Unit - 1

Indian Companies Act, 2013: Corporate Personality

The Companies Act 2013 enacted by Parliament in the Sixty-fourth Year of the Republic of India. According to section 2(20) of Companies Act 2013, company‖ means a company incorporated under this Act or under any previous company law. Some of the significant characteristics of company are discussed below-

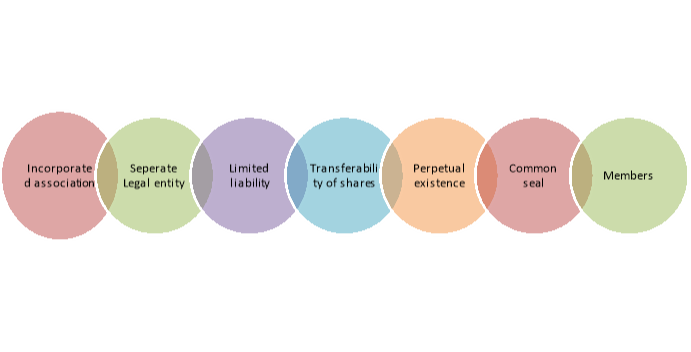

Figure 1: Features of company

1] Incorporated Association

A company is an association of person required to be registered under the Companies Act 2013 or Companies act 1956. Without incorporation mere association of person cannot be recognised as company.

2] Separate Legal Entity

Being an incorporated association company has a separate legal entity in the eyes of law. It is capable of enjoying rights is also subject to duties under the law. A company can also own and deal in property and other such assets.

3] Limited Liability

Since a company has its own legal identity, its members are not liable for its debts. The liability of the members of a company is limited to the unpaid share of their share value. There are some companies limited by guarantee, where the liability of each member is determined by such a guaranteed amount.

4] Transferability of Shares

The shares held by a shareholder of a company are transferable by nature. So the ownership in a company can be transferred in accordance with the manner provided in the Articles of Association. In a private company, there may be some restrictions placed on the transfer of shares. But the right is not taken away completely.

5] Perpetual Existence

A company is an artificial person, so it does not have a restricted span of life. Death, insolvency, insanity, retirement etc. of any or even all of its members does not affect the status of a company.

6] Common Seal

Directors of a company are essentially its agents. So when a director acts within his powers a company is bound by his actions. The Common Seal is like a signature of the company. The directors use the seal to sign documents on behalf of the company. So until there is such a seal on the documents, they cannot be enforced.

7] Number of Members

As per the Companies Act, 2013, the minimum number of members required to start a public limited company is seven while for a private limited company, it is two. The maximum number of members for a public limited company can be unlimited while it is restricted to 200 for a private limited company.

Key takeaways

- According to section 2(20) of Companies Act 2013, company‖ means a company incorporated under this Act or under any previous company law.

The companies are classified on the basis of nature, incorporation, ownership, number of members and newly registered under the Companies Act. 2013. The types of companies are discussed below-

Figure 2: Types of company

Figure 2: Types of company

A) On the basis of Incorporation

- Statutory Companies

Statutory companies are those companies that have been constituted by an Act of Parliament or State Legislature. The constitution, powers and scope of the activities of such companies or corporations are provided under a special enactment which can be altered only and only by a legislative amendment. The statutory companies/ corporations are governed by the Special Act itself. Nevertheless, the Companies Act 2013 is also applicable to statutory corporations to some extent. In case of inconsistencies between the provisions of the Special Act and the Companies Act 2013, the provisions of the Special Act shall prevail.

For example: The Reserve Bank of India

2. Registered Companies

These are the companies that have been incorporated under the Act of 2013 or under any previous company law and registered with the Registrar of the Companies.

B) On the basis of liability

- Company Limited by Shares:

In a company that is limited by shares, the liability of the members of such a company is limited to the nominal value of the shares held by them. No member can be called upon to pay anything more than the value of shares held by him. The company can call upon the members to pay the unpaid portion of their shares at any time irrespective of whether the company is a going concern or is being wound up.

2. Company Limited by Guarantee:

A company wherein the members undertake to contribute to the assets of the company in the event of winding up, such a company is a company limited by guarantee. Unlike in a company limited by shares, the liability of members to contribute the guaranteed amount arises only when the company is winding up and not when it is a going concern. That is to say that the members are called upon to pay the guaranteed amount towards the assets of the company when the company has gone under liquidation.

3. Unlimited Company:

A company having no limit on the liability of its members is termed as an unlimited company. The liability of members herein may stretch to their personal assets in the event of winding up of the company in order to contribute to the assets of the company. The members, however, are not directly liable to the creditors of the company. Their liability is only towards the company. In the event of winding up, in order to pay off the debts of the company, the Liquidator may ask the members to contribute to the assets of the company.

C) On the basis of ownership

- Public Company:

According to Sec 2(71), a company is a public company that is not a private company and has a minimum paid-up share capital.

A public company is an association having 7 members or more and is registered under the Act. Any person wishing to acquire shares or debentures in a public company can do so by paying the price. The buying and selling of shares and debentures are not restricted. The Act in Sec 58(2) provides that the shares and debentures of the public company shall be freely transferable.

A public company can be converted into a private company by passing a special resolution. Restrictions may be imposed in its articles as specified in Sec 2(68). However, the same must be approved by the Tribunal.

2. Private Company:

According to Sec 2(68), a private company is a company having a minimum paid-up share capital as may be prescribed by the Act and restricts the right to transfer the shares; limits the number of members to 200 and prohibits the invitation to public to subscribe for the securities of the company.

Although the number of members is limited to 200, debentures can be issued to any number of persons by a private company. However, the invitation to subscribe for debentures is prohibited.

D) Companies introduced under the Companies Act 2013

- Small Company:

Section 2(85) provides for small companies under the Act of 2013. This new form of a private company has been classified as a small company based on its paid-up capital and turnover. A company will be said to be a small company if its paid-up capital share does not exceed Rs. 50 Lacs with a maximum ceiling of Rs. 10 Crores; or if its turnover does not exceed Rs. 2 Crores with a maximum ceiling of Rs. 100 Crores. However, a holding or a subsidiary company; a company registered u/s 8 or a company governed by a special Act shall not be considered as a small company.

2. One Person Company:

Under the Act of 2013, a single person can constitute a company. One person company is a kind of private company having only one member. With the introduction of the concept of one Person Company, small businesses can now be corporatized. In OPC, the legal, as well as the financial liability, is limited to the company alone. The conversion of OPC into a company u/s 8 of the Act has been barred by the Companies (Incorporation) Rules, 2014.

E) Other Forms of Companies

1) Government Company:

A company in which 51% or more of the paid-up share capital is held by either the Central Government or the State Government(s) or partly by Central Government and partly by the State Government(s), is a government company u/s 2 (45) of the Act of 2013. It is to be noted that any subsidiary of a government company shall also fall under the classification of a government company. However, a government company is neither a Government establishment nor it is a Government Department irrespective of the fact that major paid-up share capital is held by the Government.

2) Foreign Company:

According to Section 2(42) of the Act, a ‘foreign company’ is any company or body corporate that is incorporated outside India. However, such a company must either have a place of business in India by itself or through its agent in a physical or electronic manner or it must conduct any business activity in India in any other manner. A foreign company is required to register itself with the Registrar of Companies within a stipulated time of 30days from its establishment of business in India. Regardless of its registration, if such a foreign company ceases to carry on its business in India, it shall be wound up as if it were an unregistered company under the Act.

3) Holding, Subsidiary and Associate Company:

The companies can be classified as holding, subsidiary and associate companies on the basis of their control. Holding Company u/s 2(46) of the Act means a company or a body corporate that has subsidiary companies. A holding company may have one or more other companies that are its subsidiaries. A holding company is basically a parent entity that owns a controlling interest in other companies known as its subsidiaries.

According to section 2(87) of the Act, a company would be a subsidiary company if the holding company has a control over the composition of the Board of Directors or owns and controls more than half of the share capital of Such a company. A subsidiary company cannot hold shares of its holding company. If a holding company makes any allotment or transfer of shares to any of its subsidiary companies, the same shall be void ab initio. Nevertheless, there are certain exceptions to this rule where a subsidiary company can hold the shares of its holding company.

An Associate company under section 2(6) of the Act, is a company in which other company has a significant influence. It is different from subsidiary company. Herein, the company has control on a minimum of 20% of share capital, and business decisions of such associate company under agreement. The parent company owns only a small stake in an associate company.

4) Dormant Company:

Dormant companies are a new set of companies that have been recognized by the Companies Act 2013. A dormant company means an inactive or an inoperative company. A company can be formed for future projects without having any significant accounting transactions. The only transactions that take place are for maintaining and running the company so as to comply with the statutory requirements. Such companies can apply to the Registrar of Companies to obtain the status of a dormant company under the Act.

5) Producer Company:

Producer companies have been provided under the Companies Act 1956. As per Sec 581A (1), a producer company is a body corporate and has its objects and activities as specified in Sec 581B. However, as per Sec 465(1) of the Act of 2013, the Companies Act, 1956 stands repealed. Nevertheless, the proviso attached to Sec 465(1) states that the provisions of Part IX-A of the Companies Act 1956 shall be applicable to the Producer Companies in such a manner as if the Companies Act 1956 has not been repealed. Thus, the producer companies are governed under the Companies Act 1956.

Key takeaways

- The companies are classified on the basis of nature, incorporation, ownership, number of members and newly registered under the Companies Act.

Conversion of Public Limited Company into Private Limited Company is mentioned in the Companies Act, 2013 and Incorporation of Companies Rules, 2014. Prior to that, we need to see why it is necessitated to the conversion of Public Limited Company into a Private Limited Company. Being a Public Limited Company it required and mandated to follow various statutory guidelines as provided under the provisions of Companies Act, 2013 and rules made thereunder. Apart from this, there are various types of compliance to be done under the provisions of Companies Act, 2013 (Act) and SEBI Act. Private Limited Company has fewer compliances compared to Public Limited Company so that generally it is a tendency to convert Public Limited Company into Private Limited Company. Earlier, the National Company Law Tribunal (NCLT) has a power pertaining to the conversion of Public Company into Private Company. There are several amendments that took place in Companies Act, 2013 and NCLT has a lot of assignments. Since 2013 Act came into effect NCLT has a jurisdiction to entertain the winding-up Petitions earlier same were entertained by the High Courts in view of this. Now we are going to see the procedure for the conversion of Public companies into Private companies. We need to go through certain provisions of Companies Act, 2013 which are associated with the conversion procedure.

Steps for conversion of public company into private company

Section 13, 14 and 18 of the Act need to be read with Rule 41 of the Companies Incorporation (Fourth Amendment) Rules, 2018. Rule 41 describes the procedure/ steps for the conversion of Public Company into Private Company. Following steps need to be taken for conversion of Public Company into Private Company:

- The Board meeting shall be convened for the conversion decisions. All formalities as per secretarial standards shall adhere to the said meetings since it’s a crucial part in terms of the conversion procedure. The Board approves the conversion procedure. The minutes of the meeting should be drafted carefully.

- The Company shall authorize any representative to act on behalf of the Company for further conversion procedure. One Certified True Copy of resolution may be required on behalf of the Company in favor of any professional to represent the Company before the Regional Director.

- The General Meeting of the Company shall be called.

- The General Meeting shall take a decision for the conversion of the Company.

- The necessary E form should be filed pertaining to the decision of conversion of the Company. S. 117 of the Companies Act, the mandate to file certain documents at the time of said filling. The said documents should be carefully submitted.

- The necessary application for conversion shall be drafted and submitted before the Regional Director.

- The said application has to file within 60 days from the passing of the said resolution. The documents /declarations as mentioned in the said Rule 41 needs to be submitted before Regional Director along with the application.

- Also, particulars as mention in Rule 41 (2) shall be submitted before the RD.

- A list of creditors and debenture holders needs to be annexed with said application. Due amounts, claims and liabilities, contingent and uncertain debt details required to be annexed.

- Further, the duly authenticated copy of the list of creditors and debenture holders shall be kept at the registered office the same can be verified and inspected during the ordinary hours of business.

- The Company has to file form NO INC 25 A in vernacular and English language.

- After submission of said details RD may seek additional information, details the same need to be submitted in the period of 15 days in E Form No. RD GNL -5. The applicant cannot file more than two resubmissions. RD may reject the application within a period of 30 days after the submission of the application.

- If no order of approval, or rejection or resubmission has been passed by the RD then said the application is deemed to allow and automatically order would be passed.

- If any objection has been received same shall be recorded in writing RD shall conduct hearing within a period of 30 days upon the receipt of the said objection. If any consensus reaches the Company can file application about the consensus. The RD shall pass an order within a period of 30 days.

- In the case where no consensus is received then, RD can reject the palliation within a period of 60 days.

- Conversion shall not pass if any prosecution is pending against the Company.

- No prosecution is pending or envisaged then RD shall allow conversion.

- The Conversion order has to file in Form No. INC 28. Within 15 days upon receipt of the order.

- The aforesaid procedure has been prescribed in the said rules.

Key takeaways

- Conversion of Public Limited Company into Private Limited Company is mentioned in the Companies Act, 2013 and Incorporation of Companies Rules, 2014.

The provisions regarding formation of company are discussed under the following heads-

a) Formation of company (Section 3)

The Section 3 of chapter II of Companies Act 2013 provides provisions regarding the formation of company. The related provisions are discussed below-

(1) A company may be formed for any lawful purpose by—

(a) seven or more persons, where the company to be formed is to be a public company;

(b) two or more persons, where the company to be formed is to be a private company; or

(c) one person, where the company to be formed is to be One Person Company that is to say, a private company, by subscribing their names or his name to a memorandum and complying with the requirements of this Act in respect of registration:

Provided that the memorandum of One Person Company shall indicate the name of the other person, with his prior written consent in the prescribed form, who shall, in the event of the subscriber‘s death or his incapacity to contract become the member of the company and the written consent of such person shall also be filed with the Registrar at the time of incorporation of the One Person Company along with its memorandum and articles:

Provided further that such other person may withdraw his consent in such manner as may be prescribed: Provided also that the member of One Person Company may at any time change the name of such other person by giving notice in such manner as may be prescribed:

Provided also that it shall be the duty of the member of One Person Company to intimate the company the change, if any, in the name of the other person nominated by him by indicating in the memorandum or otherwise within such time and in such manner as may be prescribed, and the company shall intimate the Registrar any such change within such time and in such manner as may be prescribed: Provided also that any such change in the name of the person shall not be deemed to be an alteration of the memorandum.

(2) A company formed under sub-section (1) may be either— (a) a company limited by shares; or (b) a company limited by guarantee; or (c) an unlimited company.

b) Formulation of companies with charitable objects, etc (Section 8)

(1) Where it is proved to the satisfaction of the Central Government that a person or an association of persons proposed to be registered under this Act as a limited company—

(a) has in its objects the promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other object;

(b) intends to apply its profits, if any, or other income in promoting its objects; and

(c) intends to prohibit the payment of any dividend to its members, the Central Government may, by licence issued in such manner as may be prescribed, and on such conditions as it deems fit, allow that person or association of persons to be registered as a limited company under this section without the addition to its name of the word ―Limited‖, or as the case may be, the words ―Private Limited‖ , and thereupon the Registrar shall, on application, in the prescribed form, register such person or association of persons as a company under this section.

(2) The company registered under this section shall enjoy all the privileges and be subject to all the obligations of limited companies.

(3) A firm may be a member of the company registered under this section.

(4) (i) A company registered under this section shall not alter the provisions of its memorandum or articles except with the previous approval of the Central Government.

(ii) A company registered under this section may convert itself into company of any other kind only after complying with such conditions as may be prescribed.

(5) Where it is proved to the satisfaction of the Central Government that a limited company registered under this Act or under any previous company law has been formed with any of the objects specified in clause (a) of sub-section (1) and with the restrictions and prohibitions as mentioned respectively in clauses (b) and (c) of that sub-section, it may, by licence, allow the company to be registered under this section subject to such conditions as the Central Government deems fit and to change its name by omitting the word ―Limited‖, or as the case may be, the words ―Private Limited‖ from its name and thereupon the Registrar shall, on application, in the prescribed form, register such company under this section and all the provisions of this section shall apply to that company.

(6) The Central Government may, by order, revoke the licence granted to a company registered under this section if the company contravenes any of the requirements of this section or any of the conditions subject to which a licence is issued or the affairs of the company are conducted fraudulently or in a manner violative of the objects of the company or prejudicial to public interest, and without prejudice to any other action against the company under this Act, direct the company to convert its status and change its name to add the word ―Limited‖ or the words ―Private Limited‖, as the case may be, to its name.

Key takeaways

- The Section 3 of chapter II of Companies Act 2013 provides provisions regarding the formation of company.

Promotion of a Company Promotion is the first stage in the formation of a company. It involves conceiving a business opportunity and taking and initiative to form a company so the particular shape can be given to exploiting the available business opportunity. There is a defined stage to the promotion of company’s formation, the stages include as hereunder:

Figure 3: Stages of promotion

Stage 1. Promotion Stage:

Promotion is the foremost stage in the formation of a company. He performs aggregated activities to design and to bring an enterprise to operate as a business.

Stage 2. Incorporation:

This is a registration stage, where the registration of the company brings it to existence. A company is correctly constituted only when this is duly registered under the Act.

Stage 3. Capital Subscription Stage:

This ‘capital subscription stage’ and ‘commencement of business stage’ are only relevant in case of a public company having a share capital. In this stage necessary capital is to be acquired for the company.

Stage 4. Commencement of Business Stage:

After receiving the certificate of incorporation, a private company can start its business, while a public company can start its business after getting the ‘certificate of commencement of business’.

Incorporation of company

The section 7 chapter II of the Companies Act 2013 provides provisions regarding incorporation of company. Such provisions are-

(1) There shall be filed with the Registrar within whose jurisdiction the registered office of a company is proposed to be situated, the following documents and information for registration, namely:—

(a) the memorandum and articles of the company duly signed by all the subscribers to the memorandum in such manner as may be prescribed;

(b) a declaration in the prescribed form by an advocate, a chartered accountant, cost accountant or company secretary in practice, who is engaged in the formation of the company, and by a person named in the articles as a director, manager or secretary of the company, that all the requirements of this Act and the rules made thereunder in respect of registration and matters precedent or incidental thereto have been complied with;

(c) an affidavit from each of the subscribers to the memorandum and from persons named as the first directors, if any, in the articles that he is not convicted of any offence in connection with the promotion, formation or management of any company, or that he has not been found guilty of any fraud or misfeasance or of any breach of duty to any company under this Act or any previous company law during the preceding five years and that all the documents filed with the Registrar for registration of the company contain information that is correct and complete and true to the best of his knowledge and belief;

(d) the address for correspondence till its registered office is established;

(e) the particulars of name, including surname or family name, residential address, nationality and such other particulars of every subscriber to the memorandum along with proof of identity, as may be prescribed, and in the case of a subscriber being a body corporate, such particulars as may be prescribed;

(f) the particulars of the persons mentioned in the articles as the first directors of the company, their names, including surnames or family names, the Director Identification Number, residential address, nationality and such other particulars including proof of identity as may be prescribed; and

(g) the particulars of the interests of the persons mentioned in the articles as the first directors of the company in other firms or bodies corporate along with their consent to act as directors of the company in such form and manner as may be prescribed.

(2) The Registrar on the basis of documents and information filed under sub-section (1) shall register all the documents and information referred to in that subsection in the register and issue a certificate of incorporation in the prescribed form to the effect that the proposed company is incorporated under this Act.

(3) On and from the date mentioned in the certificate of incorporation issued under sub-section (2), the Registrar shall allot to the company a corporate identity number, which shall be a distinct identity for the company and which shall also be included in the certificate.

(4) The company shall maintain and preserve at its registered office copies of all documents and information as originally filed under sub-section (1) till its dissolution under this Act.

(5) If any person furnishes any false or incorrect particulars of any information or suppresses any material information, of which he is aware in any of the documents filed with the Registrar in relation to the registration of a company, he shall be liable for action under section 447.

(6) Without prejudice to the provisions of sub-section (5) where, at any time after the incorporation of a company, it is proved that the company has been got incorporated by furnishing any false or incorrect information or representation or by suppressing any material fact or information in any of the documents or declaration filed or made for incorporating such company, or by any fraudulent action, the promoters, the persons named as the first directors of the company and the persons making declaration under clause (b) of subsection (1) shall each be liable for action under section 447.

(7) Without prejudice to the provisions of sub-section (6), where a company has been got incorporated by furnishing any false or incorrect information or representation or by suppressing any material fact or information in any of the documents or declaration filed or made for incorporating such company or by any fraudulent action, the Tribunal may, on an application made to it, on being satisfied that the situation so warrants,—

(a) pass such orders, as it may think fit, for regulation of the management of the company including changes, if any, in its memorandum and articles, in public interest or in the interest of the company and its members and creditors; or

(b) direct that liability of the members shall be unlimited; or

(c) direct removal of the name of the company from the register of companies; or

(d) pass an order for the winding up of the company; or

(e) pass such other orders as it may deem fit: Provided that before making any order under this sub-section,—

(i) the company shall be given a reasonable opportunity of being heard in the matter; and

(ii) the Tribunal shall take into consideration the transactions entered into by the company, including the obligations, if any, contracted or payment of any liability.

Key takeaways

- Promotion of a Company Promotion is the first stage in the formation of a company. It involves conceiving a business opportunity and taking and initiative to form a company so the particular shape can be given to exploiting the available business opportunity.

Memorandum of association is a legal document prepared during the formation and registration process of a company to define its relationship with shareholders and it specifies the objectives for which the company has been formed. The section 4 of the Companies Act 2013 contains provisions for Memorandum of association of a company.

(1) The memorandum of a company shall state—

(a) the name of the company with the last word ―Limited‖ in the case of a public limited company, or the last words ―Private Limited‖ in the case of a private limited company: Provided that nothing in this clause shall apply to a company registered under section 8;

(b) the State in which the registered office of the company is to be situated;

(c) the objects for which the company is proposed to be incorporated and any matter considered necessary in furtherance thereof;

(d) the liability of members of the company, whether limited or unlimited, and also state,—

(i) in the case of a company limited by shares, that liability of its members is limited to the amount unpaid, if any, on the shares held by them; and

(ii) in the case of a company limited by guarantee, the amount up to which each member undertakes to contribute—

(A) to the assets of the company in the event of its being wound-up while he is a member or within one year after he ceases to be a member, for payment of the debts and liabilities of the company or of such debts and liabilities as may have been contracted before he ceases to be a member, as the case may be; and

(B) to the costs, charges and expenses of winding-up and for adjustment of the rights of the contributories among themselves;

(e) in the case of a company having a share capital,—

(i) the amount of share capital with which the company is to be registered and the division thereof into shares of a fixed amount and the number of shares which the subscribers to the memorandum agree to subscribe which shall not be less than one share; and

(ii) the number of shares each subscriber to the memorandum intends to take, indicated opposite his name;

(f) in the case of One Person Company, the name of the person who, in the event of death of the subscriber, shall become the member of the company.

(2) The name stated in the memorandum shall not— (a) be identical with or resemble too nearly to the name of an existing company registered under this Act or any previous company law; or (b) be such that its use by the company— (i) will constitute an offence under any law for the time being in force; or (ii) is undesirable in the opinion of the Central Government.

(3) Without prejudice to the provisions of sub-section (2), a company shall not be registered with a name which contains—

(a) any word or expression which is likely to give the impression that the company is in any way connected with, or having the patronage of, the Central Government, any State Government, or any local authority, corporation or body constituted by the Central Government or any State Government under any law for the time being in force; or

(b) such word or expression, as may be prescribed, unless the previous approval of the Central Government has been obtained for the use of any such word or expression.

(4) A person may make an application, in such form and manner and accompanied by such fee, as may be prescribed, to the Registrar for the reservation of a name set out in the application as—

(a) the name of the proposed company; or

(b) the name to which the company proposes to change its name.

(5) (i) Upon receipt of an application under sub-section (4), the Registrar may, on the basis of information and documents furnished along with the application, reserve the name for a period of sixty days from the date of the application.

(ii) Where after reservation of name under clause (i), it is found that name was applied by furnishing wrong or incorrect information, then,—

(a) if the company has not been incorporated, the reserved name shall be cancelled and the person making application under sub-section (4) shall be liable to a penalty which may extend to one lakh rupees;

(b) if the company has been incorporated, the Registrar may, after giving the company an opportunity of being heard—

(i) either direct the company to change its name within a period of three months, after passing an ordinary resolution;

(ii) take action for striking off the name of the company from the register of companies; or

(iii) make a petition for winding up of the company.

(6) The memorandum of a company shall be in respective forms specified in Tables A, B, C, D and E in Schedule I as may be applicable to such company.

(7) Any provision in the memorandum or articles, in the case of a company limited by guarantee and not having a share capital, purporting to give any person a right to participate in the divisible profits of the company otherwise than as a member, shall be void.

Key takeaways

- Memorandum of association is a legal document prepared during the formation and registration process of a company to define its relationship with shareholders and it specifies the objectives for which the company has been formed.

Articles of association outline the rules for running, governing and owning the corporation; including the responsibilities and powers of the directors, and how much influence shareholders have over the board of directors. Section 5 of the Companies Act 2013 provides provisions for articles of association. Such provisions are discussed below-

— (1) The articles of a company shall contain the regulations for management of the company.

(2) The articles shall also contain such matters, as may be prescribed: Provided that nothing prescribed in this sub-section shall be deemed to prevent a company from including such additional matters in its articles as may be considered necessary for its management.

(3) The articles may contain provisions for entrenchment to the effect that specified provisions of the articles may be altered only if conditions or procedures as that are more restrictive than those applicable in the case of a special resolution, are met or complied with.

(4) The provisions for entrenchment referred to in sub-section (3) shall only be made either on formation of a company, or by an amendment in the articles agreed to by all the members of the company in the case of a private company and by a special resolution in the case of a public company.

(5) Where the articles contain provisions for entrenchment, whether made on formation or by amendment, the company shall give notice to the Registrar of such provisions in such form and manner as may be prescribed.

(6) The articles of a company shall be in respective forms specified in Tables, F, G, H, I and J in Schedule I as may be applicable to such company.

(7) A company may adopt all or any of the regulations contained in the model articles applicable to such company.

(8) In case of any company, which is registered after the commencement of this Act, in so far as the registered articles of such company do not exclude or modify the regulations contained in the model articles applicable to such company, those regulations shall, so far as applicable, be the regulations of that company in the same manner and to the extent as if they were contained in the duly registered articles of the company.

(9) Nothing in this section shall apply to the articles of a company registered under any previous company law unless amended under this Act.

Key takeaways

- Articles of association outline the rules for running, governing and owning the corporation; including the responsibilities and powers of the directors, and how much influence shareholders have over the board of directors.

The Companies Act, 2013 defines a prospectus under section 2(70). Prospectus can be defined as “any document which is described or issued as a prospectus”. This also includes any notice, circular, advertisement or any other document acting as an invitation to offers from the public.

Contents of a Company Prospectus

- Name of the Company

- Registered Address of Company

- Objects of the Company

- Purpose of the issue

- Nature of Business

- Capital structure of Company

- Name and address of Signatories and no of shares subscribed by them

- Qualification shares of the Directors

- Particulars of Debentures and redeemable preference shares

- Remuneration of Directors and Promoters

- Minimum Subscription for allotment

- Date of opening and closing of issue

- Details of Underwriter

- Underwriting Commission and Brokerage

- Name and address of Auditor, Company Secretary, Banker and Trustee of Company

- Particulars of material documents

- Expected rate of dividend and voting rights

Types of prospectus

The types of prospectus are discussed below-

Figure 4: Types of prospectus

1. Shelf prospectus

The expression "shelf prospectus" means a prospectus in respect of which the securities or class of securities included therein are issued for subscription in one or more issues over a certain period without the issue of a further prospectus.

The provisions provided under section 31 of the Companies Act, 2013 are-

(1) Any class or classes of companies, as the Securities and Exchange Board may provide by regulations in this behalf, may file a shelf prospectus with the Registrar at the stage of the first offer of securities included therein which shall indicate a period not exceeding one year as the period of validity of such prospectus which shall commence from the date of opening of the first offer of securities under that prospectus, and in respect of a second or subsequent offer of such securities issued during the period of validity of that prospectus, no further prospectus is required.

(2) A company filing a shelf prospectus shall be required to file an information memorandum containing all material facts relating to new charges created, changes in the financial position of the company as have occurred between the first offer of securities or the previous offer of securities and the succeeding offer of securities and such other changes as may be prescribed, with the Registrar within the prescribed time, prior to the issue of a second or subsequent offer of securities under the shelf prospectus:

Provided that where a company or any other person has received applications for the allotment of securities along with advance payments of subscription before the making of any such change, the company or other person shall intimate the changes to such applicants and if they express a desire to withdraw their application, the company or other person shall refund all the monies received as subscription within fifteen days thereof.

(3) Where an information memorandum is filed, every time an offer of securities is made under subsection (2), such memorandum together with the shelf prospectus shall be deemed to be a prospectus.

2. Red herring prospectus

The expression "red herring prospectus" means a prospectus which does not include complete particulars of the quantum or price of the securities included therein.

The provisions of red herring prospectus provided under section 32 of the Companies Act, 2013 are-

(1) A company proposing to make an offer of securities may issue a red herring prospectus prior to the issue of a prospectus.

(2) A company proposing to issue a red herring prospectus under sub-section (1) shall file it with the Registrar at least three days prior to the opening of the subscription list and the offer.

(3) A red herring prospectus shall carry the same obligations as are applicable to a prospectus and any variation between the red herring prospectus and a prospectus shall be highlighted as variations in the prospectus.

(4) Upon the closing of the offer of securities under this section, the prospectus stating therein the total capital raised, whether by way of debt or share capital, and the closing price of the securities and any other details as are not included in the red herring prospectus shall be filed with the Registrar and the Securities and Exchange Board.

Matters to be stated in prospectus (section 26)

(1) Every prospectus issued by or on behalf of a public company either with reference to its formation or subsequently, or by or on behalf of any person who is or has been engaged or interested in the formation of a public company, shall be dated and signed and shall—

(a) state the following information, namely:—

(i) names and addresses of the registered office of the company, company secretary, Chief Financial Officer, auditors, legal advisers, bankers, trustees, if any, underwriters and such other persons as may be prescribed;

(ii) dates of the opening and closing of the issue, and declaration about the issue of allotment letters and refunds within the prescribed time;

(iii) a statement by the Board of Directors about the separate bank account where all monies received out of the issue are to be transferred and disclosure of details of all monies including utilised and unutilised monies out of the previous issue in the prescribed manner;

(iv) details about underwriting of the issue;

(v) consent of the directors, auditors, bankers to the issue, expert‘s opinion, if any, and of such other persons, as may be prescribed;

(vi) the authority for the issue and the details of the resolution passed therefor;

(vii) procedure and time schedule for allotment and issue of securities;

(viii) capital structure of the company in the prescribed manner;

(ix) main objects of public offer, terms of the present issue and such other particulars as may be prescribed;

(x) main objects and present business of the company and its location, schedule of implementation of the project;

(xi) particulars relating to—

(A) management perception of risk factors specific to the project;

(B) gestation period of the project;

(C) extent of progress made in the project;

(D) deadlines for completion of the project; and

(E) any litigation or legal action pending or taken by a Government Department or a statutory body during the last five years immediately preceding the year of the issue of prospectus against the promoter of the company;

(xii) minimum subscription, amount payable by way of premium, issue of shares otherwise than on cash;

(xiii) details of directors including their appointments and remuneration, and such particulars of the nature and extent of their interests in the company as may be prescribed; and

(xiv) disclosures in such manner as may be prescribed about sources of promoter‘s contribution;

(b) set out the following reports for the purposes of the financial information, namely:—

(i) reports by the auditors of the company with respect to its profits and losses and assets and liabilities and such other matters as may be prescribed;

(ii) reports relating to profits and losses for each of the five financial years immediately preceding the financial year of the issue of prospectus including such reports of its subsidiaries and in such manner as may be prescribed:

(iii) reports made in the prescribed manner by the auditors upon the profits and losses of the business of the company for each of the five financial years immediately preceding issue and assets and liabilities of its business on the last date to which the accounts of the business were made up, being a date not more than one hundred and eighty days before the issue of the prospectus.

(iv) reports about the business or transaction to which the proceeds of the securities are to be applied directly or indirectly;

(c) make a declaration about the compliance of the provisions of this Act and a statement to the effect that nothing in the prospectus is contrary to the provisions of this Act, the Securities Contracts (Regulation) Act, 1956 (42 of 1956) and the Securities and Exchange Board of India Act, 1992 (15 of 1992) and the rules and regulations made thereunder; and

(d) state such other matters and set out such other reports, as may be prescribed. (2) Nothing in sub-section (1) shall apply—

(a) to the issue to existing members or debenture-holders of a company, of a prospectus or form of application relating to shares in or debentures of the company, whether an applicant has a right to renounce the shares or not under sub-clause (ii) of clause (a) of sub-section (1) of section 62 in favour of any other person; or

(b) to the issue of a prospectus or form of application relating to shares or debentures which are, or are to be, in all respects uniform with shares or debentures previously issued and for the time being dealt in or quoted on a recognised stock exchange.

(3) Subject to sub-section (2), the provisions of sub-section (1) shall apply to a prospectus or a form of application, whether issued on or with reference to the formation of a company or subsequently.

(4) No prospectus shall be issued by or on behalf of a company or in relation to an intended company unless on or before the date of its publication, there has been delivered to the Registrar for registration, a copy thereof signed by every person who is named therein as a director or proposed director of the company or by his duly authorised attorney.

(5) A prospectus issued under sub-section (1) shall not include a statement purporting to be made by an expert unless the expert is a person who is not, and has not been, engaged or interested in the formation or promotion or management, of the company and has given his written consent to the issue of the prospectus and has not withdrawn such consent before the delivery of a copy of the prospectus to the Registrar for registration and a statement to that effect shall be included in the prospectus.

(6) Every prospectus issued under sub-section (1) shall, on the face of it,—

(a) state that a copy has been delivered for registration to the Registrar as required under subsection (4); and

(b) specify any documents required by this section to be attached to the copy so delivered or refer to statements included in the prospectus which specify these documents.

(7) The Registrar shall not register a prospectus unless the requirements of this section with respect to its registration are complied with and the prospectus is accompanied by the consent in writing of all the persons named in the prospectus.

(8) No prospectus shall be valid if it is issued more than ninety days after the date on which a copy thereof is delivered to the Registrar under sub-section (4).

(9) If a prospectus is issued in contravention of the provisions of this section, the company shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to three lakh rupees and every person who is knowingly a party to the issue of such prospectus shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than fifty thousand rupees but which may extend to three lakh rupees, or with both.

3. Abridged Prospectus

It means a memorandum containing salient features of a prospectus. Furthermore it contains the information in brief which helps the investor to take investment decision quickly. In this case, Company needs to attach it along with every application form for purchase of securities.

4.Deemed Prospectus

It is a document which the company issues in case of offer for sale of securities to the public. Moreover this document is an invitation to public to purchase the shares of company through an intermediary such as Issuing House.

Liability of mis-statement in prospectus

The mis-statement in liability in prospectus is broadly divided into two parts-

Figure: Types of liability for mis-statement in prospectus

Criminal liability for mis-statements in prospectus (Section 34)

Where a prospectus, issued, circulated or distributed under this Chapter, includes any statement which is untrue or misleading in form or context in which it is included or where any inclusion or omission of any matter is likely to mislead, every person who authorises the issue of such prospectus shall be liable under section 447: Provided that nothing in this section shall apply to a person if he proves that such statement or omission was immaterial or that he had reasonable grounds to believe, and did up to the time of issue of the prospectus believe, that the statement was true or the inclusion or omission was necessary

Civil liability for mis-statements in prospectus (Section 35)

(1) Where a person has subscribed for securities of a company acting on any statement included, or the inclusion or omission of any matter, in the prospectus which is misleading and has sustained any loss or damage as a consequence thereof, the company and every person who—

(a) is a director of the company at the time of the issue of the prospectus;

(b) has authorised himself to be named and is named in the prospectus as a director of the company, or has agreed to become such director, either immediately or after an interval of time;

(c) is a promoter of the company;

(d) has authorised the issue of the prospectus; and

(e) is an expert referred to in sub-section (5) of section 26, shall, without prejudice to any punishment to which any person may be liable under section 36, be liable to pay compensation to every person who has sustained such loss or damage.

(2) No person shall be liable under sub-section (1), if he proves—

(a) that, having consented to become a director of the company, he withdrew his consent before the issue of the prospectus, and that it was issued without his authority or consent; or

(b) that the prospectus was issued without his knowledge or consent, and that on becoming aware of its issue, he forthwith gave a reasonable public notice that it was issued without his knowledge or consent.

(3) Notwithstanding anything contained in this section, where it is proved that a prospectus has been issued with intent to defraud the applicants for the securities of a company or any other person or for any fraudulent purpose, every person referred to in subsection (1) shall be personally responsible, without any limitation of liability, for all or any of the losses or damages that may have been incurred by any person who subscribed to the securities on the basis of such prospectus.

Key takeaways

- The Companies Act, 2013 defines a prospectus under section 2(70). Prospectus can be defined as “any document which is described or issued as a prospectus”. This also includes any notice, circular, advertisement or any other document acting as an invitation to offers from the public.

Case study

The client is a London based company with presence in over 80 countries across six continents. The company helps its clients to successfully deliver projects around the world by sourcing and supplying top professionals in fields such as IT, Telecom, Project Management, Cyber & IT Security, Presales, Sales & After Sales, Compliance and Security. With offices in Europe, Middle East & Africa, Asia and America, the Company is striving to be at the top in delivering the best possible services and support to organizations that need complex services on a global basis.

The Company is helping many of the worlds’ leading companies to achieve their business goals by providing them a world class outsourcing, staffing and contingent workforce services by aligning their hiring processes to each client’s distinct requirements. Support for achieving that, comes from the staff specializing in the following departments of the business:

- Recruitment & Outsourcing

- Legal

- Accounting

- Accommodation

- Travel

- Visa & Immigration

- In-Country support services

- Health and safety support

The client wishes to expand its operations and provide its discrete services in India.

The primary objective of the client was to provide their services in other countries. For this purpose they needed to set up their company at a location where they could set up a robust and reliable distribution network. Apart from this, they had various other requirements with respect to their business and location as well. Some of their requirements were:

- Setting up of the business in a location in India where companies from the same industry were located;

- Secure a specific name pattern for the Indian Company similar to its other entities around the world;

- Appointment of a Director who is ordinarily resident and citizen of India to satisfy the Indian Companies Act requirement; and

- The Indian Company would provide support in project specific needs of their clients tailored to meet their objectives along with local operational support in the territories where its client does not operate.

The client approached us for assistance in incorporation / formation of an Indian Company. After having a detailed discussion with the client and understanding their requirements, our team listed down their preferences keeping in mind their requirement to set up business in India at minimum cost. We assisted the client in identifying the desired location, apply for the name in the desired pattern, appoint a nominee Indian director and complied with other applicable statutory requirements of shareholding, directorship etc. Thus, we successfully incorporated an Indian Company for the client as specified.

References:

1. Bagrail, A.K.: Company Law

2. Chawla& Garg: Company Law

3. Grower, L.C. B.: Principles of Modern Company Law