Unit - 2

Accounting for special issue

Bonus Shares states that free shares issued to the existing shareholders of the company, in a proportion to the number of shares held by the shareholder. Bonus Shares are distributed as an alternative to paying cash dividends. To meet the income needs shareholders are allowed to sell these bonus shares. The bonus issue does not change the company's net worth but it only increases the total number of outstanding shares.

For example, if a company declares 1:2 bonus issue, then it means all the existing shareholders for every 2 shares they hold will get one additional share.

Definition

Bonus shares are additional shares given to the current shareholders without any additional cost, based upon the number of shares that a shareholder owns. These are company's accumulated earnings which are not given out in the form of dividends, but are converted into free shares.

A company may issue fully paid up bonus shares to its members, in any manner out of -

(i) Its free reserves,

(ii) The securities premium account, or

(iii) The capital redemption reserve account.

However, no issue of bonus shares shall be made by capitalizing reserves created by their valuation of assets

Accounting treatment

a) For fully paid bonus shares

1) Capital Redemption Reserve A/c Dr

Securities Premium A/c Dr

Profit and Loss Account Dr

General reserve and other Free reserves A/c Dr

To Bonus to Shareholders A/c

2) Bonus to Shareholders A/c Dr

To Equity Share Capital A/c

To Securities Premium A/c

b) For bonus shares issued to make partly paid shares fully paid up

1) Profit and Loss Account Dr

General reserve and other Free reserves A/c Dr

To Bonus to Shareholders A/c

2) Share Final call A/c Dr.

To Share Capital A/c

3) Bonus to Shareholders A/c Dr

To Share final call A/c

Key takeaways - Bonus Shares states that free shares issued to the existing shareholders of the company, in a proportion to the number of shares held by the shareholder.

Employee Stock Option Plan (ESOP) is the benefit scheme given by the company to their employee under which the company in the form of shares encourages its employees to acquire ownership.

Employees are allotted the shares at a rate considerably lesser than the prevailing market rate. ESOPs are meant to align the interests of the employees with that of the shareholders, apart from the employee-benefit motive.

It is observed that the employees, who are also the shareholders, will focus better on company performance and growth so that the value of their shares appreciates.

ESOP is governed through Section 62(1) (b) of the Companies Act, 2013 and SEBI Guidelines, 1999 as amended.

Definition

A. Employee:

An employee can be a person who is:

However, employees do not include:

B. Grant: The grant of an ESOP refers to the commitment made by the employer by issuing the ‘Letter of Grant’ informing concerned employees about their eligibility to avail benefits under the scheme.

C. Vesting: It is the process which gives an employee the right to own shares in his company over a period of time. The rights over these shares are non-forfeitable.

D. Exercise: The Company initially, grants an Option. If an employee decides to convert this option into shares, it is called ‘exercising’ the option.

E. Exercise Price: Exercise price is known as Strike Price, this is the price at which these shares are offered to the employees. This price is pre determined and usually below the current market price. The employee has to pay the strike price and own the equivalent shares.

F. Exercise Period: The employees are given some time to exercise the options granted to them, after the vesting period,. This is known as ‘Exercise Period’.

Provisions of guidance note on employee share based payments

As per the provision employee share based payment are of three types

2. Employee stock purchase plan – It is a plan under which the enterprise grants right to employees to purchase its shares at a stated price at the time of public issue.

3. Stock appreciation right – This right entitles the employees to receive cash for an amount equivalent to any excess of the market value of a stated number of enterprise’s shares over a stated price.

For accounting purpose

Advantages -

Key takeaways - Employee Stock Option Plan (ESOP) is the benefit scheme given by the company to their employee under which the company in the form of shares encourages its employees to acquire ownership.

The provisions regulating buy back of shares are contained in Section 77A, 77AA and 77B of the Companies Act,1956. These were inserted by the Companies (Amendment) Act,1999. The Securities and Exchange Board of India (SEBI) framed the SEBI(Buy Back of Securities) Regulations,1999 and the Department of Company Affairs framed the Private Limited Company and Unlisted Public company (Buy Back of Securities) rules,1999 pursuant to Section 77A(2)(f) and (g) respectively.

Objectives of buybacks

Reasons of buybacks-

A Company can purchase its own shares from

Procedure for buybacks-

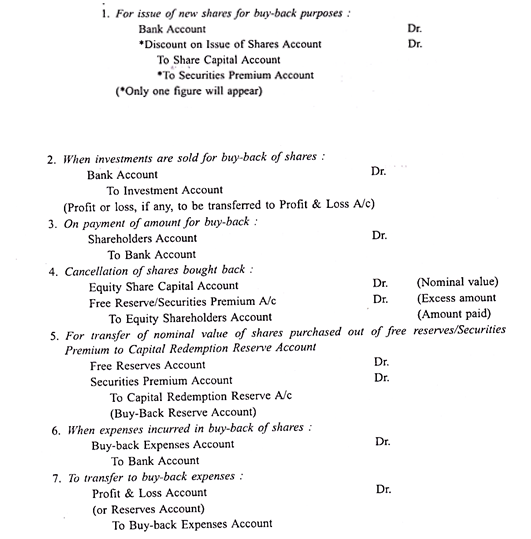

Accounting treatments

Key takeaways - Buyback, is a decision by a company to buy back its own shares from the marketplace to boost the value of the stock.

Sources-