Unit-III

Accounting for Amalgamation of Companies

Introduction

You have studied the units related to the final accounting of a partnership company in the XIIth standard. These final accounts are similar to the final accounts of individual traders, but with certain changes in the profit / loss distribution of partners in the profit-sharing ratio. However, there are various transactions that affect the accounting of a general partnership, such as partnership, retirement, death of the partnership, partnership, dissolution, and conversion of the partnership.

In this unit we will understand the need to learning Accounting for Mergers of Partnership Companies.

Meaning of Amalgamation of Partnership Companies:

A merger means merging or merging two or more business units that operate the same type of business to form a new business unit.

A merger of union corporations means that two or more union corporations merge to form a new union corporation. The merger of two or more existing partnership companies doing the same type of business, terminating another entity and forming a new company is called a partnership company merger.

Mergers can be formed in one of the following ways:

What is a "Merger" of a Partner Company?

Amalgamation means a merger or merger. When two or more entities merge or combine into one entity, it is known as a "Merger." Similarly, when two or more union corporations merge, it is a "merger of union corporations".

Including the merger of her two or more single traders into the company

The scope of this chapter is broad enough to include situations where two or more individual traders merge to form a new partnership. This is generally known as a "merger to a partner company".

It also includes the merger of one or more single traders and one or more of his partnerships.

The scope of this chapter also includes situations where one or more sole ownerships he merges with one or more partnership companies to establish a new company.

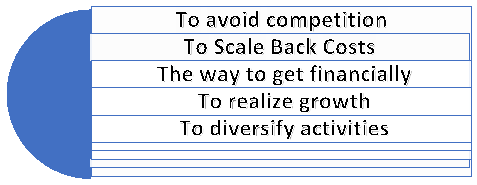

Purpose of the Amalgamation of Companies:

The main purposes of the merger of the businesses are:

1. To avoid competition:

The main purpose of a merger is to avoid competition between companies. This provides the corporate a foothold over its competitors.

2. To Scale Back Costs:

The merged company can cash in of operating costs by lowering production costs. This is often possible for a "large economy".

3. The way to get financially:

The merged company will benefit financially within the sort of tax benefits, improved creditworthiness and lower borrowing rates.

4. To realize growth:

The merged company can pool resources to market internal growth and stop the emergence of latest competitors.

5. To diversify activities:

Diversifying your business across two or more industries can reduce your company's risk. In some cases, it can act to hedge weaker merger operations with stronger ones.

Fusion Vs. Absorption

When two or more existing entities merge to form a new entity, it is a "merger". Therefore, the old entity is carried over to the newly formed business entity. M / s AB & Co. And M / s. CD & Co. Merged to establish a new company, M / s. ABCD & Co.

Absorption allows one or more existing entities to be taken over by another existing entity. No new entity will be formed for this purpose. For example, if one company AB & Co. "absorbs" another company CD & Co., It is known as the absorption of CD & Co. By AB & Co.

Therefore, in a merger, all old entities are closed and new entities are formed, but in absorption, one old entity survives after taking over another.

The scope of this chapter is large enough to include such situations.

Distinction Between Merger and Purchase

Merger | Purchase |

1. Shareholders of the transferor company holding 90% of the face value of equity shares become shareholders of transferee company. | 1. Shareholders of the transferor company may not become shareholders of transferee company. |

2. There is a genuine polling of assets and liabilities of the amalgamating companies. | 2. There is no genuine polling of assets and liabilities of the amalgamation companies. |

3. There is pooling of interest of shareholders also. | 3. There may not be pooling of interest of shareholders |

4. Values of assets and liabilities, reserves represent the same values of amalgamating companies | 4. The values of assets and liabilities may be different than the amalgamating companies. |

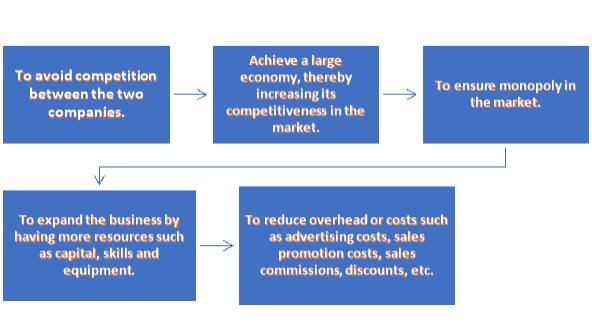

Need For Merger

Some of the key objectives of a company merger are:

Various forms of corporate "merger"

A merger of companies can take one of the following forms:

Merger of two or more single traders: Here, two or more single traders are merged into a new partnership. For example. The two certified accountants, Mr. A and Mr. B, work separately and have merged their work to create a new certified accountant office. M / s AB.

Self-employed and company merger: Here, an existing business entity loses its identity and a new business partner because one or more existing sole proprietors merge with one or more of his existing business partners. Is established and takes over the business. For example. Owner Mr. X and M / s. The partnership company YZ, which had been operating separately, merged to establish a new company, M / s. XYZ.

Merger of two or more partnership companies: Here, two or more existing partnership companies merge to form a new company to take over the business of the existing company. For example, M / s. PQ and M / s. RS will merge two competing partnerships to form a new partnership. M / s PQRS. In all of the above cases, A, B, X, YZ, PQ, RS lose their personal identity, close their business and close his new company, M / s. AB, M / s. XYZ and M / s. Each PQRS was born to take over the business.

Absorption: In this case, all the uniting units do not lose their identity. One of them will survive the succession of other existing units. For example, M / s. JK and M / s. MN has a competitive business. MS. JK absorbs or hijacks M / s. MN dissolves his M / s. MN and M / s. JK will survive. Currently, we have assets and liabilities inherited from M / s. MN, in addition to existing assets and liabilities.

Accounting Procedure

You need to study the accounting of "old companies" and "new companies".

Old Company: If there is a merger of companies, in the case of an old company, there are basically four things that happen.

The old company has dissolved: The old company has dissolved. They are involved. All results of the dissolution (see Chapter 3) follow. Assets and liabilities are either taken over by the new company or disposed of.

Financial Statements: As a result, the company's accounting books are closed as they were in the case of dissolution.

Asset and Liability Valuation: For this purpose, it is necessary to revaluate the existing assets and liabilities of the old company. Unrecorded assets and liabilities must also be considered for such valuations. This is done by mutual agreement.

Partner's final capital to check: At the time of the merger, the assets and liabilities of the old company will be taken over by the new company and an amount equal to this value (as mutually agreed) will be credited to the new company's capital account. When an old company partner becomes a new company partner. Therefore, needs to confirm the final capital of the partners of the old company, and the same becomes the starting capital of these partners of the new company.

New Office

Establishment of new company: Except in the case of absorption (Section 4.4), a new company will be established and take over the business of the old company.

Taking over the assets and liabilities of the old company: The basic purpose of the new company is to take over the running business using the assets and liabilities of the old company at an agreed price. The agreed value of an asset minus the agreed value of an inherited liability is called the "purchase consideration" or "price".

New Company Partner Capital: The "purchase consideration" above will not be paid in cash to the old partner as in the case of a normal dissolution. The “Purchase Consideration” will be credited to the capital account of the new company's old partner, as confirmed and explained in Section 5.1.4.

Devising a new share of profits: Partners united in a merger must agree to a new share of profits.

Partner Capital Restructuring: Often, the new company's partner's capital is restructured based on the new profit share. This may require the introduction of additional cash capital and, in some cases, the withdrawal of surplus capital. Excesses / shortages may even be transferred to your partner's checking / loan account.

Fusion Example

In November 2015, his pharmaceutical company Natco Pharma received shareholder approval for the merger of its subsidiary Natco Organics into the company. As a result of mail voting and electronic voting, the resolution was passed with 99.94% in Favor, 0.02% against, and 0.04% invalid.

Accounting Entry

Old Company Books

The basic purpose of passing items in the old company's books is to:

There are two possible ways to close the books of an old company. Re-evaluation method and realization (dissolution) method.

How it is realized: In the case of a merger, "Old Enterprise: Dissolve. Therefore, conceptually, all the principles described in Chapter 3," Dissolution of Partnership Farms "apply to such farms. The old company passes the following entries:

The entries are:

Step 1: Open a Realization Account and a Partner's Capital Account.

Step 2: Same as step 1 of the reassessment method (see Section 6.1.1). Transfer the partner's capital to the partner's capital A / C credit side and transfer the past profits and reserves. The entries are:

Reserve P/L A/c Dr. To Partners Capital A/c (Various past profit transferred) | XX |

XX |

Step 3: Transfer all assets to the realization account. The entries are:

Realisation A/c Dr. To Concerned asset A/c (Various assets transferred) | XXX |

XXX |

What students should be aware of here is that the new company will take over due to the merger, so cash and bank balances (accounts) will be transferred.

However, you should not transfer your cash / bank account to a cash account if all your assets and liabilities are not taken over by the company.

Step 4: Transfer all debt to the realized account. The entries are:

Concerned liabilities A/c Dr. To Realisation A/c (Various liabilities transferred) | XXX |

XXX |

Step 5: Find out the consideration for the new company's takeover of assets and liabilities. A separate statement is usually created for the "Purchase Consideration". Then the following entry is passed:

Business purchase A/c Dr. To Realisation A/c (Value of purchase consideration on amalgamation now recorded) | XXX |

XXX |

Step 6: Assets that were not taken over by the new company and were sold to the outside world / taken over by a partner:

Cash/Bank/Partners capital A/c Dr. To Concerned asset A/c (Entry at agreed value) | XXX |

XXX |

Gain / Loss of such sale / acquisition transferred to Realization A / c:

Profit | Asset A/c Dr. To Realisation A/c | XXX |

XXX |

Loss | Realisation A/c Dr. To Asset A/c | XXX |

XXX |

Step 7: Partner disclaims / takes over responsibility instead of new company taking over responsibility

Concerned Liability A/c Dr. To Cash/Bank/Partners Capital A/c (Entry at agreed value) | XXX |

XXX |

Gains / losses from such emissions / take-backs transferred to Realization A / c:

Profit | Concerned Liability A/c Dr. To Realisation A/c (Surplus Transferred as Liability taken over at Lower Value) | XXX |

XXX |

Loss | Realisation A/c Dr. To Concerned liability A/c | XXX |

XXX |

Profit | Realisation A/c Dr. To Partners Capital A/c | XXX |

XXX |

Loss | Partners’ Capital A/c Dr. To Realisation A/c | XXX |

XXX |

Step 8: Realization A / c is closed by transferring profit or loss to the partner's capital account at a profit-sharing ratio.

Step 9: The final entry:

Partners’ capital A/c Dr. To Business Purchase A/c (Entry to Close the Books of the “Old Firm”) | XXX |

XXX |

Students may find that only the implementation method follows the final answer and that the syllabus contains only the implementation method.

New office book

The entry into the new company's books can be divided into the following stages.

(a) Record of inherited assets and liabilities:

Debit: All asset accounts (taken over)

Credits: All debt accounts (taken over)

Credit: Partner's capital account (depending on the final balance of the old company's capital account)

This entry makes the final capital of the old company's partner the first capital of the new company.

(b) Partner capital restructuring:

Partners can determine the specific capital structure of the new company.

New profit-sharing partner therefore, partners can bring in additional capital or withdraw surplus capital. Alternatively, you can transfer the excess or deficit to your checking account or loan account.

(c) Remove the impact of old business-to-business transactions:

(1) If one of the debtors of the old company is the creditor of the other company, the same party will be reflected in both the debtor and the creditor of the merged company, and the common amount will be cancelled as follows.

Sunday Creditors A/c Dr. To Sundry Debtors A/c | XXX |

XXX |

(2) If the old company before the merger was a debtor / creditor of each other, the common amount will be cancelled in the company after the merger as follows.

Sundry Creditors A/c Dr. To Sundry Debtors A/c | XXX |

XXX |

(3) Similarly, if the old companies were accepting or withdrawing bills from each other, the same procedure would be performed.

Bills Payable A/c Dr. To Bills Receivable A/c | XXX |

XXX |

A similar method is used for cancellation of business-to-business loans.

(4) If one company purchased goods from the other company prior to the merger and all or part of the goods are still in stock or on the date of the merger, by the company that sold those goods. The amount of profit obtained is reduced from the combined inventory value as follows.

Goodwill A/c Dr. To Stock A/c | XXX |

XXX |

Accounting Standard 14 (AS 14): Accounting for Mergers

ICAI has made this AS mandatory since January 4, 1995. The AS handles the accounting for mergers and the processing of the resulting goodwill or reserves. This is primarily intended for businesses, and only some of its requirements apply to partners' accounts, etc.

It states that there are two main ways to account for a merger.

The use of the "equity pooling method" is not discussed here as it is limited to mergers of companies.

The purchase method of accounting for mergers applies the same principles to the purchase of this regular asset. The problem in is solved using this method.

In this way, the assets and liabilities of the transferring company are either taken over by the new company at their existing value or the consideration is allocated to the individual assets and liabilities based on their fair value at that time, according to the contract. The date of the merger. The reserve will not be taken over by the new company, but will be distributed among the partners of the merged company.

AS 14 sets out the accounting procedures that should be followed in the books of the purchasing / transferring company, but does not specify the specific method that should be followed when closing the books of the merged company.

In the above accounting, students are aware of the following:

(i) If the consideration paid exceeds the net assets (assets-liabilities) acquired, the resulting amount is "GOOD WILL".

(ii) Alternatively, if the consideration paid is less than the net assets acquired, it is a "capital reserve".

Such goodwill resulting from the merger should be systematically amortized by the new company over its useful life. Generally, the amortization period should not exceed 5 years.

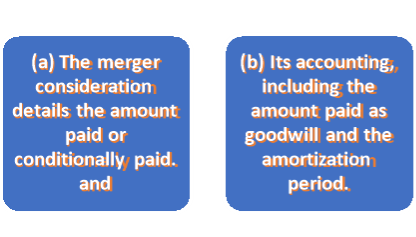

Para 45 of AS 14 sets disclosure requirements in the first financial statements of the new company after the merger.

Key takeaways:

- A merger is the formation of a new organization by combining the assets and liabilities of two or more companies into one.

- The transferor will be absorbed by a stronger transferee and become a company with a stronger customer base and more assets.

- The merger will help increase cash resources, eliminate competition and save corporate taxes.

- However, if too much competition is cut off, the workforce shrinks, and the debt burden of the new entity increases, it can lead to a monopoly.

- The terms of the merger will be finalized by the board of directors of each company.

- The plan is created and submitted for approval.

- For example, the Indian High Court and the Securities and Exchange Commission (SEBI) need to approve the shareholders of the new company when the plan is submitted.

- The new company will formally become an entity and will issue shares to the shareholders of the transferring company.

- The transferring company will be liquidated and all assets and liabilities will be taken over by the transferring company.

- One type of merger is to pool the company's assets and liabilities, as well as the interests of its shareholders.

- All assets of the transferring company are the assets of the transferring company.

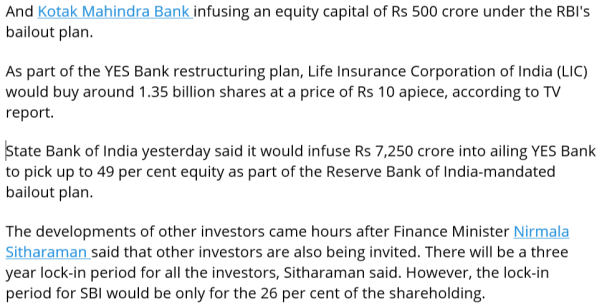

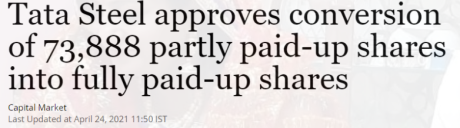

Case Study Of Recent Mergers and Acquisitions In India

Preface

Mergers and acquisitions (“M & A”) are strategies in which two or more entities engage in a series of financial transactions, through which mergers or acquisitions of related entities are carried out for a variety of purposes. These became very popular in his late 19th century and are still in large numbers today. Over the last two decades, a record number of his M & A deals have taken place not only in India but around the world. Commercial laws such as the Companies Act 2013, the Competition Act 1961, the Income Tax Act 2002, and other related regulations govern the legal, regulatory, and compliance aspects of these transactions. Therefore, all entities should be aware of all relevant laws when initiating an M & A transaction.

M & A transactions may seem simple at first glance, but they often have very complex aspects. Each transaction is concluded for a different purpose. Each trading condition can be very different from other trading, so even the result of one transaction / transaction can be quite different from the result of another. Mergers and acquisitions can be divided into several types, depending on the purpose the company seeks to achieve through the transaction, the way the transaction is structured, and the nature of the company entering the transaction. , Conglomerate mergers, conglomerate mergers, hostile takeovers, etc.

Therefore, the purpose of this blog is to discuss and establish relevance of some of the major M & A deals that have taken place in the past in various areas such as banking, telecommunications, hospitality and construction. Lessons to be provided for similar transactions in the future.

Case 1

Vodafone and Idea Merger

In August 2018, a national corporate court approved the merger of UK-based Vodafone Group (composed of Vodafone Mobile Services Limited (VMSL) and Vodafone India) with Aditya-Birla Group's Idea Cellular. The purpose of the merger was to build the largest telecommunications network with the largest customer base in India. After the merger, the Vodafone Group owns approximately 45% of the merged company, while Idea Limited owns approximately 26% of the shares.

Telecommunications market India is an oligopolistic occupying market, and the two companies faced fierce competition with his two other major operators, Reliance's Jio and Bharti-Airtel. In addition, the Supreme Court's ruling ordered payment of hundreds of billions of dollars in adjusted gross revenue, requiring the two companies to merge to leverage each other's customer base in order to comfortably pay membership fees.

Case 2

L & T Acquires Mindtree

One of India's most talked-about acquisitions in India's M & A market last year was the acquisition of IT services company Mindtree by construction and engineering giant Larson and Toubro (L & T). The deal was unique as it was called the first ever hostile takeover in the Indian market. L & T, interested in gaining control of Mindtree to expand its tech sector, offered to buy Mindtree shares from its promoter, but unanimously refused. Purchased his 20.32% stake in Mindtree from a deprecated shareholder, VG Siddhartha. He then bought a 15% stake from a post where he acquired a 31% stake in a public offering, and eventually acquired about a 60% stake in the company. Following the merger, at least three of his co-founder promoters have resigned.

Case 3

Flipkart's Acquisition of Myntra

In 2014, Flipkart and Myntra, two of the largest e-commerce giants in the Indian market at the time, merged. With the rapid rise in popularity of e-commerce and intensifying competition with foreign companies such as Amazon, Flipkart considers it suitable to benefit from his 30% market share of his Myntra in fashion e-commerce. I did. This is an example of a horizontal merger, as both companies belonged to the same industry. After the acquisition, Myntra remains under his 100% ownership of his Flipkart, but remains an independent entity.

Case 4

Merger of Sun Pharmaceuticals and Ranbaxy

In April 2014, Sun Pharmaceuticals announced the acquisition of his Ranbaxy. This is one of the largest acquisitions in the history of the pharmaceutical industry. Sun Pharmaceuticals acquired his Ranbaxy from Daiichi Sankyo, a Japanese pharmaceutical company in which he acquired Ranbaxy in 2008. It suffered regulatory damage, but suffered reputational damage and, as a result, customer-based losses. Therefore, when Sun Pharma saw this as a good opportunity to seize Ranbaxy's strong presence in pharmaceutical research and development, it sought to separate it from Ranbaxy. In addition, after the acquisition, Sun Pharma is now India's largest pharmaceutical company and his fifth largest in the world. In return for the deal, Ranbaxy's shareholders acquired his 14% stake in the post-acquisition company.

There is no doubt that this acquisition has benefited Sun Pharma. Revenue increased as we were able to leverage Ranbaxy's customer base, which favors generic and affordable medicines.

Case 5

Merger of Thomas Cook and Sterling Holidays

Thomas Cook India Limited merged with Sterling Holiday Resorts (India) Limited in 2014 in a transaction consisting of some cash and some inventories. The deal gives Thomas Cook access to his inventory of more than 1500 rooms at Sterling at various resorts in India's most popular tourist destinations. Meanwhile, Sterling Holidays has benefited from the reputation of Thomas Cook, one of the largest companies in the tourism industry. Transactions made in several tranches included Thomas Cook buying a 23% stake in Sterling Resorts, both of which are involved in the tourism industry and have a customer base. This is an example of a homologous merger because the process chain is irrelevant.

Case 6

Merger of Vedanta and Cairn India

In April 2017, Vedanta Resources announced the acquisition of Cairn India. Both are involved in the natural resources sector. Cairn India's minority shareholders opposed the proposed deal, resulting in negotiations being postponed for almost two years. Eventually, they agreed that Vedanta would offer his one share of Cairn India a redeemable preferred share of his one and four shares of the merged company. In addition, the merger gives Cairn India access to Vedanta Limited's broad asset base. Meanwhile, Vedanta, a wholly owned subsidiary of London-based Vedanta Resources, sought to meet its obligations with Cairn India's large cash reserves. This is an example of an upstream merger, as this transaction involves a merger of a subsidiary into a holding company.

Case 7

Merger and Acquisition at Ricky Chopra International Counsels

Ricky Chopra International Counsels (RCIC) is an international law firm with offices in various cities such as Gurgram and New York. RCIC lawyers have experience providing professional M & A advice for transactions taking place in India and abroad in various areas such as media, banking and corporate chains. Apart from the strategic aspects, our lawyers are also familiar with the detailed procedural aspects of M & A transactions, helping our clients execute transactions in a smooth and hassle-free manner. We have the expertise to provide state-of-the-art advice for each client, and the genuine commitment and passion of our lawyers is in building long-term relationships with all our clients. It is useful.

Conclusion

As can be seen from the above explanation, mergers and acquisitions are widespread throughout the sector and are important factors in determining the health of any economy. As far as his current M & A scenario in India is concerned, M & A deals are increasing as a result of the acquisition of a difficult entity under the IBC resolution process. Given the Punjab of Coronavirus, future growth prospects may seem uncertain at this point, but especially Edtech, FinTech, FMCG, payment systems, e--and the Ministry of Finance has 10 public sector banks. Announced mergers (for example, the merger of Syndicate Bank and Canara Bank, the merger of United Bank and Oriental Bank of India and Punjab National Bank). Reduce bad debts and rebuild the economy. In the private sector, debt-stricken airlines such as Jet Airways and Air India have already invited a statement of interest (EoI) from potential buyers who may be considering acquisitions.

Case 8

A Merger of Businesses with a common Shareholding in an International Group to promote Growth.

Parallel and parallel to form a cohesive group that expands and grows internationally under a new parent company that is acceptable for both the international debt and equity financing needed to fund such expansion. Advise and formulate mergers of businesses that integrate both verticals.

Members of the group develop software for use in defense and other sensitive areas and have intellectual property (IP) rights to this software. In other countries, they were developing IP sales platforms. We have developed our business based on a hardware agency that complements IP. Developed an irrelevant engineering infrastructure business.

Our client asked us to assess the feasibility of such a merger and analyze the processes and changes required to complete the exercise.

Arch helped clients choose new parent companies from different jurisdictions to lead new groups. We evaluated the impact of taxation on group and individual investors. He evaluated political risks, sound legal jurisdiction, political considerations in selling to restricted sectors, and the adequacy of financing, including his future IPO. Commercial costs of operation; and transfer of ownership to complete the merger.

We have confirmed that the new parent company format will be accepted by the major IPO and fixed income markets. To support the holding of shares in the new parent company, we summarized the acceptable valuations of each entity and integrated the group through the acquisition of various entities by the parent company. He also adopted management incentive schemes and service contract terms that would attract the staff needed to expand and develop the IP and would be acceptable for his future IPO financing.

Arch helped clients develop business plans and adopt levels of governance and stewardship that are acceptable to future debt and equity investors. We also helped prepare and formalize private equity bridge financing before the IPO.

Case 9

CMC Merges with TCS.

This is an example of a merger in the same industry (horizontal). This was done to consolidate the IT business. The purpose of the merger, as CMC's management has shown, is to bring TCS to a single company with streamlined structure, expanded scope, financial strength and flexibility. It was to be able to integrate. It also showed that it helps to achieve economies of scale, more focused operational efforts, standardization and simplification of business processes, and increased productivity.

Mergers and acquisitions are very important topics in CFA exams. The three levels of CFA exams help lay the foundation for mergers and acquisitions and accomplish your dream job in this area.

What is Reconstruction?

Rebuilding is the process of restructuring a company in terms of law, operations, ownership and other structures by revaluing assets and revaluing liabilities. It refers to the transfer of the business of a company or multiple companies to a new company. Therefore, this means that the old company will be liquidated, and therefore shareholders agree to acquire shares of equal value in the new company. The financial statements do not reflect the true and fair position of the business, as if the company has suffered losses over the years, it will need to be rebuilt and the net worth will be higher than the actual net worth. Hmm.

In other words, "reconstruction" is the dissolution of an existing company and the transfer of its assets and liabilities to a new company established for the purpose of business succession or succession of the existing company. Shareholders of the existing company will become shareholders of the new company. The business content and shareholders of the new company are almost the same as those of the old company.

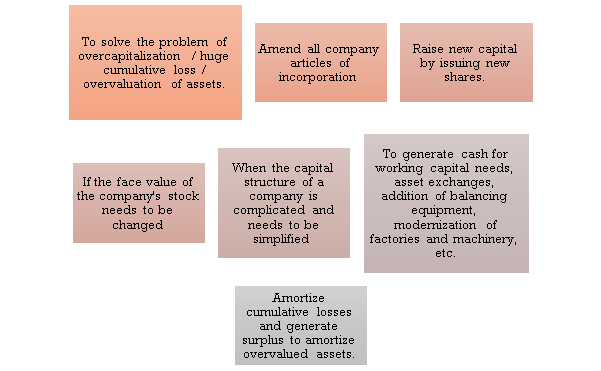

Purpose of Reconstruction

The main purposes of the reconstruction are:

Types of Reconstruction

The company can be rebuilt in one of two ways. These are:

External Restructuring: If a company suffers losses over the past few years and faces a financial crisis, it can sell its business to another newly established company. In fact, the new company was established to take over the assets and liabilities of the old company. This process is called external reconstruction. In other words, external reconstruction means selling the business of an existing company to another company established for that purpose. In the external reconstruction, one company will be liquidated and the other will be newly established. The liquidated company is called the "Vendor Company" and the new company is called the "Purchasing Company". The shareholders of the selling company are the shareholders of the purchasing company.

Internal Restructuring: Internal restructuring refers to the internal restructuring of a company's financial structure. It is also called a restructuring that allows an existing company to survive. In general, equity capital is reduced to amortize the company's past cumulative losses.

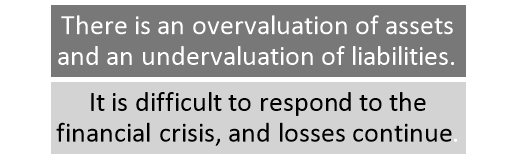

Significance of Internal Reconstruction

Internal reconstruction is done by the company in the following cases:

Conditions and regulations regarding Internal Reconstruction

1. Approval by Articles of Incorporation: The company must be approved by the Articles of Incorporation to appeal for capital reduction. The Articles of Incorporation contain all the details of the company's internal affairs and refer to provisions that include how to reduce capital.

2. Passing a special resolution: The company must pass a special resolution before appealing for a capital reduction. Special resolutions will only be passed if a majority of stakeholders agree to internal reconstruction. This special resolution must be signed by the arbitral tribunal and deposited with a registrar appointed under the Companies Act 2013.

3. Court Permission: The company must obtain the court or the court's legitimate permission before starting the capital reduction process. The court will only grant permission if the company is fair and is satisfied with the positive consent of all stakeholders.

4. Borrowing Payment: According to Article 66 of the Companies Act 2013, a company must repay all the amount deposited and its interest before reducing its capital.

5. Creditor Consent: The company that reduces the capital requires the written consent of the creditor. The court requires the company to secure the interests of the dissenting creditors. The company obtains the court's permission after the court determines that the reduction of capital does not harm the interests of the creditors.

6. Announcement: The company must announce according to the instructions of the tribe for a capital reduction. The company must also explain the justification.

Difference between Internal Reconstruction and External Reconstruction

Basis For Comparison | Internal Reconstruction | External Reconstruction |

Meaning | Internal reconstruction refers to the method of corporate restructuring wherein existing company is not liquidated to form a new one. | External reconstruction is one in which the company undergoing reconstruction is liquidated to take over the business of existing company. |

New company | No new company is formed. | New company is formed. |

Use of specific terms in Balance Sheet | Balance Sheet of the company contains "And Reduced". | No specific terms are used in the Balance sheet. |

Capital reduction | Capital is reduced and the external liability holders waive their claims. | No reduction in the capital |

Approval of court | Approval of court is must. | No approval of court is required. |

Transfer of Assets and Liabilities | No such transfer takes place. | Assets and liabilities of existing company are transferred to the new company. |

The main difference between internal reconstruction and external reconstruction

Due to the difference between internal and external reconstructions, the subsequent points are relevant:

- Internal restructuring is often defined as a restructuring of a corporation without liquidating an existing company and establishing a replacement one. On the opposite hand, external restructuring may be a sort of corporate restructuring that liquidates an existing company and creates a replacement company so as to continue the business of the prevailing company.

- A new company won't substitute the interior reorganization. Conversely, a replacement company are going to be established for external reconstruction and therefore the business of the prevailing company is going to be appropriated.

- Internal restructuring reduces the company's capital, and external liabilities like bond holders and creditors waive their debt at a reduction. On the opposite hand, external reconstruction doesn't reduce the company's capital.

- Internal reconstruction requires court approval and court confirmation, as a discount in capital stock can affect shareholder rights. On the contrary, external reconstruction doesn't require such approval.

- If the corporate goes through an indoor rebuilding process, the record created after the method will include the term "And Reduced". In contrast, within the case of external reconstruction, no particular term is employed on the record.

- In internal reconstruction, no new company are going to be established, so there'll be no transfer of assets or liabilities.

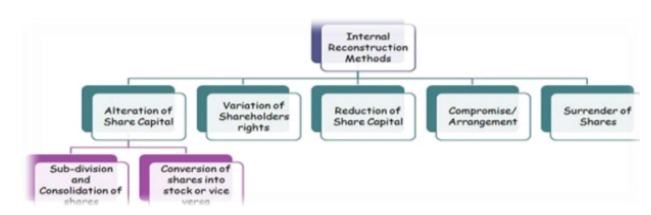

Internal Reconstruction Method

There are various methods of internal reconstruction, shown in the form shown in the following figure.

There are various methods of internal reconstruction, shown in the form shown in the following figure.

1. Alteration of Share Capital

If approved by the Articles of Incorporation, the limited liability company may change (change) the capital clause of the Articles of Incorporation. There are various ways to change stock capital:

1. Increase in stock capital due to issuance of new shares

2. Reverse Stock Split

Consolidation refers to the conversion of shares with a smaller par value to shares with a larger par value.

Example: His 5000 shares of Rs. 10 pieces can be integrated into a stock of 500 rupees. 100 each.

3. Stock Split

Subdivision is the conversion of high par value stocks to low par value stocks.

Example: 5000 shares of Rs. Each 100 can be split into 50000 shares of Rs. 10 each.

4. Equity of Shares

The company can convert its shares into shares. Stocks can be fractions that are not possible in the case of stocks. Central government approval is required to convert shares into shares.

5. Transfer of Shares

Reconstruction plans may require shareholders to relinquish some of their ownership. Such a waiver may be issued prior to immediate cancellation or to satisfy some of the company's creditors.

6. Cancellation of Unissued Shares

If the company cancels unissued shares, it does not need to pass an accounting entry. The authorized share capital of the company will be the amount of unissued shares currently cancelled.

About Stock Split and Consolidation

If approved by the Articles of Incorporation, the company may, by passing a normal resolution, decide at the General Assembly to split or consolidate the shares into an amount less or higher than the amount stipulated in the Articles of Incorporation. The ratio of paid-in to unpaid shares will continue to be the same as for the original shares.

Notifications identifying changes must be submitted to the Registrar within 30 days of the changes.

For example, a company with capital of 10,000,000 split into 10,000 shares and paid 75 for every 100 shares decides to split 100 shares of 100 shares into 10 shares to recognize capital. Each. The resulting entry passed in such a case is —

| Dr. | Cr. | |

| |||

Equity Share Capital ( 100) A/c | Dr. | 7,50,000 |

7,50,000 |

To Equity Share Capital ( 10) A/c |

| ||

(Being the sub-division of 10,000 shares of 100 each with 75 paid up thereon into 1,00,000 shares of 10 each with 7.50 paid up thereon as per the resolution of shareholders passed in the General Meeting held on...) | |||

Similar entries are passed when consolidating a smaller amount of stock into a larger amount of stock.

Conversion of Fully Paid-In Shares to Shares and Conversion of Shares to Shares

According to Article 61 of the Companies Act 2013, a company may convert fully paid-in shares into shares and convert the shares back into shares. If approved by the Articles of Incorporation, the company may, by passing a normal resolution, convert the fully paid shares into shares and reconvert the shares into shares at a general meeting of shareholders. Stock is the integration of equity capital into one of his units that can be split into aliquot parts. A stock is a fully paid bundle of stock that, for convenience, can be split into any amount and transferred to any fraction and subdivision, regardless of the original par value of the stock. He cannot have one share of equity capital, but he can transfer any amount of shares. However, in reality, the company limits the transfer of shares to multiples, such as 100 times his. Companies can convert fully paid shares into shares. When the company converts its shares into shares, the bookkeeping items only record the transfer from the stock capital account to the stock account. Another share registration will be initiated where the details of the member's holdings are entered and the annual returns change accordingly.

Example

C Ltd. Split the authorized capital of 5,000,000 into 100 shares each on March 12, 20X1, of which 4,000 were issued and paid in full. In June 220X2, the Company converted the issued shares into shares. Decided to do. However, in June 20X3, we reconverted the shares to his 10 shares and paid in full.

Pass an entry to show how equity capital appears in the balance sheet notes, such as 31-12-20X1, 31-12-20X2, 31-12-20X3.

Journal Entries

20X2 |

| |||

June | Equity Share Capital A/c | Dr | 4,00,000 |

|

| To Equity Stock A/c |

|

| 4,00,000 |

| (Being conversion of 4,000 fully paid Equity Shares of 100 into 4,00,000 Equity Stock as per resolution in General meeting dated…) |

|

|

|

20X3 |

|

|

|

|

June | Equity Stock A/c | Dr | 4,00,000 |

|

| To Equity Share Capital A/c |

|

| 4,00,000 |

| (Being re-conversion of 4,00,000 Equity Stock into 40,000 shares of 10 fully paid Equity Shares as per Resolution in General Meeting dated...) |

|

|

|

Notes to Balance Sheet

|

|

As on 31-12-20X1 | |

1. Share Capital |

5,00,000 |

Authorized | |

5,000 Equity Shares of 100 each | |

Issued and subscribed |

|

4,000 Equity Shares of 100 each fully called up | 4,00,000 |

As on 31-12-20X2 | |

1. Share Capital |

5,00,000 |

Authorized | |

5,000 Equity Shares of 100 each | |

Issued and subscribed |

|

Equity Stock-4,000 Equity Shares of 100 converted into Stock | 4,00,000 |

As on 31-12-20X3 | |

1. Share Capital |

5,00,000 |

Authorized | |

50,000 Equity Shares of 10 each | |

Issued and subscribed |

|

40,000 Equity Shares of 10 each fully called up | 4,00,000 |

Changes in Shareholder Rights

Under Article 48 of the Companies Act 2013, if a company issues different types of shares and grants such shares different rights or privileges, the rights relating to dividends, voting rights, etc. may be changed in any way. I will. This is done by the written consent of his three or more owners of her quarter of the issued shares of that type, or by a special resolution adopted at another meeting of the owners of the issued shares of that type. I will. (a) If the company's memorandum or articles of incorporation include provisions for such variations. Or (b) if there is no such provision in the Memorandum of Understanding or the Articles of Incorporation, or if such changes are not prohibited by the terms and conditions of issuance of shares of that class, provided that changes made by a shareholder of one class are the rights of another shareholder. When Impacting Regarding the type of shareholders, the consent of three-quarters of the other types of shareholders shall also be obtained and the provisions of this section shall apply to such changes.

For example, a company may (a) Change the dividend rate of preferred stock or (b) Convert cumulative preferred stock to non-cumulative preferred stock without changing the amount of equity capital by going through the following journal: can.

Reduction of Stock Capital

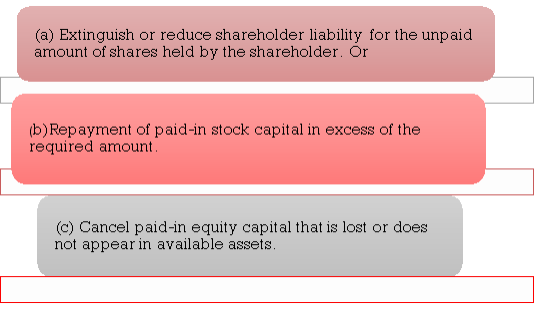

Article 66 of the Companies Act 2013 provides procedures for reducing stock capital. Subject to court confirmation of the company's application, the company may, by special resolution, reduce its share capital in the following ways:

In general, the reduction of equity capital occurs when a company suffers continuous losses over a long period of time and is not truly reflected in its assets. In such cases, the capital reduction scheme must amortize the portion of the capital that has already been lost.

This reduction is a shareholder sacrifice, and the amount of the reduction or sacrifice is credited to a new account called a capital reduction account (or restructuring account). The accounting process is as follows.

(a) Shareholders' liability to extinguish or diminish their liability for the accrued amount of shares held by the shareholders

The shareholders are not required to pay the accrued amount of their shares in the future. For example, a company decides to reduce 10 per share from 10 to 7.5 by cancelling the unpaid amount of 2.5 per share. The entry in this case looks like this:

Share Capital (Partly Paid-Up) Account Dr. ( 7.5 X No. of Shares)

To Share Capital (Fully Paid-up) Account ( 7.5 X No. of Shares)

(b) If the paid-in excess capital is refunded: If the company is unable to secure profitability, it may decide to refund the paid-in capital as excess to shareholders. For example, if a company with 10 fully paid shares each decides to refund 2 shares per share to make 8 fully paid shares, the entry would be:

Share Capital Account ( 10) Dr. ( 10 X No. Of Shares)

To Share Capital Account ( 8) ( 8 X No. of Shares)

To Sundry Shareholders Account ( 2 X No. of Shares) Sundry Shareholders Account Dr. ( 2 X No. Of Shares)

To Bank Account ( 2 X No. of Shares)

(c) If lost or hidden paid-in capital is cancelled:

Share Capital Account Dr. ( 90 X No. of Shares)

To Capital Reduction Account

(90 X No. Of Shares)

Reduction of Payment Price

Only-Here, the nominal value of the stock remains the same and only the payment price is reduced. For example, a shareholder can agree to reduce the paid-in capital of £ 100 per share to £ 10 paid-in capital per share. The sacrifice is 90 and the entry is

Share Capital Account Dr. ( 90 X No. of Shares)

To Capital Reduction Account

(90 X No. Of Shares)

Reduction of both Nominal Value and Paid-In this case, both the paid-in capital and the nominal value of the stock are reduced. Continuing with the above example, the entry looks like this:

Share Capital Account ( 100 Share) Dr. ( 100 X No. of Shares)

To Share Capital ( 10 Share) ( 10 X No. Of Shares)

To Capital Reduction Account ( 90 X No. Of Shares)

Therefore, such processing debits from the original Equity Capital Account, closes it, and deposits the amount treated as paid into the new Equity Capital Account. And credit the difference to the capital reduction account. A certified copy of the court order and minutes approved by the court must be submitted by the Registrar.

Compromise / Arrangement

A compromise and arrangement scheme are an agreement between a company and its members' external debt in the event that the company faces financial problems. Therefore, such arrangements also involve the sacrifice of shareholders, creditors, creditors, or all.

The accounting treatment in some cases is as follows:

a) If shareholders waive their right to claim reserves and cumulative profits:

Reserves Account Dr. (With the amount of To Reconstruction Account reserves)

b) Settlement of external debt with less amount: Other debt, such as creditors, may agree to accept a smaller amount in lieu of final settlement. The treatment will be as follows.

Outside Liabilities Account Dr. (With the amount of sacrifice)

Provision Account, if any Dr. made by creditors, debenture

To Reconstruction Account holders etc.)

Transfer Of Shares

This method splits the shares into smaller amounts of shares and lets shareholders transfer the shares to the company. These shares will be allocated to bondholders and creditors to reduce their debt. Abandoned shares that have not been used will be cancelled by being transferred to the reconstruction account.

Note: Issues regarding the internal rebuild method above are described after Section 3, "Entry in case of internal rebuild".

Entry For Internal Rebuild

Regarding the reconstruction plan adopted (by a special resolution confirmed by the court), the following items will be passed:

1. An increase in the value of an asset or a decrease in the amount of an liability must be debited to the relevant account and credited to the capital reduction account (or reconstruction account).

2. Eliminate all overvaluation of assets by amortizing all fictitious assets (including goodwill and patents), crediting relevant accounts, and debiting reduction (or restructuring) accounts. To do. You can use the reserves on your company's books for this purpose. If there is a balance left in the capital reduction (or reconstruction) account, it should be transferred to the capital reserve account.

Here are some things to keep in mind when creating the balance sheet for a rebuilt company:

(a) The word "and Reduced" must be added after the company name

Only if the court has so ordered.

(b) For fixed assets, the depreciation amount under the reconstruction plan must be presented for 5 years.

Legal Aspect

Internal restructuring plans should be constructed by careful examination of assets and liabilities and proper valuation. This includes compromises or arrangements between the company and its members or creditors. However, when planning an internal reconstruction, you need to pay attention to the following aspects –

1. Any form of change in equity capital should be considered in accordance with the M / A & A / A provisions and, if necessary, the company should change his M / A & A / A provisions.

2. The company must notify the company register within 30 days of the resolution being passed.

3. SEBI sanctions may be required.

4. A board resolution is required to make any changes.

Conclusion

A company restructuring is the process by which a company changes the organizational structure or processes of its business. Therefore, in the process of internal reconstruction, only the rights of shareholders and creditors are changed with a certain reduction of capital, and the rights and claims of corporate bond holders are outside the scope of the internal reconstruction procedure. The process of external reconstruction is managed by the process of "merger by the nature of the merger" under the Companies Act 2013. New stock capital without reduction of stock capital.

Accounting Entries

Capital Reduction Account is opened in the ledger to give effect of sacrifice made by shareholders & others as well as to write off accumulated losses, fictitious assets, & change in values of assets/liabilities.

Sacrifice by Shareholders:

- When the face value of share is changed

Share capital A/c (old) Dr.

(With paid up value of old shares)

To Share Capital A/c (new)

(With paid up value of new shares)

To Capital Reduction A/c (With difference)

2. When face value of share is not changed, only paid up value is changed

Share Capital A/c Dr.

To Capital Reduction A/c

(With the amount of reduction)

3. When shares are Consolidated

Share Capital A/c (say Rs. 10) Dr.

To Share Capital A/c (say Rs. 100)

4. When Shares are Subdivided

Share Capital A/c (say Rs. 100) Dr.

To Share Capital A/c (say Rs. 10)

5. When shares are converted into stock

Share Capital A/c Dr

To Share Stock A/c

Assets:

6. When the value of any asset is appreciated

Asset A/c (increase in value) Dr.

To Capital Reduction A/c

7. When the value of any asset is depreciated

Capital Reduction A/c Dr

To Asset A/c (decrease in value)

8. When recorded assets are disposed of/sold

Bank A/c Dr.

Capital Reduction A/c (if loss) Dr

To Assets A/c

To Capital Reduction A/c (if Profit)

(Note: Any profit or loss on sale should be transferred to Capital Reduction A/c)

9. When an unrecorded asset is sold off

Bank A/c Dr.

To Capital Reduction A/c

(Note: entire amount received on sale is profit as asset was unrecorded)

Liabilities:

10. When any sacrifice is made by the creditors

Creditors A/c (with sacrifice) Dr.

To Capital Reduction A/c

11. When any sacrifice is made by the Debenture Holders

Debentures A/c (decrease in value) Dr.

To Capital Reduction A/c

12. When new debentures are exchanged for old debentures

Old Debentures A/c Dr.

To New Debentures A/c

13. When recorded liability is paid for

Liability A/c Dr.

Capital Reduction A/c (if loss i.e., paid more) Dr

To Bank A/c

To Capital Reduction A/c (if profit i.e., paid less)

(Note: Any profit or loss should be transferred to Capital Reduction A/c)

14. When contingent liability/unrecorded liability/ Preference share dividend is paid

Capital Reduction A/c Dr.

To Bank A/c/ Eq sh cap/ Pref sh cap/ Debentures Etc.

(Note: No entry is required for amount foregone against such liability)

15. When provision for taxation, Capital Reserve, Securities Premium is utilised

Provision for Taxation A/c Dr.

Capital Reserve A/c Dr.

Securities Premium A/c Dr.

To Capital Reduction A/c

Writing off Losses:

16. When capital reduction is utilised for writing off fictitious assets, losses and excess value of other assets

Capital Reduction A/c Dr.

To P/L A/c

To Goodwill A/c

To Preliminary Expenses A/c

To Discount on Shares/Debentures A/c

To Other Assets A/c

To Capital Reserve A/c (if any balance is left)

Reconstruction Expenses

17. When Reconstruction expenses are paid

Capital Reduction A/c Dr.

To Bank A/c

Share Surrender:

18. When shares are surrendered

Share Capital A/c Dr

To Share Surrender A/c

19. When surrendered shares are converted into preference shares

Share Surrender A/c Dr.

To Preference Share Capital A/c

20. When surrendered shares are issued to creditors/payment of any liability

Share Surrender A/c Dr.

To Share Capital A/c

Creditors/Liability A/c Dr.

To Capital Reduction A/c

(Note: Profit or Loss on scheme to be transferred to capital Reduction A/c)

21. Cancellation of Shares not issued (balance in Share surrender A/c)

Share Surrender A/c Dr.

To Capital Reduction A/c

Issue of shares to public

22. When finance is raised by issue of shares

Bank A/c Dr.

To Share Capital A/c

Proforma:

Capital Reduction A/c

Particulars | Rs. | Particulars | Rs. |

To P & L A/c (Loss written off) To Goodwill A/c (Written off) To Preliminary expenses A/c (Written off) To Discount on Shares/Debentures (Written off) To Assets A/c (Decrease in value) To Bank A/c (payment of unrecorded liability) To Bank A/c (payment of Reconstruction Expenses) To Bank A/c (Refund of Directors Fees) To Capital Reserve (Balancing figure) | XX XX

XX

XX

XX

XX

XX XX XX | By Share Capital A/c (Amount of reduction) By Debentures A/c (Amount of Reduction) By Creditors A/c (Amount of Sacrifice) By Assets A/c (Increase in value) By Bank A/c (sate of unrecorded assets) | XX

XX

XX

XX

XX |

| XXX |

| XXX |

Key takeaways:

- The term restructuring refers to the restructuring of a company's capital structure, including the reduction of both shareholder and creditor claims against the company.

2. A sick company (deficit company) may be taken over by a profitable company, but in the event of a huge loss, the assets are overvalued or undervalued, in which case the company may head for rebuilding.

3. In short, rebuilding means that a company with an unhealthy balance sheet but a promising future rebuilds its assets and liabilities.

4. It can be an external or internal reconstruction.

5. We can rebuild internally or externally.

6. This means that two types of rebuilding are possible.

7. External reconstruction of an external restructuring, a new company will be set up to take over the business of an existing company that suffered huge losses and was in poor financial condition. The vendor company will be liquidated and its business will be taken over by the new company.

8. Internal reconstruction the company's capital structure is reorganized to bring new life to the company. This includes changes, reductions and restructurings of the company's equity capital.

9. Internal restructuring means a reduction in capital to cancel paid-in equity capital that was lost in the course of the business, that is, not represented by the actual value of the asset.

10. Companies can reduce their equity capital in the following ways:

- Amortization of lost capital

- Refund of paid-in capital surplus.

- Reduce member liability for unpaid capital.

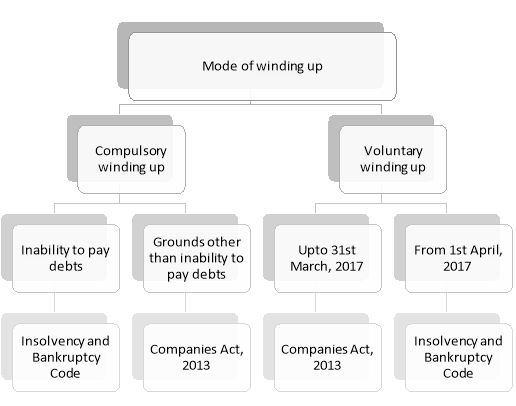

Winding up is a means to dissolve a company and realize and use its assets in the payments of debt. After satisfaction of the debts, the remaining balance, if any, is paid back to the members in proportion to the contribution made by them to capital of the company. The winding up of a company is the process whereby its life is ended, and its property is administered for the benefit of its creditors and members. An administrator, called a liquidator, is appointed and he takes control of the company, collects its assets, pays its debts and finally distributes any surplus among the members in accordance with their rights.

As per SECTION 2(94A) of the Companies Act,2013, “winding up” means winding up under this Act or liquidation under the Insolvency and Bankruptcy Code, 2016.

Thus, winding up ultimately leads to the dissolution of the company. In between winding up and dissolution, the legal entity of the company remains, and it can be sued in Tribunal of Law.

Winding up V. Liquidation:

Commonly, the expression “winding up” and “liquidation” are used interchangeably; however, there exist a line of difference between the two expressions. Winding up is a process of ending all the business affairs of the company and liquidation refers to selling off the assets of the company.

Modes [S.270]

Statement of Affairs [S.274]

Petition by Company:

In case of winding up by Tribunal, Section 272(5) of the Companies Act, 2013 provides that a petition presented by the company for winding up before the Tribunal shall be admitted only if accompanied by a statement of affairs in such form and in such manner as may be prescribed.

Petition by Others:

In accordance with Section 274(1), where a petition for winding up is filed before the Tribunal by any person other than the company, the Tribunal shall, if satisfied that a prima facie case for winding up of the company is made out, by an order direct the company to file its objections along with the statement of its affairs within thirty days of the order in such form and in such manner as may be prescribed. The Tribunal may allow a further period of thirty days in a situation of contingency or special circumstances.

Procedure/Contents:

The broad lines on which the Statement of Affairs is prepared are the following:

- Include assets on which there is no fixed charge at the value they are expected to realize.

- Include assets on which there is fixed charge. The amount expected to be realized would be compared with the amount due to creditor concerned. Any Surplus is to be extended to the other column. A Deficit is to be added to unsecured creditors.

- The total of assets in point (a) and any surplus from assets mentioned in point (b) is available for all the creditors (except secured creditors already covered by specifically mortgaged assets).

- From the total assets available, the following should be deducted one by one:

- Preferential creditors,

- Debentures having a floating charge, and

- Unsecured Creditors.

If a minus balance emerges, there would be deficiency as regards creditors, otherwise there would be surplus.

e. The amount of total paid-up capital should be added, and the figure emerging will be deficiency as regards members.

Lists:

Statement of Affairs should accompany eight lists:

- Assets:

- List A: Full particulars of every description of property not specifically pledged and included in any other list are to be set forth in this list.

- List B: Assets specifically pledged, and creditors fully or partly secured.

b. Liabilities:

- List C: Preferential creditors for rated, taxes, salaries, wages and otherwise.

- List D: List of debenture holders secured by a floating charge.

- List E: Unsecured creditors.

c. Share Capital:

- List F: List of Preference shareholders.

- List G: List of Equity shareholders.

d. Deficiency/ Surplus:

- List H: Deficiency or surplus account.

Deficiency Account

The official liquidator will specify a date for period beginning with the date on which information is supplied for preparation of an account to explain the deficiency or surplus. On that date either assets would exceed capital plus liabilities, that is, there would be a reserve or there would be a deficit or debit balance in the Profit and Loss Account. The deficiency account is divided into two parts:

- The first part starts with the deficit and contains every item that increases deficiency.

- The second part starts with the surplus on the given date and include all profits.

If the total of the first exceeds that of the second, there would be a deficiency to the extent of the difference, and if the total of the second part exceeds that of the first, there would be a surplus.

Liquidators Final Statement of Account

- Receipts:

While preparing the liquidators statement of account, receipts are shown in the following order:

- Amount realized from assets.

- In case of assets specifically pledged in favor of creditors, only the surplus from it, if any, is entered as ‘surplus from securities.

- In case of partly paid-up shares, the equity shareholders should be called up to pay necessary amount if creditors’ claims/claims of preference shareholders can’t be satisfied with the available amount. Preference shareholders would be called upon to contribute for paying off creditors.

- Amounts received from calls to contributories made at the time of winding up are shown on receipts side.

- Net results as per Trading Account are also included on the receipts side.

- Payments made to redeem securities and cost of execution and payments per trading account are deducted from total receipts.

2. Payments:

Payments are made and shown in the following order:

- Legal charges

- Liquidator’s remuneration

- Liquidator’s expenses

- Debenture holders

- Creditors:

- Preferential;

- Unsecured Creditors;

f. Preferential shareholders; and

g. Equity shareholders.

3. Partly paid shares:

In case of partly paid shares, it should be seen whether any amount is to be called up on shares. Firstly, the equity shareholders should be called up to pay necessary amount if creditors claim/claims of preference shareholders cannot be satisfied with the amount. Preference shareholders would be called upon to contribute for paying off creditors.

4. Loss of Shareholders:

The loss is suffered by each class of shareholders, i.e. the amount that cannot be repaid, should be proportionate to the nominal value of the share. The shares have nominal value of Rs. 80 per share and other set has paid Rs. 60 per share. Suitable adjustment will have to be made in cash in such a case; the latter set must contribute Rs. 20 first; or the first set must be paid Rs. 20 first.

Liquidators Final Statement of Account (Format)

Liquidators Final Statement of Accounts

Receipts | Amount (in Rs.) | Payment | Amount (in Rs.) |

To Assets Realized: | Xx | By Legal Charges | Xx |

- Land & Building | Xx | By Liquidation expenses | Xx |

- Plant & Machinery | Xx | By Liquidator’s Remuneration | Xx |

- Furniture | Xx | By Preferential creditors (unsecured) | Xx |

- Debtors | Xx | By Debenture holders (having a floating charge on assets of the Co.): |

|

- Stock | Xx | - Principle | Xx |

- Investment | Xx | - Outstanding Interest | Xx |

- Cash in Hand | Xx | By unsecured Creditors | Xx |

- Cash at Bank | Xx | By Preference Shareholder’s |

|

To Surplus from assets held by secured creditors | Xx | - Principle | Xx |

To Proceeds on call made on: |

| - Dividend in arrears | Xx |

- Equity Shares | Xx | By Equity Shareholder’s | Xx |

- Preference shares | Xx |

|

|

|

|

|

|

| Xxx |

| Xxx |

|

|

|

|

Key takeaways:

- Winding up is a means to dissolve a company and realize and use its assets in the payments of debt. After satisfaction of the debts, the remaining balance, if any, is paid back to the members in proportion to the contribution made by them to capital of the company.

- The winding up of a company is the process whereby its life is ended, and its property is administered for the benefit of its creditors and members.

- Winding up is a process of ending all the business affairs of the company and liquidation refers to selling off the assets of the company.

- The official liquidator will specify a date for period beginning with the date on which information is supplied for preparation of an account to explain the deficiency or surplus.

References:

- Sehgal, Ashok and Deepak Sehgal. Corporate Accounting. Taxman Publication, New Delhi.

- Gupta, Nirmal. Corporate Accounting. Sahitya Bhawan, Agra.

- Jain, S.P. And K.L. Narang. Corporate Accounting. Kalyani Publishers, New Delhi.

- Compendium of Statements and Standards of Accounting. The Institute of Chartered Accountants of India, New Delhi.

- Bhushan Kumar Goyal, Fundamentals of Corporate Accounting, International Book House.

Solved Examples

Q.1

From the following particulars, prepare a Statement of Affairs and the Deficiency of the Equipment Ltd., which went into liquidation on December 31, 2016:

| Rs | Rs | ||||

3,000 equity shares of 100 each, Rs 80 paid-up |

| 2,40,000 | ||||

6% 1,000 preference shares of Rs 100 each fully paid-up | 1,00,000 |

| ||||

Less: Calls in arrear | (5,000) | 95,000 | ||||

5% Debentures having a floating charge on the |

|

| ||||

Assets (interest paid upto June 30, 2016) |

| 1,00,000 | ||||

Mortgage on Land & Buildings |

| 80,000 | ||||

Trade Creditors |

| 2,65,500 | ||||

Owing for wages |

| 20,000 | ||||

Secretary’s salary (@ Rs 500 p.m.) owing |

| 3,000 | ||||

Assets | Estimated to produce | Book value | ||||

| Rs | Rs | ||||

Land & Building | 1,30,000 | 1,20,000 | ||||

Plant | 1,30,000 | 2,00,000 | ||||

Tools | 4,000 | 20,000 | ||||

Patents | 30,000 | 50,000 | ||||

Stock | 74,000 | 87,000 | ||||

Investments in the hands of a |

|

| ||||

Bank for an overdraft of Rs 1,90,000 | 1,70,000 | 1,80,000 | ||||

Book Debts | 60,000 | 90,000 | ||||

On 31st December, 2011 the balance sheet of the company showed a general reserve of Rs 40,000 accompanied by a debit balance of Rs 25,000 in the Profit & Loss Account.

In 2012 the company made a profit of Rs 40,000 and declared a dividend of 10% on equity shares. The company suffered a total loss of Rs 1,09,000 besides loss of stock due to fire of Rs 40,000 during 2013, 2014 and 2015. For 2016 accounts were not made.

The cost of winding up is expected to be Rs 15,000.

Solution:

Statement of Affairs on 31 December, 2016, the date of winding up

Estimated realisable value

Assets | Rs |

Assets not specifically pledged (as per list A) |

|

Trade debtors | 60,000 |

Stock in trade | 74,000 |

Plant | 1,30,000 |

Tools | 4,000 |

Patents | 30,000 |

Unpaid calls | 5,000 |

| 3,03,000 |

Assets specifically pledged (as per list B) |

| ||||||

| Estimated Realisation | Due to Secured Creditors | Deficiency Ranking as Unsecured Creditors | Surplus carried to the last column |

| ||

| Rs | Rs | Rs | Rs | |||

Investments | 1,70,000 | 1,90,000 | 20,000 |

50,000 |

| ||

Land & Building | 1,30,000 | 80,000 |

| ||||

| 3,00,000 | 2,70,000 |

|

|

| ||

| Estimated surplus from assets specifically pledged | 50,000 | |||||

| Estimated total assets available for preferential creditors, debenture holders and unsecured creditors | 3,53,000 | |||||

| Summary of Gross Assets: |

| |||||

| Gross realisable value of - assets specifically charged |

|

|

3,00,000 |

| ||

| Others assets |

|

|

| 3,03,000 |

| |

|

|

|

|

| 6,03,000 |

| |

| Estimated total assets available for preferential creditors, debenture holders, bank overdraft and unsecured creditors brought forward |

3,53,000 | |||||

Gross Liabilities | Liabilities |

|

| ||||

Rs |

| Rs | Rs | ||||

2,50,000 | Secured creditors (as per List B) to the extent to which claims are estimated to be covered by assets specifically pledge |

|

|

| |||

22,000 | Preferential creditors as per list C (20,000 +2,000) |

| 22,000 | ||||

| Estimated balance of assets available for |

|

| ||||

| Debenture holders, Bank & unsecured |

|

|

| |||

| Creditors |

|

|

|

| 3,31,000 | |

1,02,500 | Debenture holders secured by a floating |

|

(1,02,500) |

| Charge as per list D |

| |

| Surplus as regards debenture holders |

| 2,28,500 |

| Unsecured creditors as per list E |

|

|

| Estimated unsecured balance of claim of creditors partly secured on |

|

|

| Specific assets | 20,000 |

|

| Trade creditors | 2,65,500 |

|

2,92,500 | Outstanding expenses | 7,000 | 2,92,500 |

| Estimated deficiency as regards creditors |

|

|

| Being the difference between gross |

|

|

| Liabilities and gross assets |

| 64,000 |

6,67,000 |

|

|

|

| Issued & Called up Capital: |

|

|

3,000 Equity shares or Rs 100 each, Rs 80 paid | 2,40,000 |

| |

6% 1,000 preference shares of Rs 100 each fully called |

1,00,000 |

3,40,000 | |

Estimated Deficiency as regards members as per list H |

|

4,04,000 |

Note:

(i) The above is subject to cost to winding up estimated at Rs 15,000 and to any surplus in deficiency on trading realisation of assets.

(ii) There are 3,000 shares unpaid @ Rs 20 per share liable to be called up.

List H - Deficiency Account

- Item contributing to Deficiency: Rs

- Excess of capital & liabilities over assets on 1-1-2014 Nil

- Net dividend & bonuses during the period Jan.-Dec. 2014 29,700

- Net trading losses after charging depreciation, taxation,

Interest on debentures, etc. during the same period

(Rs 1,09,000 + Rs 1,31,300) 2,40,300

4. Losses other than trading losses written off or for which

Provision has been made in the books during the same

Period - stock loss. 40,000

5. Estimated losses now written off or for which

Provision has been made for the purpose of preparing

The statement:

Rs

Plant 70,000

Tools 16,000

Patents 20,000

Stock 13,000

Investments 10,000

Debtors 30,000 1,59,000

6. Other reducing items contributing to deficiency NIL

4,69,000

B. Items reducing Deficiency

7. Excess of assets over capital and liabilities on 1st Jan. 2012 15,000

8. Net trading profit during the period 1st Jan. 2010 to

31st Dec. 2012 40,000

9. Profit & Incomes other than trading profit during the

Same period

10. Other items Deficiency - Profit expected on

Land & Building 10,000

65,000

Deficiency as shown by the statement of Affairs (A) - (B) 4,69,000

4,04,000

Working Notes :

(1) Trial Balance to ascertain the amount of loss for 2016

| Dr. | Cr. |

Rs | Rs | |

Land & Building | 1,20,000 |

|

Plant | 2,00,000 |

|

Tools | 20,000 |

|

Patents | 50,000 |

|

Stock | 87,000 |

|

Investments | 1,80,000 |

|

Debtors | 90,000 |

|

Equity Capital |

| 2,40,000 |

6% Preference share capital |

| 95,000 |

5% Debentures |

| 1,00,000 |

Interest Outstanding |

| 2,500 |

Mortgage on Land & Building |

| 80,000 |

Trade Creditors |

| 2,65,500 |

Owing for Wages |

| 20,000 |

Secretary’s Salary |

| 3,000 |

Managing Director’s Salary |

| 6,000 |

Bank Overdraft |

| 1,90,000 |

Profit & Loss Account on 1-1-2014 | 1,23,700 |

|

| 8,70,700 | 10,02,000 |

Loss for the year (balancing figure) | 1,31,300 | - |

| 10,02,000 | 10,02,000 |

Q.2

X Co. Ltd. Went into voluntary liquidation on 1st April, 2017. The following balances are extracted from its books on that date :

|

|

|

|

Capital |

| Machinery | 90,000 |

24,000 Equity Shares of Rs 10 each | 2,40,000 | Leasehold properties | 1,20,000 |

Debentures (Secured by floating charge) | 1,50,000 | Stock | 3,000 |

Bank overdraft | 54,000 | Debtors | 1,50,000 |

Creditors | 60,000 | Investments | 18,000 |

|

| Cash in hand | 3,000 |

|

| Profit and loss account | 1,20,000 |

|

|

|

|

| 5,04,000 |

| 5,04,000 |

The following assets are valued as under:

| Rs |

Machinery | 1,80,000 |

Leasehold properties | 2,18,000 |

Investments | 12,000 |

Stock | 6,000 |

Debtors | 1,40,000 |

The bank overdraft is secured by deposit of title deeds of leasehold properties. There were preferential creditors amounting Rs 3,000 which were not included in creditors

Rs 60,000.

Prepare a statement of affairs to be submitted to the meeting of members/creditors.

Solution:

Statement of Affairs of X Co. Ltd. On the 1st day of April, 2017

Assets not Specifically Pledged: | Estimated realisable Values | ||||

Cash in Hand |

|

|

| 3,000 | |

Investments |

|

|

| 12,000 | |

Debtors |

|

|

| 1,40,000 | |

Stock |

|

|

| 6,000 | |

Machinery |

|

|

| 1,80,000 | |

|

|

|

| 3,41,000 | |

Assets specifically pledged : |

|

|

|

| |

| (a) | (b) | (c) | (d) |

|

| Estimated Realisable Value | Due to Secured Creditors | Deficiency ranking as unsecured | Surplus carried to Last column |

|

| Rs | Rs | Rs | Rs |

|

Leasehold Property | 2,18,000 | 54,000 | - | 1,64,000 |

|

| Estimated Surplus from Assets Specifically pledged | 1,64,000 | |||

| Estimated total assets available for Preferential creditors, debentures holders secured by floating charge, and unsecured creditors | 5,05,000 | |||

| Summary of Gross assets |

| |||

| Gross realisable value of assets |

| |||

| Specifically Pledged 2,18,000 |

| |||

| Other Assets 3,41,000 |

| |||

| Gross Assets 5,59,000 |

| |||

Rs | Gross Liabilities(to be deducted from surplus or added to deficiency as the case may be) |

| |||

| Secured creditors to the extent to which claims are estimated to be covered by assets |

| |||

54,000 | Specifically pledged |

| |||

3,000 | Preferential creditors | (3,000) | |||

| Balance available for Debenture Holders | 5,02,000 | |||

1,50,000 | Debentures (Payment) | (1,50,000) | |||

| Balance available for Creditors | 3,52,000 | |||

60,000 | Creditors | (60,000) | |||

2,67,000 | Estimated surplus as regards creditors [being difference between gross assets (d) and gross liabilities (e)] | 2,92,000 | |||

| Issued and called up capital 24,000 equity shares of Rs 10 each |

2,40,000 | |||

| Estimated surplus as regard members | 52,000 | |||

Q.3

M. Ltd. Resolved on 31st December 2016 that the company be wound up voluntarily. The following was the trial balance extracted from its books as on that date:

| Rs | Rs |

Equity shares of Rs 10 each |

| 2,00,000 |

9% Preference shares of Rs 10 each |

| 1,00,000 |

Plant (less depreciation w/o Rs 85,000) | 2,15,000 |

|

Stock in trade | 2,50,000 |

|

Trade receivables | 55,000 |

|

Trade payables |

| 75,000 |

Bank balance | 74,000 |

|

Preliminary Expenses | 6,000 |

|

Profit & Loss A/c (balance on 1st January, 2016) |

| 30,000 |

Trading loss for the year 2016 | 24,000 |

|

Preference dividend for the year 2016 | 6,000 |

|

Outstanding Expenses (including mortgage interest) |

| 25,000 |

4% Mortgage loan |

| 2,00,000 |

Total | 6,30,000 | 6,30,000 |

On 1st January, 2017 the liquidator sold M. Ltd.’s Plant for Rs 2,05,000 and stock in trade for Rs 2,00,000. The sale was completed in January, 2017 and the consideration satisfied as to Rs 2,62,200 in cash and as to the balance in 6% Debentures of the purchasing company issued to the liquidator at a premium of 2%.

The remaining steps in the liquidation were as follows:

The liquidator realised Rs 52,000 out of the book debts and the cost of collection amounted to Rs 2,000.

The loan mortgage was discharged on 31st January, 2017 along with interest from 31st July, 2016. Creditors were discharged subject to 2% and outstanding expenses excluding mortgage interest were settled for Rs 2,000;

On 30th June 2017 six month’s interest on debentures was received from M. Ltd.

Liquidation expenses amounting to Rs 3,000 and liquidator’s remuneration of 3% on disbursements to members were paid on 30th June, 2017 when:

The preference shareholders were paid out in cash; and

The debentures on M. Ltd. And the balance of cash were distributed rateably among the equity shareholders.

Prepare the Liquidator’s Statement of Account showing the distribution.

Solution:

M. Ltd. (in liquidation)

Liquidator’s Statement of Account from 1st January, 2017 to 30th June, 2017

Receipts | Rs | Rs | Payments | Rs | Rs |

Balance at Bank Realisation from: |

| 74,000 | Liquidator’s remuneration (3% on Rs 2,43, 398) Liquidation |

| 7302* |

Trade receivables M. Ltd. - |

| 52,000 |

|

|

|

Rs 1,40,000 6% |

|