Unit 5

Limited liability partnership Act – 2008

A limited liability Partnership or LLP is an alternate corporate business form which offers the advantages of limited liability to the partners at low compliance costs. It also allows the partners to arrange their internal structure sort of a traditional partnership. A limited liability partnership may be a legal entity, responsible for the complete extent of its assets. The liability of the partners, however, is restricted. Hence, LLP may be a hybrid between a corporation and a partnership.

SALIENT FEATURES OF LLP

LLP may be a body corporate

According to Section 3 of the Limited Liability Partnership Act (LLP Act), 2008, an LLP may be a body corporate formed and incorporated under the Act. it's a legal entity break away its partners.

Perpetual Succession

Unlike a partnership firm, a limited liability partnership can proceed its existence even after the retirement, insanity, insolvency or maybe death of 1 or more partners. Further, it can enter into contracts and hold property in its name.

Separate Legal Entity

It is a separate legal entity. Further, it's absolutely responsible for its assets. Also, the liability of the partners is restricted to their contribution in the LLP. Hence, the lenders of the limited liability partnership aren't the creditors of individual partners.

Mutual Agency

Another difference between an LLP and a partnership firm is that independent or unauthorized actions of 1 partner don't make the opposite partners liable. All partners are agents of the LLP and therefore the actions of 1 partner don't bind the others.

LLP Agreement

The rights and duties of all partners are governed by an agreement between them. Also, the partners can devise the agreement as per their choice. If such an agreement isn't made, then the Act governs the mutual rights and duties of all partners.

Artificial Legal Person

For all legal purposes, an LLP is a man-made legal person. it's created by a legal process and has all the rights of a private . it's invisible, intangible and immortal but not fictitious since it exists.

Common Seal

If the partners decide, the LLP can have a standard seal [Section 14(c)]. it's not mandatory though. However, if it decides to possess a seal, then it's necessary that the seal remains under the custody of a responsible official. Further, the harbor seal are often affixed only within the presence of a minimum of two designated partners of the LLP.

Limited Liability

According to Section 26 of the Act, every partner is an agent of the LLP for the aim of the business of the entity. However, he's not an agent of other partners. Further, the liability of every partner is restricted to his agreed contribution within the limited liability Partnership.

Minimum and Maximum Number of Partners

Every limited liability Partnership got to have a minimum of two partners and a minimum of two individuals as designated partners. At any time, a minimum of one designated partner should be resident in India. there's no maximum limit on the amount of maximum partners within the entity.

Management of Business

The partners of the limited liability Partnership can manage its business. However, only the certain partners are liable for legal compliances.

Business for Profit Only

A indebtedness Partnership can't be created for charitable or non-profit purposes. it's essential that the entity is made to hold on a lawful business with a view to incomes a profit.

Investigation

The power to research the affairs of a limited liability Partnership resides with the Central Government. Further, they will appoint a competent authority for an equivalent.

Compromise or Arrangement

Any compromise or arrangement sort of a merger or amalgamation desires to be in accordance with the Act.

Concept of LLP: limited liability Partnership enterprise, the planet wide recognized sort of business, has now been brought in India by enacting the limited liability Partnership Act, 2008. LLP Act was notified on 31.03.2009.

A limited liability Partnership, popularly referred to as LLP combines the benefits of both the corporate and Partnership into one sort of organization. Limited liability Partnership (LLP) may be a new corporate form that permits expert knowledge and entrepreneurial skill to mix, organize and operate in an revolutionary and proficient manner.

It provides an alternate to the normal partnership association with unlimited liability. By incorporating an LLP, its members can avail the advantage of limited liability and therefore the flexibility of organizing their internal management on the idea of a mutually-arrived agreement, as is that the case during a partnership firm.

CHARACTERISTICS OF AN LLP:

1. LLP is governed by way of the limited liability Partnership Act 2008, which has inherit force with effect from April 1, 2009. The Indian Partnership Act, 1932 isn't applicable to LLP.

2. LLP may be a body incorporate and a legal entity break away its partners having perpetual succession, can own assets in its name, sue and be sued.

3. The partners have the proper to manage the business directly, unlike corporate shareholders.

4. One partner isn't responsible or in charge of another partner’s, misconduct or negligence.

5. Minimum of two partners and no maximum limit.

6. Should be ‘for profit’ business.

7. The rights and duties of partners in an LLP, are going to be governed by the agreement between partners and therefore the partners have the pliability to plan the agreement as per their choice. The duties and obligations of Designated Partners shall be as provided within the law.

8 Limited liability of the partners to the extent of their contributions within the LLP. No exposure of private assets of the partner, except in cases of fraud.

9. LLP shall maintain annual accounts. However, audit of the accounts is required solely if the contribution exceeds Rs. 25 lakh or annual turnover exceeds Rs. 40 lakh. a press release of accounts and solvency shall be filed by every LLP with the Registrar of Companies (ROC) per annum .

NATURE OF LIMITED LIABILITY PARTNERSHIP

Limited Liability Partnership to be body corporate.—

(1)A indebtedness partnership may be a body corporate formed and incorporated under this Act and may be a legal entity breaks away that of its partners.

(2) A limited liability partnership shall have perpetual succession.

(3) Any change within the partners of a limited liability partnership shall not affect the existence, rights liabilities of the limited liability partnership.

4. Non-applicability of the Indian Partnership Act, 1932.—Save as otherwise provided, the provisions of the Indian Partnership Act, 1932 (9 of 1932) shall not apply to a limited liability partnership.

5. Partners.—Any individual or body corporate could also be a partner during a limited liability partnership:

Provided that a private shall not be capable of becoming a partner of a limited liability partnership, if—

(a) he has been found to be of unsound mind by a Court of competent jurisdiction and therefore the finding is in force;

(b) he's an discharged insolvent; or

(c) he has applied to be adjudicated as an insolvent and his application is pending.

6. Minimum number of partners.

(1) Every limited liability partnership shall have a minimum of two partners.

(2) If at any time the amount of partners of a limited liability partnership is reduced below two and

the limited liability partnership carries on business for quite six months while the amount is so reduced, the person, who is that the only partner of the limited liability partnership during the time that it so carries on business after those six months and has the knowledge of the very fact that it's carrying on business with him alone, shall be liable personally for the obligations of the limited liability partnership incurred during that period.

DESIGNATED PARTNERS

(1) Every limited liability partnership shall have a minimum of two designated partners who are individuals and a minimum of one among them shall be a resident in India: as long as just in case of a limited liability partnership during which all the partners are bodies corporate or during which one or more partners are individuals and bodies corporate, a minimum of two individuals who are partners of such limited liability partnership or nominees of such bodies corporate shall act as designated partners.

Explanation.—For the needs of this section, the term "resident in India" means an individual who has stayed in India for a period of not but 100 and eighty-two days during the immediately preceding one year.

(2) Subject to the provisions of sub-section (1),

(i) if the incorporation document

(a) specifies who are to be designated partners, such persons shall be designated partners on incorporation; or

(b) states that every of the partners from time to time of limited liability partnership is to be designated partner, every such partner shall be a designated partner;

(ii) any partner may become a designated partner by and in accordance with the indebtedness partnership agreement and a partner may cease to be a chosen partner in accordance with limited liability partnership agreement.

(3) a private shall not become a designated partner in any limited liability partnership unless he has given his prior consent to act intrinsically to the limited liability partnership in such form and manner as could also be prescribed.

(4) Every limited liability partnership shall file with the registrar the particulars of each individual who has given his consent to act as designated partner in such form and manner as could also be prescribed within thirty days of his appointment.

(5) a private eligible to be a delegated partner shall satisfy such conditions and requirements as could also be prescribed.

(6) Every designated partner of a limited liability partnership shall obtain a designated Partner

Identification Number (DPIN) from the Central Government and therefore the provisions of sections 266A to 266G8 (both inclusive) of the businesses Act, 1956 (1 of 1956) shall apply mutatis mutandis for the said purpose.

LIABILITIES OF DESIGNATED PARTNERS.

Unless expressly provided otherwise during this Act, a delegated partner shall be—

(a) liable for the doing of all acts, matters and things as are required to be done by the limited liability partnership in respect of compliance of the provisions of this Act including filing of any document, return, statement and therefore the like report pursuant to the provisions of this Act and as could also be laid out in the limited liability partnership agreement; and

(b) susceptible to all penalties imposed on the limited liability partnership for any contravention of these provisions.

CHANGES IN DESIGNATED PARTNERS

A limited liability partnership may appoint a designated partner within thirty days of a vacancy arising for any reason and provisions of sub-section (4) and sub-section (5) of section 7 shall apply in respect of such new designated partner:

Provided that if no designated partner is appointed, or if at any time there's just one designated partner, each partner shall be deemed to be a delegated partner.

Punishment for contravention of sections 7, 8 and 9.—(1) If the limited liability partnership contravenes the provisions of sub-section (1) of section 7, the limited liability partnership and its every partner shall be punishable with fine which shall not be but ten thousand rupees but which can reach five lakh rupees.

(2) If the limited liability partnership contravenes the provisions of sub-section (4) and sub-section (5) of section 7, section 8 or section 9, the limited liability partnership and its every partner shall be punishable with fine which shall not be but ten thousand rupees but which can reach one lakh rupees.

ADVANTAGES OF LLP:

The first LLP was registered on 2nd April, 2009 and till 25th April, 2011, 4580 LLPs were registered. this type of Organization offers the subsequent benefits:

1. The method of formation is extremely simple as compared to Companies and doesn't involve much formality. Moreover, in terms of cost, the minimum fee of incorporation is as low as f 800 and maximum is f 5600.

2. A bit like a corporation , LLP is additionally body corporate, which suggests it's its own existence as compared to partnership. LLP and its Partners are distinct entities within the eyes of law. LLP is understood through its own name and not the name of its partners.

3. An LLP exists as a separate legal entity different from the lives of its partners. Both LLP and persons, who own it, are separate entities and both function separately. Liability for repayment of debts and law incurred by the LLP lies thereon, the owner. Any business with potential for lawsuits should believe LLP sort of organisation and it'll offer another layer of protection.

4. LLP has perpetual succession. Notwithstanding any changes within the partners of the LLP, the LLP will remain an equivalent entity with an equivalent privileges, immunities, estates and possessions. The LLP shall proceed to exist till it's aroused in accordance with the provisions of the relevant law.

5. LLP Act 2008 gives an LLP flexibility to manage its very own affairs. Partners can decide the way they need to run and manage the LLP, as per the shape of LLP Agreement. The LLP Act does not regulate the LLP to large extent instead of allows partners the freedom to manage it as per their agreement.

6. It's easy to hitch or leave the LLP or in the other case it's easier to transfer the ownership in accordance with the terms of the LLP Agreement.

7. An LLP, as legal entity, is capable of owning its Separate Property and funds. The LLP is that the real person during which all the property is vested and thru which it's controlled, managed and disposed of. The property of LLP isn't the property of its partners. Therefore, partners cannot make any claim on the property just in case of any dispute amongst themselves.

8. Another main advantage of incorporation is that the taxation of a LLP. LLP is taxed at a lower rate as in contrast to Company. Moreover, LLP is additionally not subject to Dividend Distribution Tax as compared to company, so there'll not be any tax while you distribute profit to your partners.

9. Financing a little business like sole proprietorship or partnership are often difficult sometimes . An LLP being a regulated entity like company can attract finance from Private Equity Investors, financial institutions etc.

10. As a juristic legal person, an LLP can sue in its name and be sued by others. The partners aren't susceptible to be sued for dues con to the LLP.

11. Under LLP, only just in case of business, where the annual turnover/contribution exceeds Rs. 40 lakh Rs. 25 lakh are required to urge their accounts audited yearly by a accountant . Thus, there's no mandatory audit requirement.

12. In LLP, Partners, unlike partnership, aren't marketers of the partners and thus they're not responsible for the character act of other partners, which protects the interest of individual partners.

13. As compared to a personal company, the numbers of compliances are on a lesser side just in case of LLP.

DISADVANTAGES OF LLP:

The major Disadvantages of limited liability Partnership are listed below:

1. An LLP cannot raise cash from Public.

2. Any act of the partner without the opposite may bind the LLP.

3. Under some cases, liability may reach personal assets of partners.

4. No separation of Management from owners.

5. LLP might not be a choice due to certain extraneous reasons. for instance ,, Department of Telecom (DOT) would approve the appliance for a leased line solely for a corporation . Friends and relatives (Angel investors), and venture capitalists (VC) would be comfortable investing during a company.

6. The framework for incorporating a LLP is in situ but currently registrations are centralized at Delhi.

INCORPORATION OF LLP

For forming an LLP, a number of the important steps and matters are given below:

Partner:

There should be a minimum of 2 people (natural or artificial) to make an LLP. just in case any Body Corporate may be a partner, then he are going to be required to nominate a person (natural) as its nominee for the aim of the LLP. Following entities and/or persons can find yourself a partner within the LLP:

(a) Company incorporated in and out of doors India

(b) LLP incorporated in and out of doors India

(c) Individuals resident in and out of doors India.

PROCESS OF FORMULATION OF LLP:

Capital Contribution:

In case of LLP, there's no concept of any share capital, but every partner is required to contribute towards the LLP in some manner as laid out in LLP agreement. The said contribution are often tangible, movable or immovable or intangible property or different benefit to the limited liability partnership, including money, promissory notes, and different agreements to contribute cash or property, and contracts for services performed or to be performed.

In case the contribution is in intangible form, the fee of an equivalent shall be certified by a practicing chartered accountant or by a practicing cost accountant or via approved value from the panel maintained by the Central Government. The monetary cost of contribution of every partner shall be accounted for and disclosed within the accounts of the limited liability partnership within the manner as could also be prescribed.

Designated Partners:

Every limited liability partnership shall have a minimum of two designated partners to try to to all acts under the law who are individuals and a minimum of one among them shall be a resident in India. ‘Designated Partner’ means a partner who is designated intrinsically within the incorporation documents or who becomes a delegated partner by and in accordance with the LLP Agreement.

In case of a limited liability partnership during which all the partners are bodies corporate or during which one or more partners are individuals and bodies corporate, a minimum of two individuals who are partners of such limited liability partnership or nominees of such bodies corporate shall act as designated partners.

Designated Partner number (DPIN):

Every Designated Partner is required to get a DPIN from the Central Government. DPIN is an eight digit numeric number allotted by the Central Government so as to spot a specific partner and may be acquired by making a web application in Form 7 to Central Government and submitting the physical application along side necessary identity and Address proof of the person applying with prescribed fees.

However, if a private already holds a DIN (Director Identification Number), an equivalent number might be dispensed as your DPIN also. For that the users while submitting Form 7 must fill their existing DIN No. within the application.

It is not necessary to use Designated Partner number whenever you're appointed partner during a LLP, once this number is allotted it might be utilized in all the LLP’s during which you'll be appointed as partner.

Digital Signature Certificate:

All the forms like e Form 1, e Form 2, e Form 3 etc. which are required for the motive of incorporating the LLP are filed electronically through the medium of Internet. Since of these forms are required to be signed by the partner of the proposed LLP and as of these forms are to be filed electronically, it's impossible to sign them manually. Therefore, for the aim of signing these forms, a minimum of one among the Designated Partner of the proposed LLP wants to possess a Digital Signature Certificate (DSC).

The Digital Signature Certificate once obtained are going to be useful in filing quite a couple of forms which are required to be filed during the course of existence of the LLP with the Registrar of LLP.

LLP Name:

Ideally the name of the LLP must be such which represents the business or activity intended to be carried on by the LLP. LLP not select similar name or prohibited words.

LLP Agreement:

For forming an LLP, there need to be agreement between/among the partners. The said Agreement contains name of LLP, Name of Partners and Designated Partners, sort of Contribution, share Ratio, and Rights and Duties of Partners.

In case no agreement is entered into, the rights and duties as prescribed under Schedule I to the LLP Act shall be applicable. it's possible to amend the LLP Agreement but each change made within the said agreement must be intimated to the Registrar of Companies.

Registered Office:

The Registered workplace of the LLP is that the place where all correspondence related with the LLP would happen , though the LLP also can prescribe the other for an equivalent . A registered office is required for maintaining the statutory records and books of Account of LLP. At the time of incorporation, it's essential to submit proof of ownership or right to use the office as its registered office with the Registrar of LLP.

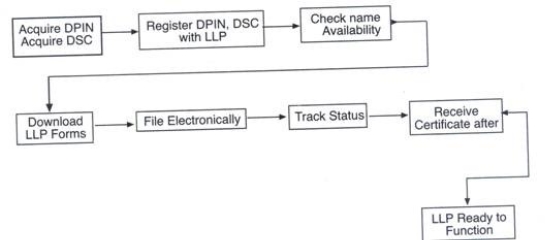

PROCESS FOR THE INCORPORATION OF AN LLP

The following things got to be ensured for the incorporation of LLP:

• Appoint/nominate partners and designated partners.

• Obtain the DPINs and Digital Signature Certificates (DSCs)

• Register a singular LLP name (applicant can indicate up to six choices)

• Draft the LLP Agreement

• File the specified documents, electronically

• Apply for the Certificate of Incorporation along side LLPIN (Limited Liability Partnership Identification Number)

• The contents of an LLP agreement

• Name of the LLP

• Names and addresses of the partners and unique partners

• The sort of contribution and interest on contribution

• Profit sharing ratio

• Remuneration of partners

• Rights and duties of partners

• The proposed business

• Rules for governing the LLP

STEPS FOR THE INCORPORATION OF AN LLP

• Reserve the name of the LLP. Applicant documents e-Form 1 to determine the supply and register the name of the LLP. Once the Ministry approves the name, it reserves it for the applicant for a period of 90 days. Also, if the LLP is not incorporated within that point frame, the reservation is removed and therefore the name is formed available to other applicants.

• Incorporation of a replacement LLP. Applicant files e-Form 2 which contains the small print of the proposed LLP alongside with details of the partners and designated partners

• Consent of the partners and detailed partners to act within the said role.

• File the LLP Agreement with the Registrar within 30 days of incorporation of the LLP. Applicant files e-Form 3. consistent with Section 23 of the LLP Act, 2008, execution of LLP Agreement is mandatory.

RIGHTS OF PARTNERS

i) Right to require part within the Conduct or Management of Business: Every partner, regardless of the quantity contributed by him, has an inherent right to participate within the conduct of enterprise of the firm. However, by mutual agreement, some partners could also be restricted to require section but, the proper to participate within the management must get on hand to all or any

ii) Right to be consulted & to require Decisions by Majority: Before taking over any major decisions, it's the proper of the partners to be consulted and heard. Any disagreement be solved by majority decision. But, no change within the nature or constitution of the business is often performed without the consent of all partners.

iii) Right of Access To Books: Every partner features a right to possess access to and to see out and replica the books of firm.

iv) Right to Share the Profits: Every partner features a right to share the profits equally, unless otherwise prescribed, and bear the losses also.

v) Right to Receive Interest on Capital: If the partnership deed so decides that a partner is entitled to get interest on capital at a hard and fast or certain rate, he features a right to receive it but, only out of profits.

vi) Right to be Indemnified: Every partner features a right to say indemnity from the association in respect of payments made or liabilities incurred by him within the ordinary and suited conduct of business and in emergency to protect the corporate from loss, provided the act should be like would are done by a individual of ordinary prudence, in his own case and under similar circumstances.

vii) Right to Receive Interest on Advances: If a associate makes any advances beyond the quantity of capital he has agreed to subscribe, he features a right to say an interest at the speed of six percent once a year .

viii) Right to Act in Emergency: A partner has every proper and authority to act in emergency, so as to guard the firm from loss, and therefore the firm would be bound through such an act, provided the act would similar in his own case, under identical situation.

ix) Right to use to the Property of the Firm for Business of the Firm: Subject to contract between the partners, every partner features a right to use and use the property of the firm exclusively for business of the firm.

x) Right to use to the Property of the Firm for Business of the Firm: Subject to contract between the partners, every partner features a proper to use and use the property of the firm exclusively for business of the firm.

xi) Right to stop Introduction of a replacement Partner: Every partner features a right to stop the introduction of any new partner within the firm. nobody are often admitted into partnership firm without the consent of all the partners.

xii) Right to Retire: A partner features a right to retire with the consent of all the partners. If the partnership is at will, he has the right to retire by giving due notice in writing to all or any other partners.

xiii) Right to not be Expelled: A partner features a proper to not be expelled by any majority of partners with none cause.

xiv) Right of an Outgoing Partner to hold on a Competing Business: Every partners features a right to hold on a business, almost like the partnership business, after his retirement with certain restrictions being that he cannot use the firm name, represent himself as carrying on the business of the corporate or solicit the customs of persons who were handling the firm before he ceased to be a partner.

xv) Right of Outgoing Partner in Certain Cases to Share Subsequent Profits: If any partner of the firm dies or otherwise ceases to be a partner and therefore the continuing partners still keep it up business with the property of the firm, with none settlement being given to the outgoing partner, then within the absence of any contract, he himself or his representative are entitled to a share of profits made since he ceased to be a partner, as could also be due to the utilization of his share of property or to activity at six percent once a year of his share within the property of the firms.

LIABILITIES OF PARTNERS

i) Joint & Several: Every partner is liable jointly and severally for all the acts of the corporate done while he was a partner. The liability of a accomplice is usually unlimited.

ii) Liability for Losses causes by HIM: Every associate shall be susceptible to observe any loss caused to the firm with the help of his fraud or willful neglect within the conduct of business. No partner can in any way exempt himself from such loss.

iii) Liability for Secret Profits: A partner is accountable to account for and pay to the firm any private profits earned from the business of the association or property or goodwill of the firm.

iv) Liability for Profits From Competing Business: If a partner carries on any business of an equivalent nature and competing thereupon of the firm, he would be responsible to account for and pay to the firm all profits made by him therein business.

v) Liability to Render true Accounts: A companion is susceptible to render true accounts to profit to different partners. he's susceptible to disclose any legal or illegal bills which fall within the scope of business of the firm.

vi) Liability for Losses of the firm: As a partner features a right to share the earnings of the firm so is he susceptible to share the losses equally unless otherwise prescribed.

PARTNERS AND THEIR RELATIONS

Eligibility to be partners.—On the incorporation of a limited liability partnership, the persons who subscribed their names to the incorporation document shall be its partners and the other person may become a partner of the limited liability partnership by and in accordance with the limited liability partnership agreement.

Relationship of partners.—

(1) Save as otherwise provided by this Act, the mutual rights andduties of the partners of a limited liability partnership, and therefore the mutual rights and duties of a indebtedness partnership and its partners, shall be governed by the limited liability partnership agreement between the partners, or between the limited liability partnership and its partners.

(2) The limited liability partnership agreement and any changes, if any, made therein shall be filed with the Registrar in such form, manner and amid such fees as could also be prescribed.

(3) An agreement in writing made before the incorporation of a indebtedness partnership between the persons who subscribe their names to the incorporation document may impose obligations on the limited liability partnership, provided such agreement is ratified by all the partners after the incorporation of the limited liability partnership.

(4) within the absence of agreement on any matter, the mutual rights and duties of the partners and therefore the refore the mutual rights and duties of the limited liability partnership and the partners shall be determined by the provisions concerning that matter as are set-out within the First Schedule.

Cessation of partnership interest.—

(1) an individual may cease to be a partner of a limited liability partnership in accordance with an agreement with the opposite partners or, within the absence of agreement with the opposite partners on cessation of being a partner, by giving a notice in writing of not but thirty days to the opposite partners of his intention to resign as partner.

(2) an individual shall cease to be a partner of a limited liability partnership—

(a) on his death or dissolution of the limited liability partnership; or

(b) if he's declared to be of unsound mind by a competent court; or

(c) if he has applied to be adjudged as an insolvent or declared as an insolvent.

(3) Where an individual has ceased to be a partner of a limited liability partnership (hereinafter mentioned as "former partner"), the previous partner is to be regarded (in reference to a person handling the limited liability partnership) as still being a partner of the limited liability partnership unless—

(a) the person has notice that the previous partner has ceased to be a partner of the limited liability partnership; or

(b) notice that the previous partner has ceased to be a partner of the limited liability partnership has been delivered to the Registrar.

(4) The cessation of a partner from the limited liability partnership doesn't by itself discharge the partner from any obligation to the limited liability partnership or to the opposite partners or to the other person which he incurred while being a partner.

(5) Where a partner of a limited liability partnership ceases to be a partner, unless otherwise provided within the limited liability partnership agreement, the previous partner or an individual entitled to his share in consequence of the death or insolvency of the previous partner, shall be entitled to receive from the indebtedness partnership—

(a) an amount adequate to the capital contribution of the previous partner actually made to the limited liability partnership; and

(b) his right to share within the accumulated profits of the limited liability partnership, after the deduction of accumulated losses of the limited liability partnership, determined as at the date the previous partner ceased to be a partner.

(6) A former partner or an individual entitled to his share in consequence of the death or insolvency of the previous partner shall not have any right to interfere within the management of the limited liability partnership.

Registration of changes in partners.—

(1) Every partner shall inform the limited liability partnership of any change in his name or address within a period of fifteen days of such change.

(2) A limited liability partnership shall—

(a) where an individual becomes or ceases to be a partner, file a notice with the Registrar within thirty days from the date he becomes or ceases to be a partner; and

(b) where there's any change within the name or address of a partner, file a notice with the Registrar within thirty days of such change.

(3) A notice filed with the Registrar under sub-section (2)—

(a) shall be in such form and amid such fees as could also be prescribed;

(b) shall be signed by the designated partner of the limited liability partnership and authenticated during a manner as could also be prescribed; and

(c) if it relates to an incoming partner, shall contain a press release by such partner that he consents to becoming a partner, signed by him and authenticated within the manner as could also be prescribed.

(4) If the limited liability partnership contravenes the provisions of sub-section (2), the indebtedness partnership and each designated partner of the indebtedness partnership shall be punishable with fine which shall not be but two thousand rupees but which can reach twenty-five thousand rupees.

(5) If any partner contravenes the provisions of sub-section (1), such partner shall be punishable with fine which shall not be but two thousand rupees but which can reach twenty-five thousand rupees.

(6) a person who ceases to be a partner of a limited liability partnership may himself file with the Registrar the notice mentioned in sub-section (3) if he has reasonable cause to believe that the indebtedness partnership might not file the notice with the Registrar and just in case of any such notice filed by a partner, the Registrar shall obtain a confirmation to the present effect from the limited liability partnership unless the limited liability partnership has also filed such notice:

Provided that where no confirmation is given by the limited liability partnership within fifteen days, the registrar shall register the notice made by an individual ceasing to be a partner under this section.

EXTENT AND LIMITATION OF LIABILITY OF limited liability PARTNERSHIP AND PARTNERS

Partner as agent.—Every partner of a limited liability partnership is, for the aim of the business of the limited liability partnership, the agent of the limited liability partnership, but not of other partners.

Extent of liability of limited liability partnership.—(1) A limited liability partnership isn't

Bound by anything done by a partner in handling an individual if—

(a) the partner actually has no authority to act for the limited liability partnership in doing a particular act; and

(b) the person knows that he has no authority or doesn't know or believe him to be a partner of the limited liability partnership.

(2) The limited liability partnership is liable if a partner of a limited liability partnership is susceptible to a person as a results of a wrongful act or omission on his part within the course of the business of the limited liability partnership or with its authority.

(3) An obligation of the limited liability partnership whether arising in contract or otherwise, shall be solely the requirement of the limited liability partnership.

(4) The liabilities of the limited liability partnership shall be met out of the property of the limited liability partnership.

Extent of liability of partner.—(1) A partner isn't personally liable, directly or indirectly for an obligation mentioned in sub-section (3) of section 27 solely by reason of being a partner of the limited liability partnership.

(2) The provisions of sub-section (3) of section 27 and sub-section (1) of this section shall not affect the private liability of a partner for his own wrongful act or omission, but a partner shall not be personally responsible for the wrongful act or omission of the other partner of the limited liability partnership.

Holding out.—(1) a person , who by words spoken or written or by conduct, represents himself, or knowingly permits himself to be represented to be a partner during a limited liability partnership is susceptible to a person who has on the religion of any such representation given credit to the indebtedness partnership, whether the person representing himself or represented to be a partner does or doesn't know that the representation has reached the person so giving credit:

Provided that where any credit is received by the limited liability partnership as a results of such representation, the limited liability partnership shall, without prejudice to the liability of the person so representing himself or represented to be a partner, be susceptible to the extent of credit received by it or any financial benefit derived thereon.

(2) Where after a partner's death the business is sustained within the same limited liability partnership name, the continued use of that name or of the deceased partner's name as a neighborhood thereof shall not of itself make his personal representative or his estate responsible for any act of the limited liability partnership done after his death.

Unlimited liability just in case of fraud.—(1) within the event of an act administered by a limited liability partnership, or any of its partners, with intent to defraud creditors of the limited liability partnership or the other person, or for any fraudulent purpose, the liability of the indebtedness partnership and partners who acted with intent to defraud creditors or for any fraudulent purpose shall be unlimited for all or any of the debts or other liabilities of the limited liability partnership:

Provided that just in case any such act is administered by a partner, the limited liability partnership is susceptible to an equivalent extent because the partner unless it's established by the indebtedness partnership that such act was without the knowledge or the authority of the limited liability partnership.

(2) Where any business is carried on with such intent or for such purpose as mentioned in sub-section (1), every one who was knowingly a celebration to the carrying on of the business within the manner aforesaid shall be punishable with imprisonment for a term which can reach two years and with fine which shall not be but fifty thousand rupees but which can reach five lakh rupees.

(3) Where a limited liability partnership or any partner or designated partner or employee of such limited liability partnership has conducted the affairs of the limited liability partnership during a fraudulent manner, then without prejudice to any criminal proceedings which can arise under any law for the nonce effective , the limited liability partnership and any such partner or designated partner or employee shall be susceptible to pay compensation to a person who has suffered any loss or damage by reason of such conduct:

Provided that such limited liability partnership shall not be liable if any such partner or designated partner or employee has acted fraudulently without knowledge of the limited liability partnership.

Whistle blowing.—(1) The Court or Tribunal may reduce or waive any penalty leviable against any partner or employee of a limited liability partnership, if it's satisfied that—

(a) such partner or employee of a limited liability partnership has provided useful information during investigation of such limited liability partnership; or

(b) when any information given by any partner or employee (whether or not during investigation) results in limited liability partnership or any partner or employee of such limited liability partnership being convicted under this Act or the other Act.

(2) No partner or employee of any limited liability partnership could also be discharged, demoted, suspended, threatened, harassed or in the other manner discriminated against the terms and conditions of his limited liability partnership or employment merely due to his providing information or causing information to be provided pursuant to sub-section (1).

CONTRIBUTIONS

Form of contribution

(1) A contribution of a partner may contains tangible, movable or immovable or intangible property or other benefit to the limited liability partnership, including money, promissory notes, other agreements to contribute cash or property, and contracts for services performed or to be performed.

(2) The price of contribution of every partner shall be accounted for and disclosed within the accounts of the limited liability partnership within the manner as could also be prescribed.

33. Obligation to contribute.—(1) the requirement of a partner to contribute money or other property or other benefit or to perform services for a limited liability partnership shall be as per the limited liability partnership agreement.

(2) A creditor of a limited liability partnership, which extends credit or otherwise acts in reliance on an obligation described therein agreement, all of sudden of any compromise between partners, may enforce the first obligation against such partner.

FINANCIAL DISCLOSURES

Maintenance of books of account, other records and audit, etc.—

(1) The limited liability partnership shall maintain such proper books of account as could also be prescribed concerning its affairs for every year of its existence on accounting or accounting and consistent with double-entry bookkeeping system of accounting and shall maintain an equivalent at its registered office for such period as could also be prescribed.

(2) Every limited liability partnership shall, within a period of six months from the top of every fiscal year , prepare a press release of Account and Solvency for the said fiscal year as at the Judgment Day of the said fiscal year in such form as could also be prescribed, and such statement shall be signed by the designated partners of the limited liability partnership.

(3) Every limited liability partnership shall file within the prescribed time, the Statement of Account and Solvency prepared pursuant to sub-section (2) with the Registrar per annum in such form and manner and amid such fees as could also be prescribed.

(4) The accounts of limited liability partnerships shall be audited in accordance with such rules as could also be prescribed:

Provided that the Central Government may, by notification within the Official Gazette, exempt any class or classes of limited liability partnerships from the wants of this sub-section.

(5) Any limited liability partnership which fails to suits the provisions of this section shall be punishable with fine which shall not be but twenty-five thousand rupees but which can reach five lakh rupees and each designated partner of such limited liability partnership shall be punishable with fine which shall not be but ten thousand rupees but which can reach one lakh rupees.

35. Annual return.—

(1) Every limited liability partnership shall file an annual return duly authenticated with the Registrar within sixty days of closure of its fiscal year in such form and manner and amid such fee as could also be prescribed.

(2) Any limited liability partnership which fails to suits the provisions of this section shall be punishable with fine which shall not be but twenty-five thousand rupees but which can reach five lakh rupees.

(3) If the limited liability partnership contravenes the provisions of this section, the designated partner of such limited liability partnership shall be punishable with fine which shall not be but ten thousand rupees but which can reach one lakh rupees.

Inspection of documents kept by Registrar.—The incorporation document, names of partners and changes, if any, made therein, Statement of Account and Solvency and annual return filed by each limited liability partnership with the Registrar shall be available for inspection by a person in such manner and on payment of such fee as could also be prescribed.

Penalty for false statement.—If in any return, statement or other document required by or for the needs of any of the provisions of this Act, a person makes a statement—

(a) which is fake in any material particular, knowing it to be false; or

(b) which omits any material fact knowing it to be material, he shall, save as otherwise expressly provided during this Act, be punishable with imprisonment for a term which can reach two years, and shall even be susceptible to fine which can reach five lakh rupees but which shall not be but one lakh rupees.

Power of Registrar to get information.—

(1) so as to get such information because the Registrar may consider necessary for the needs of completing the provisions of this Act, the Registrar may require a person including any present or former partner or designated partner or employee of a limited liability partnership to answer any question or make any declaration or supply any details or particulars in writing to him within an inexpensive period.

(2) just in case a person mentioned in sub-section (1) doesn't answer such question or make such declaration or supply such details or particulars asked for by the Registrar within an inexpensive time or time given by the Registrar or when the Registrar isn't satisfied with the reply or declaration or details or particulars provided by such person, the Registrar shall have power to summon that person to seem before him or an inspector or the other public officer whom the Registrar may designate, to answer any such question or make such declaration or supply such details, because the case could also be .

(3) a person who, without lawful excuse, fails to suits any summons or requisition of the Registrar under this section shall be punishable with fine which shall not be but two thousand rupees but which can reach twenty-five thousand rupees.

Compounding of offences.—The Central Government may compound any offence under this Act which is punishable with fine only, by collecting from an individual reasonably suspected of getting committed the offence, a sum which can reach the quantity of the utmost fine prescribed for the offence.

Destruction of old records.—The Registrar may destroy any document filed or registered with him in physical form or in electronic form in accordance with such rules as could also be prescribed.

Enforcement of duty to form returns, etc.—

(1) If any limited liability partnership is in default in complying with—

(a) any provisions of this Act or of the other law which needs the filing in any manner with the Registrar of any return, account or other document or the giving of notice to him of any matter; or

(b) any request of the Registrar to amend or complete and resubmit any document or to submit a fresh document, and fails to form good the default within fourteen days after the service on the limited liability partnership of a notice requiring it to be done, the Tribunal may, on application by the Registrar, make an order directing that limited liability partnership or its designated partners or its partners to form good the default within such time as laid out in the order.

(2) Any such order may provide that each one the prices of and accompanying the appliance shall be borne by that limited liability partnership.

(3) Nothing during this section shall limit the operation of the other provision of this Act or the other law imposing penalties in respect of any default mentioned during this section thereon limited liability partnership.

ASSIGNMENT AND TRANSFER OF PARTNERSHIP RIGHTS

Partner's transferable interest.—

(1) The rights of a partner to a share of the profits and losses of the limited liability partnership and to receive distributions in accordance with the limited liability partnership agreement are transferable either wholly or partially .

(2) The transfer of any right by any partner pursuant to sub-section (1) doesn't by itself cause the disassociation of the partner or a dissolution and completing of the limited liability partnership.

(3) The transfer of right pursuant to the present section doesn't , by itself, entitle the transferee or assignee to participate within the management or conduct of the activities of the limited liability partnership, or access information concerning the transactions of the indebtedness partnership.

CONVERSION INTO LIMITED LIABILITY PARTNERSHIP

Conversion from firm into indebtedness partnership.—A firm may convert into a indebtedness partnership in accordance with the provisions of this Chapter and therefore the Second Schedule.

Conversion from private company into limited liability partnership.—A private company may convert into a limited liability partnership in accordance with the provisions of this Chapter and therefore the Third Schedule.

Conversion from unlisted public company into indebtedness partnership.—An unlisted public company may convert into a indebtedness partnership in accordance with the provisions of this Chapter and therefore the Fourth Schedule.

Registration and effect of conversion.—

(1) The Registrar, on satisfying that a firm, private company or an unlisted public company, because the case could also be , has complied with the provisions of the Second Schedule, the Third Schedule or the Fourth Schedule, because the case could also be , shall, subject to the provisions of this Act and therefore the rules made thereunder, register the documents submitted under such Schedule and issue a certificate of registration in such form because the Registrar may determine stating that the limited liability partnership is, on and from the date laid out in the certificate, registered under this Act: as long as the indebtedness partnership shall, within fifteen days of the date of registration, inform the concerned Registrar of Firms or Registrar of Companies, because the case could also be , with which it had been registered under the provisions of the Indian Partnership Act, 1932 (9 of 1932) or the businesses Act, 1956 (1 of 1956) because the case could also be , about the conversion and of the particulars of the limited liability partnership in such form and manner as could also be prescribed.

(2) Upon such conversion, the partners of the firm, the shareholders of personal company or unlisted public company, because the case could also be , the limited liability partnership to which such firm or such company has converted, and therefore the partners of the limited liability partnership shall be bound by the provisions of the Second Schedule, the Third Schedule or the Fourth Schedule, because the case could also be , applicable to them.

(3) Upon such conversion, on and from the date of certificate of registration, the consequences of the conversion shall be like laid out in the Second Schedule, the Third Schedule or the Fourth Schedule, because the case could also be .

(4) Notwithstanding anything contained in the other law for the nonce effective , on and from the date of registration laid out in the certificate of registration issued under the Second Schedule, the Third Schedule or the Fourth Schedule, because the case could also be ,—(a) there shall be a limited liability partnership by the name laid out in the certificate of registration registered under this Act;

(b) all tangible (movable or immovable) and intangible property vested within the firm or the corporate , because the case could also be , all assets, interests, rights, privileges, liabilities, obligations concerning the firm or the corporate , because the case could also be , and therefore the whole of the undertaking of the firm or the corporate , because the case could also be , shall be transferred to and shall vest within the limited liability partnership without further assurance, act or deed; and

(c) the firm or the corporate , because the case could also be , shall be deemed to be dissolved and faraway from the records of the Registrar of Firms or Registrar of Companies, because the case could also be .

DIFFERENCE BETWEEN

S. No. | Basis | Partnership | Private Limited Company | Limited Liability Partnership |

1 | Prevailing Law | Partnership is prevailed by ‘The Indian Partnership Act, 1932’ and various Rules made thereunder | Companies are prevailed by ‘Companies Act, 2013’ | Limited Liability Partnership are prevailed by ‘The Limited Liability Partnership Act, 2008’ and various Rules made thereunder |

2 | Capital Required | No minimum amount | Normally Rs. 1 Lacs | No minimum amount |

3 | Time of Registration | 5-7 days | 7-10 days in complete process | 7-10 days in complete process |

4 | Name of Entity | Any name as per choice | Name to contain ‘Private Limited’ in case of Private Company as suffix. | Name to contain ‘Limited Liability Partnership’ or ‘LLP’ as suffix. |

5 | Registration | Registration is optional | Registration with Registrar of ROC required. | Registration with Registrar of LLP required. |

6 | Creation | Created by contract with 2 persons | Created by Law | Created by Law |

7 | Distinct entity | Not a separate legal entity | Is a separate legal entity under the Companies Act, 2013. | Is a separate legal entity under the Limited Liability Partnership Act, 2008. |

8 | Cost of Formation | The Cost of Formation is negligible | Minimum Statutory fee for incorporation of Company is Relatively High | The cost of Formation is statutory filling fees, comparatively lesser than the cost of formation of Company. |

9 | Perpetual Succession | It does not have perpetual succession as this depends upon the will of partners | It has perpetual succession and members may come and go. | It has perpetual succession and partners may come and go |

10 | Charter Document | Partnership Deed is a charter of the firm which denotes its scope of operation and rights and duties of the partners | Memorandum and Article of Association is the charter of the company that defines its scope of operations. | LLP Agreement is a charter of the LLP which denotes its scope of operation and rights and duties of the partners vis-à-vis LLP. |

11 | Common Seal | There is no concept of common seal in partnership | It denotes the signature of the company and every company shall have its own common seal | It denotes the signature and LLP may have its own common seal, dependant upon the terms of the Agreement |

12 | Formalities of Incorporation | In case of registration, Partnership Deed along with form / affidavit required to be filled with Registrar of firms along with requisite filing fee | Various eforms along the Memorandum & Articles of Association are filled with Registrar of Companies with prescribed fees | Various eforms are filled with Registrar of LLP with prescribed fees |

13 | Foreign Participation | Foreign Nationals can not form Partnership Firm in India | Foreign Nationals can be a member in a Company. | Foreign Nationals can be a Partner in a LLP. |

14 | Number of Members | Minimum 2 and Maximum 20 | 2 to 200 members in case of Private Company | Minimum 2 partners and there is no limitation of maximum number of partners. |

15 | Ownership of Assets | Partners have joint ownership of all the assets belonging to partnership firm | The company independent of the members has ownership of assets | The LLP independent of the partners has ownership of assets |

16 | Legal Proceedings | Only registered partnership can sue third party | A company is a legal entity which can sue and be sued | A LLP is a legal entity can sue and be sued |

17 | Liability of Partners/Members | Unlimited. Partners are severally and jointly liable for actions of other partners and the firm and liability extend to their personal assets. | Generally limited to the amount required to be paid up on each share. | Limited, to the extent their contribution towards LLP, except in case of intentional fraud or wrongful act of omission or commission by the partner. |

18 | Tax Liability | Income of Partnership is taxed at a Flat rate of 30% plus education cess as applicable. | Income of Company is Taxed at a Flat rate of 30% Plus surcharge as applicable. | Income of LLP is taxed at a Flat rate of 30% plus education cess as applicable. |

19 | Principal/Agent Relationship | Partners are agents of the firm and other partners. | The directors act as agents of the company and not of the members | Partners act as agents of LLP and not of the other partners. |

20 | Transfer / Inheritance of Rights | Not transferable. In case of death the legal heir receives the financial value of share. | Ownership is easily transferable. | Regulations relating to transfer are governed by the LLP Agreement . |

21 | Transfer of Share / Partnership rights in case of death | In case of death of a partner, the legal heirs have the right to get the refund of the capital contribution + share in accumulated profits, if any. Legal heirs will not become partners | In case of death of member, shares are transmitted to the legal heirs. | In case of death of a partner, the legal heirs have the right to get the refund of the capital contribution + share in accumulated profits, if any. Legal heirs will not become partners |

22 | Director Identification Number / Designated Partner Identification Number (DIN / DPIN) | The partners are not required to obtain any identification number | Each director is required to have a Director Identification Number before being appointed as Director of any company. | Each Designated Partners is required to have a DPIN before being appointed as Designated Partner of LLP. |

23 | Digital Signature | There is no requirement of obtaining Digital Signature | As eforms are filled electronically, atleast one Director should have Digital Signatures | As eforms are filled electronically, atleast one Designated Partner should have Digital Signatures. |

24 | Dissolution | By agreement, mutual consent, insolvency, certain contingencies, and by court order. | Voluntary or by order of National Company Law Tribunal. | Voluntary or by order of National Company Law Tribunal. |

25 | Admission as partner / member | A person can be admitted as a partner as per the partnership Agreement | A person can become member by buying shares of a company. | A person can be admitted as a partner as per the LLP Agreement |

26 | Admission as partner / member | A person can be admitted as a partner as per the partnership Agreement | A person can become member by buying shares of a company. | A person can be admitted as a partner as per the LLP Agreement |

27 | Cessation as partner / member | A person can cease to be a partner as per the agreement | A member / shareholder can cease to be a member by selling his shares. | A person can cease to be a partner as per the LLP Agreement or in absence of the same by giving 30 days prior notice to the LLP. |

28 | Requirement of Managerial Personnel for day to day administration | No requirement of any managerial; personnel , partners themselves administer the business | Directors are appointed to manage the business and other statutory compliances on behalf of the members. | Designated Partners are responsible for managing the day to day business and other statutory compliances. |

29 | Statutory Meetings | There is no provision in regard to holding of any meeting | Board Meetings and General Meetings are required to conducted at appropriate time. | There is no provision in regard to holding of any meeting. |

30 | Maintenance of Minutes | There is no concept of any minutes | The proceedings of meeting of the board of directors / shareholders are required to be recorded in minutes. | A LLP by agreement may decide to record the proceedings of meetings of the Partners/Designated Partners |

31 | Voting Rights | It depends upon the partnership Agreement | Voting rights are decided as per the number of shares held by the members. | Voting rights shall be as decided as per the terms of LLP Agreement. |

32 | Remuneration of Managerial Personnel for day to day administration | The firm can pay remuneration to its partners | Company can pay remuneration to its Directors subject to law. | Remuneration to partner will depend upon LLP Agreement. |

33 | Contracts with Partners/Director | Partners are free to enter into any contract. | Restrictions on Board regarding some specified contracts, in which directors are interested. | Partners are free to enter into any contract. |

34 | Maintenance of Statutory Records | Required to maintain books of accounts as Tax laws | Required to maintain books of accounts, statutory registers, minutes etc. | Required to maintain books of accounts. |

35 | Annual Filing | No return is required to be filed with Registrar of Firms | Annual Financial Statement and Annual Return is required to be filed with the Registrar of Companies every year. | Annual Statement of accounts and Solvency & Annual Return is required to be filed with Registrar of Companies every year. |

36 | Share Certificate | The ownership of the partners in the firm is evidenced by Partnership Deed, if any. | Share Certificates are proof of ownership of shares held by the members in the Company | The ownership of the partners in the firm is evidenced by LLP Agreement. |

37 | Audit of accounts | Partnership firms are only required to have tax audit of their accounts as per the provisions of the Income Tax Act | Companies are required to get their accounts audited annually as per the provisions of the Companies Act, 2013 | All LLP except for those having turnover less than Rs.40 Lacs or Rs.25 Lacs contribution in any financial year are required to get their accounts audited annually as per the provisions of LLP Act 2008. |

38 | Applicability of Accounting Standards. | No Accounting Standards are applicable | Companies have to mandatorily comply with accounting standards | The necessary rules in regard to the application of accounting standards are not yet issued. |

39 | Compromise / arrangements / merger / amalgamation | Partnership cannot merge with other firm or enter into compromise or arrangement with creditors or partners | Companies can enter into Compromise / arrangements / merger / amalgamation | LLP’s can enter into Compromise / arrangements / merger / amalgamation |

40 | Oppression and mismanagement | No remedy exist , in case of oppression of any partner or mismanagement of Partnership | Provisions providing for remedy against Oppression and mismanagement exists | No provision relating to redressal in case of oppression and mismanagement |

41 | Credit Worthiness of organization | Creditworthiness of firm depends upon goodwill and creditworthiness of its partners | Due to Stringent Compliances & disclosures under various laws, Companies enjoys high degree of creditworthiness. | Will enjoy Comparatively higher creditworthiness from Partnership due to Stringent regulatory framework but lesser than a company. |