Costing collects and analyses expenses, measures the production of products at various stages of manufacturing, and measures the link between production and expenses. Therefore, calculate or check past or actual costs, estimated costs, standard costs, and so on.

It also associates production with costs using a variety of costing methods, such as marginal costing methods, total costing methods, and direct costing methods.

The following types of costing are typically used to determine costs:

1. Uniform costing

If many companies in the industry agree to follow the same costing system in detail and adopt common terms for different items and processes, they are said to follow a uniform costing system. In such cases, you can compare the performance of each company to the performance of other companies, or to the average performance of the industry. Under such a system, it is also possible to determine the production cost of goods that apply to the entire industry. This is useful if your government requires tax cuts or protection.

2. Marginal cost:

This is defined as a confirmation of marginal costs by distinguishing between fixed and variable costs. It is used to see the impact of changes in production volume or type of production volume on profits.

3. Standard costing and variance analysis

This is the name given to the method in which the standard cost is pre-determined and then compared to the recorded actual cost. Therefore, this is a cost verification and cost management technique. This technique can be used in combination with any costing method. However, it is especially suitable when the manufacturing method involves the production of repetitive standardized products.

4. Historical cost principle

Confirmation of costs after incurred. The usefulness of this type of costing is limited.

5. Direct costing

This is the practice of charging all overhead costs to operations, processes, or products and amortizing all overhead costs to the profits they generate.

6. Absorption costing

This is the practice of charging all operational, process, or product costs, both variable and fixed. This is different from the marginal cost excluding fixed costs.

Key takeaways:

What is the unit price?

Unit costing is understood as "output" or "single output" costing. Following unit costing, there are concerns about the continual production of one product on an outsized scale. The value unit is that the same cost. Additionally, the merchandise has uniform and homogeneous properties. This product isn't manufactured during a continuous process. This is often the most difference between unit costing and process costing.

In some cases, concerns generate quite one grade of a product. Therein case, single costing or output costing is performed. Once a product is produced, cost collection and price verification are very easy.

In this method, the entire cost incurred is split by the entire production to work out the value per unit. Additionally, costs are collected for every element, and therefore the cost for every element is split by the entire output to work out the value per unit for every element.

A cost statement is made containing the figures for the previous period to supply comparison and control. We’ve successfully calculated unit costs within the manufacture of homogeneous products like bricks, pencils, pens, books, computers and laptops.

Cost accumulation procedure in unit costing

Cost details for the varied elements of cost are collected from financial records. Thereto end; you'll properly design your financial records. Therefore, you are doing not got to maintain a separate set of books to gather costing information. The subsequent costing information is required for unit costing:

1. Value of raw materials consumed

Material request documents are the idea for collecting the worth of staple consumption. Materials are only issued supported approved material request documents.

Approval documents provide details on the quantity of fabric with different grade and sort values. If the fabric is broken during storage and handling, we'll increase and adjust the difficulty price of the fabric to point normal loss. Unusual losses should be charged to the costing of the earnings report.

2. Labor costs

Labor are often divided into two categories: direct labor and indirect labor. If workers are engaged in direct manufacturing activities, they're treated as direct labor and may identify and calculate direct labor with the assistance of production details. Several workers engaged generally factory activities. They will be placed in several categories of wage tables.

3. Overhead

Overhead is assessed on a functional basis for unit costing purposes. Factory overhead or production overhead, office and management overhead, and sales and distribution overhead are categories of overhead. These overhead costs are collected at a given rate for costing purposes.

The actual overhead incurred is collected from the financial records. Cost statements are made at short intervals with the assistance of certain overhead costs.

Unit of measure in unit costing

Units of measure are a crucial factor for cost confirmation on the cost method. There are many units of measure. They’re units, litres, dozens, yards or meters, square feet, gloss, tones, veils, millilitres, kilograms, bags and more.

The company may choose or adopt one among the above units of measurement, counting on the character of the industry

Sl. | Nature of Industry | Unit of Measurement |

1 | Sugar | A Quintal |

2 | Bricks | Thousand |

3 | Collieries | A tone of Coal |

4 | Pens, Pencils | Dozen, Gross |

5 | Breweries | A liter |

6 | Cement | Tones |

7 | Paper Mills | A kg of paper, Tones |

8 | Hospitals | Patient - days |

9 | Dairies | A liter of milk |

10 | Road Transport | Passenger - Kilometers |

11 | Automobile | No. of units |

12 | Electricity | Kilowatts - hour |

13 | Cable | Meter or Kilometer |

14 | Steel | Tones |

15 | Chemical | Liter, Kilogram, Tone |

16 | Canteen | Number of Meals, Number of cups of tea or coffee |

17 | Gas | Cubic Meter |

18 | Boiler | Kilograms |

19 | Metal Plating | Square meters |

20 | Flour Mills | Sack of flour |

Confirmation of cost per unit in unit costing

The main purpose of unit costing is to ascertain the value per unit. The aim is then to research the value of every element and its share in total cost. For this purpose, costs are cumulative and analysed under various factors of cost.

Financial records are wont to collect direct costs and costs. Costing records are wont to collect overhead and expenses. Cost records like material summaries, wage summaries, time records, and price ledgers are a part of the records used for cost confirmation purposes.

Use the subsequent formula to work out the value per unit.

Cost Per Unit = Total Cost / Number of Units Produced

Costing is an accounting method that records and analyses all costs associated with the execution of a process, project, or product. Such analysis helps management make strategic decisions.

Costing uses a variety of techniques to make your organization cost-effective. Everything you need to know about the different costing methods. The term "costing method" can be used to refer to the various processes or procedures used to determine and display costs.

There are different costing methods in different industries, depending on the nature of the job.

Costing methods can be studied under the head below. –

1. Method based on the principle of job costing

2. Method based on the principle of process costing.

Some of the methods based on the principles of process costing are: -

1. Process costing

2. Operating costing

3. Department costing

4. Single or unit or output costing

5. Operation or operation or work or service costing

6. Multiple or combined costing.

In addition, some other costing methods are: -

1. Uniform costing

2. Multiple or combined costing

3. Department costing

4. Cost plus method

5. Target costing method 6. Farm costing

7. Activity-based costing.

Different types of costing methods: job costing, contract costing, batch costing, process costing, and operating costing

Different methods of costing – individual costing, contract costing, batch costing, process costing, unit costing, operating costing, operating costing, and multiple costing

The costing method refers to the cost confirmation and costing system. Industries differ in their nature, the products they produce, and the services they provide. Therefore, different costing methods are used in different industries. For example, the costing method used by building contractors is different from that of shipping companies.

Job costing and process costing are two basic methods of costing. Job costing is suitable for industries that manufacture or perform work according to customer specifications. Process costing is suitable for industries where production is continuous and the units of production are the same. All other methods are a combination, extension, or improvement of these basic methods.

Let's take a closer look at how to calculate costs.

Method # 1 Job costing:

This is also known as specific order costing. There is no standard product and each job or work order is adopted in a different industry. The work is done strictly according to the customer's specifications, and the work is usually completed in a short time. The purpose of job costing is to see the cost of each job individually. Job costing is used in printing presses, motor repair shops, car garages, movie studios, the engineering industry, and more.

Method # 2 Contract Costing:

This is also known as terminal costing. Basically, this method is similar to job costing. However, it is used when the work is large and it takes a long time. The work will be done according to the customer's specifications.

The purpose of contract costing is to see the costs incurred in each contract individually. Therefore, a separate account is provided for each contract. This method is used by companies engaged in the construction of ships, buildings, bridges, dams and roads.

Method # 3 Batch Costing:

This is an extension of job costing. A batch is a group of identical products. All units in a particular batch are uniform in nature and size. Therefore, each batch is treated as a cost unit and is costed separately. The total cost of the batch is checked and divided by the number of units in the batch to determine the cost per unit. Batch costing is adopted by manufacturers of biscuits, ready-made garments, spare parts medicines and more.

Method # 4 Process Costing:

This is called continuous costing. In certain industries, raw materials go through various processes before they take the form of final products. In other words, the finished product of one process becomes the raw material for the next process. Process costing is used in these industries.

A separate account is opened for each process to see the total cost and cost per unit at the end of each process. Process costing applies to continuous process industries such as chemicals, textiles, paper, soaps and foam.

Method # 5 unit costing:

This method is also known as single costing or output costing. It is suitable for industries with continuous production and the same unit. The purpose of this method is to see the total cost and the cost per unit. Create a cost sheet considering material costs, labor costs, and overhead costs. Unit costing applies to mines, oil rig units, cement factories, brick factories and unit manufacturing cycles, radios, washing machines, etc.

Method # 6 Operating cost:

This method is followed by the industry that provides the service. To determine the cost of such services, use composite units such as passenger kilometres and tone kilometres to determine the cost. For example, for a bus company, operating costs represent the cost of carrying passengers per kilometre. Operating costs are used in air railways, road transport companies (commodities and passengers) hotels, movie theatres, power plants, etc.

Method # 7 Operating cost:

This is a more detailed application of process costing. It includes costing by all operations. This method is used when there is a repetitive mass production with many operations. The main purpose of this method is to see the cost of each operation.

For example, manufacturing a bicycle handlebar involves many operations such as cutting a steel plate into appropriate strips, forming, machining, and finally polishing. The cost of these operations can be viewed individually. Operating costs provide a detailed analysis of costs to achieve accuracy and apply to industries such as spare parts, toy manufacturing, and engineering.

Method # 8 Multiple Costing:

Also known as compound costing. This refers to a combination of two or more of the above costing methods. It is used in the industry where multiple parts are manufactured separately and assembled into a single product.

Different methods of costing – single costing, job costing, contract costing, batch costing, process costing, operating costing, operating costing, and a few others

The term "costing method" can be used to refer to the various processes or procedures used to determine and display costs. There are different costing methods in different industries, depending on the nature of the job. For example, the chemical industry follows a continuous production process in which raw materials are processed at various stages. There are other industries that undertake different types of work. For example, motor workshops accept a variety of jobs.

In industries such as transportation, banking and insurance, the entire activity is centred on a particular service operation. Similarly, many other industries may produce only one product. The nature of the manufacturing process and the way it works varies from industry to industry, making it essential to use different costing methods.

Key takeaways:

Operating costs are a way of checking the cost of providing or operating a service. This costing method is applied by the operator who provides the service, not the production of the goods. For example, such businesses are: Transportation concerns, gas companies; power companies; hospitals; theatres, etc.

The cost system used is different from the manufacturing concerns because the nature of the activities performed by the service business varies. The industries that are suitable or applicable to operating costs are:

Classification of operating costs

Operating costs can be divided into three categories. For example, in the transportation business, these three categories are:

2. Maintenance Costs – These costs are semi-variable and include the following costs:

3. Fixed or Permanent Charges – These costs are inherently fixed, but the operation is done in a standing position.

For shipping costing, the following formula applies:

Kilometres travelled = (number of vehicles x distance x number of trips x number of working days)

Passenger kilometres = (number of vehicles x distance x number of trips x number of working days x actual number of passengers)

Ton Kilo = (number of vehicles x distance x number of trips x number of working days x goods transported)

Unit Cost under Operating Costing

Service Name | Cost Unit |

1. Passenger-transport service | Passenger kilometer |

2. Goods transport service | Ton kilometer |

3. Electricity supply | Kilowatt-hour |

4. Canteen service | Man-meal |

5. Hospital | Per patient bed per day |

6. Educational institution | Per student |

7. Private transport | Running g hour, trip, kilometer |

Distinguish between operating costing and operating costing.

Operating costs

This is a costing method applied by businesses that provide services rather than the production of goods. Therefore, like unit costing and process costing, operating costing is a form of operating costing.

Operating costs focus on looking at the cost of rendering services, not the cost of manufacturing a product.

It is used in transportation companies, gas / water, power supply companies, water bottles, hospitals, theatres, schools, etc.

Within the organization itself, a particular department is known as the service department, which provides auxiliary services to the production department.

For example, the maintenance department, Power plant; Boiler house, Dining room; Hospital; Internal transportation.

Operating costs

This represents an improvement in process costing. In this case, each operation has a separate cost, not each process in the production phase. This can give you more control.

At the end of each operation, the unit operation cost can be calculated by dividing the total operation cost by the total output.

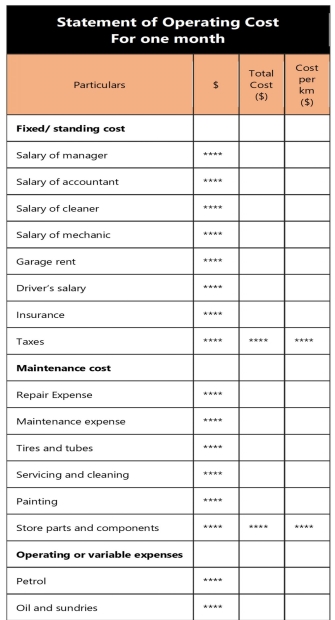

Format of Statement of Operating Cost

Statement of Operating Cost

For one month

Particulars | $ | Total Cost ($) | Cost per km ($) |

Fixed/ standing cost |

|

|

|

Salary of manager | **** |

|

|

Salary of accountant | **** |

|

|

Salary of cleaner | **** |

|

|

Salary of mechanic | **** |

|

|

Garage rent | **** |

|

|

Driver’s salary | **** |

|

|

Insurance | **** |

|

|

Taxes | **** | **** | **** |

Maintenance cost |

|

|

|

Repair Expense | **** |

|

|

Maintenance expense | **** |

|

|

Tires and tubes | **** |

|

|

Servicing and cleaning | **** |

|

|

Painting | **** |

|

|

Store parts and components | **** | **** | **** |

Operating or variable expenses |

|

|

|

Petrol | **** |

|

|

Oil and sundries | **** |

|

|

Lubricating oil | **** |

|

|

Grease | **** |

|

|

Depreciation | **** |

|

|

Cost per ton-km |

| **** | **** |

|

| **** | **** |

Key takeaways:

References: