Unit 4

Deduction from gross total income available to all types of assessee

The aggregate of income computed under each head, after giving effect to the provisions for clubbing of income and set off of losses, is known as "Gross Total Income". In computing the total income of an assessee, certain deductions are permissible under sections 80C to 80U from Gross Total Income.

These deductions are however not allowed from the following incomes although these incomes are part of Gross Total Income:

- Long-term capital gains.

- Short-term capital gain on transfer of equity shares and units of equity-oriented fund through a recognised stock exchange i.e., short-term capital gain covered under section 111A.

- Winnings of lotteries, races, etc.

- Incomes referred to in sections 115A, 115AB, 115AC, 115ACA, 115AD and 115D.

These deductions are of two types: —

- Deductions on account of certain payments and investments covered under sections 80C to 80GGC.

- Deductions on account of certain incomes which are already included under Gross Total Income covered under sections 80-IA to 80U.

Basic Rules of Deductions [Sections 80A/80AB/80AC]

- Deductions cannot exceed Gross Total Income [Section 80A (2)]:

The aggregate number of deductions under sections 80C to 80U i.e., under Chapter VI-A shall not, in any case, exceed the "Gross Total Income" (exclusive of long-term capital gains, short-term capital gain covered under section 111A, winnings of lotteries, crossword, puzzles, etc. and income referred to in sections 115A to 115AD and 115D) of the assessee. Therefore, the total income after deductions will either be positive or nil. It cannot be negative due to deductions. If the "Gross total income" is negative or nil, no deduction can be permitted under this Chapter.

2. Deduction not allowed to members if allowed to AOP/BOI [Section 80A (3)]:

If a deduction is allowed under the above sections to the AOP or BOI then deductions for the same payment/income will not be allowed to the members of the AOP/BOI. [Section 80A (3)].

3. Double deduction not allowed and deduction cannot exceed the profit of the particular undertaking or unit or enterprise, etc. [Section 80A (4)]:

Notwithstanding anything to the contrary contained in section 10AA or in any provisions of this Chapter under the heading "C.—Deductions in respect of certain incomes" (i.e. deductions under sections 80-IA to 80RRB), where, in the case of an assessee, any amount of profits and gains of an undertaking or unit or enterprise or eligible business is claimed and allowed as a deduction under any of those provisions for any assessment year, deduction in respect of, and to the extent of, such profits and gains shall not be allowed under any other provisions of this Act for such assessment year and shall in no case exceed the profits and gains of such undertaking or unit or enterprise or eligible business, as the case may be.

4. Deduction allowed only when it is claimed by the assessee [Section 80A (5)]:

Where the assessee fails to make a claim in his return of income for any deduction under section 10AA or under any provision of this Chapter under the heading "C.—Deductions in respect of certain incomes" (i.e., sections 80-IA to 80RRB), no deduction shall be allowed to him thereunder.

5. Profit or gain to be recomputed if inter unit or inter business transfer is not at market value [Section 80A (6)]

6. Assessee's duty to place relevant material:

If an assessee approaches a statutory authority for obtaining a concession under the taxing statute, he should in fairness place all the material before the said authority and be also in a position to satisfy the said authority that he was entitled to obtain the concession.

7. Deduction to be allowed in respect of net income included in Gross Total Income [Section 80-AB]:

Where any deduction is required to be made or allowed under any section in respect of any income then for the purpose of computing the deduction under that section, the net income computed in accordance with the provisions of the Income-tax Act (before making any deduction under this chapter i.e., Chapter VIA) shall alone be regarded as the income received by the assessee and which is included in his Gross Total Income. [Section 80AB].

8. Benefits of certain deductions not to be allowed in cases where return is not filed within the specified time limit [Section 80AC]:

Where in computing the total income of an assessee, any deduction is admissible under section 80-IA or section 80-IAB or section 80-IB or section 80-IC or section 80-ID or section 80-IE, no such deduction shall be allowed to him unless he furnishes a return of his income for such assessment year on or before the due date specified under section 139(1).

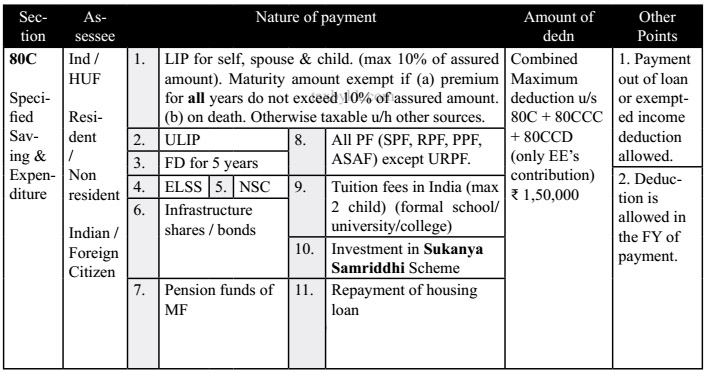

Section 80C (Specified Saving & Expenditure)

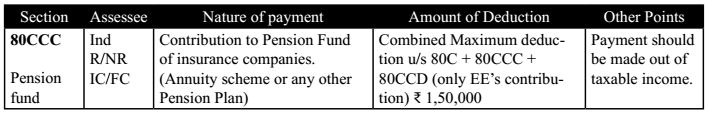

Section 80CCC (Annuity Scheme or any other Pension Plan)

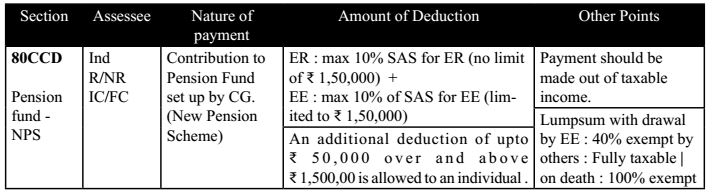

Section 80CCD (New Pension Scheme-NPS)

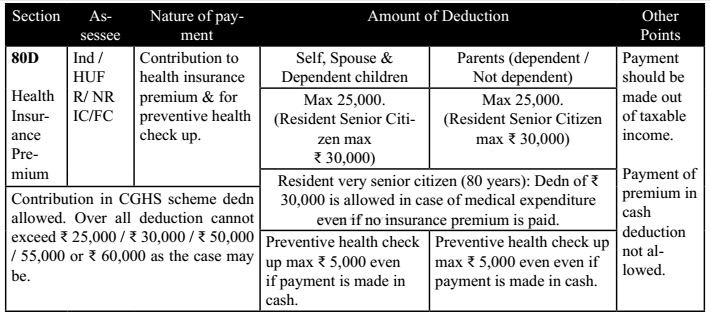

Section 80D (Health Insurance Premium & Health Check Up)

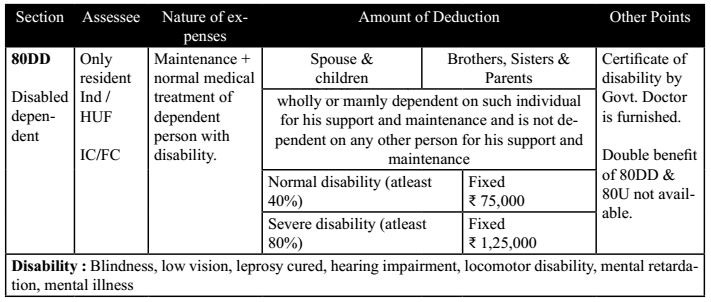

Section 80DD (Disabled Dependent)

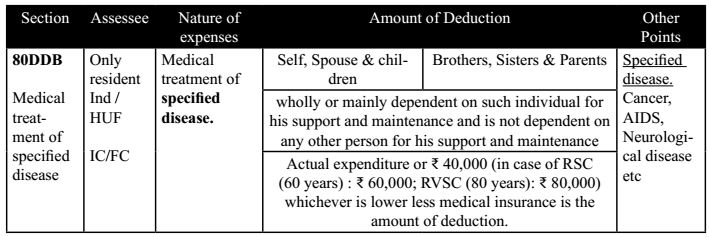

Section 80DDB (Medical Treatment of Specified Disease)

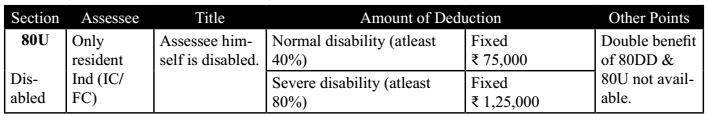

Section 80U (Assessee himself is Disabled)

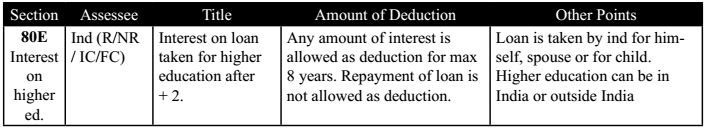

Section 80E (Interest on Higher Education Loan after +2)

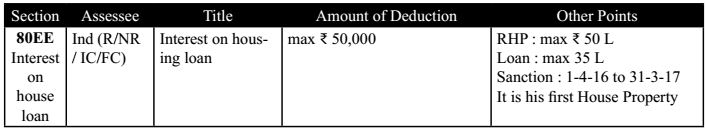

Section 80EE (Interest on Housing Loan)

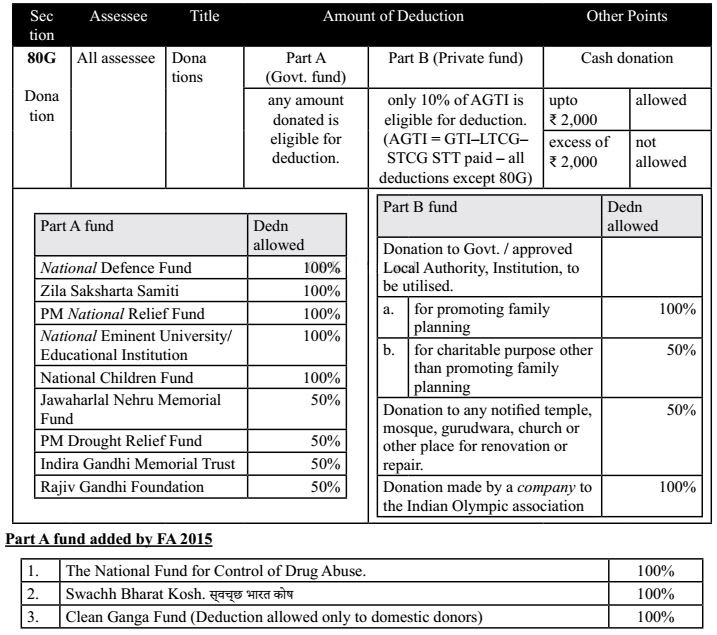

Section 80G (Donations)

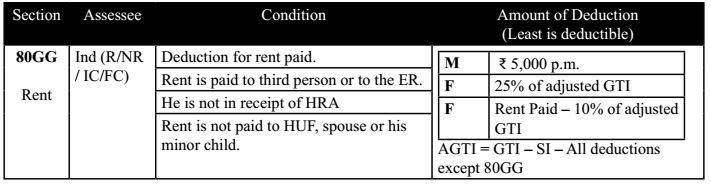

Section 80GG (Rent Paid)

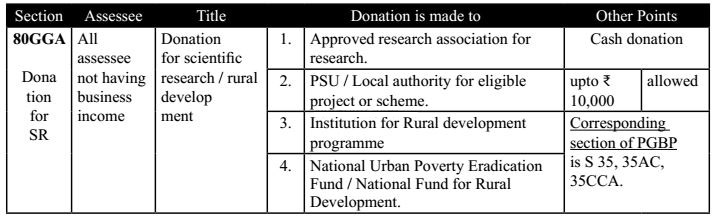

Section 80GGA (Donation for Scientific Research / Rural Development)

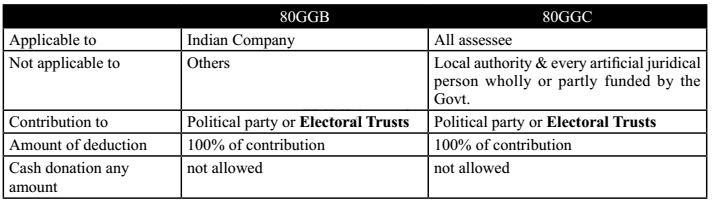

Section 80GGB & GGC

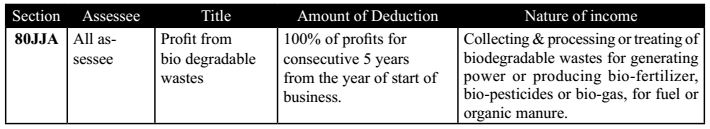

Section 80JJA (Profit from Bio Degradable Wastes)

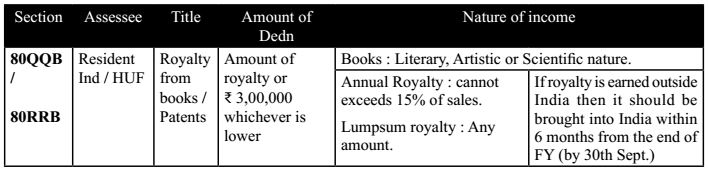

Section 80QQB / 80RRB (Royalty from Books / Patents)

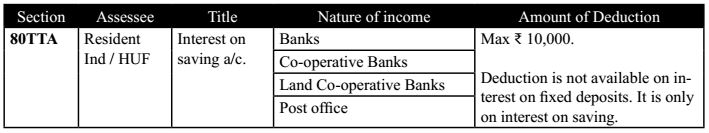

Section 80TTA (Interest on Saving A/c)

Rebate under Section 87A helps taxpayers reduce their income tax liability. You can claim the said rebate if your total income, i.e., after Chapter VIA deductions, does not exceed Rs 5 lakh in a financial year. Your income tax liability becomes nil after claiming the rebate under Section 87A.

Steps to claim a tax rebate under section 87A

- Calculate your gross total income for the financial year

- Reduce your tax deductions for tax savings, investments, etc.

- Arrive at your total income after reducing the tax deductions.

- Declare your gross income and tax deductions in ITR.

- Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh.

- The maximum rebate under section 87A for the AY 2022-23 is Rs 12,500

|

Section 87A rebate can be claimed against tax liabilities on:

- Long term capital gains - Normal income which is taxed at the slab randomly falls under Section 112 of the Income Tax Act. (Section 112 applies for long term capital gains on the sale of any capital assets other than listed equity shares as well as equity-oriented schemes of mutual funds)

- Short term capital gains - on listed equity shares and equity-oriented schemes of mutual funds under Section 111A of the Act, on which tax is payable at a flat rate of 15%.

Tax relief refers to any government program or policy designed to help individuals and businesses reduce their tax burdens or resolve their tax-related debts.

Tax relief may be in the form of universal tax cuts, targeted programs that benefit specific groups of taxpayers, or initiatives that bolster particular goals of the government. For example, the child tax credit gives a tax break to parents of minor children, while the tax credit for green improvements (e.g., energy-efficient windows) furthers the goal of U.S. Energy independence and cleaner air.

Tax relief programs and initiatives help taxpayers reduce their tax bills through tax deductions, credits, and exclusions. Other programs help taxpayers who are behind on their taxes settle their tax-related debts, potentially avoiding liens in the process.

Government policy goals are often the catalyst for amending the federal tax code. For example, in response to concerns about the general lack of retirement savings in the U.S., Congress created incentives to encourage people to save for retirement in tax-advantaged savings accounts—such as IRAs and 401(k)s.

Tax relief is also available for people affected by natural disasters. For example, the IRS made dozens of tax relief announcements in 2021 to help individuals and businesses affected by severe storms, tornados, flooding, hurricanes, straight-line winds, wildfires, and drought.5 The relief typically comes in the form of filing and payment extensions, penalty and interest waivers, and deductions for casualty and theft losses sustained due to federally declared disasters.

Tax Credits

A tax credit is another form of tax relief. Unlike tax deductions, which lower your taxable income, tax credits directly reduce the amount of tax you owe.

Here's an example. Say a taxpayer takes the standard deduction, and their tax bill amounts to $3,000. If the person is also eligible for a $1,000 tax credit, their final tax bill would be $2,000. By comparison, with a $1,000 tax deduction, someone in the 22% tax bracket would save just $220.

This type of tax relief is often described as a tax incentive because it reimburses taxpayers for expenditures the government deems worthwhile. For example, the American opportunity tax credit (AOTC) and the lifetime learning credit (LLC) programs give tax credits to people who enrol in postsecondary education programs.

Other popular tax credits include:

- Earned income tax credit (EITC)

- Child tax credit

- Saver's tax credit

- Health Insurance Marketplace premium tax credit

Tax Exclusions

- While tax deductions are amounts, you deduct from your income, tax exclusions set aside certain types of income as non-taxable. As such, tax exclusions reduce your taxable income—and your tax bill. For example, you can generally exclude from your income any child support payments, life insurance death benefits, and municipal bond income you receive.

- A common tax exclusion is the one for employer-sponsored health insurance. Health insurance premiums your employer pays are exempt from federal income and payroll taxes, and the portion of premiums you pay is generally excluded from your taxable income. The exclusion of premiums lowers your tax bill, effectively reducing your after-tax cost of health insurance coverage.

Another popular tax exclusion pertains to selling a house. If you have a capital gain from the sale of your main home, you can exclude up to $250,000 ($500,000 if married filing jointly) of that gain from your income. To qualify, you must have owned and lived in the home for at least two out of the previous five years, and you must not have excluded the gain from the sale of another home within the last two years.

Tax Debt Relief

The IRS Fresh Start program helps taxpayers catch up on back taxes and avoid tax liens, levies, wage garnishments, and jail time. Launched in 2011, the program is a group of changes to the U.S. Tax code that streamlines the collection process and makes it possible to settle your tax debt for less than the total amount you owe. Individuals and businesses are eligible for the program.

An individual means a simple person, a human being either male or female, living identity. In case of minor, assessment made on the parents, guardian or trustee. An individual is taxed not only on his total income but in some cases; he may be assessable on income of other person according to section 60 to 64.

Computation of total income and the related provision relating to an individual are as under.

- Computation of total income of an individual: -

Income earned in individual capacity: - income earned by an individual will be shown in different heads of the assessment like income from salary, income from business, capital gains are shown differently.

2. Income from membership or others entities: -

Income of other entities will be added to the individual income and he needs to pay income tax for it. Some of the examples are as follows.

a) As a member of partnership firm assessed: - if a partnership firm is assessed as such, the profits to the partners share is exempt from tax. In other words, if the firm pays all the taxes relating to it. The partners need not pay it again. But if in the partnership firm a partner receives salary, bonus, commission which is the expenses for the firm. Such remuneration is taxable in the head of business income for the partner who receives such income. Section 28(iv).

b) As a member of association of persons: - if an individual is a member of AOI, body of individuals share income from such association is includable in the individual total income only for rate purposes. (Association or body is chargeable to tax at the normal rates on such income)

c) If total income of AOP is not chargeable to tax, no rebate of tax is allowed.

d) If the AOP is chargeable to tax at maximum marginal rates, the share profits from AOP are fully exempt.

e) As a member of company: - where is an individual is a shareholder of the domestic company, any dividend paid on or after 1 April 2003 is exempt in the hands of the shareholder under section 10(34) of income tax act. Domestic company is liable to dividend tax on such distribution under section 115. However, any loan advanced by a company to a shareholder holding 10% equity shares is taxable as deemed dividend to the extent it is covered by the accumulated profits.

f) Dividends from foreign company are fully taxable in the hands of the shareholders.

g) Any income from importable estate of an H.U.F is taxable in the individual assessment of the Karta.

References:

1. Ahuja, Giri & Gupta, Ravi: Systematic Approach to Incomes Tax

2. Agrawal, B.K.: Income Tax law and practice

3. Agrawal, B.K.: Ayakar Vidhan Avam lekhe

4. Chandra, Mahesh & Shukla, D.C.: Income Tax Law and practices

5. Chandra, Girish: Income Tax