of money. By definition, money is the most commonly accepted commodity, so it is the most liquid of all resources.

With money, you can get almost every item wherever you are, and money won't lock the buyer. It is this peculiarity that distinguishes money from all other commodities. Liquidity preference is money preference.

Therefore, money acts as a general medium of exchange, a general measure of value, a standard of deferred payment, and a storage place for value.

In the modern economy, most transactions (buying and selling) are based on credit. For example, you can rent durable consumer goods such as TV sets and washing machines. House can be purchased by

L.I.C. or H.D.F.C. Loans; Most commercial transactions allow future payments for currently delivered goods. Employees wait a month or a week to receive wages and salaries. Therefore, the use of money allows members of society to postpone their spending from the present to a future date.

Therefore, it turns out that the money system has clear advantages over the barter system. But what is money? Note the first five words of our definition-"whatever is generally accepted". We use banknotes and coins to buy things, but we can only do so if shopkeepers and traders are ready to accept those banknotes and coins in the payment of the goods they sell.

If all sellers decide not to accept these notes and coins anymore, they will no longer be money. If they decide to accept the chair legs as money instead, we will have to use the chair legs that we have to use when buying something! Of course, this example is pretty ridiculous, but points out that anything can be money as long as it is generally accepted.

References:

References: