UNIT V

Recent Industrial Policy

Overview of Industrial Policy:

The government's new industrial policy: liberalisation, deregulation and privatisation

A bigger role was offered.

L-liberalization (reduced government control))

P-privatization (increase the role and scope of the private sector)

G-globalization (integration of Indian and global economies)

It also describes the government's policy on industry, its establishment, functioning, progress and management, foreign capital and technology, labour policy and tariff policy. India's industrial policy determined the pattern of financial and industrial development of the economy.

The main objectives of the new economic policy-1991

The main objectives of launching a new economic policy (NEP) in 1991 are:

- The new economic policy was intended to reduce inflation and remove payment imbalances.

- It was intended to maneuver towards higher economic process and build sufficient exchange reserves.

- The new economic policy was aimed at achieving economic stabilization and turning economic policy into a market economy by removing all kinds of unnecessary restrictions.

- The new economic policy wanted to allow an international flow of goods, services, capital, human resources and technology without much restriction.

In mid-1991, the government made some drastic changes to its policy based on trade, foreign investment exchange rates, and industry and trade fairs finances. Various factors make up economic policy. It is recorded in the literature that economic development ultimately depends on industrialization. Industrial policy implies all the principles, rules, regulations and procedures regarding the growth rate, ownership, location patterns, and functioning of the country's industrial operations on the way to industrialization. Before Independence, India had no policy for industrialization in 1947, after Independence, India changed the scenario. The industrial policy was announced by the govt of India in 1948, and therefore the industrial act of 1951 was passed to offer this policy a cloth form. This policy was changed in 1956 to offer a concrete policy. It was further modified to give shape to the ideology of mixed economy and socialist society patterns. The political party, Janta Dal, changed its policy in 1977(Pathak, 2007). The policy was revised again in 1980. The National Front government brought some changes to industrial policy in 1990. In the decade of the 1990s, the Indian government decided to deviate from its previous economic policies and learn towards privatization to come out of the economic crisis. In 1991, the devaluation of the Indian currency took place, and the government began to announce one after another new economic policies (Gupta, 1995). These policies concerned different aspects of the economic sphere, but there were several common factors. The economic component was to direct the Indian system to the world market.

The government has launched a new economic policy with three key features: liberalization, privatization and globalization. Liberalization of the economy means liberation from direct or physical control imposed by the govt. Economic change was based on the assumption that market forces could guide the economy in a more effective way than government (Pathak, 2007).

New economic policies: liberalization, deregulation, privatization

In the 20th century, there has been a wave of transformation of economic policy in developing countries, with one country taking one after another the cure for liberalization, which is often imposed by international financial institutions. This wave of reforms proceeded a quarter century of state-oriented efforts in economic development, during which the goals of economic independence and import substitution industrialization were trademarks of development strategies in developing countries. These goals seemed especially justified, given the long experience of these countries with colonialism and the agricultural nature of the economy. But all this seemed to be overtaken by a continuous stream of liberalization (Gupta, 1995).

Liberalization:

Liberalization is an important factor in modern economic policies around the world, including India, based on the idea of removing restrictions on domestic economic activity and trade relations with other countries that have a beneficial impact on the economy. Liberalization is a procedure that frees the economy from the domination of excessive bureaucratic and other restrictions imposed by the state. The phrase "liberalization" infers economic liberalization. Economic liberalization constitutes one of the fundamental elements of the new economic policy (NEP) launched by the Indian government in mid-1991. Other key aspects of policy are public sector privatisation, globalization and market-friendly states. The main confidence in the new economic policy is "liberalization." The principle of this policy is that greater freedom should be given to businesspeople in any industry, trade or business, and government control over the same is minimized (Gupta, 1995).

The purpose of liberalization was to reduce corporate freedoms for many years and dismantle the excessive control framework in which the country had developed a system of licensing permits raj. The purpose of the new economic policy was to save businessmen from unnecessary harassment of seeking permission from bab doom (the country's bureaucrats) to start a business. The main drive of the process to economic liberalization is to set up business freely and run on commercial lines. The underlying conviction is fixed, including commercial practice-matters not related to business. Unnecessary government restrictions that block economic and commercial activities and the flow of goods and services must be eliminated.

Deregulation: deregulation is a heated issue for many government bureaucrats and behemoths. Since the last few decades, a huge number of economies both developed and developing countries have deregulated their banking system.

Concept of deregulation: Management studies demonstrate that deregulation is a procedure to eliminate or reduce state regulations. There are rules and clear rules that must be followed by every company these rules are created by industry associations, regulators and governments. Adekanye(2002) states that the deregulation policy was adopted in 1987 in response to the deterioration of the domestic economic situation due to the crash of the international oil market and the harsh policies of the financial sector. Adekanier showed that policies were adopted to achieve the release of the financial system as well as the availability of fiscal balances and payments by changing and restructuring the production and consumption patterns of the economy, eliminating price distortions, reducing heavy dependence on crude oil exports and consumer goods imports, strengthening the non-export base, and achieving sustainable growth.

Privatization: Privatization is strongly associated with the phenomenon of globalization and liberalization. Management scholars described privatization as the transfer of control over ownership of economic resources from the public sector to the private sector. This means that as property rights move from state to private ownership, the role of the public sector declines. Privatization is a management approach that has attracted the interest of many people, academics, politicians, private sector government employees, corporations and public groups. It is observed that the public sector has several problems since the planning, such as low efficiency and profitability, mounting losses, excessive political interference, lack of autonomy, labor problems and delays in the completion of the project. To overcome these problems, the new industrial policy'1991 began the process of privatization into the Indian economy.

Meaning

The government's actions need to influence the ownership and structure of the industry and its performance. It pays subsidies or provides finance in other ways, or takes the form of regulation.

Procedures, principles (that is, the philosophy of the given economy), policies, rules and regulations, incentives and punishments, tariff policies, Labour policies, the attitude of the govt. To foreign capital, etc are included.

Purpose

The main objectives of the Indian government's industrial policy are:

- To maintain sustainable growth in productivity;

- To strengthen paid employment;

- To realize optimal utilization of human resources;

- To achieve international competitiveness

- Turning India into variety one partner and player within the worldwide arena.

Industrial policy in India since independence

- Industrial policy resolution of 1948-it defined a broad outline of the policy, which portrays the role of the state in industrial development as both an entrepreneur and an authority.

- It revealed that India features a mixed economic model.

- It classified the industry into four broad fields:

- Strategic industries (public sector): it included three industries that were monopolized by the central government. These included weapons and ammunition, nuclear power and rail transport.

- These industries were to be established by the central government.

- However, existing private sector companies were allowed to continue.

- These industries still remain under the private sector, but the central government, in consultation with the govt, generally controlled them.

- The industrial (development and Regulation) Act was passed in 1951 and thus the economic policy resolution was adopted in 1948.

- That period was referred to as "the economic Constitution of India" or" the Bible of state capitalism"

- It provided a basic framework for state policy on industry until 1991.

- IPR classified the industry into three categories in 1956

Schedule A

Consisted of 12 industries, which were hospitable both the private and public sectors, but such industries were gradually state-owned.

Schedule B

Schedule C

All other industries not included in these two schedules constitute a third category, which is hospitable the private sector but the state reserved the right to undertake industrial production of any type.

The resolution also involved efforts to require care of commercial peace; a justifiable share of the income of production should tend to the toil masses, in line with the professed purpose of democratic socialism.

Criticism: as this resolution significantly reduced the scope of private sector expansion IPR1956 came for sharp criticism from the private sector, The department has less state control over the system of licensed staff.

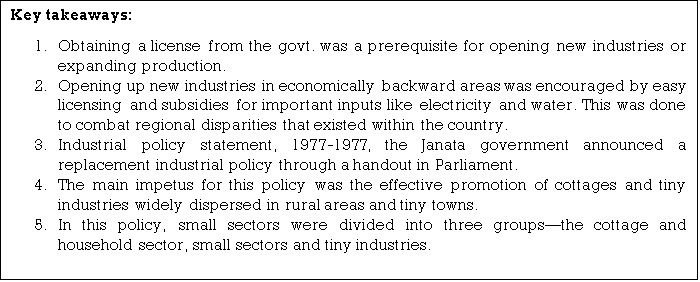

Industrial license

The industrial policy of 1977 stipulated a selection of sectors for the huge industrial sector: Basic Industries, capital goods industries, high-tech industries and other industries that are outside the list of reserved items for small-scale industries.

The industrial policy of 1977 limited the scope of giant companies, therefore the units of the same business group didn't acquire a dominant and exclusive position within the market.

It focuses on reducing the occurrence of Labor anxiety. The govt. Encouraged workers to participate in management from the world level to the board level.

The industrial policy of 1980 sought to plug the concept of economic federations, increase public sector efficiency, and reverse industrial production trends over the past three years, and reaffirmed faith within the monopoly and restricted trade practices (MRTP) Act and thus the exchange Regulation Act (FERA).

New industrial policy in 1991 economic reforms

The long-awaited liberalized industrial policy was announced by the Indian government in 1991 within the midst of severe economic unrest within the country. The aim of the policy was to increase efficiency and accelerate process.

Features of the new industrial policy

- Public sector cancellations: sectors previously reserved exclusively for the overall public sector are reduced. However, the outstanding location of the overall public sector within the 5 core areas of arms and ammunition, nuclear power, soil, rail transport and mining continued.

- Tobacco cigars and tobacco and manufactured tobacco substitutes public sector investment: government stakes in public sector companies have been cut to increase their efficiency and competitiveness.

- Foreign investment liberalization: this was the first industrial policy that allowed foreign companies to have a majority stake in India. In 47 high-priority industries, up to 51% of FDI was allowed.

- Delicens: abolition of industrial licenses for all projects except a short list of industries.

- Currently, there are only 4 industries related to security, strategy and Environment, and an industrial license is required-

- Electronic aerospace and defence equipment

- Specific hazardous chemicals

- Industrial explosives at present, only two sectors-nuclear power and rail operations-are reserved exclusively for the public sector.

- Industrial explosives foreign technology contracts: automatic approval of technology-related contracts.

- The MRTP Act was amended to remove asset threshold limits for MRTP companies and dominant businesses. The MRTP Act was replaced by the Competition Act of 2002.New industrial policy outcomes

- It sought to liberalize the economy by removing the bureaucratic hurdles of industrial growth.

- The limited role of the public sector has reduced the burden on the government.

- The policy provided easy entry of multinationals, privatization, removal of asset limits of MRTP companies, liberal licensing.

- All this led to increased competition, which led to lower prices for many goods, such as the price of electronics. This has resulted in domestic and foreign investment in almost all sectors open to the private sector.

- This policy was followed by special efforts to increase exports. Such concepts as export-oriented units, export processing zones, agricultural export zones, special economic zones, and recently, National Investment and manufacturing zones have appeared. All this brought benefits to the export sector of the country.

New industrial policy outcomes

The limited role of the general public sector has reduced the burden on the govt.

All this led to increased competition, which led to lower prices for several goods, like the worth of electronics. This has resulted in domestic and foreign investment in most sectors hospitable the private sector.

This policy was followed by special efforts to extend exports. Such concepts as export-oriented units, export processing zones, agricultural export zones, special economic zones, and recently, National Investment and manufacturing zones have appeared. All this brought benefits to the export sector of the country.

Limitations of commercial policy in India

- Manufacturing stagnation: India's industrial policy has done not push manufacturing, whose contribution to GDP has stagnated at about 16% since 1991.

- Distortion of commercial pattern thanks to selective inflow of investment: at the present stage of investment after liberalization, considerable investment has flowed into several industries, but there's concern that the pace of investment in many basic and strategic industries, like engineering, power and machine tools, is slow.

- Labour migration: the restructuring and modernization of the industry as a sequel to the new industrial policy led to labour migration.

- Lack of incentives to extend efficiency: focusing attention on internal liberalization without sufficient emphasis on national trading policy reform resulted in "consumption-led growth" rather than "investment "or" export-led growth".

- Vaguely defined industrial status policy: the new industrial policy can ensure pollution-free development of commercial climate, while highlighting the harmful effects of environmental damage.

The way forward

India's industrial policy has taken a shift from a largely socialist pattern in 1956 to a capitalist pattern since 1991.

India now has many liberalized industrial policy regimes focused on increasing foreign investment and lowering regulations.

India ranked 77th within the World Bank's Doing Business Report for 2018.

Reforms associated with bankruptcy resolution (bankruptcy and Insolvency Act, 2017) and therefore the goods and Services Tax (GST) are impressive and can bring long-term benefits for the economic sector.

Campaigns like Make in India and begin Up India have helped strengthen the country's business ecosystem.

However, power shortages and high prices, credit constraints, high unit labor costs thanks to labor regulations, political interference, and other regulatory burdens remain challenges for the robust growth of the economic sector in India.

There is a requirement for brand spanking new industrial policies to spice up the country's manufacturing sector. In 2018 the govt also felt the necessity to introduce a replacement industrial policy, which can be a roadmap for all business enterprises within the country.

There is a requirement for brand spanking new industrial policies to spice up the country's manufacturing sector. In 2018 the govt also felt the necessity to introduce a replacement industrial policy, which can be a roadmap for all business enterprises within the country.

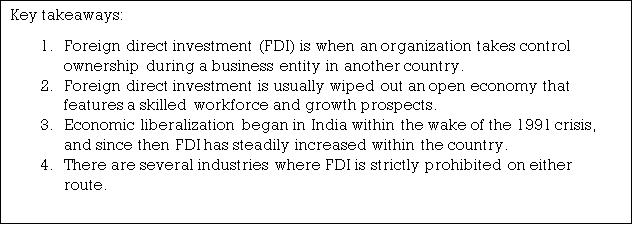

Foreign direct investment (FDI) is when an organization takes control ownership during a business entity in another country. In FDI, foreign companies are directly involved in day-to-day operations in other countries. This suggests that they're bringing money with them, also as knowledge, skills and technology.

In general, FDI is completed when an investor acquires a far off business asset, including establishing ownership or control over a far off company.

Where is FDI made?

Foreign direct investment is usually wiped out an open economy that features a skilled workforce and growth prospects. FDIs not only bring them not only skills, technology, knowledge and money.

FDI in India

FDI is a crucial financial source for India's economic development. Economic liberalization began in India within the wake of the 1991 crisis, and since then FDI has steadily increased within the country. India Today may be a component of the very best 100 clubs on simple doing business (EoDB) and is ranked no 1 globally within the Greenfield FDI rankings.

The route India gets FDI

- Automatic routes: non-residents or Indian companies don't need the prior nod of the RBI or the Indian government for FDI.

- Government route: government approval is mandatory. The corporate can file the appliance through the Foreign Investment Facilitation Portal, one window.

The sectors that come right down to the'100% automatic route' category are

- Infrastructure companies within the Securities Market: 49%

- Insurance: up to 49%

- Medical equipment: up to 100%

- Pension 49%

- Oil refining (by Psu): 49%

- Power replacement: 49%

Government agency route

- Gov. Sectors:

Banking and Public Sector: 20%

Broadcast content services: 49%

Core Investment Company: 100%

Food retail: 100%

Multi-brand retailers: 51%

Print media (scientific and technical journals, professional journals, periodicals, facsimile editions of foreign newspapers, publications and printing): 100%Satellite (installation and Operation): 100%

FDI ban

There are several industries where FDI is strictly prohibited on either route. These industries

- Nuclear power

- Any gambling or betting business

- Lotteries (online, private, government, etc)

- Investing in chit funds

- Agricultural or plantation activities (with many exceptions, like horticulture, fishing, tea plantation, aquaculture, and animal husbandry)

- Housing and land (excluding towns, commercial projects, etc.))

- TDR trading

- Cigars, cigarettes, or related tobacco industries

FDI influx

During fiscal 2019, India received the very best ever FDI inflows of $ 64.37 billion. FDI inflows were $ 45.14 billion during 2014-15 and $ 55.55 billion the next year.

What is foreign direct investment (FDI)?

Foreign Direct Investment (FDI) is an investment from a party in one country to an enterprise or enterprise in another country with the aim of establishing a lasting profit. Persistent interest distinguishes FDI from foreign portfolio investments in which investors passively hold securities from foreign countries.

Elements of persistent interest and control

- Investments in foreign companies are considered FDI if it establishes a lasting interest. Persistent interest is established when the investor acquires at least 10% of the voting rights of the company.

- Control represents the intention to actively manage and influence the business of foreign companies. This is a major differentiator between FDI and passive foreign portfolio investment.

- For this reason, to define FDI, a 10% stake in the voting shares of a foreign company is required. However, this criterion may not always apply. For example, it is possible to exert control over companies that are traded more widely, despite a small percentage of voting rights.

Advantages of foreign direct investment

Foreign direct investment provides benefits to both investors and foreign host countries. These are favourable for both sides to make a direct investment in the country.

Below are some of the benefits for companies:

- Market diversification

- Tax incentives

- Reduce labor costs

- Preferential tariffs

- Subsidies

Some of the benefits of the host country include:

- Economic stimulus

- Development of human capital

- Increased employment

- Access to management expertise, skills and technology

For companies, most of these benefits are based on cost savings and reduced risk.

Disadvantages of foreign direct investment

- Despite the many advantages, FDI still has two main drawbacks, such as:

- Displacement of local businesses

- Profit repatriation

- The entry of large companies like Walmart could replace local companies. Walmart is often criticized for driving out local companies without competition under the price.

- In the case of profit repatriation, the main concern is that companies do not reinvest their profits in the host country. This leads to large capital outflows from the host countries.

As a result, many countries have regulations that limit foreign direct investment.

Types and examples of foreign direct investment

In general, there are two main types of FDI: horizontal and vertical FDI.

- Horizontal: business to expand its domestic business to foreign countries. In this case, the business conducts the same activities in a foreign country. For example, McDonald's open restaurants in Japan are considered horizontal FDI.

- Vertical: business expands to foreign countries by moving to different levels of the supply chain. In other words, companies that conduct different overseas activities are the main business involved in these activities. Using the same example, McDonald's can buy a large farm in Canada to produce restaurant meat. But two other forms of FDI have also been observed: conglomerate and platform FDI.

- Conglomerate: business gets irrelevant business in a foreign country. This is unusual because two barriers have to be overcome: entry into foreign countries and entry into new industries and markets. An example of this is when the UK-based Virgin Group acquired a line of clothes in France.

- Platform: business will expand to foreign countries, but output from foreign business will be exported to third countries. This is also called the export platform FDI. Platform FDI generally occurs in low-cost locations within the Free Trade Area. For example, if Ford purchased a manufacturing plant in Ireland with the main purpose of exporting cars to other countries within the EU

References:

- Https://byjus.com/free-ias-prep/industrial-policy-india/

- Https://www.livemint.com/news/india/new-industrial-policy-set-to-be-unveiled-in-budget-1562181478574.html

- Https://dipp.gov.in/policies-rules-and-acts/policies/industrial-policy

- Https://en.wikipedia.org/wiki/Industrial_policy

- Https://en.wikipedia.org/wiki/Foreign_direct_investment

- Https://www.investindia.gov.in/foreign-direct-investment