UNIT I

INTRODUCTION TO ACCOUNTING

|

Accounting is as old as money itself. As a child, commercial activities were based on barter systems, so record keeping was not necessary. The Industrial Revolution of the 19th century paved the way for commercial activity, mass production, and the development of credit terms, along with the rapid population growth. Therefore, the record of commerce has become an important function. 1.

- Applicability

Accounting principles are expected to be feasible, predictable and applicable. It should be easy to apply to accounting systems and easy for anyone to implement.

For example, if you see fixed assets on your balance sheet, replacement costs are difficult, and fluctuations and people can cause fluctuations and market prices. It doesn't change from person to person, but it shouldn't.

2. Recording

Accounting has the unique function of recording all financial transactions. It provides provisions for recording transactions in a detailed way that companies can use. Recording is systematic and can be done by anyone familiar with the basics of accounting and the law.

Recording is done by similar grouping entries under a single title so that all financial transactions can be easily categorized.

3. Classification

Accounting provides the ability to categorize all financial transactions into different categories. These categories are grouped in one place according to their similarity. For example, all payments and receipts received will be reflected in your cashbook or memo book.

This helps to classify all similar transactions into one heading, which helps to find them and makes it easier. A book that has completed the process of opening an account is called a ledger.

4. Usefulness

Accounting principles have been found to be useful and provide important information to anyone trying to find them in an easy way. With different categories and headings that categorize different transactions, the finder can easily find a particular transaction.

These entries help determine and identify the nature of the transaction and analyze its impact on the overall balance sheet.

5. Objectivity

Principals are relevant when there are numbers and facts. Factual accounting principles that support numbers make it very relevant. There is no prejudice, as it is guaranteed that personal whims and prejudices are not included in the accounting case.

This is why accounting is said to be objective.

6. Summary

Accounting is known to provide a summary of the relevant complex financial statements. Cash flow, fund flow and balance sheet statements are briefly summarized and presented to investors and the general public.

These statements help investors make investment decisions. The abstract also provides a test of the organization's overall financial position without spending a lot of time.

Income statements, balance sheets, etc. are mirrors of the company, and summaries are considered to be very important statements.

7. Verification

All statements generated by a Certified Treasury Auditor or Bookkeeper can be audited and verified for their validity. All entries in the accounting system are related to a company's financial transactions. Therefore, financial statements give a glimpse of the mirror of the organization.

All of these entries can be validated and verified to test the validity of the statement.

8. Interpretation

Financial statement summaries can be read and interpreted by anyone with knowledge. The interpretation is universal and there is no difference from person to person or from auditor to auditor. It remains constant regardless of who interprets it, which gives it a characteristic of universality.

You can analyze the interpretation to find out if your organization is in good or bad financial position. Business performance can be determined with the help of accounting statements.

9. Reproducibility

Accounting is characterized by reproducibility due to established procedures and formulas. Accounting steps are calculated based on a fixed formula. For example, ratio analysis uses different formulas to determine different aspects of a stock. This is convenient for investors.

The results obtained from these analyzes are repeatable due to the universality of the formula and are not individual dependent or change over time.

The necessity and importance of accounting

When a person starts a business, big or small, his main purpose is to make a profit. He receives money from certain sources such as selling goods and interest on bank deposits. He has to spend money on certain items such as purchasing goods, salaries, and rent. These activities take place in the course of his normal business. He naturally wants to know the progress of his business at the end of his year. There are so many commerce that I can't remember his memory of how the money was made. At the same time, if he writes down his income and expenses, he can quickly get the information he needs. Therefore, in order to get an easy and accurate answer to the next question at any time, you need to clearly and systematically record the details of your commerce.

I. What happened to his investment?

ii. What will happen to the results of the commercial transaction?

iii. How much are your income and expenses?

iv. How much can I receive from a customer whose goods are sold by credit?

v. How much do you pay the supplier to buy credit?

vi. What are the nature and value of assets that business concerns have?

vii. What is the nature and value of debt of business concern?

These and some other questions can be answered with the help of accounting. The need to record commerce in a clear and systematic way is the basis for creating bookkeeping.

Accounting, one of the key aspects of an organization, has many well-defined purposes. The purpose may also vary depending on the genre of the business you belong to. Analyze your accounting objectives from a broader perspective and understand how you can achieve them.

1) Records management

The basic role of the accounting department of an organization is to keep a systematic record of all financial transactions. Systematic records management ensures an appropriate level of analysis to reach the financial position of the organization.

It makes systematic record keeping an absolute purpose of accounting. This is a great help for systematic and accurate decision analysis. Proper recording is one of the key factors and must form the backbone of an organization before it can achieve other purposes or other sections of accounting.

2) Analysis and confirmation of financial results

If you are in business, you will want to determine the exact state of your company's financial position at the end of a particular period. Companies typically prefer quarterly closing of operating finance.

The accounting department creates the profit and loss details of the organization based on the income statement generated using the records held during that period. This is a continuous process and will continue regardless of the specified time period.

3) Analysis of financial condition

Accounting also aims to check the financial status of an organization. This includes liabilities, liabilities, assets, and assets. The accounting section should be able to keep up to date with the financial status of the company.

This is ideally achieved through the creation of a balance sheet. This gives you a glimpse of your organization's financial position over a specific period of time. The balance sheet helps you analyze your company's financial position and make future decisions and goals.

4) Decision-making

Decision-making accounting has a broader purpose of supporting the decision-making of business owners and business owners. Systematic accounting is an important factor in making business decisions and setting goals for future growth and realistic goals for planning.

Here are some examples of decisions that accounting can support:

- Product pricing to achieve maximum profit. Accounting can reach operational and other costs associated with manufacturing a product, so you can reach realistic and accurate pricing without ambiguity.

- Make decisions when you're short on money to maximize your profits and improve your status.

- Helps make decisions when an organization needs to obtain additional funding. This is also true for new product launches and diversification into new businesses.

- Accounting can also help you determine poorly performing products and services.

- Decisions regarding credit lending to customers.

- In essence, these decisions can often be made without the help of accounting. However, accounting provides a reasonable basis for these decisions.

5) Liquidity status

A complete understanding of an organization's liquidity status is also an important goal that accounting must fulfil. Lack of proper accounting often leads to financial mismanagement of the organization and can lead to major problems such as lockouts and business closures.

Appropriate accounting should help management and business owners see how much cash and other resources they have at their disposal to pay their financial commitments. Must be. Knowledge of liquidity also helps to calculate the amount of working capital and the capital that can be used to repay debt.

6) Ensuring positioning

One of the main purposes of accounting is to support the positioning of an organization. Accounting provides a large amount of financial statements to help you reach this goal. The financial position of an organization would ideally be of great help in promoting the financial position of the company.

Financial statements that help you check your organization's financial position include:

- The amount of capital raised by the organization to do business.

- Amount of funds from this capital used for business activities

- The organization's complete balance sheet showing cumulative profits or losses.

- Organizational responsibility. This refers to the amount the company should pay to others

- The sum of cash, inventory, machinery, assets, and other assets owned by the organization.

- Accounting aims to manage and maintain all these statements in order to provide a sound picture of the organization.

7) Accountability

One of the most important goals of accounting perfection is to maximize the accountability of the company. It is the accounting department of an organization that provides a solid foundation for assessing the actual performance of an organization over a period of time.

This also helps to promote organizational accountability in the long run and through multiple layers of the organizational hierarchy. Financial statements in the accounting department also help to give shareholders sufficient trust. In poor performance, the same financial statements help shareholders hold the company's directors and promoters accountable. This is also useful if you are planning to fund a new project. A reliable and accountable financial position helps to secure financing through loans or from investors.

8) Legal purpose

Accounting also serves as legal support to support an organization's financial position. Therefore, one of the key objectives that accounting needs to deal with is to meet the legal requirements of the organization.

Accounting is a legal requirement in accordance with laws around the world. In accordance with the law, all companies are required to maintain and maintain financial records of transactions for a specified period of time and share this information with shareholders, promoters and regulators. In addition, proper accounting helps an organization to positively reach the right financial rights, obligations, and liabilities.

9) Fraud detection and prevention

Financial mismanagement and fraud are one of the main reasons that can cause business closures or losses. One of the main purposes of accounting is to record actual transactions to prevent fraud and mismanagement.

If the records are correct and genuine, you can prevent employees of your organization from indulging in fraudulent financial activities. Accounting provides the coveted transparency of company-wide transactions and thus ensures that fraud is reduced to near zero.

Conclusion

In essence, the main purpose of accounting is to manage and maintain good records of each financial transaction in a systematic way and analyze these records to reach the proper financial position of the organization. Once you start achieving this goal, rest on the goals outlined above.

Overview:

Accounting principles are built on some basic concepts. These concepts are so basic that most financial statement authors do not consciously consider them. As mentioned earlier, they are considered trivial. Some accounting researchers and theorists argue that some of the current accounting concepts are wrong and need to be changed.

Nevertheless, in order to understand the accounting that currently exists, it is necessary to understand the basic concepts currently in use. The basic accounting concepts described here may not be the same as those listed by other authors or groups. However, these are widely accepted and practical concepts used by financial statement authors and auditors to review financial statements.

Key takeaways:

- Accounting may be a necessary function for deciding , cost planning, and economic performance measurement, no matter the dimensions of the business.

- Bookkeepers can handle basic accounting needs, but Certified Accountants (CPA) should utilize them for larger or more advanced accounting tasks.

- Two important sorts of corporate accounting are management accounting and costing. Management accounting helps management teams make business decisions, and costing helps business owners determine the value of a product.

- Professional accountants follow a group of commonly accepted accounting principles (GAAP) when preparing financial statements.

- The main purpose of monetary accounting is to accurately prepare the financial accounting of a corporation for a specific period of your time.This is often also referred to as financial statements.

- The three main financial statements are the earnings report, the record, and therefore the income statement.

Overview:

Accounting concepts defines the assumption on the basis of which financial statement of a business entity is prepared. Concepts are those basic assumption and condition which form the basis upon which the accountancy has been laid.

Accounting principles

- They should be based on real assumption

- They must be simple, understandable and explanatory

- They must be followed consistently

- They should be able to reflect future predictions

- They should be informational to users

Accounting convention emerges out of accounting practices, commonly known as accounting principle, adopted by various organizations over a period of time. Accounting bodies may change any of the convention to improve the quality of accounting information.

The basic accounting concept is as follows:

- Entity concept:

The concept of an entity assumes that its financial statements and other accounting information belong to a particular company that is different from its owner. Therefore, an analysis of business transactions, including costs and revenues, is expressed in terms of changes in the company's financial position.

Similarly, the assets and liabilities devoted to business activities are the assets and liabilities of the entity. The company's transaction is reported, not the company's owner's transaction. Therefore, this concept allows accountants to distinguish between personal and commercial transactions. This concept applies to sole proprietorships, partnerships, businesses, and small businesses. It may also apply to multiple companies, such as when a segment of a company, such as a department, or an interrelated company is merged.

2. Going Concern Concept:

An entity is considered to be in business unless there is evidence of opposition. Because companies are relatively permanent, financial accounting is designed with the assumption that the business will survive indefinitely in the future.

The Going Concern concept justifies the valuation of assets on a non-clearing basis and requires the use of acquisition costs for many valuations. In addition, fixed and intangible assets are amortized over their useful lives, rather than in shorter periods, in the hope of early liquidation.

This further means that the data transmitted is tentative and that the current statement should disclose adjustments to the statement over the past year revealed by more recent developments.

3. Money measurement concept:

A unit of exchange and measurement is required to uniformly account for a company's transactions. The common denominator chosen in accounting is the currency unit. Money is the lowest common denominator for measuring the exchangeability of goods and services such as labor, natural resources and capital.

The concept of monetary measurement considers accounting to be a process of measuring and communicating financially measurable company activity. Obviously, the financial statements should show the money spent.

The concept of measuring money means two limitations of accounting. First, accounting is limited to the generation of information expressed in monetary units. It does not record and convey other relevant but non-monetary information. Second, the concept of monetary measurement concerns the limitation of the monetary unit itself as a unit of measurement.

There are concerns about purchasing power, which is the main characteristic of currency units, or the amount of goods and services that money can obtain. Traditionally, financial accounting has addressed this issue by stating that the concept assumes that the purchasing power of a currency unit is stable over the long term or that price changes are not significant. Although still accepted in current financial reporting, the concept of stable monetary units is subject to continuous and permanent criticism.

4. Accounting period concept:

Financial accounting provides information about a company's economic activity over a specific period of time that is shorter than the company's lifespan. The periods are usually the same length for ease of comparison.

The period is specified in the financial statements. The period is usually 12 months. Quarterly or semi-annual statements may also be issued. These are considered provisional and differ from the annual report. Statements that cover shorter periods of time, such as months or weeks, may also be created for administrative use.

5. Cost concept:

The concept of cost is that the asset should be recorded at the exchange price, that is, the acquisition cost or the acquisition cost. Acquisition costs are recognized as an appropriate valuation criterion for recognizing the acquisition of all goods and services, costs, expenses and capital.

For accounting purposes, business transactions are usually measured in terms of the particular price or cost at which the transaction occurred. That is, financial accounting measurements are based on exchange prices, where economic resources and obligations are exchanged. Therefore, the quantity of an asset listed during a company's account doesn't indicate what the asset could also be sold for.

The concept of acquisition cost means there's little point in revaluing an asset to reflect its current value, because the company has no plans to sell its asset. Additionally, for practical reasons, accountants like better to report actual costs over market values that are difficult to verify.

6. Dual aspect concept:

This concept is at the guts of the whole accounting process. Accountants record events that affect the wealth of a specific entity. The question is which aspect of this wealth is vital. Accounting entities are artificial creations, so it's essential to understand who their resources belong to or what purpose they serve.

It's also important to understand what sorts of resources you manage, like cash, buildings, and land. Therefore, the accounting record system was developed to point out two main things: (a) the source of wealth and (b) the shape it takes. Suppose Mr. X decides to line up a business and transfers Rs. 100,000 from his personal checking account to a different business account.

He may record this event as follows:

Obviously, the source of wealth must be numerically adequate to the shape of wealth. S (source) must be adequate to F (form) because they're simply different aspects of an equivalent thing, that is, within the sort of equations.

In addition, transactions or events that affect a company's wealth got to record two aspects so as to take care of equality on each side of the accounting equation.

If a corporation acquires an asset, it must be one among the following:

(A) Other assets are abandoned.

(B) There was an obligation to pay it.

(C) Profitable and increased amount of cash the operator has got to pay to the owner.

(D) The owner funded the acquisition of the asset.

This doesn't mean that the transaction affects both the source and sort of wealth.

There are four categories of events that affect accounting equations:

(A) Both the source and sort of wealth are increased by an equivalent amount.

(B) Both the source and sort of wealth are reduced by an equivalent amount.

(C) Some increase without changing the source of wealth, others decrease.

(D) Some sources of wealth increase and a few decreases without changing the shape of wealth retention.

The above example shows category (a) because once you start a transaction for an entity, the source of wealth and therefore the sort of wealth, cash, increases from zero to rupees. 1,00,000. In contrast, X may plan to withdraw Rs. 20,000 cash from business.

In that case, the financial position of the entity would be:

It is essential to know why each side of the equation are reduced. By withdrawing cash, X automatically reduces the availability of personal funds to the business by an equivalent amount. Now suppose Mr. X buys a listing of products for Rs. 30,000 in cash available. His capital supply remains an equivalent, but the composition of his business assets does.

The two aspects of this transaction aren't within the same direction, but are compensatory and are increasing stocks that set a cash reduction. Similarly, sources of wealth are often suffering from transactions. So, if X gives his son Y, it becomes Rs. 20,000 shares of the business by transferring some of his own profits, the consequences are:

However, if X gives YR. He personally receives $ 20,000 in cash, and when Y puts it into the business, each side of the equation are affected. Y capital Rs. 20,000 is balanced by additional Rs. 20,000 in cash, X capital remains rupees. 80,000.

7. The concept of accrual accounting:

According to the Financial Accounting Standards Board (USA):

"Accrual accounting is that the financial impact of transactions and other events and situations that affect a corporation on cash, not only during the amount during which it had been received, but also during the amount during which those transactions, events and situations occur. Accrual accounting is paid to the corporate as more (or perhaps less) cash spent on resources and activities, also because the start and end of the method. it's associated with the method of being returned. We recognize that purchases, production, sales, other operations, and other events that affect a company's performance during a period often do not match the receipt or payment of cash for that period. "

Realization and matching concepts are central to accrual accounting. Accrual accounting measures revenue for a period of time as the difference between the revenues recognized during that period and the costs that match those incomes. In accrual accounting, the period revenue is usually not the same as the period cash receipt from the customer, and the period cost is usually not the same as the period cash payment.

8. Cash Basis Accounting:

In cash-basis accounting, sales are not recorded until the period in which they are received in cash. Similarly, costs are deducted from sales during the period in which the cash payment was made. Therefore, neither realization nor matching concepts apply to cash basis accounting.

In reality, "pure" cash-basis accounting is rare. This is because the pure cash basis approach requires the acquisition of inventory to be treated as a reduction in profit when paying the acquisition cost, not when selling the inventory. Similarly, the cost of acquiring plant and equipment items is treated as a reduction in profit if these long-lived items are paid in cash rather than after they have been used.

Obviously, such a pure cash basis approach would result in a balance sheet and income statement with limited usefulness. Therefore, what is commonly referred to as cash-basis accounting is actually a mixture of cash-basis for some items (especially cost of goods sold and period costs) and accrual-based for others (especially product costs and long-term assets). This mix is sometimes referred to as modified cash-basis accounting to distinguish it from the pure cash-basis method.

Cash-basis accounting is most often seen in small businesses that do not have large inventories because they provide services. Examples include restaurants, hairdressers, hairdressers, and income tax filing companies.

Most of these establishments do not provide credit to their customers, so cash-basis profits may not differ dramatically from accrual income. Nevertheless, cash basis accounting is not permitted by GAAP for any type of entity.

9. Conservatism concept:

This trait can be considered a reactive version of the Minimax management philosophy. That is, it minimizes the potential for maximum loss.

The concept of accounting conservatism suggests that accounting should be cautious and cautious until the opposite evidence emerges, where and when uncertainty and risk exposure are legitimate. Accounting conservatism does not mean intentionally underestimating income and assets. It applies only to situations where there is reasonable doubt. For example, inventories are valued at the lower end of cost or market value.

In its application to the income statement, conservatism encourages recognition of all losses incurred or may occur, but does not recognize profits until they are actually realized. Early depreciation of intangible assets and restrictions on recording asset valuations have also been motivated, at least to some extent, by conservatism. Not recognizing revenue until the sale is made is another sign of conservatism.

10. Matching concept:

The concept of matching in financial accounting is the process of matching (associating) performance or revenue (measured at the selling price of goods and services offered) with labour or expense (measured at the cost of goods and services used) over a specific period of time. is. Targets for which income has been determined.

This concept emphasizes which item of expense in a particular accounting period is expense. That is, expenses are reported as expenses for the accounting period in which revenue related to those expenses is reported. For example, if the sales of some products are reported as revenue for one year, the costs for those products are reported as expenses for the same year.

The concept of matching only needs to be met after the accountant has completed the concept of realization. First measure the revenue according to the concept of realization, then associate the costs with these revenues. Cost matches revenue, but not the other way around.

Therefore, the reconciliation process requires significant cost allocation in acquisition cost accounting. Past (history) costs are investigated and steps are taken to assign a cost element that is considered to have expired service potential or to match it with the associated revenue.

The remaining component of the cost, which is considered to have continued potential for future services, is carried over to the past balance sheet and is called an asset. Therefore, the balance sheet is just a report of unallocated past costs waiting for the estimated future service potential to expire before it matches the appropriate revenue.

11. Realization or Cognitive concept:

The concept of realization or recognition indicates the amount of revenue that should be recognized from a particular sale. Realization rules help accountants determine if revenues or expenses have been incurred. This allows accountants to measure, record, and report on financial reports.

Realization refers to the inflow of cash or cash charges (accounts receivable, accounts receivable, etc.) resulting from the sale of goods or services. Therefore, if the customer purchases Rs. If you pay 500 worth of goods in cash at a grocery store, the store will realize Rs. 500 from the sale.

If the clothing store sells Rs suits. 3,000, if the buyer agrees to pay within 30 days, the store will realize Rs. From sale to 3,000 (accounts receivable) (conservative concept), provided the buyer has a good credit record and the payment is reasonably secure.

The concept of realization states that the amount perceived as revenue is reasonably certain to be realized, that is, reasonably certain to be paid by the customer. Of course, there is room for difference in judgment as to whether or not it is "reasonably certain."

However, this concept explicitly acknowledges that the perceived revenue amount is lower than the selling price of the goods and services sold. The obvious situation is the discounted sale of goods at a price lower than the normal selling price. In such cases, the revenue will be recorded at a lower price rather than the normal price.

12. Consistency concept:

In this concept, once an organization has decided on one method, it should be used for all subsequent transactions and events of the same nature unless there is a good reason to change it. Frequent changes in accounting methods make it difficult to compare financial statements for one period with financial statements for another period.

Consistent use of accounting methods and procedures over the long term checks income statement and balance sheet distortions, and possible operations on these statements. Consistency is needed to help external users compare the financial statements of a particular company over time and make sound economic decisions.

13. Materiality concept:

The law has a doctrine called de minimis non curat lex. This means that the court does not consider trivial issues. Similarly, accountants do not attempt to record events that are not so important that the task of recording them is not justified by the usefulness of the results.

The concept of materiality means that transactions and events that have a non-significant or non-significant impact must not be recorded and reported in the financial statements. Recording of non-essential events is claimed to be unjustifiable in terms of their low usefulness to subsequent users.

For example, conceptually, a brand-new paper pad is an asset of an entity. Each time someone writes on the pad's page, some of this asset is exhausted and retained earnings are reduced accordingly. Theoretically, it is possible to see how many partially used pads the company owns at the end of the accounting period and display this amount as an asset.

However, the cost of such efforts is clearly unreasonable, and accountants are not willing to do this. The accountant took a simpler action, albeit inaccurate, that the asset was exhausted (expenditure) when the pad was purchased or when the pad was issued to the user from the consumable inventory. Treat as.

Unfortunately, there is no consensus on what it means to be important and the exact line that distinguishes between important and non-important events. Decisions depend on judgment and common sense. The accounting creator is meant to interpret what is important and what is not.

Perhaps the importance of an event or transaction can be determined in terms of financial position, performance, changes in an organization's financial position, and its impact on user evaluations or decisions.

14. Full disclosure concept:

The concept of full disclosure requires companies to provide all relevant information to external users for the purpose of sound economic decisions. This concept means that information that is substantive or of interest to the average investor is not omitted or hidden from a company's financial statements.

The basic assumptions and concepts mentioned above have been modified to make accounting information useful to a variety of stakeholders. The principles of these changes are as follows:

Principles are:

1. Cost-benefit

2. Importance

3. Consistency

4. Be cautious

- Cost-benefit principle

This amended principle states that the cost of applying the principle must not exceed the benefits obtained from it. If the cost is greater than the profit, then the principle needs to be changed.

2. Materiality principle

The principle of materiality requires that all relatively relevant information be disclosed in the financial statements. Important non-essential information is omitted or merged with other items.

3. Principle of consistency

The purpose of the principle of consistency is to maintain the comparability of financial statements. The rules, practices, concepts and principles used in accounting should be continuously adhered to and applied annually. Comparing the financial results of a business between different accounting periods is important and meaningful only if you follow consistent practices in reviewing them. For example, asset depreciation can be provided in a variety of ways, but whichever method you choose, you must do it on a regular basis.

4. Principle of prudence (conservatism)

The principle of prudence takes into account all expected losses, but leaves all expected benefits. For example, when valuing a stock in trade, the lower of the market price and cost is taken into account.

Key takeaways:

- Accounting rules are guidelines that help companies determine how to record business transactions that are not yet fully covered by accounting standards.

- They are generally accepted by accounting institutions, but are not legally binding.

- Accounting rules no longer apply if the supervisory body has guidelines that address the same topics as accounting rules.

- There are four widely recognized accounting rules. Conservatism, consistency, full disclosure, and importance.

- Accounting policies are the procedures that a company uses to prepare financial statements. Unlike accounting principles, which are rules, accounting policies are the basis for following those rules.

- Accounting policies may be used to legally manipulate revenue.

- The choice of a company in its accounting policy indicates whether management is willing or conservative in reporting its revenue.

- Accounting policies should still adhere to generally accepted accounting principles (GAAP).

For management to take future decision requires financial information. This is where accounting steps in that record, summaries, analyze all the business transaction.

Accounting is the process of recording, classifying, summarizing, analysing, and interpreting the financial transactions and communicating the results to the persons interested in such information. Two methods for accounting are Single Entry System and Double Entry System. Mostly, we use Double Entry for better accounting purposes.

Double entry system

Double entry system of accounting deals with two aspects of every business transaction. In other words, every transaction has two effects. For ex, a person buys a cold drink from a store and in return pays the money to shopkeeper for the cold drink. This transaction has two effects in terms of both buyer and seller. Buyer cash balance will decrease by the cost of purchase on the other hand he will acquire a cold drink. Seller will have one drink short but his cash balance will increase.

Accounting attempts to record both effect of transaction in the financial statement. This refers to double entry concept. Under this every transaction involves two parties, one party gives the benefit and other party receives it. It is also called dual entity of transaction.

Accounting records the two affects which are known as Debit (Dr) and Credit (Cr). Accounting system is based on the duality principal that for every Debit entry, there will always be an equal Credit entry.

Debit entries are ones that account for the following effects:

- Increase in assets

- Increase in expense

- Decrease in liability

- Decrease in equity

- Decrease in income

Credit entries are ones that account for the following effects:

- Decrease in assets

- Decrease in expense

- Increase in liability

- Increase in equity

- Increase in income

Accounting equation recorded in double entry are

Assets – Liabilities = Capital

Any increase in expense (Dr) will be offset by a decrease in assets (Cr) or increase in liability or equity (Cr) and vice-versa. The accounting equation will still be in equilibrium.

Examples of double entry

- Purchase of machine by cash

Machine account debited (increase in assets)

Cash account credited (decrease in assets)

2. Payment of utility bills

Utility expenses account debited (increase in expenses)

Cash account credited (decrease in assets)

3. Receipt of bank loans

Cash account credited (increase in assets)

Bank loan account credited (increase in liability)

Characteristic of double entry system

- Two parties – every business transaction involves two parties – debit and credit. According to the duality principal that for every Debit entry, there will always be an equal Credit entry.

- Giver and receiver – every transaction must have giver and receiver. For ex, purchase a car, the buyer purchases a car from seller in return of cash – hence the buyer is the receiver and seller are the giver. When the seller receives the cash for the purchase made by buyer – the seller is the receiver of cash and buyer is the giver.

- Exchange of equal amount – the amount of money of a transaction the party gives is equal to the amount the party receives.

- Separate entity - the business enterprise and its owner are two separate independent entities. Thus, the business and personal transaction of its owner are separate.

- Dual aspects – every transaction has two aspects – debit and credit. Debit is on the left side of account ledger and credit is on the right side of account ledger.

- Result – under double entry system, total of debit is equal to total of credit.

- Complete accounting system: Double entry system is a scientific and complete accounting system.

The process of keeping accounts under the double-entry system;

- Journal - It is called as daily book because transaction are recorded on day to day basis as and when takes place

- Ledger - Ledger is the principal or primary book of accounts. The transactions are classified under appropriate heads, called accounts

- Trial balance - Trial balance is a statement, prepared with debit and credit balances of ledger accounts to test the arithmetical accuracy of the books

- Financial statement - The final accounts are prepared for ascertaining the operational results and financial position of the business. These are prepared with the help of trial balance.

Advantages of double entry system

- Through the trial balance, the system increases the accuracy of the accounting

- Profit and loss during the year can be calculated in detail

- The company keep accounting records which helps in controlling

- Using double entry system of accounting, current year can be compared with previous year to formulate the future course of action

- Under double entry system, the total amount of assets and liabilities can be ascertained

- under the double-entry system, the accounts are maintained systematically thus it become easier to fix the price of the commodity

- The balance sheet ascertains the financial position of the business.

Account classification

Transactions can be divided into three categories.

I. Transactions related to individuals and businesses

ii. Transactions related to real estate, goods or cash

iii. Transactions related to costs or losses and income or profits.

Therefore, accounts can also be categorized as personal, genuine, or nominal. The classification can be explained as follows.

I. Personal Account: An account related to an individual. Personal accounts include:

i. Natural person: An account related to an individual.

ii. Artificial person: An account associated with an individual or a group of businesses or institutions. For example, HMT Ltd., Indian Overseas Bank, life assurance Corporation of India, Cosmopolitan club.

iii. Representative: An account that represents a particular individual or group of individuals. For example, unpaid payroll accounts, prepaid insurance accounts, and so on.

A business concern may be to maintain business relationships with all of the above personal accounts in order to purchase, sell, rent, or rent goods from them. Therefore, they are either debtors or creditors.

The capital and drawing accounts of the individual owner are also personal accounts.

II. Non-personal accounts: All accounts that are not personal accounts. This can be further divided into two types. Real and nominal accounts.

i. Actual account: Assets owned by business parties and accounts related to the assets. Real accounts include tangible and intangible accounts. For example, land, buildings, goodwill, purchases, etc.

ii. Nominal Accounts: These accounts have no existence, form, or shape. They are related to income and expenses, and profits and losses of business concerns. For example, payroll accounts, dividend accounts, and so on.

Golden Rules of Accounting

1.Personal Accounts | – | Debit the receiver Credit the giver |

2.Real Accounts | – | Debit what comes in Credit what goes out |

3.Nominal Accounts | – | Debit all expenses and losses Credit all incomes and gains |

Key takeaways:

- Double-entry bookkeeping refers to the accounting concept of assets = liabilities + owner's capital.

- In double-entry bookkeeping, transactions are debited and credited.

- Double-entry bookkeeping was developed during the European commerce era to help streamline commerce and streamline trade.

- The advent of double-entry bookkeeping is associated with the birth of capitalism.

- Giver and receiver – every transaction must have giver and receiver. For ex, purchase a car, the buyer purchases a car from seller in return of cash – hence the buyer is the receiver and seller are the giver. When the seller receives the cash for the purchase made by buyer – the seller is the receiver of cash and buyer is the giver.

- The company keep accounting records which helps in controlling

- Using double entry system of accounting, current year can be compared with previous year to formulate the future course of action

- Under double entry system, the total amount of assets and liabilities can be ascertained

ACCOUNTING CYCLE

When complete sequence of accounting procedure is done which happens frequently and repeated in same directions during an accounting period, the same is called an accounting cycle.

Steps/Phases of Accounting Cycle

The steps or phases of accounting cycle can be developed as under:

(a) Recording of Transaction: As soon as a transaction happens it is at first recorded in subsidiary book.

(b) Journal: The transactions are recorded in Journal chronologically.

(c) Ledger: All journals are posted into ledger chronologically and in a classified manner.

(d) Trial Balance: After taking all the ledger account’s closing balances, a Trial Balance is prepared at the end of the period for the preparations of financial statements.

(e) Adjustment Entries: All the adjustments entries are to be recorded properly and adjusted accordingly before preparing financial statements.

(f) Adjusted Trial Balance: An adjusted Trail Balance may also be prepared.

(g) Closing Entries: All the nominal accounts are to be closed by the transferring to Trading Account and Profit and Loss Account.

Financial Statements: Financial statement can now be easily prepared which will exhibit the true financial position and operating results.

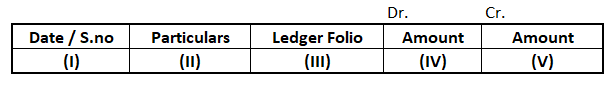

Journal

Original entry book

The book in which the transaction is recorded for the first time from the source document is called the Books of Original Entry or Prime Entry. The journal is one of the original entry books in which transactions were originally recorded in chronological order (daily) according to the principle of double-entry bookkeeping.

Journal

The journal is a dated record of all transactions, including debited and credited account details and the amount of each transaction.

Proforma of a Journal

Description:

1. Date: The date of the transaction is entered in the first column. The year and month are written only once until they change. The date and month order must be strictly maintained.

2. Details: Each transaction affects two accounts, one of which is debited and the other of which is credited. The name of the account to be debited is first written in the immediate vicinity of the row of details column, Dr. Is also written at the end of a particular column. On the second line, the name of the credited account begins with the word "To", a few spaces away from the margins of the detail column to distinguish it from a debit account.

3. Narration: After each entry, a brief description of the transaction and the required details are displayed in a detail column in parentheses called narration. The words "For" or "Being" are used before you start writing the narration. Currently, you don't have to use the word "For" or "Being".

4. Ledger Folio (L.F): All entries in the journal are later posted to the ledger account. The ledger page numbers or folio numbers posted from the journal are recorded in the L.F column of the journal. Until such time, this column remains blank.

5. Debit Amount: This column contains the amount of the account to be debited.

6. Credit Amount: This column will contain the amount of the account to be credited.

Journalizing steps

The process of analysing and journalizing business transactions under the head of debits and credits is called journalizing. The entries created in the journal are called "journal entries".

Step 1

Determine the two accounts involved in the transaction.

Step 2

Classify the above two accounts by personal, genuine, or nominal.

Step 3

Review the debit and credit rules for the two accounts above.

Step 4

Identify which account to debit and which account to credit.

Step 5

Record the trading date in the date column. The year and month are written only once until they change. The date and month order must be strictly maintained.

Step 6

Enter the name of the account you want to debit in the detail’s column very close to the left of the detail’s column, followed by the abbreviation Dr. in the same row. In contrast, the amount debited is written in the debit amount column on the same row.

Step 7

Enter the name of the account to be credited on the second row, starting with the word "To", a few spaces away from the margins in the "Details" column. In contrast, the amount to be credited is written to the credit amount column in the same row.

Step 8

Write the narration in parentheses in the next row of the detail column.

Step 9

Draw a line across the detail column to separate one journal entry from the other.

Example:

March 18, 2004 – Purchased from James with credit Rs.1,50,000.

Date |

Particulars |

L.F | Debit Rs. | Credit Rs. | |||

2004 March 18 | Purchases A/c Dr. To James A/c (Credit purchases) |

| 1,50,000 | – |

1,50,000 |

– | |

SOME IMPORTANT POINTS:

1. We write books of accounts of business.

2. Owner and business are considered as separate persons, hence there can be transaction between them.

3. Our own name cannot appear in our books of accounts (i.e. the name of the business cannot appear in the books of accounts of business).

4. Look at all the transactions from the point of view of business only.

5. Owner giver - Capital A/c Credit.

Owner receiver - Drawings A/c Debit.

Hence Capital A/c and Drawing A/c represents the owner, hence these two are personal a/c’s.

6. Capital: Amount invested by owner into the business.

7. Drawings: Amount withdrawn by owner from the business for personal use.

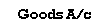

8. Goods: Items bought for re-sale and to make profit.

9. Assets: Items bought for use in the business.

9. Assets: Items bought for use in the business.

10.

|

11. (a) Cash purchase: Goods are purchased and cash is paid on the spot.

(b) Credit purchase: Goods are purchased and cash will be paid in future.

(c) Creditor: Party to whom cash will be paid in the future is known as Creditor OR Supplier.

12. (a) Cash sales: Goods are sold and cash is received on the spot.

(b) Credit sales: Goods are sold and cash will be received in the future.

(c) Debtor: Party from whom cash will be received in the future is known as Debtor OR

Customer.

13. Stock A/c Dr. ONLY WHEN owner introduces goods to start the business.

14. (a) Cash received - Cash A/c Debit

(b) Cheque received - Bank A/c Debit (because bank is the receiver of money).

15. (a) Cash paid - Cash A/c Credit.

(b) Cheque issued - Bank A/c credit (because bank is the giver of money).

16. If Nominal A/c is our income we should write the word ‘RECEIVED’.

For e.g.

(a) If Rent is our expense Rent A/c DEBIT

(b) If Rent is our Income Rent Received A/c CREDIT

17. (a) When Party’s name is given and nothing is specified, consider it to be a credit transaction.

For e.g. Goods purchased from Amit Rs. 1,000, means goods are purchased on credit.

(b) When Party’s name is not given and nothing is specified, consider it to be a cash transaction.

For e.g. Goods purchased for Rs. 2,000, means goods are purchased for cash.

18. a) Any expense paid at the time of buying the Asset or making the asset should be debited to ASSET A/c.

(b) Any routine or repair charges paid during the life time of the asset should be debited to the EXPENSE A/c.

19. OUTGOING OF GOODS AT COST

- Purchase A/c CREDIT

e.g., Goods distributed as free samples, Goods lost by theft, Goods destroyed by fire, Goods given as donation.

20. (a) Carriage Inward: Transportation charges paid at the time of purchase of goods.

(b) Carriage Outward: Transportation charges paid at the time of sale of goods.

NOTE: BOTH ARE EXPENSES and SHOULD BE DEBITED.

21. (a) Our expenses paid by us:

Expense A/c Dr.

To Cash A/c

(b) We pay expenses of Mr. X: (It is as good as paying cash to Mr. X).

Mr. X. A/c Dr.

To Cash A/c.

(c) Mr. Y pays our expense: (It means Mr. Y is the giver of money for our expenses)

Expenses A/c Dr.

To Mr. Y. A/c.

22. (a) Paid cash to Mr. X on advice of Mr. Y (It is as good as paying cash to Mr. Y).

Mr. Y. A/c Dr.

To Cash A/c

(b) Mr. X paid cash to Mr. Y on our behalf. (It is as good as: Cash received from Mr. X and then cash paid to Mr. Y)

23. Different ways of recording Personal A/cs.

OWNER - Capital A/c / Drawings A/c

Party for goods - Party A/c

Party for borrowings - Loan A/c / Advances A/c

Party for Deposits - Deposit A/c

24.

TRADE DISCOUNT (T.D.) | CASH DISCOUNT (C.D.) |

1. T.D. is allowed on sale of goods in large quantities. | 1. C.D. is allowed on prompt payment. |

2. T.D. is allowed for cash as well as credit transaction of buying / selling of goods. | 2. C.D. is allowed only for cash transactions. |

3. % of T.D. is applied on GROSS PRICE (Original price of goods) (G.P.). | 3. % of C.D. is applied on NET PRICE (N.P.). |

4. G.P. – T.D. = N.P. | 4. N.P. – C.D. = Cash received / paid |

5. T.D. is never recorded in the books of accounts. | 5. C.D. is recorded in the books of accounts.

|

6. GOODS A/C and PARTY A/C WILL BE RECORDED AT NET PRICE. | |

25. (a) Bad debts: Amount which cannot be recovered from the party. (Insolvent).

(b) Solvent: Person whose Assets > Liabilities.

(c) Insolvent: Person whose Liabilities > Assets.

26. (a) Insurance premium paid - Expense of business.

(b) Life Insurance premium paid - Personal expense of the owner.

(c) Income tax paid - Personal expense of the owner.

27. (a) Goods distributed (given) as free samples

Advertisement A/c Dr. (AT COST)

To Purchase A/c

(b) Goods received as free samples

NO ENTRY - because for us the cost is ZERO

(c) Free Samples sold:

Cash A/c Dr (AT S.P.)

To Sundry Income A/c

28. Bad debts Recovery: Amount recorded as bad debts in the past now received. It is our income, hence Bad Debts Recovery A/c is a nominal A/c.

Other Important Points of Journal:

(1) | Expenses paid by Business: (a) If it is of Business Expenses A/ c Dr. To Cash A/c To Bank A/c (lf paid by cheque) |

| (b) If it is Owner: Drawings A/ c Dr. To Cash A/c |

| (c) lf it is of Customer: Customer A/c Dr. To Cash A/c |

| (d) lf it is in relation to Purchase of Asset: Asset A/ c Dr. To Cash A/c |

| (e) Paid in Advance (Prepaid): Prepaid Expenses A/c Dr. To Cash A/c (Note: Party A/c should not be debited)

|

(2) | Expenses of business paid by other party: Expenses A/c Dr. To Party A/c (who paid the expenses)

|

(3) | Expenses due but not paid (payable) Expenses A/c Dr. To Party A/c (To whom payable) To Outstanding Expenses A/c (lf name of party is not given) (Note: In case of o/s Salary & Wages, ignore the party A/c)

|

(4) | Income Received: Cash A/c Dr. To Income A/c

|

(5) | Income due from Party (Receivable): Party A/c (From whom receivable) Dr. Income Receivable A/c (lf name of party not given) Dr. To Income A/ c |

(6) lf in the transaction of purchase or sale It is not given clearly whether it is for cash or on credit, then

(a) lf the name of party is given then It is credit transaction (ignore % of C.D. given in the transaction).

(b) lf the name of the party is not given then it is a cash transaction.

(7) ln case of purchase and sale of goods party on cash and on credit with cash discount.

(a) If Goods A/c debited then all other A/cs will be credited.

(b) lf Goods A/c is credited then all other A/cs will be debited.

(8) Entries are not passed for the following:

(a) Placing and receiving of order.

(b) Giving Change

(c) Appointing a person »

(d) Deciding for buying and selling of any asset etc.

(9) Entry is passed on the day on which order is executed. (Completed)

(10) Any amount brought in business by Owner is credit to capital A/c.

(a) Private (Personal) Car sold any money invested in the business or for business purpose.

(b) Gift received or Lottery price received and invested in business etc.

(11) Whenever goods are sold, entry should be passed with the selling price of goods. Profit or sale of goods not recorded separately.

Eg: Goods costing Rs. 10,000 sold at a loss of Rs. 1,000.,

Entry: Cash A/c Dr. 9,000

To Sales A/c - 9,000

(12) Cash discount is calculated only for cash transactions and not on credit transaction. Cash transaction means cash and cheque received or given.

(13) Bad debts recovered:

Eg: Received Rs. 3,000 cash from Amar which was earlier written off as bad.

Entry: Cash A/c Dr. 3,000

To Bad Debts recovered A/c - 3,000

Note: Amar A/c is not credited because bad debts recovered is gain (Profit). It is an income.

Ledger

In the journal, each transaction is processed individually. Therefore, the ultimate results of many transactions can't be seen at a look. Therefore, it's collected in one place in your ledger to ascertain internet effect of all transactions associated with a specific account.

A ledger may be a book that contains all the accounts that are initially entered into the journal or special purpose auxiliary books, whether personal, genuine, or nominal. consistent with L.C., Cropper, "A book that contains a categorized and protracted record of all transactions during a business is named a ledger."

The foremost commonly used ledger for many business concerns is bound notebooks. It is often stored for an extended time. As a result, the page is numbered. Each ledger account should open on a separate page, if possible. When one page is complete, your account will proceed to subsequent page or another page. But with greater concern, keeping the ledger as a bound notebook is impractical. The loose-leaf ledger has replaced the bound notebook. The loose-leaf ledger introduces an appropriate cardboard border sheet and secures it with the assistance of a binder. you'll delete the finished accounts and relocate and relocate the accounts in any order, whenever the specified additional pages could also be inserted. Therefore, this sort of ledger is understood as a loose-leaf ledger.

Utility

A utility ledger may be a principal or main ledger that contains all accounts to which transactions recorded within the original entry's books are transferred. Ledgers also are referred to as "final entry books" or "secondary entry books" because transactions are eventually incorporated into the ledger. the benefits of the ledger are:

i. Complete information at a glance:

All transactions associated with your account are collected in one place in your ledger. By watching the balance of that account, you'll see at a look the collective effect of all such transactions.

ii. Arithmetic Accuracy

With the assistance of your ledger balance, you'll prepare an attempt balance to understand the arithmetic accuracy of your account.

iii. Business Performance

Makes it easy to make a final accounting to know business performance and therefore the financial position of the business.

iv. Accounting Information

Data provided by various ledger accounts is summarized, analyzed, and interpreted to get various accounting information.

Description

- Each ledger account is split into two parts. The left side is named the accounting and therefore the right side is named the credit. The words "Dr." and "Cr." Are wont to describe debits and credits.

- The name of your account are often found at the highest (center) of your account.

- The date of the transaction is recorded within the date column.

- The word "destination" is employed before the account that appears on the accounting of the account within the detail column. Similarly, the word "By" is employed before the account that appears on the accounting of the account within the detail column.

- The names of the opposite accounts suffering from the transaction are written to either the accounting or the accounting of the detail column.

- The pagination of the journal or auxiliary workbook to which that specific entry is transferred is entered within the Journal Folio (J.F) column.

- the quantity related to this account are going to be entered within the Amount column. the method of transferring entries recorded during a posting journal or auxiliary book to every account opened within the ledger is named posting.

In other words, posting means grouping all transactions associated with a specific account in one place. All journals must be posted to different accounts in your ledger because postings assist you understand internet impact of various transactions over a specific period on a specific account.

Posting procedure

I. The posting procedure is as follows: Procedure for posting a debited account in journal entry.

Step 1

Find the account you would like to debit in your ledger and enter the date of the transaction within the debit date column.

Step 2

Record the name of the account credited within the journal as a "destination" within the debit details column. (The name of the credited account) ".

Step 3

Record the pagination of the journal within the debit J.F column and write the pagination of the ledger during which the actual account appears within the journal within the L.F. column.

Step 4

Enter the quantity related to the accounting amount column.

II. Procedure for posting an account credited to a journal.

Step 1

Find the account to be credited in your ledger and enter the date of the transaction within the credit date column.

Step 2

Record the name of the debited account within the journal as "By (the name of the debited account)" within the detail’s column on the accounting.

Step 3

Record the journal page number in column J.F on the credit side and enter the page number of the ledger for which a particular account appears in the journal.

L.F. column.

Step 4

Enter the amount associated with the amount column on the credit side.

Ledger: A book in which all accounts are kept is called a ledger. In other words, a ledger is a set of all the different type of accounts. It is a bound book of all the transactions. It includes all the different accounts of persons, assets, liability, incomes, expenses, etc. Transactions cannot be directly recorded in ledger. Every entry in the ledger accounts comes from the books of prime entry.

Important points:

- Journal is the first book or original book of entry. Ledger is the main book or principal book of entry.

- In Journal transactions are recorded date wise in Ledger transactions are recorded Account date wise.

- For each Account give a separate page in Ledger.

- Format of Ledger:

Dr. Ledger A/c Cr.

Date | Particulars | J. F | Rs. | Date | Particulars | J.F. | Rs. |

| To |

|

|

| By |

|

|

5. Process of transferring Journal entry into the ledger Account is known as posting.

6. Posting Rule:

(a) Name of opposite Account.

(b) Amount of same Account.

7. Ledger Account are closed and re-opened at regular intervals, mostly after every month.

8. Balance at the end - Closing balance (Balance c/d)

Balance at the beginning - Opening balance (Balance b/d)

9. In an Account:

If Dr. Side is heavy - A/c shows Dr. balance

If Cr. Side is heavy - A/c shows Cr. Balance

10. Closing balance - Recorded on opposite side. Opening balance – recorded on same side.

11. Personal Accounts:

Dr. Balance | Cr. Balance |

(Debtor) | (Creditor) |

(Amount receivable from) | (Amount payable to) |

(Amount due from) | (Amount due to) |

(Amount owing from) | (Amount owing to) |

12. Real A/cs - Always Dr. balance.

13. Nominal A/cs

Expenses | Incomes |

Dr. Balance | Cr. Balance |

14. (a) Cash A/c - Always Dr. balance.

(b) Bank A/c - Normally- Dr. balance

- Overdraft- Cr. balance.

15. (a) Capital A/c - Cr. balance.

(b) Drawings A/c - Dr. balance.

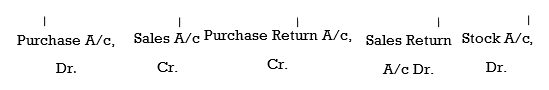

16. (a)Purchase A/c Dr. balance

(b) Sales A/c Cr. balance

(c) Purchase Return A/c Cr. balance

(d) Sales Return A/c Dr. balance

(e) Stock A/c Dr. balance

Cash Book with Cash and Discount columns is one in which and additional amount column of ‘Cash Discount’ on each side is provided.

Cash Discount is a deduction from the amount paid or received. Such cash discount can either be ‘discount allowed’ or ‘discount received’. It will be ‘discount received' if the trader pays his account promptly or within the period of credit. It will be ‘discount allowed’ if he receives the payment from his own customers promptly. Since discount is received or allowed at the time of receipt or payment of Cash, it is necessary to record this fact at the same place and time where and when cash transaction is recorded. This is why the Cash Book usually contains two additional amount columns, one on each side. Discount columns on the debit side records

Cash discount allowed by a businessman whereas the discount column on the credit side records discount received by him.

Cash discount should, however, be distinguished from trade discount. Cash discount is allowed or received for prompt settlement of account or for settlement of account within the period of credit. The trade discount on the other hand, is an allowance made by a whole-seller to a retailer on the catalogue or invoice price. The object of the trade discount may be either to encourage large scale buying by the retailer or to enable the retailer to sell the goods at the price mentioned in the catalogue or Price List issued by the wholesaler. The trade discount is deducted from the invoice itself and the entry in the books is made with the net amount, i.e., after deducting the trade discount.

Certain important points in connection with the cash discount be noted:

(1) The Discount columns are not to be balanced. This is so because the total of the debit side discount columns represents total discount allowed whereas the total of the credit side discount column represents the total discount received.

(2) Discount columns do not serve the purpose of Discount Account because they are only the memorandum columns. A discount account will be opened in the ledger and the total of these columns will be posted therein.

(3) The rules for recording discounts allowed and received in the personal accounts are:

(a) Debit the creditor’s account with the amount of discount received while debiting his account with the amount of cash paid, and

(b) Credit the debtor’s account with the amount of discount allowed together with cash received from him.

(4) The total of the discount column appearing in the debit side of the Cash Book will be posted on the debit side of the Discount Allowed Account and the total of the discount column appearing on the credit side of the Cash Book will be posted on the credit side of the Discount Received Account in the ledger.

This is at first sight appears to be incorrect. How can a debit total be transferred to the debit of an account? Here one must look at the entries for discounts in the personal account. Discount allowed have been entered in the credit of the individual personal accounts. The entry of the total in the expense account of discount allowed must, therefore, be on the debit side to preserve double entry balancing. The converse applies to discounts received.

The sides on which the two types of discounts are entered in the discount accounts in the ledger can be easily reconciled if discounts allowed are seen as an expense of attracting money. As an expense they will be found as a debit in the discount allowed account. Similarly discounts received may be seen as income received for prompt payment of account, and as income will, therefore, appear on the credit side in the discounts received account.

(5) Discount account being a nominal account, the following rule should be applied while recording discounts.

Debit all losses and expenses (Discount allowed) Credit all gains and incomes (Discount Received)

Triple column Cash Book: In this type of Cash Book, three amount columns are provided on either side. Three columns are for (a) Discounts (b) Cash (c) Bank. Triple column cash Book is generally used by big business houses which have numerous bank transactions. No bank account need be opened because the bank columns themselves represent debit and credit sides of the Bank Account. The businessmen are thus able to save their time in posting.

The method of recording in this type of Cash Book is similar to the one adopted in case of the columnar Cash Book. But contra entries involving Cash and Bank deserve special attention. When cash is deposited into the bank or cash is withdrawn from the bank, the transactions is to be recorded in the cash column on one side and the bank column on the other side. If cash is withdrawn from the bank, the amount will be debited in the cash column and will be credited in the bank column. Similarly, when we deposit the cash in the bank, an entry will be made on the credit side of the cash book in the bank column; and the corresponding entry will be made on the credit side of the cash book in the ledger column. Such entries are known as contra entries. A small letter (c) is written in ledger folio column to indicate that this is a contra entry. No further posting of contra entries is required in the ledger as both the aspects, Debit and Credit, are recorded in the Cash Book itself.

IMPORTANT POINTS:

1. Cash Book is one of the subsidiary books.

2. Cash Book is a Journal - Cum - Ledger: Cash Book is a journal because it is a subsidiary book, prepared instead of journal. Cash Book is a Ledger because after preparing cash book. We don’t have to prepare Cash A/c and Bank A/c.

3. Incoming of Money in Cash Box or Bank A/c - RECEIPTS. (Dr.) Outgoing of Money from Cash Box or Bank A/c - PAYMENTS. (Cr.).

4. Different types of Bank A/c :

(a) Current A/c - Bank A/c of business.

(b) Savings A/c - Personal and private Bank A/c of owner.

(c) Fixed Deposit A/c - Bank A/c either of business or owner but where deposits and

withdrawal cannot be frequent or day to day.

NOTE: Normally when we say Bank A/c, we refer to current A/ of Bank.

5. CONTRA ENTRY:

Transaction where (i) Cash A/c Dr. and Bank A/c Cr. OR

(ii) Bank A/c Dr. and Cash A/c Cr.

is known as Contra entry. It is recorded on both the sides of Cash Book.

6. (a) Cheque received and deposited on the same Day:

BANK A/c Dr.

(b) Cheque received and deposited later on:

* On the date of receiving the cheque:

CASH A/c Dr.

* On the date of depositing the cheque:

BANK A/c Dr. and CASH A/c Cr.

(c) Cheque received and endorsed:

* On receiving the cheque:

CASH A/C Dr.

* On endorsing the cheque:

CASH A/c Cr.

(d) Bearer cheque received:

CASH A/c Dr.

(e) Bearer cheque received and deposited into Bank :

BANK A/c Dr.

7. CHEQUE ISSUE: Always Bank A/c - Cr.

8. Dishonour of cheques: Reverse the above effects.

9. Closing of Cash Book:

(a) Cash and Bank Columns are closed like Ledgers A/cs.

(b) Discount columns of both sides are just to be totalled, which are posted to

Discount allowed A/c (Dr. side) and Discount received A/c (Cr. side)

FORMAT:

Dr. CASH BOOK Cr.

Date | Receipts | R .No. | L F | Discount | Cash | Bank | Date | Payments | V. No. | L F | Discount | Cash | Bank |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

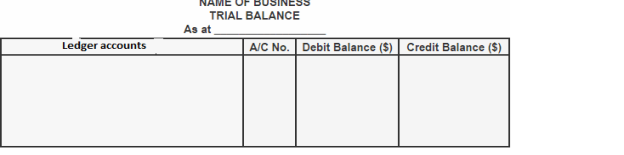

Definition

“Trial balance is a statement, prepared with debit and credit balances of ledger accounts to test the arithmetical accuracy of the books”.

J.R. Batliboi

- It is the statement from which final accounts are prepared

- It is the list of balances of all the ledger accounts

- The total of debit and credit column of trial balance must tally

|

How does trial balance work?

The trial balance is the statement of all debits and credits. Business man prepares trial balance at the end of the reporting period regularly to ensure that the entries are mathematically correct in the books of account. The total of trial balance should be equal. In case the debit and credit does not match it means there is an error. For example, the accountant may have recorded an account or classified a transaction incorrectly.

Preparation of trial balance

- Before starting the trial balance all the ledger accounts should be closed. The ledger balance is provided by the difference between the sum of all the debit entries and the sum of all the credit entries

- Prepare trial balance worksheet. The column headers should be for the account number, account name and the corresponding columns for debit and credit balances.

- Every ledger account is transferred to the trial balance worksheet. The account name and number along with the account balance in the appropriate debit or credit column

- Add up the debit and credit column. In an error free trial balance the total should be same. Trial balance are closed when the total are same

- accountants have to locate and rectify the errors, if there is a difference,

A trial balance looks like

All the account title are the closing balance of ledger account

ABC LTD - Trial Balance as at 31 December 2019 | ||

| Debit | Credit |

Account Title | rs | rs |

Share Capital | - | 15,000 |

Furniture & Fixture | 5,000 | - |

Building | 10,000 | - |

Creditor | - | 5,000 |

|

|

|

Debtors | 3,000 | - |

Cash | 2,000 | - |

Sales | - | 10,000 |

Cost of sales | 8,000 | - |

General and Administration Expense | 2,000 | - |

Total | 30,000 | 30,000 |

Keywords |

|

2. Account collation and transfer of information to other accounting records is done using the information recorded in the journal. |

3. When a transaction is recorded in a company's journal, it is usually recorded using double-entry bookkeeping, but it can also be recorded using single-entry bookkeeping. |

4. Double-entry bookkeeping reflects changes in the two accounts after the transaction occurs. One increase and corresponding decrease in accounts. |

5. Single-entry bookkeeping is rarely used and records only one account change. |

6. Journals are also used in the financial industry to refer to trading journals that detail the transactions made by investors and why. |

7. The general ledger is the foundation of a company's double-entry bookkeeping system. |

8. The general ledger contains all the transaction data needed to create income statements, balance sheets, and other financial reports. |

9. A general ledger transaction is a summary of transactions made as a journal entry to a subledger account. |

10. A trial balance is a report that lists all general ledger accounts and their balances, making adjustments easier to see and errors easier to find. |

11. Reconciliation journals are used to record transactions that have occurred but have not yet been properly recorded according to accrual accounting methods. |

12. Reconciliation journals are recorded in the company's general ledger at the end of the accounting period and adhere to the principles of matching and revenue recognition. |

13. The accounting cycle is a process designed by business owners to facilitate financial accounting of their business activities. |

14. The end of the accounting cycle provides business owners with a comprehensive financial performance report used to analyze their business. |

15. The eight steps of the accounting cycle are identifying transactions, recording transactions in journals, posting, unadjusted trial balances, worksheets, adjusting journal entries, financial statements, and closing books. |

16. Cash Book is a subsidiary of General Ledger that records all cash transactions during the period. |

17. Cash books are recorded in chronological order and balances are continuously updated and validated. |

18. Large organizations typically split the cash book into two parts. Cash payment journal and cash receipt journal. |

19. A cash account differs from a cash account in that it is a separate ledger in which cash transactions are recorded, but a cash account is an account in the general ledger. 20. There are three common types of cashbooks: 1-column, 2-column, and 3-column. |

What is a bank adjustment statement?

A bank collation statement is a summary of banking and business activities that collate a company's bank account with its financial records. This statement outlines deposits, withdrawals, and other activities that affect your bank account for a particular period of time. Bank verification statements are a useful financial internal control tool used to thwart fraud.

Understand bank adjustment statements

The bank verification statement confirms that the payment has been processed and that the cash collection has been deposited at the bank. Adjustment statements help identify the difference between bank and book balances in order to handle any necessary adjustments or adjustments. Accountants typically process adjustment statements once a month.

The accountant adjusts the year-end balance of the bank statement to reflect unpaid checks or withdrawals. These are transactions in which payment is in progress but cash has not yet been accepted by the recipient. An example is a check that will be mailed on October 30th. When preparing the October 31st bank verification statement, the accountant will deduct the amount from the bank balance because the check mailed the day before is likely not cashed. Payments that have not yet been processed by the bank may be collected, which requires positive adjustments.

Some important points:

1. (a) Our book - Cash Book.

(b) Bank’s book - Pass Book.

2. (a) In our book - Bank A/c.

(b) In Bank’s book - Our A/c

3. (a) Normally: Cash Book - Dr. balance

Pass Book - Cr. Balance

(b) Overdraft: Cash Book - Cr. balance

Pass Book - Dr. balance