UNIT V

Cost Records

Integrated system:

An integrated system or integrated system is an accounting system in which only one set of accounts is maintained to record both cost and financial transactions. This system means consolidating both cost and financial accounts into a set of books.

The two sets of accounting books are integrated into the complex system. CIMA in London defines an integral system as a system in which financial and cost accounts work together to ensure that all relevant spending is absorbed by the cost account.

The accounting system has the following advantages:

1) Since there is only one set of books, there is only one profit and loss figure, so no adjustment is necessary.

2) This system is economical because it avoids duplication of recording transactions in two separate books.

3) Accounting information is readily available and the accuracy of the data is automatically checked.

4) It enables the introduction of mechanized accounting.

5) There is a better understanding among the staff.

Basic functions of the integral system:

1) You do not need a cost ledger because all managed accounts are managed in a financial ledger.

2) You do not need to open a cost ledger management account because both aspects of every transaction (that is, debits and credits) are recorded in their respective accounts.

3) Sub ledgers, namely store ledgers, work-in-process ledgers, and finished product ledgers, are maintained as they are in non-integrated accounting. In addition, the sales ledger (including each customer's personal account) and purchasing ledger (including each supplier's personal account) are maintained.

The overhead ledger is maintained to include separate accounts for factory, administrative, sales and distribution overhead.

The management account for each sub ledger is kept in the general ledger. The key control accounts are:

4) The balance of the overhead control account represents under absorption or over absorption of the overhead transferred to the P & L account.

5) The profit and loss for each profit and loss account is transferred to the profit and loss appropriation account.

6) The degree of integration must be determined in advance. Some companies may integrate cost and financial accounting down to the prime or factory cost stage, while others fully integrate the two.

7) Appropriate coding systems are generally developed to serve both costing and financial accounting purposes.

8) An agreed accounting procedure is required for the processing of accounts payable, prepaid expenses, and other adjustments required to create an interim account.

Prerequisites for integrated accounting system:

The required prerequisites for an integrated system are:

(A) Degree of integration: You need to determine the degree of integration of the two sets of accounts. It is the management that needs to decide whether to fully or partially integrate. Full integration will change the entire accounting record.

(B) Appropriate coding system: You need to develop an appropriate coding system that serves both financial accounting and cost accounting purposes.

(C) Accounting policy: An agreed routine for processing accruals, prepaid expenses, and other adjustments required to create an interim account.

(D) Adjustment: Full coordination is required between the staff responsible for the financial and cost aspects of the account, ensuring efficient processing of various accounting documents.

Practical issues related to the integrated accounting system:

Under Integrated Accounting, enter the journal for the next transaction.

Issuance of direct materials for production

c. With payment of wages.

d. Claims for wages for production.

Non-integrated system:

A non-integrated system is an accounting system in which two separate sets of books are maintained. One is for cost accounting and the other is for financial accounting. That is, the cost account is managed separately from the financial account.

The system maintains separate ledgers for costing and financial accounting, so costing personnel are responsible for recording costing transactions and financial accounting personnel are responsible for financial transactions.

Non-integrated accounting systems are also known as non-integrated systems, interlocking systems, or cost ledger accounting systems.

CIMA in London defines a non-integrated system as a system that distinguishes between costing and financial accounting. The 2 sets of accounts are often matched continuously using control accounts or easily adjusted in other ways.

Basic functions of non-integrated system:

Non-integrated account ledger:

(A) The most financial ledgers are as follows:

(B) The most cost ledgers are as follows:

Credited for the value of labor and completed work. The balance during this account shows the value of uncertified work.

Finished product ledger: Auxiliary ledger. Includes a totally completed product and work account. The value ledger is self-balanced by opening a management account for every of the above sub ledgers.

Difference # Non-integrated system:

1. Two separate account sets are maintained. One is for recording cost transactions and the other is for recording financial transactions.

2. The cost ledger is updated.

3. The management account is opened in the cost ledger.

4. There are two numbers, profit or loss. One is by costing and the other is by financial accounting.

5. Because we have two sets of books, we have two figures for profit and loss, so we need to adjust the cost and finance accounts.

6. The balance of the overhead management account, which represents the under or over absorption of overhead, is transferred to the costing profit and loss account.

7. There is a duplicate recording a transaction in two sets of accounts. It requires more human resources, time and money.

Difference # Integral system:

1. Only one set of accounts is maintained to record both cost and financial transactions.

2. The cost ledger is not updated.

3. The control account is opened in the general ledger.

4. There is only one profit and loss figure because only one set of books is kept.

5. Since there is only one set of books, there is only one profit and loss figure, so no adjustment is necessary.

6. The balance of the overhead management account, which represents the under or over absorption of overhead, is transferred to the profit and loss account.

7. Economical because you can avoid duplication of recording transactions in two sets of books.

Key takeaways:

Preparation of adjustment statement or memorandum adjustment account:

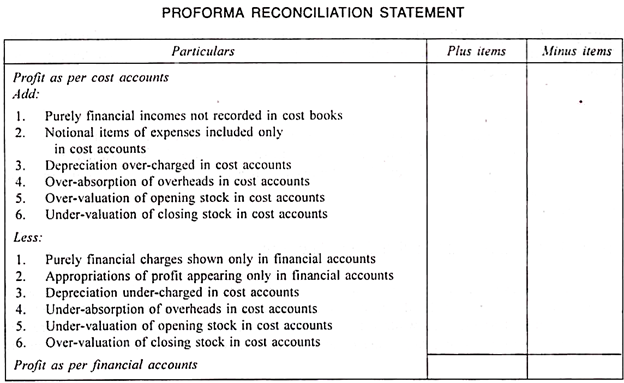

You need to create an adjustment statement or memorandum adjustment account to adjust the profits shown in the two sets of books. You can use the results shown by any set of books as a base and make the necessary adjustments to reach the results shown by any set of books. Reconciliation Statements and Memorandums The techniques for creating reconciliation accounts are described below.

Preparing the adjustment statement involves the following steps:

(1) It can be used based on the profit of each set of books (cost or finance). This is actually the starting point for determining profits, as shown in the other series of books, after making appropriate adjustments considering the causes of the differences.

(2) It is necessary to investigate the effect of a particular cause of difference on the benefits presented by other series of books.

(3) If the profits shown by another set of books increase due to the cause, the increase must be added to the profits of the previous set used as the base.

(4) If it causes a decrease in the displayed profit of other books, it is necessary to deduct the decrease from the profit based on the previous books.

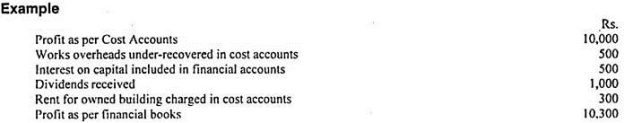

There is a difference in Rs. 300 between the profits shown on the financial books and the profits shown on the cost books.

Adjustment statements can be made to adjust the profits presented by the two sets of books on the following criteria:

1. It may be based on costing profit. In other words, if you take into account the causes of the above differences and adjust this profit figure appropriately, you will be able to find the profit shown in your financial books.

2. Overhead costs are charged more in the financial account than in the cost account. This means that the profits shown in financial accounting are less than the profits shown in costing in Rs. 500 (amount of under recovery). The amount of Rs because it is based on the profit from cost accounting. You must deduct 500 from this base profit to reach the profit shown in financial accounting.

3. Inclusion of interest on capital as an expense reduced profits as shown in the financial books. In other words, the profits shown on the cost books are greater than the profits shown on Rupee's financial books. 500 (amount of interest). Therefore, that amount must be deducted from the base profit.

4. Dividends received are credited to the financial books. This means that the profits shown on the financial books are greater than the profits shown on the Rs cost books. 1,000. Therefore, that amount should be added to the profit as shown in the cost book.

5. The rent of the building you own is listed free of charge in your financial books. However, that amount is charged on the cost statement. This means that the profits shown on the financial books are this amount higher than the profits shown on the cost books. Therefore, you need to add the amount to your profit, as shown in the cost book.

Adjustment statements can now be conveniently displayed in the following formats:

In the example above, the cost account shows a loss of Rs. For 10,000, you should enter the amount of loss in the "Minus" column instead of profit. Next, the adjustment statement should be written in the same pattern, assuming that there is a profit instead of a loss.

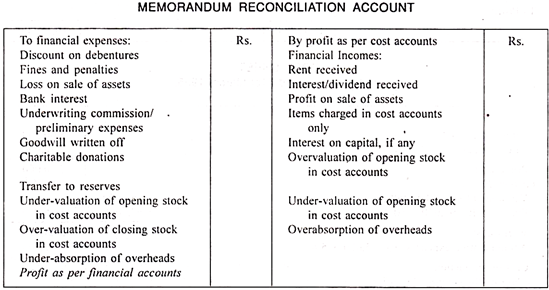

Creating a memorandum adjustment account:

Memorandum reconciliation accounts can be created on the same line as the reconciliation statement. Difference says “Dr. Means “-" and "Cr." means "+".

Taking the above example, the memo adjustment account would look like this:

Importance of Reconciliation Statement:

Meaning of Reconciliation:

Adjustments can be represented as a process of aggregating performance or profits, as shown in Costing and Financial Accounting. The arithmetic accuracy of profits revealed by two different books. Efforts have also been made to determine this. "

Therefore, costing and financial accounting adjustment involves the process of identifying and accounting for the items that led to the difference in performance, as shown in Costing and Financial Accounting. Adjustments are made in the form of analytics presented in the form of statements (called adjustment statements) or memo accounts (called memorandum adjustment accounts).

Need for reconciliation:

The need to collate cost and financial accounts arises for the following reasons:

(I) Adjustments help ensure the accuracy and reliability of the various accounting books maintained by business concerns.

(II) Analytical disclosure of reasons for fluctuations in profits or losses facilitates internal control.

(III) We support cooperation and coordination between cost accounting firms and accounting firms.

(IV) Helps develop appropriate policies regarding overhead absorption, depreciation and stock valuation.

Causes of discrepancies between costing and results shown in financial accounts:

In a non-integrated accounting system, if you manage costing and financial accounting separately, the documents used to see the amount of expenses charged for some items are the same (for example, the cost of the materials used).

The labor costs paid must be confirmed with the help of material invoices and wages, respectively), but for one or more of the following reasons –

1. Overhead under / over absorption:

Financial accounting constitutes actual expenditures for factory, office, administration, sales and distribution overheads, while costing provides estimated charges for these items based on historical records or pre-determined absorption rates. Configure. As a result, overhead costs are generally under / over absorbed in costing.

2. Receipt / income items displayed only in financial accounts:

The following receipt and income items are shown or included in financial accounting but are excluded from costing –

(A) Interest and discounts received.

(B) Rent received.

(C) Dividends received.

(D) Commission received.

(E) The transfer fee received.

(F) Take advantage of the sale of fixed assets and investments.

3. Expense / loss items displayed only in the financial account:

The following cost and loss items are billed to the financial account but do not appear in the cost account –

(A) Interest allowed on the loan.

(B) Interest on capital.

(C) Cash discounts are allowed.

(D) Interest paid on corporate bonds.

(E) Expenses and losses associated with the issuance of shares and bonds.

(F) Loss on transaction of fixed assets and investments.

(G) Profit appropriation items, that is, income tax paid or provision for income tax, transfer to reserve

+

(H) Reserve costs are amortized.

(I) Goodwill has been amortized.

(J) Donations and charity payments.

4. Unusual profit / loss items included only in financial accounts:

There are various items of extraordinary profit and loss that are included in financial accounting but excluded from costing.

These items are:

(A) Cost of extraordinary loss of material.

(B) The cost of unusual idle time for workers.

(C) The cost of extraordinary savings in materials.

(D) Exceptional non-performing loans.

(E) Fines and fines paid for violating government rules and regulations.

5. Expense items included only in costing:

The following expense items are only recorded in the cost account and are not considered in the financial account –

(A) Estimated rent of owned facilities.

(B) Depreciation of assets that do not have book values in their financial accounts.

6. Differences in billing standards for asset depreciation:

Costing and depreciation of fixed assets in the financial account may be calculated differently, which can lead to different results. In financial accounting, depreciation is typically based on the depreciation (devaluation) method or the original cost method. However, costing may follow machine time rates or unit of measure depreciation methods.

7. Differences in stock valuation criteria:

Raw material inventories in financial accounting are valued at cost or market price, whichever is lower, while costing is valued using one of the methods, FIFO, LIFO, or AVERAGE pricing. Amounts in progress for costing purposes may be valued based on prime or factory costs, but financial accounting considers some of the administrative and administrative costs.

In financial accounting, finished product inventory is valued based on cost or market price, whichever is lower, while in costing, it is valued based on actual cost.

Costing and adjustment of financial results:

If there is a difference between the work results disclosed in costing and the work results disclosed in financial accounting, you need to perform the following steps to determine the reason for the difference.

1. You need to check the degree of difference between the actual overhead recorded in financial accounting and the cost recorded in costing.

2. You need to schedule all costs and losses that are included in your trading and profit and loss accounts but not in your cost accounts.

3. You need to schedule all revenues and profits that are credited to the P & L account but excluded from the cost account.

4. You need to schedule all items that are included in costing but excluded from financial accounting.

5. You need to review the criteria by which raw material, work in process, and finished product inventories were valued for balance sheet purposes and compare them to the value shown in costing to see their differences.

6. Finally, you need to see all the items that are included in the cost and finance accounts but have different values.

If you find a discrepancy, you should create an adjustment statement starting with the profit disclosed in costing.

Next, you need to add the following items to your profit according to costing:

(I) Overhead costs (factories, offices, management, sales and distribution) are either over-absorbed or over-recovered in cost accounting or under-absorbed in financial accounting.

(II) Receipt items that appear in the financial books but not in costing.

(III) Overvaluation of starting inventory (of raw materials, work in process, or finished products) in costing.

(IV) Undervaluation of end-of-term inventory (of raw materials, work in process, or finished products) in costing.

(V) An item of unusual efficiency (abnormal savings) that appears in the financial books but not in costing.

The following items should be deducted from your profit according to costing.

(I) Underabsorption of overhead costs in the cost account or overabsorption in the financial account,

(II) The item of expense that appears in the financial account, not the cost account.

(III) Undervaluation of starting inventory (of raw materials, work in process, or finished products) in costing,

(IV) Overvaluation of closing inventory in cost accounts.

After making the above adjustments, the costing profit will match the financial accounting profit.

Below shown are the performa of reconciliation and memorandum reconciliation staement:

Key takeaways:

References: