Unit II

Cost of Capital

Meaning

Cost of capital is an important part of an investment decision because it is used to measure the value of investment proposals offered by business concerns. This is used as a discount rate to determine the present value of future cash flows associated with the capital project. The cost of capital is also known as the cutoff rate, target rate, hurdle rate, and required rate of return. If a company uses a variety of sources of funding, the finance manager must make careful decisions regarding the cost of capital. It is closely related to the value of the company and the profitability of the company.

Cost of capital concept

There is a large portion of the financial literature that explains this concept. Many studies show that the cost of capital is the rate of return that a company must earn on a project investment to maintain its market value and attract funds. This is the required rate of return on investments that belong to equity, debt, and retained earnings. If a company does not make the profits it expects, the market value of its stock will fall, damaging the overall prosperity of its shareholders. Well-known theorist John J. Hampton described the cost of capital as "the rate of return that a company needs from an investment to increase its value in the market." "Cost of capital is the minimum rate of return or cut-off rate of capital expenditure," said Solomon Ezra. According to James C. Van Horn, the cost of capital is "the cut-off rate of capital allocation to investment. It is the rate of return of the project that does not change the market price of the project." Another theorist, William. "Cost of capital may be defined as the rate at which we must earn on net income to provide the cost component of the burden by the due date," said Donaldson.

Importance of cost of capital

The importance of the cost of capital is shown below.

(1) Investment decision

The cost of capital is used as a discount factor in determining the net present value. This helps businesses and investors assess all investment opportunities. This is achieved by discounting future cash flows into present value. Similarly, the actual rate of return on a project is compared to the cost of capital of the company. Therefore, the cost of capital plays an important role in making investment decisions.

(2) Design of capital structure

The ratio of debt to capital is called the capital structure. The rate at which the cost of capital can be minimized and the value of a company can be maximized is called the optimal capital structure. It also helps to make budget calls for major companies that use the company's financial resources as capital. The cost of capital helps design a capital structure that takes into account the cost of each source, investor expectations, tax impacts, and growth potential. This helps determine the capital budget for the sources of funding used by the company.

(3) Performance evaluation

Cost of capital is a benchmark for assessing the performance of different departments. It can be used to assess the progress of ongoing projects and investments by collating them with the cost of capital. The department is considered the best that can provide the company with the highest net present value. It helps you evaluate your investment options by discounting the future cash flow of your investment instrument and converting it to present value. Activities in various departments are expanded or deleted based on their performance.

(4) Formulation of dividend policy

A certain portion of the company's gross profit is paid to shareholders as dividends. The concept of capital can be useful as a tool in making other important financial decisions. However, a company can retain all the profits of its business if it has the opportunity to invest in a project that can provide a high rate of return compared to the cost of capital. Based on that, you can make decisions regarding dividend policy, profit capitalization, and working capital choices. On the other hand, if the company does not have the opportunity to invest profits, all profits can be distributed as dividends. Therefore, the cost of capital plays an important role in formulating a dividend policy.

In short, the importance of cost of capital makes it easy to calculate so that it is used to evaluate a company's new project and gives the minimum profit that an investor expects to provide an investment to the company. That is. This is a guideline for measuring the profitability of various investments.

Calculation of Cost of Debt, Preference Shares, Equity Shares and Retained Earnings, Combined (weighted) Cost of Capital.

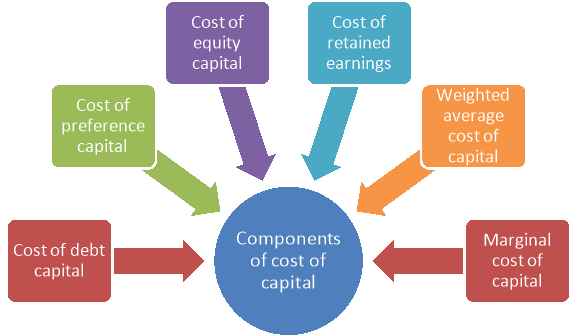

Cost of capital is a composite cost of the individual sources of funds including equity shares, preference shares, debt and retained earnings. The estimated components of cost of capital are discussed below-

Figure: Components of cost of capital

1. Cost of Debt Capital:

Generally, cost of debt capital refers to the total cost or the rate of interest paid by an organization in raising debt capital. However, in a real situation, total interest paid for raising debt capital is not considered as cost of debt because the total interest is treated as an expense and deducted from tax. This reduces the tax liability of an organization. Therefore, to calculate the cost of debt, the organization needs to make some adjustments. Formulae to calculate cost of debt are as follows:

a. When the debt is issued at par –

KD= [(1 – T) x R] x 100

Where,

KD = Cost of debt

T = Tax rate

R = Rate of interest on debt capital

KD = Cost of debt capital

b. Debt issued at premium or discount when debt is irredeemable –

KD = [1 / NP x (1 -T) x 100]

Where,

NP = Net proceeds of debt

c. Cost of redeemable debt –

KD= [{I (1-T) + (P – NP / N) x (1- T)} / (P + NP / 2)] x 100

N = Numbers of years of maturity

P = Redeemable value of debt

2. Cost of Preference Capital:

Cost of preference capital is the sum of amount of dividend paid and expenses incurred for raising preference shares. The dividend paid on preference shares is not deducted from tax, as dividend is an appropriation of profit and not considered as an expense. Cost of preference share can be calculated by using the following formulae:

a. Cost of redeemable preference shares –

Kp = [{D + F / N (1 – T) + RP / N} / {P + NP / 2}] x 100

Where,

KP = Cost of preference share

D = Annual preference dividend

F = Expenses including underwriting commission, brokerage, and discount

N = Number of years to maturity

RP = Redemption premium

P = Redeemable value of preference share

NP = Net proceeds of preference shares

b. Cost of irredeemable preference shares –

KP = (D / NP) x 100

3. Cost of Equity Capital:

It is very difficult to calculate the cost of equity capital as compared to debt capital and preference capital. The main reason is that the equity shareholders do not receive fixed interest or dividend. The dividend on equity shares varies depending upon the profit earned by an organization. Risk factor also plays an important role in deciding rate of dividend to be paid on equity capital. Therefore, there are various approaches to calculate cost of equity capital. It consists of the following approaches-

i. Dividend Price Approach:

The dividend price approach describes the investors’ view before investing in equity shares. According to this approach, investors have certain minimum expectations of receiving dividend even before purchasing equity shares. An investor calculates present market price of the equity shares and their rate of dividend.

The dividend price approach can be mathematically calculated by using the following formula:

KE = (Dividend per share / Market price per share) x 100

KE = Cost of equity capital

However, the dividend price approach his criticized on certain grounds, which are as follows:

a. Does not take into consideration the appreciation in the value of capital. The dividend price approach is based on the assumption that investors expect some dividend on their shares. It completely ignores the fact that some investors also consider the chances of capital appreciation, which increases the value of their shares.

b. Ignores the impact of retained earnings, which affect both the market price of shares and the amount of dividend paid. For example- suppose if an organization keeps major portion of its profit as retained earnings, then it would pay low dividend, which may decrease the market price of its shares.

Ii. Earnings Price Ratio Approach:

The earnings price ratio approach suggests that cost of equity capital depends upon amount of fixed earnings of an organization. According to the earnings price ratio approach, an investor expects that a certain amount of profit must be generated by an organization. Investors do not always expect that the organization distribute dividend on a regular basis.

Sometimes, they prefer that the organization invests the amount of dividend in further projects to earn profit. In this way, the organization’s profit would increase, which in turn increases the value of its shares in the market.

The formula to calculate cost of capital through the earnings price ratio approach is as follows:

KE = E / MP

Where,

E = Earnings per share

MP = Market price

However, this approach is criticized on the following grounds:

a. Assumes that EPS would remain constant

b. Assumes that market price per share would remain constant

c. Ignores the fact that all the earnings of an organization are not distributed in the form of dividend. However, some part of earnings may be kept in form of retained earnings.

Iii. Dividend Price Plus Growth Approach:

The dividend price plus growth approach refers to an approach in which the rate of dividend grows with the passage of time. In the dividend price plus growth approach, investors not only expect dividend but regular growth in the rate of dividend. The growth rate of dividend is assumed to be equal to the growth rate in EPS and market price per share. In the dividend price plus growth approach, cost of capital can be calculated mathematically by using the following formula:

KE = [(D / MP) + G] x 100

Where,

D = Expected dividend per share, at the end of period

G = Growth rate in expected dividends

This approach is considered as the best approach to evaluate the expectations of investors and calculate the cost of equity capital.

Iv. Realized Yield Approach:

In the realized yield approach, an investor expects to earn the same amount of dividend, which the organization has paid in past few years. In this approach, the growth in dividend is not considered as major factors for deciding the cost of capital.

This approach is based on the following assumptions:

a. Risk factor remains constant in an organization. Returns in the given risk remain the same as per the expectations of shareholders.

b. Realized yield is equivalent to the reinvestment opportunity rate for shareholders.

According to the realized yield approach, cost of capital can be calculated mathematically by using the following formula:

KE = [{(D – P) / p} – 1] x 100

Where,

P = Price at the end of the period,

p = Price per share to day

v. Capital Asset Price Model (CAPM):

CAPM helps in calculating the expected rate of return from a share of equivalent risk in the capital market. The cost of shares that carry risk would be equal to cost of lost opportunity. For example- an investor has two investment options- to buy the shares of either X Ltd. Or Y Ltd. If the investor decides to buy the shares of X Ltd., then the cost of shares of Y Ltd. Would be the cost of lost opportunity. CAPM is based on the following assumptions:

a. A rationale investor would always avoid risk

b. A rationale investor would always wish to maximize the expected yield

c. All investors would have similar expectations

d. All investors can lend freely on the riskless rates of return

e. Capital market is in good condition and there is no existence of tax

f. Capital market is competitive in nature

g. Securities are completely divisible and there is no transaction cost

The computation of cost of capital using CAPM is based on the condition that the required rate of return on any share should be equal to the sum of risk less rate of interest and premium for the risk.

According to CAPM, cost of capital can be calculated mathematically by using the following formulae:

E = R1 + β {E (R2) – R1}

Where,

E = Expected rate of return on asset

β = Beta coefficient of assets

R1 = Risk free rate of return

E (R2) = Expected return from market portfolio

This value can be calculated by analysing data of usually five years.

Formula used to calculate beta value is as follow:

β = PIM (SD1) (SDM) / SD2M

Where,

β = Beta of stock

PIM = Correlation coefficient between the returns on stock, I and the returns on market portfolio, M.

SD1 = Standard deviation of returns on assets

SDM = Standard deviation of returns on the market portfolio

SD2M = Variance of market returns

Vi. Bond Yield Plus Risk Premium Approach:

The bond yield plus risk premium approach states that the cost on equity capital should be equal to the sum of returns on long-term bonds of an organization and risk premium given one equity shares. The risk premium is paid on equity shares because they carry high risk. Mathematically, the cost of capital is calculated as:

Cost of equity capital = Returns on long-term bonds + Risk premium

The bond yield plus risk premium approach is based on the fact that a risky organization would have high financial leverage. As a result of this, it would be earning higher profit. Therefore, the equity shareholders due to higher risks on their investments expect higher returns in the form of risk premium.

Vii. Gordon Model:

The Gordon model was proposed by Myron Gordon to calculate cost of equity capital. As per this model, an investor always prefers less risky investment as compared to more risky investment. Therefore, an organization should pay risk premium only on risky investment. The Gordon model also suggests that an investor would always prefer more of those investments, which would provide them current income.

The Gordon model is based on the following assumptions:

a. The rate of return on the investments of an organization is constant

b. The cost of equity capital is more than the growth rate

c. The corporation tax does not exist in the economy

d. The organization has perpetual existence

e. The growth rate of the organization is a part of retention ratio and its rate of return

According to the Gordon model, cost of capital can be calculated mathematically by using the following formula:

P = E (1 – b) / K- br

Where,

P = Price per share at the beginning of the year

E = Earnings per share at the end of the year

b = Fraction of retained earnings

K = Rate of return required by shareholders

r = Rate of return earned on investments made by the organization

4. Cost of Retained Earnings:

Retained earnings are organizations’ own profit reserves, which are not distributed as dividend. These are kept to finance long-term as well as short-term projects of the organization. It is argued that the retained earnings do not cost anything to the organization. It is debated that there is no obligation either formal or implied, to earn any profit by investing retained earnings. However, it is not correct because the investors expect that if the organization is not distributing dividend and keeping a part of profit as reserves then it should invest the retained earnings in profitable projects. Further, the investors expect that the organization should distribute the profit earned by investing retained earnings in the form of dividend. Cost of retained earnings can be calculated with the help of various approaches, which are as follows:

i. KE = KR Approach:

If an organization retains the dividend, then it prohibits the shareholders from earning more profit. Therefore, for retaining the dividend, the organization should earn the profit, which the shareholders would have earned by investing the dividend in other projects. Therefore, the amount of profit expected from the organization on retained earnings is the cost of retained earnings.

Ii. Soloman Erza Approach:

Includes the two options that an organization has that are either to retain the earnings to meet future uncertainties or invest in its or other organization’s projects.

5. Weighted Average Cost of Capital:

Weighted average cost of capital is determined by multiplying the cost of each source of capital with its respective proportion in the total capital. Let us understand the concept of weighted average cost of capital with the help of an example. Suppose, an organization raises capital by issuing debentures and equity shares. It pays interest on debt capital and dividend on equity capital. When the organization adds the total interest paid on debt capital to the total dividend paid on equity capital, it obtains weighted average cost of capital. An organization requires generating the profit on its various investments equal to the weighted average cost of capital. Weighted average cost of capital can be calculated mathematically by using the following formula:

Weighted Average Cost of Capital = (KE x E) + (KP x P) + (KD x D) + (Kr x R)

Where,

E = Proportion of equity capital in capital structure

P = Proportion of preference capital in capital structure

D = Proportion of debt capital in capital structure

KR = Cost of proportion of retained earnings in capital structure

R = Proportion of retained earnings in capital structure

Key takeaways:

- Cost of capital is an important part of an investment decision because it is used to measure the value of investment proposals offered by business concerns.

- There is a large portion of the financial literature that explains this concept. Many studies shows that the cost of capital is the rate of return that a company must earn on a project investment to maintain its market value and attract funds.

- The cost of capital is used as a discount factor in determining the net present value.

- The ratio of debt to capital is called the capital structure

- Cost of capital is a benchmark for assessing the performance of different departments.

- A certain portion of the company's gross profit is paid to shareholders as dividends.

- In short, the importance of cost of capital makes it easy to calculate so that it is used to evaluate a company's new project and gives the minimum profit that an investor expects to provide an investment to the company.

- Cost of capital is a composite cost of the individual sources of funds including equity shares, preference shares, debt and retained earnings.

- Generally, cost of debt capital refers to the total cost or the rate of interest paid by an organization in raising debt capital.

- Cost of preference capital is the sum of amount of dividend paid and expenses incurred for raising preference shares.

- The dividend price approach describes the investors’ view before investing in equity shares.

- Ignores the impact of retained earnings, which affect both the market price of shares and the amount of dividend paid.

- The earnings price ratio approach suggests that cost of equity capital depends upon amount of fixed earnings of an organization.

- The dividend price plus growth approach refers to an approach in which the rate of dividend grows with the passage of time.

- In the realized yield approach, an investor expects to earn the same amount of dividend, which the organization has paid in past few years.

- The computation of cost of capital using CAPM is based on the condition that the required rate of return on any share should be equal to the sum of risk less rate of interest and premium for the risk.

- The bond yield plus risk premium approach states that the cost on equity capital should be equal to the sum of returns on long-term bonds of an organization and risk premium given one equity shares.

- The bond yield plus risk premium approach is based on the fact that a risky organization would have high financial leverage.

- The Gordon model was proposed by Myron Gordon to calculate cost of equity capital.

- Retained earnings are organizations’ own profit reserves, which are not distributed as dividend.

- If an organization retains the dividend, then it prohibits the shareholders from earning more profit.

- Weighted average cost of capital is determined by multiplying the cost of each source of capital with its respective proportion in the total capital.

Meaning

Capitalization is a document of fees as an asset, now no longer fees. This method is used while fees are predicted to be eaten up over an extended time period as opposed to being absolutely ate up over the cutting-edge duration. For example, workplace resources are predicted to be ate up withinside the close to destiny, so they may be expensive at once. Because motors are recorded as constant property and ate up longer than workplace resources, depreciation costs them for miles longer time period.

Capitalization is likewise primarily based totally at the idea of materiality. If the value is simply too small, it'll hassle you with a sequence of accounting calculations and magazine entries, capitalize it, and rate it suddenly rather than step by step charging it over time. The particular quantity that an object is robotically charged as a cost is known as a capitalization restriction or cap restriction. Cap limits are used to preserve information to a viable degree even as taking gain of maximum of all objects that want to be special as constant property.

Capitalization is regularly utilized in asset-extensive environments, inclusive of manufacturing, in which depreciation could make up the bulk of general fees. Conversely, withinside the provider industry, capitalization may be very rare, especially if the cap is about excessive sufficient to keep away from recording PCs and laptops as constant property.

When a corporation builds a hard and fast asset, the hobby cost at the borrowed budget used to pay the development fees also can be capitalized and recorded as a part of the underlying asset. This step is generally done simplest for major production projects.

Capitalization may be used as a device for making ready monetary statements that document fraud. If the fees that ought to had been charged as costs are capitalized, the cutting-edge earnings will develop on the cost of the destiny duration wherein extra depreciation may be charged. This exercise may be observed with the aid of using evaluating coins waft to internet earnings. Cash waft ought to be drastically decreased than internet earnings.

The time period "capitalization" additionally refers back to the marketplace cost of a business. It is calculated with the aid of using multiplying the full variety of issued stocks with the aid of using the marketplace rate of the cutting-edge stocks. It also can be described because the sum of a corporation's stock, retained earnings, and long-time period debt.

Over Capitalization

This is the capital in which the company's actual profits are not sufficient to pay interest on corporate bonds and borrowings, and a fair dividend rate to shareholders over a period of time. In other words, a company is said to be overcapitalized if it cannot pay interest on corporate bonds or loans and secure a fair return to shareholders.

Causes of overcapitalization:

Overcapitalization can be the result of the following factors:

(I) Acquisition of assets at a higher price:

The asset may have been acquired at a soaring price or when the price peaked. In both cases, the company's actual value is below its book value and its revenue is very low.

(II) Higher promotional costs:

The company may incur large reserve costs such as purchasing goodwill and patents. Printing prospectuses, underwriting fees, brokerage, etc. These costs are not productive, but are shown as assets.

(III) Underutilized:

Company directors may overestimate the company's earnings and raise capital accordingly. If the company is not in a position to invest these funds profitably, the company will have more capital than necessary. As a result, the profit margin per share is low.

(IV) Insufficient provision for depreciation:

Depreciation may be charged at a lower rate than guaranteed by the useful life and use of the asset, and the company may not be fully prepared for the replacement of the asset. This reduces the profitability of the company.

(V) Liberal dividend policy:

The company may not have sufficient funds to raise its own funds in accordance with its liberal dividend policy. This can lead to overcapitalization in the long run.

(VI) Inefficient management:

Inefficient management and luxury organizations can also lead to overcapitalization of the company. The profit of the company will be low.

Impact of overcapitalization on the company:

Overcapitalized companies can suffer the following adverse effects or disadvantages:

(I) Company shares may not be readily available on the market due to reduced earnings per share.

(II) The company may not be able to raise new capital from the market.

(III) Decreased profits may force management to follow unfair practices. It may manipulate your account to show higher profits.

(IV) Management can reduce the cost of maintaining and exchanging assets. Appropriate depreciation of assets may not be provided.

(V) Low profits will damage the company's reputation.

Impact of overcapitalization on shareholders:

Overcapitalization is disadvantageous to shareholders for the following reasons:

(I) Overcapitalization leads to a decrease in the company's profits. This means that shareholders will receive fewer dividends.

(II) The market value of stocks will fall due to the decline in profitability.

(III) In the future, it may not be possible for shareholders to earn a reliable income.

(IV) The reputation of the company is damaged. For this reason, company stock may not be easily available on the market.

(V) In the case of restructuring, the par value of the shares may decrease.

Impact of overcapitalization on society:

The impact of overcapitalization on society is as follows.

(I) The profits of overcapitalized companies show a declining trend. Such companies may resort to tactics such as rising product prices and poor product quality.

(II) Return on capital used is very low. This means that the financial resources of the people are not being properly utilized.

(III) Overcapitalized companies may not be able to pay interest to creditors on a regular basis.

(IV) The company may not be able to provide workers with better working conditions and adequate wages.

Overcapitalization remedies:

The following measures should be taken to remedy the situation caused by overcapitalization:

(I) It is necessary to increase the profitability of a company by increasing the efficiency of human and inhuman resources of the company.

(II) Long-term loans with higher interest rates may be redeemed from existing resources.

(III) The face value and / or number of shares may be reduced.

(IV) Management must follow conservative policies when declaring dividends and take all steps to reduce unnecessary administrative costs.

Theory of Capitalization

Capitalization Theory: Capitalization Cost Theory and Profit Theory!

The issue of determining the amount of capital is necessary for both newly established companies and established concerns. For new businesses, the problem is more serious as long as it requires reasonable preparation to meet future and current needs and there is a risk of raising excess or inadequate capital. However, the case depends on the established concerns.

They need to revise or revise their financial plans by issuing new securities or reducing capital to meet the needs of the company. However, two theories have been published to estimate the amount of capitalization.

1. Capitalization cost theory:

In this theory, the capitalization of a company is determined by adding the initial actual costs incurred when establishing the company as a going concern. This is the sum of the cost of fixed assets (plants, machinery, buildings, furniture, goodwill, etc.), the amount of working capital (investments, cash, inventory, accounts receivable) needed to run the business, and the cost of promotion. , Organize and establish a business.

In other works, the original total expenditures incurred on various items are the basis for determining the capital of the company. A company is said to be well capitalized if the funds raised are sufficient to cover initial and daily costs. This theory is very useful for new companies because it makes it easier to calculate the amount of money to raise first.

Cost theory undoubtedly provides a concrete idea for determining the size of capitalization, but it cannot provide the basis for assessing the net worth of a real business. The market capitalization determined based on this theory does not change with revenue.

Moreover, it does not take into account the future needs of the business. This theory does not apply to existing concerns as it does not suggest whether the invested capital justifies earnings. In addition, cost estimates are made during specific periods.

Changes in price levels are not taken into account. For example, if some assets are bought at soaring prices and some assets remain idle or underutilized, profits will be low and the company will be fair to the capital invested. You will not be able to pay any profits. The result is excess capital.

A “profit approach” is used to eliminate these difficulties and reach the correct number of capitalizations.

2. Capitalization Profit Theory:

This theory assumes that a company is expected to make a profit. According to it, it’s true value depends on the profitability and earning power of the company. Therefore, the market capitalization of a company or its value is equal to the market capitalization of estimated revenue. To find this value, companies need to prepare forecast profit and loss accounts to complete the overall picture of revenue or to make forecasts when estimating initial capital demand.

Once the estimated revenue is reached, the financial manager makes the necessary adjustments and compares it to the actual revenue of other companies of similar size and business.

After this, the percentage of other companies in the same industry making similar capital returns will be investigated. This rate is then applied to the company's estimated revenue to determine capitalization.

Capitalization revenue theory generally considers two factors in determining capitalization. (I) How much profit can a company make, and (ii) What is the fair rate of return on the capital invested in a company? This rate of return, also known as the "multiplier," is 100% divided by the appropriate rate of return.

Therefore, if the company can make a net profit of Rs. If you have 30,000 a year and a rate of return of 10%, your company will be capitalized at 3,000,000 (that is, 30,000 x 100/10). However, if the total investment in the entire industry during that period is 10 rupees and the total return of the industry is Rs. Therefore, 1.5 crores, the profitability of the industry is 15%.

However, the business under consideration earns only 10%. This is the case of excess capital as a return on Rs. Justify an investment of 30,000 rupees. Only 2,000,000 rupees 30,000 X 100/15) From the perspective of the profitability of the industry. Therefore, the company is overcapitalized in Rs. 1,00,000.

Key takeaways:

- Capitalization is a document of fees as an asset, now no longer fees.

- Capitalization is regularly utilized in asset-extensive environments, inclusive of manufacturing, in which depreciation could make up the bulk of general fees.

- Capitalization may be used as a device for making ready monetary statements that document fraud.

- Over Capitalization is the capital in which the company's actual profits are not sufficient to pay interest on corporate bonds and borrowings, and a fair dividend rate to shareholders over a period of time.

- Company directors may overestimate the company's earnings and raise capital accordingly.

- Depreciation may be charged at a lower rate than guaranteed by the useful life and use of the asset, and the company may not be fully prepared for the replacement of the asset.

- Inefficient management and luxury organizations can also lead to overcapitalization of the company. The profit of the company will be low.

- Overcapitalization leads to a decrease in the company's profits. This means that shareholders will receive fewer dividends.

- The profits of overcapitalized companies show a declining trend. Such companies may resort to tactics such as rising product prices and poor product quality.

- It is necessary to increase the profitability of a company by increasing the efficiency of human and inhuman resources of the company.

- The issue of determining the amount of capital is necessary for both newly established companies and established concerns.

- Cost theory undoubtedly provides a concrete idea for determining the size of capitalization, but it cannot provide the basis for assessing the net worth of a real business.

- Capitalization Profit theory assumes that a company is expected to make a profit.

- Capitalization revenue theory generally considers two factors in determining capitalization.

Meaning

Revenue theory is more appropriate for a going concern, but it is difficult to calculate market capitalization with this theory. It is based on the "rate" at which revenue is capitalized. This rate is difficult to estimate as long as it is determined by many factors that cannot be calculated quantitatively.

These factors include the nature of industry / financial risk and the prevailing competition in the industry. New companies cannot rely on this theory because it is difficult to estimate the expected return in that case.

When it comes to market capitalization, it is often said that "the concern is neither overcapitalization nor undercapitalization. The purpose is to achieve fair capitalization." To understand the importance of this statement, let's first look at the expertise of capitalization over and shorts.

Determinants:

The factors that influence the capital structure (or the determinants of the capital structure) are described below.

- Financial Leverage or Equity Transactions:

The use of long-term fixed interest obligations and preferred equity capital in conjunction with equity equity capital is called financial leverage or equity trading. We've already covered the impact of leverage on shareholder returns or earnings per share in this blog. Earnings per share increase without increasing the owner's investment if the assets funded by the debt bring more profit than the cost of the debt. Similarly, acquiring assets using preferred stock capital also increases earnings per share. However, the impact of leverage is that (i) the cost of debt is usually lower than the cost of preferred stock capital, and (ii) the interest paid on debt is a deductible fee from the profit for calculating taxable income. Feels more in the case of debt. Dividends on preferred stocks are not. Financial leverage is one of the key considerations when planning a company's capital structure, as it affects earnings per share. Companies with high levels of earnings before interest and tax (EBIT) can take advantage of a high degree of leverage to increase their return on equity. One common way to look at the impact of leverage is to analyze the relationship between earnings per share (EPS) at various possible levels of EBIT under alternative funding methods. EBIT-EPS analysis is one of the key tools financial managers have to gain insights into a company's capital structure management. He can examine the potential for fluctuations in EBIT and examine its impact on EPS under various funding plans. Using preferred stock capital also increases earnings per share, but the fact that interest is allowed to be deducted during the tax calculation has a much greater impact on debt leverage.

b. Sales Growth and Stability: A company's capital structure is heavily influenced by sales growth and stability. If a company's sales are expected to be fairly stable, it can generate higher levels of debt. Sales stability ensures that the company does not face difficulties in fulfilling its fixed promise of interest payments and debt repayments. Similarly, sales growth influences capital structure decisions.

c. Cost of capital: Every dollar invested in a company has a cost. The cost of capital is the minimum return that a supplier expects. Expected return depends on the degree of risk the investor envisions. Shareholders are at higher risk than debtors. The capital structure should provide the lowest cost of capital. Measuring the cost of different sources of funding is a complex issue and requires separate processing. Needless to say, it is desirable to minimize the cost of capital. Therefore, others should remain the same and cheaper sources should be prioritized. The main sources of capital for a company are equity capital, preferred equity capital and debt capital. The benefits that capital suppliers expect depend on the risks they have to take. For shareholders, the dividend rate is not fixed and the board has no legal obligation to pay dividends, even if the company makes a profit. The debtor's loan will be repaid within the specified period and the shareholders will only be able to repay the capital if the company is liquidated. This allows us to conclude that debt is a cheaper source of funding than stocks. Interest tax deductions further reduce the cost of debt. Preferred stock capital is cheaper than stock capital, but not as cheap as debt. Therefore, companies must spend large amounts of debt to minimize the overall cost of capital.

d. Risks: There are two types of risks to consider when planning a company's capital structure: (i) business risks and (ii) financial risks. Business risk refers to the volatility of earnings before interest and taxes are deducted. Business risks can occur not only internally but also externally. Internal risks are caused by inadequate products such as the lack of raw materials, the inability to compete, and the lack of strategic control. Internal risk is related to the efficiency with which a company operates in a wider environment. External business risk arises from changes in operating conditions caused by the conditions imposed on the company.

e. Cash flow: One of the hallmarks of a valid capital shape is conservation. Conservation does now no longer suggest hiring debt-unfastened or small debt. Conservatism is related to the valuation of debt towards constant charges. It is created through the use of debt or desired capital withinside the capital shape in terms of the enterprise's capacity to generate coins to fulfill those constant charges. The enterprise's constant prices consist of hobby bills, desired dividends and important. If the enterprise makes use of a big quantity of debt or desired capital, the quantity of constant costs could be excessive. Whenever a enterprise considers elevating extra debt, it desires to investigate the predicted destiny coins flows to fulfill its constant prices. You are obliged to pay hobby and pay off your important debt. Companies that could generate large and extra solid coins inflows can rent extra debt of their capital shape than organizations which can be unstable and much less able to producing coins inflows. Debt financing approach the load of constant costs with constant bills of hobby and important. Whenever a enterprise desires to improve extra investment, it desires to estimate and forecast destiny coins inflows to make sure insurance of constant charges.

f. Corporate nature and length: The nature and length of a enterprise additionally affects its capital shape. All software issues have a exclusive capital shape as compared to different production issues. Utility issues can also additionally use extra debt because of income balance and regularity. On the opposite hand, the priority that solid income can not be received because of the character of the commercial enterprise will specially rely upon fairness capital. The length of the enterprise additionally has a large effect at the availability of price range from a lot of sources. Small groups regularly locate it hard to get a long-time period mortgage. If for a few cause it succeeds in getting a long-time period mortgage, it's miles to be had at excessive hobby charges and inconvenient terms. Very restrictive contracts in small commercial enterprise mortgage contracts make their capital shape very inflexible. Therefore, control isn't unfastened to run a commercial enterprise. Therefore, SMEs want to depend upon capital and retained income for long-time period investment. Large organizations have extra flexibility in designing their capital shape. You can take out a mortgage below easy conditions, and you may additionally problem not unusual place inventory, desired inventory, and company bonds to the overall public. Companies want to make the maximum in their length while making plans their capital shape.

g. Management: Whenever a enterprise desires extra price range, the enterprise's control desires to improve price range without dropping manipulate of the enterprise. If the price range are raised through issuing shares, the manipulate of current shareholders could be diluted. Therefore, they will improve extra investment via constant hobby debt and desired inventory capital. Preferred stockholders and bondholders do now no longer have balloting rights. Therefore, from an administrative factor of view, debt lending is recommended. However, depending frequently on debt lending can reason different issues, which includes immoderate regulations imposed through creditors or providers of lending and lack of entire manipulate because of liquidation of the enterprise.

h. Flexibility: Flexibility refers to an enterprise's capacity to conform its capital shape to the desires of converting situations. An enterprise's capital shape is bendy so long as there aren’t any issues with modifications in capital or investment sources. Whenever its miles needed, organizations want in order to improve cash for worthwhile investments without undue put off or cost. The enterprise has to additionally be in a role to redeem its desired capital or debt each time destiny situations justify it. The enterprise's monetary plans want to be bendy sufficient to alternate the composition of the capital shape. To store on using price range, we want to stay in a role to update one shape of price range with every other.

i. Investor Requirements: Investor necessities are every other component that affects a enterprise's capital shape. Debt lending should meet the necessities of each institutional and person investors. Investors are normally divided into 3 types: formidable investors, paying investors, and paying much less attention.

j. Capital Market Situation (Timing): The capital market situation is not the same as before. Recessions can occur, markets can stagnate, and pessimistic business conditions can occur. The company should not issue shares. Investors will prefer safety.

k. Marketability: Marketability here means the ability of a company to sell or sell a particular type of security in a particular time period. This depends on whether the investor is ready to buy the security. Marketability may not have much impact on the initial capital structure, but it is an important consideration in determining the right timing for security issues. At one time, the market may favor corporate bond issuance, and at another, it may easily accept regular equity issuance. As market sentiment is changing, companies need to decide whether to raise money in common stock or in debt. If the stock market is sluggish, companies should issue debt rather than issue common stock and wait for common stock to be issued until the stock market recovers. During the booming stock market, companies may not be able to issue corporate bonds. Therefore, it is necessary to raise funds by issuing common stock without utilizing debt capacity.

l. Inflation: Another factor to consider when making a funding decision is inflation. By using debt loans during periods of high inflation, you can repay your debt in less valuable dollars. As inflation expectations rise, creditors have to compensate for loss of value, which raises the borrowing rate. Financing decisions need to be aware of inflation trends, as inflation is the main driver behind interest rates.

m. Floating costs: Floating costs will be incurred when raising funds. In general, the cost of fluctuating debt is less than the cost of fluctuating stock issuance. This allows companies to use their debt rather than issue common stock. If the owner's capital increases by maintaining profits, there will be no levitation costs. Except for small businesses, variable costs are generally less important factor affecting a company's capital structure.

n. Legal considerations: When assessing the various proposed capital structures, financial managers should also take into account legal and regulatory frameworks. For example, if a bond has a maturity of more than 18 months, it will require a credit rating according to SEBI guidelines. In addition, SEBI approval is required to raise funds from the capital markets. No such approval is required-if the company takes out a loan from a financial institution. All of these and other regulatory provisions must be taken into account when determining and selecting a company's capital structure.

Theories:

The important theories of capital structure are discussed below-

Net Income

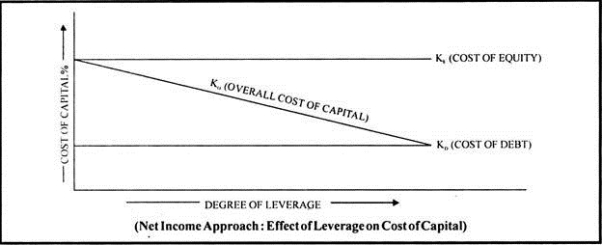

According to this approach, a firm can minimise the weighted average cost of capital and increase the value of the firm as well as market price of equity shares by using debt financing to the maximum possible extent. The theory propounds that a company can increase its value and decrease the overall cost of capital by increasing the proportion of debt in its capital structure.

This approach is based upon the following assumptions:

(i) The cost of debt is less than the cost of equity.

(ii) There are no taxes.

(iii) The risk perception of investors is not changed by the use of debt.

The line of argument in favour of net income approach is that as the proportion of debt financing in capital structure increase, the proportion of a less expensive source of funds increases. This results in the decrease in overall (weighted average) cost of capital leading to an increase in the value of the firm. The reasons for assuming cost of debt to be less than the cost of equity is that interest rates are usually lower than dividend rates due to element of risk and the benefit of tax as the interest is a deductible expense.

On the other hand, if the proportion of debt financing in the capital structure is reduced or say when the financial leverage is reduced, the weighted average cost of capital of the firm will increase and the total value of the firm will decrease. The Net Income (NI) Approach showing the effect of leverage on overall cost of capital has been presented in the following figure.

The total market value of a firm on the basis of Net Income Approach can be ascertained as below:

V= S + D

Where, V= Total market value of a firm

S = Market value of equity shares

= Earnings Available to Equity Shareholders (NI)/Equity Capitalisation Rate

D = Market value of debt,

And, Overall Cost of Capital or Weighted Average Cost of Capital can be calculated as:

K0 = EBIT/v

Net Operating Income

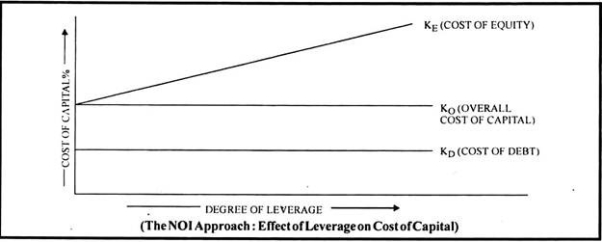

This theory as suggested by Durand is another extreme of the effect of leverage on the value of the firm. It is diametrically opposite to the net income approach. According to this approach, change in the capital structure of a company does not affect the market value of the firm and the overall cost of capital remains constant irrespective of the method of financing. It implies that the overall cost of capital remains the same whether the debt-equity mix is 50: 50 or 20:80 or 0:100. Thus, there is nothing as an optimal capital structure and every capital structure is the optimum capital structure. This theory presumes that:

(i) The market capitalises the value of the firm as a whole;

(ii) The business risk remains constant at every level of debt equity mix;

(iii) There are no corporate taxes.

The reasons propounded for such assumptions are that the increased use of debt increases the financial risk of the equity shareholders and hence the cost of equity increases. On the other hand, the cost of debt remains constant with the increasing proportion of debt as the financial risk of the lenders is not affected.

Thus, the advantage of using the cheaper source of funds, i.e., debt is exactly offset by the increased cost of equity.

According to the Net Operating Income (NOI) Approach, the financing mix is irrelevant and it does not affect the value of the firm. The NOI approach showing the effect of leverage on the overall cost of capital has been presented in the following figure.

The value of a firm on the basis of Net Operating Income Approach can be determined as below:

V = EBIT/K0

Where, V = Value of a firm

EBIT = Net operating income or Earnings before interest and tax

k0 = Overall cost of capital

The market value of equity, according to this approach is the residual value which is determined by deducting the market value of debentures from the total market value of the firm.

S = V – D

Where, S = Market value of equity shares

V = Total market value of a firm

D = Market value of debt

The cost of equity or equity capitalisation rate can be calculated as below:

Cost of equity capital= Earnings after interest and before tax/Market value of a firm-market value of debt

= EBIT – I/V – D

MM Hypothesis

M&M hypothesis is identical with the Net Operating Income approach if taxes are ignored. However, when corporate taxes are assumed to exist, their hypothesis is similar to the Net Income Approach.

(a) In the absence of taxes. (Theory of Irrelevance):

The theory proves that the costs of capital is not affected by changes in the capital structure or say that the debt-equity mix is irrelevant in the determination of the total value of a firm. The reason argued is that though debt is cheaper to equity, with increased use of debt as a source of finance, the cost of equity increases. This increase in cost of equity offsets the advantage of the low cost of debt. Thus, although the financial leverage affects the cost of equity, the overall cost of capital remains constant. The theory emphasises the fact that a firm’s operating income is a determinant of its total value. The theory further propounds that beyond a certain limit of debt, the cost of debt increases (due to increased financial risk) but the cost of equity falls thereby again balancing the two costs. In the opinion of Modigliani& Miller, two identical firms in all respects except their capital structure cannot have different market values or cost of capital because of arbitrage process. In case two identical firms except for their capital structure have different market values or cost of capital, arbitrage will take place and the investors will engage in ‘personal leverage’ (i.e., they will buy equity of the other company in preference to the company having lesser value) as against the ‘corporate leverage’; and this will again render the two firms to have the same total value.

The M&M approach is based upon the following assumptions:

(i) There are no corporate taxes.

(ii) There is a perfect market.

(iii) Investors act rationally.

(iv) The expected earnings of all the firms have identical risk characteristics.

(v) The cut-off point of investment in a firm is capitalisation rate.

(vi) Risk to investors depends upon the random fluctuations of expected earnings and the possibility that the actual value of the variables may turn out to be different from their best estimates.

(vii) All earnings are distributed to the shareholders.

(b) When the corporate taxes are assumed to exist. (Theory of Relevance):

Modigliani and Miller, in their article of 1963 have recognised that the value of the firm will increase or the cost of capital will decrease with the use of debt on account of deductibility of interest charges for tax purpose. Thus, the optimum capital structure can be achieved by maximising the debt mix in the equity of a firm.

According to the M & M approach, the value of a firm unlevered can be calculated as.

Value of unlevered firm= EBIT/cost of capital

Value of levered firm= Value of unlevered firm + tD

TD is the discounted present value of the tax savings resulting from the tax deductibility of the interest charges, t is the rate of tax and D the quantum of debt used in the mix.

Traditional Approach

The traditional approach, also known as Intermediate approach, is a compromise between the two extremes of net income approach and net operating income approach. According to this theory, the value of the firm can be increased initially or the cost of capital can be decreased by using more debt as the debt is a cheaper source of funds than equity. Thus, optimum capital structure can be reached by a proper debt-equity mix. Beyond a particular point, the cost of equity increases because increased debt increases the financial risk of the equity shareholders. The advantage of cheaper debt at this point of capital structure is offset by increased cost of equity. After this there comes a stage, when the increased cost of equity cannot be offset by the advantage of low-cost debt. Thus, overall cost of capital, according to this theory, decreases up to a certain point, remains more or less unchanged for moderate increase in debt thereafter; and increases or rises beyond a certain point. Even the cost of debt may increase at this stage due to increased financial risk.

Case study

Nike, Inc. Kimi Ford, a portfolio manager for North Point Group, is looking for value opportunities. Specifically, Nike has caught Ford’s attention in its recent drop in share price, and she would like to know as to whether this would be a good company to add to the North Point Large-Cap Fund, which Ms. Ford manages. After finding significantly conflicting conclusions from reputable analyst reports across the board, Ford decides her own independent research and forecasting will clear the air. Through a sensitivity analysis of a discounted cash flow forecast, Ms. Ford feels Nike would be a value opportunity at discount rates below 11.17%. Ford decides to delegate the task of calculating Nike’s weighted average cost of capital to Joanna Cohen, her assistant.

What is the WACC and why is it important to estimate a firm’s cost of capital? Do you agree with Joanna Cohen’s WACC calculation? Why or why not? WACC, or weighted average cost of capital, is a calculation of a company’s cost of financing proportionate to its degree of leverage. It is important to estimate a firm’s cost of capital as it serves as a type of benchmark when deciding where it would be most effective or worthwhile to deploy a company’s capital. We disagree with Joanna Cohen’s WACC calculation of 8.4% for Nike. This is due to her use of book values instead of market values in her calculation. Using a market value approach will more accurately reflect the most current opportunity cost to the company. Moreover, we noticed Joanna calculated Nike’s cost of debt by dividing the interest expense by the debt balance. We feel this calculation does not provide any meaningful information, and this approach would not be possible using only the information provided in the case study. Instead, we approach cost of debt by calculating the yield to maturity of Nike’s outstanding corporate bonds.

If you do not agree with Cohen’s analysis, calculate your own WACC for Nike and be prepared to justify your assumptions. We calculate Nike’s weighted average cost of capital to be 7.54% based on the following assumptions: Capital Structure: We started by verifying Nike’s capital structure weights. We used market values for both debt and equity. Preferred stock is given, however there is not enough information to calculate the cost of preferred stock, and its final weight is negligible regardless. Regarding debt, we used the sum of Current Portion of Long-term Debt, Notes Payable, and Market Value of long-term debt. We found MV of L.T. Debt by adjusting the book value of L.T. Debt against its current

trading price of .956 of par. Regarding equity, we simply multiplied shares outstanding by the most current price of Nike publicly traded common stock. Cost of Debt (7.17%) We calculated Nike’s cost of debt by finding the YTM of Nike’s corporate bonds. The information given includes the coupon rate of the bond, the maturity date, and the current price of the bonds. We then used the RATE function in excel while adjusting for semi-annual payments to arrive at a cost of debt of 7.17%. Cost of Equity (7.89%) We calculated Nike’s cost of equity by using the CAPM model. For the risk-free rate, we used 10-year U.S. Treasuries, as these more liquid than the also provided 10-year U.S. Treasuries. Regarding the equity risk premium, we decided to use the 2001 Implied Equity Risk Premium calculated by Aswath Damodaran of NYU Stern. We do not feel comfortable using the given 5.9% geometric mean or the arithmetic mean of 7.5% going back to 1926. Averages going back that far run the risk of being contaminated by “noise”, or variability cause by no longer relevant market environments. An example of the sensitivity of geometric mean of equity premiums can be found on page 4 of this report, and Damodaran’s risk premiums can be found here. Finally, we used the most recent market beta for Nike which is given at 0.69.

Calculate the costs of equity using CAPM, the dividend discount model, and the earnings capitalization ratio. What are the advantages and disadvantages of each method? CAPM (7.54%) CAPM is one of the most widely used models to estimate return on equity. It is very elegant in the way that it ties risk to return. This elegance comes at a cost. The degree to which the CAPM model is reliable is directly tied to the assumptions that are put into CAPM; in a sense, this is a second way in which CAPM ties risk to return. DDM (6.70%) The Dividend Discount model is also a popular tool when measuring return on equity. However, it does not account for risk in the way that beta does. In addition, DDM only uses two data points for dividends and then extrapolates the growth of those dividends at a constant rate. This type of assumption will degrade quickly over time periods of scale unless used on companies that have a very consistent track record of dividend payments as well as a solidified dividend policy. Earnings Capitalization Ratio (5.13%) We recently learned about the Earnings Capitalization Ratio and its uses. This model also does not account for risk, and it utilizes a given company’s P/E ratio and is simply [1 / (PE)]. The obvious downside to this model is the sharp variability of a company’s P/E ratio. P/E ratios are not easily forecasted, and are often most affected by investor sentiment more than fundamentals.

What should Kimi Ford recommend regarding an investment in Nike? Kimi Ford, a portfolio manager for North Point Group, is looking for value opportunities. Through a sensitivity analysis of a discounted cash flow forecast, Ms. Ford feels Nike would be a value opportunity at discount rates below 11.17%. We calculated Nike’s current weighted average cost of capital to be 7.54%, which is well below the threshold required to flag this company as undervalued. Along with this value opportunity comes the financial state of the company. Ratio analysis for 200 and 2001 shows Liquidity metrics improving across the board year over year. Regarding Asset Management, metrics have overall remained constant at favourable levels, with the only change coming in Payables Turnover, which increased slightly. All of Nike’s Debt Ratios have fallen year over year, which is our most promising sign that the company will succeed in its plans to restructure in response to changing market environments. WACC, or weighted average cost of capital, is a calculation of a company’s cost of financing proportionate to its degree of leverage. It is important in estimating a firm’s cost of capital as it serves as a type of benchmark when deciding where it would be most effective or worthwhile to deploy a company’s capital. WACC is a powerful concept that is centrally significant to measuring a company’s value. One example of its application is for value investors such as North Point in determining at what level of capital costs a company would be worth investing in or staying away from. Investors can then calculate what they believe the actual cost is, and compare these figures to make an investment decision. In this case, Ms. Ford’s decision should be to add Nike, Inc. To her portfolio, and to replace her assistant Joanna with an alumnus of Professor Sarmas’s FRL 440 class, who would make a more diligent and consistent analyst.

Key takeaways:

- Revenue theory is more appropriate for a going concern, but it is difficult to calculate market capitalization with this theory.

- When it comes to market capitalization, it is often said that "the concern is neither overcapitalization nor undercapitalization.

- The use of long-term fixed interest obligations and preferred equity capital in conjunction with equity capital is called financial leverage or equity trading.

- A company's capital structure is heavily influenced by sales growth and stability.

- There are two types of risks to consider when planning a company's capital structure: (i) business risks and (ii) financial risks.

- One of the hallmarks of a valid capital shape is conservation. Conservation does now no longer suggest hiring debt-unfastened or small debt.

- The nature and length of a enterprise additionally affects its capital shape.

- Whenever a enterprise desires extra price range, the enterprise's control desires to improve price range without dropping manipulate of the enterprise.

- Flexibility refers to an enterprise's capacity to conform its capital shape to the desires of converting situations.

- Marketability here means the ability of a company to sell or sell a particular type of security in a particular time period.

- Another factor to consider when making a funding decision is inflation.

- Floating costs will be incurred when raising funds. In general, the cost of fluctuating debt is less than the cost of fluctuating stock issuance.

- Net Income- According to this approach, a firm can minimise the weighted average cost of capital and increase the value of the firm as well as market price of equity shares by using debt financing to the maximum possible extent.

- The line of argument in favour of net income approach is that as the proportion of debt financing in capital structure increase, the proportion of a less expensive source of funds increases.

- Net Operating Income- This theory as suggested by Durand is another extreme of the effect of leverage on the value of the firm. It is diametrically opposite to the net income approach.

- According to the Net Operating Income (NOI) Approach, the financing mix is irrelevant and it does not affect the value of the firm.

- M&M hypothesis is identical with the Net Operating Income approach if taxes are ignored.

- Modigliani and Miller, in their article of 1963 have recognised that the value of the firm will increase or the cost of capital will decrease with the use of debt on account of deductibility of interest charges for tax purpose.

- The traditional approach, also known as Intermediate approach, is a compromise between the two extremes of net income approach and net operating income approach.

Reference:

- Chandra, Prasanna : Financial Management Theory and Practice

- Khan, M.Y. & Jain, P. K. : Financial Management Text and Problems

- Mclaney, E.J. : Financial Services. Business Finance Theory and Practice