Unit - 3

Valuation of goodwill and valuation of shares

Concept of goodwill

When one company buys another company, the purchasing company may pay more for the acquired company than the fair market value of its net identifiable assets (tangible assets plus identifiable intangibles, net of any liabilities assumed by the purchaser). The amount by which the purchase price exceeds the fair value of the net identifiable assets is recorded as an asset of the acquiring company. Although sometimes reported on the balance sheet with a descriptive title such as “excess of acquisition cost over net assets acquired”, the amount is customarily called goodwill.

The following reasons arises the need for evaluating goodwill

- When the company is sold to another company

- When the company is amalgamated with another company

- When the company is previously written off goodwill and wants it write back

- When a large block of shares, so as to enable the holder to exercise control over the company concerned, has to be brought or sold.

Goodwill is the excess of purchase price over share of net assets (fair value). Goodwill is an intangible assets, it is a reputation of a company. Goodwill = purchase price – FV of net assets acquired as on date of purchase.

Definition

An intangible asset that arises as a result of the acquisition of one company by another for a premium value. The value of a company’s brand name, solid customer base, good customer relations and any patents or proprietary technology represents goodwill.

Types of valuing goodwill

- Average profit method – the value of goodwill under this method is calculated by multiplying the average future profit by a certain number of year’s purchase. Simple average profits are taken as future maintainable profits when fluctuations in profit are not very large.

Steps

- Find out average trading profit.

- Find out the number of year purchase (It will always be given in problem).

- Goodwill: Number of year purchase × Average trading profit.

Calculation of Average profit:

(a) Simple Average Profit = Total profit of (past years)/ Total number of past years

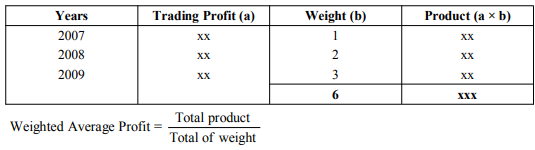

(b) Weighted average profits

For example 1– the profits of the company for the last three years are as follows

Year | Profits |

2008 | 20000 |

2009 | 20000 |

2010 | 35000 |

|

|

Solution

The average profits of the company are = (20000+20000+35000)/3 = 25000

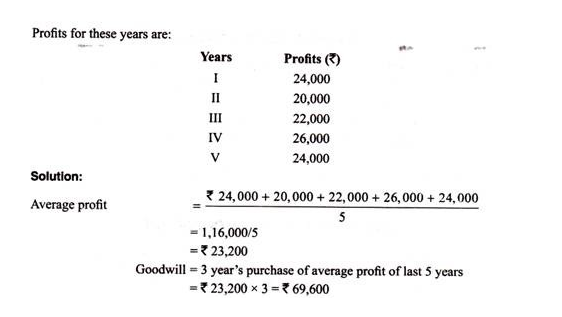

Example 2 – Xltd agreed to purchase a business. For that purchase, goodwill id to be valued at 3 years’ purchase of average profits of last 5 years

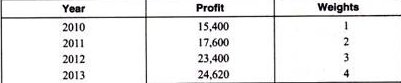

Example 3 - calculated weighted average profit

Solution

2. Super profit method - Super profit is the excess of estimated future maintainable profits over normal profits. The goodwill under this method is ascertained by multiplying the super profits by certain number of year’s purchase.

Steps

- Normal profits = capital invested *normal rate of return / 100

- Super profits = actual profits – normal profits

- Goodwill = super profits * number of years purchased

Example – the capital employed as shown by the books of ABC LTD is 50,000,000. And the normal rate of return is 10%. Goodwill is to be calculated on the basis of three years purchase of super profits of the last four years. Profits of last four years are:

Year | Profit |

2005 | 10,000,000 |

2006 | 12,250,000 |

2007 | 7,450,000 |

2008 | 5,400,000 |

|

|

Solution

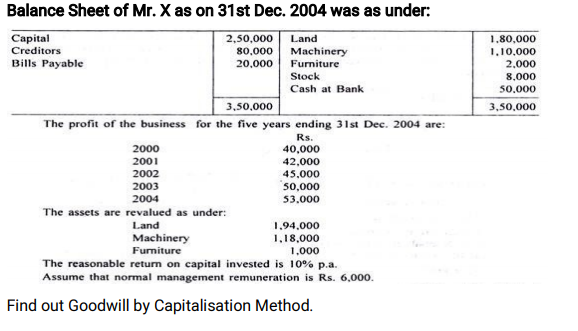

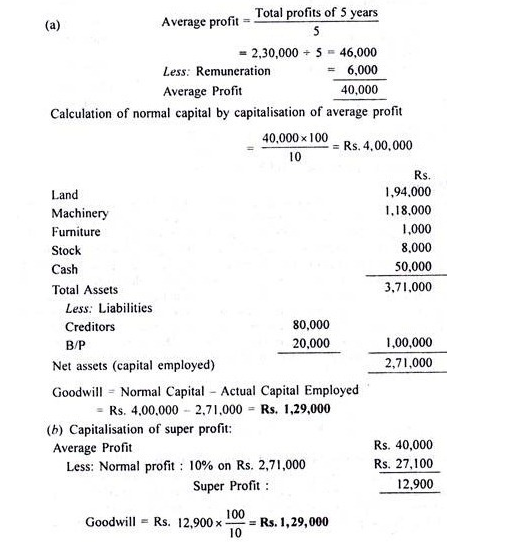

3. Capitalized method - Goodwill under this method can be calculated by capitalizing average normal profit or capitalizing super profits.

- Capitalization of average profit method - Under this method goodwill is determined by deducting Actual Capital Employed (i.e., Net Assets as on the valuation date) from the capitalised value of the average profits on the basis of normal rate of Return (also known as value of the firm or capitalised value of business)

Goodwill = Capitalised Value – Net Assets of Business

Steps

- Calculate Average future maintainable profits

- Calculate Capitalised value of business on the basis of Average Profits

- Calculate the value of Net Assets on the valuation date

- Calculate Goodwill

Goodwill = Capitalised Value – Net assets of business.

b. Capitalization of super profit method - The goodwill under this method is ascertained by capitalizing the super profits on the basis of normal rate of return. This method assesses the capital needed for earning the super profit.

Example

Solution

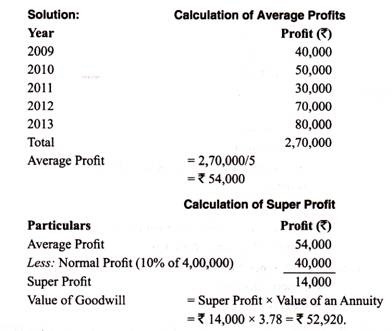

4. Annuity method - goodwill is calculated under this method by taking average super profit as the value of an annuity over a certain number of years. The present value of this annuity is computed by discounting at the given rate of interest (normal rate of return). This discounted present value of the annuity is the value of goodwill.

Steps

- Calculate superprofit as discussed above

- Goodwill=Annuity Rate × Super Profit

- Notes: Annuity Rate will always be given in the problem

Example -

The net profit of a company after providing for taxation for the past five years is:

The net tangible assets in the business are Rs. 4, 00,000 on which the normal rate of return is expected to be 10%. It is also expected that the company will be able to maintain its super profits for next five years. Calculate the value of goodwill of the business on the basis of an annuity of super profits, taking present value of an annuity of Rs. 1 for five years at 10% interest is Rs. 3.78.

Solution

Valuation of shares

Valuation of shares is the process of knowing the value of company’s shares. Normally, the value of shares is ascertained from the market price quoted on the stock exchange. Shares of limited company are required to be valued on many occasions such as –

- Sale or purchase of shares of a private limited company whose shares are not quoted on the stock exchange

- Sale or purchase of large number of shares enabling the purchaser to acquire control of management of the company

- Sale of entire company on amalgamation with, or absorption by another company

- Valuation of assets held by investment company

- Conversion of one class of shares into another

- Ascertaining the value of shares offered as security against loan.

Methods of valuation of shares

- Net asset method of valuation of shares - This is also known as Balance Sheet Method or Intrinsic Method or Break-up Value Method or Valuation of Equity basis or Asset Backing Method. Under this method, net assets of the company are divided by the number of shares to arrive at the net asset value of each share. According to this method the following points should be considered.

- Goodwill must be properly valued

- The fixed assets should be taken at their realized value

- Provision of bad debts, depreciation, etc must be considered

- Floating assets should be taken at market value

- All unrecorded assets and liabilities should be considered.

Thus the value of net asset is:

Total of realisable value of assets – Total of external liabilities = Net Assets (Intrinsic value of asset)

Total Value of Equity shares = Net Assets – Preference share capital

Value of one Equity share = Net Assets – Preference share capital/Number of Equity shares

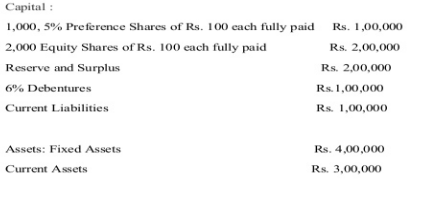

Example – the following information is available from Tina ltd as on 31st march 2009

For the purpose of valuation of shares, fixed assets and current assets are to be depreciated by 10%; interest on debentures are due for 6 months; preference dividend is also due for the year. Neither of these have been provided for in the balance sheet. Calculate value of equity under net asset method

Solution

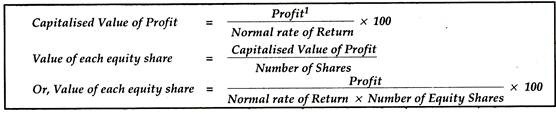

2. Yield method - the emphasis is given to the yield that an investor expects from his investment, under this method. The yield means return that an investor gets out of his holdings—dividend, bonus shares, right issue. Yield is the effective rate of return on investments which is invested by the investors. It is always expressed in terms of percentage. Under Yield-Basis method, valuation of shares is made on;

- Profit Basis;

- Dividend Basis.

Profit basis - Under this method, firstly, profit are determined on the basis of past average profit; thereafter, capitalized value of profit is to be ascertained on the basis of normal rate of return, and, the same (capitalized value of profit) is divided by the number of shares in order to find out the value of each share.

Examples –

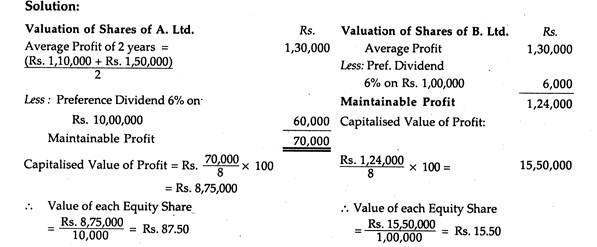

Two companies, A Ltd. And B. Ltd., are found to be exactly similar as to their assets, reserves and liabilities except that their share capital structures are different:

The share capital of A. Ltd. Is Rs. 11,00,000, divided into 1,000, 6% Preference Shares of Rs. 100 each and 1,00,000 Equity Shares of Rs. 10 each.

The share capital of B. Ltd. Is also Rs. 11,00,000, divided into 1,000, 6% Preference Shares of Rs. 100 each and 1,00,000 Equity Shares of Rs. 10 each. .

The fair yield in respect of the Equity Shares of this type of companies is ascertained at 8%.

The profits of the two companies for 2009 are found to be Rs. 1, 10,000 and Rs. 1, 50,000, respectively.

Calculate the value of the Equity Shares of each of these two companies on 31.12.2009 on the basis of this information only.

Solution

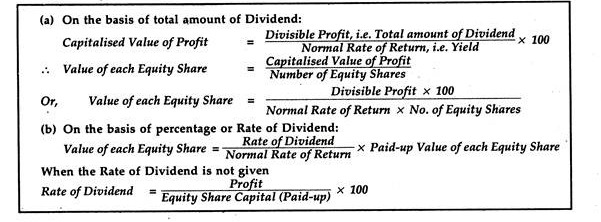

Dividend basis - Valuation of shares may be made either

- On the basis of total amount of dividend, or

- On the basis of percentage or rate of dividend:

Examples

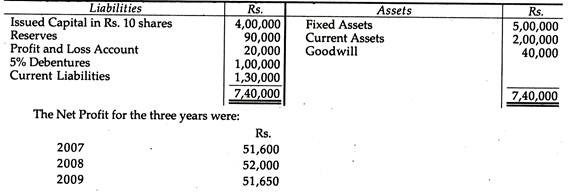

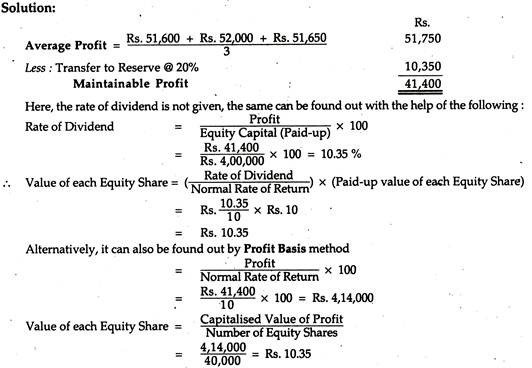

Calculate the value of each Equity Share from the following information: Of which 20% was placed to Reserve, this proportion being considered reasonable in the industry in which the company is engaged and where a fair investment return may be taken at 10%.

3. Fair value method – the Fair Value Method which is the mean of intrinsic value and Yield Value method and the same provides a better indication about the value of shares than the other methods.

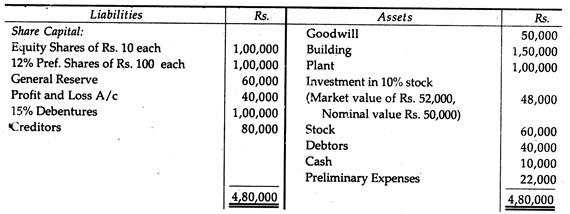

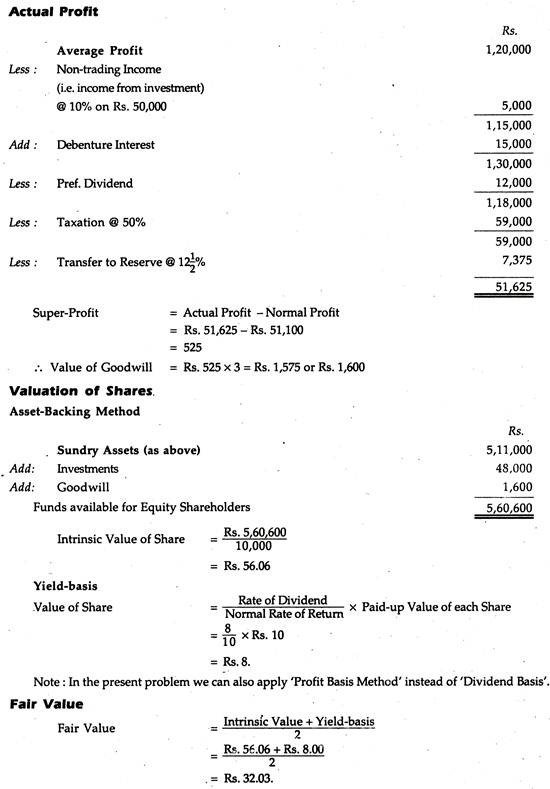

Example

Ascertain the value of equity share under fair value method

Building Rs. 3, 20,000, Plant Rs. 1, 80,000, Stock Rs. 45,000 and Debtors Rs. 36,000. Average Profit of the company is Rs. 1, 20,000 and 12½% of profit is transferred to General Reserve, Rate of taxation being 50%. Normal dividend expected on equity shares is 8% whereas fair return on capital employed is 10%. Goodwill may be valued at 3 years’ purchase of super-profit.

References

- Corporate Accounting by Raj Kumar Shah

- Corporate Accounting by V K Goyal

- Corporate Accounting by Prof. Amitabha Basu