Unit 2

Accounting

Labour cost is an important part of total cost of production. Therefore, there is a need for effective control over labour and labour–related costs. Various departments contribute to the efficient utilisation of labour and adequate control over costs. Personnel department has to provide an efficient labour force. The engineering department maintains control over working conditions and production methods for each job and department or process by preparing plans and specifications. Time-keeping department maintains an accurate record of the time spent by each employee. Preparation of the pay roll from the clock cards, job or time tickers or time sheets is done by the pay roll department. The Cost Accounting department is responsible for the accumulation and classification of all data of which labour costs are one of the most important items.

Labour cost control

Human efforts used for conversion of materials into finished products are known as labour. Payment made towards the labour is called labour cost.

“Labor cost, representing the human contribution to production, is an important cost factor which requires constant control, measurement and analysis”……… Matz, Curry and Frank

Labor cost is one of the major portion of the total cost of the product. It may increases due to inefficiency of workers, wastages of material by worker, idle time, high labor turnover. Hence the management should use effective techniques to control labor cost to ensure maximum output through proper utilization of labor force.

Classification of labor cost

- Direct Labour cost is that portion of salary or wage, which can be identified with and charged to a single unit cost of production. It has direct relationship with the product or process or cost unit. It can be measured quantitatively.

- Indirect labour cost is not identifiable within the production of goods and services even though directly incurred. Indirect labor cost is the cost of labor that is not directly related to the production of goods and the performance of services. It refers to the wages paid to workers whose duties enable others to produce goods and perform services.

- Controllable labor cost - A labour cost can be controlled by the management during production period and even during absence of production. A standard time and time rate may be fixed and request the labour to complete the job or order within such time. If so, the labour cost can be controlled to some extent.

- Non controllable labor cost - A labour cost, which cannot be easily controlled by the management. A job or order can be completed by a group of labors. The efficiency of such group of labors differs in nature. A labour can use their efficiency in full as per the prevailing environment in the product place. If so, the cost cannot be controlled by the management.

Idle time

Idle time is the time in which no production is carried out as the workers remains idle even though they are paid. Idle time is either normal or abnormal.

Normal idle time

In the normal course of the business it is the time which cannot be avoided or reduced

Causes | Treatment |

| It is treated as a part of the cost of production. In the case of direct workers an allowance for normal idle time is built into the labour cost rates

In the case of indirect workers, normal idle time is spread over all the products or jobs through the process of absorption of factory overheads |

Abnormal idle time

There are many factors which give rise to abnormal idle time which are as follows

Causes | Treatment |

| Abnormal idle time cost is not included as a part of production cost and is shown as a separate item in the Costing Profit and loss account The abnormal idle time are divided into controllable and uncontrollable idle time. Management should aim at eliminating controllable idle time and on a long-term basis reducing even the normal idle time |

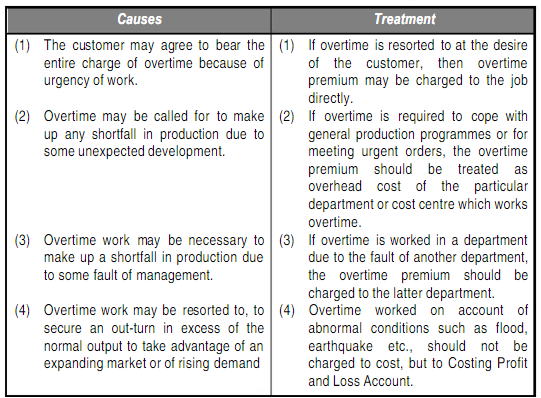

Overtime

Overtime refers to when workers work beyond normal working hours. Overtime payment is the amount of wages paid for working beyond normal working hours. The rate of overtime is higher than the normal time rate, ie double the normal rates. The extra amount so paid over the normal rate is called overtime premium.

As per the Factories Act 1948 “Where a worker works in a factory for more than nine hours in any day or for more than forty eight hours in any week, he shall, in respect of overtime work, be entitled to wages at the rate of twice his ordinary rate of wages.”

Labour turnover

Definition

Labour turnover can be defined as the overall change in the number of people employed in a business entity during a particular period. It takes into consideration the number of exiting personnel, new joinees and the total number of workers as listed in the payroll at the end of a given period.

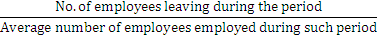

Formula

Causes of labor turnover

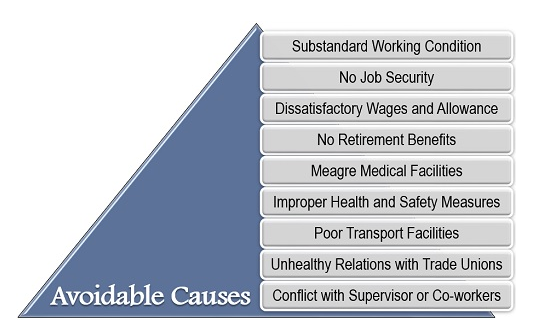

- Avoidable Causes – this includes those factors such as organizational facilities and working conditions, the ones which the management could modify to retain the workforce are considered as preventable causes.

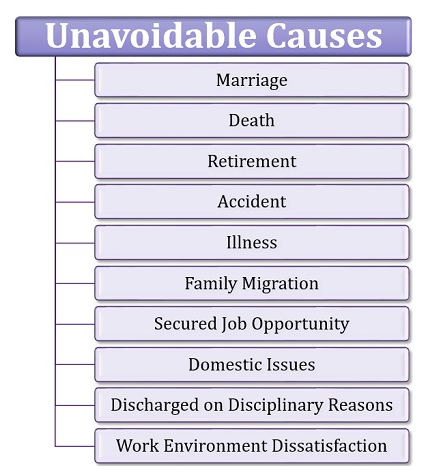

- Unavoidable causes - The workers are sometimes compelled to depart from the organization, for the inevitable reasons. Neither the organization nor the employee can take any step to avoid such circumstances.

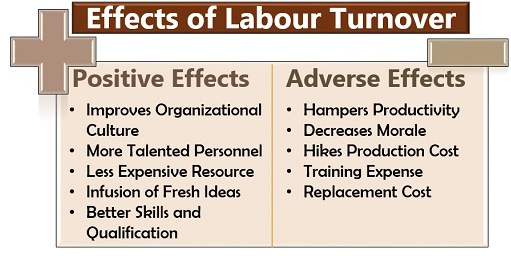

Labour turnover effects - When a worker departs from the organization, it impacts a part or sometimes overall working of the entity. At the same time, this impact could be both constructive and destructive for the organization

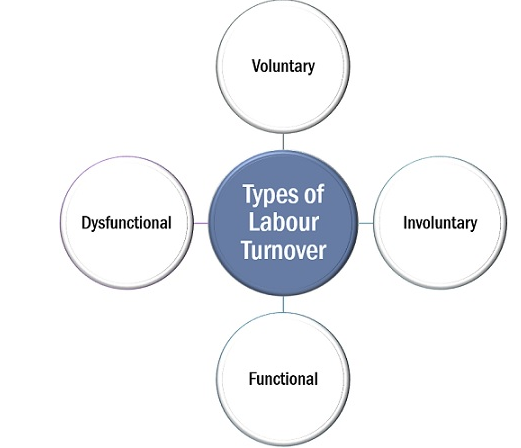

Types of labor turnover

- Voluntary: When a worker willingly exits the organization, due to any of the circumstances, it is termed as voluntary labour turnover.

- Involuntary: In the case of involuntary labour turnover, the worker is abolished from the duties by the management due to any of the reason like failing to comply with the norms.

- Functional: By saying functional, we mean the under-performing workers are terminated from work to improve the organization’s efficiency.

- Dysfunctional: The dysfunctional labour turnover takes place when highly efficient and skilled personnel leaves the job by hampering the overall functioning of the organization.

Remedial steps to minimize labour turnover

- Exit interview - Each outgoing employee are interviewed to ascertain the reasons of his leaving the organization.

- Job analysis and evaluation: Job analyses are carried out to ascertain the requirements of each job before recruiting workers.

- Scientific system of recruitment, placement and promotion - The organization should make use of a scientific system of recruitment, selection, placement and promotion for employees

- Enlightened attitude of management – the following steps should be introduced by management for creating a healthy working atmosphere

- Service rules should be framed, discussed and approved among management and workers, before their implementation.

- Provide facilities for education and training of workers.

- Introduce a procedure for settling worker’s grievances

5. Use of committee – committee comprising of members from management and workers who deals with the issues like control over workers, handling grievances.

Labor cost is one of the major portion of the total cost of the product. It may increase due to inefficiency of workers, wastages of material by worker, idle time, high labor turnover.

Key takeaways-

- Labor cost is one of the major portion of the total cost of the product.

- It may increase due to inefficiency of workers, wastages of material by worker, idle time, high labor turnover

A. Time Rate Method

Time Rate at Ordinary Levels

Under this method, rate of payment of wages per hour is fixed and payment is made accordingly on the basis of time worked irrespective of the output produced. However, overtime is paid as per the statutory provisions. The main benefit of this method for the workers is that they get guarantee of minimum income irrespective of the output produced by them. If a worker is not able to work due to genuine reasons like illness or physical disability, he will continue to get the wages on the basis of time taken for a particular job. This method is used in the following situation:-

(a) Where the work requires high skill and quality is more important than the quantity.

(b) Where the output/services are not quantifiable, i.e. where the output/services cannot be measured.

(c) Where the work done by one person is dependent upon other person, in other words where an individual worker has no control over the work.

(d) Where the speed of production is governed by time in process or speed of a machine.

(e) Where the workers are learners or inexperienced.

(f) Where continuous supervision is not possible.

The main advantage of this method is that the worker is assured of minimum income irrespective of the output produced. He can focus on quality as there is no monetary incentive for producing more output. However, the main limitation of this method is that it does not offer any incentive to the efficient workers. Efficient and inefficient workers are paid at the same rate of wages and hence there is a possibility that even an efficient worker may become inefficient due to lack of incentive.

Time Rate at High Wage Levels

This system is a variation of time rate at ordinary levels in the sense that in this system, workers are paid at time rate but the rate is much higher than that is normally paid in the industry or area. In this method, the workers are paid according to the time taken and overtime is not normally allowed. This method offers a very strong incentive to workers and it can attract talented workers in the industry. However, care should be taken that productivity also increases; otherwise the cost will go on increasing.

Graduated Time Rate

Under this method payment is made at time rate, which varies according to personal qualities of the workers. The rate also changes with the official cost of living index.

Thus this method is suitable for both employer and employees.

B. Piece Rate Method

This method is also called as payment by results where the workers are paid as per the production achieved by them. Thus if a worker produces higher output, he can earn higher wages. Under the piece rate system of wage payment the workers receive a flat rate of wages either for time worked or for units manufactured.

The advantages of such a system are summarized below:

(a) As the workers are paid on the basis of the results, i.e., for each unit produced, job performed or number of operations completed, there is a tendency on their part to increase their production so that they may earn more wages.

(b) The increased production thus achieved results in the reduction of overhead expenses per unit of production even through total overheads may increase. The increase in overheads will be relatively small as compared to the increase in turnover.

(c) The wages being paid on the basis of production, the management know the labour cost per unit or per job.

(d) The workers are rewarded for their efficiency because the inefficient workers will not get as much as the efficient workers.

(e) The workers are very careful in handling their tools and machinery, etc., because on the proper maintenance of these depends their higher efficiency and in turn, their higher wages.

(f) This method is very simple to operate.

The Disadvantages on the other hand are as follows:

(a) It is not easy to determine the piece work rate on an equitable basis. When a rate has been fixed and later on it is found to be too high, it is very difficult to reduce it as its reduction will cause dissatisfaction and friction among the workers.

(b) As the labour cost per unit remains the same, the employees do not gain as a result of increase in productivity except to some extent in the form of reduction in overheads. As such if the overhead expenses per unit are relatively small, the advantage to the employer will not be significant.

(c) Sometimes quantity may increase at the cost of quality. For the reason, a strict inspection has to be maintained in the form of quality control. This will result into additional expenditure.

(d) Materials may be used in excessive quantities and may be handed carelessly on account of the workers’ efforts to achieve high output.

(e) This method may cause discontentment amongst those who are slow and those who are paid on time basis.

(f) The workers may in an attempt to increase production, handle the machines carelessly causing major damage or breakdown.

The following are the variations of this method.

Straight Piece Rate

In this method, rate per unit is fixed and the worker is paid according to this rate. For example, if the rate per unit is fixed at Rs 10, and the output produced is 300 units, the remuneration to the worker will be Rs 10 X 300 units = Rs 3, 000. This method thus offers a very strong incentive to the workers and is particularly suitable where the work is repetitive. The benefits of this method are as follows:-

(a) The method is simple and provides a very strong incentive to the workers by linking the monetary reward directly to the results.

(b) Productivity can be increased substantially if the rate of pay includes a really adequate incentive.

(c) Higher productivity will result in lowering the cost per unit.

However, the main limitation of this method is that if a worker is not able to work efficiently due to reasons beyond his control, he will be penalized in the form of lower wages.

Differential Piece Rates

Under these methods, the rate per standard hour of production is increased as the output level rises. The increase in rates may be proportionate to the increase in output or proportionately more or less than that as may be decided. In other words, a worker is paid higher wages for higher productivity as an incentive. The rate per unit will be higher in this case as compared to the rate paid to a worker with lower productivity. For deciding the efficiency, comparison is made between the standard production and actual production of the worker. If the actual production is more, the worker qualifies for higher rate of wages. The Differential Piece Rate methods will be useful when the production is of repetitive type, methods of production are standardized and the output can be identified with individual workers. The following are the major systems of differential piece rate system:-

(i) Taylor (ii) Merrick (iii) Gantt Task and Bonus.

C. Incentive schemes:

We have seen earlier that in the time rate system, the workers are paid according to the time taken while in case of piece rate system, the output produced by the worker decides his wages as rate per unit is fixed rather than rate per hour. In the premium bonus plan, the gain arising out of increased productivity is shared by both, the employer and employee.

The bonus to be paid to the workers is computed on the basis of savings in the hours, i.e. the difference between the time allowed and time taken. The time allowed is the standard time, which is fixed by conducting a time and motion study by the work-study engineers. While fixing the standard time, due allowance is given for physical and mental fatigue as well as for normal idle time. The actual time taken is compared with this standard time and bonus is payable to the worker if the time taken is less than the standard time. The individual bonus schemes commonly used are as follows:

a. Halsey Premium Plan

This plan was introduced by F.A. Halsey, an American engineer. In this plan, bonus is paid on the basis of time saved. Standard time is fixed for a job and if the actual time taken is less than the same, the worker becomes eligible for bonus. However bonus is paid equal to wages of 50% of the time saved. A worker is assured of time wages if he takes longer time than the allowed time. The formula for computing the total wages is as follows.

Total Earnings = H X R + 50% [S – H] R

Where, H = Hours worked, R = Rate per hour, S = Standard time

b. Rowan Plan

This premium bonus plan was introduced by Mr. James Rowan. It is similar to that of Halsey Plan in respect of time saved, but bonus hours are calculated as the proportion of the time taken which the time saved bears to the time allowed and they are paid for at time rate. The formula for computation of total earnings is as follows:-

Total Earnings = H × R + [S – H]/S × H × R

Where H = Hours worked, R = Rate per hour, S = Standard time

c. Taylor’s differential piece work system

F.W.Taylor, introduced this method on the basis of time, motion & fatigue studies. A higher rate to the worker who produce equal or more than the standard fixed for production. A lower rate to the worker who do not achieve the standard

Key takeaways –

- Piece Wages: Piece wages are the wages paid according to the work done by the worker.

- Time Wages: If the labourer is paid for his services according to time, it is called as time wages

Classification and Departmentalization

All indirect costs are collectively termed as overheads. It is total of all indirect material, indirect labour and indirect expenses. They constitute an important component of total cost of a product, a job or a process. Overhead costs have to be incurred for production although they are not directly measurable, observed related to specific activity or unit of production. For example: depreciation of factory building and machinery, rent, taxes, insurance, maintenance etc.

Classification of overheads

The process of grouping the overheads according to their common characteristics is known as classification of overheads. It provides the manager with information that enables them to manage the business effectively. The overheads can be classified according to:

a) Element: Indirect materials, Labour Expenses;

b) Functions: Production, Administration, Selling and Distribution overheads;

c) Behaviour: Fixed, Variable, and Semi-variable overheads.

- Fixed overheads remain fixed and are unaffected by the changes in the level of production. For example, rent, rates, salaries, legal expenses etc.

2. Variable overheads vary in direct proportion to changes in the volume of production, such as indirect materials, fuel, power, stationery, salesmen’s commission etc.

3. Semi-variable overheads are the expenses which are partly fixed and partly variable.

They remain fixed upto a volume of production and vary when the production is made beyond the particular volume. For example, telephone charges depreciation of machinery, repairs and maintenance, cost of supervision etc.

Departmentalization

Departmentalization of overheads refers to the process of determining the overhead costs of each department involved in production.

To achieve departmentalization, the departments in a factory are divided into two categories: production departments and service departments. Also, departmentalization of overheads is undertaken in two stages:

Allocation of overheads

Apportionment of overhead expenses

1. Allocation of Overheads

The process of charging the full amount of overhead costs to a specific cost center is known as the allocation of factory overheads. This is feasible where the nature of expenses is such that they can be simply identified with a particular cost center.

For instance, the salary paid to the foreman of a specific production department can be directly linked to that department, and so it will be directly charged to the department.

2. Apportionment of Overhead Expenses

This technique involves dividing up an item of overhead cost and charging it to the cost centers on an equitable basis. This is feasible for overhead items that cannot be fully allocated to a particular department.

For instance, the salary paid to the director of a large factory cannot be charged fully to a single production department. Instead, it must be charged equitably to all of the factory’s departments.

News

Absorption of Overheads

CIMA defines Absorption of Overheads as “the process of absorb, overhead costs allocated or apportioned over a particular cost centre or production department by the units produced”.

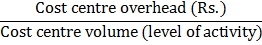

The overhead absorption rate is calculated as follows:

Methods of Overhead Absorption:

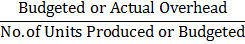

- Production Unit Method: Under this method, overhead absorption rate is calculated by dividing the overhead cost by number of units produced or expected to be produced as shown below:

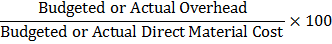

2. Percentage of Direct Material Cost Method: Under this method overhead is absorbed based on the actual or predetermined absorption rate calculated by expressing the overhead cost as percentage of direct materials for the same period.

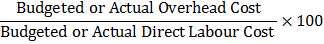

3. Percentage of Direct Labour Cost Method: Under this method, overhead absorption rate is calculated by expressing the overhead expense to be absorbed as a percentage of cost of direct labour for the same period, as shown below:

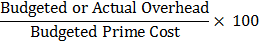

4. Percentage of Prime Cost Method: This method is a combination of both direct material cost and direct labour cost method. The overhead absorption is calculated as follows:

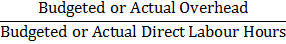

5. Direct Labour Hour Rate Method: Under this method, overhead absorption rate is calculated by dividing the overhead with the number of direct labour hours.

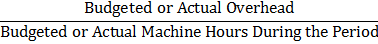

6. Machine Hour Rate Method: CIMA defines Machine Hour Rate as an “actual or predetermined rate of cost apportionment or overhead absorption, which is calculated by dividing the cost to be apportioned or absorbed by a number of hours for which a machine or machines are operated or expected to be operated.”

Application of overhead absorption rate

For the application of pre-determined absorption rates, the actual (i.e., the actual number of units or other actual base data e.g., direct labour hours, machine hours etc.,) is multiplied by the predetermined rate. The resultant amount will give the amount of overhead to be applied (or charged) to production for the period.

It is seldom applied overheads agree with the actual overheads. There will always be a difference between the actual overheads and applied overheads. If the absorbed amount exceeds actual overhead, the difference would be called as “overapplied overhead”. If however, it falls short of actual overhead, the difference would be called ‘Under applied overhead”.

Determination of overhead rates

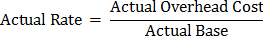

(a) Actual Rate:

Actual overhead rate/historical overhead rate is determined by dividing actual cost of overhead by the actual base of a certain period. It is calculated as

It is needless to say that actual rate may be computed monthly, quarterly, or annually.

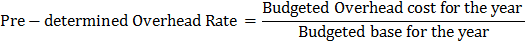

(b) Predetermined Overhead Rate:

This rate can be computed as:

Under and Over Absorption and its treatment

On the basis of predetermined overhead absorption rate the overhead are absorbed according to the actual production of goods throughout the accounting period or specific period. To determine overhead rate budgeted overheads and budgeted output are used. If budgeted overhead and budgeted outputs differ from actual overhead and actual output, three is a difference between predetermined overhead rate and actual overhead rate.

Over absorption refers to the overheads absorbed are higher than the actual overheads incurred. Under absorption refers to the overhead absorbed is lower than the actual overheads incurred during the accounting period.

Reasons for Over or Under absorption of overhead

- The actual hours worked is more or less than budgeted hours

- The actual overhead costs are different from budgeted overheads

- The method of overhead absorption may be wrong

- Unexpected expenses may be incurred during the accounting period.

- Seasonal fluctuations in the overhead expenses from period to period

- Both actual overhead costs and actual activity level are different from the budgeted costs and level.

Treatment of over or under absorbed overheads

- Application of supplementary rates - The supplementary rate is calculated by dividing the under or over absorbed amount by the actual base. The over recovered amount will be adjusted by applying the supplementary rate and vice versa, in case of over absorption.

2. Adjustment to cost of sales - The over or under absorbed overheads is closed and transferred to the cost of sale account. This is done at the end of every month or at the end of accounting period by the Cost Accountant. If the transfer is made at the end of the accounting period, the over/under-absorbed overhead is carried forward from month to month treating it as deferred income if over applied and as deferred charges, if under applied.

3. Write off to Costing Profit and Loss Account - If the over or under absorbed overhead is small, and then it will be written off by transferring it to the costing profit and loss account.

4. Adjusted to gross profit - The under or over absorbed overhead balances are closed by entering the adjustment in gross profit.

5. Carry forward to subsequent years - The under or over absorbed overhead may be carried forward to the subsequent accounting year and are transferred to Overhead Suspense Account or Overhead Reserve Account. This Overhead Suspense Account or Overhead Reserve Account will be shown in the Balance Sheet. The under or overhead absorption debit and credit balances are shown in the asset and liabilities side of the balance sheet.

Key takeaways

- The process of grouping the overheads according to their common characteristics is known as classification of overheads.

- Departmentalization of overheads refers to the process of determining the overhead costs of each department involved in production.

References:

1. Arora, M.N.: Cost Accounting- principles and Practice

2. Bansal, M.R. & Saxena, V.M.: Lagat Lekhankan

3. Gupta, R.K.: Lagat Lekhankan

4. Gupta, L.B.: Lagat Lekha