Modern business requires information about the activities planned for the future. The main function of management is decision making. It is necessary to choose the optimal course of action from a set of choices. Costing techniques play an important role in the collection and analysis of revenue and cost data. It also helps to control the results of the business and make an appropriate assessment of the performance of those who work in the organization. Costing also helps to acquire plants and machines, add or remove products, create or purchase decisions, special prices for products and exchange assets.

Evolution of Cost Accounting; Definitions:

Widespread interest in the subject of costing can be said to have developed in the Industrial Revolution, which began in 1760. As the factory system was followed by mechanization, simplification, standardization and mass production, costing had to keep up with these developments. Until the 18th century, costing was in the area of Engineers. Integration with financial accounting began when accountants began to audit cost records. Under the influence of financial accountants, costing came to be seen almost exclusively as a means of inventory valuation and profit measurement.

Costing has been found to assist in managing when compiling and providing the required statistical data. It has developed rapidly and assisted management of providing valuable information to take appropriate decisions in time. Costing sheds light on excessive waste of materials, inefficient labor operations, idle machinery and many other similar factors that are responsible for the reduction of profits in business activities. Management has found that costing can provide valuable assistance in planning, managing and coordinating activities.

Definitions

Costing:

The Society of cost control accountants (ICMA) London defines costing as a confirmation of costs, and costing includes the technology and process of confirming costs.

Cost accounting:

The Society of cost management accountants (ICMA) in London defines cost accounting as"the science, art and application of the principles, methods and techniques of cost accounting and cost accounting to the practice of cost management and confirmation of profitability, as well as the presentation of information for the purpose of management decision making". Therefore, cost accounting includes costing, costing, Budget Control, cost control, and cost audit. Costing refers to the process of determining and accounting for the cost of a particular product or activity. It also includes classification, analysis and guessing the production of costs.

Costing:

I.C.M.A. London defines costing as"the process of accounting for costs from the time when expenditures occur or from the time when they are committed to establishing the ultimate relationship with cost centers and cost units."

In practice, costing, costing, and cost accounting are often used interchangeably. Cost accounting refers to the confirmation of costs, the accumulation and measurement of costs of activities, processes, products or services. Cost data is used to create costing sheets or cost sheets. Costing is a professional Department of accounting that helps manage costs to control and create awareness of the importance of costs to the well of the business organization. Managing a business to achieve its objectives requires systematic and useful cost data and reporting.

Cost center:

A cost center is a place, person or asset that can be checked for costs and used for cost management purposes. This is an organizational segment or area of activity that is used to accumulate costs. The different types of cost centers used in manufacturing organizations are personal cost Cantor, impersonal cost center, work cost center and process Center.

Cost units:

A cost unit is a unit of the quantity of a product or service for which the cost is likely to be confirmed. There should be a unit of activity for proper confirmation of costs. Every organization has its own units for the measurement of raw materials and finished products. When the unit of activity is determined, it becomes the cost unit of the cost accountant. The cost unit must be suitable for your organization. The following is an example of cost units in different industries :-

Nature of Industry | Cost Unit |

Cement

| Tonne |

Cable | Metre

|

Power | Kilowatt/ hour |

Hospital | Per bed

|

Key References-

Cost accounting goals are usually used to indicate activities in which costs must be determined individually. Activities can be functions for which data is required,sub-divisions of the organization, contracts or other units of work. There is a direct relationship between the information needs of management, the purpose of costing, the technologies and tools used for analysis in costing. Therefore, costing has the following purposes-

Key takeaways-

Cost concept:

According to the Association of Certified Management Accountants, costs are "expenditures (actual or hypothetical) incurred or resulting from a particular thing or activity." Similarly, according to Anthony and Wilsch, "cost is a monetary measure of the amount of resources used for several purposes."

Costs have been or may be incurred by the Cost Terminology Committee of the American Accounting Association, "in the realization of the management objectives mentioned above, which may be the manufacture of products or the provision of services. Is defined. .. "

From the above, it can be said that the cost is the sum of all the costs of a product or service. Therefore, the cost of a product means the actual shipment or confirmed change that occurred in its manufacturing and sales activities. In short, it is the amount of resources that have been exhausted in exchange for some goods and services.

So-called resources are expressed in money or currency units. What is said above does not make sense until it is used only as an adjective, that is, when it conveys its intended meaning.

Therefore, when we talk about prime cost, works cost, fixed cost, etc., we want to explain the specific implications that are essential when calculating, measuring, or analysing different aspects of cost.

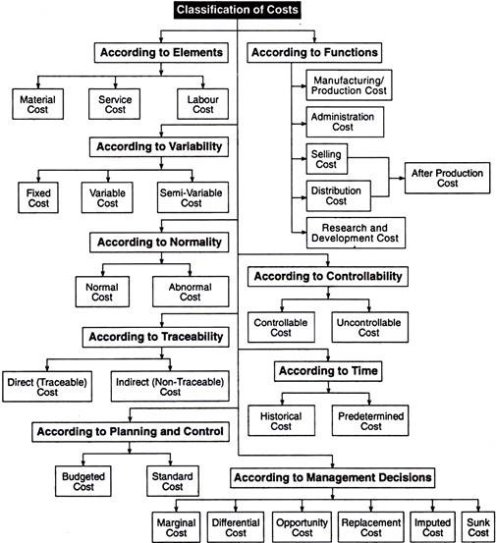

Cost classification:

To refer to costs in a cost center, proper classification of costs is absolutely necessary. Costs are usually categorized according to their nature: materials, workforce, overhead, and so on. The same cost figures can be categorized in different ways depending on the needs of the company.

(A) According to the function:

The total cost is divided into various segments according to the purpose of the company. Therefore, costs are grouped according to company requirements in order to properly evaluate the functioning of the company. In other words, the total cost includes all costs, from material costs to product packaging costs.

Direct material costs, direct labor costs, paid costs, and all overhead costs are born by the head of manufacturing / manufacturing costs.

At the same time, administrative costs (related to clerical and administrative) and sales and distribution costs (i.e. related to sales) are categorized separately and added to find the total cost of the product. If these functional classifications are not done properly, the true cost of the product cannot be accurately determined.

(B) According to volatility:

These costs per volume can be subdivided as follows:

a) Fixed costs;

b) Variable costs;

c) Semi-variable cost.

In other words, we maintain fixed costs (salary, rent, etc.) up to a certain limit regardless of production volume. It is interesting to note that if more units are products, the fixed cost per unit will be reduced, and if fewer units are produced, the fixed cost per unit will obviously increase.

On the other hand, variable costs fluctuate in proportion to production volume of production volume. In other words, changes in production (raw material prices, labor, etc.) do not have a direct impact on cost per unit. On the contrary, semi-variable costs are partially fixed and partially variable (e.g. building repairs).

(C) According to controllability:

Costs can be broadly divided into two categories, depending on the performance of the members of the company.

They are:

(I) Manageable costs. And

(II) Uncontrollable costs.

Manageable costs are costs that may be affected by decisions made by certain members of the management of the company, or costs that are at least partially management-dependent and manageable by management. All direct costs, direct material costs, direct labor costs, and billable costs (a component of prime costs) are manageable at a lower level of control and are carried out accordingly.

Uncontrollable costs are costs that are unaffected by the actions taken by a particular member of management. For example, fixed costs, that is, building rent, salary payments, and so on.

(D) According to normality:

Under this condition, costs are categorized according to the normal needs of a particular level of output for the normal level of activity generated for such output.

They are divided as follows.

(I) Normal cost; and

(II) Unusual cost.

Normal cost is the cost that is normally required for normal production at a particular output level and is part of production.

Anomalous costs, on the other hand, are costs that are not normally required to successfully produce a particular level of output, or are not part of the production cost.

(E) According to time:

Costs can also be categorized according to the time factor within them. Therefore, costs are categorized as follows:

(I) Acquisition cost; and

(II) Prescribed costs.

Acquisition costs are costs that are considered after they occur. This is possible, especially if production for a particular unit of output has already taken place. They have only historical value and cannot help manage costs.

On the other hand, the given cost is the estimated cost. Such costs are pre-calculated based on past experience and records. Needless to say, if it is scientifically determined, it will be the standard cost. Comparing these standard costs to actual costs reveals the reasons for the differences and helps management take appropriate steps to make adjustments.

(F) According to traceability:

Costs can be identified by a particular product, process, department, and so on. Costs are categorized as follows:

(I) Direct (traceable) costs; and

(II) Indirect (untraceable) costs.

Direct / traceable costs are the costs that can be directly tracked or assigned to a product. That is, it includes all traceable costs, that is, all costs associated with easily traceable costs of raw materials, labor, and other services used.

Indirect / non-traceable costs are costs that cannot be directly tracked or assigned to a product. That is, it includes all untraceable costs. Shopkeeper salary, general and administrative expenses, that is, things that cannot be properly allocated directly to the product.

(G) According to planning and management:

Costs can also be categorized as follows:

(I) Budget costs; and

(II) Standard cost.

Budget cost refers to the estimated manufacturing cost calculated based on the information available prior to the actual production or purchase. In reality, budget costs include standard costs. Both are pre-determined costs and the amounts may match, but for different purposes. It provides a medium that can measure the validity of current results and hold derivation responsibilities.

Standard costs are pre-determined for each element: materials, labor, and overhead costs. The standard costs are:

(I) the cost per unit is determined to produce the estimated total output for the next period.

(A) Material;

(B) Labor; and

(C) Overhead.

(II) Costs should depend on past experience and experimentation, and technical staff specifications.

(III) Expenses must be expressed in rupees.

(H) According to management's decision: Under this, costs may be categorized as follows:

(A) Marginal cost:

Marginal cost is the cost of producing additional units by separating fixed costs (that is, capacity costs) from variable costs (that is, production costs) that help us know profitability. In addition, we know that certain costs (fixed) may not increase at all to increase production, and only some costs related to material costs, labor costs, and variable costs will increase. Therefore, the total cost so increased by the production of one or more units is the cost of the marginal unit, which cost is known as the marginal cost or the incremental cost.

(B) Difference cost:

The differential cost is due to the additional features and is part of the cost of the features that can be identified by the additional features. That is, a cost change as a result of a change in activity level or production method.

(C) Opportunity cost:

This is the expected cost change associated with the adoption of alternative machines, processes, raw materials, specifications, or operations. In other words, it is the largest alternative revenue you could have earned if your existing capacity was changed to another alternative.

(D) Replacement cost:

This is the cost of exchanging an item or group of assets at the current price in a particular region or market region.

(E) Implicit cost:

This is the cost used to indicate the presence of an arbitrary or subjective element of product cost that is more important than usual. This is also known as notional cost. For example, interest on capital, but no interest is paid. This is especially useful when making decisions about alternative capital investment projects.

(F) Sunk cost:

This is a past cost resulting from a decision that cannot be modified at present and is associated with specialized equipment or other facilities that cannot be easily adapted to current or future objectives. Such costs are often seen as forming a small factor in future-impacting decisions.

Key takeaways:

Several methods or types of costing have been designed to suit the needs of individual business requirements. These are job costing and process costing.

All other costing methods are either variants of these two methods or techniques designed for specific purposes, specific opportunities, and specific conditions.

Job costing:this method is good for checking the cost of a job, a specific order, or a batch of finished products.

Where the cost unit is a job consisting of a specific quantity manufactured according to the order. The work can be small or large. It may be as per customer order for stock for final sale. Other variations of job costing are given below: -

Contract costing:this method is used by contractors for construction of architectural bridges etc. Where the unit of cost is the contract. The term of this contract usually extends beyond the current fiscal year.

Batch costing: this method produces economical batches of parts for subsequent assembling manufacturers large engineering companies use this method. Here, costing is done for batches of components, not for a single component.

Multiple costing:this is used in large industries such as automobile, aircraft flat industry etc.Here the cost of parts is calculated separately. Each component is a job sheet. These are then assembled to complete the cost of an airplane or other finished product.

Process costing:this method is used in industry to manufacture products by continuous process. The cost is confirmed over the period by the process or department, but time is given more importance here as it is clear from the costing of the work. Therefore, this is also called period costing. Examples of industries that use process costing are the chemical industry, papermaking and refineries. The process costing can also be changed without:

Work costing:work costing is applied to places where production goes through multiple operations in succession before the final product is manufactured. Wear and tear may occur in each operation. Work costing is used in industries such as Box manufacturing, shoe manufacturing and toy manufacturing. Where the cost unit is the work on which costs are accumulated.

Single or output or individual costing: examples of industries applying this method are mining, quarry and steel production where the production is of a continuous nature and the final product is only one or different grades of the same product.

Behavior costing:this method applies not to figure out the cost of drawing. Examples of industries using this method are transport services, electrical and boiler houses. In transport services, the unit of cost is passenger kilometers, or kilometers kilometers.

Essentials of a good costing system

The costing system must conform to the General Organization of the business. Usually no component alternation should be made to facilitate the costing system. However, unavoidable changes can be made in the establishment of the position of holding, and proper costing system.

1) All relevant technical aspects (nature and method of production, product varieties, etc.) should be properly considered in order to adopt appropriate cost control ingenuity.

the size, placement and configuration of the factory should be fully described for the advantages of those operating costing systems.

2) It is necessary to clearly specify the procedures that must be followed for the purchase, receipt, storage and issuance of materials.

3) It is necessary to specify the method of payment of wages and the system of labor management.

4) It is necessary to specify the norms of appointment and assignment of overhead.

5) Economics to ensure that the original record can be proper.

6) Form should be obtained printed. It should contain full instructions. Those who use them should be properly trained to ensure the correctness and relevance of the data written on the form.

7) The Examiner must check and sign all entries in the form.

8) Responsibility for preparing and sending cost reports to various levels of management at regular intervals should be fixed and the necessary instructions in this regard be issued.

9) Full cooperation from everyone involved in management should be enlisted. Resistance from employees should be minimal.

10) The cost of managing a costing system must be commensurate with the profit available from it.

11) Design the system appropriately to effectively perform cost control.

12) Cost accounts and financial accounts must be linked. Or the results of two sets of accounts should be adjusted.

13) Frequency, regularity and speed in the presentation of cost reports should be guaranteed.

Key takeaways-

Step 1.Goals to be achieved:

The purpose to be achieved must be very clear so that thrust is given to that aspect. If the main purpose is the expansion of production, the costing system needs to pay more attention to the aspect of production. If the focus is on improving product marketing, you need to be very careful in that area.

Step 2: Study the product:

Product research is very important. The nature of the product determines the type of costing system you use. Products with high material costs require a costing system that focuses on pricing, storage, issuance, and management of material costs. On the other hand, if the product requires high labor costs, an efficient system of time recording and wage payments is essential, and the same is true for overhead costs.

Step 3: Study the organization:

Efforts are needed to introduce a costing system into the existing organizational setup. Whenever possible, the organization should not be disturbed as much as possible. Therefore, you need to identify the nature of your business and operations, your scope of authority and responsibilities, how to deal with wasted materials, your wage payment system, and the sources of information that cost agents must do derivation of information, etc.

Step 4: Determining the structure of costing:

Determining the structure of costing is the next step in the process of installing a costing system. You need to consider the details of the appropriate costing system. The type of manufacturing process determines the structure of costing.

The sequence of production lines must follow the costing system. The system should be designed to gradually increase costs at each critical stage of production.

Step 5: Cost rate selection:

Decisions are needed to allocate different costs among different products. What are the direct and indirect costs? Overhead costs are allocated among factory, office, sales and distribution overheads. This cost split helps determine the cost rate.

Step 6: System implementation:

The success of a costing system depends on its proper implementation. Its implementation is made possible by the full cooperation of employees within the organization. This can be addressed by properly explaining the system to employees and the benefits of future implementations.

If necessary, the system should be gradually implemented rather than fully implemented. At one stage, the system may cover labor costs, and at another stage it may include material costs, etc. Whenever possible, do not disturb existing routines. The heartfelt support of all employees will help the costing system to succeed.

Step 7: Follow-up:

System follow-up is essential to make it practical and useful. When the system is actually run, its weaknesses and flaws can be recognized. While collecting cost information from different sources, there may be some difficulties in editing the information, but the data may not be sufficient. Information provision may be delayed. If you encounter any problems, please try to fix them. You will need to readjust your system to make it more convenient and efficient

Meaning and definition:

A cost audit is a crucial review conducted to verify the accuracy of costing and make sure that costing principles and plans are adhered to efficiently. it's worth noting that India is that the only country that has introduced statutory cost audits to manage about 45 key industries within the country. Cost auditing is defined by the Chartered Institute of Management Accountants (CIMA) as "verification of costing and confirmation of compliance with costing plans".

This definition means that:

(I) A costing plan must be created the aim of costing must be kept in mind to ascertain if the plan itself and therefore the numbers collected cause the achievement of goals or objective sets. for instance , if your goal is to realize maximum efficiency, data planning and analysis is different than if your sole goal is price fixing.

(II) it's necessary to think about whether the prescribed methods and other relevant decisions are implemented to verify costs. The treatment and determination of anomalous losses of profits, or the direct or indirect treatment of certain costs, are good examples.

(III) it's necessary to ensure the accuracy of the numbers.

The concept of cost auditing is elaborated by the ICWA as "Auditing the efficiency of paying details while work is ongoing and not post-inspection." Auditing is "honest compliance" and price auditing is primarily a precautionary measure, a barometer of performance, also as a guide to management policy and deciding .

Cost audits are often called efficiency audits. it's proven by the modification in Section 209. "

A management audit may be a process of "auditing the standard of a manager by evaluating the manager as a private management audits are intended to gauged how managers perform various management functions (planning, coordination, motivation, etc.).

Benefits of cost auditing:

The main advantage of cost auditing is that it ensures that management has reliable data for price-fixing, decision-making, control, and other purposes. The existence of such an audit system is additionally very helpful in maintaining internal checks. it's also very useful for accounting audits. However, it's important to know that financial and price audits have different purposes.

The former aims to stop fraud and errors, and by presenting the earnings report and record , it's possible to understand things (profit obtained during the year and economic condition at the top of the year) during a true and fair manner. Is aimed toward .

It's not about functional analysis, it's about spending and revenue as an entire . Cost audits are involved within the proper analysis and estimation of data in order that management can quickly obtain the knowledge they have , establishing cost accuracy for every product, job, activity, and so on. aside from data reliability, cost auditing has certain incidental benefits. Rather, it must be said that cost audits help integrate and realize the advantages expected from costing systems. Following a press release by Minister of Justice HR Go Curry, judicial and company issues highlight the social benefits of cost auditing.

The reasonableness of the worth charged is to properly determine the prices and margins charged by producers and their retailers. Guaranteed only by. Another purpose underlying this step is cheap to take care and efficient for the industries subject to such rules and to scale back costs the maximum amount as possible. Informing about the value . Therefore, counting on this method protects the interests of consumers and may be a clear step towards eliminating social injustice.

Advantages of Cost Audit

(I) Thoroughly check all waste (in-store materials, workers, etc.), promptly identify and report.

(II) Production inefficiencies (or efficiencies) are identified and converted into financial terms.

(III) Exceptional management is possible by establishing individual responsibilities.

(IV) The budget control and standard costing system is greatly facilitated by cost audits by qualified costing personnel.

(V) Records are up to date and information is available for a variety of purposes.

(Vi) Cost audits can uncover many errors and frauds that may not otherwise be revealed. This is because cost auditors take a closer look at spending and compare it to criteria to see the exact reason for the discrepancy.

Importance of Cost Audit

The following are some of the purposes for which cost audits are conducted.

a) To establish the accuracy of costing data. This is done by verifying the arithmetic accuracy of the costing entries in the books.

b) To ensure that costing principles are governed by management goals and are strictly adhered to when creating costing.

c) To ensure that costing is correct and detect errors, fraud, and fraud in existing systems.

d) To check the overall work of the value department of a corporation and make suggestions for improvement.

e) To help management make the right decisions about certain key issues

f) To determine the actual production cost when the goods are ready.

g) Its effective internal cost audit system is in operation to reduce the amount of detailed checks by external auditors.

h) To ensure that each spending item associated with the relevant component of the manufactured or produced product has been properly generated.

Key takeaways:

References: