Income concept

While the Income Tax Act does not define the term income, Section 2 (24) of the Act describes the various receipts contained under the income range.

Section 4 of the Income Tax Act, 1961, is the charging section of the law. Therefore, in this section:

Head of income

Income falls under 5 major heads under Section 14 of the act

Agricultural income is rent or income in cash or in kind derived from the land, which is used for agricultural purposes and the land must be located in India. Income from agriculture should be produced by the cultivator or the beneficiary of the spot rent of its agricultural products, which is suitable for incorporating it into the market.

The income should be obtained from the sale by the cultivator or the rental recipient of its products produced or received by him and cannot carry out any process other than the process of adapting it to the market.

Casual income means an income which is casual in nature, i.e., which is unplanned, uncertain, accidental, sudden income which occurs just by chance and the person cannot depend upon it to produce income in future.

Example: Winning from lotteries, gambling, betting, etc.,

Apart from these, any incomes which are unanticipated and non-recurring in nature are called Casual incomes.

Similarly, capital gains, receipt from a business or an occupation and one-time benefits like bonus given to employees are not casual incomes.

As per Income Tax Act: Casual incomes upto Rs. 5000/- were exempt from tax but at present all casual incomes are subject to tax at 30% plus education cess (including surcharge, if any). They are treated as income from other sources and are taxable u/s 56 of Income Tax Act.

Assessment Year is the year in which one file income tax returns of the year prior to it (i.e. Financial Year). It is the year in which the income that one has earned in the financial year that is just ended is evaluated.

E.g. for Financial Year 2014-15 the Assessment Year will be 2015-16.

As per the Income Tax law the income earned in current year is taxable in the next year. The year in which income is earned is known as the previous year.

In layman language the current financial year is known as the previous year. The financial year starts from 1st April and end on 31st March of the next year.

For Instance, for the salary income earned from 1 April 2017 - 31st March 2018 .The previous year would be 2017-18.

All the assessee’s are required to follow the financial year( April 1 to March 31) as previous year for all types of incomes. In case, of a newly set-up business/profession or first job then your first previous year may be less than 12 months. Though from subsequent years your previous year will always be your financial year.

What are the five heads of income?

As per section 14 of the Income Tax Act, income is classified into the following categories known as Heads of Income.

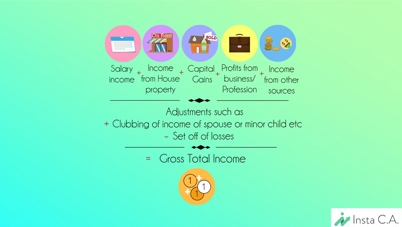

What is Gross Total Income?

Gross total income (GTI) is the sum of incomes computed under the five heads of income i.e. salary, house property, business or profession, capital gain and other sources after applying clubbing provisions and making adjustments of set off and carry forward of losses.

GTI = Salary Income + House Property Income + Business or Profession Income + Capital Gains + Other Sources Income + Clubbing of Income - Set-off of Losses

What are the types of Gross Total income (GTI)?

Gross total income is to be categorized in 2 parts

Other GTI includes:

c. Short term capital gains on which Securities Transaction Tax has been paid (taxed @ 15%).

d. Long term capital gains except for those exempted u/s 10(38) (Taxed @ 20%).

e. Casual income like lottery income, income from horse racing (taxed @ 30%).

Person [Section 2(31)]: Definition under I.Tax

Person includes:

The word person is a very wide term and embraces in itself the following:

Individual. It refers to a natural human being whether male or female, minor or major.

Hindu Undivided Family. It is a relationship created due to operation of Hindu Law. The manager of HUF is called “Karta” and its members are called ‘Coparceners’.

Company. It is an artificial person registered under Indian Companies Act 1956 or any other law.

Firm. It is an entity which comes into existence as a result of partnership agreement between persons to share profits of the business carried on by all or any one of them. Though, a partnership firm does not have a separate legal entity, yet it has been regarded as a separate entity under Income Tax Act. Under Income Tax Act, 1961, a partnership firm can be of the following two types

Association of Persons or Body of Individuals, Co-operative societies, MARKFED, NAFED etc. are the examples of such persons. When persons combine together to carry on a joint enterprise and they do not constitute partnership under the ambit of law, they are assessable as an association of persons. Receiving income jointly is not the only feature of an association of persons. There must be common purpose, and common action to achieve common purpose i.e. to earn income. An AOP. Can have firms, companies, associations and individuals as its members.

A body of individuals (BOl) cannot have non-individuals as its members. Only natural human beings can be members of a body of individuals. Whether a particular group is AOP or BOl is a question of fact to be decided in each case separately.

Local Authority, Municipality, Panchayat, Cantonment Board, Port Trust etc. are called local authorities.

Artificial Juridical Person, A public corporation established under special Act of legislature and a body having juristic personality of its own are known to be Artificial Juridical Persons. Universities are an important example of this category.

Tax Evasion in India

There are many methods that people use to evade paying taxes in India that range from false tax return and smuggling to fake documents and bribery. The penalties for this are high, from 100% to 300% of the tax for undisclosed income.

What is Tax Evasion?

Tax evasion is illegal action in which a individual or company to avoid paying tax liability. It involves hiding or false income, without proof of inflating deductions, not reporting cash transaction etc. Tax evasion is serious offense comes under criminal charges and substantial penalties.

Rooting for taxes is never an easy thing because most people question that concept of giving away part of their earning to a government but the fact is that taxes are an important source of income for the government. This is the money that is invested in various development projects that are meant to improve the company's situation. But the country has been facing a massive problem with tax evasion. People who should be paying taxes have found ways not to pay them and, as a result, it may be said that the income of the country has been suffering. So let's take a look at what are the ways in which people are avoiding taxes and what are the penalties for it.

Common Methods of Tax Evasion

There are two aspects of not paying taxes when they are due. The first is tax avoidance and the other tax evasion. The difference between the two is that tax avoidance is basically finding a loophole that exempts you from paying taxes and is not strictly illegal, while evasion is not paying the taxes when they are actually due, which is absolutely illegal. These are some of the ways in which people may avoid/evade taxes.

This is the simplest way in which someone may evade taxes. They simply won't pay it to the government, not even when the dues are called for. A person engaged in this sort of tax evasion won't, willingly or unwillingly, pay the tax before or after the due date.

b. Smuggling:

When certain goods move from one location to another, across international or state borders, a tax or charge may be payable in order to move the goods. However, some individuals may move these goods in surreptitious ways in order to avoid paying those taxes that evading the tax altogether.

c. Submitting false tax returns

In some cases, when an individual files taxes, they may submit false or incorrect information in order to either lessen the tax that they are supposed to pay or not pay it at all. This is also tax evasion since the complete information is not provided and they may actually be paying less than what they should.

d. Inaccurate financial statements

The taxes that are payable by an individual or an organisation may be decided on the financial dealing that have taken place during the assessment year. If false financial documents or accounts books are submitted, ones that show incomes less than what was actually earned, the tax may come down.

e. Using fake documents to claim exemption

The government may have provided certain exemptions and privileges to certain strata or members of society in order to ensure they have a bit more financial freedom to progress. In some cases, members who actually don't qualify for such privileges will get documents created to support their claim of being a part of that group thus claiming exemptions where they are not suited.

f. Not reporting income

It could be said that this is one of the most common methods of tax evasion. In this case, individual just won't report any income that they receive during a financial year. Not having reported any income, they don't pay any tax thus successfully evading tax all together. The simplest example of this would be a landlord who has kept tenants but has not informed the authorities that he has rented the house and is actually receiving an income from it.

g. Bribery

There may be a situation where there a certain amount due in taxes which the individual may not be willing to pay. In such a case he or she may actually offer a bribe to officials to not make them pay the tax and to make it 'disappear'.

h. Storing wealth outside the country

We have all heard tales of Swiss bank accounts. Offshore accounts are accounts maintained outside the country and information about the dealing in these accounts is not disclosed to the income tax department thereby evading any and all taxes due on that wealth.

Penalties for Tax Evasion-

There are various penalties that the income tax department can impose on anyone who is found guilty of evading or avoiding taxes. These penalties can also apply to companies that either fail to report and pay their own taxes or fail to deduct taxes at source when they are supposed to.

Some of these may be:

These are just some of the penalties that can be levied by the Income Tax department and, in some cases, it can be a hefty sum to pay, so best thing to do is to ensure that all taxes are paid when they are due.

Key Takeaways:

Tax Avoidance: Tax avoidance is an act of using legal methods to minimize tax liability. In other words, it is an act of using tax regime in a single territory for one’s personal benefits to decrease one’s tax burden. Although Tax avoidance is a legal method, it is not advisable as it could be used for one’s own advantage to reduce the amount of tax that is payable. Tax avoidance is an activity of taking unfair advantage of the shortcomings in the tax rules by finding new ways to avoid the payment of taxes that are within the limits of the law. Tax avoidance can be done by adjusting the accounts in such a manner that there will be no violation of tax rules. Tax avoidance is lawful but in some cases it could come in the category of crime.

Tax Planning: Tax planning is process of analyzing one’s financial situation in the most efficient manner. Through tax planning one can reduce one’s tax liability. It involves planning one’s income in a legal manner to avail various exemptions and deductions. Under Section 80C, one can avail tax deduction if specific investments are made for a specific period up to a limit of Rs 1, 50,000. The most popular ways of saving tax are investing in PPF accounts, National Saving Certificate, Fixed Deposit, Mutual Funds and Provident Funds. Tax planning involves applying various advantageous provisions which are legal and entitles the assesse to avail the benefit of deductions, credits, concessions, rebates and exemptions. Or we can say that Tax planning is an art in which there is a logical planning of one’s financial affairs in such a manner that benefits the assesse with all the eligible provisions of the taxation law. Tax planning is an honest approach of applying the provisions which comes within the framework of taxation law.

Features and differences between Tax evasion, Tax avoidance and Tax Planning:

1. Nature: Tax planning and Tax avoidance is legal whereas Tax evasion is illegal

2. Attributes: Tax planning is moral. Tax avoidance is immoral. Tax evasion is illegal and objectionable.

3. Motive: Tax planning is the method of saving tax .However tax avoidance is dodging of tax. Tax evasion is an act of concealing tax.

4. Consequences: Tax avoidance leads to the deferment of tax liability. Tax evasion leads to penalty or imprisonment.

5. Objective: The objective of Tax avoidance is to reduce tax liability by applying the script of law whereas Tax evasion is done to reduce tax liability by exercising unfair means. Tax planning is done to reduce the liability of tax by applying the provision and moral of law.

6. Permissible: Tax planning and Tax avoidance are permissible whereas Tax evasion is not permissible.

Tax liability of an individual can be reduced through 3 different methods- Tax Planning, Tax avoidance and Tax evasion. All the methods are different and interchangeable.

Tax planning and Tax avoidance are the legal ways to reduce tax liabilities but Tax avoidance is not advisable as it manipulates the law for one’s own benefit. Whereas tax planning is an ideal method.

Key Takeaways:

References: