Unit 2

Income from house property

The annual value of property consisting of any buildings or lands appurtenant thereto of which the assessee is the owner, other than such portions of such property as he may occupy for the purposes of any business or profession carried on by him the profits of which are chargeable to income-tax, shall be chargeable to income-tax under the head ―income from house property.

Annual value how determined (section 23)

(1) For the purposes of section 22, the annual value of any property shall be deemed to be—

(a) the sum for which the property might reasonably be expected to let from year to year; or

(b) where the property or any part of the property is let and the actual rent received or receivable by the owner in respect thereof is in excess of the sum referred to in clause (a), the amount so received or receivable; or

(c) where the property or any part of the property is let and was vacant during the whole or any part of the previous year and owing to such vacancy the actual rent received or receivable by the owner in respect thereof is less than the sum referred to in clause (a), the amount so received or receivable:

Provided that the taxes levied by any local authority in respect of the property shall be deducted (irrespective of the previous year in which the liability to pay such taxes was incurred by the owner according to the method of accounting regularly employed by him) in determining the annual value of the property of that previous year in which such taxes are actually paid by him.

(2) Where the property consists of a house or part of a house which—

(a) is in the occupation of the owner for the purposes of his own residence; or

(b) cannot actually be occupied by the owner by reason of the fact that owing to his employment, business or profession carried on at any other place, he has to reside at that other place in a building not belonging to him, the annual value of such house or part of the house shall be taken to be nil.

(3) The provisions of sub-section (2) shall not apply if—

(a) the house or part of the house is actually let during the whole or any part of the previous year; or

(b) any other benefit therefrom is derived by the owner.

(4) Where the property referred to in sub-section (2) consists of more than one house—

(a) the provisions of that sub-section shall apply only in respect of one of such houses, which the assessee may, at his option, specify in this behalf;

(b) the annual value of the house or houses, other than the house in respect of which the assessee has exercised an option under clause (a), shall be determined under sub-section (1) as if such house or houses had been let.

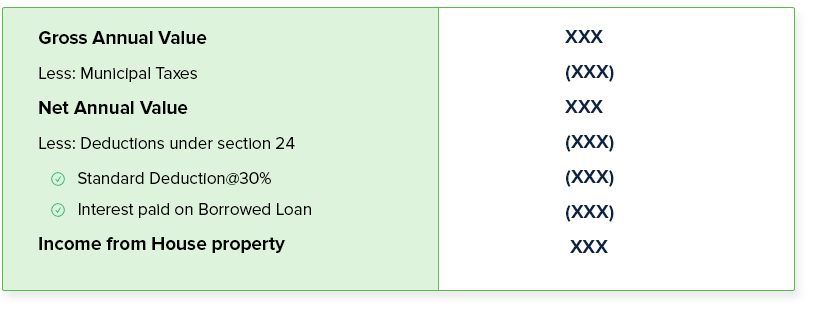

Deductions from income from house property (Section 24)

Income chargeable under the head ―Income from house property‖ shall be computed after making the following deductions, namely: —

(a) a sum equal to thirty per cent. Of the annual value;

(b) where the property has been acquired, constructed, repaired, renewed or reconstructed with borrowed capital, the amount of any interest payable on such capital:

Provided that in respect of property referred to in sub-section (2) of section 23, the amount of deduction shall not exceed thirty thousand rupees:

Amounts not deductible from income from house property (Section 25)

Interest chargeable under this Act which is payable outside India (not being interest on a loan issued for public subscription before the 1st day of April, 1938), on which tax has not been paid or deducted under Chapter XVII-B and in respect of which there is no person in India who may be treated as an agent under section 163 shall not be deducted in computing the income chargeable under the head ―Income from house property.

How to calculate Income from House Property for income tax purposes?

The income tax categorises your income under two categories for the purpose of taxability of house property income. These are:

Self-Occupied House Property | This is the type of property that is self-owned and used for own residential purposes. This may be occupied by the owner’s family or relative or self. A property that is unoccupied is considered as a self-occupied property for the purpose of income tax. Before the Financial Year 2019-20 if taxpayer owns more than one house property, only one is considered as self-occupied property and rest are assumed to be let out. From 2019-20 onwards two properties are considered as self-occupied properties. |

Let Out House Property | Any house property that is rented for complete or part of the year is considered as a let-out property for income tax purposes. |

Note: Inherited Property Any property inherited from parents, grandparents, etc, can be either considered as self-occupied or let out house property based on the usage as discussed above. | |

Steps to compute “Income from House Property”

The calculation of income from house property involves various steps. These steps are common to both the categories of house property Self-Occupied and Let Out. These are:

Calculation of Income from House property

Calculation/Assessment of “Income from House Property” in both cases – Self-occupied and Let Out

Type of House Property | Self-Occupied Property | Let Out Property |

Gross Annual Value

Income from House property | Nil | XXX |

Important Note: From the F.Y. 2017-18, set of loss of income from house property from other sources of income is restricted to Rs. 2,00,000. | ||

How to calculate the Gross Annual Value of House Property?

Assessment of Gross Annual Value of Self-Occupied House Property:

The annual value will be nil if the individual self-occupies the only property he or she owns. However, if the person has multiple properties with the purpose of self-occupation, only one property is considered as self-occupied and its annual value can be specified as nil. The assessment of the annual value of the remaining properties will be done according to the expected rent if the property was let out.

Assessment of Gross Annual Value of Let-Out House Property:

Step 1: Find out the Reasonable Expected Rent of the Property (A)

Reasonable Expected Rent is the amount for which the property can be reasonably be expected to be let out from year to year. It is higher of the Municipal Valuation or Fair Rent of the property, but cannot exceed the standard rent determined as per the Rent Control Act. Reasonable Expected Rent = Higher of Municipal Valuation or Fair Rent, subject to maximum Standard Rent

Step 2: Find out the Actual Rent Received or Receivable (B)

Step 3: Higher of (A) or (B), is the Gross Annual Value.

Section 28 highlights the following income shall be chargeable to income-tax under the head ―Profits and gains of business or profession, —

(i) the profits and gains of any business or profession which was carried on by the assessee at any time during the previous year;

(ii) any compensation or other payment due to or received by, —

(a) any person, by whatever name called, managing the whole or substantially the whole of the affairs of an Indian company, at or in connection with the termination of his management or the modification of the terms and conditions relating thereto.

(b) any person, by whatever name called, managing the whole or substantially the whole of the affairs in India of any other company, at or in connection with the termination of his office or the modification of the terms and conditions relating thereto;

(c) any person, by whatever name called, holding an agency in India for any part of the activities relating to the business of any other person, at or in connection with the termination of the agency or the modification of the terms and conditions relating thereto;

(d) any person, for or in connection with the vesting in the Government, or in any corporation owned or controlled by the Government, under any law for the time being in force, of the management of any property or business;

- Income derived by a trade, professional or similar association from specific services performed for its members;

- The value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession;

- Any interest, salary, bonus, commission or remuneration, by whatever name called, due to, or received by, a partner of a firm from such firm.

- Any sum received under a Keyman insurance policy including the sum allocated by way of bonus on such policy.

- Any sum, whether received or receivable, in cash or kind, on account of any capital asset (other than land or goodwill or financial instrument) being demolished, destroyed, discarded or transferred, if the whole of the expenditure on such capital asset has been allowed as a deduction under section 35AD.

Income from profits and gains of business or profession, how computed (Section 29)

The income referred to in section 28 shall be computed in accordance with the provisions contained in sections 30 to 43D.

Rent, rates, taxes, repairs and insurance for buildings (Section 30)

In respect of rent, rates, taxes, repairs and insurance for premises, used for the purposes of the business or profession, the following deductions shall be allowed—

(a) where the premises are occupied by the assessee—

(i) as a tenant, the rent paid for such premises; and further if he has undertaken to bear the cost of repairs to the premises, the amount paid on account of such repairs;

(ii) otherwise, then as a tenant, the amount paid by him on account of current repairs to the premises;

(b) any sums paid on account of land revenue, local rates or municipal taxes;

(c) the amount of any premium paid in respect of insurance against risk of damage or destruction of the premises.

Repairs and insurance of machinery, plant and furniture (section 31)

In respect of repairs and insurance of machinery, plant or furniture used for the purposes of the business or profession, the following deductions shall be allowed—

(i) the amount paid on account of current repairs thereto;

(ii) the amount of any premium paid in respect of insurance against risk of damage or destruction thereof.

Depreciation (Section 32)

(1) In respect of depreciation of—

(i) buildings, machinery, plant or furniture, being tangible assets;

(ii) know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature, being intangible assets acquired on or after the 1st day of April, 1998 owned, wholly or partly, by the assessee and used for the purposes of the business or profession, the following deductions shall be allowed—

(i) in the case of assets of an undertaking engaged in generation or generation and distribution of power, such percentage on the actual cost thereof to the assessee as may be prescribed;

(ii) in the case of any block of assets, such percentage on the written down value thereof as may be prescribed:

(a) any motor car manufactured outside India, where such motor car is acquired by the assessee after the 28th day of February, 1975 but before the 1st day of April, 2001, unless it is used—

(i) in a business of running it on hire for tourists; or

(ii) outside India in his business or profession in another country; and

(b) any machinery or plant if the actual cost thereof is allowed as a deduction in one or more years under an agreement entered into by the Central Government under section 42.

Rates of depreciation

Rates of depreciation on the following assets:

- Building for residential use: 5%;

- Building for non-residential use: 10%;

- Furniture and fittings: 10%;

- Computers including software: 40%;

- Plant and machinery: 15%;

- Motor vehicles for personal use: 15%;

- Motor vehicles for commercial use: 30%;

- Ships: 20%;

- Aircraft: 40%;

- All intangible assets: 25%.

Condition for claiming depreciation under Income tax

For availing the deduction on depreciation, an assessee will have to fulfil some conditions. These conditions are as follows:

- Classification of Assets:

For availing the benefit of depreciation, the owner of the asset should be an assessee. The asset can be tangible or intangible. With respect to a tangible asset, the asset should be a building, machinery, plant or furniture. With respect to intangible assets, assets should be patent rights, copyrights, trademark, license, franchise or any similar nature which is acquired on or after 1.04.1998. While calculating the depreciation on the building, the income tax department calculates the depreciation only on the building. They don’t calculate the cost of the land on which the building is situated. The reason behind not including the cost of the land into the building is that land does not suffer any depreciation because of wear and tear or its usage.

2. Ownership vs lease:

An assessee can claim the depreciation only on those capital assets which are owned by him. If the assessee wants to avail the deduction on the depreciation of building, then assessee should be the owner of those buildings. It is not necessary that an assessee should be the owner of that land. If an assessee has constructed the building but the land belongs to someone else then he has a right to claim the deduction of depreciation on buildings. If the assessee is a tenant or using the building then he can’t claim the deduction. If an assessee has taken the lease of the land and has constructed a building on that land, he is entitled to avail the allowances of depreciation. In the case of hire and purchase, if an assessee hires the machinery for a short period of time, then, in that case, he is not entitled to claim the deduction. But, in case of purchase, if an assessee acquires the property and becomes the owner of the property, he is entitled to claim the deduction.

3. Used for the purpose of profession or business:

For availing the allowance for depreciation, it is necessary that the asset has been used for the purpose of business or profession. However, it is not necessary for availing the allowance for depreciation, for which an assessee will have to use the asset throughout the accounting year. Thus, if the assessee has used the asset for a small period of time in an accounting year, then he is entitled to avail the allowances for depreciation. You can take the example of any seasonal factory. Let’s take the example of sugar factories. Sugar factories don’t open for a whole year but if the asset has been used at any time during the accounting year in a factory, then in such conditions factory owners are entitled to claim depreciation. Under Section 38 of the Income Tax Act 1961, the income tax officer has a right to determine the proportionate part of the depreciation.

4. Can’t claim the deduction on sold assets:

An assessee cannot claim the deduction on depreciable assets. If an asset is sold, destroyed or demolished in the same year when it was acquired then assessee cannot claim the deduction. If an asset has a co-owner, then the co-owner can also claim the depreciation on the asset.

References:

1. Singhanai V.K.: Student’s Guide to Income Tax; Taxman, Delhi.

2. Prasad, Bhagwati: Income Tax Law & practice: Wiley Publication, New Delhi.

3. Dinker Pagare: Income Tax Law and Practice; Sultan Chand & Sons, New Delhi.

4. Girish Ahuja and Ravi Gupta; Systematic approach to income tax; Sahitya Bhawan Publications, New Delhi.

5. Chandra Mahesh and Shukla D.C.: Income Tax Law and Practice; Pragati Publications, New Delhi.