Unit 2

Company Organization

Meaning

A company can be described as a legal entity formed by a group of people to engage in and operate a business—commercial or industrial—enterprise. A company is also organized in various ways for tax and financial liability purposes relying on the corporate law of its jurisdiction. A company is typically organized to earn a profit from business activities.

The line of business the corporate is in will generally determine which business structure it chooses like a partnership, proprietorship, or corporation. The ownership structure of the company can be identified by these structures. Companies could be either public or private; the former issues equity to shareholders on an exchange, while the latter is privately-owned and not regulated.

Companies may also be distinguished between private and public companies. Both have different ownership structures, regulations, and financial reporting requirements.

A company's product line depends on its structure, which may range from a partnership to a proprietorship, or perhaps a corporation.

Definition

According to James Stephenson, “A company is an association of any persons who contribute money or money’s worth to a common stock and employs it in some trade or business, and who share the profit and loss (as the case may be) arising there from.”

Justice James defines a company as “an association of persons united for a common object.”

According to Section 3 (1) (i) of the Indian Companies Act, 1956. “Company means a company formed and registered under this act or an existing company. ‘Existing Company’ means a company formed and registered under any of the previous Company Laws.”

“A company is an artificial person created by law having a separate entity with a perpetual succession and a common seal.” Says Prof. Haney

Concept

A company is basically a synthetic person—also referred to as corporate personhood—in that it is an entity independent from the individuals who own, manage, and support its operations. Companies are generally organized to earn a profit from business activities, though some could also be structured as non-profit charities.

A company has many of the same legal rights and responsibilities as an individual does, including the ability to enter into contracts, the right to sue (or be sued), borrow money, pay taxes, own assets, and hire employees.

The benefits of starting a company include income diversification, a powerful correlation between effort and reward, creative freedom and adaptability. Many of the world's largest personal fortunes are amassed by individuals that have started their own company.

Below are the characteristics of a company organization:

1. Legal Personality

The law divides person into two kinds viz.,

- Natural persons

- Legal persons

Natural persons are human persons like men, women, children etc. The natural persons are the creations of nature.

Legal persons or artificial persons, on the other hand, are created and devised by human laws i.e. created by a legal process and not through natural birth. An artificial person, though abstract, invisible and intangible, can do everything as a natural person except a number of acts, which only natural persons can do.

A company could be a distinct legal person, existing independent of its members. The independent corporate existence is that the outstanding feature of a corporation.

2. Limited Liability

The principle of liability is a feature as well as a privilege of the company type of enterprise. In other words, the liability of the members is limited. It implies that the shareholders enjoy immunity from liability beyond a particular limit. A shareholder can't be called upon to pay anything over the unpaid value

Of the share that he has undertaken to pay under a contract between himself and the assets of the company.

3. Perpetual Succession

As a juristic person, a corporation enjoys perpetual succession. In other words, a corporation never dies, nor its life depends on the lifetime of its members. Even if all the members die, it shall not affect the privileges, immunities, estates and possessions of the corporate.

4. Right to Property

A company, being a legal person incorporates a right to accumulate, possess and get rid of property in its own name. Its property is not that of the shareholders. Although the members contribute the capital and assets of company, the property of the corporate won't be considered as the joint property of the members constituting the company.

5. Common Seal

The common seal is taken into account as the Official Signature of the company. Its common seal must authenticate all the acts. When common seal is affixed on a document, it's considered as the authoritative document of the corporate. The secretary of the company should keep the seal under lock and key. He should make use of it only consistent with the directions of the Board of Directors.

6. Transferability of Shares

The capital of a company is divided into several small parts known as shares. The primary objective of joint stock companies is that it should be possessing the ability of transfer shares easily. The law also considers the share of an organization as movable property and hence like several other movable asset, the shareholder can transfer his title over his share to some other person.

7. Capacity to Sue and be Sued

A company being a legal person, can sue other persons in its corporate name. Similarly, others may also sue the corporate in their own name. It may also be fined for contravening any law but it can't be imprisoned for a criminal offense.

8. Not a Citizen

Although a company is a legal person, it's not a citizen under the Indian Constitution. It can act only though natural persons.

Formation or Private and Public Company

The formation of a private or public company may be a lengthy process. For convenience the entire process of company formation may be divided into the subsequent four stages: 1. Promotion Stage 2. Incorporation or Registration Stage 3. Capital Subscription Stage 4. Commencement of Business Stage.

Stage 1. Promotion Stage:

Promotion forms the first stage in the formation of a company. The term ‘Promotion’ refers to the combination of activities designed to bring into being an enterprise to control a business. The technical processing of a business proposition with regard to its potential profitability is presupposed by the promotion stage. The meaning of promotion and also the steps to be taken in promoting a business are discussed in short here.

Promotion of an organization refers to the aggregation of the activities of all those who participate within the building of the enterprise upto the organization of the corporate and completion of the plan to exploit the idea. It begins with the intense consideration given to the ideas on which the business is to be based.

Stage 2. Incorporation or Registration Stage:

Incorporation or registration involves the second stage in the formation of a public or private company. It is the registration that brings an organization into existence. A company is legally constituted only if it's duly registered under the Act and a Certificate of Incorporation has been obtained from the Registrar of Companies.

Procedure to Get a Company Registered:

In order to get a company registered or incorporated, the subsequent procedure is to be adopted:

(A) Preliminary Activities:

Before an organization is incorporated, the promoter has got to take decision regarding the following:

- To decide the name of the company

- To acquire a license under Industries Development and Regulation Act, 1951

(B) Filing of Document with the Registrar:

- Memorandum of Association

- Articles of Association

- List of directors

- Written consent of directors

- Statutory declaration

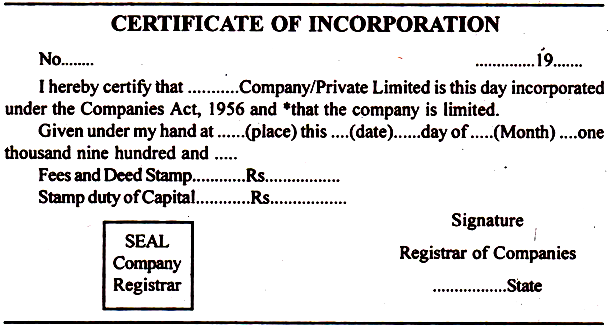

Certificate of Incorporation:

On the registration of memorandum and other documents, the Registrar will issue a certificate referred to as the Certificate of Incorporation certifying under his hand that the corporate is incorporated and, in the case of a Ltd. That the corporate is restricted.

Below is the specimen of certificate of incorporation:

Effects of Incorporation:

- The certificate of incorporation acts as an evidence of the fact that:

- The company is correctly incorporated and duly registered;

- The terms of the Memorandum and Articles are within the law;

- All requirements of the Act in respect of registration are complied with;

- a private company can start its business after getting the certificate of incorporation; and

- With the issue of certificate, the enterprise takes birth with a separate legal entity.

Formulation of Memorandum of Association (MOA) and Articles of Association (AOA)

MOA and AOA are two most significant documents for any company. MOA of company states the scope of operations of the company, whereas AOA states the principles and the way the company will be carrying the operations as per the laid Act. In case of a Private Limited company, the Articles shall mandatory consist the following three clauses in addition to general clauses:

- Limitation on the number of members up to 200

- Restriction on transfer of shares.

- Prohibition on accepting securities from public.

Through the single form SPICe, one can also apply for company’s PAN and TAN by using forms 49A for PAN and 49B for TAN. These forms will be auto generated by the system after the submission of SPICe form. One has to download it, affix digital signatures and upload both forms on MCA portal, If all the details in the form are duly filled in along with the required documents. The concerned ROC may grant the Certificate of Incorporation (COI) after due verification of the application and documents provided.

Stage 3. Capital Subscription Stage:

A private company or a public company that does not possess share capital can commence business immediately on its incorporation. The ‘capital subscription stage’ and ‘commencement of business stage’ is relevant to a public company having a share capital. Such an organization has got to undergo these additional two stages before it can commence business.

Under the capital subscription stage comes the task of obtaining the required capital for the company.

For this purpose, soon after the incorporation, a meeting of the Board of Directors is convened to contend with the subsequent business:

- Appointment of the Secretary. The appointment of pre-term secretary (who is appointed at the promotion stage) is confirmed in most cases.

- Recruitment of bankers, auditors, solicitors and brokers etc.

- Induction of draft ‘prospectus’ or ‘statement in lieu of prospectus’.

- Adoption of underwriting contract, if any.

Besides the above-mentioned activities, the Board also decides as to whether:

- a public offer for capital subscription needs to be made, and

- Listing of shares at a securities market is to be secured.

The Controller of Capital Issue will now provide permission to the company, New Delhi, under the Capital Issue Control Act, 1947 if a public offer available of shares and debentures exceeding Rs. One crore is to be made during a period of 12 months, unless the problem fulfils the conditions of exemption as laid down within the Capital Issue (Exemption) Order, 1969.

The Capital Issue Control Act, 1947 however, doesn't apply to a personal company, a depository financial institution, an insurance firm, and a government company provided it doesn't make an issue of securities to the general public.

After the above formalities are completed, the administrators of the corporate file a replica of the ‘prospectus’ with the Registrar and invite public to subscribe the shares of the company by putting the ‘prospectus’ in circulation.

Application for shares are received from the general public through the company’s bankers and if the subscribed capital is at least equal to the minimum subscription amount as disclosed within the prospectus, and other conditions of a valid allotment are fulfilled, the directors of the company pass a formal resolution of allotment.

Allotment letters are then posted, return of allotment is filed with the Registrar and share certificates are issued to the allotters in exchange of the allotment letters. If the subscribed capital is less than the minimum subscription or the company could not obtain the minimum subscription within 120 days of the issue of prospectus, all money will be refunded and no allotment can be made.

It may be noted that a public company having a share capital, but not issuing a ‘prospectus’ has got to file with the Registrar ‘a Statement in lieu of Prospectus’ at least three days before the administrators proceed to pass the primary allotment resolution.

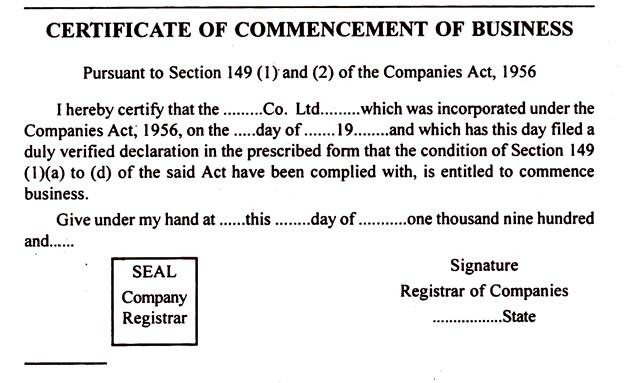

Stage 4. Commencement of Business Stage:

After getting the certificate of incorporation, a private company can start its business. A public company can start its business only after getting a’ certificate of commencement of business’.

After getting the certificate of incorporation:

- A public company issues a prospectus of inviting the general public to purchase its share capital,

- A minimum subscription is fixed, and

- The company is required to sell a minimum number of shares mentioned in the prospectus.

After making the sale of the desired number of shares a certificate is distributed to the Registrar stating this fact, along-with a letter from the banks, that it's received application money for such shares.

The Registrar scrutinizes the documents. If he is satisfied, then issues a certificate known as Certificate of Commencement of Business. This is the conclusive evidence of the commencement of the business.

The specimen of certificate of commencement of business is given below:

Merits and Demerits

A company is a legal entity, organized under state laws, whose investors purchase shares of stock as evidence of ownership in it. The merits of the company organization are as follows:

Limited liability. The shareholders of a company are only liable up to the amount of their investments. The business entity shields them from any further liability thereby their personal assets are protected.

Source of capital. A publicly-held company in particular can raise substantial amounts by selling shares or issuing bonds.

Ownership transfers. It may not be especially difficult for a shareholder to sell shares in a company, though this is more difficult when the entity is privately-held.

Perpetual life. A public or private company has no limit on its life expectancy, since ownership of it can pass through many generations of investors.

Pass through. If the company is organized as an S corporation, profits and losses are passed through to the shareholders, so that the corporation does not pay income taxes.

The demerits of a company organization are as follows:

Double taxation. Depending on the type of company, it may pay taxes on its income, after which shareholders pay taxes on any dividends received, so income can be taxed twice.

Excessive tax filings. Depending on the type of company, the various types of income and other taxes that must be paid can require a substantial amount of paperwork. The exception to this scenario is the S corporation, as noted earlier.

Independent management. If there are many investors having no clear majority interest, the management team of a company can operate the business without any real oversight from the owners.

Types of Companies

Below are the types of companies based on their structures:

On the basis of members

- One-person Company: A One Person Company is a new classification of companies introduced to encourage start-ups and young entrepreneurs wherein one person can incorporate the entity. The concept of corporatization of the business is also promoted by OPCs. It should be noted that it's not identical to as a sole proprietorship firm, in a way that OPC has separate legal existence with limited liability.

2. Private Company: A private company is one within which two or more persons get the corporate registered under the companies Act. The securities of such an organization aren't listed on a recognized stock market , and that they cannot invite the general public to subscribe for the shares/debentures. The transfer of company shares by the members is not possible in private company. The maximum number of members involved a private company is 200.

3. Public Company: This type of company is created by a minimum of seven members with a lawful objective. Its securities are listed on a recognized stock market, and its shares are freely transferable. Further, there's no limit on the maximum number of members in such an organization. The subsidiary of the general public company is also considered as a public company.

On the basis of liability

- Company limited by shares: Company limited by shares is one within which memorandum of association of the business specifies that the liabilities of the shareholders are limited to the quantity unpaid on shares which they own. Hence, the shareholders are liable only to the extent of the quantity that's not paid on their holdings.

2. Company limited by guarantee: an organization in which the liability of members is restricted to an exact sum stated in the memorandum of association of the company. Meaning that the liability of the members is confined by the MoA to a stipulated sum, as they have assured to contribute to the company’s assets, in the event of winding up of the company.

3. Unlimited Company: a vast company may be a company whose liability doesn't have any limit. In this sort of company, the liability of the member ends when he/she ceases to be a member of that company.

Special companies

- Government Company: It is a type of company in which a minimum of 51% paid up share capital is owned by Central Government/State Government, or partly by central and partly by the government authorities. Further, it also covers an organization whose holding company could be a government company.

2. Foreign Company: A foreign company is any company registered outside the country that features a business place in the home country or by way of an agent traditionally or electronically and undertakes business operations within the country in any manner.

3. Section 8 Company: a company formed for a charitable object, i.e. to encourage commerce, science, sports, art, research, education, social service, environment protection religion, etc. comes under the category of Section 8 company. These companies are given special license by the Central Government. Further, they use the hard cash and assets earned as profit for the promotion of the article and thus, dividend to members is not paid.

4. Public Financial Institution: Public financial institutions are the companies which are engaged in financial and investment business and whose 51% or more paid up share capital is held by Central Government and are established under any act. It includes LIC, ICICI, IDFC, IDBI, UTI etc.

On the basis of the control

- Holding Company: A parent company that owns and controls the management and composition of the Board of Directors of another company (i.e. subsidiary company) is termed as a holding company.

2. Subsidiary Company: a company whose over 51% of its total share capital is owned by another company, i.e. a holding company either itself or in conjunction with its subsidiaries, as well as the holding company also governs the composition of Board of Directors is termed the subsidiary.

3. Associate Company: a company within which another company possess a substantial influence over the business, then the latter is termed as an associate company. The term considerable influence implies controls a minimum 20% of total share capital, or business decisions, as per an agreement.

Apart from the list given above, there are many other companies like listed company, unlisted company, dormant company and Nidhi company.

Need

Cooperative organizations that started mainly for the provision of debt have taken many forms today. There are many cooperative institutions within the country with different sects of individuals as members. Cooperative organizations arrange loans and provide funds to their members at reasonable interest. Cooperative organizations sell their offerings in Mandis at reasonable prices, thereby avoiding exploitation by middlemen. Cooperative milk laboratories collect milk from the villages and sell it in cities and supply the members with the correct price for their milk. Cooperative stores save people's money by providing them with the proper sorts of goods at an affordable price and curb arbitrary price collection by traders. Similarly, Cooperative Housing Societies provide cheap houses to the people. Today, in almost every sphere of life, cooperative institutions are engaged for the welfare of their members.

The cooperative movement has contributed significantly to the advancement of rural areas. The feeling of brotherhood and an inclination to work together has grown among the members of these societies. Moreover, a way of real democracy is communicated among the people. Cooperative marketing institutions have helped many get out of the clutches of cash lenders and protect them from the exploitation of middlemen. Through these committees, farmers get help in saving money from moneylenders; as a result, they get into the habit of saving. It, in turn, helps them to face their problem on their own.

Meaning

A cooperative organization is an association of people, typically of limited means, who have voluntarily joined together to realize a common economic end through the formation of a democratically controlled organization, making equitable distributions to the capital required, and accepting a good share of risk and benefits of the undertaking.

The word ‘co-operation’ stands for the concept of cohabitation and working together. Cooperation is a type of enterprise the sole system of voluntary organization suitable for poorer people. It is a type of organization wherein individuals voluntarily associate together as kinsmen on a basis of equality, for the promotion of economic interests of themselves.

There are three main objectives involved in a cooperative organization - Better living, Better business and Better farming.

Characteristics of Cooperative Organization:

The following are the characteristic features of a cooperative organization as a kind of business organization:

1. Voluntary Association:

A cooperative society could be a voluntary association of persons and not of capital. Any person can join a cooperative society of his discretion and may leave it at any time. When they leave, they can withdraw their invested capital from the society. However, they cannot transfer their share to another individual.

There are two implications of the voluntary character of a cooperative association:

- The right to become a member shall not be denied

- The cooperative society won't compete anybody to become a member.

2. Spirit of Cooperation:

The spirit of cooperation works under the motto, ‘each for all and all for each.’ this implies that each member of a cooperative enterprise must work in the ultimate interest of the organization as a whole and not for his self-interest. Service is of supreme importance and self-interest is of secondary importance in a cooperative organization.

3. Democratic Management:

An individual member is taken into account not as a capitalist but as a human being and under cooperation, economic equality is fully ensured by a general rule—one man one vote. Whether one contributes as a high amount or a low amount as share capital, all enjoy equal rights and equal duties. A person having a single share can even become the president of cooperative society.

4. Capital:

Capital of a cooperative society is amassed from members through their invested share capital. Cooperatives are formed by relatively poorer sections of society; share capital is often very limited. Since it's a part of government policy to encourage cooperatives, a cooperative society can increase its capital by taking loans from the State and Central Cooperative Banks.

5. Fixed Return on Capital:

In a cooperative organization, we don't have the dividend hunting element. In a consumers’ cooperative store, return on capital is fixed and it's usually less than 12 p.c. Per annum. The surplus profits are distributed as a kind of bonus but it's directly connected with the number of purchases by the member in one year.

6. Cash Sale:

In a cooperative organization “cash and carry system” may be a universal feature. In the absence of adequate capital, grant of credit isn't possible. Cash sales also avoided risk of loss due to bad debts and it could also encourage the habit of thrift among the members.

7. Moral Emphasis:

A cooperative organization generally originates within the poorer section of population; hence more emphasis is laid on the development of ethical character of the individual member. The absence of capital is compensated by honesty, integrity and loyalty. Under cooperation, honesty is thought to be the most effective security. Thus, cooperation prepares a band of honest and selfless workers for the great of humanity.

8. Corporate Status:

A cooperative association needs to be registered under the separate legislation—Cooperative Societies Act. Every society must have at least 10 members. Registration is desirable. It gives a separate legal position to any and all cooperative organizations—just as a non-cooperative company. It also gives exemptions and privileges under the Act.

Significance

Cooperative organizations are community-based, rooted in democracy, flexible, and haveparticipatory involvement, which makes them a great instrument for economic development. The process of building and maintaining a cooperative organization involves the processes of developing and promoting community spirit, identity and social system as cooperatives play an increasingly important role worldwide in poverty reduction, facilitating job creation, national economic and social development.

Cooperative organizations are viewed as important tools for improving the living and working conditions of both women and men. Since the users of the services they supply owned them, cooperatives make decisions that balance the requirement for profitability with the welfare of their members and therefore the community, which they serve. Cooperative organizations develops economies in scope and scale, they increase the bargaining power of their members providing them, among others benefits, higher income and social protection.

Hence, cooperative organizations accord members opportunity, protection and empowerment -significant elements in elevating them from degradation and poverty.

As governments throughout the world cut services and withdraw from regulating markets, cooperatives are often considered useful mechanisms to manage risk for members and keep markets efficient.

Cooperative organizations play important role in global and national economic and social development in a number of ways. With reference to economic and social development, cooperatives promote the “fullest participation of all people” and facilitate a more equitable distribution of the advantages of globalization. They contribute to sustainable human development and have a crucial role to play in combating social exclusion. Thus the promotion of cooperative organizations should be considered as one of the pillars of national and international economic and social development.

In addition to the direct benefits they provide to members, cooperative organizations strengthen the communities in which they operate. Cooperatives can be crucial instruments for the creation of decent jobs and for the mobilization of resources for income generation. Many cooperatives provide jobs and pay local taxes because they operate in specific countries. It's estimated that cooperative organizations employ over 100 million men and women worldwide, according to Levin (2002).

In India, cooperative organizations can provide locally needed services, employment, circulate money locally and contribute to a sense of community or social cohesion. They can provide their employees with the opportunities to upgrade their skills through workshops and courses and offer youth in their base communities short and long-term employment positions. Students could also be employed in cooperative organizations on casual-appointment basis during long vacations. Through these, cooperatives will contribute to economic development.

Merits and Demerits

Merits:

Below are the main merits of cooperative organization:

1. Easy Formation:

Compared to the formation of a company, formation of a cooperative organization is easy. Any ten adult persons can voluntarily form themselves into an association and acquire it registered with the Registrar of Co-operatives. Formation of a cooperative society also doesn't involve long and complex legal formalities.

2. Limited Liability:

Like company kind of ownership, the liability of members is restricted to the extent of their capital within the cooperative societies.

3. Perpetual Existence:

A cooperative organization has a separate legal entity. Hence, the death, insolvency, retirement, lunacy, etc., of the members do not affect the perpetual existence of a cooperative organization.

4. Social Service:

The basic philosophy of cooperatives is self-help and mutual help. Thus, cooperative organizations foster sympathy among their members and inculcate moral values in them for a more robust living.

5. Open Membership:

The membership of cooperative organizations is open to all irrespective of caste, colour, creed and economic status. There is no limit on maximum members.

6. Tax Advantage:

Unlike other three forms of business ownership, a cooperative organization is exempted from income-tax and surcharge on its earnings up to a certain limit. Besides, it's also exempted from stamp duty and registration fee.

7. State Assistance:

Government has adopted cooperatives as a good instrument of socio-economic change. Hence, the Government offers a number of grants, loans and financial assistance to the cooperative organizations – to make their working more effective.

8. Democratic Management:

The management of cooperative organization is entrusted to the managing committee duly elected by the members on the premise of ‘one-member one -vote’ regardless of the number of shares held by them. The proxy is not allowed in cooperative organizations. Thus, the management in cooperatives is democratic.

Demerits

In spite of its numerous advantages, the cooperative also has some disadvantages which must be seriously considered before choosing this type of business ownership.

The most significant demerits are:

1. Lack of Secrecy:

A cooperative organization has to submit its annual reports and accounts with the Registrar of Cooperative Societies. Hence, it becomes quite difficult for it to keep up secrecy of its business affairs.

2. Lack of Business Acumen:

The member of cooperative organizations generally lack business acumen. The affairs of the society are expectedly not conducted efficiently when such members become the members of the board of directors. These also cannot employ the professional managers because it's neither compatible with their avowed ends nor the limited resources yield the same.

3. Lack of Interest:

The paid office-bearers of cooperative organizations do not take interest in the functioning of societies due to the absence of profit motive. Business success requires sustained efforts over a period of time which, however, doesn't exist in many cooperatives. As a result, the cooperatives become inactive and arrive to a grinding halt.

4. Corruption:

Lack of profit motive breeds fraud and corruption in management in a way. This is reflected in misappropriations of funds by the officials for his or her personal gains.

5. Lack of Mutual Interest:

The success of a cooperative organization depends upon its members’ utmost trust to each other. However, all members in a cooperative organization may not be imbued with the same spirit of co-operation. Mutual rivalries among the members may be bred due to absence of such spirit. Influential members tend to dominate within the society’s affairs.

Concept

The main points in the concept of public enterprises are:

- Public enterprises are established, owned, managed and controlled by government.

- Public enterprises have autonomy or semi-autonomy in functioning.

- Public enterprises have service motive to promote social welfare.

- Public enterprises have public accountability.

- Public enterprises have separate legal entity.

The concept of public enterprises in India can be classified into three forms:

Departmental Undertaking – It is a type of public enterprise which is primarily established for providing essential services like railways, postal services, etc. to the general public. Such organizations are controlled in the same way as any other department in the government by a ministry of the government. This form of a public enterprise is especially beneficial for activities which require governmental control for the public interest.

Statutory or Public Corporation – A corporate body can be created by the Parliament or State Legislature through a Special Act which defines its functions, powers, and pattern of management. This is known as a Statutory or Public Corporation. The entire capital is supplied by the government in this type of public enterprise. Following are some examples of these kinds of organizations: Life Insurance Corporation of India (LIC), State Trading Corporation, etc.

Government Company – It is a type of enterprise in which the government holds at least 51 percent of the paid-up capital. A Government Company needs to be titled and legally registered under the Companies Act. All the provisions of the Companies Act are applicable to such a company. Following are some examples of government companies: Bharat Heavy Electricals Limited, Bharat Electronics Limited, etc.

Meaning

A public enterprise can be defined as “Any commercial or industrial undertaking which the government owns and manages with a view to maximize social welfare and uphold the public interest.”

Public enterprise is a kind of company which is owned, administered and controlled by the government. It is essential that the government participates actively at both individual and commercial level. These enterprises are financed and operated by the government itself. Their primary purpose includes providing services to the general public. It also includes providing goods and services to the public at an affordable price. Although a public enterprise is guided by service motives, it can also earn considerable profits.

A public enterprise assists in maintaining the state of ownership and operation of industrial, agricultural, financial and commercial undertaking.

Characteristics

Given below are the fundamental characteristics of a public enterprise

- Financed by Government:

Public enterprises are either completely or partially financed by the government. They are either owned by the state or central government or the governing authority holds a majority stake in the form of shares in the enterprise. Private investments are also allowed in some undertakings but the dominant role is played by the government as it were.

2. Government Management:

Public enterprises are administered and managed completely by the government. In many cases the government undertakes enterprises under its own departments. In other cases, government nominates employees to manage the enterprises. The government departments also controls autonomous bodies either directly or indirectly.

3. Financial Independence:

Public enterprises are financially independent as investments in them are done by the government. However, a public enterprise does not dependent on the government for their day- to-day operations. These enterprises are independent to arrange and manage their own finances. They are also independent to consider profitability is a major element while pricing their products. This financial independence allows room for growth in public enterprises.

4. Public Services:

Providing various services to the society is the primary aim of every public enterprise. These enterprises are commenced with a public service motive in mind. A private entrepreneurship may be found only for the purpose of earning profits but it is in no way the sole purpose of a public enterprise.

5. Useful for Various Sectors:

The services of a public enterprise are not limited to a particular section of the society, they cater to each and every individual. All sectors of the economy are served by a public enterprise.

6. Direct Channels for Using Foreign Money:

Public enterprises utilize most of the government to government aid. Public enterprises also use financial and technical assistance received from industrially advanced countries.

7. Helpful in Implementing Government Plans:

One of the most important functions of a public enterprise in to implement economic policies and plans of the government.

8. Autonomous or Semi-autonomous Bodies:

Public enterprises can be either autonomous or semi-autonomous bodies. They can work under the control of government departments in some cases and they can also be established under statutes and under Companies Act in others.

Objectives

The essential objectives of public enterprises are as follows:

1. Economic development:

Public enterprises are typically set up to aggregate the rate of economic growth of a country in a planned manner. These enterprises create the foundation for the rapid industrialization of a country. They also provide infrastructure facilities for promoting balanced and diversified economic structure of development.

2. Self-reliance:

Promotion of self-reliance in strategic sectors of the national economy is one of the most important objectives of a public enterprise. Public enterprises have been set up in transportation, communication, energy, Petro-chemicals, and other key and basic industries for this purpose.

3. Development of backward Areas:

To reduce regional imbalances in development, several public enterprises are often established in backward areas. It is essential for social and strategic reasons for the balanced development of different parts of the country.

4. Employment generation:

In a country like India unemployment has become a serious problem. Public enterprises aim to provide gainful employment to people thereby reducing unemployment. Several sick units in the private sector have also been nationalized in order to protect jobs

5. Economic surplus:

Generation and mobilization of economic surplus for reinvestment is a major aim of public sector enterprises. These enterprises accumulate profits and mobilize public savings in order to accelerate industrial development.

6. Egalitarian society:

An important objective of public enterprises is to prevent the growth of private sector monopolies and the concentration of economic power in the hands of a few. The Government to enforces social control on trade and industry with the help of public enterprises for ensuring equitable distribution of goods and services. Small scale industries are also protected and promoted by public enterprises.

7. Consumer welfare:

Public enterprises aim at stabilizing prices and protecting consumers from exploitation and profiteering by ensuring supply of essential commodities at cheaper prices.

8. Public utilities:

Private sector is reluctant to invest money in public utility services like water supply, gas, electricity, public transport as it is primarily guided by economic profit. Therefore, the Government has to assume responsibility for providing such services by means of public enterprises.

9. Defence:

Supply of defence equipment and ordnance cannot be entrusted for private sector due to the need for utmost secrecy. Therefore, public enterprises are set up for the production of such equipment.

10. Labour welfare:

Public enterprises are required to serve as model employers. They aim to ensure welfare and social security of employees. The development of townships, schools, college and hospitals for workers has also been an important objective of public enterprises.

Significance

Below are some reasons why public enterprises are significant in an economy:

1. Planned Development

Most developing countries follow a five-year development plan for economic development of specific regions. Public enterprises play a vital role in achieving targets in such plans. Public enterprises also implement public sector programs. Therefore, public enterprises facilitate the planned development of an economy and country.

2. Infrastructure Development

Transport, communication, power, irrigation, drinking water and buildings are all components of infrastructure. Tasks related to infrastructure require large investments and long durations. Here, private business do not seem to be interested in the infrastructural development of a country therefore, public enterprises play a significant role in building infrastructure in the country.

3. Basic and heavy industries development

Examples of basic and heavy industries include iron and steel, electricity, cement, fertilizer, petroleum and telecommunications. All of these industries play a vital role in the industrialization process of a country. While the private sector lacks resources and interest to invest in such industries, public enterprises posses both the funds and abilities to establish and develop basic and heavy industries. Public enterprises also engage in defence equipment production and ordnance development.

4. Public utilities concerns

Public utilities consists of services such as be water supply, electricity, oil and gas, railways, airlines, public transport and telecommunications. These services are the basic amenities required for everyday life. It is the government’s responsibility to provide such services at a reasonable and affordable price. Therefore, public enterprises serve as an important tool to provide public utility services at low costs.

5. Balanced development

A balanced development of all the regions of the country is required. Because of the possibility of low economic gain, private enterprises are not attracted to less developed regions. Therefore, public enterprises play a vital role in the industrial development of backward regions.

6. Employment creation

It is the responsibility of the government to generate sufficient employment opportunities in the country. Public enterprises are important as they generate employment opportunities in the country especially in rural or less developed areas. Since the size of a public enterprise is typically humongous, the generation of employment is vast and therefore it provides ample opportunities of financial growth to a country’s youth.

7. Government revenue

Public enterprises are a considerably large source of government revenue. Customs duties, value added tax, excise duty, income tax and others are some of the types of taxes paid by a public enterprise. These taxes help increase government revenue. Development programs can also be funded from the profit generated by public enterprises.

8. Economic growth

A Public enterprise is one of the main drivers of economic growth in the country as they develop infrastructure facilities and operate public utilities. They also implement modern technology for production purposes.

9. Social welfare

One of the most important functions of a public enterprise is to provide essential goods and services at an affordable rate. Essential commodities such as fertilizer and food grains at subsidized price are also supplied by a public enterprise. The keep the price of essential goods in check with regular supply.

10. Implementation of Policies

As public enterprises are created and managed by the government, they help in administering the implementation of new government laws and policies.

Multinational Corporations (MNCs) also referred to as Transnational Corporation (TNC) or Multinational Enterprise (MNE) can be described as a business unit which operates simultaneously in numerous countries around the globe. In some cases, the manufacturing unit can be in one country, while the marketing and investment is in other country.

In other cases, all the business operations are administered is other countries, with the strategic headquarters in any part the planet. The MNCs are large corporate enterprises that extend their business operations beyond the country of origin through a network of industries and marketing operations.

Role of Multinational Corporations in the Indian Economy

Prior to 1991 Multinational companies failed to play much role within the Indian economy. The Indian economy was dominated by public enterprises in the pre-reform period.

To prevent concentration of economic power industrial policy 1956 didn't allow the private firms to grow in size beyond some extent. MNCs didn't play much role within the Indian economy where import-substitution development strategy was followed even though they played a significant role in the promotion of growth and trade in South-East Asian countries. After the adoption of business policy since of liberalization and privatization since 1991 rote of private foreign capital has been recognized as important for rapid development of the Indian economy.

Multinational corporation have been allowed to work in the Indian economy subject to some regulations since source of bulk of foreign capital and investment lie in other countries. The following are the important reasons for this alteration in policy towards multinational companies during the post-reform period.

1. Promotion Foreign Investment:

External assistance to developing countries has been declining in recent years. This is because the investing developed countries have not been willing let go of larger proportion of their GDP for supporting developing countries. MNCs can act as a bridge between the needs of foreign capital for increasing foreign investment in India.

The liberalized foreign investment (1991) allows MNCs to make investment in India subject to different limits fixed for different industries or projects. Foreign investment has also a multiplier effect on income and employment in a country like domestic investment.

For instance, the effect of Suzuki firm’s investment in Maruti Udyog manufacturing cars is not confined to income and employment for the workers and employees of Maruti Udyog but goes beyond that. Many workers are employed in dealer firms who sell Maruti cars.

2. Non-Debt Creating Capital inflows:

Foreign direct investment by MNCs was discouraged in the pre-reform period, thus, India relied heavily on external commercial borrowing (ECB) which was of debt-creating capital inflows. This elevated the external debt and debt service payments reached the alarming figure of 35 per cent of India's current account receipts. This lead to doubts about the country's ability to fulfill debt obligations which lead to the balance of payments crisis in 1991. MNCs can avoid the liability of debt-servicing payments as direct foreign investments by multinational corporation represents non-debt creating capital inflows. The benefits of investment by MNCs lies in the fact that servicing of non-debt capital begins only when the MNC firm reaches the stage of making profits to repatriate Therefore, MNCs can play a vital role in reducing stress strains and on India’s balance of payments (BOP).

3. Technology Transfer:

One of the most vital roles of an MNC is to transfer high sophisticated technology to developing countries which are crucial for raising productivity of working class and enabling them to start new productive ventures requiring high technology. MNCs not only import new equipment and machinery embodying new technology but also skills and technical know-how to use the new equipment and machinery whenever multinational firms set up their subsidiary production units or joint-venture units.

This leads to Indian workers' and engineers' increased knowledge of new superior technology and the way to use it. The corporate sector spends only few resources on Research and Development (R&D) in India. The larger MNCs tend to spend a lot on the development of new technologies which may greatly benefit the developing countries by transferring the new technology developed by them. Therefore, MNCs play a vital role in the technological advancement of the Indian economy.

4. Promotion of Exports:

Lower costs multinationals can play a significant role in promoting exports of a country in which they invest with extensive links all over the world and effective production. Historically in India, MNCs made large investment in industries whose products they exported. Japanese automobile company Suzuki made a large investment in Maruti Udyog with a joint collaboration with Government of India in recent years. This made Maruti cars available to be sold not only in the Indian domestic market but are exported in a large number to the foreign countries.

When giving permission to a multinational firm for investment in India, the Indian government granted the permission subject to the condition that the concerned multinational company would export the product so as to earn foreign exchange for India.

5. Investment in Infrastructure:

It is said that multinational corporations could invest in infrastructure such as power projects. Modernization of airports and posts, telecommunication with a large command over financial resources and their superior ability to raise resources both globally and inside India.

The investment in infrastructure will not only provide a significant boost to industrial growth but will also help in creating income and employment in the India economy. The external economies generated by investment in infrastructure by MNCs will therefore crowd in investment by the indigenous private sector and will therefore stimulate economic growth.

List of MNCs in India

Due to India’s growing economy, globalization and its potential in the market, many of the multinational companies are coming to India to extend their business. Below are the top Multinational Companies operating in India currently:

1. Microsoft

2. IBM

3. Nestle

4. Proctor & Gamble

5. Coca-Cola

6. Pepsico

7. CITI Group

8. SONY Corporation

9. Hewlett Packard

10. Apple Inc