Unit 4

Operations for Ecommerce

The online payment mechanism refers to the organized platform for transfer or payment of money using internet. The methods for online payment are-

1. Credit card: The credit card holders able to make online payment to the vendor for purchase of product/services where banks allowed credit to the card holders. The credit card holder will return the amount to the bank later.

2. Debit card: The debit card holder makes online payment out of the credit balance of the account for purchase of product or service.

3. E-wallet: E-wallet or digital currency is software where the user can add money digitally from his respective bank account. Such digital money is used by the user to make payment electronically for purchase of any product/service. For example, Google wallet, Paytm, Apple pay etc.

4. UPI: Unified Payments Interface is a real-time payment system developed by National Payment Corporation of India to facilitate interbank transactions. Under this software multiple bank accounts is added from which financial transactions are made. For example, BHIM UPI, Amazon UPI etc.

5. Net banking: Under Net banking/Internet banking/Online banking system, the banker facilitates the bank customers to use the banking services through internet without visiting to the banks in person.

6. Payment banking system: It is the application software used in mobile phones which facilitates to deposit, transfer of money digitally by linking the respective bank account of customer. Indian post payment bank, Airtel money, Jio payment bank, Google pay, etc. are some of the examples of payment bank.

7. Mobile banking: It is the application software designed for specific banks and installed in mobile phones which facilitates real time payment system and other banking services to bank customers. For example, SBI YONO, U-mobile, PNB ONE etc.

8. E-cash: E-cash or electronic cash is the digital money that facilitates to make payment digitally without using hard cash.

9. Store valued card: It is a payment system where a specific amount is stored. By using this card one can make payment for the purchases made. For example gift card of online shopping sites.

Key Takeaways-

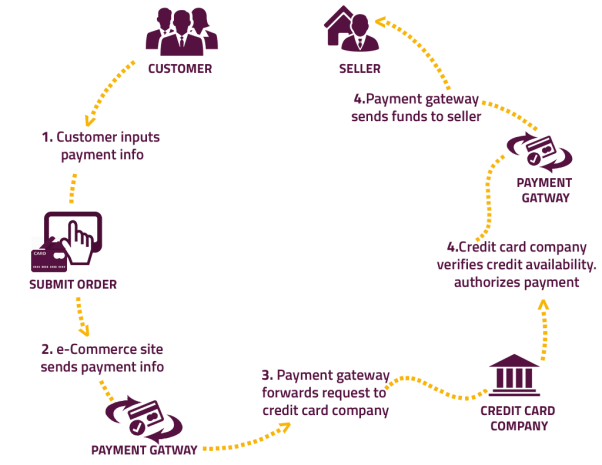

Payment gateway is the technology that enables the merchants to accept safely and securely payment from customers with the help of debit card or credit card or any other online payment method. It facilitates ecommerce applications and other retail stores to accept payments digitally. Amazon payments, Paysimple, Wepay etc. are some of the examples of payment gateway. The figure 1 shows the payment gateway system.

|

Fig 1: Payment Gateway system

Source: www.mxicoders.com

The steps involved in payment gateway process are-

1. The customer inputs payment details such as bank name, card number, account number, amount, password, pin etc. to the shopping site or retail store.

2. The ecommerce website/ device send information to the payment gateway for verification of payment details of the payer.

3. On receipt of information, the payment gateway forward request to the credit card company/bank.

4. On receipt of request, the credit card company/bank verifies the availability of balance in respective account of the customer and authorizes payment to the payment gateway.

5. On receipt of authorization from bank/credit Card Company for payment, the payment gateway finally sends the funds to the respective seller.

The benefits of payment gateway are-

1. A payment gateway checks and validates online transactions between merchants and customers.

2. It is convenient to use because anyone with basic computer knowledge can perform business transactions using payment gateways.

3. It offers lots of customizable features like security features, payment option choices, card features etc. that could greatly benefit merchants and customers.

4. It supports ecommerce to grow day by day by facilitating convenient and secured payment system.

5. It helps the banking sector to develop online banking services by providing innovative banking services.

Key takeaways-

Visitors to website indicate the persons visiting the website daily or from time to time for using the services or for purchasing the products of any company or for getting any material information. Frequent visit to website or huge traffic in website indicates the good brand image of the company. The ecommerce site must put continuous and effective effort to increase the number of visitors to the website. Some of the effective methods to increase website traffic are-

1. Blog Posts: It can post blogs about some selected products with their reviews, tutorials, news pieces and other informative articles about these products.

2. Promote Products: It must promote products based on the consumer interest. It will attract customers to visit the website for purchase or to get the information.

3. Region Specific Campaigns: Region specific campaign allows the ecommerce sites to influence the geographical different customers by influencing their regional sentiments.

4. Send Push Notifications: It sends push notifications to their smart phones, laptops etc. to induce them to visit the website.

5. Email marketing: It sends notifications through emails about the availability of product/service, discount, rebate etc. over such product/service which induces the customer to visit ecommerce site.

6. Polls and Surveys: It can run polls and surveys to ask the visitors which products they like, how was their experiences, would they recommend them to others, and other similar questions. It will increase the interest of customers about the site and motivate them to visit frequently.

7. Invest in Google Adwords: Google Adwords is a pay-per-click advertising method designed to attract more people to the ecommerce site. The benefits are-

• Show the ecommerce shop’s ads in Google search results.

• Display text or banner ads in Gmail, on websites, or in apps.

• Showcase video ads on YouTube and target your audience based on their interests or demographics data including age and location.

• Promote your online store’s app across Android and ios devices.

8. Video Content: By publishing video content like product reviews, comparison videos, unboxing, or demonstrating a product, ecommerce site can target and attract a different audience and increase the flow of visitors to the website.

Key takeaways-

Ecommerce websites adopts certain promotional tools to promote their website in the market. Some of the significant tools are-

1. Social media: It is one of the effective platforms to promote the ecommerce website. Videos, cookies, push notifications etc. about the ecommerce website in social media platforms like Facebook, instagram, YouTube, LinkedIn etc. is an effective promotional tool because such social media platforms are used a large number of people.

2. PPC (pay per click) advertising: It is a type of marketing where companies pay for every click that their advertisement receives. Google adwords is a type of pay-per-click advertising method designed to attract more people to the ecommerce site.

3. Strategic partnerships: Ecommerce websites form partnership with blogs where content writings are posted about the ecommerce websites. By having the website featured in a post on a popular site, the website can drive thousands of targeted visitors to the ecommerce site.

4. Podcast ads: Podcast add refers to advertise about brand/company on a podcast i.e., audio show downloaded or streamed for the internet. It provides information about the product, experiences etc. of others users. It helps to promote about the ecommerce website among the target group.

5. Blog: Ecommerce websites can launch blogs to provide their buyers with valuable content and build trust in their brand. Promotion via blogging is effective as content can be posted and shared on social media and drive traffic through search engines.

6. Email promotions: Promotion via email is an easy way to target buyers with by informing them about the preferred products/services.

7. Product reviews: Reviews are helpful for potential buyers to make purchase decision by reading the reviews posted by other users. Positive reviews are helpful for promotion of website.

8. Retarget your ads: This method places a cookie from the ecommerce site on visitors’ computers. When they go to another site later, the cookie enables ads to show up for earlier ecommerce products.

9. Live chat: Live Chat tool helps businesses to keep a clear line of communication with their customers. With the help of live chat businesses helps customers to find right product, provide technical support and other necessary services.

10. Referral Candy: It is the word of mouth promotion of website where reward is provided to the one for referring to his friend about the ecommerce website.

Key takeaways-

E-payment system involves risk of fraud, forgery, money laundering etc. both for merchants and customers. Appropriate measures should take to manage such e-payment risks and secure the transactions of users. Some of the important risk management technique are-

1. Security policies and measures: Proper security relies on the development and implementation of adequate security policies and security measures for processes within the bank, and for communication between the bank and external parties. Security policies and measures can limit the risk of external and internal attacks on electronic banking and electronic money systems, as well as the reputational risk arising from security breaches.

2. System testing and surveillance: Testing of systems operations help to detect unusual activity patterns and avert major system problems, disruptions, and attacks. Surveillance focuses on monitoring routine operations, investigating anomalies, and making on-going judgements regarding the effectiveness of security by testing adherence to security policies.

3. Auditing: Auditing helps in detecting deficiencies and minimizing risks in the provision of electronic banking and electronic money services. The role of an auditor is to ensure that appropriate standards, policies, and procedures are developed, and that the bank consistently adheres to them. Audit personnel must have sufficient specialised expertise to perform an accurate review.

4. Management of cross border risks: Banks that choose to provide services to customers in different national markets will need to understand different national legal requirements, and develop an appreciation for national differences in customer expectations and knowledge of products and services. A bank may need to assess country risk and develop contingency plans that take into account service disruptions due to problems in the economic or political climate abroad.

5. Internal communication: Aspects of operational, reputational, legal, and other risks can be managed and controlled if senior management communicates to key staff how the provision of electronic banking and electronic money is intended to support the overall goals of the bank. At the same time, technical staff should clearly communicate to senior management how systems are designed to work, as well as the strengths and weaknesses of systems. Such procedures can reduce operational risks; data integrity problems; reputational risk associated with customer dissatisfaction that systems did not work as expected; and credit and liquidity risk.

6. Evaluating and upgrading: Evaluating products and services before they are introduced on a widespread basis can also help limit operational and reputational risks.

Key takeaways-

References-

1. Kotlar, P. (2019). Marketing management (4th edition.). New Delhi, Pearson Education India.