Unit 3

Promotion of a venture

INTRODUCTION:

Promotion simply means an act of producing or developing or starting an enterprise. Venture means a business project or an undertaking especially a commercial one involving certain degree of risk and uncertainty.

Promotion of a venture is the process of starting an enterprise. It begins when an idea of forming or establishing a venture conceived either by a person or a group of persons and thereafter, go for identifying the scope, nature and size of the proposed enterprise.

Concepts of Projects

Projects generally refer to new attempts with a specific purpose and change so much that it is very difficult to define them accurately. Some of the commonly cited definitions are:

A project is a temporary effort to produce a unique product, service, or result.

(American National Standard ANSI / PMI99-001-2004)

A project is a unique process that consists of a set of coordinated and controlled activities, including start and end dates that are carried out to achieve the goal of confirming a particular requirement.

Includes time cost and resource constraints.(ISO10006)

Examples of projects include basin development, irrigation facility development, new crop development, new animal development, agricultural processing center development, farm building construction, concentrated forage plant puncture wounds. Of these projects, the configuration, type, range, size, and time are different.

Project Identification, Formulation and Report

Identifying a project is an important step in developing a project. They are designed to meet market demand, utilize natural resources, or generate wealth. Project ideas for development projects arise primarily from the national planning process, but industrial projects usually arise from the identification of commercial prospects and potential interests.

Since projects are a means of achieving specific goals, there may be several alternative projects that achieve these goals. It is important to support the particular project proposed for consideration and to show all other justified and considered alternatives.

Sectoral surveys, opportunity surveys, support surveys, and project identification are promising, basically screening the number of project ideas that come out based on expert opinion, based on available information and data. The focus is on coming up with a limited number of project options.

“Project development” is the process of presenting project ideas in a form that can be compared and evaluated in order to clearly determine the priorities that should be given to the project under strict resource constraints.

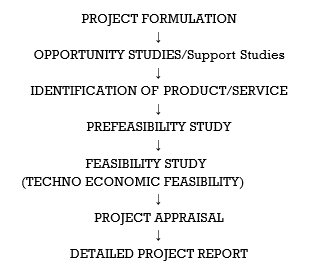

Project Formulation involves the following steps (Figure 1).

Figure 1. Project Formulation –Schematic view

- Opportunity research

Opportunity surveys identify investment opportunities and are typically conducted at the macro level by institutions involved in economic planning and development. There are three types of common opportunity studies: area studies, sector and subsector studies, and resource-based studies. Opportunity and support surveys provide a good foundation for identifying projects.

2. Pre-feasibility study / opportunity study

Pre-feasibility studies should be considered as an intermediate stage between project opportunity studies and detailed feasibility studies. The difference is primarily in the range of details of the information obtained. This is the process of gathering facts and opinions about the project. This information is then scrutinized to tentatively determine if it is worth furthering the project idea. Pre-feasibility studies focus on assessing market potential, investment size, technical feasibility, financial analysis, risk analysis and more. The breadth and depth of pre-feasibility depends on the time available and the trust of decision makers. Pre-feasibility studies help prepare project profiles for presentation to various stakeholders, including funding agencies, to seek assistance with the project. It also sheds light on aspects of the project that are inherently important and require further investigation by feature support research.

A supportive study is conducted before commissioning a feasibility study for a project that requires pre-feasibility or large investment. These studies also form an integral part of feasibility studies. These cover in detail one or more important aspects of the project. The content of the support survey depends on the nature of the survey and the project under consideration. The conclusions must be clear enough to give direction to the next stage of project preparation, as it relates to important aspects of the project.

3. Feasibility study

Feasibility studies form the backbone of project development and provide a balanced overview that incorporates all aspects of possible concerns. This study explores practicality, how to achieve goals, strategic options, and methodologies, and predicts the expected outcomes, risks, and outcomes of each course of action. It provides the basis for the definition and rationale of the project so that quality is reflected in subsequent project activities. Well-performed research provides a sound foundation for decision-making, clarification of purpose, logical planning, minimal risk, and successful cost-effective projects. To assess the feasibility of a proposal, you need to understand the STEEP factors. These are social, technical, ecological, economic, and political.

Feasibility studies are not an end in themselves, but a means of reaching investment decisions. Creating a feasibility study report is often difficult due to the number of choices (technology choice, plant capacity, location, financing, etc.) and the prerequisites for which decisions are made. The feasibility study of the project

-Economic and market analysis

-Technical analysis

--Market analysis

--Financial analysis

--Economic benefits

-Project risks and uncertainties

-Management aspect

Economic and market analysis

In recent years, market analysis has undergone a paradigm shift. Forecasting demand for products / services and forecasting supply-demand gaps can no longer be based on extrapolation of past trends using statistical tools and methods. You need to consider multiple parameters that affect the market. Forecasting should take into account all possible developments. A review of projects carried out over the years suggests that many projects failed not due to technical and financial issues, but primarily due to the fact that the projects ignored customer demands and market power. I am.

Market analysis needs to consider many factors such as product specifications, pricing, distribution channels, trade practices, alternative threats, domestic and international competition, and export opportunities. It should be aimed at providing an analysis of future market scenarios. Project investment decisions can be made objectively, taking into account market risk and uncertainty.

Technical analysis

Technical analysis is based on product and specification descriptions and quality standard requirements. The analysis includes the alternative technologies available, the selection of the most appropriate technology for the optimal combination of project components, the impact of technology acquisition, and the contractual aspects of the license. Special attention is paid to technical aspects such as project selection. The technology of choice must also take into account the requirements of raw materials and other inputs from a quality standpoint, making production costs competitive. Simply put, the technical analysis included the following aspects:

Technology-Availability

-Alternative proposal

-Latest / State-of-the-art

-Other impacts

Plant capacity-market demand

-Technical parameters

Input-Raw Materials

-component

- Power

- water

--Fuel

-others

Availability Skilled personnel

\ Location Logistics

Environmentally friendly – building / foundation of requirements such as pollution

Other related details

Environmental impact survey:

Almost all projects have some impact on the environment. Current concerns about environmental quality require environmental clearance for all projects. Therefore, an environmental impact analysis should be performed before starting a feasibility study.

Purpose of environmental impact assessment:

• Identify and explain the environmental resources / values (ER / V) or environmental attributes (EA) affected by the project (in the most quantified way possible).

• Explain, measure and evaluate the environmental impact of the proposed project on ER / V.

• Describe proposed project alternatives that can achieve the same results but have different sets of environmental impacts.

Environmental impact assessments will facilitate providing the necessary corrective actions for the equipment and facilities provided in the project to comply with environmental regulatory specifications.

Financial analysis

Financial analysis examines the feasibility of a project from financial or commercial considerations and shows the return on investment. Some of the commonly used techniques in financial analysis are:

• Repayment period.

• Return on investment (ROI)

• Net Present Value (NPV)

• Profitability Index (PI) / Cost-Benefit Ratio

• Internal rate of return (IRR)

Repayment period

This is the simplest of all methods and calculates the time required to recover the initial project investment from subsequent cash flows. It is calculated by dividing the investment amount by the sum of the annual income (income-expenditure) until it is equal to the cost of capital.

Return on Investment (ROI);

ROI is the annual return as a percentage of the initial investment and is calculated by dividing the annual return by the investment. The calculation is easy if the returns are uniform. For example, the ROI of a fishpond is (5000/10000) x 100 = 50%. If the returns are not uniform, the average annual return over a period of time is used. The average rate of return for horticultural orchards is (1,30,000 / 3) = 43333. ROI = (43333/100000) X 100 = 43.3%.

ROI calculations have the same restrictions as the payback period. Does not distinguish between the two projects. One is a project that provides immediate return (lift irrigation project) and the other is a project that returns after about 2-3 years of gestation (development of new varieties of crops).

Both the payback period and the ROI are simple and suitable for rapid analysis of the project, and the feasibility of the project may be poorly measured. These methods should be used in combination with other discounted cash flow methods such as net present value (NPV), internal rate of return (IRR), and cost-benefit ratio.

Discounted cash flow analysis:

The principle of discount is the opposite of compound interest, which takes the value of money over time. To understand him, let's first look at the compound interest example. Assuming a return of 10

%, Rs100 grows to Rs110 /-in the first year and to Rs121 in the second year. Conversely, with a 10% discount rate, the next year's Rs.110 revenue is equivalent to the current Rs100. In other words, the present value of next year's earnings at a discount rate of 10% is Rs.90.91, or (100/110). Similarly, Rs 121 in the second year is now equivalent to Rs 100 /-or the present value of revenue two years later. The year is rupees. 82.64 (100/121). These values Rs.90.91 and rs.82.64 are known as the present value of future annual revenue Rs.100 in the first and second years, respectively. Mathematically, the formula for calculating the present value (PV) of the cash flow "Cn" for the "nth" year at a discount rate of "d" is:

PV = Cn / (1 + d) n

The calculated discount factor table is also readily available. In financial analysis, the present value is calculated for both investment and return. The results are displayed with three different measurements. NPV, B-C ratio, and IRR.

Net Present Value (NPV)

Net present value is considered one of the key indicators in determining the economic feasibility of a project. The sum of the discounted values of the investment flow in the various years of project implementation indicates the present value of the cost (eg C). Similarly, the sum of the discounted earnings yields the present value of the earnings (eg B). The net present value (NPV) of a project is the difference between these two values (B-C). In a project, it is always desirable to have a high NPV value.

Cost-Benefit Ratio (B-C Ratio) or Profitability Index (PI);

The B-C ratio, also known as the Profitability Index (PI), reflects the profitability of the project and is calculated as the ratio of the total present value of earnings to the total present value of investments (B / C). The higher the ratio, the higher the return.

Internal rate of return (IRR):

Internal rate of return (IRR) indicates the limit or discount rate at which the total present value of a project (B) is equal to the total present value of an investment (C), or B-C.

= Zero. In other words, the discount rate at which the NPV of the project becomes zero. The IRR is calculated by iteration. That is, calculate the NPV at different discount rates until the value is near zero. A project with a high IRR is desirable.

Risks and uncertainties

Risks and uncertainties are associated with every project. Risk is associated with the occurrence of adverse effects and can be quantified. Analyze with the probability of occurrence. Uncertainty, on the other hand, refers to an essentially unpredictable dimension and is assessed through sensitivity analysis. Therefore, these aspects need to be analyzed during the program development and evaluation stages. Factors resulting from project risk and uncertainty fall into the following categories:

• Technology – Related to project scope, technology changes, input quality and quantity, activity time, estimation errors, and more.

• Economical-related to markets, costs, competitive environment, policy changes, exchange rates and more.

• Socio-political-including aspects such as labour and stakeholders.

• Environmental – Factors can be pollution levels, environmental degradation, etc.

Economic benefits:

Apart from the economic benefits (in terms of return on investment), the economic benefits of the project are also analyzed in the feasibility study. Economic benefits include job creation, economic development in the area where the project is located, foreign exchange savings in the case of import substitutions, or foreign exchange acquisition in the case of export-oriented projects.

Management aspect:

Management aspects are very important in project feasibility studies. Management aspects cover promoter background, management philosophy, organization establishment and staffing for project implementation and operations stages, decentralization and delegation aspects, systems and procedures, practices, and finally accountability. To do.

Project implementation time frame:

Feasibility studies also offer a wide range of timeframes for project implementation. Timeframes affect preoperative and cost escalations that affect project profitability and feasibility.

Feasibility report:

Based on a feasibility study, a techno economic feasibility report or project report is created to facilitate project evaluation and evaluation and investment decisions.

4. Project evaluation

Project evaluation is a process of critical review and analysis of the entire proposal. The assessment goes beyond the analysis shown in the feasibility report. At this stage, additional information is edited and further analysis of the project dimensions is made as needed.

Start. At the end of the process, evaluation notes are created to facilitate decisions regarding the implementation of the project.

The appraisal process generally focuses on the following aspects:

• Market Assessment: Focuses on demand forecasting, adequacy of marketing infrastructure, and the capabilities of key marketers.

• Technical assessment: Covers product composition, capacity, manufacturing engineering know-how and technical cooperation processes, raw materials and consumables, locations and locations, buildings, plants and equipment, personnel requirements and break-even points.

• Environmental assessment: Land use and micro environmental impacts, natural resource initiatives, and government policies.

• Financial Valuation: Capital, rate of return, specifications, contingencies, cost forecasts, capacity utilization, and funding patterns.

• Economic valuation: Considered a supportive valuation, it reviews the rate of return, effective protection, and domestic resource costs.

• Management Assessment: Focuses on promoters, organizational structure, management, and human resources management.

• Social Cost-Benefit Analysis (SCBA): Social Cost-Benefit Analysis is a methodology for assessing a project from a social perspective, focusing on the social cost and benefits of the project. In many cases, the financial costs and benefits that SCBA incurs from a project may be based on the UNIDO method or the Little Millil (L-M) approach. In the UNIDO method, the net profit of the project is considered in terms of economic (efficiency) prices, also known as shadow prices. According to the L-M approach, project outputs and inputs are categorized into (1) traded goods and services (2) non-traded goods and services. (3) Labour. Currently, the focus is on SCBA-based economic rate of return (ERR) around the world, including India, which is considered important in project development and investment decisions.

5. Detailed Project Report (DPR)

Once the project is evaluated and investment decisions are made, a detailed project report (DPR) is created. It provides all relevant details, including blueprints, specifications, detailed cost estimates, etc., which serves as a blueprint for project implementation.

Project Appraisal

The feasibility or feasibility assessment of a proposed project by a lender is called a project assessment.

Before I talk about the definition of project evaluation, I would like to tell you one interesting story from my life. This is the story.

I'm a PMP and have extensive experience in managing different types of projects, so how a truck driver and a neighbor with no experience in project evaluation management would do all these "projects" without prior evaluation I was always wondering if it could be done. Analysis of early concepts, problems, and solutions. A "project" is an activity that a neighbor does when building a garage in the backyard, refurbishing a kitchen, repairing a truck, or talking to a mail carrier. Mysteriously, this person can do a successful "project" without knowing anything about project evaluation and management, but not understanding that it is a project.

One day I went to my neighbour with all these thoughts. I wanted to know how he succeeded without using projects, evaluations, or anything else that I could consider to be an evaluation process. When I met him in his refurbished kitchen, I was surprised to see him making a preliminary plan for his next project, the purchase of a new car. He was sitting at a small kitchen table and writing something on a large sheet of newspaper (more precisely, "Daily News"). I walked near the table and saw many underlined and erased words and sentences on a sheet of paper with multiple arrows and circles. "What are you doing?"-That's what I asked. "Don't you see? I'm planning a new purchase. Remember the big Mercedes I showed you in a truck driver magazine last month. I decided to buy it. And now I'm trying to avoid failure. I want to plan everything in advance.

I sat at a table near my neighbor and he told me about his plans. It turns out that I was always planning before doing anything important or unusual in my daily life, such as remodeling a garage building or kitchen. As he said with a smile, "newspapers are always lying, but my records and plans will make reality more" realistic "and practical" (I still fully understand. (Cannot), so he never used documents or templates, only newspaper sheets Project Rating is a consistent review of a particular project, evaluating its content and approving or rejecting this project It is a process that was done. You need to analyze the problem or address it in your project and generate solution options (alternatives). Identify issues, select the most viable option, perform feasibility analysis of that option, create solution statements, and identify all people and organizations that are relevant or affected by the project and its expected outcomes. .. This is an attempt to justify a project through analysis, which is a way to determine the feasibility and cost-effectiveness of the project.

Evaluating a project means evaluating the proposed solution for its ability to solve an identified problem or need. Some PM methodologies and guides (such as PMBOK) consider the evaluation of technical and financial projects as a component of the initial or pre-planning phase. PRINCE2 proposes the development of a business case, which is a form of project evaluation. Method 123 (based on the MPMM, PMI and PRINCE2 standards) also uses the business case to prepare the proposed project for feasibility analysis and evaluation.

Project evaluation management is an important step in any project, regardless of its nature, type or size. This stage represents the first point of the pre-planning or start phase. It is economically and technically unreasonable to proceed with further planning and development without evaluating the project. When buying a new car (such as a neighbour’s project), building construction, improving business processes, updating network systems, conducting marketing campaigns, building garages, and other environmentally necessary and necessary changes Preliminary evaluation and evaluation of the project to ensure the addition of.

Definition of product selection:

What is product selection in your business? Starting a business venture is a huge investment in both material and human perspectives that require careful planning. There are a myriad of product and service options for entrepreneurs so that investment opportunities can be sourced from several sources.

Steps involved in the new product selection process

There are three basic steps / steps in product / venture selection. These are the generation, evaluation, and selection of ideas.

Idea Generation: Product ideas and investment opportunities come from a variety of sources, including business / financial newspapers, research institutes, consulting firms, natural resources, universities and competitors.

The starting point for idea generation can be a simple analysis of the strengths and weaknesses of your business. Ideas can also be generated through brainstorming, desk research, and various types of management consensus procedures.

Rating: Screening for product ideas is the first step in a rating. Criteria such as the potential value of the product, the time and equipment required, the potential product's fit to the business's long-term sales plan, and the availability of qualified personnel to handle its marketability need to be thoroughly considered. There is.

Each identified product / investment opportunity needs to be properly valued. Preliminary feasibility studies of product market, technical and financial aspects are required at this stage to clearly understand the associated costs and benefits.

Pre-feasibility is a preliminary version of the feasibility study. It is similar to a feasibility study, except that there are few details. This is typically done for large and complex products / projects to decide whether to proceed with a more detailed feasibility study.

Selection: Selections are made from products that are known to be commercially viable, technically viable, and economically desirable. At this stage, the necessary machines will start working.

Causes of product failure

Frequent wrong choices can lead to product failure. Product failure can occur as a result of one or a combination of the following:

Monitoring management during the basic planning phase – Initial investigation may be inadequate or interpretation may fail.

Subtle changes in the market. For example, a competitor may unexpectedly bring a competing product to market.

Lack of sound market valuation

Product problems and defects (eg, manufacturing products that are too costly or too complex.

Inadequate marketing support. For example, a company may have reduced promotions because it valued its products so much in the market.

Lack of consumer education about products.

Product changes

Product selection is one thing, and product sustainability on the market is completely different. At the very least, you need to stabilize product sales. This is where product changes occur due to the dynamic nature of the business environment.

However, the method used to modify the product depends on the condition of the product in relation to the purchaser. There are several possible alternatives to product changes.

Quality Improvement – The purpose is to make the product more competitive. The improvement may be in appearance or end use.

Functional Improvements – Increasing the number of real or imaginary product benefits.

Style Improvements – The goal is to improve the aesthetic appeal of the product, not its functional performance.

Service improvements (e.g technical advice, faster supply, bulk destruction, etc.) Often used by small businesses competing with large companies.

Promotional benefits (e.g, giveaway competitions, etc.) are used to add value to the product.

Equipment for the selected product

Ingredients: For example, Nigeria is blessed with natural resources. Indeed, all raw material requirements for most industries in Nigeria can be procured locally.

Businesses in which Nigeria has a comparative advantage in terms of raw material availability, viability, and market opportunities include:

– Production of corn starch derivatives

– Ginger processing

– Rubber production

– Sugar production

– Production of oil seed chemicals

– Kaolin treatment

-Granular limestone production

– Crude salt treatment, etc.

When choosing a product for your business venture, you need to consider the following factors:

- Supply gap

The magnitude of unmet market demand that constitutes the source of business opportunities greatly determines the need to select a particular product. The products that are reflected in demand and have the highest probability of success are selected. In essence, there must be an existing explicit demand for the selected product.

b. Fund

The size of the funds that can be mobilized is also an important factor. Appropriate funding is required to develop, produce, promote, sell and distribute selected products.

c. Raw material availability and access

Different products require different raw materials. The quality and quantity of raw material sources required is a serious consideration. Are the raw materials available in sufficient quantity?

Where are the sources of raw materials? Are they accessible? Can they be local or imported sources? You need to provide satisfactory answers to these and many other related questions.

d. Technical meaning

You need to consider the manufacturing process of the product. You need to know the technical impact of the selected product on the existing production line, the technology available, and even the workforce.

Selecting a particular product may require the purchase of a machine or the refurbishment of an older one. The product itself must be technically satisfying and user-acceptable.

e. Profitability / marketability

In most cases, the product with the highest profit potential will be selected. However, you can also select products based on their ability to take advantage of idle capacity or complement the sale of existing products. The product must be marketable.

f. Availability of qualified personnel

Must be available to qualified personnel to handle product manufacturing and marketing. Product manufacturing costs should be minimized by reducing waste. This can be achieved by competent hands.

g. Government policy

This is a factor that is very often out of control. The focus of government policy can have a significant impact on product selection.

For example, a package of government incentives for a product that contains 100% locally input content can change the direction of a company's R & D and therefore the product of choice.

h. Government purpose

The product's contribution to achieving the company's short-term and long-term goals should be considered before making a choice. For example, a company's goals are to achieve sales growth, sales stability, or increase in the company's social value.

Key takeaways:

- Promotion simply means an act of producing or developing or starting an enterprise.

- Promotion of a venture is the process of starting an enterprise.

- Venture means a business project or an undertaking especially a commercial one involving certain degree of risk and uncertainty.

- Identifying a project is an important step in developing a project.

- A project is a temporary effort to produce a unique product, service, or result.

- “Project development” is the process of presenting project ideas in a form that can be compared and evaluated in order to clearly determine the priorities that should be given to the project under strict resource constraints.

- Feasibility studies form the backbone of project development and provide a balanced overview that incorporates all aspects of possible concerns.

- Technical analysis is based on product and specification descriptions and quality standard requirements.

- Current concerns about environmental quality require environmental clearance for all projects.

- ROI is the annual return as a percentage of the initial investment and is calculated by dividing the annual return by the investment.

- The principle of discount is the opposite of compound interest, which takes the value of money over time.

- Net present value is considered one of the key indicators in determining the economic feasibility of a project.

- Risks and uncertainties are associated with every project.

- Management aspects are very important in project feasibility studies.

- Based on a feasibility study, a techno economic feasibility report or project report is created to facilitate project evaluation and evaluation and investment decisions.

- What is product selection in your business? Starting a business venture is a huge investment in both material and human perspectives that require careful planning.

- Screening for product ideas is the first step in a rating.

- Product selection is one thing, and product sustainability on the market is completely different.

- The magnitude of unmet market demand that constitutes the source of business opportunities greatly determines the need to select a particular product.

- The product's contribution to achieving the company's short-term and long-term goals should be considered before making a choice.

Concept

Fundraising events are a major part of non-profit development programs around the world. Your goal as a fundraiser is to get the most out of your event and raise as much money as you can without wasting valuable time and resources.

When planning big and small funding events, there are eight basic concepts to keep in mind in order to raise as much money as possible.

1. The fundraising event is still fundraising.

Many nonprofits focus on the event part of the fundraising event. They find great headliners, hire nice bands, find good venues and print nice invitations. Then they expect money to flow in. When they don't get paid, they wonder why.

The fundraiser is still a fundraiser and all fundraising rules apply. You need to build relationships (with sponsors, auction donors, guests, etc.). You need to train your donor. You need to ask a question (... Gasping! ... Directly and even by phone). Raising funds through an event does not eliminate the basic rules of financing.

2. Who is important on the team?

What is your event committee / host committee focusing on? Problems arise when it comes to logistics rather than financing. The same applies to your board. If your team isn't enthusiastic about raising money and has a personal network large enough to support it, it's unlikely that you'll reach your event's funding goals.

Find host committee and board members who will take ownership of some of the event funding by selling sponsorships and tickets. Then we will provide you with the training and materials you need to do so.

3. The money saved is the money earned.

Event revenue goals should be viewed in terms of "net revenue" rather than "total revenue." Gross income is all the money you bring in at the event, regardless of the cost of the event. Net income is the money collected at the event minus the cost of the event. Your non profit needs money to pay for program and organization overheads – the only money you can spend on those items remains from the event after you deduct the event costs It's the money you have. Therefore, you need to focus on net income.

The money saved at your event is the money you earn for your non profit organization. Think of it this way. Raising $ 25,000 and spending $ 15,000 on venues, catering, promotional materials, and more for a great event in your organization will ultimately bring you $ 10,000 in net revenue.

On the other hand, you probably have some of your ingredients donated and it's still a great menu, but it's a bit cheaper to go. In that case, you raise $ 25,000 and spend $ 10,000 on the event. That means the final net revenue sent to your organization is $ 15,000. This means a 50% increase in funding revenue relative to revenue.

We spend most of our time bringing money to the event, but don't forget to carefully consider the costs and possible in-kind donations so that you can keep more of the money raised at the event.

4. Don't be distracted by the side show.

There are many "side shows" with non-profit events. There are colour schemes to choose from, wine baskets to put together, event favours to package, and flower arrangements to choose from. Do not be inhaled. Financing is important to your event.

Sure, you should have a nice event. Yes, you need to choose a colour scheme and flower arrangement. But do you need a committee of five to spend an hour doing so? Or can you choose something that looks good and do it? I would like the staff to spend 50 minutes making sponsorship calls and 10 minutes choosing flower arrangements. The reverse is also true.

5. Sponsorship> Ticket Sales> Added Revenue Stream

Focus on sponsorship. Next, focus on selling tickets. Then focus on the added revenue sources.Most of the event's efforts should focus on funding, and most of the funding efforts should focus on sponsorship sales. You spend less time selling tickets and need to spend less on additional revenue sources.

Use the 80/20 principle. Focus 80% of your time on 20% of the activities that raise most of the money for your event.

6. The biggest event of the year requires a year of effort.

Do you hold large hands-on deck fundraising events every year, such as gala and annual dinners? If so, you’re big annual event will require a year of effort to raise the maximum amount.

I used to work for a non-profit organization that hosts a major annual supper. Raised a significant portion of the organization's annual budget. When I arrived at the office the next day, one of the staff said, "It was a really good event, but I'm glad it was over. It was a lot of work! When will we start next year's event? A few months?" My answer was “Enjoy today. We will start working on next year's event from tomorrow. "

He exaggerated me, but it wasn't. A big annual event requires a lot of annual effort. We need to start training this year's event donors for next year's event. You need to go see them. Thank them. Ask them other people who may be interested in sponsoring the event. Stay in touch with them. Manage them. Add new prospects. Build a new relationship. Request an event before making an update. The event should take place 4-6 months after the event. It's a year-long effort.

7. Relationships are important.

Financing is all about relationships. All fundraising events are also about relationships. Many nonprofits have corporate sponsors who donate to events each year, but the organization nevertheless has no relationship with anyone in the company. Similarly, many charities do not contact event attendees or silent auction item providers, at least until it is time to request an event next year.

The best way to exponentially increase the revenue of a fundraising event is to start developing event donors in a systematic way. Hold a meeting. Add them to the mailing list. We will hold an event to thank the item providers of the silent auction. Invite event guests to join the volunteer committee. Fostering event donors will not only increase the revenue of next year's event, but also the overall donor base.

8. Event revenue will increase over time.

If you start an event and want it to be an annual event (a large annual gala or a small, simple annual event), the revenue of the event generally increases year by year, at least until you reach the plateau point. Please understand what to do. So if you hold an event that raises $ 50,000 this year and do all the right things to grow the event (that is, what we'll explain in this class), you'll get $ 60,000 ... Next year and $ 75,000 ... Next year. And the fourth year is $ 100,000.

This is to show a combined effect when the event is executed properly. If you hold a great event, your guests will talk to their friends and bring them to next year's event. If your silent auction is reported, more companies will want to participate in the auction next year. If you treat sponsors really well and grow them throughout the year, they will introduce you to other businesses in their network that may want to sponsor your event. With proper treatment of donors and guests, event revenues will increase year by year.

Need

The ultimate goal of financing is to raise money, but at least if your radar has long-term viability, it really has to be more than that.

Sure, you need cash to keep your organization up and running and to support your philanthropy and purpose, but financing actually offers some deeper benefits than that.

When done correctly, it helps reach more people, perform better operations, and most importantly, ensure the success of the organization longer than the current funding round. Method is as follows.

- Fundraising raises awareness

Financing allows you to be creative and force you to move out of your comfort zone. To be eligible for grants, sponsorships, and other free money, you need to prove that you are reaching as many people as possible in as many parts of the world as possible. This means digging into social media, refreshing your website to take advantage of the latest SEO and marketing tactics, and taking a new approach to outreach and maintenance.

b. Financing requires planning and prioritization

Raising money is not an easy task. It takes a lot of time, energy, and thinking to come up with a solid funding strategy that needs to take a step back to evaluate the entire organization. This can result in the need to actually evaluate operations such as resource allocation, staff, and time-consuming projects. As a result, you can optimize your work and maximize the funding you can get for them.

c. Financing empowers your team and provides a sense of unity

Fundraising is a great way to inspire your employees and be passionate about your goals. It gives them a common goal to lag behind and a single milestone to reach as a group. This can make all the difference, especially for large organizations and when team members are spread across different departments and departments.

d. Financing requires finding and maintaining new donors

It's not enough to run a fundraising campaign and find new donors. Finding new donors to raise money is one thing, but maintaining donors is just as important. Organizations need to run a series of paid campaigns and storytelling events to keep donors involved with charities. Nonprofits need funding to run engagement campaigns to retain donors.

e. Financing keeps you moving forward

Achieving one funding goal doesn't mean you're done; you can sit back and relax. The number of people who support you is constantly increasing, and the things you can do to support your goals are increasing. This means that a constant flow of funds is always needed. This constant need to do more, support more, and achieve more helps to motivate and drive the team, excite the team, and make a passionate change.

Types and sources

1) Capital campaign:

These are limited campaigns that are limited by the time of a particular project. These are time-specific and require good preparation and clever execution. That's why many nonprofits do this.

2) Corporate support:

As the name implies, this is a charitable donation from a company to an organization. The organization involves NGOs and other nonprofits. Nonprofits approach businesses and explain their mission. Few companies contribute to their goals from either the set budget or its foundation. Few companies may be interested in sponsoring an NGO's capital campaign. That's because it increases the reach of the brand. This is called because branding.

3) Online fundraising:

This method is one of the easiest ways to raise money for a cause. Being online, you can reach a larger audience that may be physically impossible. Most nonprofits in India do not harness the power of online financing. There are funding platforms like Milaap that use crowd funding to raise money for projects.

4) Income:

Income is the amount of money you earn from producing goods and services offered by nonprofits. For example, NGOs may make and sell handmade products and accessories such as handbags. If you have purchased any of these handmade accessories, this usually requires a marketing plan. Accessories purchased under the Being Human brand contribute to the Being Human Foundation, and the "Being human" brand is a perfect example.

5) Grant:

A grant is the amount of cash given to an organization or individual for the exact purpose. Individuals who choose a grant should keep track of all the data they may need in the future. There are also certain government grants.

6) Membership campaign:

This is one of the effective ways to get people together to learn more about your organization and the work you are doing. Bringing in members increases the chances of raising more money for the campaign, as most members turn into donors in a short period of time.

7) Special event:

Raising funds to support a cause from a special event proves to be the most efficient way, as it not only raises funds, but also raises awareness of your brand and the importance of the cause. .. Many artists, such as Justin Bieber and Coldplay.etc, support a small number of charities and hold charitable concerts to donate a percentage of their proceeds for charitable purposes.

There are many other ways to invest money in a project. Crowd funding is one such method. People often confuse crowd funding with financing. That's why we need to see this, which distinguishes between crowd funding and funding.

Sources

Companies are always looking for a source of funding to grow their business. Financing, also known as financing, refers to the act of providing resources to fund a program, project, or need. Financing can be initiated for short-term or long-term purposes. The various sources of funding are:

a) Retained earnings

b) Debt capital

c) Net worth

- Retained earnings

Companies aim to maximize profits at a price higher than the cost of manufacturing a product by selling or servicing the product. This is the most primitive source of funding for any company.

After making a profit, the company decides what to do with the capital it earns and how to allocate it efficiently. Retained earnings can be distributed to shareholders as dividends, or the company can reduce the number of issued shares by launching a share repurchase campaign.

Alternatively, the company can invest the money in a new project. For example, you can build a new factory or partner with another company to set up a joint venture.

b. Debt capital

Companies personally obtain debt loans through bank loans. They can also raise new money by issuing debt to the public.

In debt financing, the issuer (borrower) issues debt securities such as corporate bonds and promissory notes. Debt issues also include corporate bonds, leasing and mortgages.

The company that initiates debt issuance is a borrower to exchange cash and securities needed to carry out a particular activity. The company then repays the debt (principal and interest) according to the specified debt repayment schedule and the underlying contract of the debt securities issued.

The disadvantage of borrowing money through debt is that the borrower has to pay interest as well as repay the principal on time. Otherwise, the borrower may default or go bankrupt.

c. Net worth

A company can raise funds from the public in exchange for the company's proportional ownership in the form of shares issued to shareholders who become shareholders after purchasing the shares.

Alternatively, private equity financing can be an option if the entity or individual is within a network of companies or directors ready to invest in the project, or where funding is needed.

Compared to debt-capital financing, equity financing does not require you to pay interest to the borrower.

However, one of the disadvantages of equity capital funding is the long-term sharing of profits among all shareholders. More importantly, shareholders dilute the company's ownership control as long as the company sells more shares.

Other sources of funding

Sources of funding include private equity, venture capital, donations, grants, and subsidies that do not directly require a return on investment (ROI), with the exception of private equity and venture capital. They are also called "crowd funding" or "soft funding".

Crowd funding is the process of raising funds to carry out a particular project or to raise a small amount of money from a large number of individuals to start a venture. The crowd funding process is usually done online.

Key takeaways:

- Fundraising events are a major part of non-profit development programs around the world.

- Many nonprofits focus on the event part of the fundraising event.

- Event revenue goals should be viewed in terms of "net revenue" rather than "total revenue."

- There are many "side shows" with non-profit events.

- We spend most of our time bringing money to the event, but don't forget to carefully consider the costs and possible in-kind donations so that you can keep more of the money raised at the event.

- Financing is all about relationships. All fundraising events are also about relationships.

- If you start an event and want it to be an annual event (a large annual gala or a small, simple annual event), the revenue of the event generally increases year by year, at least until you reach the plateau point.

- The ultimate goal of financing is to raise money, but at least if your radar has long-term viability, it really has to be more than that.

- Financing allows you to be creative and force you to move out of your comfort zone.

- Fundraising is a great way to inspire your employees and be passionate about your goals.

- Achieving one funding goal doesn't mean you're done; you can sit back and relax.

- As the name implies, this is a charitable donation from a company to an organization.

- Income is the amount of money you earn from producing goods and services offered by nonprofits.

- A grant is the amount of cash given to an organization or individual for the exact purpose.

- Companies are always looking for a source of funding to grow their business.

- Companies personally obtain debt loans through bank loans.

- A company can raise funds from the public in exchange for the company's proportional ownership in the form of shares issued to shareholders who become shareholders after purchasing the shares.

References:

- Desai, A.N. : Entrepreneurship and Environment

- Dvrcker, Perer : Innovation and Entrepreneurship

- Gupta, C.B. : Entrepreneurship Development

- Kenneth, P.Van : Entrepreneurship and small Business Management

- Pareek, Udai & Ven : Developing Entrepreneurship book on Learning System Kateswara, Rao, T