Unit 5

Imperfect Market Structure

The word monopoly has been derived from the combination of two words i.e., ‘Mono’ and ‘Poly’. Mono refers to a single and poly to control.

Thus, monopoly refers to a market situation in which there is only one seller of a commodity.

In monopoly market, single firm or one seller controls the entire market. The firm has all the market power, so he can set the prices to earn more profit as the consumers do not have any alternative.

Definition

“Pure monopoly is represented by a market situation in which there is a single seller of a product for which there are no substitutes; this single seller is unaffected by and does not affect the prices and outputs of other products sold in the economy.” Bilas

“Monopoly is a market situation in which there is a single seller. There are no close substitutes of the commodity it produces, there are barriers to entry”. –Koutsoyiannis

“A pure monopoly exists when there is only one producer in the market. There are no dire competitions.” –Ferguson

Features

- One seller and large number of buyers -in a monopoly one seller produces all of the output for a good or service. The entire market is served by a single firm. For practical purposes the firm is the same as the industry. But the number of buyers is assumed to be large.

2. No Close Substitutes - There is no close substitutes for the product sold by the monopolist. The cross elasticity of demand between the product of the monopolist and others must be negligible or zero.

3. Difficulty of Entry of New Firms - There are restrictions on the entry of firms into the industry, even when the firm is making abnormal profits. Other sellers are unable to enter the market of the monopoly

4. Profit maximizer: a monopoly maximizes profits. Due to the lack of competition a firm can charge a set price above what would be charged in a competitive market, thereby maximizing its revenue.

5. Price Maker - Under monopoly, monopolist has full control over the supply of the commodity. The price is set by determining the quantity in order to demand the price desired by the firm. Therefore, buyers have to pay the price fixed by the monopolist.

Causes for monopoly

- Natural: On account of some natural causes a monopoly may arise. Only in certain regions some minerals are available. For example, South Africa has the monopoly of diamonds; and oil in Middle East. This is natural monopoly.

2. Technical: Monopoly power may be enjoyed due to technical reasons. A firm may have control over raw materials, technical knowledge, special know-how, scientific secrets and formula that enable a monopolist to produce a commodity. e.g., Coco Cola.

3. Legal: Monopoly power is achieved through patent rights, copyright and trade marks by the producers. This is called legal monopoly.

4. Large Amount of Capital: Some goods require a large amount of capital. To invest such a large amount of capital all firms cannot enter the field because they cannot afford it. This may give rise to monopoly. For example, iron and steel industry, railways, etc.

5. State: Government will have the sole right of producing and selling some goods. They are State monopolies. For example, we have public utilities like electricity and railways. These public utilities are undertaken by the State.

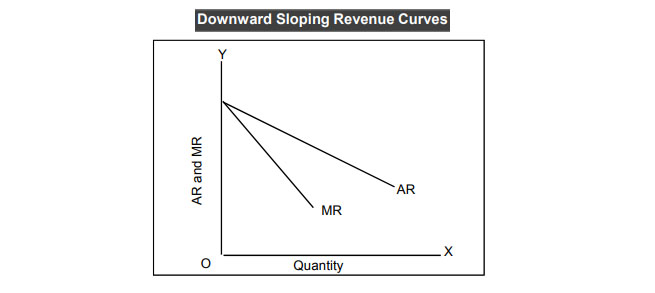

Revenue curves under monopoly

A monopolistic firm is a price-maker, not a price-taker. Thus, a monopolist can increase or decrease the price. When the price changes, the average revenue, and marginal revenue also changes .

Quantity Sold | Price per unit | Total Revenue | Average Revenue | Marginal revenue |

(TR) | (AR) | (MR) | ||

1 | 6 | 6 | 6 | 6 |

2 | 5 | 10 | 5 | 4 |

3 | 4 | 12 | 4 | 2 |

4 | 3 | 12 | 3 | 0 |

5 | 2 | 10 | 2 | -2 |

6 | 1 | 6 | 1 | -4 |

In the figure above, because of the decrease in price both the revenue curves (Average Revenue and Marginal Revenue) are sloping downwards. If a monopolist wants to increase his sales, then he must reduce the price of his product so that the existing buyers to purchase more and new buyers to enter the market

Key takeaways –

- Monopoly market is characterized by the profit maximize, price maker, high barriers to entry, single seller, and price discrimination.

- Monopoly characteristics include profit maximize, price maker, high barriers to entry, single seller, and price discrimination.

Since economic resources are scarce the efficient allocation of resources is very important. Thus, the government promoting healthy competition in the market that ensures the firms try and find out new and efficient ways of producing goods and services. Government can promote competition by restricting the practices used by firms to reduce competition.

Arguments for Government Intervention

Greater Equality –to improve equality of opportunity and equality of outcome redistribute income and wealth.

Market Failure – Markets fail to take into account externalities and are likely to under-produce public / merit goods. For example, governments can subsidise or provide goods with positive externalities.

Macroeconomic intervention. – government intervention to overcome prolonged recessions and reduce unemployment.

The main aims of government policy are to promote competition; make markets work better and contribute towards improved efficiency in individual markets and enhanced competitiveness of the businesses within the single market.

The government policy aims to ensure

- Technological innovation which promotes dynamic efficiency in different markets

- Effective price competition between suppliers

- Safeguard and promote the interests of consumers through increased choice and lower price levels

Policies to improve competitiveness

- Improving labour productivity - Labour productivity can be improved by spending on education and training to help develop skills and close any skills gap. Government may also promote a more flexible labour market, such as reducing trade union power, encouraging part-time work, and encouraging new business start-ups.

2. Improving competition in product markets - The level of competition in product markets can also be improved by deregulation to reduce barriers to entry. In addition, privatisation of industry is also likely to improve competitiveness. Through regulation and competition policy helps in reducing monopoly power that can be effective in creating a more dynamic and competitive micro-economy.

3. Improving the level of investment - Competition may be increased by investment grants and subsidies, and by tax incentives to encourage new product development. To encourage investment the government keeps the interest rate low. In addition, keeping them as stable as possible would increase certainty and reduce risk. Finally, investment may be stimulated by reducing the interest rate elasticity of investment. This could be achieved by investment grants and tax relief on investment.

4. Creating a stable macro-economic environment – the central to an effective strategy to improve competitiveness, is strategy inflation under control. This can be achieved through a combination of monetary and fiscal measures. A stable exchange rate would also create less uncertainty, and would give firms more confidence to invest.

Key takeaways

- The government policy aims to ensure technological innovation which promotes dynamic efficiency in different market, effective price competition between suppliers, safeguard and promote the interests of consumers through increased choice and lower price levels

Imperfect competition is a competitive market where a large number of sellers are engaged in selling heterogeneous goods as opposed to the perfectly competitive market.

The concept of imperfect competition was first profounded by an English economist, Joan Robinson. Under imperfect competition, both buyers and sellers are unaware of the prices. Therefore, producers can influence the price of the product they are offering for sale.

Types of imperfect competition

- Monopolistic competition – in Monopolistic competition there are large numbers of buyers and sellers which do not sell homogenous product unlike perfect competition. This is more realistic in the real world.

Features

- Large number of sellers and buyers: the primary characteristic of monopolistic competition is the presence of large number of sellers offering different products to equal number of buyers.

- Product differentiation: Another important characteristic of monopolistic competition is product differentiation means products that are sold in the market vary in style, quality standards, trademarks and brands.

- Ease of entry and exit: Similar to perfect competition, under monopolistic competition, firms are free to enter or exit the market due to the limited number of restrictions imposed by the government.

- Price control policy: Under monopolistic competition, firms do not have much control over the price of the product. If the prices of products are higher, then the buyers would switch to other sellers due to close substitutability of products.

2. Oligopoly – in oligopoly there are small number of firms in the market. As per the norms, oligopoly consist of 3 -5 dominant firms. The firms can compete with each other or collaborate to earn more profits. Here the buyers are more than the sellers.

Features

- Existence of few sellers: the primary features of oligopoly is the existence of a few sellers who dominate the entire industry and influence the prices of each other. Also there are large number of buyers under oligopoly

- Identical or differentiated products: An important characteristic of oligopoly is the production of identical products or differentiated products.

- Barriers in entry: Another important characteristic of oligopolistic competition is that organizations cannot easily enter the market; nor can they make an exit from the market.

- Enhanced role of government: Under oligopolistic market structure, the government has a greater role as it acts as a guard since it is observed that oligopolists may engage in the illegal practice of collusion, where they together make production and pricing decisions.

- Oligopolists may start acting as a single organization and further increase prices and profits. Thus the government requires to keep a watch on such activities to curb the illegal practices.

- Mutual interdependence: Under oligopoly market structure, a few numbers of sellers compete with each other. Thus mutual interdependence refers to the influence that organizations create on each other’s decisions, such as pricing and output decisions.

- Existence of price rigidity: Under oligopolistic market, organizations do not prefer to change the prices of their products as this can adversely affect the profits of the organization.

3. Monopoly – In monopoly market, single firm or one seller controls the entire market. The firm has all the market power, so he can set the prices to earn more profit as the consumers do not have any alternative.

Features

- One seller and large number of buyers -in a monopoly one seller produces all of the output for a good or service. The entire market is served by a single firm. For practical purposes the firm is the same as the industry. But the number of buyers is assumed to be large.

2. No Close Substitutes - There is no close substitutes for the product sold by the monopolist. The cross elasticity of demand between the product of the monopolist and others must be negligible or zero.

3. Difficulty of Entry of New Firms - There are restrictions on the entry of firms into the industry, even when the firm is making abnormal profits. Other sellers are unable to enter the market of the monopoly

4. Profit maximizer: a monopoly maximizes profits. Due to the lack of competition a firm can charge a set price above what would be charged in a competitive market, thereby maximizing its revenue.

5. Price Maker - Under monopoly, monopolist has full control over the supply of the commodity. The price is set by determining the quantity in order to demand the price desired by the firm. Therefore, buyers have to pay the price fixed by the monopolist.

Imperfect competition covers all situations where there is neither pure competition nor pure monopoly.

Price-Output Determination under oligopoly:

In oligopoly, there are few firms with large size, that a single firm can influence the price and supply. The oligopolist cannot determine the price independently

He has to study the reaction of the rivalry when price is changed. He does not have definite demand curve, as he does not know to which extent the sale will change if the price of product changes

The price is determined with the agreement among the oligopolists. In some cases the biggest firm act as a price leader and other firms follow the leader.

Price-Output Determination under monopolistic competition:

Under monopolistic competition a firm can some extent independently control the supply and price of the product. The demand curve is stable and slightly downward slope

A monopolistic competitor creates output at which the marginal cost is equal to marginal revenue. The price is greater than marginal cost.

In short run, monopolistic competitor earns excess profits when the price becomes higher than average cost. Because the possibility of entrance of new firm is less

But in the long run due to the possibility of new firms entering the industry the price under monopolistic competition becomes equal to long-run average cost giving only normal profits. So, no firm under monopolistic competition can make excess profit or loss in the long run.

Key takeaways

- Under imperfect competition, there are large number of buyers and sellers. Each seller can follow its own price-output policy.

- Each producer produces the differentiated product, which are close substitutes of each other

REFERENCES

- Karl E. Case and Ray C. Fair, Principles of Economics, Pearson Education Inc., 8th Edition, 2007.

- N. Gregory Mankiw, Economics: Principles and Applications, India edition by South Western, a part of Cengage

- Learning, Cengage Learning India Private Limited, 4th edition, 2007.

- Joseph E. Stiglitz and Carl E. Walsh, Economics, W.W. Norton & Company, Inc., New York, International Student

- Edition, 4th Edition, 2007

- Arthashastra- Dr .Suman