Unit 1

Money

Goods time-honoured via way of means of standard consent as a medium of cash, financial trade. It is a medium wherein fee and fee are expressed. As a currency, it circulates anonymously from individual to individual and from united states of America to united states of America, hence facilitating trade, and it's miles a prime degree of wealth.

Money issues have involved humans from the time of Aristotle to the present. Paper categorized for $ 1, 10 Euros, one hundred Yuan, and 1,000 yen is a touch specific from paper of the equal length torn from newspapers and magazines, however the proprietor can order a few food. , Drinks, apparel and different family objects are handiest appropriate for lighting. What's the difference? The easy and accurate solution is that contemporary-day cash is a social ingenuity. People be given cash that manner due to the fact they understand that others do. This not unusual place feel makes a bit of paper precious due to the fact everybody thinks it's miles. Also, in my experience, cash has usually been time-honoured in trade for precious goods, assets, or services. After all, cash is a social exercise, however an uncommon power exercise that humans comply with even below intense provocation. Of course, the power of this treaty is that it permits governments to make cash via way of means of inflating (increasing) the currency. But it is now no longer indestructible. When the quantity of those papers will increase significantly, inclusive of at some stage in and after the war, cash can also additionally appear to be not anything extra than paper after all. If the social association to preserve cash as a medium of trade collapses, humans will search for options inclusive of cigarettes and cognac that have been briefly used as a medium of trade in Germany after World War II. In much less intense situations, new cash can also additionally update vintage cash. In many nations with records of excessive inflation, inclusive of Argentina, Israel and Russia, the fee of the greenback is extra solid than the neighbourhood currency, so charges can be anticipated in different currencies inclusive of America greenback. In addition, the greenback is widely known and the United States of America’s citizens be given the greenback as a medium of trade as it affords an extra solid shopping electricity than the neighbourhood currency.

Functions of Money:

Money performs various functions. Mainly the functions of money can be classified into three groups’ namely

(i) Primary functions (ii) Secondary function (iii) Contingent functions

1) Primary function: Primary functions are basic or fundamental function of money. In fact, they are the original functions of money which ensure smooth working of the economy. Following are the primary functions:

a) Medium of exchange: Money acts as an effective medium of exchange. It facilitates exchange of goods and services. Everything is bought and sold with help of money. By performing as the medium of exchange, money removes the difficulties of barter system.

b) Measure of value: Money serves as a common measure of value. The value of all goods and services are measured in terms of money. In other words, pieces of all goods and services are expressed in terms money.

2) Secondary function: Secondary functions are those functions which are derived from primary function.

a) Standard of deferred payment: Money acts as an effective standard of deferred payments. Deferred payments refer to payment to be made in future. Deferred payments have become the day to day activity in modern society. Money facilitates all kinds of credit transactions. Both, borrowings as well as lending are done in terms of money. All kinds of Hire purchase transactions are carried out in terms of money. As money enjoys the attributes of stability, Durability and General acceptability, it acts as a better standard of deferred payments.

b) Store of value: Money serves as a store of value. Savings were discouraged under the barter system due to lack of store of value. With inventions of money, it is possible to save. At present all savings are done in terms of money. Bank deposits represent the savings of the people. Moreover, money can be easily converted into any other Marketable assets like Land, Machinery, Plant, etc. Thus it facilitates capital accumulation. Money being the most liquid assets, it acts as a better store of value than any other assets.

c) Transfer of value: Money acts as a means of transferring purchasing power. Money facilitates transfer of value from one person to another person & one place to another place. As money enjoys general acceptability, a person can dispose of his property in Delhi and purchase new property at Mumbai. Instrument like cheques and bank drafts enable such transfer easy and quick.

3) Contingent function: In additions to the above functions, money has to performs certain special function known as contingent functions –

- Basis of credit: The modern business system is entirely linked to the credit system of the country. The credit system, on the other hand, derives its strength from money. In the absence of money, the credit instruments like cheque, bill of exchange, etc. are of no use. It is the quantity of money supply which determines the supply of credit in the country.

- Measurement & Distribution of national income: The national income is the result of efforts contributed by various factors of production. Money is helpful in measuring the contribution made by each factor of production and thus facilitates the distribution of national income between factors.

- Equalization of marginal utility: Every consumer is interested in spending his limited income in such a manner as to achieve maximum satisfaction (utility) for this purpose of achieving maximum satisfaction; he has to equalize marginal utilities from different goods. Money helps the consumer in equalizing marginal utilities.

- Liquidity: Money being the most liquid asset, it can be converted into any other assets quickly. An entrepreneur has to keep capital in liquid form for various purposes, such as transaction, Precautionary and speculative motives. Money provides such liquidity.

- Estimation of Macro Economic variables: Macro economic variables like Gross National Product, total savings, total investment etc. can be easily estimated in monetary terms. It also facilitates government tax collection, budgeting etc.

Alternative measures to money supply in India and their different Components, Meaning and changing relative importance of each component

Money supply

In the real world, the money supply has different definitions: M1 and M2. Money is categorized by its liquidity. The most liquid item is in M1.

M1: Includes currencies (coins coined by the US Treasury and banknotes issued by the Federal Reserve), checkable deposits, and travellers checks (issued by commercial banks and savings and loan associations).

M1 does not include currencies and checkable deposits belonging to the federal government, the Federal Reserve System, or other financial institutions.

M1 = Currency + Checkable Deposit + Traveller's Check

M2: In addition to all the components of M1, near money is included, including items such as:

a) Time deposits: Interest deposits with a value of less than $ 100,000 and a designated maturity.

b) Savings deposits: Deposits that earn maximum value and certain non-maturity interest.

c) Money Market Accounts: Savings deposits investing in short-term financial instruments pay higher than interest on savings accounts.

d) Overnight repo contract: A contract by a financial institution to sell short-term securities to a customer and a contract to buy back securities within 24 hours.

e) Overnight Eurodollar Deposit: A 24-hour dollar-denominated deposit held by a financial institution outside the United States.

M2 = M1 + All near money (fixed deposits, savings deposits, money market accounts, overnight repo contracts, overnight euro dollar deposits, etc.).

The modern banking system was developed from the early partial reserve banks.

Goldsmiths had vaults for gold and precious metals, which they often kept for a fee for consumers and merchants. They issued receipts for these deposits. After that, receipts were used as money instead of gold, and goldsmiths

Note that much of the saved gold was never redeemed. The goldsmith realized that he could lend money by issuing a receipt to a borrower who agreed to repay the money and interest. The actual gold in the vault has become only a small part of the receipts held by the borrower and owner of the gold. Fractional reserve banking is important because banks can generate money by lending more than their original reserves.

M3 (broad money)

M3 is all currencies, with or without, and consists of all debit deposits in banks, all bank deposits in RBI, and net time deposits in all banks. M3 = M1 + Bank deposit.

M4

M4 is very much of the money supply used by RBI. M4 = M3 + post office

Creation of money:

Individual banks are not allowed to print their money. However, banks can make money by making checkable deposits that are part of the money supply.

Suppose the Federal Reserve prints $ 100 and decides to deposit it in Bank X. Bank X reserves a portion of $ 100, for example 10%, which is the required reserve (the specific amount that the bank must hold as reserve for all deposits). The remaining 90%, $ 90, will be in excess reserve. Bank X can lend that $ 90 to Customer A. Customer A deposits in his account at Bank Y. In this step, the original $ 100 remains in the system and customer A can be added.

$ 90. Bank Y secures 10% and lends the rest. This process continues

Until you can no longer create a new excess reserve.

The money multiplier is a number that multiplies the change in the monetary base to find the resulting change in the amount of money.

Change in quantity of money = Change in money multiplier X monetary base.

The money multiplier is determined by the required reserve requirement (r) and currency outflow (c). c: The increase in currencies held outside the bank shows the portion of the currency that people hold as cash for their expansion after borrowing from the bank. r is the required reserve requirement determined by the Federal Reserve System. The bank must hold the r portion of the total deposit as a necessary reserve.

RR: Required reserve = total deposit x r

ER: Excessive preparation = actual preparation-necessary preparation

The maximum new loan amount of a bank is the same as the excess reserve held by the bank.

The modern banking system was developed from the early partial reserve banks.

Importance of Money Supply:

The growth of the money supply is a key factor in achieving price stability in the economy as well as accelerating the process of economic development.

To achieve stable development goals, you need to manage the expansion of your money supply. Healthy economic growth requires that there be no inflation or deflation. Inflation is the biggest headache in developing countries.

Moderate inflation resulting from the creation of funds from deficit finance can stimulate investment by raising expectations of profits and withdrawing compulsory savings. But runaway inflation is very detrimental to economic growth. Developing countries must face the problem of resource depletion in the early stages of development, and deficit finance can make up for this shortage. However, it must be kept within strictly safe limits.

Therefore, the increase in the money supply will have a significant impact on economic growth. In fact, it is now regarded as a legitimate means of economic growth. Keeping within the appropriate limits can accelerate economic growth, but exceeding the limits delays it. Therefore, managing the money supply is essential for stable economic growth.

The concept of money supply and its measurement:

Money supply means the total inventory of exchange monetary media available to society for use in connection with a country's economic activities.

According to the standard concept of the money supply, it consists of two components:

- Currency with the people,

- Request a deposit from the general public.

Before explaining these two elements of the money supply, there are two things to note regarding the money supply in the economy. First, the money supply is the total amount of money generally available in the economy at any given time. In other words, the money supply is a concept of stocks, a flow that represents the value of goods and services produced per unit time, as opposed to national income, and is usually regarded as one year.

Second, the money supply always refers to the amount of money held by the people. The term public includes households, businesses and institutions other than banks and governments. The reason for considering the money supply held by the public is to separate money producers from those who use money to meet the demands of different types of money.

Governments and banks produce or create money for their use, so the money they hold (cash reserves) is not used for trading or speculative purposes and is excluded from standard money supply measurements. This separation of money producers and money users is important from both a monetary theory and policy perspective.

Let's take a closer look at the two elements of the money supply.

Currency with the people:

Add the following items to reach the total currency with the general public of India.

- Circulation banknotes issued by the Reserve Bank of India.

- The number of rupee banknotes and coins in circulation.

- Small coins in circulation.

It is worth noting that in order to reach the total currency with the public, the bank's cash reserve must be deducted from the value of the above three currencies. This is because the bank's cash reserves must be left in the bank and cannot be used to pay for goods or trade in commercial banks.

Also note that recently issued banknotes issued by the Reserve Bank of India (RBI) are not fully backed by gold and silver reserves and are not considered necessary. In the past, when the gold or silver standard monetary system existed, the full backing of banknotes by gold reserves was widespread.

According to modern economic thought, the size of the currency issued should be determined by the financial needs of the economy, not by the available reserves of gold and silver. In other developed countries, the Reserve Bank of India has followed the minimum reserve system for currency issuance since 1957.

In this system, the minimum reserve requirement for Rs. You must hold 200 chlores of gold and other approved securities (dollars, pound sterling, etc.), for which you can issue any amount of currency depending on the financial requirements of your economy.

RBI is not obliged to convert notes to gold or silver of the same value. Currently, currencies cannot be converted. Written on banknotes and signed by the RBI Governor, the phrase "promise to pay the owner a total of 100 rupees" is just a legacy of the past and does not mean convertibility to gold or silver.

Another important point to note is that banknotes or coins are fiat money. That is, banknotes and metal coins act as money based on government fiat money (that is, orders). In other words, about the authority of the governor No one can refuse to accept them in the payment of the transactions made. That's why they are called fiat currencies.

Demand deposits to the public:

Another important element of the money supply is the public demand deposits with banks. These demand deposits held by the public are also called bank money or deposit money. Deposits in banks can be broadly divided into two types: demand deposits and time deposits. A bank's demand deposit is a deposit that can be withdrawn by drawing a check at the bank.

Through checks, these deposits can be sent to others to make payments from the person who purchased the goods or services. Therefore, checks create these demand deposits as a medium of exchange and therefore make them function as money. Please note that the demand deposit is a suitable fiat money.

Fiat money acts as money based on the trust of the payer, not the authority of the government. Therefore, despite the fact that the demand deposits and checks they are manipulated are not fiat currencies, they act as money based on the trust ordered by those who draw checks on them. They are money because they are generally accepted as a medium of payment.

Bank deposits are created when people deposit currency with them. But much more important is that banks make deposits when they make prepayments to businessmen and others. Based on a small amount of cash reserves in the currency, they can create much larger demand deposits through a system called the Fractional Reserve System. We'll talk more about this later.

In developed countries such as the United States and the United Kingdom, deposits make up more than 80% of the total money supply, and currencies are a relatively small part of it. This is because the banking system has evolved significantly and people have developed banking habits.

On the other hand, in developing countries, the banking industry is not well developed, they do not have the habit of banking, and they prefer to trade in currencies. However, in India, after 50 years of independence and economic development, the share of bank deposits in the money supply has risen to about 50%.

Key takeaways:

- Money is a commonly accepted, recognized and centralized exchange medium in the economy used to facilitate the trading of goods and services.

- The use of money eliminates the problem of the double chance of desire that can occur in bartering.

- Economically, each government has its own financial system, defined and monitored by central authorities.

- Cryptocurrencies represent a replacement sort of money with international exchange opportunities.

- Money itself has no real value. Its value is symbolic because it conveys the importance that folks place thereon.

- Money allows people to indirectly trade goods and services and convey the price of goods, which provides individuals with a way to preserve their wealth over the long term.

- Before money, people acquired and exchanged goods through a bartering system that included direct trading of goods and services.

- The first region in the world to use industrial facilities to produce coins that could be used as currency was the region called Lydia (modern West Turkey) in Europe around 600 BC.

- Around 770 BC, the Chinese first devised a system of banknotes.

- Bartering was one way people exchanged goods for other goods before money was born.

- Like gold and other precious metals, money is valuable because it represents something of value to most people.

- Fiat currency is a government-issued currency, supported by the stability of the issuing government, not a physical commodity

Meaning and Uses

High-powered plutocrat or strong plutocrat refers to currencies issued by the Government of India and the Reserve Bank of India. Some of this currency is stored with the general public and the rest is stored in reserve banks as wherewithal. So, we've the following equation

H = C R

Where H = strong plutocrat

C = Currency with the general public (bills coins)

R = Government and bank deposits by RBI

So, the sum of the Croesus deposited with the people and the bankroll of the bank is called strong Croesus. It's generally created by the central bank. Because corporate bank bankroll plays an important capacity in credit creation. So it's really important to study endowment. There are two types of reserves (i) legal reserves (RR) for banks associated with central banks and (ii) another reserves (ER).

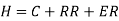

So, H = C RR ER

High- powered plutocrat is also called collateralized plutocrat (RM) because the bank holds a reserve fund (R) and is created rested on this demand deposit (DD). High power plutocrat is called base plutocrat because the warp for creating credits is the Reserve Fund (R) and Ris is acquired as part of the High-Power Money (H) Security Fund.

Uses:

As mentioned anteriorly in this chapter, the following are vital factors in determining high power plutocrat

- Currency with the people

- Other deposits by RBI

- Cash with the bank

- Bank deposit by RBI.

High power Croesus (H) includes public currency (C), important marketable bank reserves, and other reserves (ER). So, the following equation is drawn.

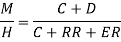

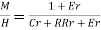

Thus we get the equation:

Supply of money (M) includes bank deposits (D) and currency with public ©. Thus

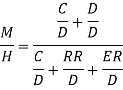

Dividing both the equations, we get

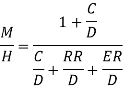

Now, dividing the numerator and the denominator by D we get:

Presently, the demanded reserve proportion is RRr, the demanded reserve must proportion is RR/ D, and the else reserve proportion is ERr.

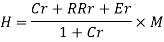

The enclosed figure shows that when the fund of high-power Croesus increases the AH, the Hs bend jumps to Hs and the fund and demand of high-power money in equilibrium at E. When the fund of high-power Croesus goes to Hs, the Croesus fund is turned on. The new equilibrium point is E, the Croesus fund in these two OMs. From the enclosed figure, it's also clear that when high- power Croesus increases AH, the Croesus fund increases to AM.

Sources of changes in high-powered money

The following are influential sources of high-powered money:

(1) Reserve Bank of India claims; The Reserve Bank also lends to the government. The loan is in the form of a reserve bank investing in government bonds. After subtracting government deposits from the reserve bank loan volume, the volume of net bank credit to the government is calculated. It's also a significant source of plutocrat.

(2) Reserve Bank's Net Foreign Exchange Wherewithal Arranging foreign exchange resources is the job of the Reserve Bank. When the reserve bank pays the public plutocrat to buy foreign securities, the volume of foreign exchange increases and the strong plutocrat increases. Conversely, when a reserve bank sells foreign securities, the volume of foreign exchange with the country's central bank losses. As a result, strong plutocrat is reduced.

(3) Government Monetary Responsibility to the People the Ministry of Finance of the Government of India is responsible for publishing 1-rupee notes and coins. This function is carried out through the government to fulfil its pecuniary liabilities to the people.

The volume of debt and plutocrat reservoir will increase, and the volume of high-powered plutocrat will also increase.

(4) Reserve Bank's Net Non-Monetary Debt Reserve Bank's non-monetary debt is in the form of capital introduced into public and statutory wherewithal. The main points are the Reserve Bank of India workers paid-in capital, reserve fund, donation fund and pension fund.

Reserve Bank’s non-monetary debt is differently proportionate to high-powered plutocrat. This means that as non-monetary debt increases, the volume of new high-powered plutocrat will reduce. So,

H = 1 2 3 – 4

The succeeding discussion provides information on the sources of high-powered plutocrat, but we also need to know what changes will transpire in the plutocrat stock, etc. as these sources and factors change. In fact, the plutocrat stock is the result. The size of H depends on the rate of reserves to deposits and the rate of time deposits to demand deposits.

Importance

The following are the importance:

(1) Base Croesus Public deposits in banks and the expansion of credit are the bedrock of the capitalist budget. As a result, some economists considered it base capitalist.

(2) Source of change The direction in which changes in high- power capitalist befall is driven by the direction in which the capitalist budget changes. So, high-powered capitalist is also important from this point of view.

(3) Deep pocket multiplier The deep pocket multiplier (M) is declared in the penny-pinching of high- power deep pocket, as the inventory of deep pocket is much forward than high- power deep pocket.

(4) Fiscal government When it comes to fiscal government, central banks in every country pay special attention to high-powered deep pocket. Because it's the maturity of the country's total moneybag’s repertoire.

Key takeaways:

- The monetary base of the economy, also known as M0, includes all the paper and coin currencies in circulation, as well as bank reserves held by the central bank.

- The monetary base is sometimes referred to as "high-powered money" because it can be extended by the money multiplier effect of the Fractional-Reserve Banking System.

- Economists usually look at more comprehensive monetary sums, such as M1 and M2, rather than the monetary base.

What is Finance?

Treasury is the allocation of assets, liabilities, and funds to time, processes, and media to get the most out of your activities. In other words, manage or expand your funds to maximize profits while addressing risks and uncertainties. Finance can be broadly divided into three segments: personal finance, corporate finance, and public finance.

Role of finance in an economy:

The functioning of the economic system relies upon at the economic device of the country. The economic device consists of banks as a relevant entity at the side of different economic carrier vendors. The country's economic device is deeply rooted in society and affords employment to many human beings. According to Baily and Elliott, the economic device has 3 most important capabilities.

- Providing Credits – Credits assist financial activity. Governments can put money into infrastructure initiatives through lowering tax sales cycles and enhancing spending, groups can make investments greater than coins, and people should purchase houses and different utilities with out saving the total quantity in advance. Growth. Banks and different economic offerings vendors provide this credit score facility to all stakeholders.

- Liquidity Supply – Banks and different economic vendors guard corporations and people from unexpected coins call for. Banks offer the characteristic of call for deposits that groups or people can withdraw at any time. Similarly, they offer corporations with credit score and overdraft capabilities. In addition, banks and economic establishments are presenting to shop for and promote securities, frequently in huge quantities, as had to meet the unexpected coins necessities of stakeholders.

- Risk Management Services-Finance affords danger control from the dangers of economic markets and commodity expenses through pooling the dangers. Derivative transactions permit banks to offer danger control. These offerings are extraordinarily precious in spite of being over-attacked in the course of the economic crisis.

Relationship among financial savings and funding

The above 3 key capabilities are vital for all financial operations and improvement activities. Apart from those capabilities, financial boom is pushed through the connection among financial savings and funding. Only when you have sufficient financial savings can you are making a large funding and manufacturing activity. This financial savings facility is obtainable through economic establishments via appealing hobby price schemes. The cash stored through the human beings is utilized by economic establishments to lend to corporations at a large hobby price. These price range permit corporations to growth their manufacturing and distribution activities.

Capital marketplace boom

Another vital challenge of finance is to reinforce the boom of capital markets. A organisation wishes styles of capital: constant capital and running capital. Fixed capital refers back to the price range had to put money into infrastructure inclusive of buildings, plants, and machinery. Working capital refers back to the price range required to run a commercial enterprise on each day basis. This can also additionally check with ongoing uncooked fabric purchases, completed product costs, and completed product shipments to shops or customers. The economic device allows you to boost cash withinside the following ways:

Fixed Capital – Companies problem stocks and company bonds to elevate constant capital. Both public and personal economic offerings vendors put money into those shares and company bonds to make a earnings with minimum danger.

Working Capital – Companies problem invoices, promissory notes, etc. to elevate short-time period loans. These credit score merchandise are legitimate withinside the cash marketplace that exists for this purpose.

The Forex market marketplace

To assist import and export businessmen, there are forex markets in which groups can acquire and switch price range in different nations and currencies. These forex markets additionally permit banks and different economic establishments to borrow and lend cash in different currencies. In addition, economic establishments could make a earnings through making an investment in short-time period idle price range through making an investment withinside the foreign exchange marketplace. The authority additionally meets forex necessities via those markets. Therefore, the forex marketplace impacts financial boom and credit score withinside the global marketplace.

Government securities

Governments use the economic device to elevate price range that meets each short-time period and long-time period investment necessities. The authorities troubles bonds and invoices at appealing hobby charges and additionally gives tax concessions. Budget gaps are closed through authority’s securities. Therefore, capital markets, forex markets, and authorities’ securities markets are critical to assist corporations, industries, and governments perform financial improvement and boom activities.

Infrastructure and boom

Economic boom relies upon at the boom of countrywide infrastructure facilities. Major industries inclusive of electricity, coal and oil decide the boom of different industries. These infrastructure industries are funded through the countrywide economic device. The capital necessities of the infrastructure enterprise are enormous. Raising such massive sums is hard for personal sectors, so historically governments had been totally liable for infrastructure initiatives. However, financial liberalization guidelines have brought about the participation of the personal zone withinside the infrastructure enterprise.

Development banks and service provider banks, which include IDBI in India, are supporting to fund those sports for the personal sector.

Trade improvement

Trade is the maximum crucial financial interest. Both home and global change are supported via way of means of the economic gadget. Traders want finances furnished via way of means of economic establishments. Financial markets, on the alternative hand, assist cut price economic merchandise which includes promissory notes and bills. Commercial banks fund global change via pre-cargo and post-cargo financing. A letter of credit score is issued to the importer, which facilitates the United States earn tremendous overseas exchange.

Employment boom

The economic gadget performs a crucial position withinside the boom of employment withinside the financial system. Businesses and industries are funded via way of means of economic structures that cause employment boom and consequently boom financial interest and home change. Increased change will cause intensified competition, sports which include income and marketing, and similarly boom in employment in those sectors.

Undertaking capital

Increased funding in undertaking capital and ventures will improve financial boom. Currently, the variety of undertaking capital in India is small. Due to the dangers involved, it's far tough for man or woman groups to make investments immediately in ventures. Financial establishments specifically fund ventures. The growing variety of economic establishments assisting ventures will guide this segment.

Balance financial boom

Growth in diverse sectors of the financial system is balanced via the economic gadget. There are primary, secondary and tertiary industries, all of which want enough investment for boom. The country wide economic gadget finances those sectors and offers enough investment for the industrial, agricultural and offerings sectors.

As such, finance performs an crucial position withinside the improvement of any financial system, and an financial system can't be triumphant without a valid economic gadget.

Kinds of Finance

There are two main types of finance.

- Debt finance

- Equity finance.

Other types of finance

- Public Finance,

- Personal loan,

- Corporate finance

- Private finance.

Each type is described below with a definition and description.

- Debt Finance:

Basically, the cash you earn to maintain or run your business is known as debt finance. Debt Finance does not provide ownership control for money lenders. The borrower must repay the principal with the agreed interest rate. In most cases, interest rates are based on the amount of the loan, the duration, the purpose of borrowing a particular type of finance, and the rate of inflation.

Debt finance can be divided into three types:

- Short term

- Mid-term and

- Long term

- Short-term debt finance:

Loans that are typically required for a period of 1 to 180 days or more are called short-term debt financing. These loans are borrowed to cover shortages of funds and temporary or irregular requirements. Daily operations such as paying staff wages and obtaining raw materials basically require short-term funds. The amount of money you get for a short-term loan depends primarily on other sources of income for repayment. Credit lines from business suppliers are the most common form of short-term debt financing.

Trade credit, credit cards, bill discounts, bank overdrafts, working capital loans, small business loans, short-term loans from retail banks, and customer prepayments are other forms of short-term financing.

Ii. Medium-Term Debt Finance:

Loans that are typically required for a period of 180 to 365 days or more are called medium-term debt financing. How to use the funds depends mainly on the type of industry. Companies typically repay loans from their source of cash flow. Companies choose this type of finance to buy equipment, fixed assets, and so on.

Small business owners and start-ups may use medium-term debt financing to carry out fund rotation. This is because new businesses have to pay the supplier in advance for all the necessary goods, such as the purchase of equipment, machinery, inventory, etc. Examples of medium-term debt financing include employment purchase financing, leasing finance, medium-term credit from commercial banks, and bond / corporate bond issuance.

Iii. Long-term debt finance:

Loans that are generally required for a period of 365 days or more are called long-term debt financing. This type of financing is primarily needed to buy plants, land, office and building restructuring, etc. for business. Long-term finance has higher interest rates than short-term finance. The repayment period for this debt financing is typically 5, 10, or 20 years.

Car loans or mortgages are two popular examples of long-term finance. Bond / corporate bond issuance, preferred stock issuance, stock issuance, long-term loans from governments, financial services institutions or investment banks, venture funds or funds from investors are other examples of long-term debt financing.

b. Equity finance:

Equity finance is a classic way to raise funds for a company by issuing or offering shares in the company. This is one of the major differences between equity finance and debt finance. This funding typically applies to seed funding for start-ups and new businesses. Well-known companies are using this money to raise additional capital to expand their business.

Equity financing is typically raised by issuing a business or offering shares. Basically, each stock is a unit of ownership of that particular company. For example, if a company offers 10,000 shares to a public investor. Investors buy 1000 shares of the company. That is, the investor owns 10% of the ownership of the company.

Other types of finance are described below.

- Public finance:

Finance deals with state spending and income research. It only considers government finances. The scope of finance includes the collection and distribution of funds across various sectors of state activity that are considered important functions or obligations of government.

Finances can be divided into three types:

- Public spending

- Public income

- Public debt

- Public spending:

Public spending means the costs that governments incur to maintain it and to the welfare and conservation of its economy, society, and the state.

Ii. Public income:

Broadly speaking, public income includes all income and income that the government earns at any time, regardless of its nature or source. It also includes government-procured loans. In a narrow sense, it only includes income from sources of income, including taxes, prices, fees, fines, fines, gifts and more.

Iii. Public Debt:

Public debt means a loan raised that is a source of public funds with repayment obligations to individuals and interest.

b. Personal loan:

Personal finance means applying the principles of finance to the financial decisions of a family member or individual. This includes how families and individuals can acquire, budget, spend, and save financial resources over a period of time, taking into account various future life events and financial risks. Financial status focuses on understanding the personal resources available by examining household cash flows and net worth. Net worth is an individual's balance sheet, which is derived by summing all the assets under an individual's control minus all the household's liabilities at one time.

c. Corporate finance:

Corporate finance includes financial activities related to corporate management. This is the department or department that oversees the financial functions of the company. Corporate finance's primary concern is maximizing shareholder value through short-term and long-term financial planning and the implementation of various strategies.

d. Private finance:

Private finance is an alternative to corporate finance that helps businesses raise funds to avoid financial problems in a limited time frame. Basically, this method helps companies that are not listed on the stock exchange or cannot raise funds in such markets. Private financial planning is also suitable for nonprofits.

Key takeaways:

- Treasury is the allocation of assets, liabilities, and funds to time, processes, and media to get the most out of your activities. In other words, manage or expand your funds to maximize profits while addressing risks and uncertainties.

- The functioning of the economic system relies upon at the economic device of the country.

- Banks and different economic vendors guard corporations and people from unexpected coins call for.

- Another vital challenge of finance is to reinforce the boom of capital markets.

- Companies problem invoices, promissory notes, etc. to elevate short-time period loans.

- Governments use the economic device to elevate price range that meets each short-time period and long-time period investment necessities.

- Economic boom relies upon at the boom of countrywide infrastructure facilities.

- The economic gadget performs an crucial position withinside the boom of employment withinside the financial system.

- Growth in diverse sectors of the financial system is balanced via the economic gadget.

- Basically, the cash you earn to maintain or run your business is known as debt finance.

- Loans that are typically required for a period of 1 to 180 days or more are called short-term debt financing.

- Small business owners and start-ups may use medium-term debt financing to carry out fund rotation.

- Equity finance is a classic way to raise funds for a company by issuing or offering shares in the company.

- Finance deals with state spending and income research.

- Personal finance means applying the principles of finance to the financial decisions of a family member or individual.

- Corporate finance includes financial activities related to corporate management.

- Private finance is an alternative to corporate finance that helps businesses raise funds to avoid financial problems in a limited time frame.

Introduction

The country's economic development is reflected in the progress of various economic sectors, which are broadly divided into the corporate, public, and domestic sectors. Some places and people have more money, while others are shorter. The financial system or financial sector acts as a mediator, making it easier for funds to flow from residual to arrears. The financial system consists of various institutions, markets, regulations and laws, practices, financial managers, analysts, transactions, claims and liabilities.

The financial system consists of a set of sub-methods for financial institutions, financial markets, financial instruments and services that support capital formation. Provides how you save money that is converted into cash.

The term "system" in the term "financial system" means a set of complexes, closely related or related institutions, agents, mechanisms, markets, transactions, claims, and liabilities in the economy. The financial system prefers money, debt and finance. The three words are closely related, but slightly different from each other. The Indian financial system consists of financial markets, financial products and financial intermediaries.

Description of the Financial System

The financial system acts as a liaison between rescuers and investors. It facilitates the flow of funds from the residual area to the residual area. She is worried about money, debt and finances. These three parts are closely related and interdependent.

A financial plan can be defined as a set of institutions, methods, and markets to promote savings and efficiency. It has people (saver), mediators, markets, and savings users (investors).

In Van Horn's world, "the financial system is making good use of money in the economy for the end user, either through investment or the use of real assets."

According to Prasanna Chandra, "The financial system is made up of a variety of institutions, markets and related systems and provides key ways to turn savings into investment."

Therefore, a financial system is a complex and closely related set of financial institutions, financial markets, financial instruments, and services that facilitate money transfers. Financial institutions collect funds from providers and provide these funds to those who request them. Similarly, financial markets are required to transfer money from depositors to mediators and mediators to investors. In short, a financial system is a way of saving money and converting it into money.

Components:

There are five main components:

1. Financial institution

- Their role is to act as an intermediary between lenders and borrowers.

- Lenders' savings are collected through various commercial markets.

- These can turn risky financing into a safe investment.

- Short-term debt can be turned into longer-term investments.

- These allow you to compare comparable large deposits and loans with small deposits and loans because of their uniform face value.

- These provide a balance between the recipient of the loan and the depositor of the amount.

There are two main types of financial institutions.

a. Banking or deposit handling institution

- Their role is to make money from the masses.

- Interest is paid on these deposits made by people.

- The loaned money is offered as a loan to those who need it.

- Interest will be charged on these loans given to those who need it.

- Examples are banks and other co-operatives.

b. Non-banking or non-depositing institution

- Their role is to sell commercial and financial goods and products to those who visit them.

- These are based on the provision of insurance, investment trusts, brokerage transactions and more.

- These examples primarily include businesses.

These have three additional categories:

- Regulation:Management and institutions that regulate and overlook commercial and financial markets. Example – RBI, IRDA, SEBI, etc.

- Intermediate: An institution that provides financial counselling and supports by providing loans and the like. Example – PNB, SBI, HDFC, BOB, Axis Bank.

- Non-Intermediate: These institutions support the finances of corporate visitors. Example – NABARD, SIDBI, etc.

2. Financial assets

These objectives are to provide convenient trading of securities in the commercial and financial markets, based on the requirements of credit seekers.

These are goods or products sold in the financial markets. Financial assets include:

- Call Money: Without guarantee, this is a one-day loan that will be repaid the next day.

- Notice: Without guarantee, this is the rent for a loan of 1 to 14 days.

- Term Money: When a certain amount of money deposited exceeds the maturity of 14 days.

- Treasury Short Term Securities: These belong to the government in the form of bonds or debt securities as they have a maturity of less than one year. These are purchased in the form of government T-Bills, which are received as government loans.

- Certificate of Deposit: This works in the form of electronic funds that remain in a particular bank for a period of time.

- Commercial Paper: A product used by a company that is unsecured despite short-term debt.

3. Financial services

- Their primary purpose is to provide counselling to visitors regarding the purchase or sale of real estate, transactions, transactions, loans, and investment permits.

- They also ensure the effectiveness of the investment and the placement of funding sources.

- These are usually picked up by asset and liability management companies.

Financial services are also included in them:

Banking Services: The functions that banks perform, such as providing loans, accepting debits, distributing credit or debit cards, opening accounts, and granting checks, are some of these services.

Insurance Services: These include services such as providing insurance, selling insurance, and brokerage transactions.

Investment Services: These services include oversight and management of investments, assets and deposits,

Forex Services: These include foreign currency exchange, foreign exchange, and foreign money transfers.

4. Financial market

These are the markets where bonds, stocks, money, investments and assets are traded and exchanged between buyers.

There are four main types of financial markets:

a. Capital market

- These deal with transactions and transactions that take place in the market.

- These are done for a year.

- These are the three main types:

- Corporate securities market

- Government securities market

- Long-term loan market

b. Financial market

- These are for short-term investments.

- They are built by governments, banks, and other institutions.

- This market is based on low-risk wholesale debt with transparent products and formats.

It has two main types:

a) organized money market

b) Unorganized money market

c. Forex market

- A highly developed market that handles several currencies.

- It is responsible for the foreign remittance of funds.

- This is based on the foreign currency rate.

d. Credit Market

- This includes both short-term and long-term loans.

- It is often given to both individuals and organizations.

- These are granted by some banks, financial institutions, non-banks and more.

5. Money

This is an important exchange that can be used to purchase goods and services. It also can act as a store useful. It is evenly accepted everywhere.

It facilitates trading, especially instant daily purchases. It serves as a verifiable record in the socio-economic context.

Conclusion

The above article on Indian financial system raises awareness about Indian financial system. It helps you prepare for a competitive exam.

It also encourages people to know more about their country's economic function and allows them to make useful decisions regarding various investments.

Financial Intermediaries

An economic middleman is an organization that acts as an middleman among events to assist economic transactions. Financial intermediaries are extraordinarily specialised and join marketplace individuals with every different. Financial intermediaries consist of banks, funding banks, credit score unions, coverage corporations, pension finances, agents and exchanges, clearing institutions, sellers and funding trusts.

1) Bank

Banks are the maximum famous economic intermediaries’ withinside the global due to the fact they're extraordinarily regulated through the authorities and play an essential function in financial stability.

The diverse specialties of banks consist of savings, funding, lending, and plenty of different subcategories. Banks be given deposits from the overall public and create credit score merchandise for borrowers.

2) Investment financial institution

Investment banks focus on big and complicated economic transactions. Investment banks offer recommendation to company customers in issuing new capital, issuing a huge variety of securities, and in mergers and acquisitions. They additionally assist customers achieve debt loans and attain capability acquisition targets.

3) Credit union

Cooperative banking is a kind of financial institution owned through a member and is ruled through a board of administrators elected through the member. Credit unions assist their contributors through imparting credit score at aggressive rates.

The distinction among a normal financial institution and a co-operative is that co-operatives are supposed to serve contributors without always motivating profits. Credit unions might not most effective lend cash, however can also be answerable for credit score-associated activities.

4) Pension fund

Another famous economic middleman is the pension fund for full-time personnel. Pension finances are utilized by personnel to keep for retirement through investing. After retirement, personnel acquire all contributions, hobby, and found out benefits.

5) Insurance company

There are one-of-a-kind styles of economic intermediaries that assist people and companies offset the hazard of coverage premiums. Insurance corporations provide hazard mitigation at low cost. Insurance corporations are tightly regulated; however they also can be afflicted by fraud and ethical hazard.

6) Investment accept as true with

A funding accept as true with is an organization that swimming pools finances from many buyers and invests in diverse securities. Investment trusts are a famous desire amongst buyers due to the fact they provide capabilities consisting of expert management, diversification, affordability and mobility.

7) Stock trade

Another economic middleman is the inventory trade, which acts as a marketplace in which inventory shoppers connect to inventory sellers. The inventory trade acts as a big platform that allows all transactions for people. Like different economic intermediaries, they make cash through including transaction charges and hobby rates.

8) Clearing house

The clearinghouse acts as a middleman to set up the very last agreement of transactions withinside the futures marketplace. Clearinghouses offer protection and performance for economic marketplace stability.

It acts as a middleman among the client and dealer to make certain that the transaction manner is clean. Clearinghouses impose margin necessities to mitigate hazard. Basically, a clearinghouse gives extra protection through making sure that transactions are clean and unfastened for buyers to trade.

9) Financial adviser

An economic adviser is an economic middleman who's answerable for executing transactions on behalf of the client. Financial advisors use their know-how to acquire their customers' economic goals. Investment recommendation is an essential motive to paintings with an economic adviser, however it helps each element of your economic life. We additionally help our customers in different regions consisting of budgeting, savings, and coverage and tax strategy.

10) Dealer

The supplier acts as an essential who buys and sells securities in his account. In the inventory marketplace, sellers purchase securities of their money owed and promote them to make a profit. Dealers assist create liquidity withinside the marketplace. Dealers should be registered with the Securities and Exchange Commission (SEC) and observe the necessities.

11) Securitization

Securitization transfers a present day asset or asset organization to securitization. Securitization diversifies hazard through aggregating property right into a pool and issuing securities sponsored through the property. Financial intermediaries securitize many property consisting of financial institution loans, automobile loans, mortgages and credit score card receivables.

Financial intermediaries classify securities into different categories with different rights to cash flows from asset pools.

12) Arbitrator

They profit from market flaws by taking advantage of price differences between two or more markets. Usually they try to profit from the inefficiencies of the market. This is the act of buying a product in one market and selling it at a high price in another.

Transactions must occur at the same time to avoid market risk, as prices may change before the transaction is completed. Arbitragers are experienced investors and play an important role in the operation of capital markets as efforts to take advantage of price inefficiencies keep prices more accurate.

Role of financial intermediaries

In general, financial intermediaries act as intermediaries in the context of financial transactions, create funds and manage payment systems.

Through financial intermediaries, capital is sent from those who have it to those who need it for productive use.

For example, banks receive consumer deposits and issue loans and mortgages to people who need money for their business or personal projects.

This allows a financial institution (in this case a bank) to move from a person with surplus capital (a customer making a deposit) to a person who needs capital (for example, a company that needs a business loan or an individual who needs a mortgage). You can allocate funds. ..

A financial intermediary is a third party in a transaction between various parties whose purpose is to benefit by meeting the needs of the parties.

In this example, the intermediary can pool the funds by receiving the customer's deposits, then create financial products and pass the funds to those who need them, such as companies that need business loans.

The reason financial intermediaries are used and attractive is to allow the parties to the transaction to reduce transaction costs.

Consumers also benefit from transactions with intermediaries such as improved transaction security, much higher liquidity, and economies of scale.

In certain industries, such as financial markets, technology is gradually eliminating the need for intermediaries in a process called "disintermediation."

Other industries, such as banking and insurance, are not facing increased mediation as a financial markets industry.

Key takeaways:

- A economic middleman is an organization that acts as an middleman among events to assist economic transactions.

- Banks are the maximum famous economic intermediaries’ withinside the global due to the fact they're extraordinarily regulated through the authorities and play an essential function in financial stability.

- Cooperative banking is a kind of financial institution owned through a member and is ruled through a board of administrators elected through the member.

- Another famous economic middleman is the pension fund for full-time personnel.

- Another economic middleman is the inventory trade, which acts as a marketplace in which inventory shoppers connect to inventory sellers.

- An economic adviser is a economic middleman who's answerable for executing transactions on behalf of the client.

- The supplier acts as a essential who buys and sells securities in his account.

- Securitization transfers a present day asset or asset organization to securitization.

- In general, financial intermediaries act as intermediaries in the context of financial transactions, create funds and manage payment systems.

- A financial intermediary is a third party in a transaction between various parties whose purpose is to benefit by meeting the needs of the parties.

- In certain industries, such as financial markets, technology is gradually eliminating the need for intermediaries in a process called "disintermediation."

Markets and Instruments

Financial market

What's a monetary market?

Financial markets, because the call implies, are a type of market that offers a way of purchasing and promoting property which includes bonds, shares, forex and derivatives. They are frequently cited by means of one-of-a-kind names, along with "wall street" and "capital markets," but they all have the same meaning. Without a doubt put, organizations and traders can every go to the monetary markets to elevate money, develop their business and make extra money.

To be greater explicit, imagine a financial institution where an character holds a financial savings account. Banks can use their cash and the money of different depositors to lend to different individuals and groups and claim interest.

Depositors themselves also earn via watching their money develop via the interest paid on it. Consequently, banks act as financial markets that advantage each depositor and borrowers.

Sorts of monetary markets

There are so many financial markets and that they vary in size. Has as a minimum one economic market. Some are small and others are across the world known, together with the new stock alternate, which trades trillions of greenbacks each day. There are several varieties of economic markets here.

1. Stock market

The stock market trades shares owned via public corporations. Every inventory has a charge, and investors make money with that stock once they perform nicely within the market. Buying stock is simple. The actual venture is selecting the proper shares to make money for buyers.

There are numerous indicators that investors can use to screen inventory marketplace tendencies, consisting of the Dow jones commercial average (djia) and the s & p 500. While a stock is sold at a decrease charge and sold at a higher charge, the investor gets from the sale.

2. Bond marketplace

The bond marketplace provides an opportunity for groups and governments to comfortable investment to fund tasks and investments. Inside the bond market, an investor buys a bond from an enterprise and the organisation returns the quantity of the bond plus interest in the agreed duration.

3. Commodity market

Commodity markets are wherein investors and investors purchase and sell natural assets and commodities including corn, oil, meat and gold. Unpredictable costs create a selected marketplace for such assets. There is a commodity futures market that has already identified the fees of commodities introduced at some future time and is sealed nowadays.

4. Derivatives marketplace

Such markets include valuable derivatives or contracts based totally available on the market value of the property traded. The above commodity marketplace futures are examples of derivatives.

Marketplace function

The role of economic markets in monetary achievement and electricity cannot be underestimated. Here are 4 crucial functions of economic markets

1. Leverage financial savings for extra efficient use

As cited in the instance above, a financial savings account that carries cash should no longer just maintain the money in a secure. Consequently, economic markets consisting of banks open it up to individuals and corporations that need a loan, student mortgage, or enterprise mortgage.

2. Determine the fee of the safety

Traders purpose to make a take advantage of their securities. However, not like items and services whose prices are determined through the legal guidelines of deliver and call for, securities costs are decided via monetary markets.

3. Liquidate financial property

Consumers and dealers can determine to alternate their securities at any time. They could use economic markets to promote securities and invest as needed.

4. Reduce transaction expenses

Inside the monetary markets, you may get loads of information about securities without spending.

The significance of financial markets

There are numerous matters the economic markets can do, including:

- Monetary markets provide an area for participants, which includes investors and borrowers, to receive honest and appropriate remedy, irrespective of size.

- They offer get admission to capital for people, corporations, and governmental corporations.

- Financial markets offer many employment possibilities that help lower the unemployment price.

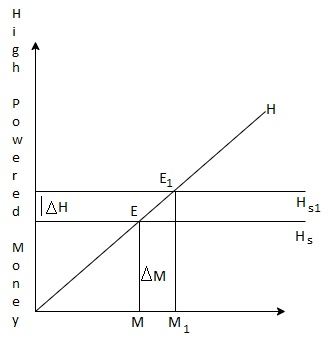

Classification:

A financial market is a market in which financial assets such as stocks, bonds, corporate bonds, and commodities are created and traded, and is known as a financial market. Financial markets act as an intermediary between fund seekers (generally companies, governments, etc.) and fund providers (generally investors, households, etc.). It mobilizes funds among them and helps allocate the country's limited resources. Financial markets can be divided into four categories

- Depends on the nature of the claim

- By maturity of claims

- Depending on the timing of delivery

- By organizational structure

Let's elaborate on each –

# 1-Depends on the nature of the claim

Markets are categorized by the type of claim the investor has for the assets of the entity in which the investor has invested. There are two main types of claims: fixed claims and residual claims. There are two types of markets, based on the nature of the claim.

Bond market

The bond market is the market in which bonds such as corporate bonds and bonds are traded between investors. There is a fixed charge for such items. That is, those charges on a company's assets are limited to a certain amount. These goods generally carry a coupon rate commonly known as interest, which remains fixed for a period of time.

Stock Market

Equity products are traded in this market. Equity, as the name implies, refers to the owner's capital in the business, and therefore has a residual claim, which means that everything remaining in the business after repayment of fixed liabilities belongs to the shareholders. Regardless of the face value of the shares they hold.

# 2 – Depends on billing maturity

When making an investment, the amount of investment depends on the duration of the investment, so the duration plays an important role. Duration also affects the risk profile of your investment. Short-term investments are less risky than long-term investments.

There are two types of markets, based on the maturity of the claim.

Financial market

For short-term funds traded by investors who plan to invest within a year. This market deals with monetary assets such as government bonds, commercial paper and certificates of deposit. The maturity of all these products does not exceed one year.

Due to their short maturity, these products are generally in the form of interest, which is less risky for investors and provides a reasonable rate of return.

Capital Market

A market in which products with medium- to long-term maturities are traded. This is the largest exchange of funds market and helps companies access their funds through equity capital, preferred equity capital and more. It also provides access for investors to invest in and become a party to the company's equity capital. The profit that the company earned.

There are two industries in this market.

Primary Market

A market in which a company first lists securities or a market in which an already listed company issues new securities. This market involves trading between companies and shareholders. The company receives the amount paid by the shareholders for the major issues. There are two main types of products for the primary market. Initial public offering (IPO) or further initial public offering (FPO).

Liquidity-When a company lists a security, it becomes available for trading on the exchange between investors. Markets that facilitate such transactions are known as secondary or stock markets.

In other words, it is an organized market where securities are traded among investors. Investors include individuals and merchant bunkers. Secondary market transactions do not affect a company's cash flow position, as receipts or payments on such exchanges are settled between investors without the involvement of the company.

# 3-Depending on the timing of delivery

In addition to the above factors such as duration and nature of billing, there is another factor that distinguishes the market into two parts: the timing of delivery of securities. This concept is generally prevalent in the secondary or stock markets. There are two types of markets based on the timing of delivery:

Cash Market

In this market, transactions are settled in real time and investors are required to pay the full amount of their investment through their own funds or borrowed capital commonly known as margin. This is allowed in the current holdings. Account.

Futures Market

In this market, settlement or delivery of securities or commodities will take place in the future. Transactions in these markets are usually settled in cash rather than delivered. Total amount of assets to trade in the futures market you don't have to pay. Rather, margins up to a certain percentage of the asset's value are sufficient for trading assets.

Financial Instruments

Preface

A financial instrument is defined as an individual / party contract that retains its monetary value. They can be created, traded, settled, or modified according to the requirements of the parties involved. Simply put, an asset that holds capital and can be traded on the market is called a financial instrument.

Examples of financial instruments include checks, stocks, stocks, bonds, futures and options contracts.

Understand Financial Products

Financial products can be divided into two main types: derivative products and cash products.

Derivative products can be defined as products whose characteristics and values can be derived, among other things, from underlying assets such as interest rates, indices and assets. The value of such equipment can be derived from the performance of the underlying components. You can also link to other securities such as bonds and stocks.

Cash products, on the other hand, are defined as products that are easily transferable and valuable in the market. Some of the most common examples of cash products are deposits and loans that lenders and borrowers need to agree on.

Other classifications

Financial instruments can also be categorized based on asset class, that is, equity-based and debt-based financial instruments.

- Equity-based financial instruments include securities such as equities / equities. Exchange-traded derivatives such as stock futures and stock options also fall into the same category.

- Debt-based financial products, on the other hand, consist of short-term securities with a maturity of one year or less, such as commercial paper (CP) and government bonds (T-bill).

- Cash products such as certificates of deposit (CD) also fall into this category. Similarly, exchange-traded derivatives such as short-term interest rate futures fall into this category.

- Securities such as fixed income fall into this category because long-term debt-based financial instruments have a maturity of more than one year. Listed derivatives include fixed income futures, and options are another example.

How to record Financial Products

On the accounting side, financial products can be a bit complicated. How they are recorded depends on whether the company buys or issues them, and of course it is related to the type of financial instrument as described above.

If a financial instrument involves an investment such as the sale of stocks, bonds, or credits (accounts receivable), these are considered financial assets. If an instrument has a balance of accounts payable or long-term loans, they are considered financial liabilities.

In accounting, bonds and receivables are considered assets, long-term loans and receivables are considered liabilities, and capital is considered capital. Derivatives are also financial products.

Issuance of Financial Products

When a company issues a financial instrument, this transaction is recorded as an asset in accounts receivable.

Purchase of Financial Products

If the business or party is on the purchaser side of a transaction involving financial instruments, this is recorded as a liability in accounts payable. Buyers and sellers are unknown to each other because transactions involving financial instruments can be done anonymously.

Key takeaways:

- A monetary asset is a liquid asset that represents and derives price from a organization's claim of ownership or contractual proper to future payments from the organization.

- The value of a economic asset can be based on the tangible or real belongings of the underlying asset, however market supply and demand additionally influences its fee.

- Equity, fixed earnings and coins financial markets widely talk to any market wherein securities are traded.

- There are different varieties of economic markets together with foreign exchange, money, stocks and bond markets.

- These markets might also include belongings or securities which are listed on regulated exchanges or traded over-the-counter (otc).

- Economic markets alternate all forms of securities and are critical to the smooth operation of a capitalist society.

- Failure of economic markets can cause economic turmoil which include recession and unemployment. CDs and financial institution deposits are examples of financial assets.

- An "economic gadget" is a machine that allows the alternate of funds among economic market individuals which includes lenders, investors and debtors.

- The monetary system operates at national and worldwide ranges.

- Economic institutions include complicated and carefully related services, markets and establishments that goal to provide green and normal links among buyers and depositors.

References:

- Chanduler, L.V. & Goldfield, S.M. : The Economics of Money and Banking

- Gupta, S.B. : Monetary Planning of India

- Khan, M.Y. : Indian Financial Systems Theory & practice