UNIT IV

Monetory Theories

Prices are measures of the amount of money that one has to give up to obtain units of goods and services. When this macro measurement is extended to the entire economy, we get the concept of general price level.

The price level measures the amount of money that has to be given up to obtain a unit of the average good in the economy, or to obtain one unit of the total output.

The inverse or reciprocal of the price level represents value of money, or what a unit of money can buy. This is referred to as the real value of money or its purchasing power. Study of the factors that determine the price level and thus, the value of money, is one of the important subject matter of macroeconomics.

Different views on what determines the price have been put forward by different economist. Though they may differ in their approaches, most have concluded that the price level is determined by the supply of money and demand for money. The demand- supply analysis of price level determination at macro- level is essentially different from the demand- supply analysis of price determination at the micro-level for an individual good. Goods produced are flows while money can be both stock and flow.

The quantity theory of money was used by economists to explain changes in general price level. They believed that the quantity of money in the economy was the prime factor determining price level. Any change in the quantity of money would bring about a change in the general level. The theory is based directly on the changes brought about by an increase in the money supply. The quantity theory of money states that the value of money is based on the amount of money in the economy.

Understanding the Quantity Theory of Money

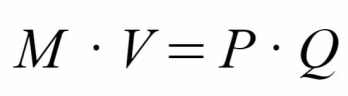

The Fisher equation is calculated:

M×V=P×T

Where:

M=money supply

V=velocity of money

P=average price level

T=volume of transactions in the economy

What is the amount of money theory?

Financial Theory refers to plan the amount of accessible money (money supply) grows at the same rate as the price level in the long run. With lower interest rates, lower taxes, and no longer limited access to money, consumers are less sensitive to price changes and have a higher consumption trend. As a result, the aggregate demand curve shifts to the right, shifting up the equilibrium price level. Replaceable

To better understand the theory of the amount of money, you can use the exchange equation:

The formula is the Economist model with the relationship between gold supply and price. The replacement formula is:

Where,

M-refers to the money supply

V-refers to the rate of money that measures how much a single dollar of money supply contributes to GDP

P-refers to the prevailing price level

Q-refers to the amount of goods and services produced in the economy

If we keep Q and V constant, we can see that an increase in the money supply increases the price level and causes inflation. The assumption that Q and V are constant holds in the long run, since these factors cannot be affected by changes in the money supply of the economy.

This theory provides a brief overview of the monetarist theory, which states that changes in the current money supply cause fluctuations in overall economic production and that excessive growth in the money supply causes an increase in inflation.

Demand for money

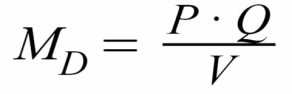

The exchange equation can also be modified into the equation of demand for money as follows:

Where,

Md-refers to the demand for money

P-refers to the price level of the economy

Q-refers to the amount of goods and services offered in the economy

V-refers to the speed of money

In this formula, the molecular term (P x Q) refers to the nominal GDP of the country. Moreover, the equation provides another take on the monetarist theory because it associates GDP with the demand for money (contrary to Keynesian economists who believe that interest rates cause inflation).

Modern theory of Money

Modern theory reflects that the demand for money should depend not only on the risks and returns provided by money, but also on the various assets that households can hold instead of money.

The reason why the demand for money is wealth should depend upon total wealth, which measures the dimensions of the portfolio to be allocated between money and alternative assets.

Money is wealth (w) two alternative forms that can hold wealth are:

(i) Bonds.

(ii) Shares (shares).

... (M/P) d=L (rs, Rb, ne, W)... (1) Where rs is the expected real rate of return on stocks and Rb is the expected real rate of return on bonds

This is the expected rate of inflation

W is real wealth.

M→ nominal money demand

P→ price level

Formula (1) shows that the demand for money depends on the return of bonds and stocks. Inflation affects the amount of wealth held.

Therefore, Md depends on the return of bonds and capital. Inflation affects the amount of wealth held.

Increasing Rs or rb reduces the demand for money as other assets become more attractive.

When the FT increases, the demand for money decreases as the attractiveness of money decreases.

If the W increases in gold demand increases the abundance of a large portfolio

For simplicity, expression 1 can be written as follows:

(M/P)d=L(Y,i)...(2)

Real income (Y) is used instead of W

I am an interest rate. This is a return variable that contains nominal interest rates.

=rb+Σe

The demand function of this monetary Equation (2) is very similar to the one derived from the Keynesian approach.

Limitations of portfolio theory:

The usefulness of portfolio theory in studying the demand for money depends on which measure of cash supply is employed.

Portfolio theory of money demand is only plausible when adopting a broad measure of money supply (M2)):

Because this is:

M1 is a narrow measure of money because it includes only coins and currencies and demands deposits with people earning very low or no interest rates.

M1=currency +demand deposit

Thus the portfolio theory helps to include only one (M2) measure of the gold supply:

M2=M1 + savings account +money market mutual fund.

Cash balance approach of money

Cambridge Equations

The Cambridge version of quantity theory of money was first developed by Alfred Marshall and later modified by A.C Pigou and D.H Robertson. Since all these economists were from the Cambridge University, their version of the quantity theory came to be known as the Cambridge Version. This version is an improvement over the classical cash transactions approach. The cash balance approach provided the basis for Keynes to develop his famous Liquidity Preference Theory of Money.

According to the Cambridge version, people demand to hold money not only for transactions but also because money’s function as a ‘store of value’. Therefore, real demand for money is for transaction as well as other purposes. When money is held or hoarded, it has utility as it acquires wealth value. The amount of cash balances held by people is determined by their real value, or the purchasing power of the balances held. People will want to hold money not for the money’s sake but for the command that money has over real resources and goods.

Taken together, the community’s total demand for cash balances constitutes a certain proportion of the country’s real national income. This proportion is represented by the letter k’ in the Cambridge equation. It represents a proportion of the total real income (output produced) that people of the country demand to hold in the form of cash balances.

If we assume that in an economy, the volume of transactions are given over a period of time, the community’s total demand for real cash balances may be represented by a certain proportion (k) of the annual real national income (Y).

The proportion k, known as ‘Cambridge k’ is determined by individuals and groups of individuals on the basis of several factors like spending pattern, price level, rate of interest, general economic condition, the opportunity cost of holding cash. When people want to hold more cash, they spend less on goods and services. This lowers the demand for goods and services and price level falls. Similarly, if people want to hold less cash and spend more on transacting in goods and services, the price level will rise. Price level falls. Similarly, if people want to hold less cash and spend more on transacting in goods and services, the price level will rise. Price level determines the value of money. Higher the price level, lower will be the purchasing power of one unit on money, and vice versa.

The Cambridge version is represented by the following equation:

Md = kPY

Where,

Md = community’s demand for money

Y = real national output

P = average price (general price level)

k = proportion of national output or income that people want to hold

Let assume that money supply Ms is determined by monetary authorities

Ms = M

At full employment equilibrium, supply of money is equal to demand for money.

Ms = Md

Or

M = kPY

P = M/kY

Where,

K and y are independent of money supply

K is constant and is given by transactions demand for money

Y is constant at full employment

P and money supply M are directly proportional. If money supply is doubled, so will P and if money supply is halved, P will also be halved.

Fisher Equation

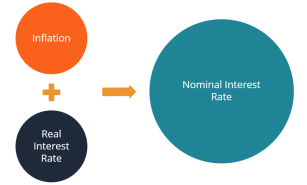

What is the Fisher equation?

The Fisher equation is a concept in economics that describes the relationship between nominal and real interest rates affected by inflation. The formula states that the nominal interest rate is equal to the sum of the real interest rate and the rate of inflation.

The Fisher equation is often used in situations where investors and lenders seek additional compensation to compensate for the loss of purchasing power due to high inflation. This concept is widely used in the field of Finance and economics. It is often used when calculating returns on investments or predicting the behavior of nominal and real interest rates. One example is when an investor wants to determine the actual (actual) interest rate earned on an investment after considering the impact of inflation.

One of the particularly important implications of the Fisher equation is related to monetary policy. This formula reveals that monetary policy moves inflation and nominal interest rates together in the same direction. On the other hand, monetary policy generally does not affect real interest rates.

American economist Irving Fisher proposed the Fisher equation to the equation

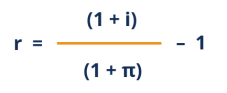

The Fisher equation is represented by the following equation:

(1+i)=(1+r)(1+∞)

Where

I-nominal interest rates

r-real interest rates

① –Inflation rate

However, you can also use an approximate version of the previous expression:

i∩r+∩

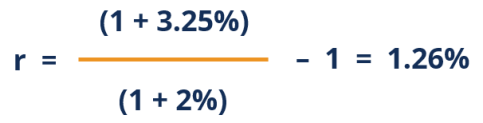

Fisher equation example

Last year, when Sam owned an investment portfolio, the portfolio earned a return of 3.25 per cent. But last year inflation was about 2%. Sam wants to determine the real returns he has earned from his portfolio. To find the real rate of Return, use the Fisher equation. The equation says:

(1+i)=(1+r) (1+∞)you can sort the equation to find the real interest rate: therefore, the real interest rate of the portfolio, or the real return on investment, after accounting for inflation.

(1+i)=(1+r) (1+∞)you can sort the equation to find the real interest rate: therefore, the real interest rate of the portfolio, or the real return on investment, after accounting for inflation.

Therefore, the real interest rate that Sam's investment portfolio earned last year is 1.26%.

Keynes does not agree with the old quantity theorists that there is a direct and proportional relationship between the amount of money and the price. According to him, the impact of changes in the amount on the price is indirect and non-proportional.

This dichotomy between the relative price level (determined by the supply and demand of goods) and the absolute price level (determined by the supply and demand of money) arises from the failure of classical financial economists to integrate value theory and money theory. Thus, changes in the money supply affect only the absolute price level, but not the relative price level.

In addition, Keynes criticizes the classical static equilibrium theory, in which money is considered neutral and does not affect the real equilibrium of the economy with respect to relative prices. According to him, the problems of the real world are related to the theory of shifting equilibrium, while money enters as a “link between the present and the future".

Keynes reformulated quantity of money theory:

Keynes ' reformulated theory of quantities is based as follows:

Assumption:

1. All factors of production are in a completely elastic supply as long as there is unemployment.

2. All unemployed factors are homogeneous, completely divisible and interchangeable.

3. There is a constant return on the scale, because this price will rise or fall and the output will increase.

4. As long as there are unemployed resources, the effective demand and the amount will change at the same rate.

Given these assumptions, the Keynesian chain of causal relationships between changes in the amount of money and the price is indirect through the rate of interest. Therefore, as the amount of money increases, its first impact is on the rate of interest, which tends to fall. Given the marginal efficiency of a person], a decrease in the rate of interest will increase the amount of investment.

Increased investment raises effective demand through the multiplier effect, thereby increasing income, production and employment. Wage and non-wage factors are available at a certain compensation rate, since the supply curve of production factors is completely elastic in the situation of unemployment. There is a constant return to the scale; prices will not rise with an increase in output, as long as there is any unemployment.

Under such circumstances, production and employment will increase at the same rate as effective demand, and effective demand will increase at the same rate as the amount of money. Depending on the change in supply, which was infinite as long as unemployment was, the elasticity of the supply of output falls to zero. The whole effect of the change in the supply of money is exerted on the price, which rises exactly in proportion to the increase in effective demand. So, as long as there is unemployment, the output will change at the same rate as the amount of money, there will be no change in the price, and if there is full employment, the price will change at the same rate as the amount of money. Thus, the reformulated volume theory of money emphasizes that with an increase in the volume of money, the price rises only when the

Level of full employment is reached, and not before this.

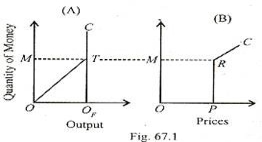

This reformulated monetary quantity theory is shown in figures 67.1(A)and(B). OTC is the output curve for money volume and PRC is the price curve for money volume. Panel A in the figure shows that as the amount of money increases from Σ to M, the output level also increases along the Σ part of the otc curve.

As the amount of money reaches OM level, full employment output OQF is being produced. But after Point T, a further increase in the amount of money cannot raise the output beyond the full employment level OQF, so the output curve will be vertical.

The figure panel ① shows the relationship between the amount of money and the price. As long as there is unemployment, the price will remain constant whatever the increase in the amount of money. Prices begin to rise only after the level of full employment is reached.

However, an increase in the amount above the OM will raise the price by the same percentage as the amount. This is indicated by the RC part of the price curve PRC.

Keynes himself noted that the real world is very complex, and simplified assumptions, on which the theory of reformulated quantities is based, do not hold. According to him, the following possible complications will qualify the statement that, as long as there is unemployment, employment will change at the same rate as the amount of money, and when there is full employment, prices will change at the same rate as the amount of money.”

- Because resources are not interchangeable, some goods reach a state of inelastic supply while there are still unemployed resources available for the production of other goods.

- Wage units tend to rise before they reach full employment.

- Compensation for factors that fall into the marginal cost does not all change at the same rate."Taking into account these complications, it is clear that the reformulated amount of money theory does not hold.

- The increase in effective demand will not change exactly in proportion to the amount of money, but in part it will be spent on an increase in output and an increase in price levels. As long as there are unemployed resources, the general price level will not rise much as output increases.

- But a sharp significant increase in aggregate demand will run into bottlenecks when resources are still unemployed.

It may be that the supply of some factors becomes inelastic or others are scarce and are not replaceable. This may lead to marginal costs and price increases. Thus, the price is above the average unit price, the profit increases rapidly, and due to the pressure of trade unions there is a tendency to raise wages. Diminishing returns may also set in. When full employment is reached, the elasticity of the supply of production decreases to zero, and the price increases in proportion to the increase in the amount.

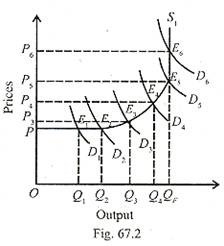

The complex model of Keynesian theory of money and prices is shown graphically in Figure 67.2 in terms of the total supply and demand (D) curves. Price levels are measured on the vertical axis and output on the horizontal axis. According to Keynes, an increase in the amount of money increases the demand for total money for investments as a result of a decrease in the rate of interest. This initially increases production and employment, but does not increase the price level. In the figure, the increase in total monetary demand from D1 to D2 increases the output from OQ1 to OQ2, but the price level at Op remains constant, as the total monetary demand from D2 to D3 increases further, oq2 to OQ3, and the price level also increases to OP3.

This is because costs rise as bottlenecks develop due to immobility of resources. Dwindling returns have been set, and less efficient labour and capital have been employed. The output increases at a slower rate than the given increase in the total monetary demand, which leads to higher prices. As full employment approaches, bottlenecks increase. Further-the more, the increase in prices leads to an increase in demand, especially for stocks. Thus, prices rise at an increasing rate. This is shown throughout the figure. However, when the economy reaches the level of full employment of production, a further increase in the demand for total gold leads to a proportional increase in the price level, but production remains unchanged at that level. This is shown in the figure when the demand curve D5 shifts upwards to d6, the price level rises from OP5 to OP6, and the output level remains constant in oqf.

The superiority of Keynesian theory over traditional monetary theory:

Reasons

Keynes's reformulated quantity-quantity theory is better than the traditional approach in that he discards the old view that the relationship between the amount of money and the price is directly proportional.

In establishing such relationships, Keynes led to the transition from pure price theory to currency theory of production and employment. In doing so, he integrates currency theory and Value Theory. He integrates the theory of interest rates with the theory of value, and also with the theory of production and employment through the rate of interest.

In fact, the integration of money theory and Value Theory takes place through the output theory, where the rate of interest plays an important role. As the amount of money increases, the rate of interest decreases, thereby increasing the amount of investment and aggregate demand that raises output and employment. In this way, money theory is integrated with the theory of production and employment.

As production and employment increase, the demand for production factors increases even more. As a result, certain bottlenecks emerge that raise marginal costs, including the money wage rate. Thus the price begins to rise. Money theory is thus integrated with Value Theory.

So, as long as there is unemployment, production and employment will change at the same rate as the amount of money, but there will be no change in prices. Thus, the Keynesian analysis is better than the traditional analysis, as it studies the relationship between the amount of money and price under both unemployment and full employment conditions.

Furthermore, Keynesian theory is superior to traditional quantum gold theory in that it emphasizes important policy implications. Traditional theory believes that every increase in the amount of money leads to inflation.

Keynes, on the other hand, has established that as long as there is unemployment, the rise in prices will be moderate and there will be no risk of inflation. Only when the economy reaches the level of full employment, the increase in prices becomes inflation with each increase in the amount of money.

Criticism of Keynesian money and price theory:

Keynes ' views on money and prices have been criticized by monetarists for the following reasons:

1. Direct relationships:

Keynes accidentally took the price as fixed, so the effect of money appears in his analysis, rather than in terms of the amount of goods traded than their average price. Therefore, Keynes adopted an indirect mechanism through investment of bond prices, interest rates, and the impact of financial fluctuations on economic activity. However, the impact of real financial fluctuations is direct, not indirect.

2. Stable money demand:

Keynes assumed that changes in money would be absorbed primarily by changes in demand for money. But Friedman, based on his empirical research, shows that the demand for money is very stable.

3. The nature of money:

Keynes could not understand the essence of money. He believed that money could only be exchanged for bonds.

4. Money effect:

Keynes wrote during the recession, so this led him to conclude that money had little effect on income. According to Friedman, it was the contraction of money that caused the depression. Therefore, it was wrong on Keynes's side to argue that money has little effect on income. Money affects national income.

Keynes wrote during the recession, so this led him to conclude that money had little effect on income. According to Friedman, it was the contraction of money that caused the depression. Therefore, it was wrong on Keynes's side to argue that money has little effect on income. Money affects national income.

References:

- Https://www.sciencedirect.com/topics/economics-econometrics-and-finance/quantity-theory-of-money

- Https://en.wikipedia.org/wiki/Quantity_theory_of_money

- Https://www.investopedia.com/modern-monetary-theory-mmt4588060#:~:text=Modern%20Monetary%20Theory%20(MMT)%20is,comes%20to%20federal%20government%20spending.

- Https://www.toppr.com/guides/fundamentals-of-economics-and-management/money/quantity-theory-of-money/

- Https://www.investopedia.com/modern-monetary-theory-mmt-4588060#:~:text=Modern%20Monetary%20Theory%20(MMT)%20is,comes%20to%20federal%20government%20spending.