Unit - 1

Engineering Economics

Economics is the study of allocation of scarce resources among unlimited human ends/wants. Engineering economics deals with the methods that enable one to take economic decisions towards minimizing costs and/or maximizing benefits to business organizations. Engineering economy involves the systematic evaluation of the economic merits of proposed solutions to engineering problems. To be economically acceptable (i.e. affordable), solutions to engineering problems must be demonstrate a positive balance of long-term benefits over long-term costs (Accreditation board for Engineering and Technology). Development of Engineering Economy as a separate field of study is relatively recent. It has no well recorded past history. It does not mean that, historically, costs are overlooked in engineering decisions. Ultimate economy is primary concern to the engineer.

Features of engineering economics

The features of engineering economics are-

1. Engineering Economics is closely aligned with Conventional Micro-Economics.

2. Engineering Economics is devoted to the problem solving and decision making at the operations level.

3. Engineering Economics can lead to sub-optimisation of conditions in which a solution satisfies tactical objectives at the expense of strategic effectiveness.

4. Engineering Economics is useful to identify alternative uses of limited resources and to select the preferred course of action.

5. Engineering Economics is pragmatic in nature. It removes complicated abstract issues of economic theory.

6. Engineering Economics mainly uses the body of economic concepts and principles.

7. Engineering Economics integrates economic theory with engineering practice.

Scope of engineering economics

The scope of engineering economics are discussed below-

- Elementary economic analysis

- Interest formula

- Bases for comparing alternatives

- Present worth method

- Future worth method

- Annual equivalent method

- Rate of return method

- Replacement analysis

- Depreciation

- Devaluation of public alternatives

- Inflation adjusted investment decisions

- Make or buy decisions

- Inventory control

- Project management

- Value engineering, and

- Linear programming

The steps/procedure in the engineering economic

The steps/procedure in the engineering economic decision making are:

- Identification of problem and prospects

- Develop feasible & relevant alternatives

- Determine appropriate selection criteria.

- Analysis, comparison of various alternatives

- Evaluate & recommend the alternative

- Select the best alternative

- Implementation of the selected alternative

- Monitoring and controlling

Principles of engineering economics

The principles of engineering economics are discussed below

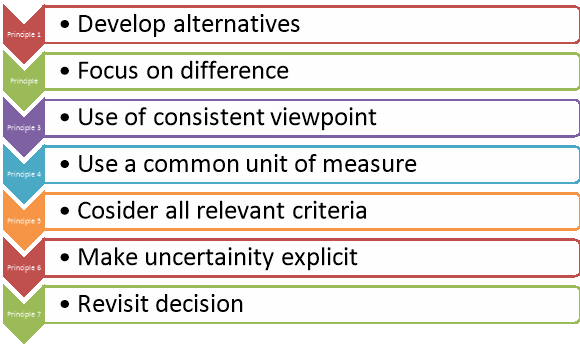

Figure: Principle of engineering economics

- Develop the alternatives:

The choice (decision) is among alternatives. The alternatives need to be identified. A decision involves making a choice among alternatives. Developing and defining alternatives depends upon engineer’s creativity and innovation.

2. Focus on the difference:

Only the differences in expected future outcomes among the alternatives are relevant to their comparison and should be considered in the decision. If all prospective outcomes of the feasible alternatives were exactly the same, obviously, only the differences in the future outcomes of the alternatives are important. Outcomes that are common to all alternatives can be disregarded in the comparison and decision. For example, if two apartments were with same purchase price or rental price, decision on selection of alternatives would depend on other factors such as location and annual operating and maintenance expenses.

3. Use a consistent viewpoint:

The prospective outcomes of the alternatives, economic and other, should be consistently developed from a defined viewpoint (perspective). Often perspective of decision maker is owner’s point of view. For the success of the engineering projects viewpoint may be looked upon from the various perspective e.g. Donor, financer, beneficiary group & stakeholders. However, viewpoint must be consistent throughout the analysis.

4. Use a common unit of measure:

Using a common unit of measurement to enumerate as many of the prospective outcomes as possible will make easier the analysis and comparison of the alternatives. For economic consequences, a monetary units such as dollars or rupees is the common measure.

5. Consider all relevant criteria:

Selection of preferred alternative (decision making) requires the use of a criterion (or several criteria). The decision process should consider both the outcomes enumerated in the monetary unit and those expressed in some other unit of measurement or made explicit in a descriptive manner. Apart from the long term financial interest of owner, needs of stakeholders should be considered.

6. Make uncertainty explicit:

Uncertainty is inherent in projecting (or estimating) the future outcomes of the alternatives ad should be recognized in their analysis and comparison. The magnitude & impact of future impact of any course of action are uncertain or probability of occurrence changes from the planned one. Thus dealing with uncertainty is important aspect of engineering economic analysis.

7. Revisit your decisions:

Improved decision making results from an adaptive process; to the extent practicable, the initial projected outcomes of the selected alternative should be subsequently compared with actual results achieved. If results significantly different from the initial estimates, appropriate feedback to the decision making process should occur.

Key Takeaways

- Engineering economics deals with the methods that enable one to take economic decisions towards minimizing costs and/or maximizing benefits to business organizations.

Time value of money

The relationship between money and time leads to the concept of time value of money. A rupee or dollar in hand is worth more than a rupee or dollar received ‘N’ years from now. Money has time value because the purchasing power of money as well as the earning power of money changes with time. During inflation, purchasing power of money decreases over time. Money can earn an interest for a period of time. Interest represents the earning power of money. Therefore, both purchasing power and earning power of money should be considered while taking into account the time value of money. Engineering economic investment studies involve huge capital for longer period of time. So, the effect of time value of money should be considered in the analysis. When the interest earned or charged is directly proportional to the initial investment or principal amount (P), the interest rate (i), and number of interest period (N), the interest (I) and the interest rate is said to be simple interest and simple interest rate.

I = P*N*i

When the interest charge for any interest period (a year) is based on the remaining principal amount plus any accumulated interest charges up the beginning of that period, the interest is said to the compound. In general, interest charged or earned on the principal amount is quoted as ' i % compounded annually or i % per year'. Very often, the interest period or time between successive compounding, is less than year. It has become customary to quote interest rates an annual basis, followed by the compound period if different from one year in length. For example, if the interest rate is 6% per six month, it is customary to quote this rate as '12% compounded semi-annually. The basic annual interest rate, 12% in this case, is known as nominal interest rate and denoted by 'r'. The actual or exact rate of interest rate earned on the principal during one year is known as effective interest rate and dented by 'i'.

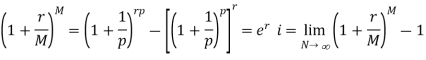

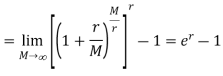

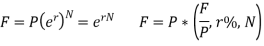

The effective interest rate is always expressed on annual basis or per annum. The relationship between effective interest rate 'i' and nominal interest rate 'r' is i = (𝟏 + 𝒓) 𝑴 − 𝟏

Where M is number of compounding periods per year.

When M > 1, then i > r the effective interest rate is useful for describing the compounding effect of interest earned on interest within one year.

As a limit, interest may be considered an infinite number of times per year - i.e. continuously, Under these conditions, the effective interest for continuous compounding is derived from equation.

Discrete cash flows assume the cash flows occur a discrete intervals (e.g. Once a year), but continuous compounding assumes compounding is continuous throughout the interval.(M = ∞)

Substitute

Cash flow and Time Diagrams

A cash flow occurs when money is transferred from one organization or individual to other. Thus, cash flow represents the economic effects of an alternative in terms of money spend or received. Cash Inflow or Positive Cash Flow: Actual rupee or dollar coming into firm. i.e. receipts or incomes.

- Cash Outflow or Negative Cash Flow: Actual rupee or dollar paid out by a firm. i.e. expenditures or payment.

- Net Cash Flow: Difference between total cash inflows (receipts) and the total cash outflows for a specified period of time. e.g. One year.

Cash flow diagrams visually represent income and expenses over some time interval. The diagram consists of a horizontal line with markers at a series of time intervals. At appropriate times, expenses and costs are shown.

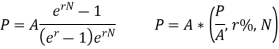

Figure: Cash flow diagram

- Horizontal line in a cash flow diagram is a time scale with progression of time moving from left to right. The period (or year) labels are applied to the intervals of time rather than points on the tie scale. The end of the period 2 is coincident with beginning of period 3.

- The arrows signify cash flows. Cash outflows are represented by downward arrows and Cash inflows are represented by upward arrows.

- Cash flow diagram is dependent on point of view. If a lender lends Rs. 25,000. (it is cash outflows for him) and at the end of 4 years, receives compound interest plus his principal Rs. 11,713 at 10% interest rate per annum (it is cash inflow for him).

- If the directions of arrows are reversed, diagram would be from borrower's point of view.

Choosing between alternative investment proposals

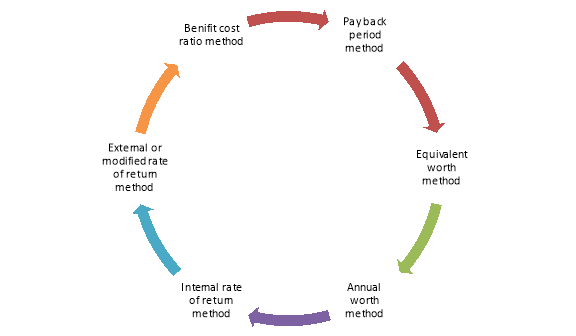

There are various methods for choosing alternative investment proposals are discussed below-

Figure: Methods for choosing alternative investment proposals

- Payback period method:

Payback period is defined as the number of years required to recover the initial investment. It focus on liquidity i.e. how fast an initial investment can be recovered (easy recovery). It is not measure of profitability. It does not consider cash flows of entire life of project. i.e. ignores cash flow information after payback period.

i) Simple payback period

Simple Payback Period is the payback period which ignores the time value of money. i.e. i = 0. It does not consider the time value of money.

- Equal or uniform cash flow

Simple Payback Period = Initial Investment Annual net cash flow If Calculated Payback Period < Standard Payback Period, Accept the project, If Calculated Payback Period > Standard Payback Period, Reject the Project

B. Unequal or uneven cash flow

Ii) Discounted Payback Period

Simple Payback Period ignores the time value of money. i.e. i = 0. It does not consider the time value of money. To remedy this defect of simple payback period, time value of money is considered in the Discounted Payback period. Cash flows are discounted at certain MARR and determine the number of years required to recover the initial investment

2. Equivalent worth method

Equivalent worth methods convert all cash flows into equivalent present, future, or annual amounts at the MARR. If a single project is under consideration, If EW ≥ 0; Accept the project, If EW < 0, Rejected the project. Future worth criterion has become popular because a primary objective of all time value of money is to maximize the future wealth of the owners of the firm. i.e. how much it worth at the end of given number of years

PW methods convert all cash flows into equivalent present amounts at the MARR. All cash inflows and outflows are discounted to the base or beginning point in time at the interest period rate MARR. Present worth of project is a measure of how much fund will have to be put aside now to provide all future expenditures during the project period. It is assumed that such fund placed in reserve earns interest rate equal to MARR.

PW = F0(1 + i ) 0 + F1 (1 + i ) -1 + F2 (1 + i ) -2 + ... + Fk (1 + i ) -k + ... + FN (1 + i ) –k

If a single project is under consideration,

If PW ≥ 0; The project is economically justified.

Therefore, accept the project,

If PW < 0, The project is economically not justified.

Therefore, reject the project.

Higher the interest rate and further the future cash flow occurs, lower is its PW.

3. Annual worth method

Annual worth of a project is uniform series of amount that is equivalent to the cash inflows and outflows occur during the project duration. AW methods convert all cash flows into equivalent annual amounts at the MARR.

If a single project is under consideration,

If AW ≥ 0; Accept the project,

If AW < 0, Rejected the project

4. Internal rate of return method

If the return on investment is expressed in terms of rate of return or percentage, even common layman can readily understand. There would be little danger of misinterpreting rate of return figures because interest rate is well understood throughout the world. Rate of return should be at least equal to or greater than MARR to accept a proposed project, otherwise rejected. So, this method is widely used in practice. In this method, that interest is found out that equates the equivalent worth of an all cash inflows (receipts or savings) and cash outflows (investment and expenditure). In other word IRR is the interest rate at which given cash flow becomes zero. IRR can be found out by any of EW (PW or FW or AW) Method. If I = Initial Investment, S = Salvage Value, R = annual Revenue, and E = annual expenses N = Study Period and i = MARR and i*= IRR

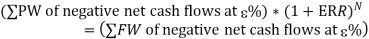

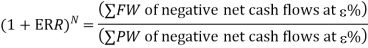

5. External or modified rate of return method

The ERR method takes into account the external reinvestment rate (Ԑ) at which net cash flows generated (or required) by the project over its life can be reinvested (or borrowed) outside the firm

Positive net cash flows = excess of receipts over expenses in period k.

Negative net cash flows = excess of expenses over receipts in period k.

6. Benefit cost ratio method:

Private enterprises evaluate its activities in terms of profitability. Public sector evaluates public activities in terms of the general welfare of public. Therefore, the economic evaluation of public activities proceeds on the basic element that the purpose of government is to serve its citizens. Public projects are financed and operated by agencies. Sources of finance are generally the taxes collected from its citizens. Multipurpose projects are common. Effects of politics are frequent. Conflict of purposes and conflict of interests are quite common. Measurement of efficiency of public projects is very difficult. In many cases decisions are made by elected officials whose tenure of office is very uncertain. As a result, immediate cost and benefits may be stressed, to the detriment of long-range economy. Basically, an engineering public projects have multiple benefits. Public projects are evaluated by equivalent worth of annual costs or by benefit cost ratio (BCR). The benefit cost ratio (BCR or B/C ratio) can be defined as the ratio of the equivalent worth of benefits to the equivalent worth of costs. The equivalent worth utilized is customarily present worth (PW) or annual worth(AW), but it can also be future worth(FW). The BCR is also referred to as the savings-investment ratio (SIR).

If a single project is under consideration,

If BCR ≥ 1; Accept the project,

If BCR < 1; Reject the project.

Key Takeaways

- The relationship between money and time leads to the concept of time value of money.

- A cash flow occurs when money is transferred from one organization or individual to other.

References:

1. Engineering Economic Principles, Henry Malcom Stenar- McGraw Hill Pub.

2. “Modern Economic Theory”, Siltan Chand & Co.

3. Agrawal AN, “Indian Economy”, Dewett K.K., - Wiley Eastern Ltd, New Delhi