UNIT 1

Meaning and scope of public finance

Public finance is the study of income and expenditure or receipt and payment of government. Public finance refers to how government raises its resources to meet the growing expenditure. Thus, in public finance we study the finances of government. The terms ‘finance’ is money resource i.e. coins. And public is collected name for individual within an administrative territory and finance. Thus public finance in this manner can be said the science of the income and expenditure of the government.

Definition:

According to prof. Dalton “public finance is one of those subjects that lie on the border lie between economics and politics. It is concerned with income and expenditure of public authorities and with the mutual adjustment of one another. The principal of public finance are the general principles, which may be laid down with regard to these matters.

According to Adam Smith “public finance is an investigation into the nature and principles of the state revenue and expenditure”

In simple terms, public finance studies the income and expenditure of the government or the public bodies for the welfare of the country.

Nature and scope of public finance

Nature of public finance

Nature of public finance is a science as well as an art.

Science refers to the systematic study of facts. It studies the relationship between facts, various principles, problems and policies relating to revenue and expenditure of the government. It systematically studies the spending and raising of funds by the public authorities. It also explains the best way of collection of taxes and spending them economically.

Arguments in support of public finance as a science

a) Public finance studies the relationship between revenue and expenditure of the government.

b) Scientific methods are used to study public finance.

c) Public finance is concerned with definite and limited field of human knowledge.

d) Principles of public finance are empirical.

Science is of two types

a) It is a positive science as it studies the factual information relating to the problems of government’s revenue and expenditure. In this respect it also offers suggestions

b) It is a normative science as it studies the norms of government financial operations. It teaches which taxes to be imposed such as direct or indirect taxes.

2. Public finance as an art:

In the words of J.N. Keynes, ”Art is the application of knowledge for achieving definite objectives.” Public finance as an art studies which principles and policies to be adopted in solving the financial problems of the government in best possible way to benefit the society. Fiscal policy is an important instrument to achieve the objective of full employment, economic equality, economic development and price stability, etc. In sort, public finance is both science and art. It is a positive science as well as normative science.

Scope of public finance

The scopes of public finance are as follows

a) Public Revenue.

b) Public Expenditure.

c) Public Debt.

d) Financial Administration.

Public revenue refers to the various sources from which the government collects revenues. Tax is the main sources of government revenue. In other words, public revenue includes income from taxes and receipts from public deposits. Hence all principles of taxation and incidence of taxation are the part of public revenue.

2. Public expenditure:

This part studies the principles and problems relating to government expenditure out of the revenue collected from different sources. It also studies the means through which the government keeps the check on its expenditure.

3. Public debt:

In this part, we study the problems of raising loans. To meet certain abnormal situations like war, natural calamities, etc government borrows funds from public. The deficit in the budget is met by borrowing the funds. This part studies the borrowing activities of the government.

4. Financial administration:

In this part we study how the government controls its financial operations. It includes preparation of budget, audit of accounts, etc.

Key takeaways –

Public finance is the study of policies and principles relating to the income and expenditure of the government. On the other hand, private finance is the study of income and expenditure of the individual. In some cases they are similar but in most of the cases they are different from each other. The below points discussed tells about the difference between public and private finance.

2. Income expenditure adjustments - Every individual first determine his income and then spend according to his needs. But the government first estimates his expenditure and then determines the income.

3. Nature of borrowing - Government resources are larger than the private individual. Government can raise revenue by national taxes. While individual cannot force others to pay him. At the time of financial crisis government can raise money from its own citizens as well as from foreign markets. But an individual can only borrow funds externally. Government can print money where as individual do not have such right.

4. Printing of new currency - Government can print money where as individual do not have such right. In order to meet obligation during war, flood, etc government can raise money by printing new currency.

5. Nature of budget – The individual prepare family budget according to the income he expects to receive. An individual budget is a surplus budget as he liked to save something for future. But the government prepares the budget of expenditure and then searches ways to fund its expenditures. The government prepares budget annually. Where as an individual does not prepare budget regularly

6. Secrecy of budget – Budget of an individual is kept secret and nobody is concerned about an individual personal budget. Whereas the government budget is presented in parliament and widely discussed. All the information is available in news and thus the transparency is maintained.

7. Elasticity of finance – Government finance is more elastic then private finance. Government can increase revenue by imposing more taxes. While an individual cannot increase its income suddenly.

8. Coercion to get revenue – Government can force those who refuse to pay tax. While an individual do not have such right.

9. Solvency – A state is a long-term institution and cannot be declared insolvent. While for an individual, if his liabilities exceeds assets , then he is declared insolvent

10. Provision for the future – Government spend large amount on projects which benefits the future generation such as investment in education, health, etc. but for an individual present is more valuable then future.

Key takeaways –

1. Public finance is the study of policies and principles relating to the income and expenditure of the government. On the other hand, private finance is the study of income and expenditure of the individual.

Financial activities of the state have significant influence on the consumption, production and distribution of the national income of the country the principle of maximum social advantage governs the financial activities of the government to maximize welfare of the society.

The 'Principle of Maximum Social Advantage' was introduced by British economist Hugh Dalton.

According to Hugh Dalton – the best system of public finance is that which secures the maximum social advantage from its fiscal operations. He stated the following

a) Government should collect money and spend it to maximize the welfare of the people.

b) When taxes are imposed, dis – utility is created and when expenditure is done, utility is created.

c) Government must adjust its revenue & expenditure in such a way that the surplus of utility is maximum and dis-utility is minimum.

Assumption of principle of maximum social advantage

a) All taxes result in sacrifice and all public expenditure lead to benefit.

b) Public revenue consist of only taxes and no other sources of income.

c) The government has only balanced budget, no surplus and deficit budget.

d) Public expenditure is subject to diminishing marginal social benefit and taxes are subject to increasing marginal social sacrifice.

Hugh Dalton explains the principle of maximum social advantage with reference to

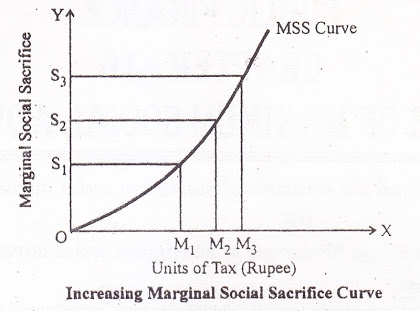

Marginal social sacrifice (MSS) refers to that amount of social sacrifice undergone by public due to the imposition of an additional unit of tax. Dalton says increase in additional unit of taxation results in additional burden (marginal sacrifice). Total sacrifices increases at an increasing rate.

The above diagram indicates MSS curve rises upwards from left to right. This indicates each additional unit of taxation, result in increase in the level of sacrifice. When unit of taxation is OM1, the marginal social sacrifice id OS1. As the taxation increase from OM1 to OM2, the marginal social sacrifice also increases from OS1 to OS2 and so on.

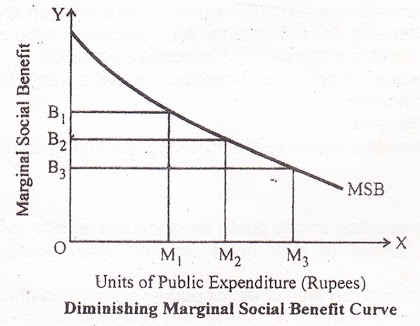

Marginal social benefits (MSB) refer to the benefit conferred on the society, by an additional unit of public expenditure. The marginal utility of the commodity declines as more units of commodity are made available to the consumers. The social benefit declines as more unit of public expenditure spent. In beginning public expenditure spent on essential activities and later they are spent on less important activities. This result in downward sloping MSB curve from left to right as shown in below figure

The above figure indicates that the social benefit derived out of public expenditure is reducing at a diminishing rate. When the public expenditure was OM1, the marginal social benefit was OB1, and when the public expenditure increase to OM2, the marginal social benefit is reduced at OB2 and so on.

The point of maximum social advantage

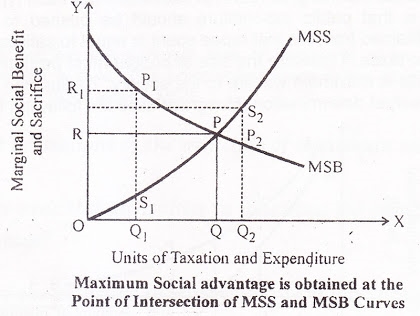

Social advantage is maximized at the point where marginal social sacrifice cuts the marginal social benefits curve.

This is at the point P. At this point, the marginal disutility or social sacrifice is equal to the marginal utility or social benefit. Beyond this point, the marginal disutility or social sacrifice will be higher, and the marginal utility or social benefit will be lower.

At point P social advantage is maximum. Now consider point P1, at this point marginal social benefit is P1Q1. This is greater than marginal social sacrifice S1Q1. Since the marginal social sacrifice is lower than marginal social benefit, it makes sense to increase the level of taxation and public expenditure. At point P2 marginal social sacrifice S2Q2 is greater than marginal social benefit P2Q2. Here any increase in taxation and public expenditure bring down the social advantage.

Maximum Social Advantage is achieved at the point where the marginal social benefit of public expenditure is equal to the marginal social sacrifice of taxation, i.e. where MSB = MSS.

This shows that to obtain maximum social advantage, the public expenditure should be carried up to the point where the marginal social benefit of the last rupee spent becomes equal to the marginal social sacrifice of the last unit of rupee taxed.

Limitations-

The principle is explained with the help of marginal utility analysis. The marginal utility and disutility are concepts and its objective is difficult to measure. The marginal utility is criticized because it is not possible to measure utility or disutility experienced by people.

2. Unrealistic assumptions

Assumption that every tax is burden to society is unrealistic. For example, taxes on tobacco and alcohol are benefit to society. But tax on education can harm the interest of society. Also, expenditure on health care will rise the interest of society.

3. Neglect non-tax revenue

The principle states that pubic revenue includes only taxation. But in practice public expenditure also financed by other sources like public borrowing, profits from public sector enterprises, etc.

4. Lack of divisibility

The marginal benefit from public expenditure and marginal sacrifice from taxation can be equated only when public expenditure and taxation are divided into smaller units. But this is not possible practically.

5. Large budget size

The government financial operations involve collection of large amount from taxation and spending large amount in public expenditure. The effect of small additional amounts is difficult to measure. Thus it’s difficult to estimate the marginal benefits and the marginal sacrifices.

6. Assumption of static condition

Conditions in an economy continuously changes. It’s not static economy. Some condition can be considered as the point of maximum social advantage but under some certain situation may not be same. For example, in times of war government expenditure and revenue must increase.

Key takeaways - The principle of maximum social advantage governs the financial activities of the government to maximize welfare of the society.

Public debt is also called as government debt. It states the total outstanding debt (bonds and other securities) of a country’s central government. It is also represented as the ratio of gross domestic product. Government uses public debt as an important source of resource to finance public spending and fill holes in the budget. Public debt is an indicator of the ability of a government to meet its future obligations.

Definition

Public debt receipts and public debt disbursals are borrowings and repayments during the year, respectively, by the government.

Classification of public debt

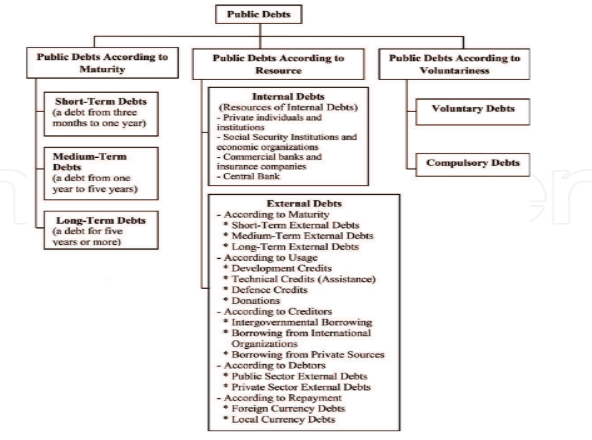

According to the characteristics public debts are classified into three main groups according to maturity, resources and voluntariness.

1) Public debt according to maturities –

a) Short term public debts also known as floating debts refer to debt up to 1 year. Treasury bills and treasury guaranteed bond are used in short term borrowings.

b) Medium term public debts refers to debt ranging from 1 to 5 years

c) Long term public debt refers to debt more than 5 years. Capital market helps in providing long term debts and has a higher interest rate than the interest rate of short-term borrowings. Long term debts are classified as redeemable and irredeemable debts.

2) Public debt according to sources –

a) Internal borrowing refers to borrowing short term or long-term loans from the own national resources. This borrowing has no effect on increasing or decreasing national income.

b) External borrowing refers to the resources provided from a foreign country that is repaid with principal and interest at the end of a certain period.

3) Public debt as a voluntary basis –

a) Voluntary debts refer the debts that are lent to the state by its own will and desire

b) Obligatory debts refer to the debts which are lent by forcing to take the bonds issued by the government. These debts are applied in times of war, natural disaster, or economic crises.

Cause of increase in public debt

a) War or war-preparedness, including nuclear programmes.

b) To cover the budget deficits on current account.

c) To undertake public welfare schemes.

d) Urge for economic growth.

e) Inefficiencies of public organizations and corruption.

Key takeaways –

1. Public debt receipts and public debt disbursals are borrowings and repayments during the year, respectively, by the government.

Zero based budgeting ZBB

Zero based budgeting has been defined as a planning and budgeting process required by each manager to:

a) Establish objectives for his function.

b) Define alternative ways of achieving the objectives.

c) Selecting the best alternative so as to achieve these objectives.

d) Break the alternatives into incremental level of efforts.

e) Cost and benefit of each incremental level.

f) Describe the consequence of disapproval.

Zero base budgeting is a method of budgeting in which all expense must be justified for each new period. Zero based budgeting starts from a zero base and every function within an organization is analyzed for its need and costs. Budgets are then built around what is needed for the upcoming period, regardless of whether the budget is higher or lower than the previous one.

ZBB is a management accounting involves preparing the budget from the scratch with a zero base.

Steps involved in ZBB

Advantages of zero-based budgeting

a) Inefficient operation is identified.

b) Allow manager to quickly respond to changes in external environment.

c) It promotes questioning and challenging attitudes.

d) It ensure efficient use of limited resources.

e) It helps management to design and develop cost effective techniques for improving operations.

f) The corporate objectives can be achieved successfully.

Disadvantages of ZBB

a) Increased paper work.

b) Cost of preparing any packages.

c) Subjective ranking.

d) More emphasis on short term benefits and qualitative benefits are ignored.

e) Small organization cannot afford it.

Performance based budgeting

Performance budgeting aims at improving the effectiveness and efficiency of public expenditure, by linking the funding of public sector organization to the result they deliver. Performance based budgeting is the allocation of funds based on programmatic results that contribute to organizational goals. It result in optimum utilization of resources such as finance, skills of the staff, use of the productive time etc.

Performance Budget focuses on the “results”. The final outcome is analyzed. Performance budgeting is a motivating tool for the staff.

Steps of PBB

2. The next step is the periodic evaluation of the performance to achieve the desired goals of the organization. The organization shall develop a systematic step by step approach for evaluation.

3. The primary focus of the performance budget is the outcome and not the inputs. The organization is going to be accountable for the result or outcomes.

Advantages

a) Performance budget helps to increase the accountability.

b) Performance budgeting indicates clearly the objective on which the money is going to be spent.

c) On a continuous basis it improves the performance of the programs

d) In the budget preparation, performance budget helps in bringing the transparency.

Disadvantages

a) the performance budget is subjective in nature, it creates disagreement amongst the management.

b) staffs may manipulate the data.

c) It makes difficult to measure the results of the projects in long-term.

Key takeaways –

Deficit financing is defined as financing the budgetary deficit through public loans. Deficit financing refers to excess of expenditure over revenue. By borrowing from the public by the sale of bonds and by creating new money the gap is covered.

Definition

According Mc. Graw Hill Dictionary of Modern Economics deficit financing is a practice by a government of spending more than what receives in revenue. Thus a government is said to be practicing deficit financing when it spends in excess of its current revenue.

Objectives

2. Economic development – The main objective of deficit financing is to promote economic development. Especially in underdeveloped countries the use of deficit financing becomes essential for financing the development plan.

3. Mobilization of resources – The objective of deficit financing is to mobilization of surplus, ideal and unutilized resources in the country.

4. For granting subsidies – Deficit financing helps in granting subsidies to the producer to produce a particular type of commodities. Granting subsidies is a costly affair which cannot be meet through regular income. Thus deficit financing becomes must for it.

5. To increase aggregate demand – Deficit financing leads to increase in aggregate demand through increased public expenditure. As there is availability of goods and services this leads to increase the income and purchasing power of the people.

6. Payment of loans – Deficit financing plays an important role to get the income for the repayment of loan along with the interest.

Adverse effect of deficit financing-

2. Adverse effects on savings – Deficit financing leads to inflation and inflation affect the habit of voluntary saving adversely. In fact it is not possible for the people to maintain the previous rate of savings in the state of rising prices.

3. Inequality – In case of deficit financing income distribution become unequal. During deficit financing deflationary pressure can be seen on the economy which makes the rich richer and poor poorer.

4. Adverse affect on investment – Deficit financing affects investment adversely when there is inflation in the economy trade unions make demand for higher wages. For this demand they go for strikes and lock out which decreases the business efficiency which in result decreases the level of investment of the country.

Key takeaways –

1. Deficit financing is defined as financing the budgetary deficit through public loans.

2. Deficit financing refers to excess of expenditure over revenue.

Sources-

1. Public finance in theory Baltic – Musgrave.

2. Public Finance Department and Developing countries - Dr. S.K. SINGH.