Unit 1

Basic concepts of income

Income

According to section 2(24) of the Income Tax act 1961, income includes—

(i) profits and gains;

(ii) dividend;

(iii) voluntary contributions received by a trust created wholly or partly for charitable or religious purposes or by an institution established wholly or partly for such purposes or by an association or institution referred to in clause (21) or clause (23), or by a fund or trust or institution referred to in sub-clause (iv) or

(iv) the value of any benefit or perquisite, whether convertible into money or not, obtained from a company either by a director or by a person who has a substantial interest in the company, or by a relative of the director or such person, and any sum paid by any such company in respect of any obligation which, but for such payment, would have been payable by the director or other person aforesaid;

(v) any sum chargeable to income-tax under clauses (ii) and (iii) of section 28 or section 41 or section 59;

(vi) any capital gains chargeable under section 45;

(vii) the profits and gains of any business of insurance carried on by a mutual insurance company or by a co-operative society, computed in accordance with section 44 or any surplus taken to be such profits and gains by virtue of provisions contained in the First Schedule;

(viii) any winnings from lotteries, crossword puzzles, races including horse races, card games and other games of any sort or from gambling or betting of any form or nature whatsoever.

Total Income

According to section 2(45) total income means the total amount of income referred to in section 5, computed in the manner laid down in this Act. Section 5 of the act provides scope of total Income-

(1) Subject to the provisions of this Act, the total income of any previous year of a person who is a resident includes all income from whatever source derived which-

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of sub-section (6) of section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act, the total income of any previous year of a person who is a non-resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year.

Agricultural income

According to section 2(1A) of the income tax act 1961, agricultural income means—

(a) any rent or revenue derived from land which is situated in India and is used for agricultural purposes;

(b) any income derived from such land by—

(i) agriculture; or

(ii) the performance by a cultivator or receiver of rent-in-kind of any process ordinarily employed by a cultivator or receiver of rent-in-kind to render the produce raised or received by him fit to be taken to market; or

(iii) the sale by a cultivator or receiver of rent-in-kind of the produce raised or received by him, in respect of which no process has been performed other than a process of the nature described in paragraph (ii) of this sub-clause;

(c) any income derived from any building owned and occupied by the receiver of the rent or revenue of any such land, or occupied by the cultivator or the receiver of rent-in-kind, of any land with respect to which, or the produce of which, any process mentioned in paragraphs (ii) and (iii) of sub-clause (b) is carried on.

Assessee

According to section 2(7), assesse means a person by whom any tax or any other sum of money is payable under this Act, and includes—

(a) every person in respect of whom any proceeding under this Act has been taken for the assessment of his income or assessment of fringe benefits or of the income of any other person in respect of which he is assessable, or of the loss sustained by him or by such other person, or of the amount of refund due to him or to such other person;

(b) every person who is deemed to be an assessee under any provision of this Act;

(c) every person who is deemed to be an assessee in default under any provision of this Act;

Assessment year

According to section 2(9), assessment year means the period of twelve months commencing on the 1st day of April every year.

Previous year

Section 2(3) previous year means the financial year immediately preceding the assessment year:

Provided that, in the case of a business or profession newly set up, or a source of income newly coming into existence, in the said financial year, the previous year shall be the period beginning with the date of setting up of the business or profession or, as the case may be, the date on which the source of income newly comes into existence and ending with the said financial year.

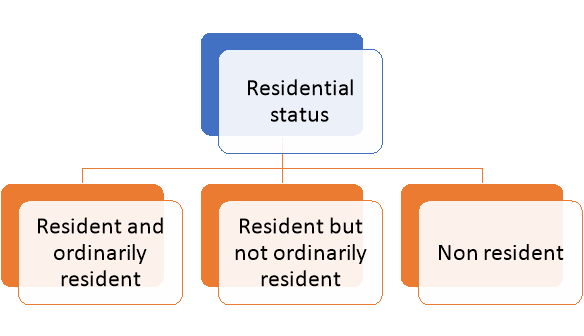

Section 4(6) of the income tax act provides provisions for residential status of person in India. According to the Income Tax Act, 1961, residential status of a person is one of the important criteria in determining the tax implications. The residential status of a person can be categorised into-

a) Resident and Ordinarily Resident (ROR)

b) Resident but Not Ordinarily Resident (RNOR)

c) Non- Resident (NR)

Figure: Residential status

Such types are discussed below-

a) Resident and Ordinarily Resident (ROR)

A resident taxpayer is an individual who satisfies any one of the following conditions:

- Resides in India for a minimum of 182 days in a year, or

- Resided in India for a minimum of 365 days in the immediately preceding four years and for a minimum of 60 days in the current financial year.

b) Resident but Not Ordinarily Resident (RNOR)

If an individual qualifies as a resident, the next step is to determine if he/she is a Resident ordinarily resident (ROR) or an RNOR. He will be a ROR if he meets both of the following conditions:

- Has been a resident of India in at least 2 out of 10 years immediately previous years and

- Has stayed in India for at least 730 days in 7 immediately preceding years

c) Non- Resident (NR)

An individual satisfying neither of the conditions stated above conditions would be a non-resident for the year.

Taxability of residential status

The tax liability of persons according to residential status are discussed below-

- Resident:

A resident will be charged to tax in India on his global income i.e., income earned in India as well as income earned outside India.

2. Non-resident and Resident but not ordinarily resident:

Their tax liability in India is restricted to the income they earn in India. They need not pay any tax in India on their foreign income. Also note that in a case of double taxation of income where the same income is getting taxed in India as well as abroad, one may resort to the Double Taxation Avoidance Agreement (DTAA) that India would have entered into with the other country in order to eliminate the possibility of paying taxes twice.

Exempted income is that income on which income tax is not chargeable. Such

Incomes are classified as under:

i) Incomes which do not form part of total income nor is income tax payable on them. They are called fully exempted incomes.

Ii) Incomes which are included in the total income but are exempt from income tax at the average rate of income tax applicable to the total income. They are called partially exempted incomes.

Iii) Incomes of certain Institutions or authorities are exempted subject to fulfilment of the required conditions.

List of exempted income

The list of exempted income is highlighted below-

1) Agricultural income [Sec.10 (1)]

Agricultural income from the land situated in India is fully exempted from

Income tax (Agricultural income definition given under Income Tax Act.)

2) Sum received by a member from Hindu undivided family [Sec.10 (2)]

Any sum received by a member of Hindu undivided family at the time of division is tax free.

3) Share of a partner in firm’s income [Sec.10 (2A)]

The share of a partner in firms’ profit is fully tax free.

4) Profit of newly established industrial undertaking in free trade zone [Sec.10AA].

5) Compensation received by victims of Bhopal gas leak disaster [Sec.10

(10BB)]

Any compensation paid under any Plan of Bhopal Gas Leak Disaster (Processing of claims Act, 1985) is exempted from tax.

6) Sum received from life insurance [Sec.10 (10D)]

Any sum received from life insurance Corporation as the maturity of insurance policy is fully exempt from tax, even bonus received is also fully exempted. But, Keyman Insurance Policy and any sum received under u/s 80DD (3) will not be exempted.

7) Sum received from Public Provident Fund [Sec.10 (11)]

Any sum received from public provident fund (in state bank and head offices) is fully exempted.

8) Payment from Sukanya Samridhi account [Sec.10 (11A)]

Any sum received from Sukanya Samridhi Account rules, 2014 made under Government saving bank Act, 1873 is fully exempt from tax.

9) Payment from National Payment System Trust [Sec.10 (12A)] Exempted Incomes

Any payment from national payment system trust u/s 80(CCD), if it does not exceed 40% of total amount, payable to assessee at time of closure of the scheme is exempt from tax.

10) Partial withdrawal from National Pension System Trust [Sec.10 (12B)]

Any withdrawal by the assessee from national pension system trust, upto 25% of it is tax free.

11) Interest, premium or bonus on specified investments [Sec.10(15)]

Like Annuity certificates, National Saving Certificates, Post Office Savings, Bank Account, Interest on relief Bonds, Post office cash certificates etc. are fully exempt from tax.

12) Scholarships [Sec.10 (16)]

Any fellowship or scholarship granted by Government for education and research work will be exempted.

13) Allowances of M. Ps and MLA’s [Sec.10 (17)]

For example, daily allowances, constituency allowance, shall be exempt fully.

14) Award or reward [Sec.10 (17A)]

Any award in form of cash or kind granted by Central or State Government for work of literature or scientific shall be exempted. Any award from any other institution apart from Government, shall be exempted from tax provided, such exemption is approved by Central Government.

15) Pension to an individual awarded by ‘Vir Chakra’ [Sec.10 (18)]

Any amount in form of pension received by an individual or family who had been a central or state Government employee and was awarded ‘Param Veer Chakra, Vir Chakra, Mahavir Chakra, shall be exempted.

16) Family pension to family members of armed forces [Sec.10 (19)]

Family pension to widow or children or nominated pension of a member of the armed forces died during operational duty shall be exempted.

17) Annual value of a palace of the Ex-rulers [Sec.10 (19A)]

18) Incomes of scheduled tribes [Sec.10 (26)]

Any income accrued to scheduled tribes living in tribal areas (as given in VI schedule of constitution) of State of Manipur, Sikkim, Tripura, Mizoram, Nagaland and Arunachal Pradesh shall be exempted.

19) Subsidy received from tea board [Sec.10(30)]

Any subsidy from tea Board, to the assessee, carrying on the business of growing and manufacturing tea in India, received shall be exempt from tax, provided, the certificate of exemption, has been presented to Income Tax officers.

20) Subsidy received by planters [Sec.10(31)]

Any subsidy from Rubber Board office or spice board, to the assessee, under any scheme for replantation of rubber plants or coffee plants etc. shall be exempt.

21) Income of minor child [Sec.10 (32)]

Income upto Rs.1,500/- in respect of minor is exempt from tax and any excess of that amount is included in parent’s income whose income is greater.

22) Capital gain on transfer of units of US-64 [Sec.10(33)]

Any capital gain on transfer of units US-64 shall be exempted provided such transfer is done on or after 1/4/2002.

23) Dividend from domestic company [Sec.10 (34)]

Any dividend declared by a domestic company is exempt from tax (with effect from AY 2004-05). It does not include dividend u/s 2(22) (e).

24) Any income received in respect of units of a mutual fund, Units from the administrator of the specified undertaking or units from the specified company [Sec.10 (35)]

This income is exempt with effect from AY 2004-05.

25) Long term capital gain on eligible equity shares [Sec.10(36)]

This exemption is applicable only when shares have been held for at least 12 months and when investment have been made on or after 1/3/2003 and not later on 31st March, 2004.

26) Exemption of capital gains on compensation received on compulsory acquisition of agricultural land situated within specified urban cities [Sec.10 (37)].

Such exemption is available to an individual or Hindu undivided family, on short- or long-term capital gain, provided such compensation should be received on or after 1/4/2004 and land is used in agriculture preceding 2 years from compulsory acquisition.

27) Exemption of long-term capital gain arising from sale of shares and units (With effect from 1-10-2004) [Not applicable W.e.f. AY 2019-20] [Sec.10 (38)].

28) Exemption of specified income from international sporting event held in India (with effect from assessment year 2006-07) [Sec.10 (39)].

29) Exemption in respect of grant etc. received by a subsidiary company from its holding company engaged in business of distribution of power [Sec.10 (40)] (with effect from AY 2006-07).

30) Exemption of capital gain to undertakings engaged in business of generation of power (with effect from assessment year 2006-07) [Sec.10 (41)].

31) Exemption of specified income of certain bodies or authorities (with Exempted Incomes effect from assessment year 2006-07) [Sec.10 (42)].

32) Exemption of amount received by an individual as loan under reserve mortgage scheme [Sec.10 (43)]

Such exemption is available to senior citizen, who does not make payment of principal amount and interest throughout his life under the scheme.

33) Exemption of sum received by an individual on behalf of new pension scheme trust [Sec.10 (44)].

34) Perquisites and allowances to chairman and members of Union Public Service Commission [Sec.10 (45)]

If chairman and members of UPSC have not been retired, then the following allowances and perquisites are exempted, rent free official residence, transport allowance, and leave travel concession. If retired, then Rs.14, 000 pm for meeting expenses and Rs.1,500 pm for residential telephone.

35) Exemption of a specified income of notified body or authority or trust or board or commission [Sec.10 (46)].

36) Income of infrastructure debt fund [Sec.10 (47)]

Such exemption can be availed, only if return of income is filed as per section 139.

37) Income of foreign company [Sec.10 (48)]

Such exemption is allowed to a foreign company in India, only if any income is received by sale of crude oil (in Indian currency).

38) Income of foreign company on account of storage of crude oil [Sec.10 (48A)].

39) Income of National Financial Holdings Company Limited [Sec.10 (49)].

Such company must have been set up by central Government relating to the AY on or before 1st April, 2014.

Salary is chargeable to tax either on ‘due’ basis or on ‘receipt’ basis, whichever is earlier. Hence, taxable salary includes:

- Advance salary (on ‘receipt’ basis)

Salary paid in advance is taxable under the head ‘Salaries’ in the year of receipt.

- Outstanding salary (on ‘due’ basis)

Salary falling due is taxable under the head ‘Salaries’ in the year in which it falls due.

- Arrear salary

Any increment in salary with retrospective effect which have not been taxed in the past, such arrears will be taxed in the year in which it is allowed. Arrear salary are taxable on receipt basis

In case Salary is received after deduction of following items... These are added back to get fully Salary:

(i) Own Contribution to Provident Fund.

(ii) Tax Deducted at Source (TDS)

(iii) Repayment of Loan etc.

(iv) LIC Premium, if deducted from salary.

(v) Group Insurance Scheme.

(vi) Rent of House provided by employer.

Salary U/s 17(1):

1.Wages. Fully Taxable.

2.Annuity or Pension. Fully Taxable

3.Gratuity. It has been treated separately.

4. (a) Any Fees -- Fully Taxable

(b) Commission -- Fully Taxable

(c) Bonus -- Fully Taxable

(d) Perquisites -- (Perks) These are treated separately u/s 17(2)

(e) Profit in lieu of Salary -- These are treated separately u/s17(3)

5.Salary in lieu of Leave / Leave Encashment. Fully Taxable.

6.Advance Salary. Fully Taxable

7.Arrears of Salary. Fully Taxable.

8.Refund of Provident Fund (PF)

(a) If SPF -- Fully exempted

(b) If RPF -- Fully exempted if service is more than 5 years.

(c) If URPF -- Taxable portion is added in salary income. Taxable portion is equal to employer’s contribution + interest on this part. Interest on own contribution to URPF is taxable under the head “Income from Other Sources.”

Allowances:

A. Fully Exempted Allowances:

Foreign Allowance given by Govt. To its employees posted abroad. HRA given to Judges of High Court & Supreme Court.

B. Fully Taxable Allowances:

(i) Dearness Allowance / Additional D.A. / High Cost of Living Allowance -- Fully Taxable.

(ii) City Compensation Allowances (CCA).

(iii) Capital Compensatory Allowance

(iv) Lunch Allowance

(v) Tiffin Allowance

(vi) Marriage / Family Allowance

(vii) Overtime Allowance

(viii) Fixed Medical Allowance.

(ix) Electricity and Water Allowance

(x) Entertainment Allowance. It is fully added in employee’s Salary.

In case of Government employees, a deduction is allowed u/s 16(ii) at the rate of least of following:

(a) Statutory Limit Rs. 5,000 p.a.

(b) 1/5 (20%) th of Basic Salary; or

(c) Actual Entertainment Allowance received.

Partly Taxable Allowances:

1. House Rent Allowance (HRA)

(a) Fully Exempted, if received by the Judges of High Court and Supreme Court.

(b) Fully Taxable, if received by an employee who is living in his own house or in a house for which no rent is paid.

(c) Exempted upto least of following for those employees who are living in rented houses:

(i) Actual HRA received by the employee.

(ii) Rent paid - 10% of Salary; or

(iii) 40% of Salary in ordinary town; 50% of Salary in Mumbai, Kolkata, Chennai or Delhi.

Ø Taxable HRA = HRA Received - Least of Above.

Ø Salary = Pay + D.A. Which enters into Pay for Service or Retirement Benefits + Commission on Turnover Achieved by Him.

Following Allowances are Exempted upto actual expenditure incurred for employment. Excess, if any, shall be taxable...

2. Uniform Allowance

3. Conveyance Allowance

4. Traveling Allowance

Following Allowance are Exempted up to amount so notified.

5. Special Compensatory Allowance

6. Border Area Allowance

7. Tribal Area Allowance -- Exempted upto Rs. 200 p.m. If received in the States of M.P., Tamil Nadu, U.P., Karnataka, Tripura, Assam, West Bengal, Bihar, or Orissa.

8. Children’s Education Allowance -- Exempted up to Rs.100 p.m. Per child for education in India of own two children only.

9. Hostel Expenditure Allowance -- Exempted up to Rs. 300 p.m. Per child for Hostel expenditure on own two children only.

Perquisites:

A. Exempted Perquisites:

1. Leave Travel Concession subject to conditions & actual spent only for travels.

2. Computer/ Laptop provided for official / personal use.

3. Initial Fees paid for corporate membership of a club.

4. Refreshment provided by the Employer during working hours in office premises.

5. Payment of annual premium on Personal Accident Policy.

6. Subscription to periodicals and journal required for discharge of work.

7. Provision of Medical Facilities.

8. Gift not exceeding Rs. 5,000 p.a.

9. Use of Health Club, Sports facility.

10. Free telephones whether fixed or mobile phones.

11. Interest Free / concessional loan of an amount not exceeding Rs.20,000 (limit not application in the case of medical treatment)

12. Contribution to recognised Provident Fund / approved super annulation fund, pension or deferred annuity scheme & staff group insurance scheme.

13. Free meal provided during working hours or through paid non-transferable vouchers not exceeding Rs. 50 per meal or free meal provided during working hours in a remote area.

The value of any benefit provided free or at a concessional rate (including goods sold at concessional rate) by a company to the Employees by way of allotment of shares etc., under the Employees stock option plan as per Central Government Guidelines.

B. Taxable Perquisites:

1. Rent Free Accommodation

2. Provision of Motor Car or any other Conveyance for personal use of Employee.

3. Provision of Free or Concessional Education Facilities.

4. Reimbursement of Medical Expenditure.

5. Expenditure on Foreign Travel and stay during medical expenditure.

6. Supply of Gas, Electricity & Water.

7. Sale of an Asset to the Employee at concessional price including sale of Share in the Employer Company.

C. Perks Exempted for Employees but Taxable for Employer under Fringe Benefit Tax.

Value of the following benefits is not taxable in the hands of an employee. The employer has to pay tax on deemed income calculated as percentage of expenditure incurred.

- Any free or concessional ticket provided by the employer for private journeys of his employee or their family members

- Any contribution by the employer to an approved superannuation fund for employees;

- It includes-

- Expenditure incurred on entertainment;

- Expenditure incurred on provision of hospitality of every kind by the employer to any person.

- Expenditure incurred on conference like conveyance, tour & travel (including foreign travel), on hotel, or boarding and lodging in connection with any conference shall be deemed to be expenditure incurred for the purposes of conference.

- Expenditure incurred on sales promotions including publicity;

- Expenditure incurred on employee’s welfare;

- Expenditure incurred on conveyance

- Expenditure incurred on Hotel, Boarding & Lodging facilities;

- Expenditure incurred on Repair, Maintenance of Motor Cars and the amount of Depreciation there on.

- Expenditure incurred on use of telephone and Mobile Phones.

- Expenditure incurred on maintenance of any accommodation in the nature of Guest House other than used for Training purpose.

- Expenditure incurred on Festival Celebrations.

- Expenditure incurred on use of Health Club and similar facilities.

- Expenditure incurred on gifts;

Fringe Benefit Tax (FBT) is not applicable in case of following type of employers.

- An Individual or a sole Proprietor

- A Hindu Undivided Family

- Government

- A Political Party

- A person whose income is exempt u/s 10(23c)

- A Charitable Institution registered u/s 12AA.

- RBI

- SEBI

Profits in Lieu of Salary:

Receipts which are included under the head ‘Salary’ but Exempted u/s 10.

1. Leave Travel Concession (LTC) - Exempt upto rules.

2. Any Foreign Allowance or perks - If given by Govt. To its employees posted abroad are fully exempted.

3. Gratuity: A Govt. Employee or semi-Govt. Employee where Govt. Rules are applicable -- Fully Exempted.

A. For employees covered under Payment of Gratuity Act. --

Exempt up to least of following:

(a) Notified limit = Rs. 10,00,000

(b) 15 days Average Salary for every one completed year of

service (period exceeding 6 months =1 year)

1/2 month’s salary = (Average monthly salary or wages x 15/26

(c) Actual amount received.

B. Other Employees -- Exempted up to least of following provided service is more than 5 years or employee has not left service of his own:

(a) Notified limit = Rs. 10,00,000

(b) 1/2 month’s average salary for every one year of completed service (months to be ignored.)

(c) Actual amount received

Average Salary = Salary for 10 months preceding the month of retirement divided by 10.

4. Commutation of Pension:

In case commuted value of pension is received --

(a) If Govt. Employee -- is Fully Exempted.

(b) If other employee who receive gratuity also -Lump sum amount is exempted upto commuted value of 1/3rd of Pension.

If other employee who does not get gratuity -- Lump sum amount is exempted upto commuted value of 1/2 of pension.

5. Leave Encashment u/s 10(10AA)

(a) If received at the time of retirement by a Govt. Employee---Fully Exempted

(b) If received during service---Fully taxable for all employees

(c) If received by a private sector employee at the time of retirement exempted upto:

(i) Notified limit Rs. 3,00,000

(ii) Average salary x 10 months

(iii) Actual amount received.

(iv) Average Salary x No. Of months leave due.

6. Any Tax on perks paid by employer. It is fully Exempted.

7. Any payment received out of SPF Any payment received out of SPF is Fully Exempted.

8. Any payment received out of RPF Any payment received out of RPF is Fully Exempted, if service exceeds 5 years.

9. Any payment received out of an approved superannuation fund. is Fully Exempted

Deduction Out of Gross Salary [ Sec. 16]

1. Entertainment Allowance [ U/s 16(ii)]

Deduction u/s 16(ii) admission to govt. Employee shall be an amount equal to least of following:

- Statutory Limit of Rs.5,000 p.a.

- 1/5 th of Basic Salary

- Actual amount of entertainment allowance received during the previous year.

2. Tax on Employment u/s 16(iii

In case any amount of professional tax is paid by the employee or by his employer on his behalf it is fully allowed as deduction.

Deduction U/S 80C Out of Gross Total Income (GTI)

The following are the main provisions of the newly inserted Section 80C.:

- Under Section 80C, deduction would be available from Gross Total Income.

- Deduction under section 80C is available only to individual or HUF.

- Deduction is available on the basis of specified qualifying investments / contributions / deposits / payments made by the taxpayer during the previous year.

- The maximum amount deduction under section 80C, 80CCC, and 80CCD cannot exceed Rs.1 lakh.

Deduction u/s 80C shall be allowed only to the following assessee:

- An Individual

- A Hindu Undivided Family (HUF)

![Computation of 'Salary' Income [Section 15-17]](https://glossaread-contain.s3.ap-south-1.amazonaws.com/epub/1657609255_875495.jpeg)

References:

1. Singhanai V.K.: Student’s Guide to Income Tax; Taxmann, Delhi.

2. Prasad, Bhagwati: Income Tax Law & practice: Wiley Publication, New Delhi.

3. Dinker Pagare: Income Tax Law and Practice; Sultan Chand & Sons, New Delhi.

4. Girish Ahuja and Ravi Gupta; Systematic approach to income tax; Sahitya Bhawan Publications, New Delhi.

5. Chandra Mahesh and Shukla D.C.: Income Tax Law and Practice; Pragati Publications, New Delhi.