UNIT 5

Partnership Accounts

Partnership

Partnership’ involves association of two or more persons who pool their financial and managerial resources and agree to carry on a business, and share its profit. The persons who form a partnership are individually known as partners and collectively a firm or partnership.

Definition of Partnership:

Indian Partnership Act, 1932 defines partnership as “the relation between persons who have agreed to share the profits of the business carried on by all or any of them acting for all”.

Features

- Members – At least two people are required to form a partnership firm.

2. Contractual relationship – To become partners, the person should not be minor, lunatics and insolvent. However minor can share the profit without any obligation for losses.

3. Sharing profits – partnership agreement contains the partner can share the profits and losses of the business.

4. Existence of lawful business – the partnership business carried on by the partners must be lawful.

5. Unlimited liability – the partners of the firm have unlimited liability. Personal properties of the partners are used to pay the debts and business obligations

6. Principal agent relationship – there must be agency relationship between the partners. Every partner is a principal as well as agent of the firm

7. Voluntary registration – the registration of partnership firm is voluntary in nature. Firm which is not registered suffers from some limitations

Maintenance of Capital Accounts of Partners

The partner’s capital accounts are maintained according to fluctuating capital method or fixed capital method.

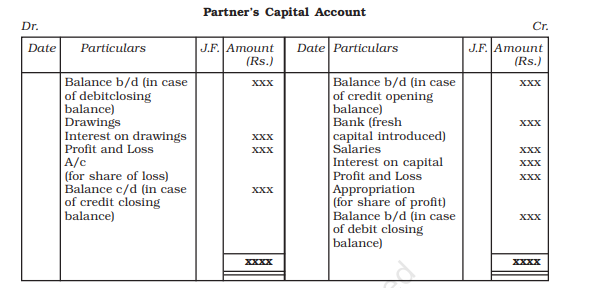

• Fluctuating capital method – under fluctuating capital method, only one account – capital account for each partner is maintained and all the transactions relating to a partner are recorded in his capital account. As a result, the balance in the capital accounts keeps on fluctuating.

Pro forma of partner’s capital account under fluctuating capital method

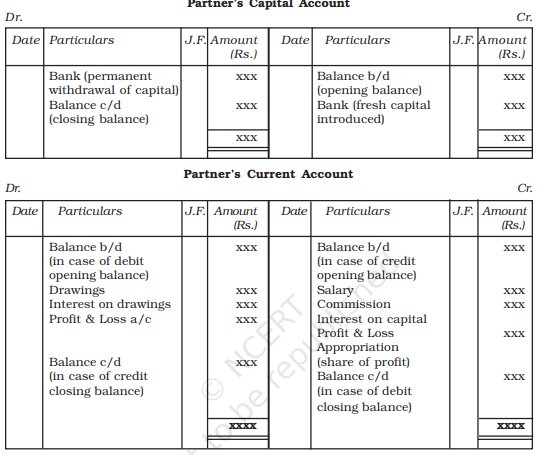

• Fixed capital method – under fixed capital method, two accounts – capital account and current account for each partner are maintained. The transaction relating to introduction or withdrawal of capital are recorded in capital account and other transaction like interest on capital, salary, interest on drawing, drawings are recorded in current account.

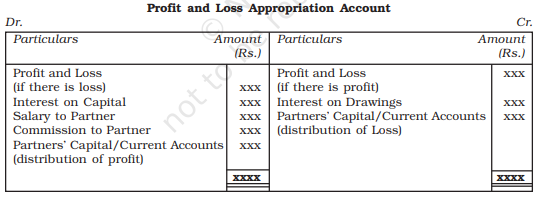

Profit and loss appropriation account

Profit and loss appropriation account is an extension of profit and loss that is prepared to distribute the net profit among the partners. All adjustments relating to partners like interest on capital, interest on drawings, commissions partners, etc are made in this account. The main purpose of preparing profit and loss appropriation account of a partnership concern is to calculate and distribute the divisible profit and loss.

Journal Entries

1. Transfer of the balance of Profit and Loss Account to Profit and Loss Appropriation Account:

(a) If Profit and Loss Account shows a credit balance (net profit):

Profit and Loss A/c Dr.

To Profit and Loss Appropriation A/c

(b) If Profit and Loss Account shows a debit balance (net loss)

Profit and Loss Appropriation A/c Dr.

To Profit and Loss A/c

2. Interest on Capital:

(a) For allowing interest on capital:

Interest on Capital A/c Dr.

To Partner’s Capital/Current A/cs (individually)

(b) For transferring interest on capital to Profit and Loss Appropriation Account:

Profit and Loss Appropriation A/c Dr.

To Interest on Capital A/c

3. Interest on Drawings:

(a) For charging interest on drawings to partners’ capital accounts:

Partners Capital/Current A/c’s (individually) Dr.

To Interest on Drawings A/c

(b) For transferring interest on drawings to Profit and Loss Appropriation Account:

Interest on Drawings A/c Dr.

To Profit and Loss Appropriation A/c

4. Partner’s Salary:

(a) For Allowing partner’s salary to partner’s capital account:

Salary to Partner A/c Dr.

To Partner’s Capital/Current A/c’s (individually)

(b) For transferring partner’s salary to Profit and Loss Appropriation Account:

Profit and Loss Appropriation A/c Dr.

To Salary to Partner’s A/c

5. Partner’s Commission:

(a) For crediting commission allowed to a partner, to partner’s capital account:

Commission to Partner A/c Dr.

To Partner’s Capital/Current A/c’s (individually)

(b) For transferring commission allowed to partners to Profit and Loss Appropriation Account.

Profit and Loss Appropriation A/c Dr.

To Commission to Partners Capital/Current A/c

6. Share of Profit or Loss after appropriations:

(a) If Profit:

Profit and Loss Appropriation A/c Dr.

To Partner’s Capital/Current A/c’s (individually)

(b) If Loss:

Partner’s Capital/Current A/c (individually)

To Profit and Loss Appropriation A/c

Proforma of profit and loss appropriation account

Interest on capital

The drawings are usually made by the partners at regular intervals. Thus, interest on drawings is calculated with reference to the time period involved. It can be worked out by any of the following methods

When dates of drawing are not given –

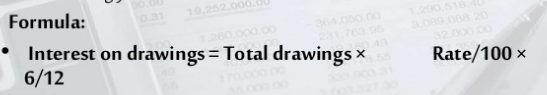

• Average period method – if the dates of drawing are not given, the interest on drawing is calculated on the average basis on the total amount of drawings made during the accounting period for half of the accounting period. It is based on the assumption that the amounts were drawn evenly throughout the accounting year.

• Average rate of interest method – sometimes the average rate of interest is given in case it is assumed that the rate of interest is already half on the basis of 6 months. Thus, time will not be considered.

When dates of drawing are given

• Product method – When different amounts are withdrawal at different levels, the interest will be calculated with the help of product method. Interest is calculated on the total product at the rate of interest for one month or one day

• Monthly quarterly drawing method – If uniform amount is withdrawn each time and the interval between two withdrawals is also uniform. Time period in this method is calculates as follows

- When drawings are for 12 month periods

At the beginning of each month = total drawings *rate/100*6.5/12

At the end of every month = total drawings *rate/100*5.5/12

At the middle of every month = total drawings *rate/100*6/12

- When drawings are for 6 months period –

At the beginning of each month = total drawings *rate/100*3.5/12

At the end of every month = total drawings *rate/100*2.5/12

At the middle of every month = total drawings *rate/100*3/12

- When drawings are made quarterly during the period

At the beginning of each quarter = total drawings *rate/100*7.5/12

At the end of every quarter = total drawings *rate/100*4.5/12

Interest on partners capital

Interest on capital is to be allowed on partners if the same is provided in the partnership deed and is allowed at the given rate with reference to the time period for which the capital has been used in the business.

Salary or commission of partner – salary or commission to a partner is to be allowed if the partnership agreement provides the same. These are allowed only if there are profits.

Calculation - commission is allowed as a percentage of net profits before charging such commissions or after charging such commissions

- Commission as percentage of net profit before charging such commissions = net profit before commission *rate of commission /100

- Commission as percentage of net profit after charging such commissions

= net profit before commission *rate of commission /100+rate of commission

Accounting treatment of salary or commission

P&l appropriation account Dr

To patner’s capital account

Dissolution of partnership changes the existing relationship between partners but the firm may continue its business as before. The dissolution of partnership may take place in any of the following ways:

- Change in existing profit sharing ratio among partners;

- Admission of a new partner;

- Retirement of a partner;

- Death of a partner;

- Insolvency of a partner;

- Completion of the venture, if partnership is formed for that; and

- Expiry of the period of partnership, if partnership is for a specific period of time;

Dissolution on Account of Insolvency of Partners

When one or more partner become insolvent the firm normally dissolves. Dissolution on account of insolvency will be discussed under two sub-heads: (1) When one of the partners is insolvent and (2) When all the partners are insolvent. The accounting treatment in certain respects will be different under the two

Before we understand the two aspects, lets discuss simple dissolution

Simple dissolution means that the partners have decided to dissolve the firm in normal course and all the partners are solvent and the firm has not been sold to a Joint Stock Company.

Under simple dissolution for cash the assets will be disposed off in the market although one or two items of assets may also be taken over by a partner and the liabilities will be paid off and books closed. The journal entries required to close the books under simple dissolution are as follows:

- All the marketable assets except cash in hand, bank balance, debit balance of profit and loss account and debit balance of partners' capital or current accounts shall be transferred to the Realisation Account at book values.

Realisation A/c Dr. With the total amount

To Bills Receivable

To Debtors (Gross Figure)

To Stock

To Prepaid Expenses

To Investments

To Furniture

To Plant & Machinery

To Land & Buildings

To Patents, Licences, Trade Marks, etc.

To Goodwill (it is a marketable asset and not fictitious)

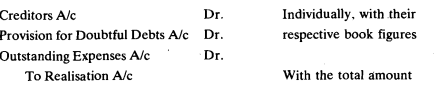

2. All the outside liabilities including the claims of relatives of the partners and

The Provision for Doubtful Debts to be transferred to the credit side of

Realisation Account.

3. For the disposal of the assets the entries may be made as follows depending on the mode of disposal:

If the assets are sold for cash, the amount so realised should be debited to Cash or Bank Account and Realisation Account should be credited.

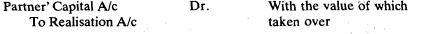

If any asset is taken over by a partner at an agreed value the partner should be debited instead of cash and Realisation Account to be credited:

If there is an unrecorded asset (like furniture completely written off in accounts but which is still in use and can be marketed), the entry for its sale will be made and no entry is required for bringing it into account books. The entry will be:

Cash A/c Dr. With the realised value

To Realisation A/c

4. For the discharge of outside liabilities Realisation A/c should be debited and the relevant account to be credited depending upon the mode of discharge:

If cash is paid to discharge the claim, Realisation Account is debited and Cash Account is credited:

Realisation A/c Dr. With the amount actually.

To Cash A/c

If a partner takes over the responsibility of discharging a liability, such partner's capital account should be credited instead of cash

Realisation A/c Dr.

To Partner's Capital A/c

If there is an unrecorded liability, it will also have to be paid off and the entry will be: Realisation A/c Dr. With the amount actually

To Cash A/c paid

5. The realisation winding up expenses, if any, incurred in the course of dissolution should be debited to Realisation Account and the entry will be:

Realisation A/c Dr.

To Cash A/c

In case the realisation expenses are paid by the partner or the partners is entrusted with the job of winding up, the entry will be

Realisation A/c Dr.

To Partner's Capital A/c

6. Loans advanced by partners as distinguished from their capital accounts should be paid and the entry will be:

Partner's Loan A/c Dr.

To Cash A/c

7. All accumulated profits (standing in the name of Reserve Fund, General Reserve, Profit and Loss Account credit balance etc.) and all accumulated losses (standing in the name of profit and loss debit balance) should be transferred to the partners' capital accounts in the profit sharing ratio as follows:

If there is accumulated Profit:

Reserve Fund Dr. As

General reserve Dr.

Profit and Loss A/c Dr.

To Partners' Capital A/cs

b) If there is accumulated loss:

Partners' Capital A/cs Dr. Individually

To Profit and Loss A/c

Dissolution of accounts of insolvency partner

The procedure for closing the books under insolvency is almost the same as under simple dissolution i.e. marketable assets and external liabilities are transferred to a newly opened Realisation Account and they are realised and paid off through the same account and the loss or profit on realisation transferred to the capital accounts of the partners. The capital account of the partners are kept on fixed basis or fluctuating basis.

Fixed and Fluctuating Capitals: each partner will have two accounts- one capital account and the other a current account, if the capital accounts of the partners are kept on fixed basis,.'Under capital account of each partner will show a fixed balance year after year. All entries relating to drawings, profit or loss, interest on capital or drawings etc. will be made in the current account of each partner. The current account of a partner may show a debit balance or a credit balance but the capital account of each partner will show the same fixed credit balance year after year. Hence the deficiency of the insolvent partner will be borne by the solvent partners in the ratio of their fixed capitals.

There will be only one capital account, If the capital accounts of partners are kept on fluctuating basis. Interest on capital or drawings are made in the capital account. Thus, the balance in the capital accounts of each partner will fluctuate every year and every time an entry is made. Under such situation, the deficiency of the insolvent partner will be borne by the solvent partners in the ratio of their capitals as on the date of insolvency. This means that all the accumulated profits or losses should first be divided among all the partners in their profit sharing ratios which will make the capital accounts of the partners as on the date of insolvency.

When one of the Partners is Insolvent

The entries in the preparation of Realisation Account and the transfer of realisation profit or loss to the partners capital accounts will be the same as under simple dissolution, When a partner becomes insolvent and the books are to be closed,. Then depending on whether the capital accounts are kept on fixed basis or fluctuating basis, the debit balance in the capital account of the insolvent partner after adjusting any cash brought in by him (known as the deficiency of the insolvent partner) shall be divided among the solvent partners in the capital ratio as explained above

When All the Partners are Insolvent

When all the partners become insolvent, the unsecured creditors cannot be paid in full as the amount available will not be sufficient to pay them in full. Hence, the unsecured creditors should not be transferred to the Realisation Account but only the marketable creditors which can be paid in full out of the sale proceeds of the asset pledged against may be transferred to; the Realisation Account. The assets shall be realised and the secured creditors paid through the Realisation Account and in their profit sharing ratio as usual the realisation profit or loss transferred to the capital accounts of all the partners. It will be debited to Cash Account and credited to the partner's capital account, if anything is recovered from the private estate of any partner. Thereafter, the total amount of cash available will be paid to the unsecured creditors. The unpaid balance in the unsecured creditors account shall then be transferred to a newly opened Deficiency Account. Similarly, the debit or credit balance in the partners' capital accounts shall also be transferred to the Deficiency Account. Thus all the accounts will be closed.

You have studied in the XIIth standard the unit related to the Final Accounts of Partnership firm. These final accounts are similar to the final accounts of sole trader, with certain changes regarding the distribution of profit/loss in the partners in their profit sharing ratio. But there are different transactions in partnership regarding admission, retirement, death of a partner, amalgamation, dissolution, conversion of partnership firm etc. which affect on the accounting of partnership firm. In this unit you have to learn accounting for amalgamation of partnership firms.

The unit amalgamation of partnership firms covers meaning of amalgamation of partnership firms, objectives of amalgamation of partnership firms, the accounting procedure for amalgamation, the journal entries and ledger posting for amalgamation of partnership firms and the problems solved.

Meaning of Amalgamation of Partnership Firms

Amalgamation means to merge or to combine two or more business units carrying on same type of business and form a new business unit.

Amalgamation of partnership firms means merger of two or more partnership firms with one another and form a new partnership firm. When two or more existing partnership firms, carrying on same type of business, come together end their separate entity and form a new firm it is called as amalgamation of partnership firms.

Amalgamation may be formed with any one of the following ways :

- Merging of two or more existing sole proprietors into each another and form a new partnership firm.

- Merging one existing partnership firm with one existing sole proprietor and form a new partnership firm.

- Absorbing one existing partnership firm by another existing partnership firm.

- Merging two or more existing partnership firms with one another and form a new partnership firm.

Objectives of Amalgamation of Partnership firms

Amalgamation of partnership firm is done to achieve the following objectives :

- To avoid the cut-throat competition.

- To minimize the common expenses of business.

- To get advantage of large scale business.

- To strengthen the capital position.

- To get advantage of expertise of different people, etc.

Accounting Procedure for Amalgamation of Partnership Firms

Accounting for amalgamation of partnership firms includes closing the books of accounts of amalgamating / old firms and opening the books of accounts of amalgamated / new firm. There are two methods used for closing the books of accounts -

1. Revaluation Method, and

2. Realisation Method.

In Revaluation Method, a Revaluation or Profit & Loss Adjustment A/c is prepared to record the effect of increase or decrease in the value of assets and liabilities. In Realisation Method, the purchase price is calculated and all assets and outsider liabilities are transferred to Realisation A/c at book values. In this unit the Revaluation Method is followed. As per this method, for closing the books of accounts of old firms journal entries are to be passed taking into consideration the following points:

i) Revaluation of Assets and liabilities.

Ii) Creation of Goodwill.

Iii) Close Reserves and other Profit Accounts.

Iv) Close Loss Account.

v) Close Assets and Liabilities Accounts which are not taken over by the new firm.

Vi) Transfer / close Assets and Liabilities Accounts which are taken over by the new firm.

Vii) Close Capital Accounts of the partners.

To open the books of accounts of the New Firm the journal entries are to be passed taking into consideration the following points :

- Assets of the old firm taken over by the new firm.

- Liabilities of the old firm taken over by the new firm.

- Capitals of the partners of the old firm taken over by the new firm.

- Adjustment of Goodwill.

- Adjustment of Capitals of the Partners.

Journal Entries and Ledger Accounts for Amalgamation of Partnership Firms: In the amalgamation of partnership firms closing entries and opening entries are to be passed. The closing entries are to be passed to close the books of accounts of amalgamating /old firms and the opening entries are to be passed to open the books of accounts of amalgamated/new firm.

Journal Entries in the Books of Old Firms (Closing Entries)

i) For Revaluation of Assets and Liabilities: Assets and Liabilities of the old firms may be revalued at the time of amalgamation. There may be increase or decrease in the values of assets and liabilities which shows profit or loss. To record this profit or loss a Profit & Loss Adjustment A/c or Revaluation A/c is to be opened. The net profit or loss on this account is to be transferred to Partner's Capital A/c in the old profit sharing ratio. For this purpose following journal entries are to be passed.

a) For increase in the value of asset and decrease in the value of Liability which shows revaluation profit.

Particular Asset / Liability A/c Dr.

To Profit & Loss Adjustment A/c / Revaluation A/c

b) For decrease in the value of asset and increase in the value of liability which shows revaluation loss.

Profit & Loss Adjustment A/c / Revaluation A/c. Dr.

To Particular Asset / Liability A/c

c) For closing the Profit & Loss Adjustment A/c / Revaluation A/c and transferring profit.

Profit & Loss Adjustment A/c / Revaluation A/c. Dr.

To Partner's Capital A/c’s

(If there is a loss, a reverse entry will be passed)

d) For Creation of Goodwill : If there is no goodwill account in the books of the old firm and if it is to be created the following entry will be passed,

Goodwill A/c Dr.

To Partner's Capital A/c’s

(Goodwill is to be transferred in the old profit sharing ratio)

e) For closing Reserves and Profit Accounts: The balance on these accounts is to be transferred to Partner's Capital A/c’s in the old profit sharing ratio.

Reserves A/c Dr.

Profit & Loss A/c (Cr. Balance) Dr.

To Partner's Capital A/c’s

f) For closing Loss Account: The Profit & Loss A/c showing Dr. Balance is a loss account It appears on the asset side of the Balance sheet. The balance on this account also transferred to Partner's Capital A/c’s in the old profit sharing ratio.

Partner's Capital A/c’s Dr.

To Profit & Loss A/c’s

g) For closing Assets and Liabilities A/c’s which are not taken over by the New Firm: Those assets and Liabilities which are not taken over by the new firm will be either sold away / paid off by the old firm or transferred to Partner / Partner's Capital A/c’s in the capital ratio. The profit or loss on such transaction will be transferred to P & L Adjustment A/c or directly to Partner's Capital A/c’s in the old profit sharing ratio. For this purpose following journal entries are to be passed.

a) If an asset is sold away for cash

Cash / Bank A/c Dr.

To Particular Asset A/c

b) If an asset is taken over by the partner / partners Partner/s Capital A/c Dr.

To Particular Asset A/c

c) If a liability is paid off

Particular Liability A/c Dr.

To Cash / Bank A/c

d) If a liability is taken over by the partner/ partners

Particular Liability A/c Dr.

To Partner/s Capital A/c

h) For closing Assets and Liabilities which are taken over by the New Firm: The accounts of assets and liabilities which are taken over by the new firm will be closed by transferring them to the New Firm A/c at agreed values.

a) For closing Assets

New Firm A/c Dr

To Assets A/c

b) For closing Liabilities

Liabilities A/c Dr

To New Firm A/c

• For closing Partner's Capital A/c’s: Partner's Capital A/c’s of the old firm are to be closed with the net balance by transferring them to the New Firm A/c

Partner's Capital A/c Dr

To New Firm A/c

Meaning:

To avail the facilities and advantages available to joint stock companies under Companies Act 1956, some partnership firms convert themselves into company. A company is formed to purchase the business of the firm. The purchase consideration is discharged by the company in the agreed mode. The shares and debentures received in the payment of purchase consideration are divided amongst partners. The partners become the shareholders of the company. Thus the firm is dissolved and a new company comes into being. The following are the two major advantages of conversion:

1. Number of members can exceed 20.

2. Member’s liabilities become limited.

Purchase Consideration

Meaning:

The value paid by the company to the firm for taking over the business of the firm is called purchase consideration which can be calculated by the following methods:

- Lumpsum method – Here the purchase price is clearly given in the question

- Net Payment method – Here the purchase price is the total of all the payments given by the company to the firm in discharge of purchase consideration.

- Net Assets Method – In this method the purchase price is calculated by the following formula :Purchase consideration = Assets taken over at agreed values-Liabilities taken over at agreed values.

The following points should be considered while calculating purchase consideration:

1. Only those assets will be considered which are taken over by the company. The agreed values of such assets are added.

2. Only those liabilities are considered which are assumed by the company. The agreed values of such liabilities are deducted.

3. Normally cash and bank balance are included in purchase price but if they are not taken over, they will be ignored. Goodwill and prepaid expenses are also included in the assets taken over.

4. Fictitious assets and debit balance of P & L account are never included in the assets.

5. If it is given that business is taken over it means assets as well as liabilities both are taken over.

But if it is given that asset are taken over then only assets are considered and liabilities are ignored.

Distribution of purchase price amongst partners

The shares and debentures received from the company are divided amongst the partners in their final capital ratio. According to some author these are divided in the profit sharing ratio also. For this purpose if any ratio is given in the agreement of the partnership deed, it should be followed.

Accounting treatment

Entries in the books of vendor firm

The following entries are passed to close the books of vendor firm:

1. Transfer of assets to realisation account:

Realisation A/c Dr.

To Assets (individually) A/c

(Being assets transferred)

The following points must be remembered while passing this entry:

- All the assets whether or not taken over by the company are transferred to realisation account at book value.

- Cash and bank balance are transferred to realisation account only when they too are taken over by the company along with the other assets.

- Fictitious assets such as debit balance of P & L account and other unwritten off expenses are not transferred to realisation account. They are debited to partners’ capital account in their profit sharing ratio.

- Goodwill and other intangible assets such as prepaid expenses, trademarks, patent etc. are also debited to realisaion account.

- If any provision is made against any assets the gross value of the assets is debited to realisation account and the provisions are credited to realisation account:

2. Transfer of liabilities to realisation account:

Liabilities (individually) A/c Dr.

To Realisation A/c

(Being Liabilities transferred)

Note: All the liabilities whether or not taken over by the, company are transferred to realization account with the exception of reserves and surplus, Capital and current accounts of partners.

3. For purchase consideration

Purchasing Company Dr.

To Realisation A/c

(For purchase consideration due.)

4. On receipts of purchase price

Cash/Bank A/c Dr.

Shares in purchasing co. A/c Dr.

To Purchasing company

(For purchase consideration received)

5. Realisation of assets not taken by company :

Bank A/c Dr.

To Realisation A/c

(For cash recovered on sales of assets)

6. Payment of Liabilities not assumed by the company:

Realisation A/c Dr.

To Bank A/c

(Being payment made)

7. Realisation expenses (if borne by the firm)

Realisation A/c Dr.

To Bank A/c

(For payment of expenses of liquidation)

Note : If realisation expenses are borne by the company no entry is passed.

8. Payment of contingent liability :

Realisation A/c Dr.

To Bank A/c

(For the payment of contingent liabilities)

9. Profit on realisation :

Realisation A/c Dr.

To Partner's Capital A/c

(For profit on realisation transferred to partner's capital a/c)

10. Loss on realisation :

Partners' Capital A/c Dr.

To Realisation A/c

(For loss on realisation transferred)

11. Payment to partners :

Partner's Capital A/c Dr.

To Bank A/c

To Shares in purchasing co.

(For cash and shares distributed amongst partners).

Entries in the books of purchasing company

1. For Purchase consideration:

Business Purchase A/c Dr.

To Vendor's firm A/c

(For purchase consideration becoming due.)

2. For assets and liabilities taken over :

3. For discharge of purchase price:

Vendor firm A/c Dr.

To Share Capital A/c

To Bank A/c

(Being payment made)

4. For bearing realisation expenses of Vendor:

Goodwill A/c or Capital Reserve A/c Dr.

To Bank

5. For formation expenses:

Preliminary Expenses A/c Dr.

To Bank A/C

REFERENCE

- Gupta R.L. And Radhaswamy. M, Sultan chand & Sons, New Delhi.

- Shukla M. C. Grewal T. S and Gupta S.C., S. Chand & Sons. New Delhi.

- Shukla S. M., Sahitya Bhawan Publication, Agra.

- Murti Guru Prasad, Himalaya Publishing House, Mumbai.

- Jain and Narang, Kalyani Publisher, New Delhi.

- S. N. Maheswari, Vikas Publishing House, New Delhi.

- Sharma and Gupta, RBD Publishing House, Jaipur.

- Khatik S. K., Jitendra Saxena K, Extol Publication, Bhopal.

- Gangwar Sharda, Himalaya Publishing House, Agra.