UNIT IV

Job, Batch and Contract costing

Job costing generally refers to the specific accounting method used to track the costs of creating your own products. The job costing form has space to include direct labor, direct materials, and overhead costs.

The cost remains in the work in process account throughout the job. When the jobs are finally completed, they will be transferred to the finished product account. Using this method, accountants can understand the complex work that is going on towards the process of completion.

Overhead, such as overhead, is applied as part of the overhead Use of association with working hours or activity-based costing. In this way, by using the workforce or certain tools, overhead costs are not excluded from the equation and companies can use job costing to ensure that they cover all significant costs.

Industries that produce products as a job use this method. This includes, but is not limited to, job costing of construction. Shipping, auditing, maintenance and repair, installation, and any industry that creates products that are specific to their needs. Job costing is often the most efficient method in this situation.

Job costing Example

For example, Roy was once a curator at a large museum in the United States. He has connected with the scientific community at various levels and enjoyed his career. After a while, Roy decided to change jobs. Since then, he has set up a company that provides maintenance work for historical works in museums.

Roy has all the connections needed for this business, including other curators, archaeologists, and his entire Rolodex community. After a little effort, he was able to connect with the people doing this job. Roy acts as a salesperson, but he had to hire a team to perform the operation. Roy is a huge success. One of his concerns, an area of ignorance to him, is how bookkeeping is done. So he hires an accountant, holds a meeting, and begins learning how his business overcomes this need.

Meaning and definition of job costing:

Job costing as a characteristic method is a specific form of order costing that is adopted to perform work strictly according to customer specifications. The manufacturing process depends on the members of your order. Such production is not standardized and is essentially intermittent. Manufactured goods are not for storage, but for delivery as soon as they are completed in all respects.

All work orders are different for each customer, so costs are identified individually for each job. The purpose of job costing is to see the profits or losses incurred in each job. The cost of additional work is compared to the estimated cost to indicate whether the estimate was incomplete or the actual cost incurred was excessive. Such an analysis will help improve efficiency and take corrective action to facilitate the correction of estimates.

According to Eric Caller, "Job costing is a method of costing, with continuously identifiable units, applicable materials, labor, and specific quantities of products and equipment that move the production process as direct costs. The costs of repairs, repairs, or other services are summarized. Normally, the calculated portion of the overhead is charged to the job order.

From the above definition, it is clear that job costing is a costing method that allows you to see the cost of each job individually. This is a specific form of order costing that applies when work is done to meet the special requirements of the customer. Unlike contract costing, each job has a relatively short duration.

The features of job costing are as follows:

(1) Job costing is adopted due to manufacturing and non-manufacturing concerns.

(2) Following the job costing method these concerns produce goods for specific orders from customers, not inventory.

(3) Job costing is adopted when the work done is analyzed into different jobs and each job is considered as a separate cost unit.

(4) From the start date to the completion date, a separate account will be opened for each job for which all costs incurred in that job will be deducted. This allows concerns to know the cost of each job.

(5) In job costing, the cost of each job is confirmed after the job is completed.

(6) Since each job is different from other jobs, each job needs to be processed individually under job costing.

(7) By comparing the actual cost of each job with the price charged to each job, you can see the profit or loss incurred by each job.

(8) In this method, the cost of each job and the profit or loss of each job are calculated separately.

(9) With this method, production is intermittent, not continuous.

(10) The industry does not have to bear the sales and distribution costs because the customer places the order and collects the goods after production.

Examples of industries that employ job costing include foundries, printers, machine tool manufacturing, engineering workshops, toy manufacturing concerns, furniture manufacturing concerns, management consulting concerns, upholstery, musical instruments, and advertising concerns.

Objectives of job costing:

The main objectives are of job costing are:

1) The main purpose of job costing is to see the cost and profit or loss of each job.

(2) Another purpose of job costing is to find highly profitable and low-profitable or low-profitable jobs.

(3) Cost management by comparing the actual cost with the estimated cost is also one of the purposes of job costing.

(4) Job costing also aims to show whether the estimation is incorrect or the actual cost is excessive by comparing the actual cost of the job with its estimated cost.

(5) Another purpose of job costing is to provide a basis for estimating or determining the cost of similar work to be done in the future.

Similarities between job costing and contract costing

(1) Both individual costing and contract costing are specific order costing.

(2) For both job costing and contract costing, each job or contract constitutes a cost unit.

(3) Both methods have the same purpose of finding costs and benefits.

(4) Either method will open another account.

(5) Since customers come by either method, there is no demand creation in either case.

(6) Either method will work according to the customer's specifications.

(7) In either case, work will start after receiving an order from the customer.

(8) In both cases, the customer will call you a quote before ordering.

The procedures that are generally applicable to regular sales transactions also apply to job costing.

This is explained in the next step.

1. Accepting inquiries:

Before placing an order with the manufacturer, customers typically inquire about price, quality to maintain, duration of order, and other job specifications.

2. Job price quote:

Cost calculators estimate the cost of a job, taking into account various factors of cost and keeping customer specifications in mind. It is based on the cost of running similar jobs from the previous year and takes into account changes that may occur due to various factors in the cost. The prospect is then notified of the estimated cost of the job.

3. Receipt of order:

The customer places an order if he / she is satisfied with the quoted price and other job execution conditions. The production control department receives orders and assigns a number called the job order number to each received order. The job will be recognized by this number until it completes.

4. Preparation of manufacturing instructions:

The production instructions created by the production control department are sent to related parties such as employees so that they can carry out their duties. It is also sent to the shopkeeper so that all the necessary materials can be stored and sent to the costing officer. Create a job cost sheet to see the profits of all completed jobs.

The production order consists of the following details:

(I) the date the order was prepared,

(Ii) Job order number,

(Iii) Description of the products produced,

(Iv) Number of products produced,

(V) Work start date,

(Vi) Work completion date,

(Vii) List of materials used,

(Viii) Sequence of manufacturing process,

(Ix) Signature of production manager, etc.

5. Design preparation:

If the work you perform requires special processing, the production planning department will create a design that meets your specifications. This is done by the engineering department in consultation with the production planning department.

6. Job execution and its inspection:

Start the job according to the production schedule. Complete production with the materials, employees, tools and more you need. The production process is overseen from time to time by the production manager or supervisor to ensure that the jobs performed are in compliance with customer specifications and completed according to the production schedule.

7. Shipping of goods:

The finished product is then packed according to the delivery schedule and delivered to the customer. Payments will be settled according to the agreed payment method.

8. Accounting system under job costing: When a job is performed directly on the job, the employee records the job number to indicate that the job is a direct job. The costing department collects all working hours’ tickets, records the employee's wage rate on the ticket, and calculates the labor cost of the work.

Treatment of overtime pays in job costing:

If overtime is done to speed up production for the purpose of shortening delivery times, overtime is debited to work that is done as part of the factory's daily work.

1. Direct expenses:

Direct costs in the job ordering industry typically include design, molds, hiring specialized tools and equipment, and maintenance costs for such tools.

2. Factory overhead:

In most cases, pre-determined overhead is used to absorb factory overhead. The pre-determined overhead rate is calculated at the beginning of the year by estimating the total overhead for the year and dividing by one.

There are four components to cost (that is, materials, labor, billable costs, and overheads), which also apply to job costing.

They are discussed as follows:

1. Material cost:

Materials are classified into direct and indirect materials based on the traceability of the material to work. Materials that can be tracked by the job are treated as prime cost factors, and materials that cannot be tracked by the job are treated as manufacturing overhead.

2. Direct labor costs: Direct labor costs are debited to jobs where the work is done directly. Clock cards are used to record the working hours of each employee. At the end of each week, the payroll department uses the information on the clock card to calculate the salary for each employee. The clock card only records the total working hours of each employee.

It is used to indicate how much time an employee has worked during that period, and the employer is used to determine how much to pay the employee for that job. The clock card does not record the time each employee spends on work. This information is recorded on the time ticket by the employee. The time ticket shows the date the work was completed, the name of the employee, the name of the department, and the start and end times of the work.

When a job is performed directly on the job, the employee records the job number to indicate that the job is a direct job. The costing department collects all working hours’ tickets, records the employee's wage rate on the ticket, and calculates the labor cost of the work.

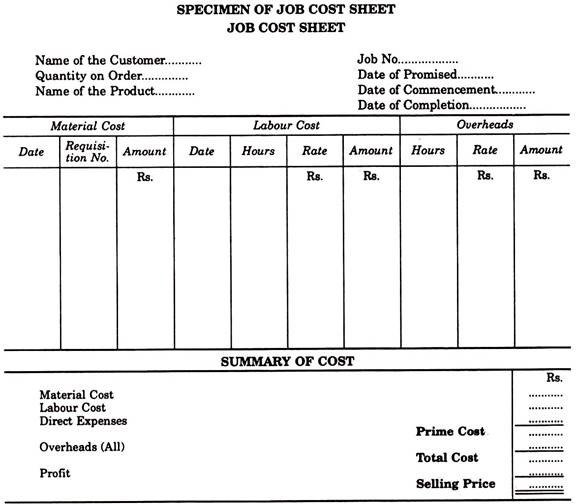

Preparation of job costing sheet:

Job costing creates a job costing sheet for every job. It shows the cost data associated with the job. It shows different factors of cost, such as direct materials, direct labor, direct costs, and overhead costs under different cost categories such as prime cost, working cost, production cost, total cost. It also describes selling prices and profits or losses at work.

Advantages of job costing:

(1) It is convenient to check the cost and profit or loss of each job individually.

(2) It helps management to know about the profitability of their work.

(3) Ideal for cost plus contracts.

(4) Provides a detailed analysis of cost factors. This is very helpful in making cost estimates and estimates.

(5) This costing method makes it easy to identify corrupt or defective jobs and lock their responsibilities to specific departments or individuals.

(6) Job costing data is very useful for preparing future budgets.

(7) Cost data related to completed jobs helps managers understand trends in material costs, labor costs, and overhead costs and manage future job costs.

Limitations of job costing

(1) Increased clerical work for collecting expenses. In addition, it includes more directors. These increase costs and increase costs.

(2) With this costing method, it is necessary to collect costs for many small jobs. Therefore, the potential for error in cost collection lies in job costing.

(3) Job costing, which is historical in nature, is not very useful for cost control unless combined with estimated or standard costing.

Key takeaways:

Specific order costing is also called batch costing. Job costing refers to the job costing performed on a particular order, but in batch costing, the material is manufactured for inventory. The finished product may require different components to assemble and may be manufactured in economical batch lots.

When you receive orders from different customers, the orders have a common product. You can then place a job in batch that consists of a given quantity of each type of product. In such cases, the batch costing method is used to calculate the cost of each batch.

The cost per unit is determined by dividing the total cost of the batch by the number of items produced in that batch. For that purpose, a batch cost sheet is available. Creating a batch cost sheet is similar to creating a job cost sheet. This method is mainly applied to biscuit manufacturing, garment manufacturing, spare parts and component manufacturing, pharmaceutical companies, etc.

Illustration

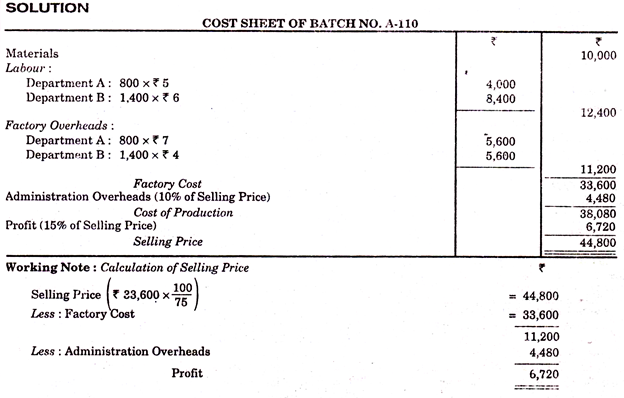

Batch number A-110 incurred the following costs:

Direct material Rs10, 000

Department: 800 working hours at 500 rupees per hour

B1400 Working hours @ 6 rupees per hour

Factory overhead is absorbed on a working hour basis, with rates of Rs 7 per hour for department A and Rs 4 per hour for department B. The company uses a cost plus system to sell prices and expects a gross profit of 25% (sales minus factories). Cost). The management fee is absorbed at 10% of the selling price. Calculate the selling price per unit, assuming that A-110 units were produced in batch A-110.

Production is usually done in batches, and each batch can contain any number of component units. The optimum quantity for a batch is the quantity that minimizes setup and shipping costs. Such optimal quantities are known as economical batch quantities or economical lot sizes.

Economical lot size determination is important in industries where batch costing is employed.

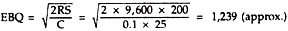

Need for determining economic lot size: (I) Every time you create a component / product, you need to set up the tool. This causes a loss of production time. Therefore, to reduce the cost per unit, the maximum number of units is generated when the machine is configured. (Ii) Such mass production in a single run leads to the accumulation of inventory and associated costs.(Iii) Therefore, there are quantities in which the reduction in production costs is offset by the transportation costs of the quantity inventory. Many factors related to cost and economy needs to be considered in determining the most economical batch quantity.Illustration:Check the economic batch quantity from the details below.Annual demand Rs.9, 600Setting cost Rs.200Production cost per unit Rs.50Interest rate 10% p.a.Solution

Key takeaways:

Accounting Treatment of Costs:

1. Material:

(A) All materials purchased for the contract or sent to the site will be charged for the contract.

(B) If the material is returned to the store, or is on an unused site, or if the material is transferred to another contract site, it will be credited to the contract account.

(C) If the material is not needed immediately, the material will be stored and its costs will be debited to the stock account.

2. Labor:

All labor employed or worked in the field is treated as direct labor and all costs associated with them are charged to the contract account. Salaries and incentives for management and supervisory staff of a particular contract are also charged for that particular contract.

3. Plants:

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

4. Subcontract fee:

Part of the contract work may be provided on a subcontract basis and payments made in the subcontract work may be debited to the contract account.

5. Overhead:

General overhead and head office expenses are fairly distributed to different contracts, and some overhead is charged to the contract account.

6. Difficulty of cost control:

Contracts are generally large and contract work is done on-site. This causes some problems with material use, labor utilization, labor supervision, plant and work damage, material and tool theft, and more. This site-based work makes it difficult to control the cost of contracts.

7. Surveyor Certificate and Deposit:

In contract work, surveyors, architects, and civil engineers visit the site on a regular basis to inspect the completed work. He issues a certificate stating the completion stage of the work and the value of the work completed by the certificate issuance date. Payment will be released to the contractor by the contractor based on the certificate.

Payments are typically released only up to a certain percentage, for example 80% of certified work. The balance of certified work is retained by the contractor until the entire contract is successfully completed.

The amount of money so reserved is called a "reservation". The contractor does so to protect itself from the risks that may arise from the contractor. Generally, the percentage of retained earnings is up to 20% of the amount of certified work.

8. Work in progress:

The amount of work in process includes the value of certified and uncertified work in process as it appears in your contract account.

9. Cost of running contract:

Due to the long-term nature of the contract, it was necessary to determine the profit attributable to each accounting period. For long-term contracts, it is believed that the results can be evaluated with reasonable certainty before they are signed, and imputed profits should be carefully calculated and included in the current account.

The profits taken up should be based on the principles of standard costing. For completed contracts, all profits arising from the contract can be transferred to the income statement.

However, in the case of an incomplete contract, preparations are made to deal with unforeseen circumstances and unexpected losses, so depending on the scope of work completed in the contract, only part of the profit is reflected in the income statement will be done. There are no strict rules for calculating profits reflected in the income statement.

However, in general, the following principles are followed:

(1) If an incomplete contract causes a loss, the entire loss will be debited to the income statement.

(2) Profit should only be considered for certified jobs. Uncertified work should be evaluated at cost.

(3) Contract completion is less than 25% of the contract price – no profit should be recorded on the income statement and the entire amount is retained as a reserve for contingencies.

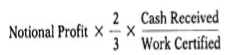

(4) Contract completion up to 25% or more, less than 50% of the contract price – in this case, one-third of the profit, a decrease in the ratio of cash received to the certified work will be reflected in the profit and loss. Account. The balance remains as a reserve in case of contingency.

(5) Contract completions up to 50% or more and less than 90% – in this case, two-thirds of the profit is reduced by the percentage of cash received for the work authorized to be brought into the income statement, leaving the rest Keep up the amount of reserve. The formula is given below:

Key takeaways:

Meaning

It is a way of costing adopted to seek out the value of these goods which are manufactured in stages. Each stage is called a process. The output of every process becomes the input for subsequent process and so on.

The staple introduced within the first process loses its identity and therefore the output is transferred to

B. Abnormal loss

1. Loss due to external factors such as natural disasters, loss due to fire or theft, strike, failure, Machines, etc.

2. Unexpected loss.

3. Somewhat avoidable and therefore controllable.

4. Credited to process A / c as a balance number in the quantity column.

The 5 amount column is calculated using the following formula:

Abnormal loss (amount) =

Dr – Cr (% from quantity)

Dr – Cr (Amt Col.)

× Abnormal loss (quantity)

C. Abnormal profit / profit

1. If the actual loss is less than the expected loss, it is called anomalous gain.

2. Due to the large amount of R / M, efficient workforce, advanced technology, etc.

3. Recorded as the balance number in the quantity column on the debit side of process A / c.

4. A monetary column calculated using the following formula.

Abnormal gain (amount) =

Dr – Cr (quantity column)

Dr – Cr (Amt column)

× Abnormal gain (quantity) the next process.

Example: Process costing is applicable to product like sugar industry, refining industry, paper industry. Etc... There are two types of losses in process costing.

Example: Input 20 Kgs

(–) Output 18 Kgs

= Loss 2 Kgs

Abnormal loss Normal loss

A. Normal Loss

1. it's a loss thanks to internal factors like heating, boiling, evaporation,

2. Expected loss.

3. A given percentage of the input amount.

4. It is an unavoidable loss and an unmanageable loss.

5. There are usually two types: (A) Scrap: It has feasible value. (B) Weight Loss: No Realizable value because it is an invisible process.

6. Credited to process A / c and calculated as% of the input quantity.

Process Costing- Meaning

Process costing is a method of costing under which all costs are accumulated for each stage of production or process, and the cost per unit of product is ascertained at each stage of production by dividing the cost of each process by the normal output of that process.

Definition:

CIMA London defines process costing as “that form of operation costing which applies where standardize goods are produced”

Features of Process Costing:

(a) The production is continuous

(b) The product is homogeneous

(c) The process is standardized

(d) Output of one process become raw material of another process

(e) The output of the last process is transferred to finished stock

(f) Costs are collected process-wise

(g) Both direct and indirect costs are accumulated in each process

(h) If the revise stock of semi-finished goods, it is expressed in terms of equal units

(i) The total cost of each process is divided by the normal output of that process to find out cost per unit of that process.

Advantages of process costing:

Limitations:

Accounting procedure of costing

For each process an individual process account is prepared.

Each process of production is treated as a distinct cost center.

Items on the Debit side of Process A/c.

Each process account is debited with

1) Cost of materials used in that process.

2) Cost of labor incurred in that process.

3) Direct expenses incurred in that process.

4) Overheads charged to that process on some pre-determined.

5) Cost of ratification of normal defectives.

6) Cost of abnormal gain (if any arises in that process)

Items on the Credit side:

Each process account is credited with

1) Scrap value of Normal Loss (if any) occurs in that process.

2) Cost of Abnormal Loss (if any occurs in that process)

Cost of Process:

The cost of the output of the process (Total Cost less Sales value of scrap) is transferred to the next process. The cost of each process is thus made up to cost brought forward from the previous process and net cost of material, labor and overhead added in that process after reducing the sales value of scrap. The net cost of the finished process is transferred to the finished goods account. The net cost is divided by the number of units produced to determine the average cost per unit in that process. Specimen of Process Account when there are normal loss and abnormal losses.

Dr. Process A/c. Cr.

Particulars | Units | Rs. | Particulars | Units | Rs. |

To Basic Material | xxx | xx | By Normal Loss | xx | xx |

To Direct Material |

| xx | By Abnormal Loss | xx | xx |

To Direct Wages |

| xx | By Process II A/c. | xx | xx |

To Direct Expenses |

| xx | (output transferred to |

|

|

To Production Overheads |

| xx | Next process) |

|

|

To Cost of Rectification of Normal Defects |

| xx | By Process I Stock A/c. | xx | xx |

|

|

|

|

|

|

To Abnormal Gains |

| xx |

|

|

|

| xx | xxx |

| xx | xx |

Inter process profit

Normally the output of one process is transferred to another process at cost but sometimes at a price showing a profit to the transfer process. The transfer price may be made at a price corresponding to current wholesale market price or at cost plus an agreed percentage. The advantage of the method is to find out whether the particular Process is making profit (or) loss. This will help the management whether to process the product or to buy the product from the market. If the transfer price is higher than the cost price then the process account will show a profit. The complexity brought into the accounting arises from the fact that the inter process profits introduced remain a part of the prices of process stocks, finished stocks and work-in-progress. The balance cannot show the stock with profit. To avoid the complication a provision must be created to reduce the stock at actual cost prices. This problem arises only in respect of stock on hand at the end of the period because goods sold must have realized the internal profits. The unrealized profit in the closing stock is eliminated by creating a stock reserve. The amount of stock reserve is calculated by the following formula.

Stock Reserve = (Transfer Value of stock X Profit included in transfer price)/(Transfer Price).

Key takeaways:

Co-costs are costs that benefit multiple products, and by-products are minor consequences of the manufacturing process and are low-selling products. Joint costing or by-product costing is used when there is a production process in which the final product is split at a later stage in production. The point at which a company can determine the final product is called the split point. There may be some dividing points. Each can clearly identify another product, is physically separated from the manufacturing process, and in some cases is further refined into a finished product. If manufacturing costs are incurred before the split point, you need to specify how these costs are distributed to the final product. If an entity bears any costs after the split point, those costs are likely to be related to a particular product and can be more easily allocated to them.

In addition to the dividing points, there may be one or more by-products. Given the importance of by-product revenue and cost, by-product accounting tends to be a minor issue.

If a company bears costs before the split point, it must be assigned to the product under the direction of both generally accepted accounting principles and International Financial Reporting Standards. If you do not assign these costs to a product, you will have to treat them as period costs and will charge them as costs for the current period. This can be a mishandling of costs, as if the related product is not sold until some point in the future, it will charge a portion of the product cost as an expense before the offset sale transaction is realized.

Co-cost allocations are not administratively useful, as the resulting information is essentially based on arbitrary allocations. Therefore, the best allocation method does not have to be particularly accurate, but it should be easy to calculate and easy to defend if reviewed by the auditor.

How to allocate joint costs

There are two common ways to allocate joint costs. The calculation method is as follows.

Allocate based on sales. Sum all manufacturing costs up to the split point, determine the sales value of all joint products at the same split point, and assign costs based on the sales price. If there are by-products, do not allocate costs to them. Instead, you charge the cost of goods sold as revenue from the sale. This is the simpler of the two methods.

Allocate based on gross profit. Sum the costs of all processing costs incurred by each joint product after the split point and deduct this amount from the total revenue each product ultimately earns. This approach requires additional cost accumulation work, but may be the only viable alternative if the selling price of each product at the point of split cannot be determined (of the calculation method described above).

Pricing for joint products and by-products

The costs allocated to joint products and by-products should not be related to the pricing of these products, as they are not related to the value of the items sold. Prior to the split point, all costs incurred are sunk costs and do not affect future decisions such as product prices.

The situation is quite different when it comes to costs incurred after the split point. Do not set the product price below the total cost incurred after the split point, as these costs can be attributed to a particular product.

If the lower limit of the price of a product is only the total cost incurred after the split point, this may result in a lower price than the total cost incurred (including the cost incurred before the split point). A strange scenario occurs. Obviously, charging such a low price is not a viable alternative in the long run, as companies will continue to suffer losses. This offers two alternative prices.

Short-term price

If market prices cannot be raised to sustainable levels in the long run, it may be necessary to allow very low product prices in the short run, even if they are close to the sum of costs incurred after the split point.

Long-term price

In the long run, companies need to set prices to achieve revenue levels that exceed total production costs. Otherwise, there is a risk of bankruptcy.

That is, if the individual product price cannot be set high enough than to offset the production cost, and the customer does not want to accept the higher price, then the different co-products can be set.

An important point to remember about cost allocation related to joint products and by-products is that the allocation is simply an expression, not related to the value of the product to which the cost is allocated. The only reason to use these allocations is to achieve valid sales costs and inventory valuations under the requirements of various accounting standards.

Key takeaways:

(a) The point at which a company can determine the final product is called the split point.

(b) How to allocate joint costs.

(c) Pricing for joint products and by-products.

(d)

References: