Unit - 5

Cost Accounting

Introduction

Modern business requires information about the activities planned for the future. The main function of management is decision making. It is necessary to choose the optimal course of action from a set of choices. Costing techniques play an important role in the collection and analysis of revenue and cost data. It also helps to control the results of the business and make an appropriate assessment of the performance of those who work in the organization. Costing also helps to acquire plants and machines, add or remove products, create or purchase decisions, special prices for products and exchange assets.

Evolution of Cost Accounting; Definitions

Widespread interest in the subject of costing can be said to have developed in the Industrial Revolution, which began in 1760. As the factory system was followed by mechanization, simplification, standardization and mass production, costing had to keep up with these developments. Until the 18th century, costing was in the area of Engineers. Integration with financial accounting began when accountants began to audit cost records. Under the influence of financial accountants, costing came to be seen almost exclusively as a means of inventory valuation and profit measurement.

Costing has been found to assist in managing when compiling and providing the required statistical data. It has developed rapidly and assisted management of providing valuable information to take appropriate decisions in time. Costing sheds light on excessive waste of materials, inefficient labor operations, idle machinery and many other similar factors that are responsible for the reduction of profits in business activities. Management has found that costing can provide valuable assistance in planning, managing and coordinating activities.

Definitions

Costing:

The Society of cost control accountants (ICMA) London defines costing as a confirmation of costs, and costing includes the technology and process of confirming costs.

Cost accounting:

The Society of cost management accountants (ICMA) in London defines cost accounting as"the science, art and application of the principles, methods and techniques of cost accounting and cost accounting to the practice of cost management and confirmation of profitability, as well as the presentation of information for the purpose of management decision making". Therefore, cost accounting includes costing, costing, Budget Control, cost control, and cost audit. Costing refers to the process of determining and accounting for the cost of a particular product or activity. It also includes classification, analysis and guessing the production of costs.

Costing:

I.C.M.A.London defines costing as"the process of accounting for costs from the time when expenditures occur or from the time when they are committed to establishing the ultimate relationship with cost centers and cost units."

In practice, costing, costing, and cost accounting are often used interchangeably. Cost accounting refers to the confirmation of costs, the accumulation and measurement of costs of activities, processes, products or services. Cost data is used to create costing sheets or cost sheets. Costing is a professional Department of accounting that helps manage costs to control and create awareness of the importance of costs to the well of the business organization. Managing a business to achieve its objectives requires systematic and useful cost data and reporting.

Cost center:

A cost center is a place, person or asset that can be checked for costs and used for cost management purposes. This is an organizational segment or area of activity that is used to accumulate costs. The different types of cost centers used in manufacturing organizations are personal cost Cantor, impersonal cost center, work cost center and process Center.

Cost units:

A cost unit is a unit of the quantity of a product or service for which the cost is likely to be confirmed. There should be a unit of activity for proper confirmation of costs. Every organization has its own units for the measurement of raw materials and finished products. When the unit of activity is determined, it becomes the cost unit of the cost accountant. The cost unit must be suitable for your organization. The following is an example of cost units in different industries :-

Nature of Industry | Cost Unit |

Cement

| Tonne |

Cable | Metre

|

Power | Kilowatt/ hour |

Hospital | Per bed

|

Nature and Scope of cost accounting

Cost accounting goals are usually used to indicate activities in which costs must be determined individually. Activities can be functions for which data is required,sub-divisions of the organization, contracts or other units of work. There is a direct relationship between the information needs of management, the purpose of costing, the technologies and tools used for analysis in costing. Therefore, costing has the following purposes-

- Cost analysis: costing determines the deviation of the actual costs compared to the planned costs and the reason for such fluctuations.

- Cost audit: a cost audit is performed to verify the cost sheet and ensure the efficient application of cost accounting principles in the industry.

- Cost report: Cost Report is created from data taken through cost accounting that is analyzed by management for strategic decision making.

- Cost confirmation: to determine the price of a product or service, it is essential to know the total cost involved in the generation of that product or service.

- Cost book keeping:as with Financial Accounting, Journal entries,ledgers,balance sheets and profit and loss accounts are also prepared in costing. Here, the different costs incurred are debited, and the income from the product or service is credited.

- Cost system: it provides time to monitor and evaluate the costs incurred in the production of goods and services, to generate cost reports for management.

- Cost comparison:it examines the costs involved in it with other alternative product lines and activities to seek better opportunities to generate high profits.

- Cost Contol: sometimes the actual cost of a product or service is higher than its standard cost. Costing is required to eliminate variances and control the actual costs.

- Cost calculation:if the company is engaged in the production of bulk units of a particular product or goods, the actual cost per unit is derived by costing.

- Cost reduction: acts as a tool in the hands of management to find out if there is scope to reduce standard costs involved in the production of goods and services. Its purpose is to obtain additional benefits.

Key takeaways

- Costing is used internally by management to make informed business decisions.

- Unlike financial accounting, which provides information to external financial statement users, costing does not have to comply with set standards and gives you the flexibility to meet your management needs.

- Costing takes into account all input costs associated with production, including both variable and fixed costs.

- Types of costing include standard costing, activity-based costing, lean accounting, and marginal costing.

- Determine the cost of the product.

- To facilitate the planning and management of regular business activities.

- Provide information for short-term and long-term decisions.

- The purpose of costing, the technologies and tools used for analysis in costing

Cost Concepts and Classification

Cost concept:

According to the Association of Certified Management Accountants, costs are "expenditures (actual or hypothetical) incurred or resulting from a particular thing or activity." Similarly, according to Anthony and Wilsch, "cost is a monetary measure of the amount of resources used for several purposes."

Costs have been or may be incurred by the Cost Terminology Committee of the American Accounting Association, "in the realization of the management objectives mentioned above, which may be the manufacture of products or the provision of services. Is defined. "

From the above, it can be said that the cost is the sum of all the costs of a product or service. Therefore, the cost of a product means the actual shipment or confirmed change that occurred in its manufacturing and sales activities. In short, it is the amount of resources that have been exhausted in exchange for some goods and services.

So-called resources are expressed in money or currency units. What is said above does not make sense until it is used only as an adjective, that is, when it conveys its intended meaning.

Therefore, when we talk about prime cost, works cost, fixed cost, etc., we want to explain the specific implications that are essential when calculating, measuring, or analysing different aspects of cost.

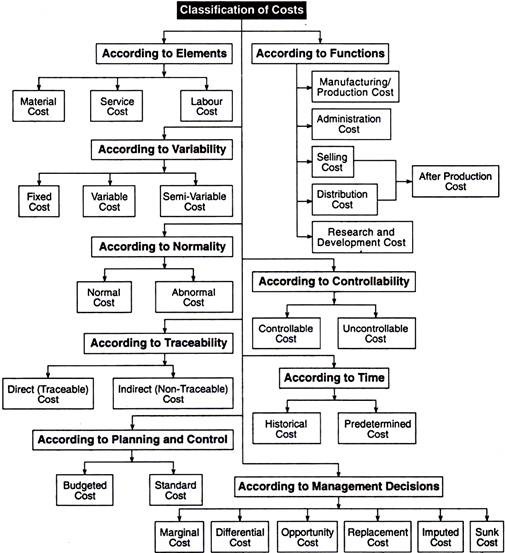

Cost classification:

To refer to costs in a cost center, proper classification of costs is absolutely necessary. Costs are usually categorized according to their nature: materials, workforce, overhead, and so on. The same cost figures can be categorized in different ways depending on the needs of the company.

(A) According to the function:

The total cost is divided into various segments according to the purpose of the company. Therefore, costs are grouped according to company requirements in order to properly evaluate the functioning of the company. In other words, the total cost includes all costs, from material costs to product packaging costs.

Direct material costs, direct labor costs, paid costs, and all overhead costs are born by the head of manufacturing / manufacturing costs.

At the same time, administrative costs (related to clerical and administrative) and sales and distribution costs (i.e. related to sales) are categorized separately and added to find the total cost of the product. If these functional classifications are not done properly, the true cost of the product cannot be accurately determined.

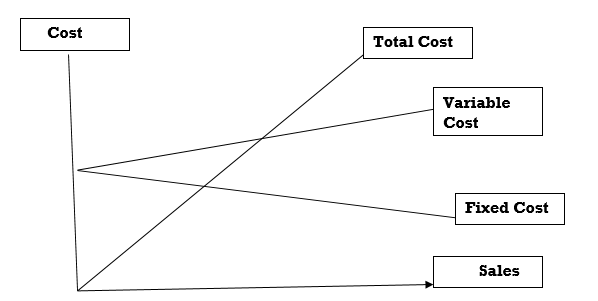

(B) According to volatility:

These costs per volume can be subdivided as follows:

- Fixed costs;

- Variable costs;

- Semi-variable cost.

In other words, we maintain fixed costs (salary, rent, etc.) up to a certain limit regardless of production volume. It is interesting to note that if more units are products, the fixed cost per unit will be reduced, and if fewer units are produced, the fixed cost per unit will obviously increase.

On the other hand, variable costs fluctuate in proportion to production volume. s of production volume. In other words, changes in production (raw material prices, labor, etc.) do not have a direct impact on cost per unit. On the contrary, semi-variable costs are partially fixed and partially variable (e.g. Building repairs).

(C) According to controllability:

Costs can be broadly divided into two categories, depending on the performance of the members of the company.

They are:

(I) Manageable costs. And

(II) Uncontrollable costs.

Manageable costs are costs that may be affected by decisions made by certain members of the management of the company, or costs that are at least partially management-dependent and manageable by management. All direct costs, direct material costs, direct labor costs, and billable costs (a component of prime costs) are manageable at a lower level of control and are carried out accordingly.

Uncontrollable costs are costs that are unaffected by the actions taken by a particular member of management. For example, fixed costs, that is, building rent, salary payments, and so on.

(D) According to normality:

Under this condition, costs are categorized according to the normal needs of a particular level of output for the normal level of activity generated for such output.

They are divided as follows.

(I) Normal cost; and

(II) Unusual cost.

Normal cost is the cost that is normally required for normal production at a particular output level and is part of production.

Anomalous costs, on the other hand, are costs that are not normally required to successfully produce a particular level of output, or are not part of the production cost.

(E) According to time:

Costs can also be categorized according to the time factor within them. Therefore, costs are categorized as follows:

(I) Acquisition cost; and

(II) Prescribed costs.

Acquisition costs are costs that are considered after they occur. This is possible, especially if production for a particular unit of output has already taken place. They have only historical value and cannot help manage costs.

On the other hand, the given cost is the estimated cost. Such costs are pre-calculated based on past experience and records. Needless to say, if it is scientifically determined, it will be the standard cost. Comparing these standard costs to actual costs reveals the reasons for the differences and helps management take appropriate steps to make adjustments.

(F) According to traceability:

Costs can be identified by a particular product, process, department, and so on. Costs are categorized as follows:

(I) Direct (traceable) costs; and

(II) Indirect (untraceable) costs.

Direct / traceable costs are the costs that can be directly tracked or assigned to a product. That is, it includes all traceable costs, that is, all costs associated with easily traceable costs of raw materials, labor, and other services used.

Indirect / non-traceable costs are costs that cannot be directly tracked or assigned to a product. That is, it includes all untraceable costs. Shopkeeper salary, general and administrative expenses, that is, things that cannot be properly allocated directly to the product.

(G) According to planning and management:

Costs can also be categorized as follows:

(I) Budget costs; and

(II) Standard cost.

Budget cost refers to the estimated manufacturing cost calculated based on the information available prior to the actual production or purchase. In reality, budget costs include standard costs. Both are pre-determined costs and the amounts may match, but for different purposes. It provides a medium that can measure the validity of current results and hold derivation responsibilities.

Standard costs are pre-determined for each element: materials, labor, and overhead costs. The standard costs are:

(I) the cost per unit is determined to produce the estimated total output for the next period.

(A) Material;

(B) Labor; and

(C) Overhead.

(II) Costs should depend on past experience and experimentation, and technical staff specifications.

(III) Expenses must be expressed in rupees.

(H) According to management's decision: Under this, costs may be categorized as follows:

(A) Marginal cost:

Marginal cost is the cost of producing additional units by separating fixed costs (that is, capacity costs) from variable costs (that is, production costs) that help us know profitability. In addition, we know that certain costs (fixed) may not increase at all to increase production, and only some costs related to material costs, labor costs, and variable costs will increase. Therefore, the total cost so increased by the production of one or more units is the cost of the marginal unit, which cost is known as the marginal cost or the incremental cost.

(B) Difference cost:

The differential cost is due to the additional features and is part of the cost of the features that can be identified by the additional features. That is, a cost change as a result of a change in activity level or production method.

(C) Opportunity cost:

This is the expected cost change associated with the adoption of alternative machines, processes, raw materials, specifications, or operations. In other words, it is the largest alternative revenue you could have earned if your existing capacity was changed to another alternative.

(D) Replacement cost:

This is the cost of exchanging an item or group of assets at the current price in a particular region or market region.

(E) Implicit cost:

This is the cost used to indicate the presence of an arbitrary or subjective element of product cost that is more important than usual. This is also known as notional cost. For example, interest on capital, but no interest is paid. This is especially useful when making decisions about alternative capital investment projects.

(F) Sunk cost:

This is a past cost resulting from a decision that cannot be modified at present and is associated with specialized equipment or other facilities that cannot be easily adapted to current or future objectives. Such costs are often seen as forming a small factor in future-impacting decisions.

Key takeaways:

- Costs have been or may be incurred by the Cost Terminology Committee of the American Accounting Association, "in the realization of the management objectives.

- Most accounting is employed internally by management to form informed business decisions.

- Unlike financial accounting, which provides information to external budget users, costing doesn't need to suits set standards and provides you the pliability to satisfy your management needs.

- Costing takes under consideration all input costs related to production, including both variable and glued costs.

- The purpose of costing is to help management during a decision-making process s that optimizes operations supported efficient cost control.

- In general, cost represents the entire cost related to creating one unit of a product or service.

- Product-centric unit price measurements vary from company to company.

- Large organizations can lower unit prices through economies of scale.

- Costs are useful for margin of profit analysis and form the essential level of market offer prices.

- Companies try to maximize their profits by lowering unit prices and optimizing market prices.

Methods and Techniques

Several methods or types of costing have been designed to suit the needs of individual business requirements. These are job costing and process costing.

All other costing methods are either variants of these two methods or techniques designed for specific purposes, specific opportunities, and specific conditions.

Job costing:this method is good for checking the cost of a job, a specific order, or a batch of finished products.

Where the cost unit is a job consisting of a specific quantity manufactured according to the order. The work can be small or large. It may be as per customer order for stock for final sale. Other variations of job costing are given below: -

- Contract costing:this method is used by contractors for construction of architectural bridges etc. Where the unit of cost is the contract. The term of this contract usually extends beyond the current fiscal year.

- Batch costing: this method produces economical batches of parts for subsequent assembling manufacturers large engineering companies use this method. Here, costing is done for batches of components, not for a single component.

- Multiple costing:this is used in large industries such as automobile, aircraft flat industry etc.Here the cost of parts is calculated separately. Each component is a job sheet. These are then assembled to complete the cost of an airplane or other finished product.

Process costing:this method is used in industry to manufacture products by continuous process. The cost is confirmed over the period by the process or department, but time is given more importance here as it is clear from the costing of the work. Therefore, this is also called period costing. Examples of industries that use process costing are the chemical industry, papermaking and refineries. The process costing can also be changed without:

- Work costing:work costing is applied to places where production goes through multiple operations in succession before the final product is manufactured. Wear and tear may occur in each operation. Work costing is used in industries such as Box manufacturing, shoe manufacturing and toy manufacturing. Where the cost unit is the work on which costs are accumulated.

- Single or output or individual costing: examples of industries applying this method are mining, quarry and steel production where the production is of a continuous nature and the final product is only one or different grades of the same product.

- Behavior costing:this method applies not to figure out the cost of drawing. Examples of industries using this method are transport services, electrical and boiler houses. In transport services, the unit of cost is passenger kilometers, or kilometers kilometers.

Essentials of a good costing system

- The costing system must conform to the General Organization of the business. Usually no component alternation should be made to facilitate the costing system. However, unavoidable changes can be made in the establishment of the position of holding, and proper costing system.

- All relevant technical aspects (nature and method of production, product varieties, etc.) should be properly considered in order to adopt appropriate cost control ingenuity.

- The size, placement and configuration of the factory should be fully described for the advantages of those operating costing systems.

- It is necessary to clearly specify the procedures that must be followed for the purchase, receipt, storage and issuance of materials.

- It is necessary to specify the method of payment of wages and the system of labor management.

- It is necessary to specify the norms of appointment and assignment of overhead.

- Economics to ensure that the original record can be proper.

- Form should be obtained printed. It should contain full instructions. Those who use them should be properly trained to ensure the correctness and relevance of the data written on the form.

- The Examiner must check and sign all entries in the form.

- Responsibility for preparing and sending cost reports to various levels of management at regular intervals should be fixed and the necessary instructions in this regard be issued.

- Full cooperation from everyone involved in management should be enlisted. Resistance from employees should be minimal.

- The cost of managing a costing system must be commensurate with the profit available from it.

- Design the system appropriately to effectively perform cost control.

- Cost accounts and financial accounts must be linked. Or the results of two sets of accounts should be adjusted.

- Frequency, regularity and speed in the presentation of cost reports should be guaranteed.

Key takeaways

- Where the cost unit is a job consisting of a specific quantity manufactured according to the order.

- Process costing is a method is used in industry to manufacture products by continuous process.

- The cost of managing a costing system must be commensurate with the profit available from it.

- It is necessary to specify the norms of appointment and assignment of overhead.

Cost Sheet

A cost sheet is a statement created to show the detailed cost of total output during a period. It provides information on the cost per unit at various stages of total production cost. Creating a cost statement is one of the important and key functions of cost accounting. The cost sheet is not an account. There is a prescribed form for creating a cost statement. A cost sheet is a statement that shows the cost over a period of time in a way that makes the various factors of cost as clear as possible. Cost sheets help you understand total production costs per unit, develop production plans, determine selling prices, and minimize production costs. Standard cost data may be provided to facilitate comparison with the increased actual cost. To prepare a cost sheet, you need to understand how to handle the following items:

- Raw Material Inventory: Raw material start and end stocks are adjusted in the purchase of raw materials to determine the value of the raw materials consumed for the output produced. Transportation / freight transportation, Octroi at the time of purchase, etc. are also added to the purchase. This is part of the prime cost.

- Work-in-process inventory: The value of work-in-process inventory is part of the factory cost and must be adjusted for factory overhead. The sale of scrap must be deducted from the factory overhead to determine the total cost of the factory.

- Finished Product Inventory: A finished product is a product that has been worked on in the factory. This is the completed production cost. The opening and closing prices of the finished product are adjusted at the total cost of goods sold to reach the cost of goods sold.

Costs excluded from the cost sheet:

There are certain costs / costs that do not form part of the cost sheet. Part of these costs is the distribution of profits. Examples of these costs are:

1. Dividends to shareholders

2. Income tax

3. Loan interest

4. Payment of donations

5. Capital investment

6. Capital loss due to asset sale.

7. Outsourcing to a partner / Representative director

8. Discount on issuance of stocks and corporate bonds

9. Underwriting fee.

10. Book of goodwill and non-performing loans

11. Allowance for taxation, bad debt, or any kind of fund or reserve.

Specimen of Cost Sheet

Cost Sheet for the period

Particulars | Total Cost Rs. | Cost Per Unit Rs. |

Direct Materials Raw Materials Opening stock Materials : Add : Purchases Add : Carriage / Freight Inwards Less : Closing stock Cost of materials consumed Direct Labour Direct Expenses

Prime cost Factory overheads Add: Work in Progress (Opening ) Less : Work in Progress (Closing )

Works /Factory cost Add: Office and administrative expenses

Cost of Production (of goods produced)

Add: Op. Stock of finished goods Less closing of finished goods

Cost of production (of goods sold) Add: Selling & Distribution expenses

Cost of Sales Add: Profit (Loss) Sales |

|

|

(Production ------ Units)

Total Cost

Definition: Total cost is an economic indicator of all costs paid for the production of a product, the purchase of an investment, or the purchase of equipment, including not only the initial cash outlay but also the opportunity cost of choice. I will.

What does the Total Cost mean?

What is the definition of total cost? The meaning of this term varies slightly depending on the content. For example, if you use it to define production costs, you measure the sum of fixed, variable, and overhead costs associated with the production of goods. This is a basic concept for business owners and managers. This allows you to track the total cost of your business. This allows individuals to make pricing and revenue decisions based on whether total costs are increasing or decreasing. In addition, interested individuals can delve into the total cost figures into fixed and variable costs and adjust operations accordingly to reduce total production costs. Management also uses this idea when considering capital investment.

However, investors use this concept differently by considering the funds needed to buy an investment and the opportunity costs associated with choosing one investment from another.

Let's look at an example.

Jane is the Chief Operating Officer of the world's largest automobile manufacturer. The company recently confirmed that total costs increased by 15% year-on-year, and Jane is in charge of analysis to correct this trend.

She sees the overall cost of the company as she rose from $ 100,000 to $ 132,250 in her two years. This proves an extreme increase in cost. After looking at the numbers, she was surprised to find that fixed costs weren't really increasing, and she was down from $ 70,000 to $ 65,000. In addition, she noticed that the company's variable costs, especially salaries and benefits, swelled from her $ 30,000 to $ 67,250.

What is the Total Cost Formula?

The total cost formula is used to determine the total by combining variable and fixed costs to provide the goods. The formula is:

Total cost = (Average Fixed Cost X Average Variable Cost) x Production Volume

To use this formula, you need to know the fixed and variable cost numbers.

Fixed costs are fixed project costs regardless of the number of units produced. This includes monthly costs such as rent, insurance, payroll taxes, office supplies, wages for staff who are not directly involved in the provision of services or the production or manufacture of products sold.

Variable costs are costs that increase or decrease depending on the number of products produced and the number of customers who need services. It can also change due to other factors, such as rising material prices and rising heating costs during the winter. Variable costs include materials used for manufacturing, costs for packing and shipping products, labor costs for staff directly engaged in the purchase, rental and maintenance of equipment used for production, service or delivery of goods, and production. Contains the utilities used for. Work area.

Total Cost Factor

Costs are categorized under various headings that represent successive stages of cost flow.

Cost

Prime cost consists of costs that can be traced back directly to it. The main costs consist of direct material costs, direct labor costs, and direct costs. Direct costs include special costs that can be identified by the product or work and are charged directly to the product as part of the main costs. For example, the cost of hiring a special plant or machine, the cost of a special mold, the cost of a design or pattern, the cost of an architect, royalties, license fees, etc.

Construction Cost:

The work cost of a product is the basic cost plus a portion of the work or factory costs incurred on production. Work or factory costs include overhead and overhead costs for indirect materials. Indirect materials are the materials needed to complete a product, but the consumption of these materials is very low or complex and it is not appropriate to treat them as direct materials. These are consumables that cannot be conveniently and economically charged for a particular output unit. For example, lubricants, lint, stationery for work, etc.

Indirect labor is labor that does not affect the structure or composition of the finished product. This is the labor cost of production-related activities that cannot

Be easily associated with or easily tracked to a particular product by physical observation. For example, the salary of a foreman or the salary of an employee engaged in maintenance or service operations. Indirect costs cover all expenses incurred by the manufacturer at the rate of the product from the time of manufacture to the completion of delivery to the customer. Expenses that cannot be allocated but can be allocated or absorbed by a cost center / cost unit are called indirect expenses. These costs are incurred for the benefit of multiple products, jobs, or activities and must be allocated to different features or products according to appropriate criteria. For example, lighting / heating, salary of maintenance shop manager, salary of clock / ward department, etc.

Production cost:

The production cost is the work cost plus the office cost and management cost. This includes all costs associated with management functions such as planning, organizing, directing, coordinating and managing the operation of the manufacturing business. For example, office rent, salary, lighting, stationery, office building repair and maintenance and depreciation, audit costs, legal costs, etc.

Cost Per Unit

The cost per unit is usually calculated when a company mass-produces the same product. Then compare this information with your budget or standard cost information to see if your organization produces goods in a cost-effective way.

The cost per unit is derived from the variable and fixed costs incurred in the production process divided by the number of units produced. Variable costs such as direct materials fluctuate approximately in proportion to the number of units produced, but this cost should decrease somewhat as the unit quantity increases due to the large quantity discounts, such as building rent. Fixed costs should remain the same no matter how many units are produced, but can increase as a result of the need for additional capacity (known as step costs, reaching a certain unit volume). Examples of step costs include the addition of new or production equipment, the addition of forklifts, or the addition of a second or third shift. When a step cost is incurred, the new step cost is added to the total fixed cost, increasing the cost per unit. Depending on the size of the gradual cost increase, the manager may want to leave the capacity as it is and outsource additional production instead. This is a wise choice if the need to increase capacity is unclear.

Calculation formula of cost per unit

Within these limits, the cost per unit calculation is as follows:

(Total fixed costs + Total variable costs) ÷ Total production volume

The cost per unit should declines as the number of units produced increases. This is mainly because the total fixed costs are spread across more units (affected by the step costing issue above). Therefore, the cost per unit is not constant.

Example of Unit Price

ABC Company's total variable costs for May are $ 50,000 and fixed costs are $ 30,000. This happened when producing 10,000 widgets. The cost per unit is as follows:

($ 30,000 fixed cost + $ 50,000 variable cost) ÷ 10,000 units = $ 8 cost per unit

The following month, ABC will produce his 5,000 units at a variable cost of $ 25,000 and the same fixed cost of $ 30,000. The cost per unit is as follows:

($ 30,000 fixed cost + $ 25,000 variable cost) ÷ 5,000 units = $ 11 / unit

Key takeaways:

- For a company to succeed, it needs a clear understanding of profitability.

- To do this, there are several elements in the account that need to be calculated.

- One of these is the total cost, which is calculated using a total cost formula that requires you to enter various metrics to calculate a particular number.

- You can use this number to determine the profitability of your business.

- Costs per unit produced or supplied are a clear measure, as cost center managers are responsible for costs.

- An easy way to calculate this is to divide the costs incurred in a period by the units produced during that period.

- In general, the unit cost represents the total cost required to create her one unit of a product or service.

- Product-centric unit price measurements vary by business.

- Larger organizations can lower unit costs with economies of scale.

- Costs help analyze gross margins and form the basic level of market offer prices.

- Enterprises seek to maximize profits by reducing unit costs and optimizing market prices

Solved Examples

Q.1. Bombay Manufacturing Company submits the following information on 31-3-2010.

Particulars Sales for the year Inventories at the beginning of the year- |

Rupees 2,75,000 |

- Raw Materials | 3,000 |

- Work in Progress | 4,000 |

- Finished Goods | 1,10,000 |

Purchase of materials | 65,000 |

Direct Labour | 6,000 |

Inventories at the end of the year - |

|

- Raw Materials | 4,000 |

- Work in Progress | 6,000 |

- Finished Goods | 8,000 |

Other expenses for the year – |

|

Selling expenses | 27,500 |

Administrative expenses | 13,000 |

Factory overheads | 40,000 |

Prepare Statement of cost |

|

Solution:

Bombay Manufacturing Company

Statement of cost for the year ended 31-3-2010.

| Rs. | Rs. |

Materials consumed Opening stock: Add: Purchases |

3,000 1,10,000 |

1,09,000 65000 6000 |

Less: Closing stock

Direct Labour Direct Expenses | 1,13,000 4,000 | |

40000 4000 | ||

| ||

| ||

Prime cost | 180000 | |

Factory overheads Add: Work in Progress (beginning ) |

| |

Less: Work in Progress (Closing ) Works cost Administrative expenses Cost of Production Add: Opening Stock of finished goods | 44000 6000 |

38000 |

| 2,18,000 13,000 | |

2,31,000 7,000 | ||

Less: Closing Stock of finished goods | 2,30,000 8,000 | |

Selling & Distribution expenses Cost of Sales Profit (Bal. Fig) Sales | 2,30,000 27,500 | |

2,57,500 17,500 | ||

2,75,000 |

Q.2. From the following information prepare a statement showing (i) Prime cost (ii) Works cost (iii) Cost of Production (iv) Cost of Sales (v) Net profit of X Ltd. Which produced and sold 1000 units in June 2009.

Particulars | Rs. |

Opening Stock: |

|

Raw Materials | 24,000 |

Finished goods Closing stock: | 16,000 |

Raw Materials | 20,000 |

Finished goods | 15,000 |

Purchase of Raw Materials | 80,000 |

Sales | 2,00,000 |

Direct Wages | 35,000 |

Factory Wages | 2,000 |

Carriage Inward | 2,000 |

Carriage Outward | 1,000 |

Factory Expenses | 4,000 |

Office Salaries | 15,000 |

Office Expenses | 12,000 |

Factory Rent & Rates | 2,500 |

Depreciation - Machinery | 2,500 |

Bad Debts | 1,500 |

Solution:

Cost Statement for June 2009

Particulars | Rs. | Total Cost | Cost per Unit |

|

| Rs. | Rs. |

Opening stock of materials | 24,000 |

|

|

Add: Purchase of materials | 80,000 |

|

|

Add: Carriage Inward | 2,000 |

|

|

| 1,06,000 |

|

|

Less: Closing stock of materials | (20,000) |

|

|

Cost of Materials consumed |

| 86,000 | 86.00 |

Direct Wages |

| 35,000 | 35.00 |

(i) PRIME COST |

| 121000 | 121.00 |

Factory overheads: |

|

|

|

Factory Wages | 2,000 |

|

|

Factory expenses | 4,000 |

|

|

Factory Rent & Rates | 2,500 |

|

|

Depreciation | 2,500 | 11,000 | 11.00 |

|

|

|

|

(ii) WORKS COST |

| 1,32,000 | 132.00 |

Administrative Overheads: |

|

|

|

Office Salaries | 15,000 |

|

|

Office Expenses | 12,000 | 27,000 | 27.00 |

(iii) COST OF PRODUCTION |

| 1,59,000 | 159.00 |

Selling & Distribution Overheads: |

|

|

|

Carriage Outwards | 1,000 |

|

|

Bad Debts | 1,500 | 2,500 | 2.50 |

TOTAL COST |

| 1,61,500 | 161.50 |

Add: Opening Stock of finished goods |

| 16,000 |

|

|

| 1,77,500 |

|

Less: Closing Stock of finished goods |

| (15,000) |

|

(iv) Cost of Sales |

| 1,62,500 | 162.50 |

(v) Net Profit (Bal.Fig) |

| 37,500 | 37.50 |

Sales |

| 2,00,000 | 200.00 |

Q.3. NRC Ltd. Manufactured and sold 1000 Radio sets during the year 2009. The summarized accounts are given below:

Mfg. / Trading & Profit & Loss A/c

To Cost of Materials | Rs. 40,000 |

By Sales | Rs. 2,00,000 |

To Direct Wages | 60,000 |

|

|

To Manufacturing Exp. | 25,000 |

|

|

To Gross Profit | 75,000 |

|

|

| 2,00,000 |

| 2,00,000 |

To Salaries | 30,000 | By Gross Profit | 75,000 |

To Rent, Rates & Taxes | 5,000 |

|

|

To General Expenses To Selling & Distribution Exp. | 10,000

15,000 |

|

|

To Net Profit | 15,000 |

|

|

| 75,000 |

| 75,000 |

It is estimated that output and sales will be 1200 Radio Sets in the year 2010. Prices of Materials will rise by 20% on the previous year’s level. Wages per unit will rise by 5% Manufacturing expenses will rise in proportion to the combined cost of materials and wages. Selling and distribution expenses per unit will remain unchanged. Other expenses will remain unaffected by the rise in output. Prepare cost sheet showing the price at which the Radio Sets should be sold so as to earn a profit of 20% on the selling price.

Solution:

Cost Sheet

Particulars | 2009 | 2010 | ||

1000 Radios | 1200 Radios | |||

Total | Per Unit | Total | Per Unit | |

Rs | Rs | Rs | Rs | |

Direct Materials | 40,000 | 40.00 | 57,600 | 48.00 |

Direct Wages | 60,000 | 60.00 | 75,600 | 63.00 |

PRIME COST | 1,00,000 | 100.00 | 1,33,200 | 111.00 |

Manufacturing Expenses | 25,000 | 25.00 | 33,300 | 28.00 |

WORKS COST | 1,25,000 | 125.00 | 1,66,500 | 139.00 |

Salaries | 30,000 | 30.00 | 30,000 | 25.00 |

Rent, Rates Insurance | 5,000 | 5.00 | 5,000 | 4.00 |

General Expenses | 10,000 | 10.00 | 10,000 | 8.00 |

COST OF PRODUCTION | 1,70,000 | 170.00 | 2,11,500 | 176.00 |

Selling & Distribution Expenses | 15,000 | 15.00 | 18,000 | 15.00 |

Cost of Sales | 1,85,000 | 185.00 | 2,29,500 | 191.00 |

Net Profit | 15,000 | 15.00 | 57,275 | 48.00 |

SALES | 2,00,000 | 200.00 | 2,86,775 | 239.00 |

Q.4. A factory can produce 60,000 units per year at its 100% capacity. The estimated cost of production are as under: -

Direct Material- Rs. 3 per unit

Direct Labour- Rs. 2 per unit

Indirect Expenses:

Fixed- Rs. 1,50,000 per year

Variable- Rs. 5 per unit

Semi-variable- Rs.50,000 per year up to 50% capacity and an extra expenses of Rs.10,000 for every 25% Increase in capacity or part thereof.

The factory produces only against order and not for stock. If the Production programme of the factory is as indicated below and the management desires to ensure a Profit of Rs. 1,00,000 for the year, work out the average selling price at which per unit should be quoted:

First 3 months of the year 50% of capacity remaining 9 months 80% of the capacity. Ignore selling, distribution and administration overheads.

Solution:

Particulars |

First 3 months |

9 Months |

Total |

| (7500 Units ) | (3600 Units) |

|

| Rs. | Rs. | Rs. |

Direct Material | 22500 | 108000 | 130500 |

Direct Labour | 15000 | 72000 | 87000 |

| ---------------- | ---------------- | -------------------- |

| 37500 | 1,80,000 | 2,17,500 |

Add : Indirect Expenses: |

|

|

|

Fixed 1: 3) | 37500 | 112500 | 150000 |

Variable @ Rs.5 b.u. | 37500 | 180000 | 217500 |

Semi –variable |

|

|

|

For 3 months | 12500 | ----- | ------ |

@ Rs.50,000 p.a. |

|

|

|

For 9 months |

|

|

|

@ Rs.70,000 p.a. | -- | 525000 | 65000 |

| -------------- | -------------- | --------------- |

Total Cost | 125000 | 525000 | 650000 |

Profit | -- | - | 100000 |

|

|

| ---------------- |

Sales |

|

| 750000 |

Q.5. In a factory two types of T.V sets are manufactured i.e. black & white + color. From the following particulars prepare a statement showing cost and profit per T.V Set sold. There is no opening or closing stock.

| B & W Rs. | Color Rs. |

Materials | 273000 | 10,80,000 |

Labour | 156000 | 6,20,000 |

Works overhead is charged at 60% of Prime cost and Office overhead is taken at 20% at Works cost. The selling price of B & W is Rs.60,00 and that of color is 10000. During the period 200 B & W and 400 color T.V. Sets were sold. The selling expenses are Rs. 50 per T.V .Set.

Solution:

Statement of Cost and Profit

Particulars | B & W | Color | ||

Rs. | Per Unit | Rs. | Per Unit | |

Materials | 2,73,000 | 1,365 | 10,80,000 | 2700 |

Labour | 1,56,000 | 780 | 6,20,000 | 1550 |

Prime Cost | 4,29,000 | 2,145 | 17,00,000 | 4250 |

Add: Work Overheads | 2,57,400 | 1,287 | 10,20,000 | 2550 |

(60% of Prime Cost) |

|

|

|

|

|

|

|

| |

Works Cost | 6,86,400 | 3,432 | 27,20,000 | 6800 |

Add: Office overheads | 1,37,280 | 686.40 | 5,44,000 | 1360 |

(20% of Works cost) |

|

|

|

|

|

|

|

| |

Cost of Production | 8,23,680 | 4118.40 | 32,64,000 | 8160 |

Add: Selling Expenses | 10,000 | 50 | 20,000 | 50 |

Cost of Sales | 8,33,680 | 4,168.40 | 32,84,000 | 8210 |

Profit (Bal. Fig) | 3,66,320 | 1,831.60 | 7,16,000 | 1790 |

Sales | 12,00,000 | 6,000 | 40,00,000 | 10,000 |

Breakeven Analysis – Meaning and its application, Limitations

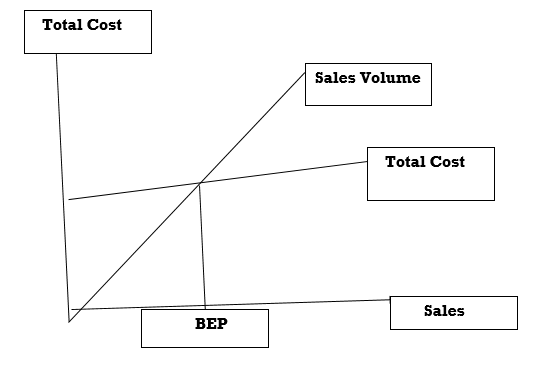

Break-even analysis is additionally referred to as cost-volume profit analysis. Break-even point analysis is a relationship between asking price, sales volume, fixed costs, variable costs, and profits at various level activity. Break-even analysis may be a widely used technique for studying the cost-volume-profit relationship narrow

Here, the entire cost is adequate to the entire asking price. The broader interpretation refers to the analytical system. Determines expected profits for all levels of activity. It describes the connection between production costs, Production volume and sales value.

Here, CVP analysis is additionally commonly performed, but it's not accurate, but it's called "break-even point analysis". The difference between the 2 terms is extremely narrow. CVP analysis includes full range Break-even analysis is one among the techniques utilized in this process. But as mentioned the above break-even point analysis techniques are so popular in CVP analysis research that the 2 terms are used as a synonym. For the needs of this investigation, we also these two terms to know the concept of break-even analysis, it's helpful to understand the following specific basic terms listed below application

- You’ll use break-even analysis to work out your company's break-even point (BEP).

- The break-even point is that the level of activity where total revenue is adequate to total cost. At this level, the corporate doesn't make a profit

1. Contribution

This is a more than the asking price that exceeds the variable cost also called "gross profit". The amount of profit (loss) is often confirmed by deducting fixed costs from contributions. In other words, it had been fixed Costs and benefits correspond to contributions. It is often expressed by the subsequent formula.

Contribution = Selling Price – Variable Cost or Contribution = Fixed Cost + Profit = Contribution – Fixed Cost

2. Profit / Volume ratio (P / V ratio)

This term is important for studying the profitability and profit ratio of operating a business.

Establish a relationship between contribution and sales. The ratio can be displayed in the following format Percentage too. The expression can be expressed as:

This ratio can also be found by comparing changes Contribution to changes in sales or changes in profits due to changes in sales. Increased contribution .Fixed costs are assumed to be constant at all production levels, which mean increased profits.

Therefore,

P/V Ratio (or, C/S ratio) = Contribution S𝑎𝑙𝑒𝑠 = C S or, P/V Ratio = Sales−Variable Cost S𝑎𝑙𝑒𝑠 = S−V S or, 1- Variable Cost S𝑎𝑙𝑒

This ratio is also known as the "contribution / sales" ratio. This ratio can also be found by comparing changes Contribution to changes in sales or changes in profits due to changes in sales increased contribution. Fixed costs are assumed to be constant at all production levels, which mean increased profits.

Therefore, Thus, P/V Ratio = Change in Contribution by Change in S𝑎𝑙𝑒𝑠 or, P/V Ratio = Change in Profit (or Loss) Change in S𝑎𝑙𝑒

The characteristics of the P / V ratio are as follows.

(I) Helps administrators see the total amount of contribution to a particular sale.

(II) The selling price and the variable cost per unit are constant or constant as long as they are constant. It fluctuates at the same rate.

(III) Not affected by changes in activity level. In other words, the PV ratio of the product. The amount of activity is the same whether it is 1,000 units or 10,000 units.

(IV) Fixed costs are not considered at all, so the ratio is also unaffected by fluctuations in fixed costs while calculating the PV ratio. For multi-product organizations, PV ratios are very important for management to decide which one to find. The product is more profitable. Management is trying to increase the value of this ratio by reducing variable costs or by raising the selling price.

3. Break-even point: A point that indicates the level of output or sales by dividing the total cost and sales price evenly. There is no profit or loss, it is considered a break-even point. At this point, business income exactly equal to that spending. If production is boosted beyond this level, profits will be generated in the business. And if it decreases from this level, the loss will be incurred by the business. Here it is appropriate to understand the different concepts of marginal costs and break-even points. Go further. This is explained below.

It's neither a profit nor a loss. Therefore, at the break-even point, the contribution is equal to the fixed cost.

Contribution = Fixed cost (1) Break-even point (in units) = Fixed Cost Contribution per unit (2) Break-even point (in amount) = Fixed Cost Contribution per unit x Selling Price per unit Or, = Fixed Cost Total Contribution x Total Sales Or, = Fixed Cost 1− Variable Cost per unit Selling price per unit = Fixed Cost P/V Ratio

Sales at break-even point = break-even point x selling price per unit

At the break-even point, the desired profit is zero. When calculating production or sales

You need to add a fixed amount of "desired profit" or "target profit" "desired profit" or "target profit" The cost of the above formula. For example:

(1) No. Of units at Desired Profit = Fixed Cost+Desired Profit Contribution per unit (2) Sales for a Desired Profit = Fixed Cost+Desired Profit P/V Ratio

(2) Sales at break-even point = break-even point x selling price per unit

(3) At the break-even point, the desired profit is zero. When calculating production or sales

(4) You need to add a fixed amount of "desired profit" or "target profit" "desired profit" or "target profit"

(5) The cost of the above formula. For example:

Break-even point analysis: Relationship between selling price, sales volume, fixed costs, variable costs, and profits at various levels activity application.

- You can use break-even analysis to determine your company's break-even point (BEP).

- The break-even point is the level of activity where total revenue is equal to total cost.

- At this level, the company does not make a profit

Break-even point analysis assumptions

- Related range

- The relevant range is the range of activities for which fixed costs remain fixed in total.

- Variable costs per unit remain constant

- Fixed costs

- Total fixed costs are assumed to be constant in total Variable cost

- Total variable costs increase because the number of units produced increases Sales

- Total revenue increases as the number of units produced increases Safety range

Application

- Fixed costs are kept constant for all production volumes.

- Variable costs fluctuate in direct proportion to production volume.

- The selling price remains constant and

- The product configuration is unchanged.

- The number of sales units matches the units produced so that there is no starting or ending stock.

- Productivity per worker does not change.

- There is no change in the general price level.

- All costs can be divided into fixed and variable components

Break-even analysis limits:

1. Break-even analysis is based on the assumption that all costs and costs can be clearly separated into fixed and variable components. However, in practice, it may not be possible to clearly divide costs into fixed and variable types.

2. Fixed costs are assumed to be constant at all activity levels. It should be noted that fixed costs tend to fluctuate beyond a certain level of activity.

3. Variable costs are assumed to fluctuate in proportion to production volume. In reality, they definitely move in sympathy for the amount of output, but not necessarily in direct proportions.

4. The assumption that the selling price does not change gives a linear revenue line that may not be true. The selling price of a product depends on certain factors such as market supply and demand, competition, etc., so it is also not constant.

5. The assumption that only one product is produced or the product composition remains unchanged is actually difficult to find.

6. Allocating fixed costs to different products causes problems.

7. This assumes that business conditions may not change, but this is not true.

8. It is assumed that the production quantity and the sales quantity are equal and there is no change in the open / closed inventory of the finished product, but these do not actually work.

9. The break-even analysis does not take into account the amount of capital used in the business. In fact, capital used is an important determinant of the profitability of concerns.

Key takeaways:

- Break-even analysis shows the number of units of product that need to be sold to cover fixed and variable production costs.

- The break-even point is considered a measure of the safety margin.

- Break-even analysis is widely used, from trading stocks and options to corporate budgets for a variety of projects.

- The break-even point is the production level at which the production cost is equal to the revenue of the product.

- In an investment, it is said that the break-even point is achieved when the market price of the asset is the same as the original cost.

References:

1. Engineering Economic Principles, Henry Malcom Stenar- McGraw Hill Pub.

2. “Modern Economic Theory”, Siltan Chand & Co.

3. Agrawal AN, “Indian Economy”, Dewett K.K., - Wiley Eastern Ltd, New Delhi.

4. “Accounting Part-I’, Jain and Narang - Kalyani Publishers.

5. “Cost Accounting”, Arora, M.N. - Vikas Publications.