UNIT II

Money

2.0 Money

Money will go around the world. The economy relies on the exchange of money for products and services. Economists define money, where it comes from and what it is worth. Here are the multifaceted features of money.

Medium of exchange

Before the development of the medium of exchange—that is, money-people would barter to get the goods and services they need. Two individuals would each own some goods the other wanted and enter into trade contracts.

But early forms of barter do not provide transferability and divisiveness that make transactions efficient. For example, a person may have a cow with a banana, but not just a banana, but also a desire. What is the person who saw the meat of a banana, can not only potatoes? Car meat, its view is bananas and potatoes, etc.

The lack of transferability of barter for goods is exhausting, confusing and inefficient. Even if the person finds someone who trades meat for bananas, they may not believe that a bunch of bananas is worth a whole cow. Such a trade requires coming to an agreement and devising a way to determine how many bananas are worth to a particular part of the cow.

Money for goods solved these problems. Commodity money is a type of goods that act as currency. For example, in the 17th and early 18th centuries, American settlers used beaver fur and dried corn for trade.1. Having general values, these goods were used to buy and sell. The goods used in trade were widely desired and therefore valuable, but they were characterized by durability, portability and ease of storage

Another, more advanced example of commodity money is precious metals such as gold. Until the 1970s, gold was used on the flip side of banknotes, for example, in the case of the US Dollar 2, which meant that foreign governments could take dollars and exchange them with the US Federal Reserve at a specified rate for gold. It is interesting that, unlike beaver fur and dried corn (which can be used for clothing and food, respectively), gold is purely valuable, because people want it is not always useful—you cannot eat gold, and it will not keep you warm at night, but for the majority because it's a person, gold is something of value. Gold therefore acts as a physical token of wealth based on people's perceptions.

During this time, Gold-Gold insight is carried out interest income expressed as its value.

Impressions create everything

The second type of money is fiat money, which does not require backup by physical goods. Instead, the value of fiat currency is set by people's faith in supply and demand and its value. Gold is a scarce resource, and the fast-growing economy has not always been a sufficient mine to support currency supply requirements, so fiat currencies were developed.3 4 for a booming economy, the need for gold to give value to money is very important, especially if its value is really created by people's perception.

Fiat money becomes a token of people's perception of value and the basis for why money is made. A growing economy has clearly succeeded in producing other things that are valuable to it and other economies. The stronger the economy, the more that money is perceived (and sought after) and vice versa. But people's perceptions must be supported by an economy that can produce the products and services people want.

For example, in 1971, the US dollar was removed from the gold standard—the dollar could no longer be redeemed with gold, and the price of gold was no longer fixed on any amount.5. This means that it became possible to create more banknotes than there was gold to back it up, the health of the US economy the value of the dollar if the economy stopped, the value of the US dollar would fall through the currency exchange rates domestically and internationally through inflation. America's implosion economy plunges the world into the financial dark ages; so many other countries and entities work tirelessly to ensure that it never happens.

Today, the value of money (not only the dollar, but most currencies) is determined purely by purchasing power, as determined by inflation. That is why simply printing new money does not generate wealth in the country. Money is a kind of eternal interaction between real, tangible things, our desire for them, and our abstract faith in what has value.

Economic development is generally believed to be dependent on the growth of real factors such as capital accumulation, technological progress, and increase in quality and skills of labour force. This view does not adequately stress the role of money in the process of economic development. It is said that money is a mere veil and intrinsically unimportant. What matters is the real goods and productive factors which money buys. However, this extreme view about the unimportance of money as such is no longer believed. Not only is money an important factor without which modern complex economic organization is impossible, but it is also an important factor for promoting economic development. We discuss below the importance of money in the process of economic development.

In the economy today money performs several functions. Money serves as a standard of value in which other values are measured. Money is a store of value, that is, the means in which wealth can be held. It acts as a standard for deferred payments.

However, the most important function of money which distinguishes it from other goods is that it serves as a medium of exchange. That is, money is a means of payment for goods and services. It is this use of money that distinguishes a monetary economy from a barter economy. A monetary economy is one in which goods are sold for money and money is used to buy goods.

Money Promotes Productivity and Economic Growth:

Barter system was full of difficulties of exchanging goods and services between individuals. In the absence of easy exchange of goods and services the barter system worked as an obstacle to the division of labour and specialization among individuals which is an important factor for increasing productivity and economic growth. Further, the process of economic growth leads to the expansion of production of goods and services and consequential rise in incomes of the people.

As a result, volume of transactions in the developing economy increases. This raises the demand for money to finance the increased transactions brought about by the expanded level of economic activity. Thus, the process of economic growth would be held in check if adequate supply of money is not forthcoming to meet the requirements of increase in the level of economic activity.

Money Promotes Investment:

From the viewpoint of development another important role of money lies in making the magnitude of investment independent of the current level of savings. In a barter system, the goods not consumed constitute the savings as well as investment. That is, investment is not different from current savings. The greater the current savings, the greater the investment. However, in a modern economy, this is not so. Whereas it is households which save in the form of money, it is the firms which invest money in capital goods.

Therefore, investment can differ from saving because investment activity is separated from the act of saving. More importantly, investment in a monetary economy can exceed the current level of savings. This excess of investment over savings is possible because new money can be created by the Government in the form of currency or by banks in the form of bank deposits. And this is what is important for the purpose of economic development.

In the developed countries in times of depression when idle productive capacity exists, the increase in investment made possible by creation of new money by the Government or banks would lead to the increase in aggregate demand for goods and services. In such times the supply of goods and services is elastic due to the existence of excess capacity. Therefore, increase in aggregate demand generated by the investment financed by created money brings about expansion in output of goods and services and thereby causes an increase in the level of employment.

In developing countries, the created money can play a useful role in promoting economic development. Rapid economic development can be achieved by stepping up the rate of investment or capital formation. But additional resources are required to increase the rate of investment. But in a country where a majority of the people are living at the bare subsistence level, voluntary savings, taxation.

Government borrowing cannot by themselves provide sufficient investible resources for development. The government therefore attempts to increase the volume of investible resources beyond what is possible on the basis of current level of savings through creating new money. The newly created money can be spent on investment projects both in the industrial and agricultural fields which would lead to the increase in output, income and employment.

Money and Investment in Quick-Yielding Projects:

It is widely believed that any increase in the supply of money in developing countries would lead to the rise in prices or to the emergence of inflationary pressures. However, this is not always true. A reasonable amount of newly created money helps the development of the economy by raising the level of investment. In the developing economies a lot of natural and human resources lie un-utilized and underutilized which can be employed for productive purposes.

If the newly created money is used for investment in those projects such as small irrigation works, land reclamation schemes, flood control and anti-soil erosion measures, cottage industries which yield quick returns, then the danger of inflation will not be there. These quick- yielding projects will increase the production of essential consumer goods in the short run and will therefore prevent the rise in prices.

Further, if development strategy is such that a higher priority is assigned to agriculture and other wage goods industries and further that organizational and institutional reforms are undertaken to provide all farmers with irrigation facilities, fertilizers and high- yielding varieties, agricultural output can be raised in the short period. In this framework, new money can be created to increase the level of investment without much adverse effect on prices.

Monetization and Economic Growth:

Further, as is well known, most underdeveloped countries have a large non-monetized (i.e. barter) sector where production is for the purpose of subsistence only. To break the subsistence nature of economic activity and thus generate new forces for economic growth, its monetization is required. The introduction of money helps in bringing it in contact with the modern sector. This contact of the subsistence sector with the modern sector will lead to the expansion of its output.

In order to obtain the products of the modern industrial sector, the people engaged in the subsistence sector will make efforts to raise their output. Thus, a surplus of output over their self-consumption will be generated in this way which will ultimately break their subsistence nature.

It is supported by the past history of the developing countries. During the colonial period, the monetization of the peasant sector led to the expansion in exports in exchange for the imported industrial products. This stepped up their agricultural development to a good extent.

Similar to the growth of production for exports the introduction of money in the subsistence agricultural sector and its contact with the modern sector, would lead to the increase in marketable surplus of food grains and other agricultural products which is an important factor in economic development.

If some rise in agricultural prices occurs as a result of increase in investment financed by the created money, as is likely the case, it would serve as an incentive to produce more food grains and supply it the market. The rise in agricultural incomes will increase demand for industrial products and would therefore accelerate their growth.

Further, the monetization of the subsistence sector will also help in raising the volume of savings. Monetization will bring this sector in contact with the financial institutions such as commercial and cooperative banks and insurance companies. The opportunities of earning more income through interest on saving will raise the propensity to save of the people in the present-day subsistence sector. If proper monetary policies are pursued, then instead of consuming or hoarding all their therefore incomes, these people can deposit a part of them in the financial intermediaries.

Prices are measures of the amount of money that one has to give up to obtain units of goods and services. When this macro measurement is extended to the entire economy, we get the concept of general price level.

The price level measures the amount of money that has to be given up to obtain a unit of the average good in the economy, or to obtain one unit of the total output.

The inverse or reciprocal of the price level represents value of money, or what a unit of money can buy. This is referred to as the real value of money or its purchasing power. Study of the factors that determine the price level and thus, the value of money, is one of the important subject matter of macro economics.

Different views on what determines the price have been put forward by different economist. Though they may differ in their approaches, most have concluded that the price level is determined by the supply of money and demand for money. The demand- supply analysis of price level determination at macro- level is essentially different from the demand- supply analysis of price determination at the micro-level for an individual good. Goods produced are flows while money can be both stock and flow.

The quantity theory of money was used by economists to explain changes in general price level. They believed that the quantity of money in the economy was the prime factor determining price level. Any change in the quantity of money would bring about a change in the general level. The theory is based directly on the changes brought about by an increase in the money supply. The quantity theory of money states that the value of money is based on the amount of money in the economy.

What is the amount of money theory?

Financial Theory refers to plan the amount of accessible money (money supply) grows at the same rate as the price level in the long run. With lower interest rates, lower taxes, and no longer limited access to money, consumers are less sensitive to price changes and have a higher consumption trend. As a result, the aggregate demand curve shifts to the right, shifting up the equilibrium price level. Replaceable

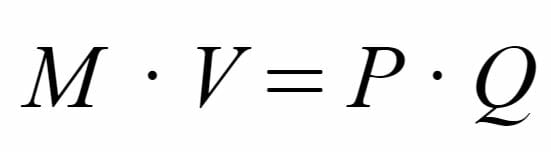

To better understand the theory of the amount of money, you can use the exchange equation:

The formula is the Economist model with the relationship between gold supply and price. The replacement formula is:

Where,

M-refers to the money supply

V-refers to the rate of money that measures how much a single dollar of money supply contributes to GDP

P-refers to the prevailing price level

Q-refers to the amount of goods and services produced in the economy

If we keep Q and V constant, we can see that an increase in the money supply increases the price level and causes inflation. The assumption that Q and V are constant holds in the long run, since these factors cannot be affected by changes in the money supply of the economy.

This theory provides a brief overview of the monetarist theory, which states that changes in the current money supply cause fluctuations in overall economic production and that excessive growth in the money supply causes an increase in inflation.

Demand for money

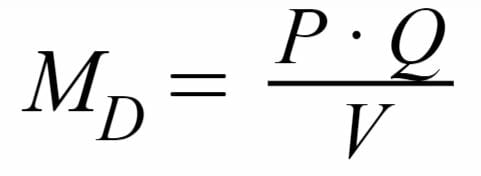

The exchange equation can also be modified into the equation of demand for money as follows:

Where,

Md-refers to the demand for money

P-refers to the price level of the economy

Q-refers to the amount of goods and services offered in the economy

V-refers to the speed of money

In this formula, the molecular term (P x Q) refers to the nominal GDP of the country. Moreover, the equation provides another take on the monetarist theory because it associates GDP with the demand for money (contrary to Keynesian economists who believe that interest rates cause inflation).

Cambridge Equations

The Cambridge version of quantity theory of money was first developed by Alfred Marshall and later modified by A.C Pigou and D.H Robertson. Since all these economists were from the Cambridge University, their version of the quantity theory came to be known as the Cambridge Version. This version is an improvement over the classical cash transactions approach. The cash balance approach provided the basis for Keynes to develop his famous Liquidity Preference Theory of Money.

According to the Cambridge version, people demand to hold money not only for transactions but also because money’s function as a ‘store of value’. Therefore, real demand for money is for transaction as well as other purposes. When money is held or hoarded, it has utility as it acquires wealth value. The amount of cash balances held by people is determined by their real value, or the purchasing power of the balances held. People will want to hold money not for the money’s sake but for the command that money has over real resources and goods.

Taken together, the community’s total demand for cash balances constitutes a certain proportion of the country’s real national income. This proportion is represented by the letter k’ in the Cambridge equation. It represents a proportion of the total real income (output produced) that people of the country demand to hold in the form of cash balances.

If we assume that in an economy, the volume of transactions are given over a period of time, the community’s total demand for real cash balances may be represented by a certain proportion (k) of the annual real national income (Y).

The proportion k, known as ‘Cambridge k’ is determined by individuals and groups of individuals on the basis of several factors like spending pattern, price level, rate of interest, general economic condition, the opportunity cost of holding cash. When people want to hold more cash, they spend less on goods and services. This lowers the demand for goods and services and price level falls. Similarly, if people want to hold less cash and spend more on transacting in goods and services, the price level will rise. Price level falls. Similarly, if people want to hold less cash and spend more on transacting in goods and services, the price level will rise. Price level determines the value of money. Higher the price level, lower will be the purchasing power of one unit on money, and vice versa.

The Cambridge version is represented by the following equation:

Md = kPY

Where,

Md = community’s demand for money

Y = real national output

P = average price (general price level)

k = proportion of national output or income that people want to hold

Let assume that money supply Ms is determined by monetary authorities

Ms = M

At full employment equilibrium, supply of money is equal to demand for money.

Ms = Md

Or

M = kPY

P = M/kY

Where,

K and y are independent of money supply

K is constant and is given by transactions demand for money

Y is constant at full employment

P and money supply M are directly proportional. If money supply is doubled, so will P and if money supply is halved, P will also be halved.

Fisher Equation

What is the Fisher equation?

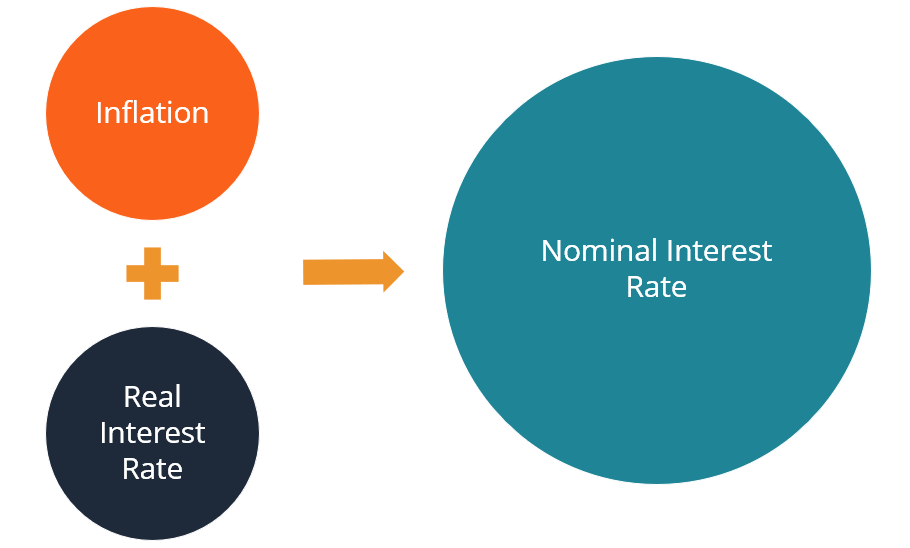

The Fisher equation is a concept in economics that describes the relationship between nominal and real interest rates affected by inflation. The formula states that the nominal interest rate is equal to the sum of the real interest rate and the rate of inflation.

The Fisher equation is often used in situations where investors and lenders seek additional compensation to compensate for the loss of purchasing power due to high inflation. This concept is widely used in the field of Finance and economics. It is often used when calculating returns on investments or predicting the behavior of nominal and real interest rates. One example is when an investor wants to determine the actual (actual) interest rate earned on an investment after considering the impact of inflation.

One of the particularly important implications of the Fisher equation is related to monetary policy. This formula reveals that monetary policy moves inflation and nominal interest rates together in the same direction. On the other hand, monetary policy generally does not affect real interest rates.

American economist Irving Fisher proposed the Fisher equation to the equation

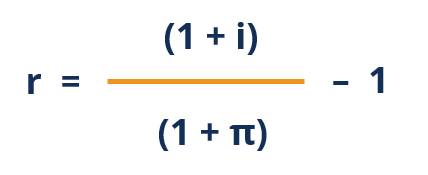

The Fisher equation is represented by the following equation:

(1+i)= (1+r) (1+∞)

Where

I-nominal interest rates

r-real interest rates

① –Inflation rate

However, you can also use an approximate version of the previous expression:

i∩r+∩

Fisher equation example

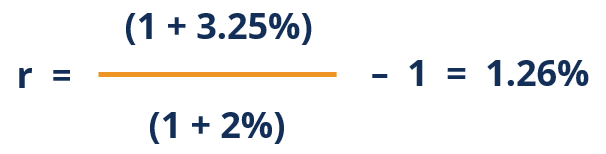

Last year, when Sam owned an investment portfolio, the portfolio earned a return of 3.25 per cent. But last year inflation was about 2%. Sam wants to determine the real returns he has earned from his portfolio. To find the real rate of Return, use the Fisher equation. The equation says:

(1+i)= (1+r) (1+∞) you can sort the equation to find the real interest rate: therefore, the real interest rate of the portfolio, or the real return on investment, after accounting for inflation.

Therefore, the real interest rate that Sam's investment portfolio earned last year is 1.26%.

Measuring India's Money Supply

One of the most important concepts to understand in economics is the concept of money. It forms the basis of overall economic research. And one of the important aspects of money is the supply of money in the economy. Learn more about the money supply and measuring the money supply in India.

Money supply

First, let's understand the meaning of money supply or money supply. Simply put, the money supply is the total inventory of money in circulation in the economy on a particular day.

This includes all banknotes, coins, and demand deposits held by the general public on that day. Money demand, money supply, etc. are also stock variables

Please note that the money supply held by the government, central banks, etc. is not considered as a money supply. This money is not actually in circulation in the economy and therefore does not form part of the money supply.

Today, our economy has essentially three major sources of money. They are a product of money and are responsible for its distribution in the economy. They are Government producing all coins and 1 rupee banknotes Reserve Bank of India (RBI), which issues all banknotes and a commercial bank that creates credits according to demand deposits

Measuring India's Money Supply

Then move on to the next logical question. How can I measure the amount of money in the economy? It's certainly neither easy nor easy. There is no only way to calculate the money supply in our economy. Instead, the Reserve Bank of India has developed four alternatives to the money supply in India.

These four alternatives to the money supply are labeled M1, M2, M3, and M4. RBI collects data and calculates and publishes the numbers for all four indicators. Let's see how they are calculated.

M1 (narrow money)

M1 includes all banknotes held by the general public on a particular day. It also includes all demand deposits, both savings and checking deposits at all banks in the country. It also includes all other bank deposits held at RBI. Therefore, M1 = CC + DD + other deposits

M2

M2 is also narrow money and includes all the contents of M1 as well as the bank savings of the post office. Therefore, M2 = M1 + postal savings deposit

M3 (broad money)

M3 consists of all banknotes held by the general public, all demand deposits in banks, all bank deposits in RBI, and net time deposits in all domestic banks. Therefore, M3 = M1 + bank time deposit.

M4

M4 is the broadest measure of the money supply used by RBI. This includes all aspects of M3, including savings at the national post office bank. It is the least liquid indicator of all of them. M4 = M3 + postal savings

Creating credits (money) by commercial banks

RBI makes money, commercial banks

Money by creating credits, which are also treated as credit creation.

Commercial banks generate credit in the form of secondary deposits.

There are two types of total bank deposits.

(I) Primary deposits (initial cash deposits by the general public) and (ii)Secondary deposits (deposits generated by loans from banks and expected to be re-deposited in banks) Funds generated by commercial banks are (i) primary deposits (initial cash deposits) and (ii) statutory reserves. It is determined by two factors. Ratio (LRR), the minimum ratio of deposits that a commercial bank is legally required to hold as liquid cash. Broadly speaking, when a bank receives a cash deposit from the general public, the bank holds a portion of the deposit as a cash reserve (LRR) and uses the remaining amount for lending. In the process of lending money, banks can generate credit through secondary deposits that are many times larger than the initial deposit (primary deposit).

How? It is explained below.

Money (credit) making process:

A man like X deposits 2,000 rupees in a bank and LRR

Ten%. This means that the bank holds only the minimum required Rs 200 as a cash reserve (LRR). The bank can use the remaining amount Rs 1800 (= 2000 – 200) to lend to someone. (To be on the safe side, the loan will not be offered in cash, but will be re-deposited into the bank as a demand deposit in favor of the borrower.) The bank does not actually lend, only the demand deposit account we will lend 1800 rupees to the opened Y. The name and amount will be credited to his account.

This is the first round of credit creation in the form of secondary deposits (Rs 1800), which is 90% of the primary (initial) deposits. Again, 10% of Y's deposit (i.e. Rs 180) is kept in the bank as a cash reserve (LRR) and the remaining Rs 1620 (= 1800 – 180) goes to Z, for example. The bank will receive a new demand deposit of Rs. 1620. This is the second round of credit creation, which is 90% of the primary round of increase of 1800 rupees. The third round of credit creation will be 90% of the second round of 1620. This is not the end of the story. The credit creation process continues until the derivative deposit

(Secondary deposit) will be zero. After all, the amount of total credit

Anything created this way will be a multiple of the initial (primary) deposit. The·

The quantitative result is called the money multiplier. If the bank successfully creates total credits, Rs 18000 means that the bank has created 9 primary deposits for Rs 2000. This is the meaning of credit creation.

Money multiplier:

This means a multiple that increases total deposits due to initial deposits

(Primary) deposit. The money multiplier (or credit multiplier) is the reciprocal of the statutory reserve ratio (LRR). If the LRR is 10%, that is, 10/100 or 0.1, then the money multiplier = 1 / 0.1 = 10.

The smaller the LRR, the larger the size of the money multiplier deposited in his account. He is only given a checkbook to draw a check when he needs money. Again, 20% of Sohan's deposit, which is considered a safe limit, is held for him by the bank and the remaining Rs 640 (= 80% of 800) is remitted to Mohan, for example. Therefore, the credit creation process goes on and on, and the final volume of the total credits created this way will be a multiple of the first cash deposit. Bank loans only make deposits (or credits) for the borrower, so banks can lend money and claim interest without letting go of cash. If a bank succeeds in creating a credit of, for example, 15,000 rupees, it means that the bank has created 15 times as many credits as a primary deposit of 1,000 rupees. This is the meaning of credit creation. Similarly, banks buy securities and create credits when they pay the seller their own check. Checks are deposited in some banks and deposits (credits) are created for the seller of securities. This is also called credit creation. As a result of credit creation, the money supply in the economy will be higher. Because of this credit creativity of commercial banks (or banking systems), they are called credit factories or money manufacturers.

The limits of the credit creation process are explained as follows:

(A) Cash amount:

Affects the creation of credit by commercial banks. Cash is high Commercial banks in the form of public deposits, more will be credit Created. However, the amount of cash held by commercial banks it is managed by the central bank. Central banks have the potential to increase or decrease cash in commercial banks. Purchase or sale of government securities. In addition, credit Creation ability depends on the rate of increase / decrease in CRR.

(B) CRR:

Refers to the cash reserve rate that needs to be stored in a central bank. According to a commercial bank. The main purpose of maintaining this reserve is meet depositors' trading needs; ensure security, Liquidity of commercial banks. Credit creation when the ratio goes down more and vice versa.

(C) Leakage:

It means the outflow of cash. The credit creation process is Cash leak.

The different types of leaks are described as follows:

(I) Excessive preparation:

It generally happens when the economy is heading into a recession. In such cases, the bank may decide to keep the reserve instead of using it. Funds for lending. Therefore, in such situations, the credits created by Commercial banks will be small, as large amounts of cash are indignant.

(II) Currency outflow:

It means that the public does not deposit all the cash. Customers are possible to hold with them cash that affects the credit creation of banks. Therefore, banks' ability to generate credit is diminished.

(D) Borrower availability:

It affects the credit creation of banks. Credits are created by lending money in the form of a loan to the borrower. No credit creation if there is no borrower.

(E) Availability of securities:

A security that a bank lends. Therefore, the availability of securities is required to grant a loan. Otherwise, credit creation will not occur. According to Clauser, "Banks do not generate money from thin air. It turns other forms of wealth into money."

(F) Business conditions:

Credit creation means being influenced by the cyclical nature of the economy. For example, when the economy enters a recession, credit creation becomes smaller. This is because during the depression stage, businessmen do not like to invest in new projects. On the other hand, during the prosperous period, businessmen ask banks for loans, which leads to credit creation.

Despite that limitation, we create that credit Commercial banks are an important source of income.

The basic conditions for creating a credit are as follows:

- Accept fresh deposits from the public

- Banks willing to lend money

- Willingness to borrow the borrower.

Instruments of Monetary Policy and the Reserve Bank of India

RBI is the governing body of India's monetary policy. They control the flow of money to the market through various means of monetary policy. This helps the RBI manage inflation and liquidity in the economy. Let's take a look at the monetary policy tools used by the RBI.

Reserve Bank of India

RBI is the Central Bank of India. It was founded in 1935 under the special law of Parliament. The RBI is a major authority on national monetary policy. The main function of the RBI is to maintain economic stability and the required level of liquidity.

RBI also controls and regulates the monetary system of our economy. This is the only banknote issuer in India. RBI is the central bank that manages all other commercial banks, financial institutions, financial companies and more. The RBI oversees the country's entire financial sector.

Monetary policy means

Monetary policy is the way the RBI manages the money supply in the economy. Therefore, these credit policies help control inflation and thus help the country's economic growth and development. Let's take a look at the various monetary policy tools that RBI has at its disposal.

s1] Open market operations

Open market operations are the direct involvement of the RBI in buying and selling short-term securities in the open market. This is a direct and effective way to increase or decrease the money supply in the market. It also has a direct impact on the market's ongoing interest rates.

Let's say the market is in equilibrium. The RBI then decides to sell the short-term securities in the market. The money supply in the market will decrease. And after that, the demand for credit lines will increase. Therefore, interest rates will rise accordingly.

On the other hand, if RBI buys securities from the open market, it has the opposite effect. The money supply to the market will increase. As a result, the demand for credits declines and interest rates fall.

2] Bank interest rates

One of the most effective means of monetary policy is bank interest rates. Bank interest rates are basically the interest rates at which RBI lends funds to commercial banks with or without collateral. This is also the standard rate at which RBI purchases or discounts bills of exchange and other such products.

Therefore, if RBI raises bank interest rates, commercial banks also need to raise lending rates. And this helps manage the money supply in the market. And vice versa will obviously increase the money supply in the market.

3] Variable reserve requirements

This monetary policy instrument has two components: the cash reserve ratio (CLR) and the statutory liquidity ratio (SLR). Let's understand both.

The Cash Reserve Rate (CRR) is part of a commercial bank deposit that must be deposited with the RBI. Therefore, CRR is the percentage of deposits that a commercial bank must hold in RBI. The RBI adjusts the above percentages to control the money supply available at the bank. Therefore, the loans offered by banks will be cheaper or more expensive. CRR is a great tool for controlling inflation.

The statutory liquidity ratio (SLR) is the percentage of total deposits that a commercial bank must hold in the form of cash reserves or gold. Therefore, increasing SLR means that banks provide less money as loans and control the money supply in the economy and vice versa.

4] Liquidity adjustment facility

The Liquidity Adjustment Facility (LAF) is an indirect means of managing currencies. Control the flow of funds through repo rates and reverse repo rates. Repo rates are actually the rates at which commercial banks and other institutions obtain short-term loans from central banks.

Reverse repo rate is the rate at which RBI deposits funds in a commercial bank in a short period of time. Therefore, RBI constantly changes these rates to control the flow of funds in the market according to economic conditions.

5] Moral appeal

This is an informal method of money management. The RBI is the central bank of the country and therefore enjoys a supervisory position in the banking system. If necessary, banks can be encouraged to exercise credit control from time to time in order to maintain a balance of funds in the market. This method is actually very effective, as banks tend to follow the policies set by the RBI.

References

- Https://en.m.wikipedia.org/wiki/Macroeconomics

- Principles of Economics by N. Gregory Mankiw

- Foundations of Macroeconomics: Principles, Applications and Tools by Stephen Perez

- A Concise guide to Macro Economics by David A Moss