UNIT III

Inflation

According to A.C. Pigou (Cambridge University), inflation comes in existence “when money income is expanding more than in proportion to income activity”. An increase in general price level takes place when people have more money income to spend against less goods and services.

G. Crowther (British economists) brings out the meaning precisely when he says, “inflation is a state in which the value of money is falling i.e. prices rising”.

Inflation, according to Harry G. Johnson (Canadian economist), “is a sustained rise in prices”.

Paul Samuelson (American economist) defines inflation as “a rise in the general level of prices”.

According to Milton Friedman (American economists), ‘inflation is taxation without representation’.

Causes of Inflation

Demand- Pull Inflation

- Increase in Money Supply: When the monetary authorities increase the money supply in excess of the supply of goods and services it results in additional demand and consequent increase in price level. As Milton Friedman put it “inflation is always and everywhere a monetary phenomenon”.

- Deficit Finance: As increase in money supply also takes place when the government resorts to deficit financing to incur the public expenditure. Deficit financing undertaken for unproductive investment or expenditure becomes purely inflationary. Even when it is used on productive activities, prices would still increase during the gestation period.

- Credit Creation: Commercial banks increase the quantity of money in circulation when they advance loans through credit creation. Credit creation is similar to that of deficit financing in its effects.

- Exports: Exports reduce the goods available in domestic market. Export earnings enhance the purchasing power of the exporters and others linked with export. An increase in exports would aggravate the situation by reducing the supply of goods and at the same time pushing up the demand because of additional income.

- Repayment of Public Debt: Public debt is a common feature of modern governments. When such debts are repaid, people will have more income at their disposal. Additional disposable income tends to raise the demand for goods and services.

- Black Money: Social and economic evils like corruption, tax evasion, smuggling and other illegal activities give rise to unaccounted (for tax payment) or black money. People with black money indulge in extravanza, affecting demand and thus the price level.

- Increase in Population: The size of the population is one of the important determinants of demand in many developing countries population is large in size and still increasing. India provides an example where demand outstrips supply due to the large and increasing population.

Cost- Push Inflation

Inflation need not necessarily be due to an increase in demand but increase in cost. Increase in the prices of inputs including labour, increase in profit margin by the business firms and monophony in factor market may push up prices as they influence the supply price.

The important cost push factors are:

- Increase in wages: When prices increase due to increase in wages it is called wage-push inflation. Wages are influenced by many factors besides the demand and supply forces. Trade unions play an important role in deciding the wage rate. Strong and powerful trade unions succeed in securing higher wages for their members. Higher wages granted in the organized sector influencing the wage rate in the unorganized sector too, resulting in an increase in cost everywhere.

- Increase in Material cost: Prices of materials used in producing goods constitute a significant part of the cost. Prices of the materials may increase either due to an increase in demand for these materials or independently owing to national and international developments. Increase in crude oil price till recently is an example in this context. When the prices of basis inputs like energy, cement, steel, etc. increase, the effect is felt throughout the economy. An increase in the prices of materials especially the basic inputs alters the cost structure of all goods and services. Higher the cost of production leads to upward revision of final prices.

- Increase in Profit Margin: Firms operating under oligopoly or enjoying monopoly power (petroleum firms in public sector) may have ‘administered prices’ with higher profit margins. Such administered prices though imposed by few firms, have their impact on other firms too. The desire to have higher profit margins by all those who have the power to do so becomes the cause for inflationary trend.

- Other factors: Cost of production may increase when input prices go up due to scarcity – natural or artificial. Natural calamities like draught or floods adversely affect supplies of raw materials thus making them dearer. Firms operating with excess capacity either because of monopolistic competitive market or any other reasons, produce at a higher cost.

Remedies to Inflation in the economy

.

The fiscal measures are

(i) taxation

(ii) public borrowing

(iii) compulsory saving and

(iv) Public expenditure.

Direct and Indirect taxes are levied to reduce the disposable income of the people. While imposing the tax, care should be taken to avoid the adverse effects of taxation on savings, investment and production. Essent Inflation must be controlled at an appropriate level. Uncontrolled inflation may turn into hyper inflation. Since inflation occurs due to disequilibrium in aggregate demand and aggregate supply, it would be controlled by correcting the forces which causes such disequilibrium. Control of inflation requires a combination of monetary, fiscal and other measures.

Monetary Measures

An increase in money supply without the corresponding increase in supply of goods and services creates excess demand causing inflation. Monetary and services creates excess demand causing inflation Monetary authorities through monetary instruments could increase the cost of credit and reduce the money supply. At the same time monetary measures may encourage the production and supply of essential commodities by supplying the required amount of credit at concessional terms. For this purpose the central bank of the country applies quantitative and qualitative methods.

The Quantitative Methods Are:

- Bank Rate: Inflation compels the Central Bank of the economy to increase the Bank Rate. Bank rate is the rate at which the central bank lends money to the member banks. An increase in bank rate makes borrowing costlier thus discourages borrowing, leading to a check on increase in supply. Similarly lowering bank rate makes borrowing cheaper, increases money supply along with decrease in cost. Cost push inflation may require to bring down the cost of borrowing. A change in bank rate brings changes in other interest rates in market in the same direction.

- Open Market Operation (OMO): Under this method a central bank sells or purchases government securities in the market. Anybody can participate in this purchase or sale; hence it is called open market operation. The central bank reduces quantity of money in circulation through the sale of securities and increases the quantity of money by purchasing them. During inflation it is expected to sell the securities, bringing down the money in circulation, hence the aggregate demand in the economy for goods and services.

- Variable Reserve Ratio (VRR): Variable reserve ratio has two components: (i) Cash reserve ratio (CRR) and Statutory Liquidity Ratio (SLR). An increase in these ratios reduces the ability to create credit. A reduction in CRR and SLR increases the reserves with banks and consequently their ability to expand credit. During inflation these ratios are usually increased. In recent decades many central banks have introduced some additional quantitive measures. They are in the form of repo rate and liquidity adjustment facility (LAF). They influence the cost of borrowing (higher cost during inflation) affecting total money in circulation.

The above mentioned quantitative methods may not be very effective in controlling inflation. Increase in prices which bring more profits and prevailing optimism will not deter business firms from borrowing at a higher costs.

A uniform monetary policy- dear or cheap- throughout the economy does not bring the required result. The central banks, therefore, apply the selective credit control measures too. These measures comprise margin requirements, consumer credit controls, directives, rationing of credit and any other method whereby a selective approach can be adopted in supplying credit. Selective credit controls discriminate in favor of essential activities and discourage demand for credit for non-essential uses. In developing countries selective credit controls are more popular as they help the monetary authorities to have a ‘controlled – expansion’ of credit. Quantitative measures in these countries are less effective due to the underdevelopment of the money market. Monetary measures by themselves are not enough to control inflation. They become more helpless if inflation is due to cost- push.

In extreme cases the central bank/ government, may resort to demonetization of currency. This measure is usually applied to higher denomination currency. It helps to bring out black money and check excess demand. Hyper inflation may even compel the government to issue new currency and replace the existing one in a given ratio, for example 100: 1. India demonetized its higher value currencies on 8 November 2016, to flush out black money and check the price level.

Fiscal Measures

Inflation cannot be controlled by monetary measures alone. They should be supported by fiscal measures. Broadly speaking, the government manipulates the budget to reduce the private as well as the public expenditure to check demand in commodities should not be taxed, lest inflation be aggravated.

Public borrowing can be undertaken to reduce the disposable income of the people. It is to reduce the quantity of money with the public. It is a costly instrument since the government has to pay interest on public loans. Repayment of public loans during inflation should be avoided. This would prevent additional money supply and consequent additional demand.

Compulsory saving or any other forced saving scheme and deferred payment (a part of the payment is credited to the employees provident fund accounts, thus blocking its current use) are some other instruments to reduce excess demand.

Public expenditure is the major source of injecting money into the economy. Modern welfare states spend huge amounts of money through public projects and welfare schemes. Public expenditure should be reduced during inflation. Though it is difficult to cut down public expenditure the government should attempt to avoid all unproductive expenditure Direct (Administrative) Measures

Some of the direct measures are:

Price control or ceiling on price especially of essential commodities.

- Public distribution system (PDS) to supply or distribute essential consumer goods. Rationing and fair price shops are the channels through which the pubic distribution system is operated.

- Imports of essential consumer commodities may be required to maintain the supply.

- Control or freezing of wages, profits, dividends and bonus may also be introduced. Such controls aim at limiting the income of the people and thereby reducing the demand for goods and services. These measures being drastic are likely to create social and political tension.

Increase in supply: If inflation is due to shortage of goods and services, controlling demand through monetary and fiscal measures is not of much use. Here the solution lies in increasing the supply of goods and services by improving the working of supply chains. The long-run solution lies in increasing production by creating a positive and conducive environment. This may involve improving infrastructure, providing incentives and effective implementation of various measures which enable more production.

Indexation: Inflation affects all sections of people. Among the different sections, wage/ salary earners and other fixed income group suffer the most. To compensate against inflation, a method of indexation of their income can be introduced. Indexation, according to Samuelson and Nordhaus, “is a mechanism of wages, prices and contracts that are partially or wholly compensated for changes in the general price level”. Under this system, payment received by the above mentioned groups can be increased to the extent of rate of inflation, so that their real income remains the same. In India the practice of periodical increase in dearness allowance is one of the methods of compensation against inflation.

Control of inflation is a must and should be attempted before it crosses a moderate limit. Attempts to control inflation by any particular types of measures are bound to fail. A judicious combination of all methods is a must to achieve success. A dear monetary policy must be supported by a surplus budgetary (or reduced deficit) policy along with necessary direct measures.

Success of the measures to control inflation depends on effective implementation which requires efficient and honest administration.

Hyperinflation: Its Causes and Effects with Examples

Hyperinflation is the increase in the price of goods and services by more than 50% per month.

At that rate, one loaf of bread can cost one amount in the morning and one higher in the afternoon. The seriousness of the cost increase distinguishes it from other types of inflation. The next worst, galloping inflation, will send prices up to 10% or more a year.

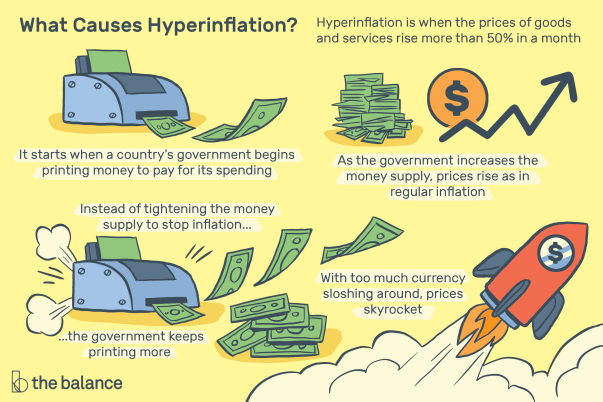

Cause

There are two main causes of hyperinflation: pull inflation-increased money supply and demand. The former happens when a country's government starts printing money to pay for its spending. By increasing as gold supply-as the price rises will be normal inflation.

Another cause, demand pull inflation, occurs when a surge in demand outstrips supply and drives prices higher. This could occur because of growth in the economy, a sharp rise in exports, or an increase in consumer spending due to more government spending.3

The two often go hand in hand. Instead of tightening the supply of funds to stop inflation, the government will continue to print. Too many currencies sloshing and prices skyrocketing. At once consumers realize what is happening; they will be followed by inflation. The more they buy, the higher the price they are now avoiding paying. Its excessive demand worsens inflation. It's even worse if they stockpile goods and make shortages.

Key takeout of Hyperinflation

Five important things to understand

- When prices rise above 50% in one month, the economy is experiencing hyperinflation.

- This is often caused by governments printing more money than that country's GDP can support.

- Hyperinflation tends to occur during periods of economic turmoil or depression.

- Demand-pull inflation could also trigger hyperinflation. Soaring prices cause people to stock up and create a rapid rise in demand chasing too little goods. Hoarding can create shortages, exacerbating inflation.

- Countries suffering from terrible inflation are Germany, Venezuela, Zimbabwe, and the United States during the Civil War. Venezuela is still trying to deal with hyperinflation in the current day.

Effects

Keep from paying more tomorrow and start the downturn. That stockpile causes shortages. It starts with durable goods such as cars and washing machines. When hyperinflation continues, People stock up on perishable foods like bread and milk. These daily supplies run out and the economy collapses.

Individuals lose their life giving's as cash becomes useless. That's why older people are most vulnerable to hyperinflation. Soon, banks and lenders will go bankrupt as their loans lose value. They run out of money as people stop making deposits.

Hyperinflation sends the value of a currency to plummet in the foreign exchange market. As the cost of foreign goods soars, the country's importers are out of business. The rise in unemployment, as companies, fold. And with the fall in government tax revenues, with training manuals, basic services completed, the government prints more money to pay its bills, exacerbating hyperinflation.5 6

Hyperinflation has two winners. The first beneficiaries are those who take out the loan and find that the higher price makes their debt worthless by comparing until it is virtually extinguished; exporters are also winners, because the drop in the local currency makes exports cheaper than foreign competitors. In addition, exporters receive hard foreign currency, which increases in value as the local currency declines.

Germany

The best known example of hyperinflation was in the Weimar Republic of Germany in the 1920s, and throughout the First World War, the amount of German paper marks increased fourfold. By the end of 1923, it had increased billions of times. From the outbreak of the war until 1923, the German Imperial Bank issued the 92.8 quintillion mark. In that period, the value of the mark fell to about four to one trillion dollars to the dollar.7 8

First, this fiscal stimulus has lowered export costs and increased economic growth.

When the war ended, the allies hugged Germany with another 13.2 billion mark in war reparations. Production collapsed, which led to a shortage of goods, especially food. The price of daily necessities doubled every 3.7 days as there was excess cash in circulation and there was little commodity. Inflation was 20.9% per day. While 10 farmers and others who produced goods did well, most lived in dire poverty or left the country.

Venezuela

The latest example of hyperinflation is Venezuela. Prices rose by 41 per cent in 2013 and by 2018 inflation was 65,000 per cent.11 in 2017, the government increased its money supply by 14%.1213 Bolivar has lost almost all its value against the US dollar, so it is promoting a new cryptocurrency,"Petro".14 it cannot afford the cost of printing new banknotes.

In response, people began to use eggs as currency. A carton of eggs was worth 250,000 bolivars compared with 6,740 bolivars in March 2017. The unemployment rate rose to more than 20 percent, similar to the US rate during the Great Depression.

Why not create Venezuela. Former President Hugo Chavez had enacted price controls for food and medicine. However, the mandated price was so low that domestic companies were forced to go out of business. In response, the government paid for imports. In 2014, oil prices plummeted, eroding revenue to government-owned oil companies. When the govt ran out of money, it started printing more.16

As of 2019, Venezuela's external debt is about $ 100 billion. The annual inflation rate of 17 consumer prices was 15,000% in the first half of 2020/18, the collapse of the economy continues, and the country faces a monumental problem of debt repayment. At the moment, it is the only country in the world suffering from true hyperinflation.

Zimbabwe

Zimbabwe experienced hyperinflation from 2004 to 2009. The government printed money to pay for the war in Congo. Drought and confiscation of farms also restricted the supply of food and other locally produced goods. The outcome of which hyperinflation was worse than in Germany. Inflation was 98% a day, and prices doubled every 24 hours. It finally ended when 20 countries changed their currency to the US dollar.21 22 23

United States

The only hour the United States ached from hyperinflation was in course of the Civil War when the Confederate government listed money to reimburse for the war.2425 if hyperinflation were to recur in America, the buyer price level would measure it. The current inflation rate shows that the United States is not approaching hyperinflation (it's not even in double digits).26 in fact, inflation may be too low, but mild inflation can be good for economic growth.

The Fed's main job is to control inflation while avoiding a recession. This is done by tightening or easing the money supply, an amount that is acceptable to the market.27 to tighten the money supply to reduce the risk of inflation while increasing the risk of inflation.28

The Fed has an annual inflation target of 2 percent. That's core inflation, leaving volatile oil and gas prices. They move up and down rapidly depending on commodity trading. It affects the price of food, where trucks carry long distances. For this reason, the CPI also removes food prices from the core rate of inflation .29

If the core inflation rate exceeds 2%, the Fed will raise the Fed's funds rate. It will use other monetary policy tools to strengthen the money supply and lower prices again.

Most of the funds sit in bank reserves fed into the banking system. It's not going into circulation. If the bank starts to lend, the Fed will be ready to raise the money sooner.

Hyperinflation that survives

Despite the scarcity of hyperinflation, many people are still worried about it. So, if it happens, what should you do? There are three ways to protect yourself against inflation of any kind. Sound financial habits help to survive hyperinflation.

First, be prepared by diversifying your assets well. You need to balance your assets between US stocks and bonds, international stocks and bonds, gold and other hard assets, and real estate.

Second, the passport. If hyperinflation abounds, the standard of living will be unbearable.

Third, make sure that you have a great variety of skills and talents. Hyperinflation requires a barter system when money is wasted. A wide range of practical skills will give you an advantage when trading.

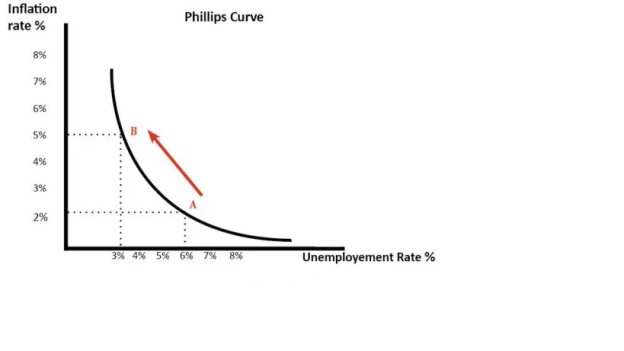

Look at the extent to which policymakers are facing trade-offs between unemployment and inflation. The Phillips curve urges that there is barter between inflation and unemployment, at least in the short duration. Other economists argue that the trade-off between inflation and unemployment is weak.

Why is there barter between unemployment and inflation?

If the economy experiences an increase in AD, it will cause increased output. As the economy nears full employment, we also experience a rise in inflation.

However, with the increase in real GDP, companies will employ more workers, which will lead to a decrease in unemployment (a decrease in unemployment due to lack of demand)

So, in the short term, economic growth is faster, so inflation is higher and unemployment is lower.

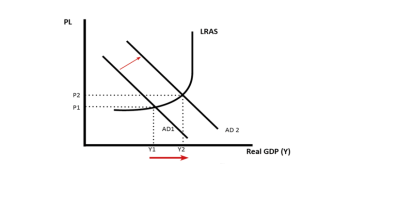

The increase in AD, which causes his Keynesian view of the as curve, suggests there could be a trade-off between inflation and under-demand unemployment.

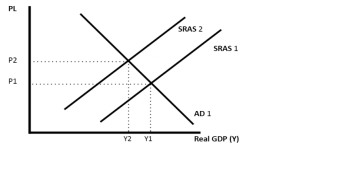

When AD rises from AD1 to AD2, real GDP rises. This increase in real output creates a decrease in employment and unemployment. However, the rise in AD also causes an increase in the price level from P1 to P2. (Inflation)

Increase in AD causing inflation

The Keynesian view of this AS curve suggests that there may be a trade-off between inflation and under-demand unemployment.

When AD rises from AD1 to AD2, real GDP rises. This increase in real output creates a decrease in employment and unemployment. However, the rise in AD also causes an increase in the price level from P1 to P2. (Inflation)

When AD rises from AD1 to AD2, real GDP rises. This increase in real output creates a decrease in employment and unemployment. However, the rise in AD also causes an increase in the price level from P1 to P2. (Inflation)

In this Phillips curve, the increase in ad is causing the economy to shift from point A to point B, while unemployment is falling, but the trade in higher inflation is falling.

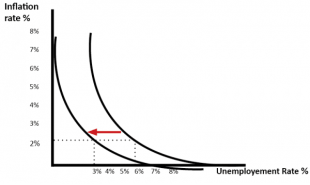

If the economy experiences inflation, the central bank can raise interest rates. Higher interest rates will reduce consumer spending and investment, resulting in lower aggregate demand. This fall in aggregate demand will lead to a decline in inflation. However, if real GDP falls, companies will have fewer employees and the unemployment rate will rise.

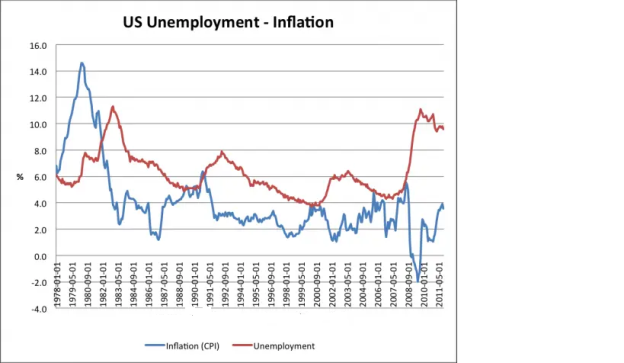

Empirical evidence behind the trade-offs

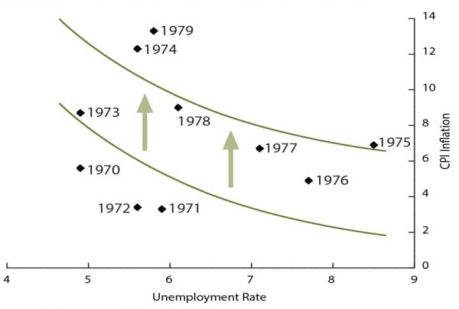

The Phillips curve is a measure of the relationship between unemployment and the rate of change in monetary wages in the UK between 1861 and 1957.W.It is based on Phillips ' findings. Note: Originally Phillips saw a link between unemployment and nominal wages

This graph shows the unemployment and inflation rates of the U.S. Economy. There is an opportunity for you to see the trade-offs.

To illustrate, between 1979 and 1983, we see inflation (CPI) fall from 15% to 2.5%. During this period, the unemployment rate has risen from 5% to 11%.

In the late 1980s, inflation dropped from 6.5% to 2.8%. But unemployment will rise from 5% to 8%%

In 2008, we saw inflation fall from 5% to twenty. During this time, the unemployment rate has risen sharply from 5% to more than 10%.

This suggests there may be a trade-off between unemployment and inflation.

But you can see other periods as well, and the trade-offs are hard to see.

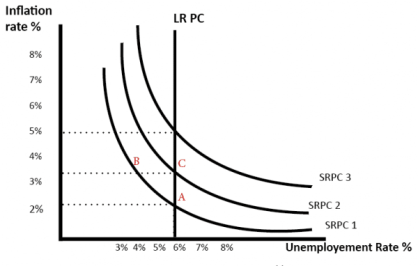

Monetarist view

The Phillips curve has been criticized by monetarist views. Monetarians argue that the increase in aggregate demand will only cause a temporary drop in unemployment. In the long run, higher AD will only cause inflation, and in the long run there will be no increase in real GDP.

Monetarists claim that LRAS are inelastic, and thus the Phillips Curve looks like this: rational expectations monetarists believe that there is no trade-off in the short term either. They believe that if the government or central bank increased the money supply, people would automatically expect inflation, so there would be no improvement in real GDP.

Falling inflation and falling unemployment

In some periods we have seen both lower unemployment and lower inflation. In the 1990s, for example, unemployment fell, but inflation remained low. This is possible without reducing unemployment and inflation. But we can argue that there is still a potential trade-off because there is a better trade-off, except that the Phillips curve has shifted to the left.

It also impacts on the part of monetary policy. If monetary policy is done well, it will avoid some of the business cycles we have experienced before, enabling sustainable low inflation growth, unemployment. It is also possible to have a rise in both inflation and unemployment. If there was a rise in cost push inflation, the total supply curve would shift to the left, there would be a decline in economic activity and an increase in prices. For example, during an oil price shock, you can have an increase in inflation (cost push) and an increase in unemployment due to low growth. But there is still a trade-off. Through higher interest rates, they are likely if central banks try to reduce cost-pushing inflation. But that would lead to an even greater rise in unemployment

Rising Inflation and Rising Unemployment

References

- Https://en.m.wikipedia.org/wiki/Macroeconomics

- Principles of Economics by N. Gregory Mankiw

- Foundations of Macroeconomics: Principles, Applications and Tools by Stephen Perez

- A Concise guide to Macro Economics by David A Moss