Unit - 2

Share

Share means small part in the total share capital of a company. Share capital refers to the funds that a company raises from selling shares to investors. For example, the sale of 1,000 shares at Rs.15 per share raises Rs.15,000 of share capital. In this example,

Share= 1000 number of shares

Share capital= Rs. 15000 which is derived from (No of shares x price) 1000x Rs15.

Types of shares/share capital

The share capital of a company limited by shares shall be of two kinds, namely-

Figure: Types of share capital

- Equity share capital [Section 43(i)]

Equity share capital‘‘, with reference to any company limited by shares, means all share capital which is not preference share capital. Equity share capital—

(i) with voting rights; or

(ii) (ii) with differential rights as to dividend, voting or otherwise in accordance with such rules as may be prescribed.

2. Preference share capital [Section 43 (ii)]

Preference share capital‘‘, with reference to any company limited by shares, means that part of the issued share capital of the company which carries or would carry a preferential right with respect to—

(a) payment of dividend, either as a fixed amount or an amount calculated at a fixed rate, which may either be free of or subject to income-tax; and

(b) repayment, in the case of a winding up or repayment of capital, of the amount of the share capital paid-up or deemed to have been paid-up, whether or not, there is a preferential right to the payment of any fixed premium or premium on any fixed scale, specified in the memorandum or articles of the company.

Certificate of shares (section 46)

(1) A certificate, issued under the common seal, if any, of the company or signed by two directors or by a director and the Company Secretary, wherever the company has appointed a Company Secretary, specifying the shares held by any person, shall be prima facie evidence of the title of the person to such shares.

(2) A duplicate certificate of shares may be issued, if such certificate —

(a) is proved to have been lost or destroyed; or

(b) has been defaced, mutilated or torn and is surrendered to the company.

(3) Notwithstanding anything contained in the articles of a company, the manner of issue of a certificate of shares or the duplicate thereof, the form of such certificate, the particulars to be entered in the register of members and other matters shall be such as may be prescribed.

(4) Where a share is held in depository form, the record of the depository is the prima facie evidence of the interest of the beneficial owner.

(5) If a company with intent to defraud issues a duplicate certificate of shares, the company shall be punishable with fine which shall not be less than five times the face value of the shares involved in the issue of the duplicate certificate but which may extend to ten times the face value of such shares or rupees ten crores whichever is higher and every officer of the company who is in default shall be liable for action under section 447.

Key Takeaways

- Share means small part in the total share capital of a company. Share capital refers to the funds that a company raises from selling shares to investors.

Clause 2(55) of the companies act 2013, “Member”, in relation to a company, means—

(i) the subscriber to the memorandum of the company who shall be deemed to have agreed to become member of the company, and on its registration, shall be entered as member in its register of members;

(ii) every other person who agrees in writing to become a member of the company and whose name is entered in the register of members of the company;

(iii) every person holding shares of the company and whose name is entered as a beneficial owner in the records of a depository.

The techniques of acquiring membership in a company

- By registration

A person whose name is entered in the Register of Member shall be treated as member irrespective of whether he holds the beneficial interest or not. The holder of beneficial owner (under section 89) is not recognised as a member.

2. Subscriber to the shares

A person who agrees to subscribe memorandum of association the company shall be treated as a member of the company, once the company is registered. His name shall also be entered in the register of members.

3. Membership by transfer

In case of a person who acquired shares by acquiring from other person, he will not become the member till the transfer of shares is registered by the company and his name is entered in the register of members of the company.

4. Membership by transmission

In Indian Chemical Products Limited v. State of Orissa [1966 SCR 380] it was held that in case of a transmission of shares unless intimation of transmission is submitted in writing which constitutes an agreement in writing the legal heir cannot be admitted as member of the Company.

Key Takeaways

- The subscriber to the memorandum of the company who shall be deemed to have agreed to become member of the company, and on its registration, shall be entered as member in its register of members.

Issue of shares means offering shares to the public for subscription. When a company wishes to issue shares to the public, there is a procedure and rules that it must follow as prescribed by the Companies Act 2013.

The procedure involved in issue of shares are-

1. Issue of Prospectus

Before the issue of shares, comes the issue of the prospectus. The prospectus is like an invitation to the public to subscribe to shares of the company. A prospectus contains all the information of the company, its financial structure, previous year balance sheets and profit and Loss statements etc.

2. Receiving Applications

When the prospectus is issued, prospective investors can now apply for shares. They must fill out an application and deposit the requisite application money in the schedule bank mentioned in the prospectus.

3. Allotment of Shares

Once the minimum subscription has been reached, the shares can be allotted. Generally, there is always oversubscription of shares, so the allotment is done on pro-rata bases. Letters of Allotment are sent to those who have been allotted their shares.

Issue of sweat equity shares (Section 54)

(1) Notwithstanding anything contained in section 53, a company may issue sweat equity shares of a class of shares already issued, if the following conditions are fulfilled, namely:—

(a) the issue is authorised by a special resolution passed by the company;

(b) the resolution specifies the number of shares, the current market price, consideration, if any, and the class or classes of directors or employees to whom such equity shares are to be issued;

(c) not less than one year has, at the date of such issue, elapsed since the date on which the company had commenced business; and

(d) where the equity shares of the company are listed on a recognised stock exchange, the sweat equity shares are issued in accordance with the regulations made by the Securities and Exchange Board in this behalf and if they are not so listed, the sweat equity shares are issued in accordance with such rules as may be prescribed.

(2) The rights, limitations, restrictions and provisions as are for the time being applicable to equity shares shall be applicable to the sweat equity shares issued under this section and the holders of such shares shall rank ‘pari passu’ with other equity shareholders.

Further issue of share capital (Section 62)

(1) Where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered—

(a) to persons who, at the date of the offer, are holders of equity shares of the company in proportion, as nearly as circumstances admit, to the paid-up share capital on those shares by sending a letter of offer subject to the following conditions, namely:—

(i) the offer shall be made by notice specifying the number of shares offered and limiting a time not being less than fifteen days and not exceeding thirty days from the date of the offer within which the offer, if not accepted, shall be deemed to have been declined;

(ii) unless the articles of the company otherwise provide, the offer aforesaid shall be deemed to include a right exercisable by the person concerned to renounce the shares offered to him or any of them in favour of any other person; and the notice referred to in clause (i) shall contain a statement of this right; after the expiry of the time specified in the notice aforesaid, or on receipt of earlier intimation from the person to whom such notice is given that he declines to accept the shares offered, the Board of Directors may dispose of them in such manner which is not disadvantageous to the shareholders and the company.

(b) to employees under a scheme of employees‘ stock option, subject to special resolution passed by company and subject to such conditions as may be prescribed; or

(c) to any persons, if it is authorised by a special resolution, whether or not those persons include the persons referred to in clause (a) or clause (b), either for cash or for a consideration other than cash, if the price of such shares is determined by the valuation report of a registered valuer subject to such conditions as may be prescribed.

(2) The notice referred to in sub-clause (i) of clause (a) of sub-section (1) shall be despatched through registered post or speed post or through electronic mode to all the existing shareholders at least three days before the opening of the issue.

(3) Nothing in this section shall apply to the increase of the subscribed capital of a company caused by the exercise of an option as a term attached to the debentures issued or loan raised by the company to convert such debentures or loans into shares in the company: Provided that the terms of issue of such debentures or loan containing such an option have been approved before the issue of such debentures or the raising of loan by a special resolution passed by the company in general meeting.

(4) Notwithstanding anything contained in sub-section (3), where any debentures have been issued, or loan has been obtained from any Government by a company, and if that Government considers it necessary in the public interest so to do, it may, by order, direct that such debentures or loans or any part thereof shall be converted into shares in the company on such terms and conditions as appear to the Government to be reasonable in the circumstances of the case even if terms of the issue of such debentures or the raising of such loans do not include a term for providing for an option for such conversion: Provided that where the terms and conditions of such conversion are not acceptable to the company, it may, within sixty days from the date of communication of such order, appeal to the Tribunal which shall after hearing the company and the Government pass such order as it deems fit.

(5) In determining the terms and conditions of conversion under sub-section (4), the Government shall have due regard to the financial position of the company, the terms of issue of debentures or loans, as the case may be, the rate of interest payable on such debentures or loans and such other matters as it may consider necessary.

(6) Where the Government has, by an order made under sub-section (4), directed that any debenture or loan or any part thereof shall be converted into shares in a company and where no appeal has been preferred to the Tribunal under sub-section (4) or where such appeal has been dismissed, the memorandum of such company shall, where such order has the effect of increasing the authorised share capital of the company, stand altered and the authorised share capital of such company shall stand increased by an amount equal to the amount of the value of shares which such debentures or loans or part thereof has been converted into.

Issue of bonus shares (Section 63)

(1) A company may issue fully paid-up bonus shares to its members, in any manner whatsoever, out of—

(i) its free reserves;

(ii) the securities premium account; or

(iii) the capital redemption reserve account: Provided that no issue of bonus shares shall be made by capitalising reserves created by the revaluation of assets.

(2) No company shall capitalise its profits or reserves for the purpose of issuing fully paid-up bonus shares under sub-section (1), unless—

(a) it is authorised by its articles;

(b) it has, on the recommendation of the Board, been authorised in the general meeting of the company;

(c) it has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it;

(d) it has not defaulted in respect of the payment of statutory dues of the employees, such as, contribution to provident fund, gratuity and bonus;

(e) the partly paid-up shares, if any outstanding on the date of allotment, are made fully paid-up;

(f) it complies with such conditions as may be prescribed. (3) The bonus shares shall not be issued in lieu of dividend.

Key Takeaways

- Issue of shares means offering shares to the public for subscription. When a company wishes to issue shares to the public, there is a procedure and rules that it must follow as prescribed by the companies act 2013.

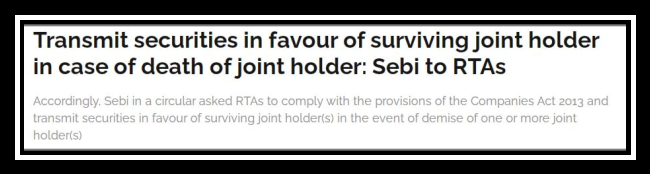

Transfer of share means the transfer of ownership of shares from one person to another. On the other hand, Transmission of shares occurs when the shares of a deceased share holder are inherited or bequeathed to an heir or personal representative of the deceased shareholder. Section 56 of the companies act provides the provisions related to transfer and transmission of shares.

(1) A company shall not register a transfer of securities of the company, or the interest of a member in the company in the case of a company having no share capital, other than the transfer between persons both of whose names are entered as holders of beneficial interest in the records of a depository, unless a proper instrument of transfer, in such form as may be prescribed, duly stamped, dated and executed by or on behalf of the transferor and the transferee and specifying the name, address and occupation, if any, of the transferee has been delivered to the company by the transferor or the transferee within a period of sixty days from the date of execution, along with the certificate relating to the securities, or if no such certificate is in existence, along with the letter of allotment of securities: Provided that where the instrument of transfer has been lost or the instrument of transfer has not been delivered within the prescribed period, the company may register the transfer on such terms as to indemnity as the Board may think fit.

(2) Nothing in sub-section (1) shall prejudice the power of the company to register, on receipt of an intimation of transmission of any right to securities by operation of law from any person to whom such right has been transmitted.

(3) Where an application is made by the transferor alone and relates to partly paid shares, the transfer shall not be registered, unless the company gives the notice of the application, in such manner as may be prescribed, to the transferee and the transferee gives no objection to the transfer within two weeks from the receipt of notice.

(4) Every company shall, unless prohibited by any provision of law or any order of Court, Tribunal or other authority, deliver the certificates of all securities allotted, transferred or transmitted—

(a) within a period of two months from the date of incorporation, in the case of subscribers to the memorandum;

(b) within a period of two months from the date of allotment, in the case of any allotment of any of its shares;

(c) within a period of one month from the date of receipt by the company of the instrument of transfer under sub-section (1) or, as the case may be, of the intimation of transmission under subsection (2), in the case of a transfer or transmission of securities;

(d) within a period of six months from the date of allotment in the case of any allotment of debenture: Provided that where the securities are dealt with in a depository, the company shall intimate the details of allotment of securities to depository immediately on allotment of such securities.

(5) The transfer of any security or other interest of a deceased person in a company made by his legal representative shall, even if the legal representative is not a holder thereof, be valid as if he had been the holder at the time of the execution of the instrument of transfer.

(6) Where any default is made in complying with the provisions of sub-sections (1) to (5), the company shall be punishable with fine which shall not be less than twenty-five thousand rupees but which may extend to five lakh rupees and every officer of the company who is in default shall be punishable with fine which shall not be less than ten thousand rupees but which may extend to one lakh rupees.

(7) Without prejudice to any liability under the Depositories Act, 1996 (22 of 1996), where any depository or depository participant, with an intention to defraud a person, has transferred shares, it shall be liable under section 447.

Key Takeaways

- Transfer of share means the transfer of ownership of shares from one person to another. On the other hand, transmission of shares occurs when the shares of a deceased share holder are inherited or bequeathed to an heir or personal representative of the deceased shareholder.

Section 2(16) charge means an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage. The decisions regarding borrowing, mortgages and charges are lies with the board of directors of a company. The provisions related to borrowing are-

- Under Section 179 (3) (a) of the Companies Act, 2013, the directors have the power to pass a resolution to borrow money and the power to borrow money can be delegated only by passing a resolution.

- Under Section 180 of the Act, the directors are restricted from borrowing temporary loans that are obtained from the company’s banker. This section also defines temporary loans as the loans which are repayable on demand within 6 months from the date.

Consequences of unauthorised borrowings are:

- No Loan: An ultra vires lender has no legal debt against the company. Such borrowings are forbidden on the grounds of public policy.

- Injunction: If the money advanced by the lender to the company has not been spent then the lender can obtain an injunction to restrain the company from spending it.

- Subrogation: The total indebtedness of a company remains unaffected when a lawful debt has been paid off with an ultra vires loan. In this way, the ultra vires lender is protected against the loss and the burden of the company is not increased.

- Identification and Tracing: If the money of the ultra vires lender is with the company in its original form and is still capable of identification, then he can claim the money from the company.

Duty to register charges, etc. (Section 77)

(1) It shall be the duty of every company creating a charge within or outside India, on its property or assets or any of its undertakings, whether tangible or otherwise, and situated in or outside India, to register the particulars of the charge signed by the company and the charge-holder together with the instruments, if any, creating such charge in such form, on payment of such fees and in such manner as may be prescribed, with the Registrar within thirty days of its creation:

Provided that the Registrar may, on an application by the company, allow such registration to be made within a period of three hundred days of such creation on payment of such additional fees as may be prescribed:

Provided further that if registration is not made within a period of three hundred days of such creation, the company shall seek extension of time in accordance with section 87:

Provided also that any subsequent registration of a charge shall not prejudice any right acquired in respect of any property before the charge is actually registered.

(2) Where a charge is registered with the Registrar under sub-section (1), he shall issue a certificate of registration of such charge in such form and in such manner as may be prescribed to the company and, as the case may be, to the person in whose favour the charge is created.

(3) Notwithstanding anything contained in any other law for the time being in force, no charge created by a company shall be taken into account by the liquidator or any other creditor unless it is duly registered under sub-section (1) and a certificate of registration of such charge is given by the Registrar under sub-section (2).

(4) Nothing in sub-section (3) shall prejudice any contract or obligation for the repayment of the money secured by a charge.

Application for registration of charge (section 78)

Where a company fails to register the charge within the period specified in section 77, without prejudice to its liability in respect of any offence under this Chapter, the person in whose favour the charge is created may apply to the Registrar for registration of the charge along with the instrument created for the charge, within such time and in such form and manner as may be prescribed and the Registrar may, on such application, within a period of fourteen days after giving notice to the company, unless the company itself registers the charge or shows sufficient cause why such charge should not be registered, allow such registration on payment of such fees, as may be prescribed:

Provided that where registration is effected on application of the person in whose favour the charge is created, that person shall be entitled to recover from the company the amount of any fees or additional fees paid by him to the Registrar for the purpose of registration of charge.

Key Takeaways

- Section 2(16) charge means an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage. The decisions regarding borrowing, mortgages and charges are lies with the board of directors of a company.

Debenture is the debt capital of company. According to Sec 2(30) of the companies act, debenture includes debenture stock, bonds or any other instrument of a company evidencing a debt, whether constituting a charge on the assets of the company or not. Section 179 (3) of the Companies Act, 2013, gives the power to the board of directors to issue debentures on behalf of the company. Section 71 of the Companies Act, 2013, deals with the issuance of debentures along with the penalties for non-compliance of the same.

Section 71 of the companies act 2013 deals with the following provisions regarding dividend-

(1) A company may issue debentures with an option to convert such debentures into shares, either wholly or partly at the time of redemption: Provided that the issue of debentures with an option to convert such debentures into shares, wholly or partly, shall be approved by a special resolution passed at a general meeting.

(2) No company shall issue any debentures carrying any voting rights.

(3) Secured debentures may be issued by a company subject to such terms and conditions as may be prescribed.

(4) Where debentures are issued by a company under this section, the company shall create a debenture redemption reserve account out of the profits of the company available for payment of dividend and the amount credited to such account shall not be utilised by the company except for the redemption of debentures.

(5) No company shall issue a prospectus or make an offer or invitation to the public or to its members exceeding five hundred for the subscription of its debentures, unless the company has, before such issue or offer, appointed one or more debenture trustees and the conditions governing the appointment of such trustees shall be such as may be prescribed.

(6) A debenture trustee shall take steps to protect the interests of the debenture-holders and redress their grievances in accordance with such rules as may be prescribed.

(7) Any provision contained in a trust deed for securing the issue of debentures, or in any contract with the debenture-holders secured by a trust deed, shall be void in so far as it would have the effect of exempting a trustee thereof from, or indemnifying him against, any liability for breach of trust, where he fails to show the degree of care and due diligence required of him as a trustee, having regard to the provisions of the trust deed conferring on him any power, authority or discretion: Provided that the liability of the debenture trustee shall be subject to such exemptions as may be agreed upon by a majority of debenture-holders holding not less than three-fourths in value of the total debentures at a meeting held for the purpose.

(8) A company shall pay interest and redeem the debentures in accordance with the terms and conditions of their issue.

(9) Where at any time the debenture trustee comes to a conclusion that the assets of the company are insufficient or are likely to become insufficient to discharge the principal amount as and when it becomes due, the debenture trustee may file a petition before the Tribunal and the Tribunal may, after hearing the company and any other person interested in the matter, by order, impose such restrictions on the incurring of any further liabilities by the company as the Tribunal may consider necessary in the interests of the debenture-holders.

(10) Where a company fails to redeem the debentures on the date of their maturity or fails to pay interest on the debentures when it is due, the Tribunal may, on the application of any or all of the debenture-holders, or debenture trustee and, after hearing the parties concerned, direct, by order, the company to redeem the debentures forthwith on payment of principal and interest due thereon.

(11) If any default is made in complying with the order of the Tribunal under this section, every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than two lakh rupees but which may extend to five lakh rupees, or with both.

(12) A contract with the company to take up and pay for any debentures of the company may be enforced by a decree for specific performance.

(13) The Central Government may prescribe the procedure, for securing the issue of debentures, the form of debenture trust deed, the procedure for the debenture-holders to inspect the trust deed and to obtain copies thereof, quantum of debenture redemption reserve required to be created and such other matters.

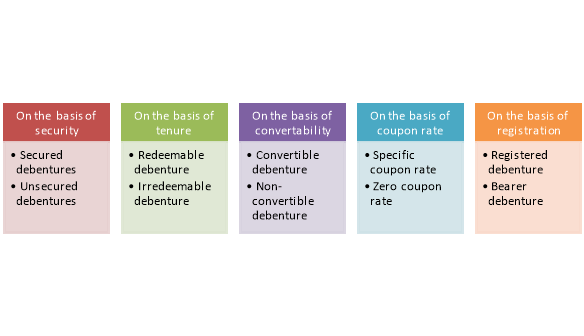

Classification of debenture

The debentures are classified depending on its nature like security, tenure, convertibility, coupon rate and registration.

Figure: Types of debenture

a) On the basis of security

- Secured Debentures: Secured debentures are that kind of debentures where a charge is being established on the properties or assets of the enterprise for the purpose of any payment. The charge might be either floating or fixed. The fixed charge is established against those assets which come under the enterprise’s possession for the purpose to use in activities not meant for sale whereas floating charge comprises of all assets excluding those accredited to the secured creditors. A fixed charge is established on a particular asset whereas a floating charge is on the general assets of the enterprise.

2. Unsecured Debentures: They do not have a particular charge on the assets of the enterprise. However, a floating charge may be established on these debentures by default. Usually, these types of debentures are not circulated.

b) On the basis of tenure of Tenure

1. Redeemable Debentures: These debentures are those debentures that are due on the cessation of the time frame either in a lump-sum or in instalments during the lifetime of the enterprise. Debentures can be reclaimed either at a premium or at par.

2. Irredeemable Debentures: These debentures are also called as Perpetual Debentures as the company doesn’t give any attempt for the repayment of money acquired or borrowed by circulating such debentures. These debentures are repayable on the closing up of an enterprise or on the expiry (cessation) of a long period.

c) On the basis of Convertibility

1. Convertible Debentures: Debentures which are changeable to equity shares or in any other security either at the choice of the enterprise or the debenture holders are called convertible debentures. These debentures are either entirely convertible or partly changeable.

2. Non-Convertible Debentures: The debentures which can’t be changed into shares or in other securities are called Non-Convertible Debentures. Most debentures circulated by enterprises fall in this class.

d) On the basis of coupon rate

1. Specific Coupon Rate Debentures: Such debentures are circulated with a mentioned rate of interest, and it is known as the coupon rate.

2. Zero-Coupon Rate Debentures: These debentures don’t normally carry a particular rate of interest. In order to restore the investors, such type of debentures are circulated at a considerable discount and the difference between the nominal value and the circulated price is treated as the amount of interest associated to the duration of the debentures.

e) On the basis of Registration

1. Registered Debentures: These debentures are such debentures within which all details comprising addresses, names and particulars of holding of the debenture holders are filed in a register kept by the enterprise. Such debentures can be moved only by performing a normal transfer deed.

2. Bearer Debentures: These debentures are debentures which can be transferred by way of delivery and the company does not keep any record of the debenture holders Interest on debentures is paid to a person who produces the interest coupon attached to such debentures.

Key Takeaways

- Debenture is the debt capital of company. According to sec 2(30) of the companies act, debenture includes debenture stock, bonds or any other instrument of a company evidencing a debt, whether constituting a charge on the assets of the company or not.

Case study

A Case study on Legal Heir Certificate – Share Transmission & IEPF Claim

Raj Kamal is one of our recent clients for the transmission of Shares inherited from his late father Shri. Dhayanand Kotecha and the shares have also moved to IEPF. When he came to our office we realized that his father’s shares are worth more than a crore. While discussing with him our services to assist him with transmission and IEPF. We believed that it would be a cakewalk to service his needs and that if we could complete the work diligently we may realize our service charges quickly.

Lets quickly see the case that has been detailed to us on day 1 of the meeting. Raj claimed that he would like to take ownership of his Dad’s shares through transmission and IEPF claim directly to his Demat account as his Mother Mrs.Shanthi Dhayanand and two Sisters Mrs.Rekha Shankar & Mrs.Sajna Choudary do not have any objection in him claiming the shares to himself.

As has been the practice, we have prepared our agreement to enter into a service agreement so as to start our work in preparing for the Transmission Process. However, it has been decided to a do bit of research on all the Share certificates we collected the basic KYC documents, copy of Legal Heir Certificate and copies of all the Share certificates which were in his possession.

The Revelation:

In this case, the Legal Heir document should be mentioned ideally the following persons as the Legal Heirs of Shri. Dhayanand Kotecha:

- Mrs.Shanthi Dhayanand (wife of Dhayanand)

- Mr.Raj Kamal (Son)

- Mrs.Rekha Shankar (daughter) &

- Mrs.Sajna Choudary (daughter)

Normally the total shares left by Mr.Dhayanand will be claimed and split to all the four Legal Heirs whereas, in this case since all the other 3 Legal heirs have consented for NOC (No Objection Certificate) in favor of Mr.Raj Kamal, he would have the rights to enjoy the entitlements.

While the back office team was ready to prepare the required documentation something new popped up. The Legal Heir Certificate actually reflected a 5th name to it. Yes, it contained Mrs.Sita Devi. On inquiry with Raj, it was found that the Legal heir certificate was obtained 12 years before itself after the first death anniversary of his Dad Mr.Dhayanand and Mrs.Sita Devi, being Mother to Mr.Dhayanand and was alive then is also one of the Legal heir and her name is also included.

Here is the real tricky situation! Since Mrs. Sita Devi’s demise was later to her Son, she would also have separate legal heirship under her.

Sita Devi’s Legal Heir’s:

Sita Devi and her husband had 7 children and currently, 4 had demised. These 4 Children has a total of 15 Children among them as detailed below

- Late Bharathi (3 Children)

- Late Kala (1 Child)

- Ms.Reema (Alive)

- Late Vijaya (8 Children)

- Shiyaram (Alive)

- Late Dhayanand (3 Children)

- Abhaya (Alive)

Since Mr.Dhayanand died intestate and his mother also being a Legal heir and beneficiary, on her demise all Legal heirs would also be beneficiary of Shares of limited to the share ration due to her (Sita Devi).

Thus, if in case Mr.Raj Kamal intends to enjoy the whole shares then legally either he has to obtain NOC from all 18 Legal heirs or part ⅕th of the total shares to be shared among other Legal heirs of his Grandmother.

Raj would come back with his decisions and concurrence from others. Team SMB Enablers Pvt Ltd is a highly experienced team and would identify such legal challenges well in advance and thereby ensure quick turn around time in realizing every penny that is due to its clients.

References:

1. Bagrail, A.K.: Company Law

2. Chawla& Garg: Company Law

3. Grower, L.C. B.: Principles of Modern Company Law