UNIT II

Concept of Capital and Revenue

Introduction

Accounting aims in ascertaining and presenting the results of the business for an accounting period. For ascertaining the periodical business results, the nature of transactions should be analyzed whether they are of capital or revenue nature. The Revenue Expense relates to the operations of the business of an accounting period or to the revenue earned during the period or the items of expenditure, benefits of which do not extend beyond that period. Capital Expenditure, on the other hand, generates enduring benefits and helps in revenue generation over more than one accounting period. Revenue Expenses must be associated with a physical activity of the entity. Therefore, whereas production and sales generate revenue in the earning process, use of goods and services in support of those functions causes expenses to occur. Expenses are recognised in the Profit & Loss Account through matching principal which tells us when and how much of the expenses to be charged against revenue. A part of the expenditure can be capitalised only when these can be traced directly to definable streams of future benefits.

The distinction of transaction into revenue and capital is done for the purpose of placing them in Profit and Loss account or in the Balance Sheet. For example: revenue expenditures are shown in the profit and loss account as their benefits are for one accounting period i.e. in which they are incurred while capital expenditures are placed on the asset side of the balance sheet as they will generate benefits for more than one accounting period and will be transferred to profit and loss account of the year on the basis of utilisation of that benefit in particular accounting year. Hence, both capital and revenue expenditures are ultimately transferred to profit and loss account.

Revenue expenditures are transferred to profit and loss account in the year of spending while capital expenditures are transferred to profit and loss account of the year in which their benefits are utilised. Therefore, we can conclude that it is the time factor, which is the main determinant for transferring the expenditure to profit and loss account. Also, expenses are recognized in profit and loss account through matching concept which tells us when and how much of the expenses to be charged against revenue. However, distinction between capital and revenue creates a considerable difficulty. In many cases borderline between the two is very thin.

CONSIDERATIONS IN ASCERTAINING CAPITAL AND REVENUE EXPENDITURES

The basic considerations in distinction between capital and revenue expenditures are:

(a) Nature of business: For a trader dealing in furniture, purchase of furniture is revenue expenditure but for any other trade, the purchase of furniture should be treated as capital expenditure and shown in the balance sheet as asset. Therefore, the nature of business is a very important criterion in separating expenditure between capital and revenue.

(b) Recurring nature of expenditure: If the frequency of an expense is quite often in an accounting year then it is said to be an expenditure of revenue nature while non-recurring expenditure is infrequent in nature and do not occur often in an accounting year. Monthly salary or rent is the example of revenue expenditure as they are incurred every month while purchase of assets is not the transaction done regularly therefore, classified as capital expenditure unless materiality criteria define it as revenue expenditure.

(c) Purpose of expenses: Expenses for repairs of machine may be incurred in course of normal maintenance of the asset. Such expenses are revenue in nature. On the other hand, expenditure incurred for major repair of the asset so as to increase its productive capacity is capital in nature. However, determination of the cost of maintenance and ordinary repairs which should be expensed, as opposed to a cost which ought to be capitalised, is not always simple.

(d) Effect on revenue generating capacity of business: The expenses which help to generate income/ revenue in the current period are revenue in nature and should be matched against the revenue earned in the current period. On the other hand, if expenditure helps to generate revenue over more than one accounting period, it is generally called capital expenditure.

When expenditure on improvements and repair of a fixed asset is done, it has to be charged to Profit and Loss Account if the expected future benefits from fixed assets do not change, and it will be included in book value of fixed asset, where the expected future benefits from assets increase.

(e) Materiality of the amount involved: Relative proportion of the amount involved is another important consideration in distinction between revenue and capital.

CAPITAL EXPENDITURES AND REVENUE EXPENDITURES

As we have already discussed, capital expenditure contributes to the revenue earning capacity of a business over more than one accounting period whereas revenue expense is incurred to generate revenue for a particular accounting period. The revenue expenses either occur in direct relation with the revenue or in relation with accounting periods, for example cost of goods sold, salaries, rent, etc. Cost of goods sold is directly related to sales revenue whereas rent is related to the particular accounting period. Capital expenditure may represent acquisition of any tangible or intangible fixed assets for enduring future benefits. Therefore, the benefits arising out of capital expenditure last for more than one accounting period whereas those arising out of revenue expenses expire in the same accounting period.

Solved Examples

ILLUSTRATION 1

State with reasons whether the following statements are ‘True’ or ‘False’.

(1) Overhaul expenses of second-hand machinery purchased are Revenue Expenditure.

(2) Money spent to reduce working expenses is Revenue Expenditure.

(3) Legal fees to acquire property are Capital Expenditure.

(4) Amount spent as lawyer’s fee to defend a suit claiming that the firm’s factory site belonged to the plaintiff’s land is Capital Expenditure.

(5) Amount spent for replacement of worn out part of machine is Capital Expenditure.

(6) Expense incurred on the repairs and white washing for the first time on purchase of an old building are Revenue Expenses.

(7) Expenses in connection with obtaining a license for running the cinema are Capital Expenditure.

(8) Amount spent for the construction of temporary huts, which were necessary for construction of the Cinema House and were demolished when the cinema house was ready, is Capital Expenditure.

SOLUTION:

(1) False: Overhaul expenses are incurred to put second-hand machinery in working condition to derive endurable long-term advantage. So it should be capitalised.

(2) False: It may be reasonably presumed that money spent for reducing revenue expenditure would have generated long-term benefits to the entity. It becomes part of intangible fixed assets if it is in the form of technical know-how and tangible fixed assets if it is in the form of additional replacement of any of the existing tangible fixed assets. So, this is capital expenditure.

(3) True: Legal fee paid to acquire any property is part of the cost of that property. It is incurred to possess the ownership right of the property and hence a capital expenditure.

(4) False: Legal expenses incurred to defend a suit claiming that the firm’s factory site belongs to the plaintiff are maintenance expenditure of the asset. By this expense, neither any endurable benefit can be obtained in future in addition to that what is presently available nor will the capacity of the asset be increased. Maintenance expenditure in relation to an asset is revenue expenditure.

(5) False: Amount spent for replacement of any worn-out part of a machine is revenue expense since it is part of its maintenance cost.

(6) False: Repairing and white washing expenses for the first time of an old building are incurred to put the building in usable condition. These are the part of the cost of building. Accordingly, these are capital expenditure.

(7) True: The Cinema Hall could not be started without license. Expenditure incurred to obtain the license is pre-operative expense which is capitalised. Such expenses are amortised over a period of time.

(8) True: Cost of temporary huts constructed which were necessary for the construction of the cinema house is part of the construction cost of the cinema house. Therefore, such costs are to be capitalised.

ILLUSTRATION 2

State with reasons whether the following are Capital or Revenue Expenditure:

(1) Expenses incurred in connection with obtaining a license for starting the factory for Rs. 10,000.

(2) Rs. 1,000 paid for removal of Inventory to a new site.

(3) Rings and Pistons of an engine were changed at a cost of Rs. 5,000 to get fuel efficiency.

(4) Money paid to Mahan agar Telephone Nigam Ltd. (MTNL) Rs. 8,000 for installing telephone in the office.

(5) A factory shed was constructed at a cost of Rs. 1,00,000. A sum of Rs. 5,000 had been incurred in the construction of temporary huts for storing building material.

SOLUTION:

(1) Money paid Rs. 10,000 for obtaining license to start a factory is a capital expenditure. This is an item of expenditure incurred to acquire the right to carry on business.

(2) Rs. 1,000 paid for removal of Inventory to a new site is revenue expenditure. This is neither bringing enduring benefit nor enhancing the value of the asset.

(3) Rs. 5,000 spent in changing Rings and Pistons of an engine to get fuel efficiency is capital expenditure. This is an expenditure on improvement of a fixed asset. It results in increasing profit-earning capacity of the business by cost reduction.

(4) Money deposited with MTNL for installation of telephone in office is not expenditure. This is treated as an asset and the same is adjusted over a period of time against actual telephone bills.

(5) Cost of construction of building including cost of temporary huts is capital expenditure. Building is fixed asset which will generate enduring benefit to the business over more than one accounting period. Construction of temporary huts is incidental to the main construction. Such cost is also capitalised with the cost of building.

CAPITAL RECEIPTS AND REVENUE RECEIPTS

Just as a clear distinction between Capital and Revenue expenditure is necessary, in the same manner capital receipts must be distinguished from revenue receipts.

Receipts which are obtained in course of normal business activities are revenue receipts (e.g. receipts from sale of goods or services, interest income etc.). On the other hand, receipts which are not revenue in nature are capital receipts (e.g. receipts from sale of fixed assets or investments, secured or unsecured loans, owners’ contributions etc.). Revenue and capital receipts are recognised on accrual basis as soon as the right of receipt is established. Revenue receipts should not be equated with the actual cash receipts. Revenue receipts are credited to the Profit and Loss Account.

On the other hand, Capital receipts are not directly credited to Profit and Loss Account. For example, when a fixed asset is sold for Rs. 92,000 (cost Rs. 90,000), the capital receipts Rs. 92,000 are not credited to Profit and Loss Account. Profit/Loss on sale of fixed assets is calculated and credited to Profit and Loss Account as follows:

Sale Proceeds Rs. 92,000

Less: Cost Rs. 90,000

Profit Rs. 2,000

ILLUSTRATION 3

Good Pictures Ltd., constructs a cinema house and incurs the following expenditure during the first year ending 31st March, 2016.

1. Second-hand furniture worth Rs. 9,000 was purchased; repainting of the furniture costs Rs. 1,000. The furniture was installed by own workmen, wages for this being Rs. 200.

2. Expenses in connection with obtaining a license for running the cinema worth Rs. 20,000. During the course of the year the cinema company was fined Rs. 1,000, for contravening rules. Renewal fee Rs. 2,000 for next year also paid.

3. Fire insurance, Rs. 1,000 was paid on 1st October, 2015 for one year.

4. Temporary huts were constructed costing Rs. 1,200. They were necessary for the construction of the cinema. They were demolished when the cinema was ready.

Point out how you would classify the above items.

SOLUTION:

1. The total cost of the furniture should be treated as Rs. 10,200 i.e., all the amounts mentioned should be capitalised since without such expenditure the furniture would not be available for use. If Rs. 1,000 and Rs. 200 have been respectively debited to the Repairs Account and the Wages Account, these accounts will be credited to the Furniture Account.

2. License for running the cinema house is necessary, hence its cost should be capitalised. But the fine of Rs. 1,000 is revenue expenditure. The renewal fee for the next year is also revenue expenditure but pertains to the next year; hence, it is a prepaid expense.

3. Half of the insurance premium pertains to the year beginning on 1st April, 2016. Hence such amount should be treated as prepaid expense. The remaining amount is revenue expense for the current year.

4. Since the temporary huts were necessary for the construction, their cost should be added to the cost of the cinema hall and thus capitalised.

ILLUSTRATION 4

State with reasons, how you would classify the following items of expenditure:

1. Overhauling expenses of Rs. 25,000 for the engine of a motor car to get better fuel efficiency.

2. Inauguration expenses of Rs. 25 lakhs incurred on the opening of a new manufacturing unit in an existing business.

3. Compensation of Rs. 2.5 crores paid to workers, who opted for voluntary retirement.

SOLUTION:

1. Overhauling expenses are incurred for the engine of a motor car to derive better fuel efficiency. These expenses will reduce the running cost in future and thus the benefit is in form of endurable long-term advantage. So this expenditure should be capitalised.

2. Inauguration expenses incurred on the opening of a new unit may help to explore more customers. This expenditure is in the nature of revenue expenditure, as the expenditure may not generate any enduring benefit to the business over more than one accounting period.

3. The amount paid to workers on voluntary retirement is in the nature of revenue expenditure. Since the magnitude of the amount of expenditure is very significant, it may be better to defer it over future years.

ILLUSTRATION 5

Classify the following expenditures and receipts as capital or revenue:

(i) Rs. 10,000 spent as travelling expenses of the directors on trips abroad for purchase of capital assets.

(ii) Amount received from Trade receivables during the year.

(iii) Amount spent on demolition of building to construct a bigger building on the same site.

(iv) Insurance claim received on account of machinery damaged by fire.

SOLUTION:

(i) Capital expenditure.

(ii) Revenue receipt.

(iii) Capital expenditure.

(iv) Capital receipt.

ILLUSTRATION 6

Are the following expenditures capital in nature?

(i) M/s ABC & Co. runs a restaurant. They renovate some of the old cabins. Because of this renovation some space was made free and number of cabins was increased from 10 to 13. The total expenditure was Rs. 20,000.

(ii) M/s New Delhi Financing Co. sold certain goods on instalment payment basis. Five customers did not pay instalments. To recover such outstanding instalments, the firm spent Rs. 10,000 on account of legal expenses.

(iii) M/s Ballav & Co. of Delhi purchased a machinery from M/s Shah & Co. of Ahmedabad. M/s Ballav & Co. spent Rs. 40,000 for transportation of such machinery. The year ending is 31st Dec, 2015.

SOLUTION:

(i) Renovation of cabins increased the number of cabins. This has an effect on the future revenue generating capability of the business. Thus the renovation expense is capital expenditure in nature.

(ii) Expense incurred to recover instalments due from customer does not increase the revenue generating capability in future. It is a normal recurring expense of the business. Thus, the legal expenses incurred in this case are revenue expenditure in nature.

(iii) Expenses incurred on account of transportation of fixed asset are capital expenditure in nature.

Key takeaways: |

|

2. Capital investment is usually a one-time, large-scale purchase of fixed assets used to generate long-term revenue. |

3. Income and expenditure are continuous operating expenses, short-term expenses used for daily business operations. |

4. A capital receipt is a receipt that creates debt or reduces assets. As mentioned above, receipts for capital are inherently irregular. And this kind of receipt is not sometimes received either. |

5. Income receipts are receipts that do not reduce a company's assets or generate liabilities. They are essentially always repetitive and are acquired in the normal course of business. |

6. Since income receipts look like the opposite of capital receipts, it makes perfect sense to look at the various features of income receipts so that you can understand what they mean and compare them to the characteristics of capital receipts. |

7. The receipt of capital is inherently irregular. On the other hand, income receipts are essentially recurring. |

8. Without a receipt for capital, the company can survive, but without a receipt for income, the company cannot be permanent. |

9. Receipts of capital cannot be used as a profit share. Receipts of income can be distributed after deducting the costs incurred to earn income. |

10. Receipts of capital can be found on the balance sheet. The receipt of income can be found on the income statement. |

11. Receiving capital reduces the company's assets or creates company responsibility. The receipt of income is the opposite. |

12. They do not hold the company accountable or reduce the company's assets |

|

Meaning

The final account is the account prepared by the Joint Stock Company at the end of the fiscal year. The purpose of creating a final account is to provide a clear picture of the financial situation of the organization to its management, owners or other users of such accounting information.

Final account preparation involves preparing a set of accounts and statements at the end of the fiscal year.

- Trading and profit and loss accounts

- Balance sheet

- Profit and loss appropriation account

- Purpose of Final Account preparation

The final account is prepared for the following purposes:

- To determine the profit and loss incurred by the company within a certain financial period

- To determine the financial status of the company

- To serve as a source of information to inform users of accounting information (owners, creditors, investors and other stakeholders) about the solvency of the company.

Trading account

The results of the purchase and sale of goods are known as the trading account. This sheet is provided to show the difference between the sales price and the cost price. It is prepared to show the trading results of the business i.e. The total profit or total loss maintained by the business. It records the direct costs of the business company.

According to Batliboi,

The trading account shows the results of buying and selling goods. When we prepare this account, the general establishment costs are not taken into account and only the transaction of goods is included."

Profit and loss accounts

This account is prepared to check the net profit/loss and fiscal year expenses of the business during the fiscal year. It records the indirect expenses of the business company like rent, salary, and advertising expenses. Profit and loss a/C includes expenses and losses and gains and losses incurred in business other than the production of goods and services.

Balance sheet

The balance statement shows the financial status of the business at a specific date. The financial status of a business is discovered by aggregating its assets and liabilities on a specific date. The excess of assets over liabilities represents the capital sunk into the business and reflects the financial health of the enterprise.

Now it is known as a statement of the financial status of the company.

Trading account

Trade and manufacturing operating companies deal with the sale and purchase of goods. Therefore, only the manufacturing and trading entities prepare the trading account. Service providers do not prepare for this.

Advantages of preparing a trading account format

- It is a very important statement from the point of view of the cost of goods. By preparing a trading account, an entity may take a decision to continue or discontinue a particular product, which helps to obtain maximum profit or reduce losses.

- With the help of a trading account, the sales tax authority can, in accordance with the sales tax declaration filed by the business,. It also helps the excise duty authorities to assess the excise duty of a business enterprise.

- The management, having in mind the market competition, determines the price of the product with the help of a trading account.

Items in trading account format

- The trading account contains the following details:

- Details of raw materials, semi-finished goods and finished products, opening stock.

- Close inventory details of raw materials, semi-finished products, and finished products.

- Total purchase of goods less purchase return.

- Total sales of goods less sales return.

- All direct costs associated with the purchase or sale or manufacture of goods.

- Item of income (Cr.Side)

- Less sales return than total sales of goods

- Close the stock of the product.

- Expenditure item (Doctor) side

- Item of expenditure (Dr.Side)

- Opening stock

- Total purchase of goods less purchase return

- All the direct cost like carriage interior & freight cost, rent, electricity and power cost, wages for godown or factory, packing cost, etc. for workers and supervisors.

Notes

The trial count will not be displayed on the close. But, firstly, we need to show the amount of closing shares on the income side of the trading account, and secondly, on the balance sheet under current assets.

We value closing inventory at either lower cost or market price.

On the day of preparation of the trading account, we value the physically available closed shares.

However, the trading account can also be prepared in horizontal form, but the content remains the same.

Trading Account Format

Particulars | Amount | Particulars | Amount |

To opening stock | Xxx | By sales | xxx |

To purchase | Xxx | Less: Returns | xxx |

Less: returns | Xxx | By Closing stock | xxx |

To direct expenses: | Xxx | By Gross loss c/d |

|

Freight & carriage | Xxx |

|

|

Custom & insurance | Xxx |

|

|

Wages | Xxx |

|

|

Gas, water & fuel | xxx |

|

|

Factory expenses | xxx |

|

|

Royalty on production | Xxx |

|

|

To Gross profit c/d | xxx |

|

|

Profit and loss A/C

All companies generally prepare profit and loss accounts/statements at the end of the year to gain visibility of income, revenue, expenses, and losses incurred in a certain range of periods. It is important to prepare a profit and loss statement because this information helps organizations make the right business decisions, such as where to cut costs, from where the business can generate more profit, and which parts of the business are suffering from losses.

Profit and loss accounts / statements

Types of profit and loss

- Gross profit/gross loss

- Profit / loss

Trading account is prepared to check gross profit/loss while profit and loss account is created to check profit and loss/net loss.

Profit and loss accounts are made to check the annual profit or loss of a business. This account only shows overhead. All items of income and expenses, whether cash or non-cash, are considered in this account.

Only revenue or expenses related to the current period are debited or credited to the profit and loss account. The profit and loss account starts with gross profit on the credit side and, if there is a total loss, appears on the debit side. Items not displayed in the profit and loss account format

Drawing: the drawing is not the company's expense. Therefore, we debit it to capital a/c, and not to profit and loss a/c.

Income tax: for a company, income tax is an expense, but for a sole proprietor, it is his personal expense. Therefore, we debit it to the capital A/C.

Discounts: as we know, discounts are of two types–trade discounts and cash discounts. We deduct the trade discount from the amount charged and therefore do not show it in the account books. On the other hand, if the customer pays the amount on a certain date, a cash discount will be possible. We view cash discounts in account books. Therefore, we debit it to the profit and loss account.

Bad debt: it is because of the customer and the amount he does not pay it. We debit this amount to profit and loss a/c in the event that preparations have already been made for a bet that is worse than it is initially written off from it. When bad loans are recovered, it is again. Now it is not credited to the account of the party, but recovered account should be credited to the bad debt and is written on the credit side of the profit and loss account

Profit and Loss Account Format

Particulars | Amount | Particulars | Amount |

To Gross loss b/d | Xxx | To Gross profit b/d | xxx |

Management expenses: | Xxx | Income: | xxx |

To salaries | Xxx | By Discount received | xxx |

To office rent, rates, and taxes | Xxx | By Commission received | xxx |

To printing and stationery | Xxx | Non-trading income: | xxx |

To Telephone charges | Xxx | By Bank interest | xxx |

To Insurance | Xxx | By Rent received | xxx |

To Audit fees | Xxx | By Dividend received | xxx |

To Legal charges | Xxx | By Bad debts recovered | xxx |

To Electricity charges | Xxx | Abnormal gains: | xxx |

To Maintenance expenses | Xxx | By Profit on sale of machinery | xxx |

To Repairs and renewals | xxx | By Profit on sale of investments | xxx |

To Depreciation | Xxx | By Net Loss(transferred to Capital A/c) | xxx |

Selling distribution expenses: |

|

|

|

To Salaries | Xxx |

|

|

To Advertisement | Xxx |

|

|

To Godown | Xxx |

|

|

To Carriage outward | Xxx |

|

|

To Bad debts | Xxx |

|

|

To Provision for bad debts | Xxx |

|

|

To Selling commission | Xxx |

|

|

Financial expenses: |

|

|

|

To Bank charges | Xxx |

|

|

To Interest on loan | Xxx |

|

|

To Discount allowed | Xxx |

|

|

Abnormal losses: | Xxx |

|

|

To Loss on sale of machinery | Xxx |

|

|

To Loss on sale of investments | Xxx |

|

|

To Loss by fire | Xxx |

|

|

To Net Profit(transferred to capital a/c) | Xxx |

|

|

TOTAL |

| TOTAL |

|

Balance Sheet

A balance sheet (also known as a financial statement) is a financial statement that shows the Assets, Liabilities and ownership interests of a business at a specific date. The main purpose of drawing up a balance sheet is to disclose the financial status of the enterprise at a certain date. The balance sheet can be prepared at any time, but it is prepared mainly at the end of the accounting period.

Most of the information about Assets, Liabilities and owner's equity items is taken from the company's adjusted trial balance. Retained earnings are the part of the owner's equity section which is provided by the retained earnings statement.

Section of the balance sheet

To be widely considered about the balance sheet of the division part of assets part of liabilities main capital. For each department:

Assets section

In the balance sheet, assets with similar characteristics are grouped. The mainly adopted approach is to divide assets into current and non-current assets. Liquid assets include cash and all assets that can be converted into cash or expected to be consumed in a short period of time–usually one year. Examples of current assets include cash, cash equivalents, accounts receivable, prepayment costs or prepayment, short-term investments and inventories.

All assets that aren't listed as current assets are grouped as non-current assets. A common feature of such assets is that they continue to provide profit for a long time-usually more than one year. Examples of such assets include long-term investments, equipment, plants and machinery, land and buildings, and intangible assets.

Debt Division

A debt is an obligation to a party other than the owner of the business. They are grouped as current and long-term liabilities in the balance sheet. Current liabilities are obligations that are expected to be met within a one-year period by using current assets of the business or by providing goods or services.

Owner's equity division

The owner's interest is the obligation of the business to its owner. The term owner's equity is mainly used in the balance sheet of a business in the form of a sole proprietor and partnership. In the balance sheet of the company the term “ownership interest “is often replaced by the term "shareholder interest".

When the balance sheet is created, the liabilities section appears first, and the owner's equity section appears later.

Balance sheet format there are two formats on the balance sheet that present Assets, Liabilities and owner's ' equity–the account format and the report format.

Assets | $ | Liabilities & Stockholder’s equity | $ |

Current assets: Cash Account receivable Prepaid building rent Unexpired insurance Supplies

Total current assets

|

85,550 4,700 1,500 3,600 250

| Liabilities: Notes payable Accounts payable Salaries payable Income tax payable Unearned service revenue

Total liabilities |

5,000 1,600 2,000 3,000 4,400

|

95.600 | 16,000 | ||

Non-current assets: Equipment 9,000 Acc. dep. –Equipment 3,600

Total assets |

5,400

| Stockholder’s equity: Capital stock 50,000 Retained earnings 35.000

Total liabilities & stockholder’s equity

|

85,000

|

101,200 | 101,000 | ||

|

|

|

|

In the account form, the balance sheet is divided into the left and right, like the t-account. Both liabilities and the owner's capital are listed on the right side of the balance sheet, while assets are listed on the left. If all the elements of the balance sheet are listed correctly, then the sum on the asset side (that is, on the left) is equal to the sum on the debt and the capital side of the owner (that is, on the right).

BUSINESS CONSULTING COMPANY

BALANCE SHEET

As at December 31, 2015

In reporting format, the balance table element is displayed vertically, the asset section is displayed at the highest, and therefore the liabilities and owner's equity sections are displayed below the asset section.

The example below shows both formats.

Assets Current assets:

Cash Account receivable Prepaid building rent Unexpired insurance Supplies

Total current assets

|

85,500 4,700 1,500 3,600 250

|

95,600

| |

Non-current assets: Equipment 9000 Acc. Dep- Equipment 3600

Total assets

|

5,400

|

101,000

| |

Liabilities & Stockholder’s Equity Liabilities Notes payable Accounts payable Salaries payable Income tax payable Unearned service revenue

Total liabilities

|

5,000 1,600 2000 3000 4,400

|

16,000 | |

Stockholder’s equity: Capital stock Retained earning

Total stockholder’s equity

Total liabilities and stockholder’s equity |

50,000 35,000

|

85,000

| |

101,00 |

Types of adjustment entry for the final account

Closing stocks:

The value of the closing stock is checked at the end of the fiscal year, so it is displayed as an adjustment. It must be credited to the transaction a/c and displayed on the asset side of b/S.

The adjustment entry is:

Closing stock a/c ------ Dr.

To trade A / c

Trading account and balance sheet

Rs | |

| By Sales |

| By Trading Stock |

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Closing Stock |

|

Unpaid expenses:

These are expenses incurred in the fiscal year, but no payments have been made. Any unpaid or unpaid expenses will be added to such expense a/c in P&L a/c and will be displayed as current liability in b/S.

For example, monthly rent in May 2002 Rs. 1,000 remains unpaid. A calendar year is an accounting year.

Adjusting entries:

Rent account Dr. Rs.1000

To Outstanding Rent, a/c Rs. 1,000

Profit and loss accounts

|

| Rs |

TO Rent Account Add: Outstanding [11 month rent] [December] | 11,000 1,000 |

12,000 |

Balance Sheet as on 31st December 2002

Liabilities | Rs | Assets |

Outstanding Expenses: Rent |

1,000 |

|

Prepaid Expenses

These are the costs paid, but part of the amount paid extends to the next year. It is also called" expiring expenses". The prepaid amount paid should be deducted from such expenses and displayed as current assets in the B/S.

For example, Rs premium a total of 2,400 people were paid on July 1, 2002. A calendar year is an accounting year. The annual premium is paid for 1 month, so the 6-month premium concerns half of the current year and the other half the following year.

Hence Rs. 1,200 must be treated as an upfront payment, deducted from the premium paid and displayed as an asset on b/S.

Adjusting entries:

Prepaid insurance a / c Dr Rs. 1, 200

To Premium A / c Rs. 1, 200

Profit and Loss Account

| Rs | Rs |

To Insurance Premium a/c Less: Prepaid insurance | 2,400 1,200 | 1,200 |

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Prepaid Insurance | 1,200 |

Accrued income:

It is an income that has already been earned [i.e., the service has already been rendered], but no money has been received. For example, interest on investments accrued Rs. 1,200.

Interest in the current year is due to the end of the year. That amount can actually be received in the next year. Currently, it represents income, which has become accounts receivable or accrued. Therefore, P&L is credited to a/c, IS accounts receivable and appears as an asset in b/S.

Adjusting entries:

Accrued interest a / c Dr. Rs. 1,200

To be interested in a / c Rs. 1,200

Profit and Loss Account

| By Interest on investment Add: Interest accrued | …… 1,200 |

|

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Interest accrued | 1,200 |

Income received in advance:

These are the income received during the current year, but part of the amount received is related to the following year. Such amounts must be deducted from the total amount received in P & L A / C and displayed on the debt side of B / S, which represents the amount that the business is obliged to return.

For example, business concerns have received a three-year apprenticeship premium equivalent to Rs.6, 000. Rs in this amount.2, 000 IE, 1/3 of Rs.6, 000 is for the current year and must be credited to P&L a/c as income. And balance Rs. As business is obliged to return 4, 000 represents responsibility.

Adjusting entries:

Apprentice premium A / c Dr Rs. 4000

To Apprentice premium received in advance Rs. 4000

Profit and Loss Account

|

| Rs | Rs |

| By Apprentice Premium Less: Received in advance | 6,000 4,000 |

2,000 |

Balance Sheet

Liabilities | Rs | Assets | Rs |

Apprentice Premiu received in advance | 4,500 |

|

|

Depreciation of assets:

Depreciation implies a decrease or decrease in the value of an asset due to its constant use. It may also occur due to wear and tear, the passage of time and obsolescence. It's a loss to business.

It is usually calculated at a certain percentage to the value of the asset, and so the amount obtained is shown first on the debit side of the P & L A/C, and then subtracted from the original value of the asset of B/s.

For example, a business has furniture worth Rs. At the end of the year 50, 000 it is depreciated by 5%.

Adjusting entries:

Depreciation A / c Dr Rs. 2,500

To Furniture A / c to Rs. 2,500

[5% Rs 50,000 = 2,500]

Profit and Loss Account

| Rs. |

|

To Depreciation a/c Furniture | 2,500 |

|

Balance Sheet

Liabilities | Rs | Assets |

| Rs |

|

| Furniture Less: Depreciation | 50,000 2,500 |

47,500 |

Bad debts

Debt represents money from the debtor [i.e., the uncollected portion of the credit sale]. When a debt becomes irretrievable, it becomes a bad debt and is treated as a loss. The amount of non-performing loans is debited to P&L a/c and deducted from the various debtors of B/S.

For example, a trader's ledger balance on sundry debtors shows Rs with 20,000. 1,000 are estimated to be unrecoverable.

Adjusting entries:

Bad debts a / c Dr Rs. 1,000

To Sundry debtor a / c to Rs. 1,000

Provision for bad and doubtful debt:

Every business has a lot of trading through margin trading. This gives rise to a significant amount of book debts or debtors. But 100% of these debts are rarely recovered.

Therefore, it would be necessary to bring down the balance of the debtor to it true position. The usual practice is to calculate such a bad debt at a certain rate, based on the past experience of the debtor. It is called reserves or reserves for doubtful debts.

However, the allowance for bad loans and bad debt is calculated on good debt, that is, after deducting previously unadjusted bad loans.

For example:

At the end of the year the sundries debtors of traders stood in the Rs.21, 000. It is estimated to be Rs. 1,000 is written off as bad loans and a 5% allowance is created for bad debt.

Adjusting entries:

Bad Debts a/c Dr. Rs. 1,000

To Sundry Debtors a/c Rs. 1,000

To Profit and Loss a/c Dr. Rs. 2,000

To Bad Debts a/c Rs. 1,000

To Provision for Doubtful Debts 1,000

Profit and Loss Account

| Rs |

|

TO Bad Debts To Reserve for doubtful Debts | 1,000 1,000 |

|

If there is an old provision for doubtful debts, it should be adjusted [deducted] against the new provision.

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

|

| Sundry Debtors Less: Bad Debts

Less: Provision for Doubtful Debts | 21,000 1,000 |

19,000 |

20,000 | ||||

1,000 |

Provision for discounts to debtors:

Cash discounts are allowed to debtors to prompt quick payments. After providing bad loans and bad debts, the debtor's balance represents the debt from a healthy party.

They may pay their dues on time and try to take advantage of the acceptable cash discounts themselves. Therefore, this discount should be expected and offered. It is, therefore, the usual practice in business is to offer debtors discounts at a certain percentage on good debt.

For example:

Suppose a trader has various debtors equivalent to rs.20, 000 and he estimates that a provision for a discount of 5% is desirable, after a provision of 2% for bad debts. Then about healthy debt, i e a provision of 19,000 at 2% has been made as a reserve for debtors ' discounts.

Adjusting entries:

Profit and Loss a/c Dr. Rs.380

To Reserve for Discount on Debtors a/c Rs.380

Profit and Loss Account

| Rs |

|

To ad Debts To Reserve for Doubtful Debts To Reserve for Discount on Debtors |

1,000 380 |

|

Balance Sheet

Liabilities | Rs | Assets |

| Rs |

|

| Sundry Debtors Less: Provision for Doubtful on Debts

Less: Provision for Doubtful Debts | 20,000 1,000

19,000 380 |

18,620 |

Provision for discounts to creditors:

The creditor represents the amount paid by the business to the supplier of goods on credit. A healthy business concern is the creditor's goodwill and the practice of settling accounts with creditors in time to get the discounts allowed by them.

In that case, the liability for various creditors can be reduced to the extent of the expected discount. Based on past practice, a certain percentage of the balance of receivables is calculated as a reserve for discounts and subtracted from the balance of receivables of B/S, and the same amount is calculated as the gain of P&L A/C.

For example:

Traders had various creditors at Rs. 10,000on31th December2002. It is desirable to *provide 3% for this amount for discounts.

Adjusting entries:

Discounts on creditors for Reserve a /c Dr Rs. 300

To Profit and loss a / c Rs. 300

Profit and Loss Account

| Rs |

| Rs |

|

| By Reserve for Discount on Creditors | 300 |

Balance Sheet

Liabilities | Rs |

|

|

|

Sundry Debtors Less: Reserve for Discount | 10,000 300 |

9,700 |

|

|

Interest on capital:

Often, interest at the usual rate is allowed to the owner's capital, which is adopted in the business. This is necessary in order to assess the efficiency of the business. Otherwise, the profit will include interest and will be displayed at a higher rate.

So the interest charged is a loss to the business and a profit to the owner. Thus, it is debited to profit and loss a/c and added to the capital of the balance sheet.

Adjusting entries:

Interest on Capital a/c Dr.

To Capital a/c

Profit and Loss a/c Dr.

To Interest on Capital a/c

Interest in drawing:

The drawing is the money that the owner has withdrawn from the capital. It charge interest on the drawing so that it allows business interest on capital. It's a profit to the business and a loss to the owner. Thus, it is credited to profit and loss a/c and deducted from the capital on the balance sheet.

Profit and Loss Account

| Rs |

| Rs |

To Interest on Capital |

| By Interest on Drawings |

|

Balance Sheet

|

|

|

|

Capital Add: Interest on Capital Less: Drawings Interest on Drawings |

|

|

|

Adjustment of special items:

1. Products distributed as free samples:

To promote the products, free samples are supplied to experts in the field. For example, distributed a free sample of a book to a professor, a free sample of medicine to a doctor, etc.

Since it is a promotional activity, the cost of such a sample should be treated as promotional costs, for example, advertising. Free sample distribution is equivalent to a decrease in purchase or sale without a monetary return.

Thus, the adjusted entry is:

Particulars | Dr (Rs) | Cr (Rs) |

Advertising A/C To Purchases A/C or To Trading A/C |

|

|

The transfer entry is as follows:

Particulars | Dr (Rs) | Cr (Rs) |

Profit and Loss A/C To Advertisement A/c |

|

|

The net effect will be the reduction of purchases as promotional costs and the charge to the profit and loss account

2. Goods sold or sold on an approval basis: sometimes goods are sold on an approval basis in order to gain the trust of customers about the quality of the goods. If the customer approves it, it becomes a sale. If the customer does not approve it, the sale is not completed and therefore cannot be treated as a sale. Suppose that at the end of the fiscal year, you have a specific product with the customer that was sent on an approval basis, and you need to pass the necessary entries for reconciliation.

The adjustment entry is as follows: the treatment is as follows:

Particulars | Dr (Rs) | Cr (Rs) |

Sales A/C To Debtors A/C (At sales price of the goods) |

|

|

Particulars | Dr (Rs) | Cr(Rs) |

Stock A/C To Trading A/C |

|

|

(A) As a deduction from sales at the selling price on the credit side of the trading account, and in addition to closing the shares at the cost price.

(h) As a deduction from debtors on the asset side, and as the total inventory displayed at the cost on the asset side of the balance sheet (cost finished stock in stock with authorized customers).

3. About shipping of products by consignment sale:

Since consignment transactions are not sales transactions, they do not directly affect transactions and profit and loss accounts. Another consignment account is opened, and the goods sent to the consignment are debited to the consignment account. When an account sale is received, it is treated as a consignment sale, credited to the consignment account and debited to the consignment account.

The consignment inventory remaining at the consignment is deposited into the consignment account, and after invoicing the consignment cost, the consignment fee, etc., the consignment profit is confirmed. However, the closing stock of the deposit is displayed on the asset side of the balance sheet, and the profit and loss of the deposit is credited to the profit and loss account (if there is a loss of the deposit, it is cancelled).

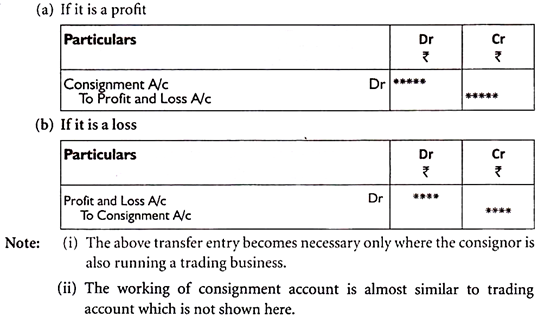

The transfer input of consignment profit and loss is as follows:

|

4. Loss of stock due to fire:

If the stock is destroyed by fire, the losses incurred will be treated differently under the following three possible circumstances:

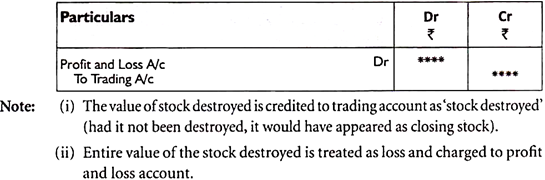

if the stock is not insured-the entire value of the stock destroyed by fire is treated as a loss, at the entry –

|

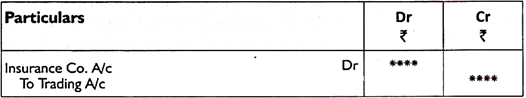

If the stock is fully insured-when the fully insured stock is destroyed, the company has a claim to the insurance company for the recovery of losses due to the goods destroyed by fire. Therefore, the claim takes precedence in the entry –

|

In practice, claims against the insurance company are treated as "debtors" and are indicated on the asset side of the balance sheet as payments from the insurance company.

If the insurance company settled the dues, the entry would be

In fact, the account of the insurance company does not appear on the balance sheet, since the cash/bank balance on the balance sheet increases with the settled claims.

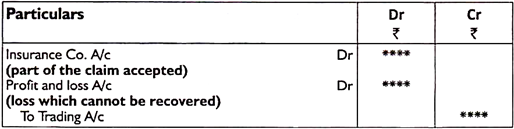

if the shares are partially insured-in this case, the total value of the destroyed shares will be credited to the trading account, that portion of the claim settled by the insurance company will be debited to the insurance company account, and the difference between the destroyed shares and the accepted insurance claim will be debited to the profit and loss account as a loss. The entries are as follows –

|

5. Deferred appropriations: A huge expenditure of the nature of the revenue generated at the initial stage of a business enterprise with the belief that it derives profit from such expenditure during subsequent years is considered a deferred revenue expenditure if the charge of such expenses is spread over the number of years in which the profit is expected to be derived.

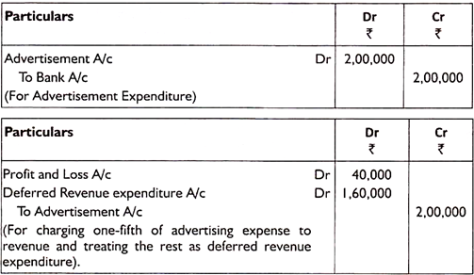

Part of such expenditure is charged as revenue for each year, and the rest is capitalized on the basis of the matching concept. For example, huge expenditures on "advertising" occur in the first year of the business and derive profits over an estimated period of ten years. Then one-tenth of that expenditure each year is charged to income over a decade period. The Important point here is that the expenditure that is not charged to the revenue is capitalized and appears as a fictitious asset on the balance sheet.

For example, suppose that the ad cost incurred Rs.2, 00,000 will be able to bring benefits over five year’s term. Then a fifth of two, 00,000, i.e., Rs.40, 000 are going to be charged on revenue for the primary year and therefore the remaining Rs.1,60,000 are shown as fictitious assets. In the second year Rs.40, 000 are charged for earnings and 1,20,000 outstanding are shown as fictitious assets. This process lasts for five years until the full expenditure is written off. Entries passed in the first year are –

|

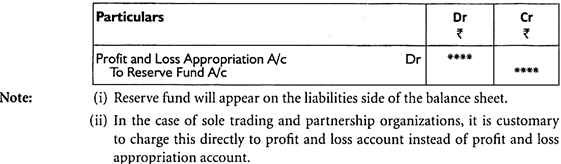

Creation of reserve funds: To strengthen the financial situation of the enterprise, a part of the net profit can be transferred to the reserve account by appropriation. The entries for creating a reserve fund are –

|

7. Committee of managers:

Business companies sometimes offer profit incentives to managers in the form of commissions to motivate people to increase business profits. This fee is given as a percentage of net profit. There are two ways to provide this percentage of net profit.

(a) The percentage of the commission against net profit before charging such fees;

(b) The percentage of fees to net income after invoicing such fees;

8. Specific hidden tweaks:

The adjustments are not given explicitly under the array of adjustments, but they need to be placed and adjusted. For example, the balance displays the subsequent items alongside other items at the top of Dec31, 2009:

DR Cr |

10% loan January 1, 2009 - - |

Interest on loan 3,000 - |

(Paid during the year) |

If we carefully observe loans are obtained in March 1, 2009 at a rate of interest of 10%. That is, the interest paid on a one-year loan in December31, 2009 (Rs.50, 000×10/100) rupees.5, 000. But the interest paid is only Rs.3, 000 as shown in the trial balance. This indicates that interest is not paid (Rs.5, 000-3,000-2,000. Therefore, this should be considered as an adjustment. The entry is –

Profit and Loss A/c Dr 2 | 000 |

TO Interest payable A/c 2 | 000 |

Here, the total interest charged to the profit and loss account is Rs. Will you be given 3,000 trial balances plus interest expense? 2,000, which is completely equivalent to Rs.5,000. Interest expense Rs.2,000 will appear as liabilities on the balance sheet.

Please note that there are many adjustments to different types of courses and preparations for the final. Their treatment is explained when they appear.

Worksheet

When all the necessary information for financial reporting is ready (that is, information on the trial balance and adjustment, officially aggregated without errors), the accountant prefers to draft a work sheet. The worksheet is a rough work and is not part of the financial statements.

The worksheet is provided for convenience to ensure that the financial statements prepared in the debit and credit columns representing the trial balance, adjusted, adjusted trial balance, trading account, profit and loss account and balance sheet are in order.

Key takeaways:

- Financial accounting follows either the accrual basis of accounting or the cash basis.

- Nonprofits, companies, and small businesses use financial accountants.

- Financial reporting is done by using financial statements in five different areas. Accounting records are all documents involved in the preparation of financial statements of the company.

- Certain regulatory bodies require companies to keep accounting records for several years if they need to be reviewed.

- Accounting records can be used for audits, compliance checks, or other business related necessities.

- Accounting record types include transactions, general ledgers, trial balances, journals, and financial statements.

Depreciation

|

The nature of Depreciation

Depreciation can be defined as a measure of the depletion of an asset's lifetime due to any cause during a particular time period. -Spicer and Pegler.

“Depreciation is a measure of the consumption, consumption, or other loss of value of a depreciable asset resulting from use, time wasted, or obsolescence due to changes in technology or market. During that time, you will be assigned to charge a significant portion of the depreciation amount for each accounting period. Depreciation expense includes the depreciation of assets with a predetermined useful life. "

-Accounting Standard-6 (revised), issued by ICAI.

Depreciation features:

(I) Depreciation is a decline in the value of fixed assets (excluding land). The decline in the value of an asset is inherently permanent. Once shrunk, it cannot be restored to its original value.

(Ii) Depreciation is a gradual and continuous process because the value of an asset decreases due to the use of the asset or the expiration of time.

(Iii) It is not an asset valuation process. This is the process of allocating the cost of an asset to its lifetime.

(Iv) Depreciation reduces the book value, not the market value of an asset.

(V) Depreciation is only used for property, plant and equipment. It is not used to waste intangible assets such as amortization of goodwill and depletion of natural resources.

Causes of depreciation:

1. Normal physical wear and tear:

The normal use of an asset causes it to physically deteriorate, resulting in a decrease in the value of the asset.

2. Time outflow:

Certain intangible assets, such as trademarks, patents and copyrights, have a fixed lifespan. The value of these assets diminishes over time, whether or not they are used by a company.

3. Obsolescence:

R & D brings innovation in the form of better, technologically advanced machines that dispose of older machines, even if they can be physically performed.

In that case, the market price of certain assets such as computers and automobiles may fall permanently. This reduces the value of older machines. Obsolescence is the loss that results from aging an existing asset and replacing it with a new and improved model of that asset.

4. Accident:

Accidental destruction or damage can reduce the value of an asset.

The accounting concept of Depreciation

Fixed assets are long-term assets. They help produce goods and services. However, when an asset is in use, normal wear, time spills, and obsolescence reduce the value of the asset. This reduction in the value of fixed assets is known as depreciation. Understand the concept of depreciation.

Assets owned by a company for the production and supply of goods and services, expected to be used for more than a fiscal year, and have a limited useful life are called depreciable assets.

When you purchase a fixed asset, it is recorded in your books at its original cost or purchase price. Organizations use this fixed asset to earn or generate revenue for several fiscal years before selling or discarding the asset.

Therefore, you must allocate a portion of your purchase or acquisition costs by fiscal year until you use it. This allocation of costs is called depreciation. Depreciation is an organizational expense.

For example, a Setu company buys a machine for £ 2,000,000, uses it for 10 years and then sells it for £ 400,000. Therefore, the cost of a machine for business use is £ 1600,000 (£ 2000000-400000). Now, for every 10 fiscal years you've been using this machine, you need to allocate this £ 1600,000 cost as a project cost. This cost is a depreciation cost of £ 160,000 (1600000/10).

In other words, the concept of depreciation is the cost of getting a service from the use of an asset. You need to match the depreciation cost of a fixed asset with the revenue for the year in which it was used. Therefore, depreciation is charged as an income statement expense.

Factors in the measurement of Depreciation

As already mentioned, depreciation is not an attempt to record changes in the market value of an asset, but a systematic allocation of the total cost of the depreciable asset (capital investment) to the expense (income and expenditure) over the useful life of the asset. The value of some assets can increase in the short term, but the depreciation process continues. Based on the principle of matching, a reasonable portion of capital expenditure (that is, the cost of an asset) should be charged to revenue during the useful life of the asset.

Depreciation

The calculation of depreciation expense for the accounting period is affected as follows:

- The actual cost of the asset

- Estimated useful life of the asset

- Estimated residual value of the asset.

It is worth mentioning here that of the three factors, two are based on mere estimation and only one is actually based. Therefore, the depreciation calculation is an estimated loss on the value of the asset, not the actual exact reduction in the value of the asset.

The following is a detailed description of each of the above elements.

1. Actual cost of the asset:

The actual cost or acquisition cost means the acquisition cost of the asset and includes all incidental costs required to return the asset to its current state and location. Examples of such costs are installation costs, internal transportation, or capital-based costs incurred to improve such assets.

2. Estimated useful life of the asset:

The estimated useful life of an asset is one of the following:

(I) The period during which the depreciable asset is expected to be used by the entity or

(Ii) The number of production or similar units expected to be derived from the use of assets by a company.

3. Estimated residual value or scrap value of the asset:

The salvage value or scrap value is the expected value that may be realized when an asset is sold or exchanged at the end of its estimated useful life. If residual value is important, it should be considered in the depreciation calculation. However, insignificant residual value can be ignored in the depreciation calculation.

Depreciation is an ongoing process, but we do not record depreciation daily. In fact, the total depreciation expense charged on an asset is the prepaid expense paid by the entity at the time of acquisition of the asset.

In other words, this expense should be treated like a deferred expense, and only adjustment entries should be passed each year to claim reasonable and appropriate depreciation for income statement revenue.

Here are some other factors that influence the measurement of depreciation:

Original cost of the asset: The cost includes all costs incurred to acquire the asset. In other words, the purchase price includes shipping and installation costs, if any.

When an asset is added during the year, taking into account the date the addition was made.

- Estimated useful life of the asset.

- Scrap or residual value of an asset.

- Obsolescence, that is, the possibility of assets becoming obsolete

- Repairs and updates.

- Operator skills to handle assets.

- Legal provisions or other restrictions related to depreciation.

- Working hours of the asset.

Methods of computing depreciation: Straight line method and Diminishing Balance Method; Disposal of Depreciable assets – change of method.

Straight line method

What is the straight-line method?

The straight-line method is the default method used to evenly recognize the carrying amount of fixed assets over their useful lives. This is used when there is no particular pattern in how an asset is used over time. The straight-line method is the easiest depreciation method to calculate and is highly recommended for use as it causes few calculation errors. The procedure for flat-rate calculation is as follows.

- Determines the initial cost of an asset recognized as a fixed asset.

- Subtract the estimated residual value of the asset from the amount recorded in the books.

- Determines the estimated useful life of an asset. It is easiest to use the standard useful life for each class of asset.

- Divide the estimated useful life (yearly) by 1 to calculate the depreciation rate using the straight-line method.

- Multiply the depreciation rate by the cost of assets (minus salvage value).

- Once calculated, depreciation expense is recorded in accounting records as a depreciation expense account and a credit to the accumulated depreciation account. Accumulated depreciation is against assets. That is, it is paired with the fixed asset account and the depreciation is reduced.

Formula:

Depreciation = (Asset Cost – Net Residual Value) / Service Life

Depreciation rate = (annual depreciation cost x 100) / cost of capital

Straight-line Journal Entries:

1. Purchase of Assets A / c Dr. xx

To cash / bank / creditor A / c xx

(Purchasing assets)

2. Depreciation of assets A / c Dr. xx

To asset A /c xx

(Assets are subject to depreciation)

3. Transfer depreciation gains / losses A / c Dr. xx

To depreciation of asset A / c xx

(Asset depreciation is transferred to the profit and loss account)

Example 1

Pensive Corporation will purchase a Procrastinator Deluxe machine for $ 60,000. It has an estimated salvage value of $ 10,000 and a useful life of 5 years. Pensive calculates the machine's annual flat-rate depreciation as follows:

Solution

$ 60,000 Purchase Cost – $ 10,000 Estimated Residual Value = $ 50,000 Depreciable Asset Cost

1/5-year useful life = 20% annual depreciation rate

20% depreciation rate x $ 50,000 depreciation asset cost = $ 10,000 annual depreciation

Diminishing Balance Method

The various depreciation methods are based on mathematical formulas. This formula is derived from a study of asset behaviour over a period of time. One such depreciation method is the depreciation method. Learn more about this method.

According to the depreciation method, depreciation is charged at a fixed percentage of the book value of the asset. It is also known as depreciation or depreciation because its book value decreases each year.

Since the book value decreases every year, the depreciation amount also decreases every year. This way, the value of the asset never goes to zero.

If you plot the depreciation amount billed this way and the corresponding period on the graph, the line will move down.

This method was previously based on the assumption that the cost of repairing an asset is low and therefore more depreciation costs must be charged. In addition, depreciation costs will decrease as repair costs increase in later years. Therefore, this method puts an equal burden on profits each year for the life of the asset.

However, this method may not provide full depreciation at the end of the asset's useful life if the applicable depreciation rate is not appropriate.

In addition, when applying this method, it is necessary to consider the period of use of the asset. If the asset is used for only two months in a year, depreciation will only be charged for two months.

However, if the asset is used for more than 180 days for income tax purposes, you will be charged full-year depreciation. Income tax rules also allow you to depreciate using the depreciation method.

The formula is:

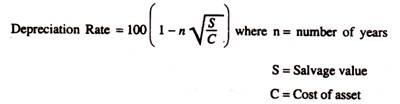

|

Amount of depreciation= Book Value x Rate of Depreciation

100

Disposal of Depreciable assets – change of method

Accounting policies and principles need to be applied consistently when recording financial transactions. This is the principle of consistency.

At the end of each fiscal year, management should consider depreciation methods. If there are significant changes in the pattern of future economic returns from the asset, the depreciation method will also need to change.

Accounting Standard 1-According to the disclosure of accounting policies, changes in depreciation methods are changes in accounting estimates. Therefore, footnote quantification and full disclosure are required. You also need to disclose the legitimacy of the change and its economic impact.

Therefore, the depreciation method can be changed without or with a retroactive effect. The lack of retroactive impact means that no adjustments have been made to past entries and only future depreciation will be billed in the new way. While having a retroactive effect, it means that the depreciation amount charged will be adjusted from the date of purchase of the asset.

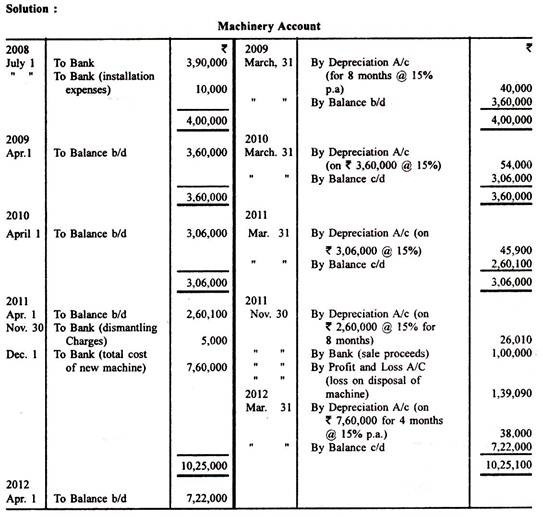

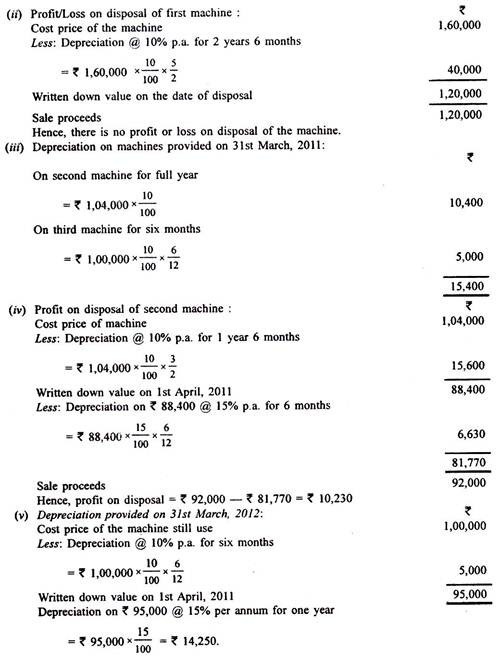

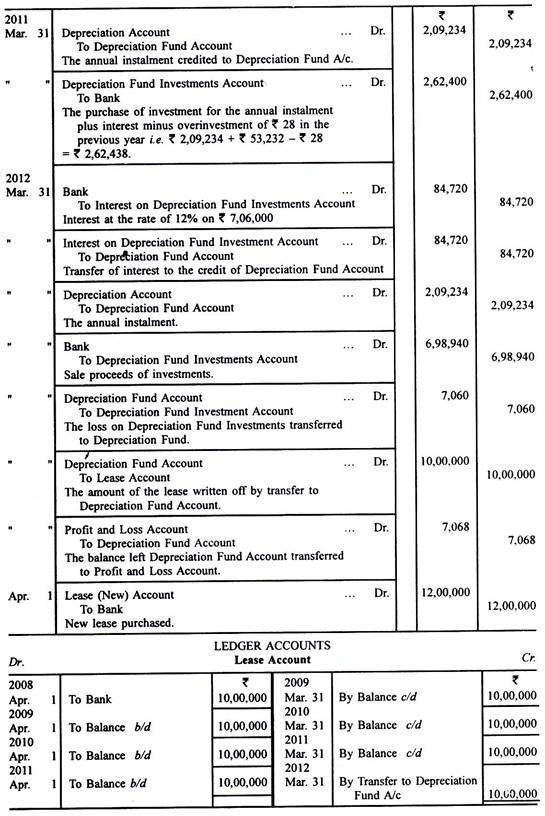

Example 2

On July 1, 2008, a company bought a machine for Rs 3,90,000 and spent Rs 10,000 on its installation. We have decided to provide depreciation at 15% per year using the write-down method. On November 30, 2011, the machine was dismantled at a cost of 5,000 rupees and then sold for 1,00,000 rupees.

On December 1, 2011, the company acquired a new machine and put it into operation at a total cost of Rs 7,60,000. The new machine was depreciated on the same basis as the previous machine. The company closes its books on March 31st each year.

Solution

|

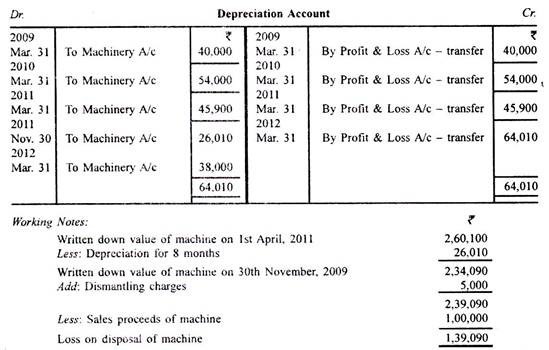

Example 3

The cost of the machine used by the company on April 1, 2011 was Rs 250,000, while the depreciation cost for that day was Rs 1,05,000. The company provided depreciation at 10% of the reduced value.

Two machines purchased on December 31, 2011 and October 1, 2008, Rs. 15,000 and Rs. 12,000, respectively, were discarded due to damage and replaced with two new machines, Rs. 20,000 and Rs. 15,000, respectively. I had to.

One of the discarded machines sold for Rs 8,000. On the other hand, the Rs 3,000 was expected to be feasible.

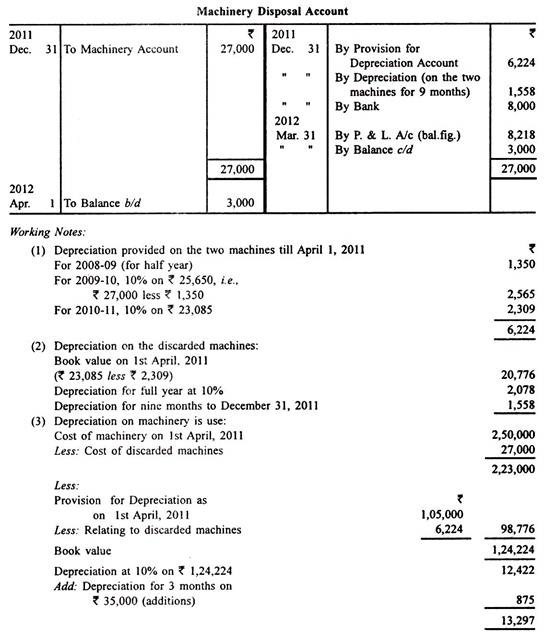

Shows the accounts related to the company's ledger for the year ended March 31, 2012.

|

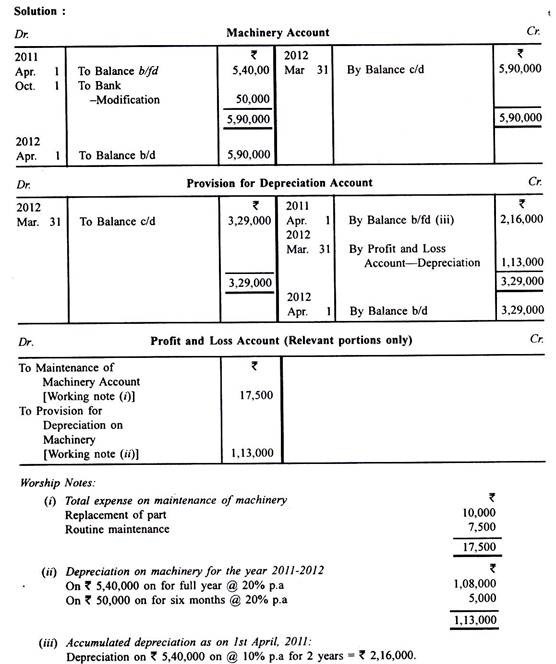

Example 4

Metropol Ltd. purchased the machine on April 1, 2009 for Rs 5,40,000. Depreciation is billed at an annual rate of 20% on a straight-line basis.

On October 1, 2011, a change was made to improve technical efficiency at a cost of 50,000 rupees, which was expected to extend the useful life of the machine by two years. At the same time, important components of the machine were replaced at a cost of 10,000 rupees due to excessive wear.

The cost of regular maintenance during the fiscal year ending March 31, 2012 is Rs 7,500.

Shows for the year ending March 31, 2012:

Machine account

Reserve for depreciation account and

The relevant part of the income statement showing the revenue and expense associated with the machine.

|

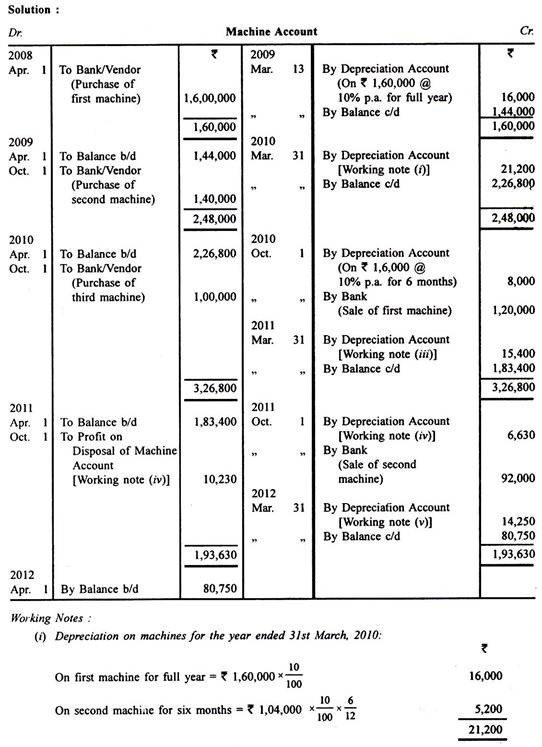

Example 5

X Co. Ltd. purchased the machine on April 1, 2008 for Rs 1,60,000. On October 1, 2009, another machine was acquired. for Rs 1,40,000. On October 1, 2010, the first machine sold for Rs 1,20,000. On the same day, another machine was purchased for Rs 1,00,000. On October 1, 2011, the second machine sold for Rs 92,000.

The depreciation rate on March 31 was 10% of the original cost. On March 31, 2011, the depreciation billing method was changed to the depreciation method, with a rate of 15%.

Prepare machine accounts for the years ending March 31, 2009, 2010, 2011, and 2012.

|

Example 6

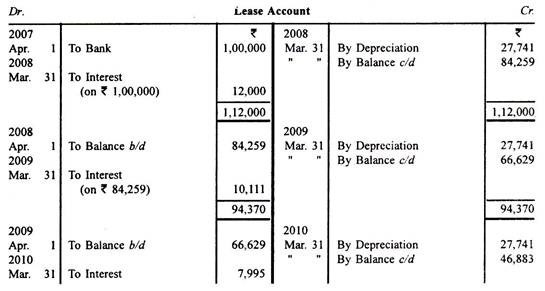

The lease will be purchased on April 1, 2007 for 5 years at a cost of Rs 1,00,000. It is proposed to depreciate the lease by the pension law, which charges 12% interest. Shows the 5-year lease account and related entries in the P & L account.

Solution:

A reference to the pension table indicates that Re will be depreciated. Under the 15-year pension law, you must claim 12% interest and amortize the total of Re. 0.277410. To amortize Rs 1,00,000, you need to amortize Rs 1,00,000 x 0.277410, or Rs 27,741 each year.

|

From the example above, you can see that the amount depreciated as depreciation is higher than in the straight-line or instalment payments, but because of the interest, it does not ultimately affect the income statement. Assets that are debited are credited to the income statement. Therefore, the pension law only pays attention to the amount of money spent on the use of assets: lost costs and interest.

Example 7

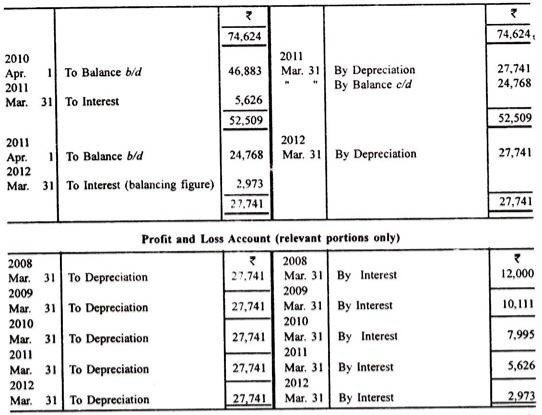

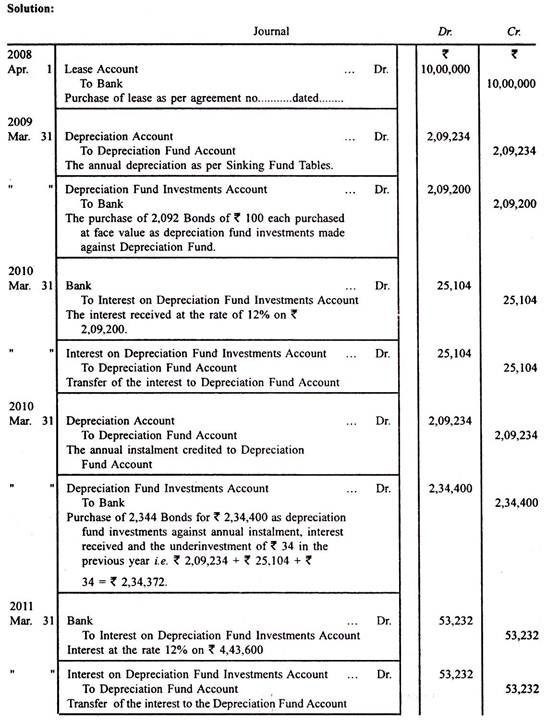

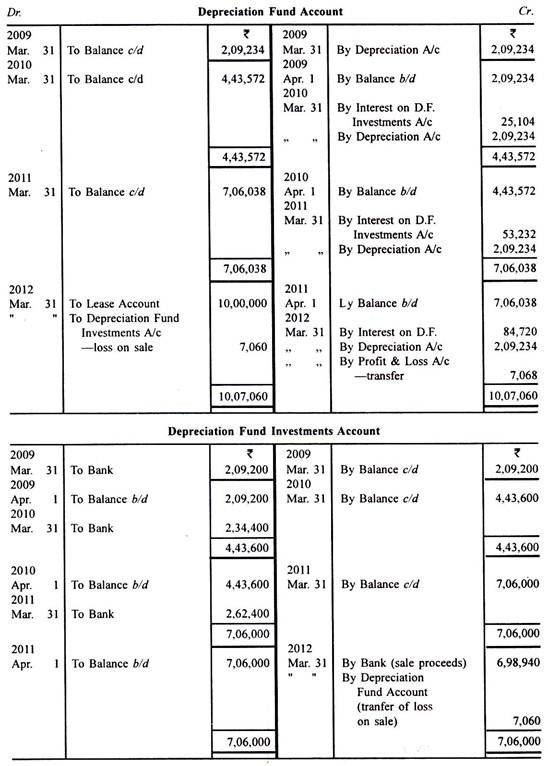

A company purchased a four-year lease for Rs 10,00,000 on April 1, 2008. By establishing a depreciation fund, it has been decided to offer a lease exchange at the end of four years. The investment is expected to be of interest at 12%. The table of the sinking fund is Re. Investing 0.209234 each year will generate Re. 12% per year at the end of 4 years 1. The investment was made in a 12% bond of Rs 100 available at par. Interest was received on March 31st of each year.

On March 31, 2012, the investment was sold for Rs 6,98,940. On April 1, 2012, the same lease was renewed for another four years with a payment of Rs 12,00,000.

View journals and specify important ledger accounts to record the above.

|

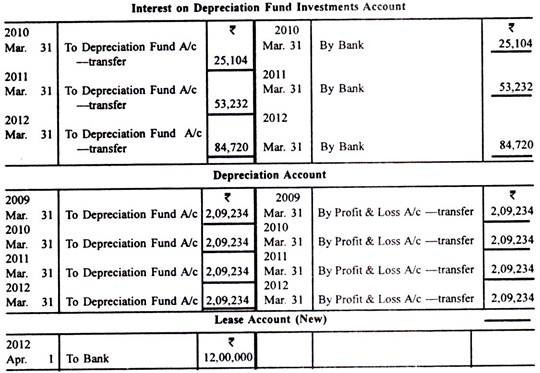

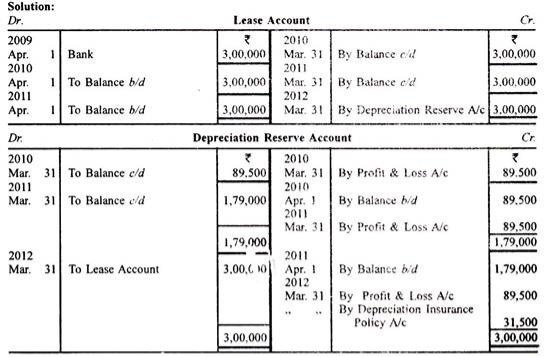

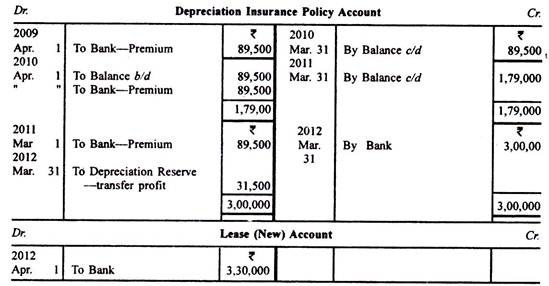

Example 8

A company bought a three-year lease on April 1 for Rs 3,000,000. In 2009, we decided to offer a replacement under an insurance policy of Rs 3,000,000. The annual premium is 89,500 rupees.

On April 1, 2012, the lease will be renewed for another 3 years at Rs 330,000. Display the required ledger accounts.

|

Example 9

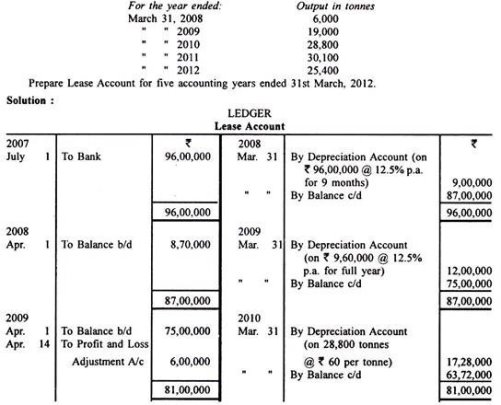

Experts estimated that the mine contained a total of 160,000 tonnes of minerals. On July 1, 2007, P leased the mine for eight years and paid the owner Rs 96,00,000 with the above estimate in mind.

P has decided to offer depreciation at an annual rate of 12.5% on a straight-line basis. However, in April 2009, we decided to switch to the depreciation method because we thought it would be more appropriate. He passed the required adjustment entry on April 14, 2009.

The output for the first five fiscal years of the lease is as follows:

Solution

|

Example 10

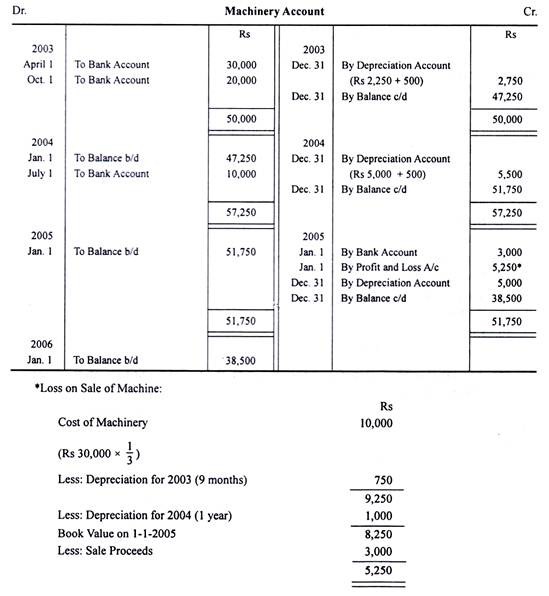

Companies whose financial year purchased on April 1, 2003 may be a civil year. the worth of the machine is 30,000 rupees.

I bought another machine for 20,000 rupees on October 1, 2003 and 10,000 rupees on Dominion Day, 2004.

One-third of the machines installed on January 1, 2005 and April 1, 2003 were abolished and sold for Rs 3,000.

Shows how machine accounts appear within the company's books. The machine may be a fixed instalment method @ 10% p.a. Depreciated by.

Solution

|

Example 11

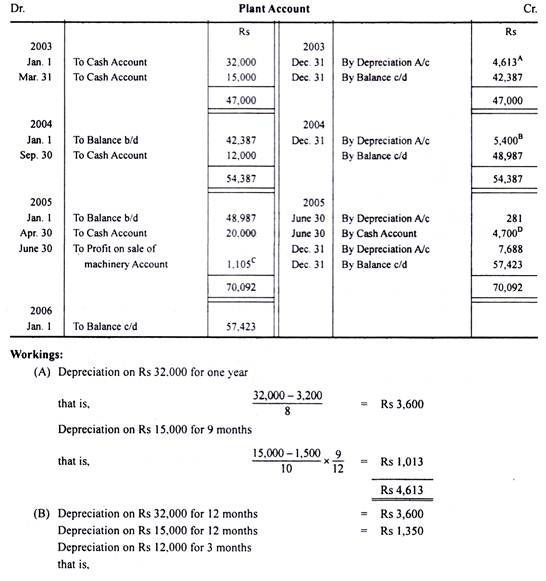

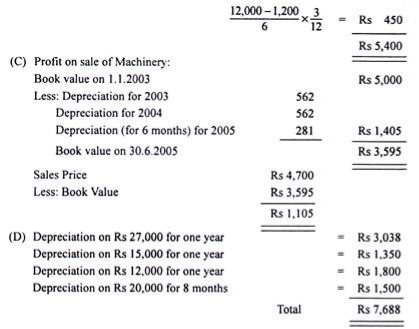

The 32,000-rupee plant purchased on January 1, 2003 has an estimated lifespan of 8 years.

Further purchases of plants are:

1. As of March 31, 2003, the value of the plant is 15,000 rupees and therefore the estimated life is 10 years.

2. On September 30, 2004, the factory cost is 12,000 rupees and therefore the estimated life is 6 years.

3. On April 30, 2005, the factory cost is 20,000 rupees and therefore the estimated life is 8 years.

Of the first plant acquired on January 1, 2003, one machine of Rs 5,000 was sold for Rs 4,700 on June 30, 2005.

The residual value of every asset is 10% of the first cost.

Prepare a plant account for the primary three years.

Solution:

|

Example 12

The balance of the plant and machinery accounts on New Year's Eve , 2003 was Rs 19,515 after depreciation for the year. (The total cost of the plant was 35,800 rupees and eight ,900 rupees including the plant purchased in 1995.)

In January 2004, a substitute factory was purchased at a price of Rs 2,950, and in 1980 a machine costing Rs 550 was sold as scrap of Rs 35.

In January 2005, there was an addition of 1,800 rupees, and in 2001 a 700-rupee machine was sold for 350 rupees.

You need to make machine accounts for 2004 and 2005. All calculations are displayed.

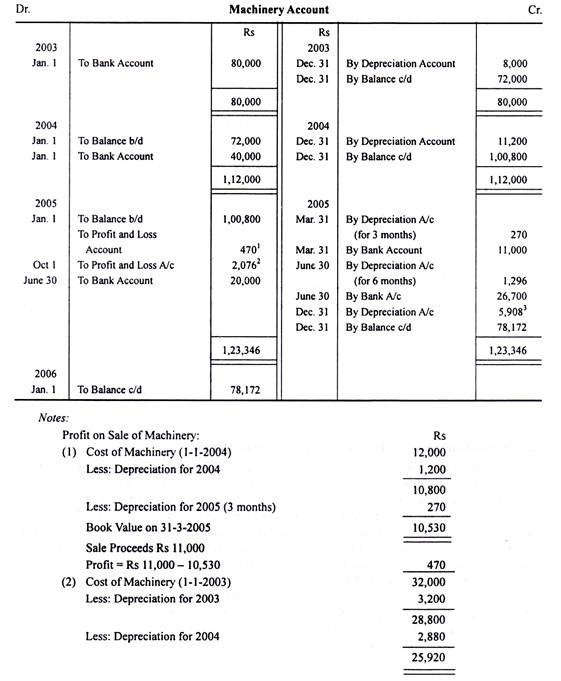

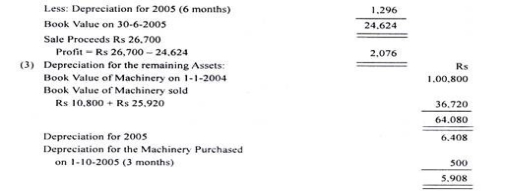

On January 1, 2003, the machine was purchased for Rs 80,000. On January 1, 2004, a machine of 40,000 rupees was added. On March 31, 2005, a machine of Rs 12,000 purchased on January 1, 2004 was sold for Rs 11,000 and 32,000 purchased on June 30, 2005 on January 1, 2003. The rupee machine was sold for 26,700 rupees. On October 1, 2005, an amount of Rs 20,000 was added. Depreciation was provided at an annual rate of 10%. About the reduction balance method.

Shows machine accounts for the three years from 2003 to New Year's Eve, 2005.

Solution:

|

Example 13

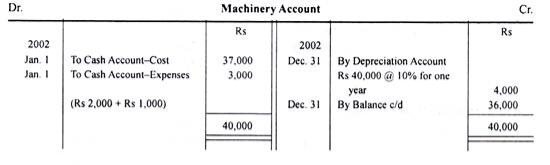

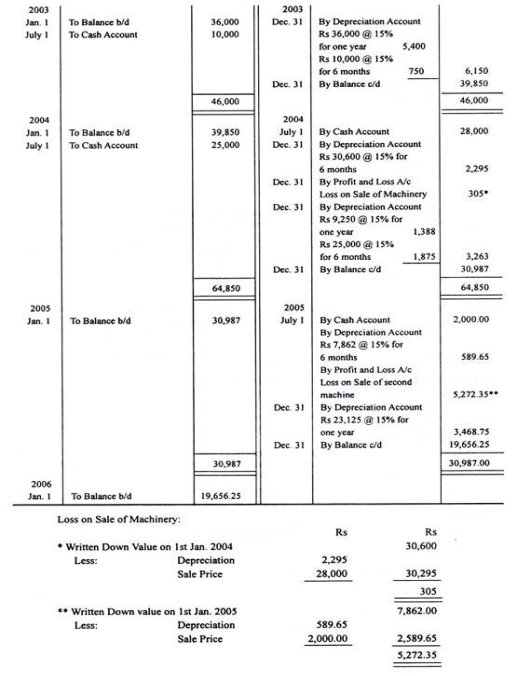

A company bought a second hand machine for Rs 37,000 on January 1, 2002 and immediately spent Rs 2,000 for repairs and Rs 1,000 for construction. I bought another machine for Rs 10.000 on Dominion Day, 2003 and sold the primary machine I bought in 2002 on Dominion Day, 2004 for Rs 28,000. On an equivalent day, I bought the machine for 25,000 rupees. The second machine, which was purchased for 10,000 rupees, was also sold for 2,000 rupees on Dominion Day, 2005.

Depreciation was provided to the machine on December 31st annually at a rate of 10% of the first cost. However, in 2003, we changed the depreciation method and adopted a depreciation method with a rate of depreciation of 15%.

We will offer you a machine account for 4 years from January 1, 2002.

|

Salient Features of Accounting Standard (AS): 6 (ICAI)

The key features of accounting standards are:

a. Written:

This is a document of a descriptive nature regarding a particular accounting policy that is essential for editing financial statements.

b. Contents:

In addition to drafting financial statements, the accounting standards include rules regarding the recognition, measurement and disclosure of this financial information.

Key takeaways:

- According to accounting matching principles, depreciation links the value of employing a tangible asset with the profits gained over its useful life.

- There are differing types of depreciation, including the straight-line method of depreciation and various sorts of accelerated depreciation.

- Accumulated depreciation is that the sum of all depreciation recorded on an asset up to a specific date.

- The value of an asset on the record is that the acquisition cost minus all accumulated depreciation.

- The carrying amount of an asset in any case depreciation has been made is named its salvage value.

- The straight-line method of depreciation may be a method of calculating depreciation and is that the process of paying an asset for a extended period of your time than when it had been purchased.

- Straight-line bases are popular because they're easy to calculate and understand, but they even have some drawbacks.

c. issuing authority:

Almost every country in the world has established statutory accounting institutions that have been entrusted with the sole authority to issue accounting standards.

d. Flexible in nature:

Accounting standards are not strict, but they are inherently flexible to continually develop amendments to existing accounting standards and ensure the issuance of new accounting standards.

e. Reliable guidelines:

Accounting standards provide credible principles that serve as guidelines for accounting and drafting financial statements.

Problem 1:

From the following ledger balance presented by Sen. on 31st March, 2016 prepare a trading account:

Particulars | Rs | Particulars | Rs |

Stock(1-4-2015) Purchase Wages Carriage inwards Freight inward | 10,000 1,60,000 30,000 10,000 8,000 | Sales Returns inward Return outward Gas and Fuel | 3,00,000 16,000 10,000 8,000 |

Other information:

Closing value of stock for 31st March, 2016. 20,000

Unpaid wages reached Rs. 4,000

Gas and fuel were paid in advance for Rs. 1,000

Trading account for the year ended 31st March, 2016

Dr Cr

Particulars | Rs | RS | Particulars | Rs | Rs |

To Opening Stock To purchase Less: Return outwards To wages Add: Outstanding To carriage inwards To freight inwards To Gas and fuel Less: Prepaid To Gross profit c/d |

1,60,000 10,000 | 10,000

1,50,000

34,000 10,000 8,000

7,000 85,000

| By Sales Less: Returns inward BY Closing Stock | 30,00,000 16,000 |

2.84,000 20,000

|

| |||||

30,000 4,000 | |||||

8,000 1,000 | |||||

| |||||

3,04,00 | |||||

3,04,00 | |||||

|

|

Problem 2:

From the following details presented by Thilak for the year 31st March, 2017, we will prepare a profit and loss account.

Particulars | Rs | Particulars | Rs |

Gross profit Rent paid Salaries Commissions (Cr.) Discount received Insurance Premium paid | 1,00,000 22,000 10,000 12,000 2,000 8,000 | Interest received Bad debts Provisions for bad debts(1-4-2016) Sundry debtors Buildings | 6,000 2,000 4,000 40,000 80,000 |

Adjustment:

The unpaid salary reached Rs. 4,000

The rent was paid for 11 months

Interest expense reached Rs but was not received. 2,000.

Prepaid insurance has reached Rs. 2,000

Depreciating buildings by 10%

Further bad debts reached Rs. over 3,000 of 5%、

The fee received in advance reached Rs. 2,000

Solution:

Profit and Loss Account for the year ended 31st March, 2017

Dr. Cr.

Particulars | Rs | RS | Particulars | Rs | Rs |

To Rent Add: Outstanding (22,000x1/11) To Salaries Add: Outstanding To Insurance premium

Less: Prepaid insurance To Provision for bad and doubtful debts(closing)

Add: Bad debts Add: Further bad debts

Less: Opening provisions for bad and doubtful debts To Depreciate on building (80,000 x 10%)

To Net profit (transferred to capital A/c)

| 22,000 2,000 |

24,000

14,000

6,000

2,900 8,000 | By Gross profit b/d By Commission

Less: Received in advance By Discount received By interest received Add: Accrued | - 12,000 2,000 | 1,00,000

10,000 2,000

8,000

|

10,000 4,000 | 6,000

2,000 | ||||

8,000 2,000 | |||||

1,900 2,000 3,000

| |||||

6,900

4,000 | |||||

| |||||

65,100 | |||||

1,20,000 | |||||

1,20,000 |

Working notes:

Debtors: 40,000

Less: further bad loans: 2,000: 38,000

Allowance for bad and bad debt of 5%: 38,000x5 % =Rs. 1,900

Problem 3:

As of 31st December, 2017, from the balance below, prepare a profit and loss account.

Particulars | Rs | Particulars | Rs |