Unit – 1

Accounting for Share Capital & Debentures

Issue of shares

The issue of shares is the procedure in which enterprises allocate new shares to the shareholders. While circulating the shares the enterprise follow the rules stipulated by Companies Act 2013.

Steps in the process of issue of the shares are as follows

- Issue of prospectus – initially the enterprise issues the prospectus to the public generally. The prospectus is an appeal to the public that a new enterprise has come into the presence and it would require funds for operating the trading concern. It contains complete data regarding the enterprise and the way in which the money is to be collected from the prospective investors.

- Receipt of Applications: When the prospectus is circulated to the public, prospective investors can now apply for shares. As mentioned in the prospectus they must fill out an application and deposit the requisite application money in the schedule bank. The process of application stays open for 120 days. Issue of shares will be cancelled, if in these 120 days minimum subscription has not been reached.

- Allocation of shares: The shares can be allocated, once the minimum subscription has been done. Normally, there is always oversubscription of shares, so the allocation is done on pro-rata ground. Letters of Allotment are sent out to those people who have been allocated their part of shares. This is a valid contract between company and applicants.

Forfeiture of shares

Forfeiture of shares is referred to as the situation when the allotted shares are cancelled by the issuing company due to non-payment of the subscription amount as requested by the issuing company from the shareholder.

Forfeiture means cancellation. The shares are forfeited when the shareholder fails to pay any of the calls (one or more) on the authorization of the board of Directors.

Before forfeiture a notice must be given to the shareholder. The notice must provide the shareholder with a minimum of 14 days to make the payment due, or his shares will be forfeited. Even after such notice if the shareholder does not pay, then the shares will be canceled.

Accounting Entries on Forfeiture of Share

When Forfeiture of shares Issued at Par

Share Capital A/c (Called up amount) Dr.

To Share Forfeiture A/c (Paid-up amount) Cr.

To Share Allotment A/c Cr.

To Share Calls A/c (individually) Cr.

Forfeiture of shares issued at Premium

- Securities Premium amount has been received

Share Capital A/c Dr.

To Share Allotment A/c Cr.

To Forfeiture Share Allotment A/c Cr.

To First Calls A/c Cr.

b. Securities Premium amount has not been received

Share Capital A/c Dr.

Securities premium account Dr

To Share Allotment A/c Cr.

To Forfeiture call A/c Cr.

To First Calls A/c Cr.

Forfeiture of Shares issued at discount

Share Capital A/c Dr

To Discount on Share Issue A/c

To Share Forfeiture A/c

To Share Allotment/Call A/c

Reissue of forfeited shares

Forfeited shares are available with the company for sale. The company is under an obligation to dispose of the forfeited shares, after the forfeiture of shares.

The company requires to pass a resolution in its Board Meeting for the re-issue of forfeited shares. Re-issue of forfeited shares is a mere sale of shares for the company. A company does not make allotment of these shares.

Journal Entries for Re-issue of Forfeited Shares

On re-issue of shares

Bank A/c (Actual amount received) Dr.

Forfeited Shares A/c (loss on re-issue) Dr.

To Share Capital A/c Cr.

On transfer of profit on re-issue

Forfeited Shares A/c Dr.

To Capital Reserve A/c Cr.

Book building

Every business organisation requires funds for its business activities. It can raise funds through external or internal sources. Two of the most popular means to raise money are Initial Public Offer (IPO) and follow-on Public Offer (FPO).

At the IPO or FPO, the company offers its shares to the public either at fixed price or offers a price range, so that the investors can decide on the right price. The method of offering shares by providing a price range is called book building method. This method helps the market to discover price for the securities which are on offer.

Definition

Book Building may be defined as a process used by companies raising capital through Public Offerings-both Initial Public Offers (IPOs) and Follow-on Public Offers (FPOs) to aid price and demand discovery.

Book building process

- The Issuer who is planning an offer nominates lead merchant banker as ‘book runners’.

- The number of securities to be issued and the price band for the bids are specified by the issuer

- The Issuer appoints syndicate members with whom orders are to be placed by the investors.

- The orders are put into an ‘electronic book’ by the syndicate members. This process is called ‘bidding’.

- The book normally remains open for a period of 5 days.

- Bids have to be entered within the specified price band.

- Bids can be revised by the bidders before the book closes.

- The book runners evaluate the bids on the basis of the demand at various price levels, on the close of the book building period.

- The book runners and the Issuer decide the final price at which the securities shall be issued.

- The issue size gets frozen based on the final price per share.

- Allocation of securities is made to the successful bidders. The rest bidders get refund orders

Rights issue

Rights issues are fresh shares which are offered by the company to the existing shareholders, with an aim to raise more capital from the market. The right shares are primarily offered at a discounted price to the current equity shareholders.

For example

A company may declare rights issue of 2.3 at100 per share, where the current market price is at Rs 170 per share. This means the company is issuing two rights shares for every three shares owned by the shareholders of that company at 100 per share.

Bonus Issue of Shares

Bonus Shares states that free shares issued to the existing shareholders of the company, in a proportion to the number of shares held by the shareholder. Bonus Shares are distributed as an alternative to paying cash dividends. To meet the income needs shareholders are allowed to sell these bonus shares. The bonus issue does not change the company's net worth but it only increases the total number of outstanding shares.

For example, if a company declares 1:2 bonus issue, then it means all the existing shareholders for every 2 shares they hold will get one additional share.

Bonus issue vs rights issue

Basis for comparison | Right issue | Bonus issue |

Meaning | Right shares are offered to the existing shareholders in a proportion to their existing holdings. | Bonus shares are shares issued by the company to their existing shareholders for free. |

Objectives | To raise fresh capital from the market | Issued as an alternative to dividend payment. Also used to bring down the share price. |

Price | Offered at discounted price | Issued free of cost |

Renunciation | Shareholders may fully or partly renounce their rights | No such option |

Minimum subscription | Required if you want to buy rights shares. | Not required |

Paid up value | Can be either fully or partly paid up. | Always fully paid up |

Cash receipt | Results in cash receipt for the company | Does not result in cash receipt. |

Share price | Does not affect the share price. | Bring down the share price according to the proportion. |

The provisions regulating buy back of shares are contained in Section 77A, 77AA and 77B of the Companies Act,1956. These were inserted by the Companies (Amendment) Act,1999. The Securities and Exchange Board of India (SEBI) framed the SEBI(Buy Back of Securities) Regulations,1999 and the Department of Company Affairs framed the Private Limited Company and Unlisted Public company (Buy Back of Securities) rules,1999 pursuant to Section 77A(2)(f) and (g) respectively.

Objectives of buybacks

- To increase promoters holding

- Increase earnings per share

- Rationalize the capital structure by writing off capital not represented by available assets.

- Support share value

- To thwart takeover bid

- To pay surplus cash not required by business

Reasons of buybacks

A Company can purchase its own shares from

- Free reserves; Where a company purchases its own shares out of free reserves, then a sum equal to the nominal value of the share so purchased shall be transferred to the capital redemption reserve and details of such transfer shall be disclosed in the balance-sheet or

- Securities premium account; or

- Proceeds of any shares or other specified securities. A Company cannot buy back its shares or other specified securities out of the proceeds of an earlier issue of the same kind of shares or specified securities.

Procedure for buybacks

- Where a company proposes to buy back its shares, it shall, after passing of the special/Board resolution make a public announcement at least one English National Daily, one Hindi National daily and Regional Language Daily at the place where the registered office of the company is situated.

- The public announcement shall specify a date, which shall be "specified date" for the purpose of determining the names of shareholders to whom the letter of offer has to be sent.

- A public notice shall be given containing disclosures as specified in Schedule I of the SEBI regulations.

- A draft letter of offer shall be filed with SEBI through a merchant Banker. The letter of offer shall then be dispatched to the members of the company.

- A copy of the Board resolution authorizing the buyback shall be filed with the SEBI and stock exchanges.

- The date of opening of the offer shall not be earlier than seven days or later than 30 days after the specified date

- The buyback offer shall remain open for a period of not less than 15 days and not more than 30 days.

- A company opting for buy back through the public offer or tender offer shall open an escrow Account

Preference shares cannot be redeemed unless they are fully paid up. In other words partly paid-up shares cannot be redeemed. Preference shares can be redeemed in two ways- one is profits which would be available for dividend. The other one is out of the proceeds of a fresh issue of shares made with the object of redemption.

When Preference shares are redeemed out of profits available for distribution as dividend, a sum equal to the nominal amount of the shares so redeemed must be transferred out of profits to a reserve account to be called ‘Capital Redemption Reserve Account’. Such reserve can be used for issuing fully paid bonus shares to the shareholders.

Conditions for redemption of preference shares

Before going for redemption, the company must follow the following conditions

- There must be a provision in the Articles of Association regarding the redemption of preference shares.

- The redeemable preference shares must be fully paid up. If there is any partly paid share, it should be converted in to fully paid shares before redemption

- The redeemable preference shareholders should be paid out of undistributed profit/ distributable profit or out of fresh issue of shares for the purpose of redemption.

- If the shares are redeemed at a premium, it should be should be provided out of securities premium or profit and loss account or general reserve account.

- The proceeds from fresh issue of debentures cannot be utilized for redemption.

- The amount of capital reserve cannot be used for redemption of preference shares.

- If the shares are redeemed out of undistributed profit , the nominal value of share capital, so redeemed should be transferred to Capital Redemption Reserve Account. This is also known as capitalization profit.

The redeemable preference shares can be redeemed by a) the proceeds of a fresh issue of equity shares/ preference shares, b) the capitalization of undistributed profit i.e. creating capital redemption reserve account, or c) a combination of both (a) and (b).

Accounting entries required for redemption of preference shares.

When new shares are issued at par:

Bank A/c …………………Dr.

To Share Capital A/c.

When new shares are issued at premium:

Bank A/c ……………………..Dr.

To Share Capital A/c

To Share Premium A/c

When new shares are issued at a discount:

Bank A/c ………………Dr.

Discount on Issue of Share Capital………..Dr.

To Share Capital A/c.

Conversion of partly paid shares into fully paid shares:

a) Share Call A/c ………..Dr.

To Share Capital A/c

b) Bank A/c ……………..Dr.

To Share Call A/c.

When preference shares are redeemed at par:

Redeemable Preference Share Capital A/c ………………Dr.

To Preference shareholders A/c.

When preference shares are redeemed at a premium:

Redeemable Preference Share Capital A/c ………………Dr

Premium of Redemption Preference Share Capital A/c….Dr.

To Preference shareholders A/c.

Adjustment of premium on redemption:

Profit and Loss A/c………………..Dr.

Share Premium A/c ……………….Dr.

To Premium of Redemption Preference Share Capital A/c

Transferring the amount to Capital Redemption Reserve Account:

General Reserve A/c …………….Dr.

Profit and Loss A/c …………….Dr.

To Capital Redemption Reserve A/c

Expenses on issue of shares:

Expenses on Issue of shares A/c…………….Dr.

To Bank A/c.

When payment is made to preference shareholders:

Preference Shareholders A/c ……………Dr.

To Bank A/c.

When the fully paid bonus shares are issued:

Capital Redemption Reserve A/c …………….Dr.

General Reserve A/c …………………………..Dr.

Share Premium A/c ……………………………Dr.

Profit & Loss A/c …………………………….. Dr.

To Bonus to Shareholders A/c

Capitalization of profit:

Bonus to Shareholders A/c ………………Dr.

To Equity share capital A/c

Debentures is a document evidencing debt to the debenture holder, generally secured by a fixed or floating charge.

The definition of ‘debentures’ as contained in section 2(12) of the Companies Act does not explain the term. It simply reads “debenture includes debenture stock, bonds and any other securities of a company whether constituting a charge on the assets of the company or not.”

Issue of debentures

The procedure for the issue of debentures is the same as that for the issue of shares. The intending investors apply for debentures on the basis of the prospectus issued by the company. The company may either ask for the entire amount to be paid on application or by means of installments on application, on allotment and on various calls. Debentures can be issued

- For cash

- For consideration other than cash

- Issued at par, payable at par

- Issued at discount, payable at par

- Issued at par, payable at premium

- Issued at discount, payable at premium

- Issued at par, payable at discount

- Issued at discount, payable at discount

Issue of Debentures for Cash

Debentures are said to be issued at par when their issue price is equal to the face value. The journal entries recorded for such issue are as under:

(a) If whole amount is received in one instalment:

- On receipt of the application money

Bank A/c Dr.

To Debenture Application & Allotment A/c

- On Allotment of debentures

Debenture Application & Allotment A/c Dr.

To Debentures A/c

(b) If debenture amount is received in two instalments:

- On receipt of application money

Bank A/c Dr.

To Debenture Application A/c

- For adjustment of applications money on allotment

Debenture Application A/c Dr.

To Debentures A/c

- For allotment money due

Debenture Allotment A/c Dr.

To Debentures A/c

- On receipt of allotment money

Bank A/c Dr.

To Debenture Allotment A/c

(c) If debenture money is received in more than two instalments

Additional entries:

- On making the first call

Debenture First Call A/c Dr.

To Debentures A/c

- On the receipt of the first call

Bank A/c Dr.

To Debenture First Call A/c

Redemption of debentures

Redemption of debentures refers to payment of the amount of debentures by the enterprise. The amount of capital needed for redemption of debentures is large and, therefore, economic enterprises make adequate provision out of gains and accrue capital to reclaim debentures.

It involves repayment of the number of debentures to the debenture holders. Debentures can be redeemed either at par or at a premium.

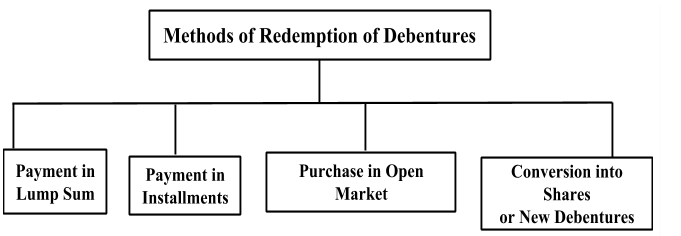

Methods of redemption of debentures

- Payment in lump sum – this payment involves during the maturity the enterprise reclaims the debentures by paying the fund in lump sum to the debenture holders hereof as per the terms and conditions of issue.

2. Payment in installments: Under this method, usually redemption of debentures is paid in installments on the particular date during the time in the position of the debentures. The total amount of debenture liability is being divided by the total number of years.

3. Purchase in open market: for the aim of cancellation when an enterprise buys its own debentures, such an act of buying and cancelling the debentures comprises redemption of debentures by purchase in the open marketplace.

4. Conversion into shares or new debentures: An enterprise can reclaim its debentures by transforming them into a new class of debentures or shares. These new shares or debentures can be either circulated at a premium, at a discount or at par. It may be noted that this method is applicable only to convertible debentures.

References

- Corporate Accounting by Raj Kumar Shah

- Corporate Accounting by V K Goyal

- Corporate Accounting by Prof. Amitabha Basu