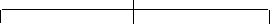

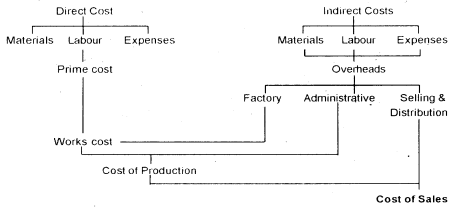

Composition of elements of cost:

Composition of elements of cost:

The manufacturing organization converts raw materials into finished products. To that end, it employs labour and provides other facilities. It is necessary to check the amount spent on all this, while aggregating the cost of production. For this purpose, the cost is mainly classified into various factors. This classification is necessary for accounting and management.

The cost elements are

(I) Direct material

(II) Direct labour

(III) Direct expenses and

(IV) Overhead

The following chart shows the wide heading of the cost and these acts as the basis for preparing the cost sheet.

Materials Labour Other Expenses

Direct Indirect Direct Indirect Direct Indirect

Overheads

Factory Administrative Selling & Distribution

Prime cost:

The sum of direct material costs, direct labor and direct costs is called Prime costs. The direct cost is traceable to the product or job.

Direct material

This includes the costs of materials consumed in the production process that can be assigned directly to the cost centre. Direct materials can be identified and filled into.

For example、:

In some cases, direct materials are used in small quantities, and it is impossible to check and directly allocate their costs. For example, nails used in the manufacture of chairs and tables, glue used in the manufacture of toys. In such cases, the cost of the total quantity consumed during the period is treated as an indirect cost.

Direct labour

This includes the amount of wages that can be easily identified and billed directly to the product. These are the costs for converting raw materials into finished products. Wages paid to workers to operate lathe machines, drilling machines etc. In the tool room is a direct pay.

Direct expenses

This includes costs other than materials and labour that can be easily identified in a particular product or process. For example: the cost of excise duty. Overhead costs cannot be easily identified in a particular product or process.

Indirect materials

Materials that cannot be traced as part of a finished product are known as indirect materials.

For example、:

Indirect labor:

Indirect labor is a cost that cannot be invoiced or identified directly on the finished product. Indirect labor is assigned to or appropriately absorbed by the cost centre or cost unit.

For example、:

Overhead:

These are general costs that are not incurred for a particular product or service and cannot be billed directly to the product.

For example:

Overhead can be subdivided into the following main groups.

Factory or work overhead: Also known as manufacturing or production overhead it consists of all the costs of indirect materials, indirect labor and other overhead incurred in the factory.

Example: Factory rent and insurance. Depreciation of factory buildings and machinery.

Office or management overhead: All indirect costs incurred by the office for the management and management of the enterprise.

Examples: Rent, fees, taxes and insurance for office buildings, audit fees, director fees.

Sales and distribution overhead: These are overhead related to marketing and sales.

Examples: Advertising of distributors, salaries and fees, travel expenses of salesmen.

Key takeaways-

Concept of Material:

A material is a substance (physical term) that is part of a finished product or is composed of a finished product. In other words, a material is a product that is supplied to a business for the purpose of consuming it in the process of manufacturing or providing services, or for the purpose of converting it into a product. The term "store" is often used as a synonym for material, but store has a broader meaning, not only the raw materials consumed or used in production, but also miscellaneous goods, maintenance stores, processed parts, components. Also includes items such as tools. Jigs, other items, consumables, lubricants, etc. Finished and partially finished products are also often included in the term "store". Materials are also called inventory. The term material / inventory include not only raw materials, but also components; work in process, finished products, and scrap.

Material costs are an important component of the total cost of a product. It accounts for 40% to 80% of the total cost. Percentages may vary from industry to industry. But for the manufacturing sector, material costs are paramount. Inventory is also an important component of working capital. Therefore, it is treated the same as cash. Therefore, analysis and control of material costs is very important.

Purpose of material management system

Material management: The ability to ensure sufficient inventory of goods to meet all requirements without carrying unnecessarily large amounts of inventory.

The purpose of the material management system is to:

2. Make the material available continuously so that the flow of material for production is uninterrupted. Production cannot be postponed due to lack of materials.

2. Purchase the required amount of materials to avoid working capital locks and minimize the risk of surplus or obsolete stores.

3. Make competitive and wise purchases at the most economical prices so that you can reduce material costs.

4. Purchase the right quality material to minimize the waste of material.

5. Acts as an information centre for material knowledge about prices, suppliers, lead times, quality and specifications.

Key takeaways:

Introduction to purchasing materials:

For manufacturing concerns, there is another purchasing department under the control of the purchasing person. The main function of the purchasing department is to purchase the required amount of materials in time so that the store can provide the production department with a continuous supply of materials and purchase higher quality materials at a reasonable price.

Buyers need to play an important role as they can save or lose a lot of money. He requires good technical knowledge of the industry and some management skills. He also needs to be aware of management policies and sources of concern.

He also needs to be aware of market conditions and have knowledge of suppliers, trusted suppliers, prices and purchasing procedures.

He must keep up with government policies on import and export restrictions and various tariffs and taxes on goods. He must have practical knowledge of the law relating to contracts and the sale of goods so that he can negotiate and enter into contracts on behalf of his employer.

Centralized and Decentralized purchases:

Centralized purchase:

Centralized purchase means the purchase of materials by one specialized department. The purchasing department has personnel with expertise in all aspects of the material. The purchasing department has the authority to make purchases for the entire organization.

In this system, the requirements of the entire organization are confirmed through the creation of purchasing budget, the purchasing department makes purchases according to the accepted principle, and the materials are distributed to each production department according to the requirements.

In most cases, the purchasing department purchases materials based on the requisition form issued by the store. The supplier delivers the material to the Material Receipt section. Individual departments are not allowed to purchase their own materials when centralized purchases are made.

Decentralized purchase:

Decentralized purchases mean that each department can purchase materials according to their needs. Therefore, the authority to make purchases rests with the individual departments.

(A) Advantages of local purchase: If the production unit is far from the body, it is beneficial to have the unit available for purchase locally. You can enjoy the benefits of basic low price and seasonal price, and reduce the cost.

(B) Reduction of transportation costs: By supplying materials locally, transportation costs will be significantly reduced.

(C) Quick resolution of the problem: Disputes caused by refusals, shortages and returns can be resolved easily and quickly.

Advantages of centralized purchase:

From a centralized purchase, you can derive the following benefits:

a) Benefits of bulk purchase: Because materials are purchased in bulk, trade discount rates are high, credit lines are improved, bargaining power, quantity, and discounts are increased, so materials can be purchased at much lower prices.

(B) Maintaining quality: All purchases are made by the purchasing department, which has expertise in product quality, which helps maintain the quality of the materials and ultimately leads to the production of better quality finished products. Improving product quality ensures that your business is more credible, resulting in higher sales and higher profits.

(C) Reduction of transportation costs: This system purchases materials in bulk, significantly reducing shipping costs. This has a positive impact on the total cost or unit cost of the material. This makes your organization more competitive.

(D) Advantages of specialization: The Purchasing Department has dedicated purchasing personnel to ensure the right purchases from the right type of supplier. This guarantees both quality and price.

(E) You can avoid duplication: All purchases are made by one person, avoiding duplicate purchases.

(F) Planned purchases: You can systematically eliminate the purchase and holding of surplus stores, which enables better space management and easily avoids unnecessary blocks of working capital.

Restriction:

The restrictions on centralized purchases are as follows:

(A) Expensive

The management costs of the purchasing department can be very high, resulting in a solid increase in total costs and defeating the very purpose of costs to reduce costs.

(B) It functions as an obstacle to smooth functioning.

If a production department does not have the materials it needs, it must wait for the purchasing department to purchase it. This delay leads to production outages, which in turn leads to increased costs.

Purchasing routine:

In general, the following routine is used to purchase materials.

(I) Request for purchase. The request is made by the store officer.

(Ii) Offering bids and quotations for the supply of the required amount of material.

(Iii) Place an order with a supplier after considering bids and quotations submitted by different suppliers.

(IV) Receipt of material after proper inspection.

(V) Confirm and pass the supplier's payment invoice.

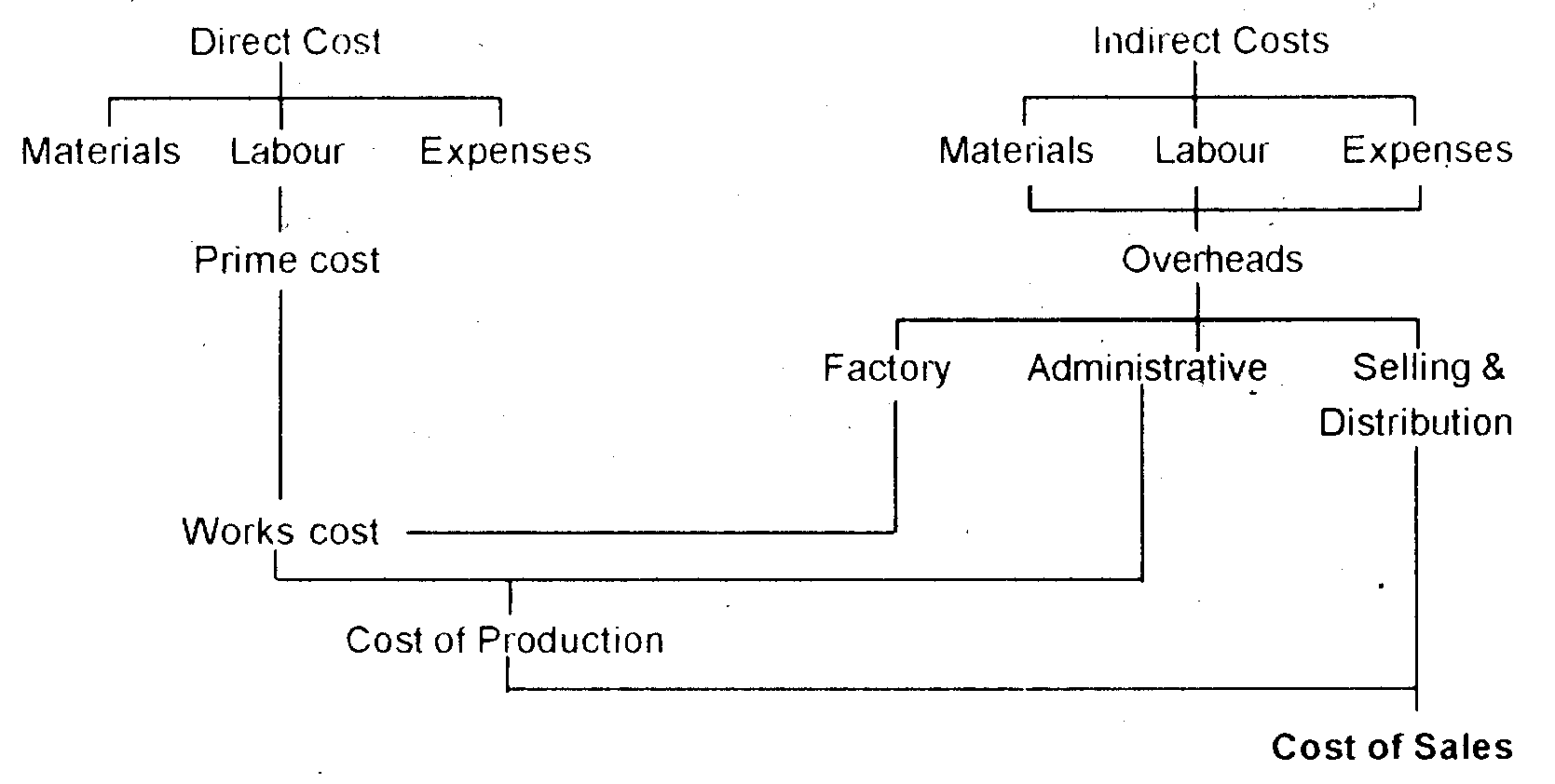

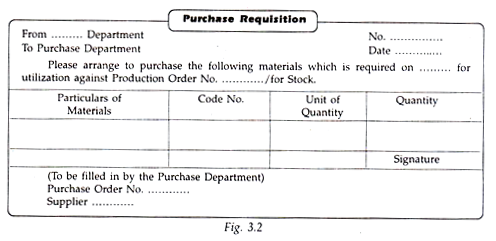

Purchase requisition:

The decision to purchase the material is made by the purchasing department after receiving the purchase request from the authorized department. A purchase request is made from an approved department to the purchasing department in a prescribed form called a purchase request.

Requisitions provide three basic pieces of information that help buyers perform their purchasing functions efficiently.

The information is as follows:

Purchase requisitions are received by the purchaser from:

(I) Shopkeepers of all standard materials.

(II) Production control department of non-standard materials required for production.

(III) Plant and maintenance engineers for special maintenance and capital investment.

(IV) Head of special items such as office supplies.

The requisition is created three times. Two copies will be sent to the purchasing department, one copy will be retained as proof of approval and the other copy will be returned to the inventor after quoting the order details. Purchasing department. A third copy is kept by the store for office records and future references.

Material specifications or bill of materials:

The requisition contains details and specifications of the materials to purchase. Material specifications are known as bills of material. This starts in the production control department or the plant and maintenance engineer department. The BUI of Material is a complete schedule of materials or parts required for a particular job or work order created by a drafting office.

A bill of materials is created for every job and a copy is sent to the storekeeper.

BOM Benefits:

The following benefits can be obtained in different departments of the BOM.

(I) upon receiving the bill of materials, the purchasing department can place an order with the supplier of choice. Therefore, the bill of materials serves the purpose of the purchase requisition.

(Ii) The bill of materials allows the store to publish materials.

(Iii) The bill of materials contains details of the materials used in the job or work order, so the supervisor does not need to prepare detailed material requirements. This saves time and makes it easier to pull out the material.

Purchase time:

Requisitions indicate the date on which the use of the material is required. The storekeeper makes a request to the purchaser as soon as the material reaches the reorder level. Upon receiving the purchase requisition, the purchaser places an order with the supplier with a delivery date.

Delivery times are fixed taking into account the material consumption rate and the minimum level fixed to it.

Purchases are also made when market conditions are good, despite the fact that there is no immediate need for materials for production. In an inflationary economy, we buy materials in bulk in the hope that prices will rise further.

For raw materials such as jute, cotton and sugar cane, quantity, quality and price are used to make bulk purchases during the season. To prevent future price increases, long-term contracts may be entered into with suppliers to purchase materials for a specified period of time and at a specified rate.

However, in doing so, the purchaser must take into account the following factors:

(I) a storage facility for storing quantities.

(II) Financial resources of concern. And

(III) Transportation costs, capital costs, storage costs, etc.

Purchase quantity:

Before placing an order with a supplier, the purchaser must ensure that only the right quantity of stores is purchased. The following factors should be taken into account when determining the purchase quantity:

(I) Material inventory levels must be maintained to meet the requirements of the production sector.

(II) Production is not hindered by a shortage of raw materials.

(III) There should be no excess inventory or material shortage inventory to unnecessarily block working capital. And

(IV) Availability of funds

Purchase order:

Definition:

A purchase order is an agreement between a material buyer and a supplier. It is a requirement from the purchaser to the supplier to supply goods of a specific quantity and quality in accordance with the terms set forth in the contract. It also means the buyer's commitment to deliver and pay for the goods according to the terms and conditions stated on the purchase order.

After carefully determining the purchase quantity, the purchasing department should place an order with the supplier of choice. You need to choose a supplier that can deliver the products you need at a competitive price and at the right time. We are looking for a quote from our supplier.

Quotations received from different suppliers are compared and an acceptable supplier is selected. After completing the above procedure, a purchase order will be issued to the supplier to supply the required quantity of goods at the specified time.

Purchase order i is issued in the prescribed format, produced in quadruples (4 copies), and sent to the next department for reference and coordination.

(I) the first copy will be sent to the supplier.

(II) One copy will be sent to the department that sent the purchase requisition.

(III) One copy will be sent to the store or the internal department of the product.

(IV) One copy will be kept in the purchasing department as a permanent record.

(V) A copy will be sent to your account department.

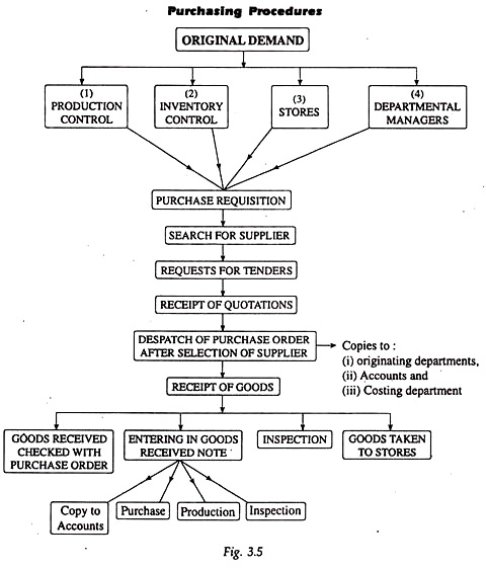

Purchase procedure:

Purchasing departments need to follow specific steps for efficient purchasing. The purchasing procedure includes the following steps:

(2) Purchase request:

Receive purchase requisitions that you might receive from your store, production control department, or department manager. The amount of material you purchase should be carefully determined.

(2) Supplier search:

Purchasing departments need to find potential suppliers. Care must be taken when choosing the right supplier. Once the supplier has been identified, you will be asked to submit a quote or bid. You need to start bidding and select a supplier considering the conditions stated in the bid.

(3) Purchase order:

Once a supplier is selected, you need to pass the purchase order to the selected supplier. A copy of the purchase order should be sent to the original department, the accounting department, and one copy to the costing department.

(4) Receipt of materials:

The materials you receive must be entered in the receipt note and sent to the inspection department for inspection. After receiving the inspection report, the material is sent to the store and shipped to the manufacturing department.

To better understand the chart in this regard, it is shown below.

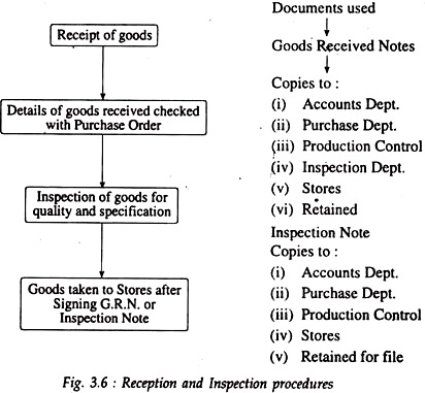

Receipt of goods:

The following chart shows the procedure for receiving and inspecting materials.

The warehousing department is usually located at the entrance of the factory. All carriers of goods are to report to this department. After receiving the delivery note or shipping advice from the supplier, the receiving department must arrange the unloading of the goods.

The receiving office must receive the goods after comparing the quantity, quality, and other details that should have been included in the purchase order. When you receive the item, you should check it by weighing, counting, or inspection.

If there is any damage or missing, you should state that fact on the carrier's copy or Challan. After being satisfied in all respects, the recipient of the goods must sign a copy of the carrier Challan. Next, you need to enter the item details on the receipt (below). The receipt memo is an important document and is required to confirm the supplier's invoice and pass it to payment.

The goods receipt note is prepared with an additional copy distributed as follows:

(I) To the purchasing department to update the purchase record.

(II) To the department that sent the purchase request.

(III) To the accounting and inventory management department.

(IV) To the shop owner. And

(V) Stored in the receiving department for records and future reference.

(VI) Goods receipt note (GRN):

This is a testimony of the goods received according to the purchase order. Otherwise, the supplier will be notified by formal contact. When making adjustments for damaged or defective items, it is customary to send a debit note to the supplier with the value of the damaged or rejected item and the shipping costs for the return.

Confirmation of purchase invoice:

Along with the goods, the supplier sends an invoice containing details of the materials supplied and their price.

The purchaser who receives the material should refer to the following document to verify the accuracy of the details.

(I) Order form.

(Ii) Receipt notes.

(Iii) Inspection report.

(IV) Debit notes (if any).

If the invoice is determined to be correct, it will be stamped with a rubber stamp by the responsible authority of the purchasing department and passed to the accounting department for payment. Invoices are now checked by an authorized person in the accounting department to ensure that the calculations are correct.

The invoice will be entered in the purchase diary that will be credited to the supplier's account. Periodically, the purchase journal totals are debited to the general ledger purchase account.

The invoice will be entered in the purchase diary that will be credited to the supplier's account. Periodically, the purchase journal totals are debited to the general ledger purchase account.

Pricing of material issues

The important methods to follow in pricing material issuance are: -

1. Actual cost method .

2. First-in first-out (FIFO) method .

3. Last-in first-out (LIFO) method .

4. Maximum first-in first-out method (HIFO) method .

5. Simple average cost method .

6. Weighted average cost method.

7. Periodic average cost method .

8. Standard Cost method.

9. Exchange cost method .

10. Last-in first-out (NIFO) method .

11. Base stock method.

1. Actual cost method:

If you purchase a material specifically for a particular job, the actual cost of the material will be charged to that job. Such materials are usually kept separately and published only for that particular job.

2. First-in first-out (FIFO) method:

CIMA defines FIFO as "a method of setting the price of material issuance using the purchase price of the oldest unit in stock." With this method, the materials are issued out of stock in the order in which they were first stocked. It is assumed that the material that opens first is the material that is used first.

Advantage:

(A) Easy to understand and easy to price in question.

(B) It is a good store management practice to ensure that raw materials leave stores in chronological order based on age.

(C) This is an easy method with less administrative costs than other pricing methods.

(D) This inventory valuation method is accepted under standard accounting practices.

(E) Consistent and realistic practices in inventory and finished product valuation.

(F) Inventory is valued at the latest market price, close to the value based on replacement costs.

Cons: Disadvantages:

(A) If confused with other materials purchased at a different price at a later date, it is uncertain whether the material with the longest stock will be used.

(B) If the price of the purchased material fluctuates significantly, there will be more clerical work and errors may occur.

(C) Manufacturing costs are modest in situations where prices are rising.

(D) Inflationary markets tend to lower prices for key issues. The deflationary market tends to set higher prices for these issues.

(E) Generally, it is necessary to adopt multiple prices for the publication of a single document.

(F) This method makes it difficult to compare costs for different jobs when billed for the same material at different prices.

3. Last in first out (LIFO) method:

With this method, the latest purchase is issued first. Issues are priced on the latest batch you receive and will continue to be billed until the new batch you receive arrives in stock. This is a way to set the issue price of a material using the purchase price of the latest unit in stock.

Advantage:

(A) Shares issued at more recent prices represent the current market value based on exchange costs.

(B) Easy to understand and apply.

(C) Product costs tend to be more realistic as material costs are billed at more recent prices.

(D) When the price is rising, the issue pricing will be the more recent current market price.

(E) It tends to show modest profit figures by minimizing unrealized inventory gains and valuing inventory at its pre-price value, providing a hedge against inflation.

Cons: Disadvantages:

(A) Valuation of inventory in this way is not accepted in the creation of financial accounting.

(B) This is an assumption of a cash flow pattern and is not intended to represent the actual physical flow of material from the store.

(C) It may be necessary to adopt multiple prices for one problem.

(D) It becomes difficult to compare costs between jobs.

(E) It involves more clerical work and sometimes the evaluation may go wrong.

(F) During inflation, the valuation of inventory in this way does not represent the current market price.

4. Highest in first out (HIFO) method:

With this method, the most expensive material is published first, regardless of the date of purchase. The basic assumption is that in a fluctuating inflation market, material costs are quickly absorbed into product costs, hedging the risk of inflation. This method is used when the material is in short supply and when you are running a contract with costs. This method is uncommon and is not accepted by standard accounting practices.

5. Simple average cost method:

In this way, all the materials received are merged into the inventory of existing materials and their identities are lost. The simple average price is calculated regardless of the quantity involved. The simple average cost is obtained by dividing the number of batches and adding the various prices paid during the period to the batches purchased. For example, three batches of material received in Rs. 20, rupees 22 and Rs. 24 per unit each.

The simple average price is calculated as follows:

Rs. 20+ rupees 22+ rupees 24/3 batch = Rs. 36/3 batch = 22 rupees per unit

This method takes into account the prices of different batches, but is not common because it does not take into account the quantity purchased in different batches. Use this method when the price is less volatile and the stock price is small.

6. Weighted average cost method:

This is a permanent weighted averaging system in which the issue price is recalculated each time after each receipt, taking into account both the total quantity and the total cost when calculating the weighted average price. For example, three batches of material received in a quantity of 2,000 units @ Rs. 25, 2,300 units @ Rupee 26 and 800 units @ Rs. 24.24.

The weighted average price is calculated as follows:

(2,000 units x Rs .25) + (2,300 units x Rs .26) + (800 units x Rs .24) / 2,000 units + 2,300 units + 800 units

= Rs. 25,000+ rupees 20,800 + rupees 22,200 / 3,200 units = rupees 47,000 / 3,200 units = 25.26 per rupee unit

This method tends to smooth out price fluctuations and reduce the number of calculations because each issue is billed at the same price until you receive a new batch of material.

This method is easier than FIFO and LIFO because you do not have to identify each batch individually. However, this method adds more clerical work in calculating the new average price each time you receive a new batch. The calculated issue price rarely represents the actual purchase price.

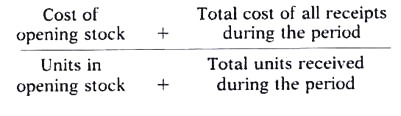

7. Periodic average cost method:

With this method, instead of recalculating the simple or weighted average cost each time you have a receipt, the average for the entire accounting period is calculated.

The average price of all materials published during the period is calculated as follows:

8. Standard cost method:

In this way, important issues are priced at a given standard issue price. The difference between the actual purchase price and the standard issue price is amortized on the income statement. The standard cost is a predetermined cost set by management before the actual material cost is known, and the standard issue price is used for all issuance to production and valuation of final stock.

Careful setting of standard prices first significantly reduces all clerical work and errors and simplifies inventory recording procedures. Eliminating cost fluctuations due to material price fluctuations makes it easier to compare realistic manufacturing costs. This method is not suitable in situations where prices fluctuate.

9. Exchange fee method:

The replacement cost is the cost of replacing the same material by purchasing it on the pricing date of the material issue. It is different from the actual cost on the purchase date. The exchange price is the exchange price of the material at the time the material is issued or on the valuation date of the end-of-term inventory.

This method is unacceptable to standard accounting practices as it reflects costs that are not actually paid. If the shares are held at exchange costs and are purchased at a lower price for balance sheet purposes, an element of profit that has not yet been realized will be included in the income statement.

This method is advocated by charging the job or process for the market price of the material, making it easier to determine the profitability of the job or process. This method is especially suitable for inflationary trends in material market prices. Without the exact market for a particular material, it is difficult to ascertain the replacement price for a material problem.

10. Next Inn First Out (NIFO) Method:

This method is a variant of the exchange cost method. In this way, the price quoted in the latest purchase order or contract is used for all issuance until a new order is placed.

11. Basic stock method:

With this method, the specified quantity of material is always kept in stock and priced as a buffer or base stock at its original cost. In addition, issuance of materials that exceed the basic stock quantity is priced using one of the above methods.

This method shows how prices fluctuate over time. However, this method is uncommon and makes stock valuation completely unrealistic and is not accepted by standard accounting practices.

Treatment of material losses

Material requirements for production are issued based on material requirements. Output is taken with waste, scrap, rot, and defects. The exact cost of the output can be calculated after considering the loss.

Losses in the form of waste, scrap, putrefaction, and defects are inherent in any manufacturing activity and are unavoidable. These losses can be managed through proper reporting and liability accounting. The standard for each type of loss is fixed. Management needs to take steps to compare performance and manage anomalous losses based on variance.

The different types of material loss are described below:

1. Waste:

Waste is unique to every manufacturing activity. Waste is part of the raw materials lost during the production process and has no recoverable value. Waste is generated invisibly in the form of evaporation or shrinkage. It can also be visibly solid. Examples of visible waste include gas, dust, and worthless residues. Disposal of waste may incur additional costs. Example- Radioactive waste. Losses in the form of waste increase production costs.

Waste management:

Waste reports are prepared on a regular basis. Actual waste is compared to standard waste and corrective actions are taken to manage the anomalous waste.

Accounting for Waste:

Waste has no value. Accounting treatment differs depending on whether the waste is normal or abnormal.

I. Normal waste:

This is an inherent waste during manufacturing. It is in the form of evaporation, deterioration, etc. The total cost of normal waste is distributed to good production units.

II. Abnormal waste:

Abnormal waste is transferred to costing gains / losses A / c to avoid fluctuations in manufacturing costs.

2. Scrap:

Scrap is a residue from a particular manufacturing activity that is usually worth disposable. It can also be a waste material that can earn some income. Examples of scrap are stamping, filing, sawdust, short lengths from woodworking, sprue from casting and moulding processes and contoured materials from "flashes". Scrap can be sold or reused.

Scrap management: Scrap is managed by fixing scrap standards, fixing responsibilities for each department of scrap, and so on. Maintaining proper scrap records and regular reporting can help you manage your scrap. The actual scrap is compared to the standard scrap. If there is too much actual scrap than standard scrap, appropriate action will be taken.

Accounting for Scrap:

(A) Selling price of scrap credited to profit and loss A / c: The selling price is credited to the income statement as other revenue. Production costs include scrap costs. This accounting method is used when the value is negligible.

(B) Selling price recorded in overhead or material costs: The selling price is reduced along with the selling cost of scrap and the net selling price is deducted from the factory overhead or material costs. This method is used when multiple jobs are running at the same time and scrap cannot be separated for each job.

(C) Credit sales to the job or process in which the scrap occurred: The sales amount of the scrap is credited to the associated job or process in which the scrap occurred. This method is used when you can easily identify scrap for a particular job or process.

3. Corruption:

Corruption occurs when a product is damaged beyond modification. The spoilage is disposed of without further treatment. Corruption cost is the cost to the rejection point minus the selling price.

The method of selling spoilage depends on the degree of spoilage. If the degree of damage is small, some of the rot is sold in seconds. The rest may be sold as scrap or treated as waste.

Corruption Management: Corruption is managed through appropriate reporting of the degree of corruption. The standard is fixed as a percentage of production. The actual rot is compared to the standard and the differences are recorded. If the actual corruption exceeds the norm, appropriate measures will be suggested to control it.

Accounting for corruption:

Accounting depends on whether corruption is normal or abnormal. Normal spoilage is production-specific and occurs even under efficient conditions, so it is borne by good production units. Abnormal rot can be avoided under efficient conditions. The cost of abnormal corruption will be charged to the income statement.

4. Defects: It is part of the production that can be fixed and made into a good unit at an additional cost. Defective work is caused by poor quality raw materials, poor planning, and poor finish. Defective units are fixed with additional material, labor and overhead costs and are sold as "First Quality" or "Second Quality".

(A) Defect management: As with any loss, defects are managed with accurate and regular reports. The defective standard has been fixed. The actual defective product is compared with the standard. If the performance exceeds the standard, corrective action is taken to control it.

(B) Defect accounting:

The accounting process depends on the degree of production of defective products. If it is normal for it to be production-specific, it is identified in a particular job. The cost of the correction will be charged to the specific job. If the cost is not tracked in the job, the cost of the fix is treated as factory overhead.

If the defective work is in an unusual situation, the cost of the adjustment will be transferred to the income statement.

5. Obsolete, slow-moving, dormant stocks: These items are part of the inventory. Appropriate and timely action is required on the part of management to prevent over-the-counter losses and prevent working capital lockups.

(A) Obsolete inventory: These are inventories that have been left unused due to changes in product processes, designs, or manufacturing methods. They are generally outdated.

(B) Slow-moving material: It is in stock and has been used for a long time, so it has been idle for a long time.

(C) Dormant strains: It is an in-stock item that has not been used for a considerable period of time. Shopkeepers emphasize such items in regular reports and management either:

Key takeaways:

Waste

Scrap

Corruption

Defects

Obsolete, Slow moving, Dormant Stock.

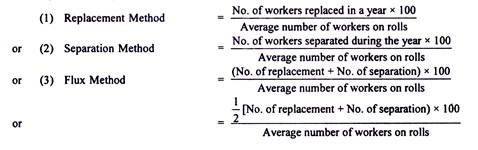

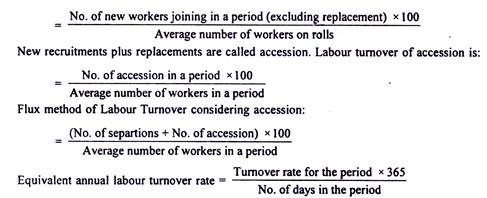

Labor turnover rate:

Labor turnover can be defined as the number of workers replaced during a particular period relative to the average workforce during the period. This is the number of workers who quit their jobs during the period relative to the average workforce during the period. It is a factor that affects labor efficiency and thus labor costs. It means the rate of change in the composition of the workforce.

There are three ways to measure it:

2. A high turnover rate is bad because it indicates that the worker will not stay long. When they go, they bring their experience with them. New workers must be engaged and trained. Aside from the cost of hiring and training new workers, their quality is expected to decline. Therefore, the turnover rate of workers is very costly for employers, but when workers take a break from work or get a job that is not suitable for them, they also lose.

3. Both worker turnovers and shifts are costly, but most of the turnover costs usually occur during shifts. Separation is the cause of sales and the exchange continues.

4. There is a certain amount of irreducible turnover due to illness, death, retirement, or marriage of female workers. However, research shows that actual sales are unnecessarily high in most industries.

Causes of turnover:

Some of the causes that contribute to high turnover are the disagreement between work and workers, low wages, bad working conditions, bad treatment on the part of employers, or simply the raging nature of workers. Therefore, the cause may be unavoidable.

The avoidable causes of turnover are:

(1) Redundancy due to seasonal fluctuations, material shortages, project completion, etc. The efficiency and foresight of senior management can eliminate sales from these causes.

(2) Boring work

(3) Bad working conditions

(4) Low wages

(5) Unstable employment

(6) There are few opportunities for promotion

(7) Unfair treatment

(8) Labor dispute.

The unavoidable causes are as follows:

(1) Difficulty of housing

(2) Personal improvement

(3) Domestic responsibility

(4) Illness and accident

(5) Leave the district

(6) Discharged because it was judged to be inappropriate

(7) Discharge due to disciplinary action

(8) Retirement

(9) Death.

Employers can significantly reduce worker turnover, thereby saving labor costs.

Labor turnover cost:

It is a good idea to calculate the labor turnover cost individually.

It consists of:

(A) Recruitment costs for additional men engaged due to excessive turnover.

(B) Training costs for additional men engaged. And

(C) Loss due to reduced production quantity and quality due to sales, represented by lack of recovery of hourly wages and fixed costs.

(D) Costs of lost time, wasted, scrap, defective work and tools, and machine damage due to inefficiencies of new employers.

(E) Cost of products lost due to delayed acquisition of new workforce.

(F) Frequency of accidents due to lack of experience of new employees.

Idle time and overtime

Over time

If a person works longer than normal working hours, the extra time the person worked is known as overtime. The cause of two factors, normal costs and additional costs, is known as overtime costs. The rate of overtime is higher than twice the normal rate.

It's a win-win situation for both the organization and the employees, as the organization has optimal capabilities and the company needs additional capabilities for people and machines, which are fully utilized. Employees are in the form of overtime pay.

Causes of overtime

It may be caused by the following circumstances:

1) To work for the seasonal rush

2) For the time lost due to unreasonable conditions

3) To complete the work according to the customer's request

4) To work for policy making, for example, when there is a shortage of workers and there is extra pressure from existing workers.

Overtime treatment

Treatment of overtime pays in cost accounting, if overtime is done according to the customer's wishes, the full amount of overtime, including freedom of overtime, must be charged directly to the work.

This is due to the pressure of common work to increase insurance production, and overtime may need to be charged for common overheads.

If the cause is the negligence or delay of a worker in a particular department, the relevant department may be charged.

If the cause is an uncontrollable situation that may be charged to the costing P & L account.

Disadvantages of overtime

Procedures for managing overtime

Idle time

This is usually the difference between the time paid to workers and the time spent on production. The loss of time that an employer faces but does not benefit directly is called ideal time.

Cause of idle time

The causes of idle time can be classified into the following groups:

1) According to their control ability.

2) Depending on the function

3) According to controllability, the causes are:

Normal idle time, including gate-to-work time, lunch breaks, breaks, tea time, loot setting time, and machine adjustment time.

Abnormal idle time due to failure, shortage, known availability of raw materials, neglect of strike or lockout.

Depending on the function:

The productive causes are:

2) The following are the ideal primes caused by the administrator:

3) The idle time caused by economic causes is as follows:

Idle time control

All idle time managers need to be identified and corrective action taken.

Handling of idle time

The idle time that is not available remains merged into the job or automatic transfer that the worker was hiring. Normal idle time is reserved for work overhead exercises, which are categorized according to cause and assigned to individual transfer numbers.

Abnormal idle time is usually heavy, takes a long time, and is included in the profit and loss account when it is adjusted to the costing profit or loss account or when the accounts are consolidated.

Methods of wage payment-time and piece rates

Everything you need to know about how to pay wages! The success of an organization depends heavily on the efficiency of labor, which is significantly affected by the amount of wages paid to them. In many cases, management is of the opinion that the benefits of concern can only be maximized by lowering the wage rate paid to workers. However, this view is incorrect.

Low-wage workers are usually inefficient, leading to wasted materials, reduced economic use of tools, frequent machine failures, lost time, resulting in higher production costs, reasonable and fair. It should be remembered that the wages allowed will ultimately lead to a more economical use of machinery, tools, materials, and time.

Therefore, the importance of wage payment methods should not be underestimated.

Some of the wage payment methods are:

1. Time rate planning

2. Partial rate planning

3. Balanced or debt method.

1. Hourly rate plan:

This is the oldest and most common way to fix wages. Under this system, workers are paid at a rate of 1 hour, 1 day, 1 week, 2 weeks, 1 month, or other fixed period, depending on the work done over a period of time.

The important point is that the production of workers is not taken into account when determining wages. You will be paid a flat rate as soon as the contract expires.

Advantages and disadvantages of Hourly wage plans

Merit

i. It's easy because you can easily calculate how much a worker has earned.

ii. Since there is no time limit for performing work, workers may not finish their work in a hurry and pay attention to the quality of their work.

iii. All workers hired to do a particular type of work receive the same wages, avoiding malice and jealousy between them.

iv. The slow and stable pace of the workers eliminates the rough handling of machines, which is a clear advantage for employers.

v. It is the only system that can be beneficially used when the production of individual workers or groups of employees cannot be easily measured.

vi. Daily or hourly wages provide workers with a regular and stable income, and the budget can be adjusted accordingly.

vii. This system is favoured by organized workers because it provides solidarity between specific classes of workers.

viii. Hourly wage contracts are based on integrity and mutual trust between the parties and therefore require less administrative attention than others.

Demerit:

i. The fact that men have different abilities and that better workers do not have the incentive to work harder and better if everyone is paid equally is not taken into account. Therefore, they are reduced to the level of the most inefficient craftsmen.

ii. Labor costs for certain jobs are not fixed. This puts the authorities in a difficult position in estimating the price of a particular work. There is always the potential for systematic avoidance of work by workers, as workers do not have a specific requirement to complete their work within a certain period of time.

iii. This system allows many to work in jobs where he has neither taste nor ability, when he may mark him in other jobs.

iv. Employers do not know how much work each worker puts in, so they cannot adequately assess the total wage spending to create a particular job.

v. The lack of records of individual workers' achievements makes it difficult for employers to determine his relative efficiency for promotion purposes.

2. Peace rate system:

Under this system, workers are paid according to the amount of work completed or the number of units completed, regardless of how long it takes to work, and the rate for each unit is settled in advance. This does not mean that the worker can take any time to complete the rate at which each unit is prepaid, regardless of how long it takes to perform the task. This does not mean that workers can take time to complete their work at any time. This is because if his performance far exceeds the time expected by the employer, the overhead of each item will increase.

It has the indirect implication that workers should not exceed the average time. If he consistently spends more time than average, he does it at the risk of losing his job.

In this plan, a worker working on a given machine under given conditions will be paid in exact proportion to his physical production. He is paid for a direct promotion to his output, and the actual amount paid per unit of service is approximately equal to the limit of his service in supporting the production of that output. This system is commonly used for repetitive nature jobs where tasks can be easily measured, inspected, and counted.

It is particularly well suited for standardized processes and appeals to skilled and efficient workers who can maximize their capabilities and increase their bottom line. In the textile industry weaving and spinning, local growing in mines, leaf picking in plantations, and in the shoe industry, this system is very useful.

However, it is difficult to apply when different shifts are employed in the same job, such as in the gas and electrical industries, or when different grades of workers are employed in different unmeasurable services.

Advantages and disadvantages of peace rate system:

Merit

I. It pays the craftsman according to his efficiency as reflected in the amount of work found by him. It satisfies hard-working and efficient workers, as he thinks his efficiency will be fully rewarded.

ii. Supervision costs are not that heavy. Because workers know that their wages depend on the amount of work they do, they are less likely to waste time.

iii. Direct labor costs per unit of production are constant and constant, making it easier to calculate costs when filling out bids and quotes.

iv. Not only will production and wages increase, but production methods will also improve. This is because workers demand defect-free materials and machines in perfect working conditions.

v. The total unit cost of production is reduced at higher output because the fixed overhead can be distributed to more units.

Demerit:

I. This system is not particularly favoured by workers, although it benefits workers as well as business owners. The main reason for this is that the fixed piece rate by the employer is not scientifically based. In most cases, he determines the rate by empirical law and finds that on average workers get higher wages compared to the wages of workers doing the same job on a daily basis. Burden workers to reduce rates.

Nevertheless, the goose must be killed. Without it, the employer is extravagant in his job. Will continue to pay for, so he will curb the growing ambitions of his men. "

ii. Workers want to work at tremendous speeds, so they generally consume more power, overuse machines, and don't try to avoid wasting materials. As a result, production costs are high and profits are low.

iii. Workers' enthusiasm for increased production is likely to reduce the quality of their work. This zeal affects their health and can lead to reduced efficiency.

iv. It encourages soldiers.

v. If you work too fast, your plants and machines can wear out and be replaced frequently.

vi. Trade unions often oppose this system. Because it fosters competition among workers and puts their solidarity in labor disputes at risk.

3. Balance or debt method:

This is a mixture of time and peace rate. Workers are guaranteed hourly or daily rates at different peace rates. If the worker's income calculated at the peace rate exceeds the amount he would have earned if paid on an hourly basis, he would get a balance, a credit for excess peace rate income that exceeds the time rate income. ..

If his peace rate earnings are equal to his time rate earnings, then the overpayment issue does not occur.

If the peace rate revenue is less than the time rate revenue, he will be paid based on the time rate. However, the excess paid to him will be carried over as debt to him and will be recovered from the future piecework balance of overtime income. This system assumes that the time and peace rate are fixed on a scientific basis.

How to pay wages-time and partial wages (advantages, disadvantages, and suitability)

1. Hourly wage:

This is the oldest and most commonly used standard for labor compensation. In this way, employees are paid based on working hours, that is, hourly, weekly, monthly, or other fixed time periods, regardless of the amount of work done. The important point is that employees are paid a flat rate as soon as the contract time expires. And his work is not taken into account.

Hourly wage payments are actually found in these industries and in jobs where the quality of the goods produced is very important. For example, a work of art whose production speed is beyond the control of the employee, is automatic in production, or is difficult to measure the work done by the employee, such as clerical, managerial, or supervisory. This system is very simple and easy to follow.

Merit:

The hourly wage system has the following advantages.

(I) it is the simplest system to calculate wages because it is very easy to check the time spent on work. The cost of the uptime wage system is negligible.

(II) There is no time limit to complete the work, so you can maintain the quality of the product with special care.

(III) Workers do not have to rush to complete their work, avoiding speeding and consequent equipment damage. Therefore, there is no rough handling.

(IV) If production is not standardized, it will not be possible to accurately measure worker productivity. In such situations, Shin is the best system for paying wages.

(V) All workers doing a particular type of work receive the same wages under this system. Therefore, there is no reason for malice or jealousy among the members of the group.

(VI) It gives workers a sense of security. If you are temporarily inefficient due to injury or illness, don't be afraid to cut your wages. This system is suitable in case of unavoidable interruption of work.

(VII) This system promotes industrial peace for the following reasons: Trade unions support it and allow it for the benefit of workers, as it makes no distinction in the class of workers.

Cons: Disadvantages:

This system has some drawbacks. The main drawbacks are:

(I) the system does not distinguish between efficient and inefficient workers, and honest workers and sharkers. Wages are paid to all according to the time spent on work. It demoralizes competent workers.

(II) There is a lack of incentives for workers to increase productivity because there is no provision for compensation for extra efforts. Therefore, it does not provide a positive incentive for the worker to demonstrate his abilities by improving his efficiency and giving him better performance.

(III) Jobs tend to be loose because there is no specific time limit to complete the job.

(IV) This system suppresses superior workers because they are paid the same wages as inferior workers. They are refraining from producing better results.

(V) Continuous and rigorous supervision is required to maintain the quality and quantity of work and thereby reduce production costs.

(VI) Employers determine if it is difficult to calculate labor and production costs due to the large fluctuations in production and costs in this system.

Compatibility:

After considering the strengths and weaknesses of the hourly wage system, we can conclude that this system is suitable for the following situations:

(I) the quality of work is the first consideration

(II) Inevitable interruptions and delays in work or output

(III) Production is done on a small scale so that effective supervision is possible.

(IV) Workers are learning work,

(V) The nature of work changes frequently,

(VI) The work is not standardized and the output is beyond the control of the operator.

(Vii) Professional skills are required to carry out the work.

(Viii) It is not possible to measure the production of workers easily or accurately. And

(IX) It is considered to be the only practical method.

2. Peace wage:

This is the second oldest way to pay wages. In this way, the amount of work is the basis for paying wages, not the time spent on work. A fixed rate for generating units of output is agreed and paid.

Workers are paid a fixed fee for each work produced or completed, which is typically developed based on an analysis of previous performance and the establishment of average performance based on specific skill criteria.

Workers' income can be calculated based on the following formula: "WE = NR" where WE are the worker's income, N is the number of pieces produced, and R is the rate per piece.

Merit:

This system has several advantages.

(I) It is very easy to calculate wages under this system.

(II) The cost of supervision is not so heavy as strict supervision is not required as the workers themselves are interested in raising production to get higher wages.

(III) Since the labor force per unit of cost is constant, the production cost and the cost per unit can be easily calculated and estimated.

(IV) Increased productivity and productivity due to the great motivational effect of financial incentives.

(V) There is greater cooperation from workers to avoid interruptions in work. They take great care to prevent machine and workplace breakdowns.

(VI) Workers themselves can improve labor arrangements and production methods. Workers demand flawless materials and machines in perfect operation.

(VII) Fixed overhead can be distributed to more units, resulting in lower production costs with larger production volumes.

(VIII) Good workers are encouraged to put more effort and work harder.

Cons: Disadvantages:

Among the main drawbacks of this system, the following are important:

(I) too much emphasis is placed on production at the expense of product quality.

(II) Workers are in a hurry to finish their work, which often results in tool and equipment breakage, material waste, machine overwork, and increased power consumption.

(III) Excessive enthusiasm causes the work to be done at the highest speed possible, which puts a heavy burden on the operator and causes excessive fatigue. They compromise their health and efficiency. It may cause an accident

(IV) Increasing income has reduced the regularity of workers' attendance and has a negative impact on employee morale.

(V) Workers feel uneasy because they earn wages based on their output. If efficiency drops temporarily due to health conditions, wages will be lost during that period.

(VI) Trade unions oppose this system because the peace rate is not fixed on a scientific basis. Political, too, this system undermines trade unions because workers cannot spend time on union activities.

(VII) This system fosters jealousy, suspicion and unhealthy competition among workers, thereby endangering trade union solidarity in labor disputes.

(VIII) Production planning and management prevent workers from earning more income and become hostile to their attitudes.

(IX) Workers may need to lose wages if the production process is interrupted for reasons beyond their control, such as power outages or the availability of materials.

(X) This system is complicated because it requires a lot of time and effort to develop and maintain. It's also expensive. You need an up-to-date record of each worker's output. In addition, standards are needed and more time studies are needed.

Compatibility:

This system is suitable for the following cases:

This system is very useful in the textile industry (weaving and spinning), mining (coal procurement), and plantations (leaf picking). However, it is difficult to apply when using different shifts for the same task.

Key takeaways:

Classification and departmentalization of overhead

Overview of overhead

All overhead costs are collectively referred to as overhead costs. This is the sum of all indirect materials, indirect labor, and indirect expenses. They make up a key component of the total cost of a product, job, or process. Overhead is not directly measurable and is observed in relation to a particular activity or unit of production, but must be incurred in production. Examples: Factory building and machine depreciation, rent, taxes, insurance, maintenance, etc.

Classification of expenses

The process of grouping overheads according to common characteristics is known as overhead classification. It provides managers with information that allows them to effectively manage their business. Overhead can be categorized as follows:

a. Elements: indirect materials, labor costs;

b. Function: Expenses for production, management, sales and distribution.

c. Behaviour: Fixed, variable, and semi-variable overhead.

1. Fixed overhead remains fixed and is not affected by changes in production levels. For example, rent, fees, salaries, statutory expenses, etc.

2. Variable overhead costs change in direct proportion to changes in production, such as indirect materials, fuel, electricity, stationery, and sales staff commissions.

3. Semi-variable overhead costs are partially fixed and partially variable costs. They remain fixed to production volume and change when production exceeds a certain volume. For example, telephone charges include machine depreciation, repair and maintenance, and supervision costs.

Collection of expenses and codification

Overhead is collected and systematized under the appropriate head. Similar overhead items should be grouped. Overhead grouping is done by a technique called "Codification". This is a way to identify and describe various expenses with numbers, letters, or a combination of both, making it easy to collect cost data. The coding of the entire item is done through a proper coding system. Expenses are collected through store requests, financial accounting, wage tables, registries, and report sources.

Departmentalization of overhead

What is overhead departmentalization?

Organizations include production, finance, human resources, accounting, sales, research,

Efficient work, collection allocation, development for cost absorption, etc. Therefore, the overhead collected is allocated or allocated to each department on an appropriate basis. This process is called overhead division.

This process assists in managing costs and managing expenses for each department. In addition, the production cost of goods and services is confirmed, the department is passed through, and the services provided by the department are performed.

Absorption of overheads; Determination of overhead rates

Cost Absorption:

1) The ultimate aim of Overhead Accounting is to absorb them in the product units produced by the firm,

2) Therefore, overhead or overhead must be finally distributed Product to complete charging.

3) This process is known as cost absorption or overhead “absorption”

4) This means that costs are absorbed by production (or product units) during the period Alternatively, charge each unit of the product a fair distribution of overhead costs.

Generally, one of the following methods is used to absorb costs.

– Direct Labour Cost Percentage

– Prime Cost Percentage

– Direct Labour Hour Rate Method

– Machine Hour Rate, etc.

Absorption’ of overheads

• Accurate absorption helps accurate arrival Production cost.

• Overhead is an overhead, so many difficulties in charging overhead to Product unit.

• Criteria should be selected after careful maximization accuracy of cost allocation to various productions unit.

• The foundation should be reviewed regularly necessary corrective action must be taken Improves absorption accuracy.

•

Under-absorption and over absorption of Overhead

• Specific costs Specific direct expenses although it is a cost center Indirect for production Department. Do not do these forming part of the prime cost, it is absorbed as overhead.

• Amount of overhead the total is absorbed by the cost Total overhead costs will be allocated to personal expenses Unit by application of Overhead rate.

Under-absorption and over absorption of Overhead

Under-absorption | Over absorption |

When the amount of absorption is small Than the amount of money incurred The difference indicates under absorption. Also called "bottom" recovery' • It may be the cause – The actual cost is Quote; and / or – Output or working hours Less than the estimate | Absorption amount More than spending This happened Over absorption, it goes Inflate costs. Over absorption is also formed as "excessive recovery". • It may be the cause – The cost is below Quote; and / or – Output or working hours Exceeded the estimate |

Causes of Under or Over Absorption of Overhead

• There is an error in the estimation of expenses.

• An error in estimating production levels, i.e. Headquarters.

• The main unexpected changes to the method of production.

• Unexpected changes in production capacity.

• Overhead seasonal variation Cost per period.

• Overhead may apply normally

• Capacity that may be less than full

• Business management ability.

What are the strategic consequences of product under costing and over costing?

• Low-priced products –Low price-Increase Profit that lowers demand(loss)

• High-Products will be lost Market share to competitors

• Produce similar products, Product excess cost, Low cost Administrative notes, and Wrong product.

Methods of Overhead Absorption

Conclusion

Allocation and allocation of overhead costs and then the absorption of overhead helps to find Total production cost for better decision making. Achieve cost control and cost reduction.

Determination of overhead rates

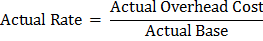

a) Actual rate:

The actual overhead rate / historical overhead rate are determined by dividing the actual overhead cost by the actual basis for a particular time period. It is calculated as

Needless to say, the actual rate is calculated monthly, quarterly, or yearly.

(B) Prescribed overhead costs:

This rate can be calculated as follows:

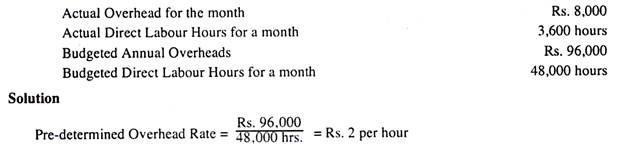

Example:

Calculate the predetermined overhead costs using the direct working hours of the budget period and the overhead charges charged for production for the month from the following details.

The actual time in a month was 3,600 hours, so the overhead charged to production Rs. 7,200 (that is, 3600 x Rs. 2). However, the actual overhead for the month was only Rs. 8,000.

Key takeaways:

Machine hour rate

Machine time rate is similar to the working hour rate method and is mainly used when working with machines.

Formula:

The formula used to calculate the rate is:

Factory overhead / machine time

If the factory overhead is Rs 4, 00,000 and the total machine time is 2,500, the machine time rate is Rs 300 per machine time (Rs 4, 00,000 ÷ 2500 hours).

Advantage:

This method can be used to advantage when the machine is a major element of production. In a capital-intensive industry, plants and machines are heavily used, with one operator participating in multiple machines or multiple operators participating in a single machine. Therefore, by being machine-based, overhead costs can be fairly absorbed across different products.

Cons: Disadvantages:

The drawbacks are:

(1) It is necessary to collect machine time data. Therefore, additional clerical work is required. It is not feasible for small businesses because of the increased costs of collection and accounting activities.

(2) This method is not universally available due to all business concerns. It can be used mainly when producing by machine. In comparison, direct working hours can be widely used by organizations.

Calculation of machine time rate:

If each machine (or group of similar machines) becomes a cost center for the purpose of calculating machine hour rates and many such centers are created within the department, then all overhead is the machine cost center or different. You will be billed to the Machine Cost Center. .. The machine time rate for a particular machine cost center is calculated by dividing the total overhead estimated or incurred on that machine by the actual or estimated machine time.

Machine hour rates have a variety of concepts, including:

(1) Normal machine time rate: This rate fluctuates and only takes into account overheads directly due to the operation of the machine. Such costs are electricity, fuel, repair, maintenance, and depreciation. The sum of all these costs is divided by the total machine time.

(2) Combined machine time rate: This method takes into account not only the costs directly related to the machine as described above, but also other costs called fixed costs or fixed costs. Such costs include rent and fees, supervision, labor, lighting and heating. These costs are inherently fixed, are determined over a specific period of time, and are distributed to different departments on some fair basis. Expenses allocated to each department in this way are fairly distributed to the machines (machine cost center) of that department.

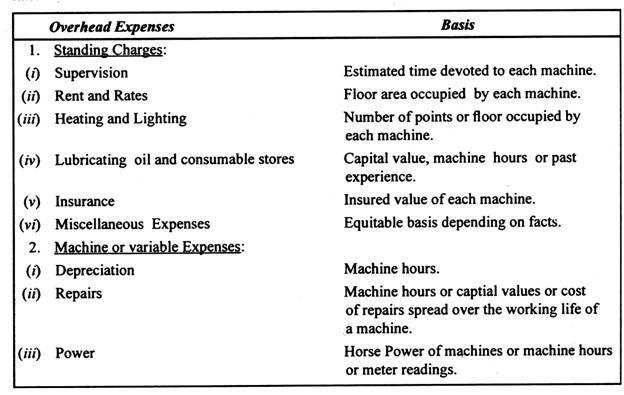

The following are the criteria used to allocate costs for calculating the time rate of a machine.

Allocation of costs to calculate machine time rate

Absorption rate selection:

Each of the above absorption rates has its strengths and weaknesses. The method used depends on the general factors and circumstances of the manufacturer.

No matter which method your company chooses, you need to achieve the following goals:

(1) The basic purpose is to select an absorption base that will help determine the exact amount of factory overhead charged for individual products, jobs, processes, etc. The base must have a causal relationship with overhead costs. Must be physically related to the production of the product. If overhead costs are primarily related to the use of the machine, then the hourly rate of the machine is appropriate. If overhead costs are incurred due to the purchase and handling of materials, you can choose based on material costs.

(2) The second purpose in choosing an absorption method is to minimize clerical labor and costs. The simplest base can be used if two or more absorption rates tend to charge the same amount of overhead. Generally speaking, the direct labor cost or material cost base has the lowest clerical work and costs, while the direct working hours and machine hours are more clerical and costly. In a standard costing system, the usual criteria are standard direct labor costs, standard working hours, and standard machine hours.

(3) Absorption-based choices are influenced not only by the suitability of the method under certain circumstances, but also by other factors such as the industry and, if there are legal requirements, its management policy.

Example Problem:

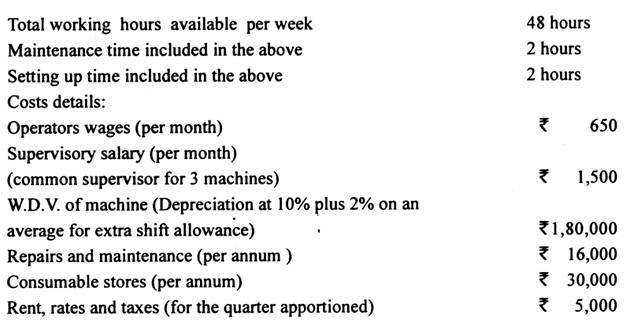

Machine shops calculate machine time rates at the beginning of the year based on a 13-week period that corresponds to three calendar months.

The following quotes for operating the machine are relevant.

Power consumption is 15 units per hour and 40 paisa’s per unit. Power is needed only during production hours. Setup time is part of production time, but job setup does not require power.

Key takeaways:

It is necessary to collect machine time data.