Section 2(87) of the Companies Act, 2013 provides that holding company—

a) Controls the composition of the Board of Directors; or

b) Exercises or controls more than one-half of the total voting power either at its own or together with one or more of its subsidiary companies

Need for consolidated financial statement

The consolidated financial statements are needed to serve the following purposes:

1) To ascertain the financial performance of the group as a whole;

2) To ascertain the financial position of the group as a whole;

3) To ascertain the appropriate value of the share of a holding company;

4) To ascertain whether an excessive or otherwise price has been paid for acquiring the shares of a subsidiary company

Consolidated balance sheet

As per Schedule III of the Companies Act, 2013 consolidated financial statements shall disclose the information as per the requirements specified in the applicable Accounting Standards including the following:

1) Profit or loss attributable to “minority interest” and to owners of the parent in the statement of profit and loss shall be presented as allocation for the period.

2) “Minority interests” in the balance sheet within equity shall be presented separately from the equity of the owners of the parent.

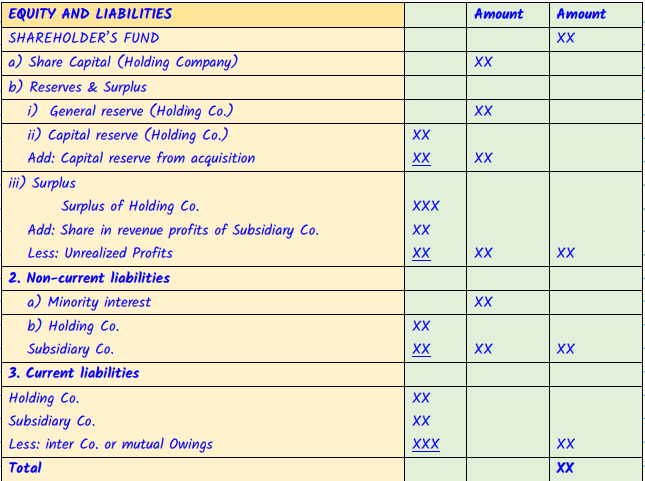

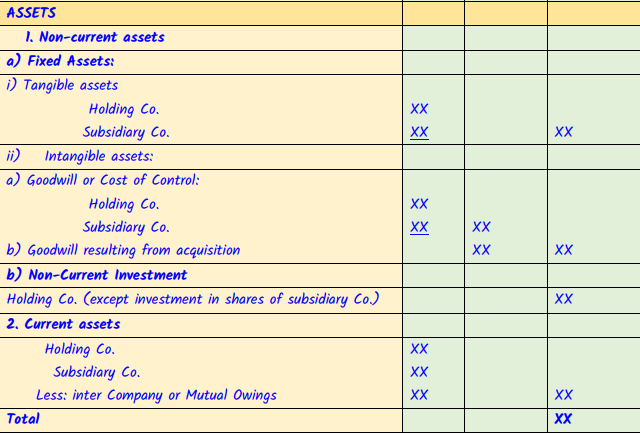

Consolidated balance sheet of holding company and its subsidiaries as on……

The following are the most important points which reserve special consideration in the preparation of the consolidated Balance Sheet of the holding company and its subsidiaries.

1) Cancellation of Investment and Share Capital

A Consolidated Balance Sheet can be prepared by simply combining all the assets and liabilities of the holding company and its subsidiary. It will certainly balance, but it is not a Consolidated Balance Sheet. This is because the inter-company balances have first to be eliminated. The "Investment in Subsidiary Company" by the holding company should cancel out the Share Capital of the subsidiary company.

2) Minority interest calculation

When the holding company acquires all the shares of the subsidiary company, the latter company becomes a wholly owned subsidiary when the holding company acquires more than half but less than all the shares of the subsidiary company, those shareholders who have a minority share are referred to as Minority Shareholders. The interest of the minority shareholders, known is Minority Interest must be accounted for separately in the Consolidated Balance Sheet. A minority interest the proportion of the subsidiary company's net assets / shareholders' fund which belongs to the minority shareholders. Therefore the value of the minority interest is the portion of the share capital and reserves at the date when the holding company acquires its controlling interest and the share of income after acquisition.

Minority interest may be computed as follows:

Minority Interest = Share Capital of subsidiary related to outsiders + Minority interest in reserves and profits of subsidiary company

1) Goodwill / Capital Reserve on Consolidation

When the value of "Investment in subsidiary" in the holding company's balance sheet is more than the book value of the net assets acquired, the difference represents "Goodwill on Consolidation". In this case, Investment in subsidiary will not cancel out against the share capital of the subsidiary unless a goodwill equal to the difference of (he two items is shown on the asset side or till' Consolidated Balance Sheet. Conversely, if the value of "Investment in subsidiary" in the holding company's balance sheet is less than the book value of the net assets acquired tile difference represents "Capital Reserve on Consolidation". In this case, Investment in subsidiary will not cancel out against the share capital of the subsidiary unless a capital reserve equal to the difference of (he two items is shown on the liability side of the Consolidated Balance Sheet. To calculate goodwill or capital reserve the value of the net assets acquired by the holding company in the subsidiary company must he compared with the cost of the investment. This value call is ascertained by adding together proportionate share capital and reserve of the subsidiary.

2) Reserves - While preparing Consolidated Balance Sheet, reserves of the subsidiary company are treated just as though they were part of the share capital of the subsidiary company. Therefore, while Calculating goodwill or capital reserve on consolidation and the minority interest reserves are to be apportioned between the holding company and the minority shareholders. The reserves of the subsidiary company at the dale of the acquisition form a part of goodwill/capital reserve and minority interest calculation.

3) Pre post acquisition of profit sharing - The profits earned by the subsidiary company before the holding company acquires its control, is known as pre-acquisition profit or capital profit. Undrawn pre-acquisition profit is taken into consolidation for calculation of goodwill or capital reserve. It is split between cost of control (goodwill I capital reserve calculation) and minority interest. The profits earned by the subsidiary company after the holding company acquires its control. Is known as post-acquisition profit or revenue profit, which can be distributed as dividend. It should be noted that post-acquisition profit of a subsidiary company do not form part of the goodwill or capital reserve calculation. Minority shareholders are not concerned whether. The profits are pre-acquisition or post acquisition. Post-acquisition profit is apportioned between holding company and minority shareholders. The share of holding company is added with its profit, while the share of the minority shareholders form a part or the calculation of minority interest.

4) Inter-company Debts - Inter-company debts for the sale of goods on credit owing by one company to the other company in the same group should be eliminated from sundry debtors and sundry creditors

Inter-company Bills of Exchange Bills drawn or accepted either by the holding company or its subsidiary are not an outside obligation. The item "Bills Receivable" in one company's Balance Sheet and corresponding item "Bills Payable" in another company's Balance Sheet are to be cancelled out against each other like ordinary debts. But if some or the bills are discounted, their adjustment is not possible because they are no longer an intercompany obligation. When a bill is discounted, it will have to be paid by the drawer (if not, by the drawer in case of dishonour) to the bank (outside the group).

5) Cancellation of intercompany loans and advances - Usually a Current Account is used to record inter-company loans and advances. When a loan is provided by either of the companies to the other, a current account will exist between the holding company and its subsidiary.

6) Adjustment of Bank Balances - Bank accounts may be held by the holding company and its subsidiary at different banks. While some balances are favorable, others are overdrawn balances; they should appear in the Consolidated Balance Sheet as assets and liabilities respectively. It would be incorrect to adjust the overdraft balances against credit balances for the purpose of the Consolidated Balance Sheet. But when both the companies maintain their bank accounts at the same branch and the bank has a set off agreement between the holding company and its subsidiary the usual method is to combine all bank balances and to set off overdraft against credit balances.

Relevant provisions of Accounting Standard: 21 (ICAI)

AS 21- Consolidated Financial Statements should be applied in preparing and presenting consolidated financial statements for a group of enterprises under the sole control of a parent enterprise.

Applicability of AS 21

This standard must be applied when accounting for investment in subsidiaries in a separate financial statement of the parent.

It is to be noted that while preparing a consolidated financial statement, other standards also stay relevant in a similar manner as for standalone statements.

This accounting standard doesn’t deal with:

1) Accounting methods for amalgamations and effects on consolidation, which includes goodwill which arises on amalgamation.

2) Accounting for investments in JVs (joint ventures).

3) Accounting for investments in associates.

Presentation of Consolidated Financial Statements

A parent company presenting its consolidated financial statements must present these statements along with its standalone financial statements.

The users of financial statements of a parent company are typically concerned with and are required to be educated about, the results of operations and financial position of not only the company itself but also of that group together.

This requirement is served by offering the users of financial statements –

(a) Standalone financial statements of a parent; and

(b) Consolidated financial statements that provide financial information about the business group as that of a lone enterprise without respect to the legal restrictions of the distinct legal entities

Scope of Consolidated Financial Statements

A parent company which presents its consolidated financial statements must consolidate all of its subsidiaries, foreign as well as domestic. Where a company doesn’t have any subsidiary, however, has associates and/or joint ventures such company also needs to prepare consolidated financial statements as per Accounting Standard 23 – Accounting for Associates in Consolidated Financial Statements and Accounting Standard 27 – Financial Reporting of Interests in JVs respectively.

Exclusion of Subsidiaries

A Subsidiary must be excluded from the consolidation when:

1) Control is planned to be temporary since the subsidiary was taken over and was held exclusively for disposal in the near future; or

2) The subsidiary is operating under severe long-standing restrictions that considerably impair the subsidiary’s ability to transfer funds to its parent

In a consolidated financial statement, investments in such subsidiaries must be accounted for as per AS 13 – Accounting for Investments. Reasons for which a subsidiary isn’t included in the consolidation must be disclosed in such consolidated financial statements.

Consolidation Procedures

While preparing a consolidated financial statement, the parent company’s financial statements and its subsidiaries must be combined line by line by totaling together similar items such as assets, liabilities, income, and expenses.

For consolidating financial statements in a way to present financial information about a group as that of a lone enterprise, the below-motioned steps must be taken:

1) Eliminate the cost to the parent of its investment made in each of its subsidiaries and such parent’s equity portion of each of its subsidiaries, at the date when the investment in such subsidiaries are made

2) Any additional cost to the parent company of the investment in the subsidiary over the parent company’s share of the equity of subsidiary, at the date on which the investment in such subsidiary is done, must be shown as goodwill for recognizing as the asset in its consolidated financial statements

3) When the cost to the parent of the investment in the subsidiary is lower than the parent company’s share of the equity of subsidiary, a date on which the investment in such subsidiary is done, the difference must be treated as the capital reserve in its consolidated financial statements

4) A portion of minority interests in net income of the consolidated subsidiary for reporting period must be recognized and adjusted against income of the group for arriving at the net income which is attributable to owners of such parent company; and

5) A portion of minority interests in net assets of the consolidated subsidiaries must be recognized and provided for in consolidated balance sheet distinctly from the equity and liabilities of the parent company. Minority interests in net assets comprise of:

(i) Mount of equity which is attributable to the minorities at the date on which such investment in the subsidiary is done; and

(ii) Minorities’ share of the movements in equity from the date the relationship of parent-subsidiary came in to force

Where carrying investment amount in a subsidiary is different from the cost, such carrying amount is to be considered for the above calculations.

Accounting for Investments in the Subsidiaries in Separate Financial Statement of the Parent

In a parent company’s separate financial statements, the investments made in subsidiaries must be accounted for as per AS 13 – Accounting for Investments.

Disclosures in the Financial Statements

Following disclosures must be made w.r.t. AS 21 Consolidated Financial Statements:

(a) In the consolidated financial statements the list of all the subsidiaries of the parent company which includes the name, country of residence or incorporation, the share of ownership interest and, in case different, the share of voting power held

(b) In case the consolidation of particular subsidiary hasn’t been made according to the grounds permissible in the accounting standard, reasons for which such subsidiary isn’t included in the consolidation must be disclosed in such consolidated financial statements

(C) In the consolidated financial statements, where valid:

(i) Type of relationship between a parent and its subsidiary, whether direct control or indirect control through the subsidiaries

(ii) Effect of acquisition and disposal of the subsidiaries on financial position at the date of reporting results for the reporting period and on corresponding amounts for preceding period; and

(iii) Name of the subsidiary(s) of which reporting date(s) is different

Major Differences between AS 21 and Ind AS 110

Particulars | Ind AS 110 | AS 21 |

Preparation of Consolidated Financial Statements | Ind AS makes preparation of Consolidated Financial Statements compulsory for the parent company | AS 21 doesn’t mandate preparation of Consolidated Financial Statements by the parent company |

Accounting for investments in subsidiaries | Ind AS provides guidance for accounting for investments in the subsidiaries, associates and jointly controlled entities in preparing separate financial statements | AS 21 doesn’t deal with the same |

Exclusion from Consolidation | Ind AS 27 doesn’t give any such exemption from consolidation of financial statements | AS 21 excludes subsidiaries from consolidation when the control is intended to be transitory or when the subsidiaries operate under severe restrictions which are of long-term nature |

Control | Ind AS defines control as the principle-based, that states that control, is power to govern the operating and financial policies of the entity for obtaining the benefits from its activities | AS 21 requires ownership, either directly or indirectly through the subsidiary, of more than half of voting power of the enterprise; or control of composition of BOD |

Share Ownership | As per Ind AS 27, the existence and effect of prospective voting rights which are presently convertible or exercisable are considered while assessing whether the company has control over such subsidiary | As per AS 11, for considering ownership, the potential equity shares of investee held by the investor aren’t taken into account |

Presentation of minority interest | According to Ind AS 27 non-controlling interests should be presented in consolidated balance sheet within the equity distinctly from parent shareholders’ equity | According to AS 21 minority interest must be showed in the consolidated balance sheet distinctly from equity and liabilities of the parent company |

Uniform Accounting Policies | Ind AS 27 doesn’t recognize the situation of impracticality | AS 21 explicitly states that in case its impracticable to employ uniform accounting policies in presenting the consolidated financial statements, such fact must be disclosed along with the share of the items in a consolidated financial statement to which such different accounting policies are applied |

Accounting for Income Tax | Ind AS 27 doesn’t deal with the same | AS 21 offers guidance with respect to accounting for taxes on income in consolidated financial statement |

Consolidation of Special Purpose Entities (SPEs) | Ind AS 27 (Appendix A) offers guidance on consolidation SPEs (Special Purpose Entities) | AS 21 doesn’t offer guidance on the consolidation of SPEs (Special Purpose Entities) |

The inclusion of notes which appears in the separate financial statement | Ind AS 27 doesn’t offer any clarification with respect to this | AS 21 offers clarification with respect to inclusion of notes which appears in separate financial statements of parent company and the subsidiary in consolidated financial statement |

Key takeaways - The consolidated balance sheet ascertain the financial position of the group as a whole and appropriate value of the share of a holding company.

Source-

1) Corporate accounting by BS Raman.

2) Corporate accounting by Dr. S.M. Shukla, Dr. K.L. Gupta.

3) Corporate accounting by V RAJASEKARAN and R LALITA.