UNIT V

Open Economy

5.0 Open Economy

What is an open economy?

An open economy deals with other countries through different ways. So far, we have not considered this feature and have limited it to closed economies that have no connection to the world in order to facilitate analysis and elucidate the basic macroeconomic system. In fact, most modern economies are open. It has been done. There are three ways these connections are well established.

Production Market: The economy can trade and trade goods and services with other countries. This broadens preferences in the sense that customers and manufacturers can choose between domestic and foreign products.

Financial Markets: In many cases, the economy can buy financial assets from other countries. This gives investors the opportunity to choose domestic and foreign assets

Labor Market: Companies can choose where to put their manufacturing plants, and workers can choose where to work. There are several immigration laws that constrain the movement of labor between nations

Commodity movement has usually been seen as an alternative to the labor movement. We focus on the first two connections. Therefore, an open economy is said to trade with other countries in goods and services, often financial assets. Indians have access to goods manufactured around the world, for example, and some of the goods from India are exported to other countries.

When goods move across national borders, money must be used for trading. In international degrees, there are no currencies issued by banks. Foreign economic brokers and agents have been persuaded that the number of commodities they can buy in a definite amount of their currency does not change intermittently.

Capital flow

Purchase of foreign assets on the part of residents (= import of foreign assets) = export of capital.

Purchase of domestic assets on the foreign side (= export of domestic assets) = import of capital.

Example: A French buys Ford stock and a Japanese buys Greek government bonds.

Definition:

Net capital outflow (NCO = net capital outflow) = (export of capital-import of capital) = (purchase of foreign assets from residents-purchase of domestic assets from foreigners) =-capital transfer balance (BMC) = (domestic Asset Exports-Foreign

BMC> 0 (hence NCO <0) => if the country owes RoW: This gives us the position of the country's net responsibility to the line.

Factors Affecting Capital Flow

Interest rates paid on foreign assets

Interest paid on domestic assets

Economic or political risks associated with holding securities abroad or domestically

An exchange rate at which an economic agent can exchange domestic currencies for foreign currencies (spots and expectations).

Government policies affecting asset holdings (taxes, controls, restrictions ...)

Importance of capital flow

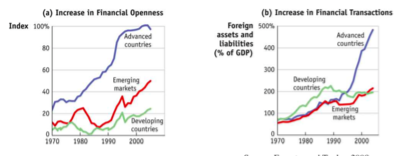

With the gradual liberalization of financial markets, it has become more and more important since the 1970s.

Net export

The value of a country's exports minus its value

Of its import

Also known as the trade balances

Trade surplus

Excessive exports beyond imports

Trade deficit

-Excessive imports for exports

Balance trade

Exports are equal imports

Factors affecting national exports, Imports and net exports:

-Domestic-Consumer preferences for overseas products

-Prices of domestic and foreign products

- Exchange rate

• People use domestic currency to buy foreign currency

-Consumer income at home and abroad

-Cost of transporting goods from country to country

-Government policy towards international trade

Export (EXP) = Acquisition by the rest of the world of goods and services produced on the territory of a country.

Import (IMP) = Acquisition of goods and services produced overseas by residents.

Net Export (NX) = Export-Import = Trade Balance (BC).

We will talk about the trade surplus when EXP> IMP (NX> 0) and the trade deficit when IMP> EXP (NX <0). When the trade balance is = 0, trade is in equilibrium.

Factors Affecting Net Exports

- Consumer preferences for domestic and foreign products

- Domestic and overseas product prices

- An exchange rate at which an economic agent can exchange domestic currency for foreign currency.

- Domestic and other global consumer income (row)

- Cost of transporting goods and services

- Trade policy

BALANCE OF PAYMENTS, DISEQUILIBRIUM AND CORRECTIVE MEASURES

Most of the exports and imports involve finance, i.e., receipts and payments in money. An account of all receipts and payments is termed, balance of payments. “The balance of payments of a country is a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given period of time” The term ‘residents’ is broadly interpreted as all individuals, businesses and governments and their agencies. International organizations are classified as foreign residents. Economic transactions which enter into the balance of payments record, involve transfer of goods and assets, or rendering services from residents of one country to the residents of the rest of the world.

The balance of payments record is maintained in a standard double-entry book-keeping method. International trade transactions enter into the record as credit and debit. The payments received from foreign countries entry as credit and payments made to other countries as debit. The balance of payments record is shown in table.

Receipts (Credits) | Payments (Debits) |

|

|

Trade Account Balance | |

2. Export of services | 2. Imports to services |

3. Interest, profits and dividends received | 3. Interest, profits and dividends paid

|

4. Unilateral receipts | 4. Unilateral payments |

5. Current Account Balance (1 to 4) | |

6. Foreign investment | 6. Investment abroad |

7. Short term borrowing | 7. Short term lending |

8. Medium and long term borrowing | 8. Medium and long term lending |

9. Statistical discrepancy (Errors and omissions) | |

10. Capital Account Balance (6 to 9) | |

11. Overall Balance = Current Account + Capital Account Balance (5 + 10) | |

12. Change in reserves (-) | 12. Change in reserves (+) |

Total receipts = Total payments | |

The balance of payments account is traditionally dividend into (i) trade account (ii) current account and (iii) capital account. However it can be vertically divided into many more components as per the requirements.

A. Trade Account Balance

It is the different between exports and imports of goods, usually referred as visible or tangible items. Till recently, goods dominated international trade. Trade account balance tells as whether a country enjoys a surplus or comprising consumer and capital goods always had an advantageous position. Developing countries with its exports of primary goods most of the time suffered from a deficit in their trade account except most of the OPEC countries. The balance of trade is also referred as the balance of visible trade or balance of Merchandise trade.

B. Current Account Balance

Current account includes Nos. 1, 2, 3 and 4 in table no.24.1. They comprise

- Export and import of goods which are traditionally referred as visible or tangible exports and imports.

- Export and import of services, also known as invisibles. Services include insurance, transport, banking, income from tourism, etc.

- Income received and paid in the form of interest, profits and dividends for lending or investing in other countries.

- Unilateral receipts or payments which are also referred as transfer payments include gifts, donations, private remittances etc, received by the residents or paid to residents of other countries. Such receipts and payments do not have any counter obligation i.e. they are received free.

C. Capital Account Balance

The capital account records all receipts and payments that involve the residents of a country changing either their assets or liabilities to residents of other countries. The transactions under this title involve direct investment, portfolio investment and borrowings and lendings from and to other countries.

Foreign Investments

Direct investment

Portfolio investment

Short term investment

Short term borrowing

Medium and Long Term Borrowings

Financial Accounts

D. Statistical Discrepancy (Errors and Omissions)

Statistical discrepancy (errors and omissions) reflects transactions that have not been recorded for various reasons and so cannot be entered under a standard hearing but must appear since the full balance of payments account must sum to zero.

E. Overall Balance

Overall balance is obtained by adding up current account and capital account balances.

F. Foreign Exchange Reserves

Foreign exchange reserves in item no.12 shows the reserves which are held in the form of foreign currencies usually in hard currencies like dollar, pound etc., gold and Special Drawing Rights (SDRs). Foreign exchange reserves are analogous to an individual’s holding of cash. They increase he has a deficit. When a country enjoys a net surplus in current and capital accounts combined, it results in a positive balance in overall balance is negative, it leads to decrease in reserves.

G. The Basic Balance

The basic balance is the sum of the current account and capital account, when the two sides of the current and capital accounts are equal i.e. when the difference between the two is equal to zero, the basic balance is achieved. An increase in deficit or reduction in surplus or a move from surplus to deficit is considered worsening of the basic balance.

H. Deficits and Surpluses

The balance of payments always balance in a technical or accounting sense(in a double entry record) The balance in the balance of payments implies that a net credit in any one of the items must have a counterpart net debit in another. When the total credits and debits of all accounts balance, we say the balance of payments balances.

I. Autonomous and Accommodating Capital Flows.

Autonomous flows take place in the ordinary course of foreign trade and they are independent of other items in the balance of payments. Accommodative flows take place to equalize the balance of payments.

Credits $ | Debits $ |

|

|

a) Autonomous exports (visible and invisible) 800 | a) Autonomous imports (visible and invisible) 1300 |

b) Autonomous unilateral receipts 100 | b) Autonomous unilateral payments 50 |

c) Autonomous capital receipts 300 | c) Autonomous capital payments 150 |

2. Accommodating receipts 1500 | 2. Accommodating payments Nil |

1500 | 1500 |

DISEQUILIBRIUM

A disequilibrium in the balance of payments is the result of imbalance between receipts and payments for exports and imports.

A. Causes of Disequilibrium

Increase in Imports

- Import of essential goods and services

- Development Programmes

- Population Growth

- Demonstration Effect

Low or Decline in Exports

5. Low income Elasticity of demand

6. Discovery of substitutes

7. Protectionist trade policy

8. Modernization

CORRECTIVE MEASURES

Measures to control deficit in Balance of payments

A. Devaluation

Devaluation aims at influencing the prices of only traded goods and not the general price level. Devaluation refers to an official announcements or an act of monetary authority through which the exchange rate is changed i.e. the value of domestic currency is reduced vis-à-vis foreign currency. For example, if the existing rate is Rs 60 = $1.

B. Depreciation

Depreciation like devaluation lowers the value of domestic currency or increases the value of the foreign currency. Depreciation of a currency takes place in free or competitive foreign exchange market due to market forces. An existing exchange rate, say Rs 60 = $1 may depreciate to Rs70 or more.

C. Deflation

Deflation refers to the process of decline in general price level. It was a method adopted under gold standard.

Deflation leads to expenditure adjustment that is, people in that country spend money mainly on domestic goods and services and less on imports.

D. Direct Controls

- Tariffs:

Tariffs are the duties (taxes) imposed on imports. When tariffs are imposed the prices of imports would increase to the extent of tariff the increased prices will reduce the demand for imported goods and at the same time induce domestic producers to produce more of import substitutes. Non- essential imports can be drastically reduced by imposing a very high rate of tariff.

2. Quotas:

To reduce imports for correcting the deficit in the balance of payments, the government may introduce restrictions on the quantity or volume of goods imported. Quotas may be different types: i) the tariff or custom quota, ii) the unilateral quota iii) the bilateral quota iv) the mixing quota and v) import licensing.

3. Export Promotion:

The government is required to devise special policy measures to promote exports. Some of the important incentives than the government usually offers are: i) subsidies ii) Tax concessions iii) grants iv) other monetary or non-monetary incentives.

4. Import Substitution:

Industries which produce import substitutes require special attention in the form of various concessions, which includes i) tax concession ii) technical assistance iii) subsidies iv) providing scarce inputs etc.

Savings and investments in a small open economy

Income in an open economy includes net element payments-commodity markets equilibrium.

Y + NF P = C

d + I

d + G + NX + NF P = C + I + G + CA

Savings = investment + current account balance

S d = Y + NF P T C d + (T G) = I d +

Y + NF P = C d + I d + G + NX + NF P = C + I + G + CA

Savings can increase net foreign assets through current account surp

Interest rates in a small open economy are determined, not in the global market

In a small open economy

Graph-horizontal excess of savings beyond investment in global interest

The rate is in the current account surplus

- Shock to change desired investment

- Shock to change desired savings

National wealth = capital + net foreign assets (NF A) sovereign debt crisis

The country can be rented in the international market, so S d I d = C, International creditors are only condensed that the country can repay the debt it owes.

Intergovernmental budget constraint due to debt balance (B):

Further tax increases as well as e current and future spending,

But to pay the initial debt

Future debt grows (reduces) as taxes fall below government spending and debt interest payments will raise government spending and lower taxes to meet the needs of policies, assuming the economy is going into recession today

Recession means that the government will increase its debt. Moreover, the government has no reliable means it will be future expenses and future taxes for the promised disconnection.

What is the response of international creditors?

What is the response of the domestic government? Or assume the world interest rate sovereign debt crisis of the 1980s

(1) The country had high debt due to the oil price shock in the 1970s.

(2) Partially borrowing investment that exceeds savings

- Reductions of inspiration by US monetary policy raised global interest rates and reduce LDC exports, thereby causing a global recession. Reduce income and tax revenue

- The country had to pay interest and maturity debt

- As long as the country is in debt, it cannot even provide services (interest +Mature debt), cannot be borrowed in the international market

Mexico 1994

▲ Mexico had big CA deficits.

- Big I meant rapid growth and ability to repay

- The government has made recent reforms to reduce the budget deficits.

- NAFTA fueled growth expectations

- Crisis Trigger-Political instability questioned investors

- Governments Can Sustain Reforms-Governments Really Offer

- Low Gf and high Tf

Savings and investments in a large open economy

Suppose the world has two countries, a domestic country and a foreign country. These "countries" are relatively similar in size, probably with the United States, Europe. The equilibrium of the global goods market determines the world interest rate.

Graphically - Determine Global Interest Rates and Balance of Payments for each country. The world checking balance must be zero. Policy effect to reduce our savings

1970s- Significant increase in OPEC savings due to high oil revenues. In the early 1980s, US savings were significantly reduced.

Fiscal policy and current account balance

What is the current tax cut effect for my current account?

Tax cuts cannot occur alone, as it would violate the government budget Constraints. We do not know if it will be adjusted in the future to guarantee that the budget. The constraint is retained. Or in some cases we have the government It will not fail to adjust future policies and result in default. For now suppose the government is certain to repay. Let's say the tax cut is o§ set by a future tax increase.

- Consumption depends on the present value of taxes and is not there changes in the present value of taxes do not change consumption.

- There is no effect in your savings or checking account.

- There is an increase in the current budget o§ set to deficit

The future with a budget surplus ñ If the drug has liquidity constraints, its tax cuts may increase consumption and we will have a budget deficit and a balance of payments deficit, Stvin-Diesit”

Let's make the tax cuts set by future government spending cuts offs:

- Since the present value of taxes is decreasing, consumption will increase. We have a current account deficit and a budget deficit, štwin de Öcits. "

- If government spending falls in the next period, it will be the current one -Account surplus and budget surplus “Twin surplus “.

Introduction:

One of the key facts about the world economy today is the high degree of integration or link between financial or capital markets.

Households, banks, or businesses in different countries search for the best returns (of course, adjusted for risk) around the world.

As a result, the returns or yields of capital markets in different countries are linked together. For example, if India's interest rate or return on equity rises compared to that of the United States, US investors will try to lend or invest in India to take advantage of higher returns. Borrowers, on the other hand, will borrow money from the US financial markets and head to the US to take advantage of lower rates of return.

As a result of full mobility, the rate of return on capital tends to be equal in the financial markets of different countries. It was modeled by Robert Mundell, a professor at Columbia University in the 1960s, and the late Marcus Fleming, an IMF economist.

They assume:

(1) Small open economy

(2) The tax rate is the same everywhere

Under these conditions, we seek to invest in assets in any country that provides the perfect mobility and highest returns for capital investors and foreign asset holders. This will force return on assets to be equal everywhere in the international capital markets, as everyone will invest with low returns.

However, it can be noted that the perfect equalization of returns in different countries depends decisively on the full mobility of capital and the twin assumptions of fixed foreign or global interest rates in the economy. In fact, the Mundell-Fleming model assumes a small, open economy that cannot influence global interest rates.

Optimal Capital Transfer "It is mobile globally because you can buy assets in any country of your choice, with low transaction costs and fast purchases for unlimited amounts. Being mobile, asset holders can move large amounts of money across national borders in search of the highest returns or lowest borrowing costs. "

The small open economic belief with full reserves movements play a major role in the Mundell-Fleming model. The belief of a tiny open economy means that it can lend as much as it wants in the world of money markets without influencing the interest rate. Therefore, in the case of a small open economy, interest rates are determined by global interest rates.

Mathematically, this assumption can be made as follows:

r = rf

Where r represents the domestic interest rate in the economy and rf represents the world interest rate. It is the perfect mobility of capital that equalizes the domestic interest rate (r) to the world interest rate. If the domestic interest rate is lower than the world interest rate due to some event or economic policy, the capital outflow will return the domestic interest rate to the world interest rate.

On the other hand, if the domestic interest rate exceeds the world interest rate due to some event or policy, the capital inflow will lower the domestic interest rate to the level of the world interest rate. Therefore, the formula r = rf expresses that the flow of international capital quickly equalizes the domestic interest rate to the world interest rate.

The Mundell-Fleming model centers on the exchange rates in deciding national income in the short run, as domestic interest rates are determined by global interest rates. Major feature of the Mundell-Fleming-model is that economic behavior relies on whether it adjusts a specified exchange rate system or a flexible exchange rate system.

In the following, we will first explain under the Mundell-Fleming model when the economy operates under a fixed exchange rate system, and then analyze the model when the economy adopts a flexible exchange rate system.

A Mundell-Fleming model of a compact open economy with full reserves mobility can be described by the following equation for the IS and IM curves:

Is an equation:

Y = C (Y-T) + I (rf) + G + NX (R))

LM equation:

M / P = L (rf, Y)

The IS equation describes the commodity mark equilibrium and the second LM equation describes the financial market equilibrium. G and Tare are variables determined by fiscal policy, M is a variable in monetary policy, and they are important exogenous variables. Price P and the world interest rate (r4) are other extrinsically given variables.

For the interest rate given, the intersection of the IS and LM curves determines the level of national income in which both the goods and financial markets are in equilibrium. In the case of a floating exchange rate system, the equilibrium between the two markets also determines the exchange rate.

However, the Mundell–Fleming model is based on the same conditions that cannot be won in the real world. First, there are tax differences that impede capital movements in response to interest rate disparities between countries.

Second, exchange rates between different currencies can sometimes change significantly, affecting the dollar's return on foreign investment. Finally, the country defaults when adopting measures to limit capital outflows or simply making payments. These are some of the reasons why interest rates in different countries are not equal.

Mundell-Fleming model of a small open economy with a fixed exchange rate system: Monetary policy impact:

Major impact of the Mundell-Fleming chain model under a fixed exchange rate rules that the central bank of a country cannot follow monetary policy. Under perfect mobility, interest rates in different countries are very high. Small differences will cause endless capital flows that will change the balance of payments.

These changes in the balance of payments affect the exchange rates between the currencies of different countries, which eliminate interest rate differentials. Let me give you an example. The central bank of the country will tighten its monetary policy to raise interest rates on the economy. With the adoption of this policy, as interest rates in the economy rise, foreigners will shift their investment funds to this country in order to take advantage of higher interest rates.

The huge inflow of capital will raise the exchange rate of domestic currencies, which means that the currencies of countries that have adopted higher interest rate monetary policy will be grateful. This currency appreciation will block exports and encourage imports that adversely affect the balance of payments.

This forces the central bank of a country that is committed to maintaining a fixed level exchange rate that intervenes to prevent the exchange rate of the country's currency from rising.

To prevent the currency from rising, the central bank buys foreign currencies and calls them the US dollar. This will lead to increased foreign exchange reserves with central banks that issue more national currencies in response to increased foreign exchange reserves.

As a result, the money supply in the economy expands and interest rates fall. Therefore, given the full mobility of capital and fixed exchange rates, domestic interest rates are being pushed back to their initial levels.

To quote Dornbusch and Fischer again, "Under fixed exchange rates and perfect capital movements, the country cannot be set apart from what is dominant in the world market. Independent monetary policy attempts are in the flow of capital. We need to connect and intervene until interest rates match those of the global market. "

From the above, considering the high mobility of capital in each country, interest rates do not change much. Differences in interest rates above the point will result in a flow of capital across countries that tend to offer world-class yields on all of them.

Expanded monetary policy under fixed exchange rates and full capital movements:

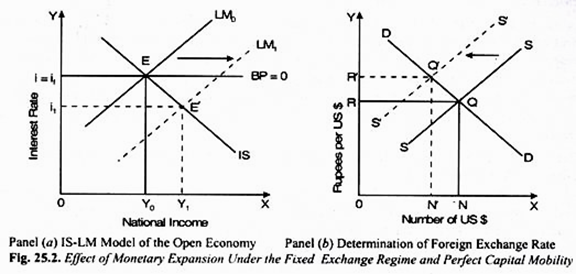

Here, let's analyze the effect of currency expansion under a fixed exchange rate system using the IS-LM model. Consider Figure 25.2. In panel (a), the is curve, the LM curve, and the horizontal straight line BP are drawn. If the country has no balance of payments deficit or surplus, that is, the balance of payments is in equilibrium, then (i = if) shoes, the horizon BL = 0 at the domestic interest rate i is equal to the foreign interest rate.

Other interest rates create large capital flows that cause balance of payments imbalances and force central banks to intervene to maintain exchange rates. I think to explain this. Let's adopt the government and look at the economy in the panel (a) of the figure to expand policy finance. 25.2 is first at the point E where the given IS-LM curve intersects at e, which determines the domestic interest rate i equal to the foreign interest rate.

With the expansion of finance, the LM curve shifts to the right, resulting in the economy moving to a new equilibrium position E'where domestic interest rates have fallen to i1. In the new position, the economy will have a large balance of payments deficit that puts pressure on the depreciating domestic currency exchange rates.

The determination of the exchange rate is shown in panel (b) of the figure. 25.2 First the demand curve DD and the US dollar supply curve SS determine that the exchange rate is equal to or (i.e., the number of rupees per US dollar). As a result of the expansion of the money supply, the LM1 curve shifts to the right to the new position LM, resulting in a large capital outflow as the domestic interest rate falls to i1 (panel (a) in Figure 25.2)

.

.

These capital outflows reduced the supply of the US dollar in the foreign exchange market, resulting in the US dollar supply curve shifting to the left to s'S'(panel (b) in Figure 25.2) and the new exchange rate R'(i.e., i.e.). Brings more rupees per US dollar). To maintain this exchange rate rising to the US dollar per pound, the country's central bank intervenes, which sells foreign exchange reserves in the forex market.

Therefore, the supply of domestic money supply in the economy will decrease. As a result of this decline in the domestic money supply, the LM curve shifts back to the left [see panel (a) in the figure. 25.2], this process of contraction of the money supply and the accompanying shift back of the LM curve to the left continues until the initial equilibrium at E is reached again.

In fact, with perfect capital movements, the economy is unlikely to reach a new equilibrium congruence E'. This is because the response of capital flows is so large and rapid that central banks are forced to quickly reverse the initial expansion of the money supply before reaching the new equilibrium of e'. Reduction of Money Supply in Fixed Exchange Rate System:

Conversely, if the central bank adopts a money supply contraction policy, the LM curve shifts to the left of the initial equilibrium point E. Given the IS curve, the new equilibrium will be reached at domestic interest rates, which are higher than foreign interest rates. This will trigger a large inflow of capital that will increase the demand for the domestic currency, and as a result, the domestic currency will be grateful.

To maintain the exchange rate, the central bank will buy foreign currency and give it domestic currency in exchange. As a result, central banks are forced to expand their money supply, which shifts the LM curve to the right and eventually returns the domestic economy to an initial equilibrium.

Conclusion:

The above survey of the Mundell-Fleming model under a fixed exchange rate system shows that if capital signs are done, interest rates in the home country cannot deviate from interest rates abroad. Under a fixed exchange rate regime, due to the full mobility of capital, monetary policy in a small open economy has no effect on affecting national income (output) and employment levels.

Any attempt by a country's central bank to lower interest rates by expanding the money supply will lead to a large outflow of capital that tends to cause depreciation of the home currency. Central banks, which are obliged to keep the exchange rate at a certain level, will buy domestic currency in exchange for foreign currency.

This will reduce the money supply to its original level when the domestic economy regains equilibrium at the initial level. This shows that under the fixed exchange rate system, the central bank of the country cannot implement independent monetary policy.

Mundell-Fleming-Model: The Role of Extended Fiscal Policy in the Fixed Exchange Rate System:

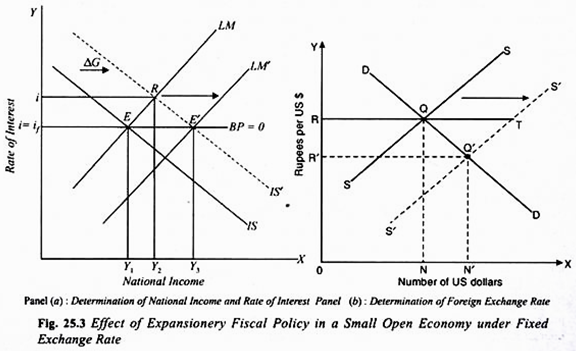

Expanded monetary policy under the fixed interest rate regime is not very effective in influencing people's income and production, but given the full mobility of capital, fiscal policy is very effective. Is there. To illustrate this with the open economy IS-LM model, consider Figure 25.3.

Temporary recruitment- The government will provide expansionary fiscal policy. From panel (a), we can see that increased government spending causes a shift to the right of the is curve to the new position IS'. As can be seen from panel (a), this raises both interest rates and national income levels (outputs). Domestic interest rates, which are high compared to world interest rates (if), will cause capital inflows into the economy.

These capital inflows will bring appreciation at the exchange rates of national currencies. The exchange rate determination is shown in panel (b) of Figure 25.3. From panel (b), it is observed that the foreign exchange (i.e. US dollar) supply curve shifts from SS to S's to the right as a result of capital inflows.

The new exchange rate supply curve S's' intersects the forex demand curve at point Q to determine a lower new exchange rate R'(rupees per US dollar). This means that there is a rupee appreciation. To maintain the R exchange rate, the central bank must expand the money supply, shift the LM curve to the right, and further increase national income.

From panel (a) in Figure 25.3., The money supply has increased significantly, the LM curve has shifted to the new position LM', domestic interest rates have returned to their original levels, and are once again equal to world interest rates (I = if). You can see. Thus, in this case, interest rates remain substantially fixed at a given level as the money supply grows endogenously to maintain the exchange rate. Fiscal expansion leads to an increase in national income by y1y3, which is equal to Keynes's multiplier effect.

Conclusion:

The conclusion of the above analysis is that the commitment to maintain a fixed exchange rate makes changes in the money supply intrinsic. Through that intervention, the central bank may have to sell or buy foreign exchange so that it can maintain a fixed-level currency exchange system.

Central banks under a fixed exchange rate system with full capital movements cannot implement independent monetary policy to achieve stability in the domestic economy. However, the government can use extended fiscal policy to raise the level of national income and employment.

Mundell-Fleming model for a tiny open economy under ductile exchange rates:

Here we use the Mundell-Fleming model to explain how monetary and fiscal policies in a small open economy work in the presence of a fully flexible exchange rate regime and full capital movements. Exchange rates are fully flexible, but domestic prices are assumed to remain fixed.

It is important to note that under a flexible exchange rate regime, central banks do not intervene in the forex market. The exchange rate is adjusted to balance the supply and demand of foreign exchange. Therefore, under a flexible exchange rate system, the balance of payments must always be in equilibrium without the intervention of a central bank, that is, there is no deficit or surplus.

This means that the current account deficit must be covered by the inflow of private capital. Conversely, the current account surplus must be balanced by capital outflows.

The second important result of a fully flexible exchange rate regime is that under it the central bank can pursue independent monetary policy, i.e. freely expanding the money supply in response to the assessment of the needs of the domestic economy. Or it can be reduced. Under flexible exchange rates, there is no obligation for the central bank to intervene, so there is no relationship between the balance of payments and the money supply in the economy.

In the Mundell-Fleming-model, the assumption of full capital movement guarantees that the balance of payments is zero, or equilibrium (BP = 0), at the only interest rate equal to the world interest rate (i = if). Other interest rates affect the capital flow of the domestic economy, causing changes in the real exchange rate.

Assuming that domestic and foreign commodity prices (p and pf) are constant, a decline in domestic interest rates below the world interest rate (i.e. if) causes unlimited capital outflows, and the aggregate exchange rate is an open economy. Is a determinant of net exports (NX) influencing aggregate demand in, and therefore the level of an open economy is a curve (curve: Y = (Y, i) + NX (Y, Yf R) here. R represents the real exchange rate and represents the net export NX).

Now, the fall in the exchange rate following the capital outflow at i <if will raise exports, reduce imports and cause an increase in net exports (NX). Increased net exports shift the curve to the right, thereby affecting national income and output.

Conversely, if i> if, there is an unlimited capital inflow that causes the exchange rate to rise, reducing exports and increasing imports, thus leading to a decrease in net exports (NX). A decrease in net exports (NX) due to rising exchange rates causes a shift to the left of the IS curve, thus affecting national income and production.

In a small open economy with international connections from the perspective of trade in goods and capital flow, an open economic model under a flexible exchange rate system consists of the following three equations:

IS curve: Y = A (Y, i) + NX (Y, Yf, and R) (i)

BP = NX (Y, Yf R) + CF (I – if) (ii)

i = if (iii)

Where CF stands for capital flows.

CF stands for capital flow.

In this Mundell-Fleming linkage model of a small open economy under a flexible exchange rate regime, the following factors and the impact of policies on national income (output), interest rates and exchange rates are explained below.

1. Exogenous increase in exports

2. Fiscal policy

3. Monetary policy

Extrinsic increase in exports under flexible exchange rates:

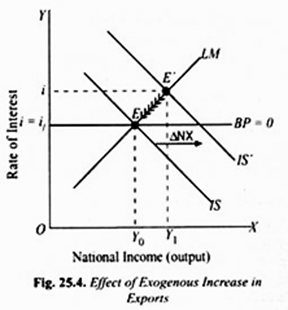

The impact of the exogenous increase in exports is, for example, due to the increase in global demand for our commodities, as shown in Figure 25.4. Initially, the economy is equal to y0 national production and global interest rates if Equilibrium at point E with interest rate i equal to (i = if). When there is an extrinsic increase in our exports, the curve shifts to the right to IS'.

Impact of exogenous increase in exports

Now, what's new is the "curve profit LM curve" where both commodities and financial markets are clear. It can be noted that at this new equilibrium point, e', national income will increase. An increase in national income also causes a rise in equilibrium interest rates that exceeds the world interest rate if.

Such a rise in domestic interest rates leads to capital inflows that put pressure on exchange rates. As mentioned above, the influx of these capitals causes the domestic currency to be highly valued. Rising exchange rates will make our exports relatively expensive and import cheaper than before. As a result, demand will shift from domestic goods, resulting in a decrease in net exports (NX).

In Figure 25.4, the IS curve shifts back to the left due to the rise in exchange rates and the consequent decline in net exports. Capital inflows continue, net exports continue to decline as a result of rising domestic currencies, the is curve returns to its original level, and the equilibrium between national income and production is at the OY0 level, which is consistent with the financial equilibrium at global interest rates. Until it recovers

Conclusion:

From the above, under the condition of full capital movement, the increase in exports of a small open economy will not have a lasting effect on the equilibrium level of national income and production. An increase in net exports (NX) raises interest rates through rising levels of national income.

This will induce capital inflows that will lead to higher exchange rates and reduce net exports. This counteracts the impact of the early exogenous increase in national exports on national income.

Effect of extended fiscal policy on a small open economy under flexible exchange rates:

The Mundell-Fleming chain model can be used to analyze the effects of extended fiscal policy on a small open economy under a flexible exchange rate system. Expanded fiscal policy has the same effect as an exogenous increase in exports. Under extended fiscal policy, government spending will increase or taxes will be reduced.

This fiscal expansion will lead to an increase in aggregate demand and will shift the IS curve to the right. Given the LM curve, this induces rising interest rates and capital inflows into the economy. These capital inflows lead to higher exchange rates.

The rise in the exchange rate due to such a rise in interest rates leads to a decrease in exports and an increase in imports. The result is a decline in net exports, which completely offsets the impact of fiscal expansion on national income and production.

We come to an important conclusion from the above analysis. Real turmoil, such as exogenous increases in exports, increased government spending, and tax cuts, does not affect income equilibrium levels in a small open economy under a flexible exchange rate system with full capital movements. ..

Under the fixed exchange rate regime, expansive fiscal policy in a small open economy is very effective in raising the level of national income. However, under a flexible exchange rate system with full capital movement conditions, the equilibrium level of total income or production is not affected as a result of extended fiscal policy.

Under flexible exchange rates, fiscal expansion causes exchange rates to rise, exports to decline and imports to rise, leading to a shift in the composition of domestic demand towards foreign goods and away from domestic goods.

Mundell-Fleming Model: Expanded Monetary Policy in a Small Open Economy under Flexible Exchange Rates:

In contrast to the expansionary fiscal policy, in the Mundell-Fleming model, expansionary monetary policy under a flexible exchange rate system is very effective in raising the level of national income or production. This positive impact of the expansion of the money supply on domestic production levels is brought about by causing the exchange rates of domestic currencies to fall.

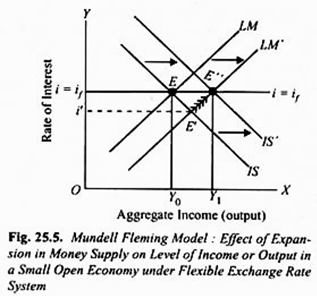

Consider Figure 25.5, where we should start and determine the level of interest and national income Y0 and interest rate i at LM curve point E, (i = if). Where the name of the money supply M is suppose there is an increase in quantity.

This causes an oversupply of the actual money balance at equilibrium point E. To restore equilibrium, interest rates must fall or total income must rise. As a result, the LM curve shifts to the right with respect to the new position LM'. The new LM'curve intersects the original IS curve at the new point E'.

Comparison:

For a small open economy, it is interesting to compare the impact of the expansion of the money supply under a flexible rate system with the impact under a fixed exchange rate system. Under a fixed exchange rate regime, expanding monetary policy has no effect on raising national income or total production.

Attempts to increase the money supply will reduce interest rates below the global interest rate, which causes unlimited capital outflows. These capital outflows lead to a reversal of the increase in the money supply, eventually restoring economic equilibrium at early levels of income or production.

On the other hand, under a flexible exchange rate system without central bank intervention, the above-mentioned increase in money supply will not reverse in the foreign exchange market. Capital outflows in the foreign exchange market following a decline in interest rates below the global interest rate will lead to depreciation of domestic currencies.

This depreciation will increase exports, decrease imports and increase net exports (NX). Therefore, income or output growth actually occurs assuming a fixed price. Therefore, the central bank's ability to control the money supply under flexible exchange rates is an important effect of flexible exchange rate systems.

Beggar Neighbor Policy and Competitive Depreciation:

We have seen that the above expansionary monetary policy causes the depreciation of domestic currencies, which in turn increases net exports and thus the income and employment of the economy. The depreciation of domestic currencies causes a shift in demand from foreign goods to domestic goods.

As a result, income (or output) and overseas employment will decrease. That is, one country benefits at the expense of the other. Therefore, the expansion of net exports, and thus the expansion of income and employment as a result of depreciation, is called the policy of your neighbor of beggars. That is, the increase in production and employment in one country is done by causing unemployment and loss of production in another country.

From the above, it is said that the decline in the exchange rate is mainly a method of shifting the demand from foreign products to domestic products, rather than raising the level of global demand. Can play an important role in promoting economic stability at the full employment level when at different stages

That is, some are in the boom phase and are experiencing full employment, while others are in the recession phase of the business cycle. In this case, if a country experiencing a recession depreciates its domestic currency; foreign demand will shift to domestic products. In this way, this will remove the divergence from full employment in each country.

However, as a result of the global recession in the early 1930s and the oil shack in 1973, it has been witnessed that the business cycle is much synchronized, such as the exchange rate adjustment in 2001-03.

For example, if the level of aggregate global demand is insufficient, the decline in exchange rates by each country will only affect the distribution of global demand given among countries, raising the level of global demand for goods and services. It doesn't help. In other words, exchange rate adjustments by country, experiencing a recessionary situation are simply a policy of diversity for your neighbors of beggars.

Of course, depreciation of domestic currencies from the angle of individual countries can shift foreign demand to it and increase its output and employment. But in one country, its output and employment can be cheap, currency, and so on. This competitive depreciation will capture the growing global demand in different countries and bear the cost of goods.

What is an interest rate?

Interest rate is the amount charged by the lender for the use of the asset, expressed as a percentage of the principal. Interest rates are listed on an annual basis, commonly known as the Annual Percentage Rate (APR). Borrowed assets can include cash, consumer goods, or large assets such as vehicles and buildings. Understand interest rates

Interest is essentially a rental or lease fee to the borrower to use the asset. For large assets such as vehicles and buildings, the lease rate can act as an interest rate. If the borrower is considered low risk by the lender, the borrower is usually charged a lower interest rate. If the borrowers are considered high risk, the interest rates they will be charged will be high. Risk is usually assessed when a lender sees a potential borrower's credit score, which is excellent if you want to qualify for the best loan

For loans, the interest rate applies to the principal, which is the amount of the loan. Interest rates are the rate of debt costs for borrowers and returns for credits.

When will interest rates apply?

Interest rates apply to most loan or borrowing transactions. The college tuition fees for the home where you purchased your personal debt, the start or fund business of a fund business, or the payment of your personal debt are as follows: Companies fund capital projects and obtain loans to expand their business by purchasing fixed and long-term assets such as land, buildings and machinery. Borrowed money will be repaid in one lump sum on a pre-determined date or in regular installments.

The money repaid is usually more than the amount borrowed, as the lender needs compensation for the loss of money use during the loan period. The lender may be investing money during that period rather than offering a loan that would be generating income from the asset. The difference between the total repayment total and the original loan is of interest to be fulfilled. The interest charged will be applied to the principal amount.

Compound interest rate

Some lenders prefer the compound interest rate method, which means the borrower pays more for interest. Interest, also known as compound interest, applies not only to the principal, but also to the cumulative interest of the previous period. The bank assumes that at the end of the first year, the borrower bears the principal and interest of the year. The bank also assumes that at the end of the second year, the borrower bears principal plus first year interest plus first year interest.

The interest paid at the time of compounding is higher than the interest paid using the simple interest method. Interest is charged monthly on the principal, including accrued interest from the previous month. For short time frames, the calculation of interest is similar in both ways. However, as lending time increases, the gap between the two types of interest rate calculations increases.

Compound interest=p× [(1+interest rate) n−1] where: p=principaln=number of

Compounding periods

How Interest Rate Differentials

The Forex market is the largest and most liquid market with nearly $ 5 trillion day traders. There are many drivers for a particular currency pair. The most attractive is the interest rate differential. The difference in short-term or long-term interest rates of the countries that make up a currency pair is used to create a forward rate and, in the long run, helps drive the direction of the currency pair. Most professional traders find that with the bond market. While keenly aware of how it affects the currency market, many novice traders are wondering how interest rates make up the forward curve of currency market dynamic interest rates.

When you buy or sell a currency pair, you buy one currency and sell another at the same time. Most of the global currency transactions are in the spot market. Spot market transactions will be settled within 2 business days. If you are interested in holding currency trading longer than 2 business days, you need to trade futures trading. Forward contracts add forward points to currency pairs that are traded for three days or more.

To calculate the forward rate, currency traders use the rate of interest differential. This is the difference in short-term interest rates for every of the countries that structure a currency pair. For example, if you buy a US dollar / yen currency pair, you will receive a US dollar interest rate and you will have to pay the Japanese short-term interest rate.

Certain things are added or subtracted from it. First, you need to determine which rate is higher. Currently, US dollar interest rates are above Japanese interest rates. Using the USD / JPY purchase example, you would deduct the forward points from the rate that offers the new rate that incorporates the forward points.

How will it affect interest rate differentials?

There are several factors that drive interest rate differentials. Clearly, changes in monetary policy are key to changing national interest rate levels. Changes in economic data are also an important factor as market power raises interest rate levels. This allows you to follow the economic calendar to determine if there are any specific events that will drive future rate directions. In addition to economic events and policy changes, political conflicts can also raise interest rate levels. If there is uncertainty in a country, the market will demand more from the country to lend them money.

Bond markets in most developed countries move in parallel with each other. Most developed bond markets move in tandem when certain events have plenty of opportunities to change the course of interest rates in a country, but when there is little new information available. Historically, the US bond market has been the driving force behind most of the global rate movements.

How will interest rate differentials affect currency pairs?

Interest rate differentials can be profitable or deterrent when you decide to buy or sell a currency pair. For example, if you plan to buy or sell dollars / yen for two years, you will receive 2.68% for buying dollars or 2.68% for buying yen and selling dollars. This is because the US 2-year yield is 2.50% and Japan's 2-year yield is -0.18%. If you buy dollars and nothing happens for 2 years, you will get 2.68%. If you buy Japanese Yen and sell Dollars and nothing happens for 2 years, you will lose 2.68%

Chart interest rate differentials

One of the best ways to follow interest rate differentials is to graph it. Each currency pair reacts differently to changes in interest rate differentials. It's important to remember that the diff works in tandem with the currency pair, so we're trying to see what the future interest rate diff will be.

From the US 10-year yield and Japanese 10-year government bond yield charts, you can see that the interest rate differential is traded in conjunction with the US dollar / yen currency pair. There are times when two assets diverge, but over time they move in parallel with each other.

Many people are asking the question, do rate differences drive currency pairs, or currency pairs drive interest rate differences? The answer is both, as the interest rate differential constitutes the forward rate. What you want to evaluate as a trader is whether the currency pair is moving in one direction and whether the interest rate differential is moving in the other direction.

Overview

Interest rate differentials are the fundamental driving force behind the movement of currency pairs. Interest rate differentials make up the currency forward curve and are therefore an integral part of currency trading. Monetary policy, economic events, and political conflicts are key factors driving interest rates. To get a gauge of where the interest rate differential is relative to a currency pair, you can graph the two. What you are looking for is a divergent interest rate differential and currency pair path that may give you a clue as to the future direction of the currency pair.