Unit 3

Input Tax credit (ITC)

Input Tax Credit (ICT) means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business. The Mechanism of Input Tax Credit is the backbone of GST and is one of the most important reasons for the introduction of GST. As GST is a single tax levied across India (right from manufacture of goods/ services till it reaches the end customer), the chain does not get broken and everybody is able to take benefit of the same and there is seamless flow of credit.

Input Tax Credit of CGST/ SGST/ UTGST/ IGST

GST comprises of the following levies:-

- Central Goods and Services Tax (CGST) [also known as Central Tax] which is levied on intra-state or intra-union territory on supply of goods or services or both.

- State Goods and Services Tax (SGST) [also known as State Tax] which is levied on supply of goods or services or both within the same state.

- Union Territory Goods and Services Tax(UTGST) [also known as Union Territory Tax] which is levied on supply of goods or services within the same union territory.

- Integrated Goods & Services Tax (IGST) [also known as Integrated Tax) on inter-state supply of goods or services of both.

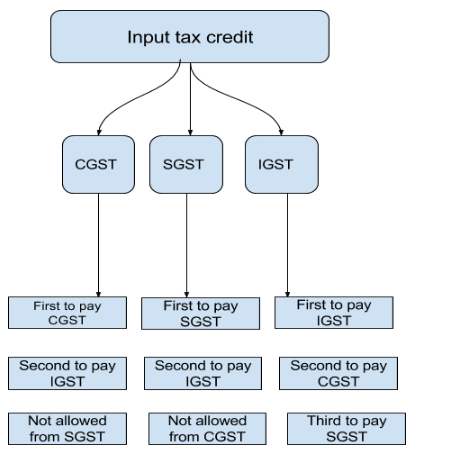

The input tax credit of these components of GST would be allowed in the following manner:-

- Credit of CGST – Allowed 1st for payment of CGST and the balance can be utilised for the payment of IGST. Credit of CGST is not allowed for payment of SGST.

- Credit of SGST/ UTGST – Allowed 1st for payment of SGST/UTGST and the balance can be utilised for the payment of IGST. Credit of SGST/ UTGST is not allowed for payment of CGST.

- Credit of IGST – Allowed 1st for payment of IGST, then for payment of CGST and the balance for payment of SGST/ UTGST.

Figure: Concept of ICT

Manner of utilization of ITC

The manner of utilisation of ICT are stated below-

- The input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully towards such payment. (Section 49 of the CGST Act)

- The Government may, on the recommendations of the Council, prescribe the order and manner of utilisation of the input tax credit on account of integrated tax, central tax, State tax or Union territory tax, as the case may be, towards payment of any such tax. (Section 49B)

- Input tax credit on account of integrated tax shall first be utilised towards payment of integrated tax, and the amount remaining, if any, may be utilised towards the payment of central tax and State tax or Union territory tax, as the case may be, in any order. (Rule 88A)

- Credit of integrated tax has to be utilised first for payment of integrated tax, then Central tax and then State tax.

- From 1st January 2021, certain taxpayers cannot utilise the ITC balance available in the electronic credit ledger to discharge more than 99% of the tax liability for a tax period. It means atleast 1% of tax liability must be paid by cash.

Block credit

Blocked Credit under GST means the supply of goods and services on which the availment of credit has been restricted by the relevant provisions of law.

Apportionment of credit and blocked credits (Section 17)

(1) Where the goods or services or both are used by the registered person partly for the purpose of any business and partly for other purposes, the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.

(2) Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.

(3) The value of exempt supply under sub-section (2) shall be such as may be prescribed, and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building.

(4) A banking company or a financial institution including a non-banking financial company, engaged in supplying services by way of accepting deposits, extending loans or advances shall have the option to either comply with the provisions of sub-section (2), or avail of, every month, an amount equal to fifty per cent of the eligible input tax credit on inputs, capital goods and input services in that month and the rest shall lapse.

(5) Notwithstanding anything contained in sub-section (1) of section 16 and subsection (1) of section 18, input tax credit shall not be available in respect of the following, namely:—

a) motor vehicles and other conveyances except when they are used––

(i) for making the following taxable supplies, namely:—

(A) further supply of such vehicles or conveyances ; or

(B) transportation of passengers; or

(C) imparting training on driving, flying, navigating such vehicles or conveyances;

(ii) for transportation of goods;

(b) the following supply of goods or services or both—

(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery except where an inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply;

(ii) membership of a club, health and fitness centre;

(iii) rent-a-cab, life insurance and health insurance except where––

(A) the Government notifies the services which are obligatory for an employer to provide to its employees under any law for the time being in force; or

(B) such inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as part of a taxable composite or mixed supply; and

(iv) travel benefits extended to employees on vacation such as leave or home travel concession;

c) works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;

d) goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

e) Explanation.–– For the purposes of clauses (c) and (d), the expression “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation, to the said immovable property;

f) goods or services or both on which tax has been paid under section 10;

g) goods or services or both received by a non-resident taxable person except on goods imported by him;

h) goods or services or both used for personal consumption;

i) goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

j) any tax paid in accordance with the provisions of sections 74, 129 and 130.

(6) The Government may prescribe the manner in which the credit referred to in sub-sections (1) and (2) may be attributed.

Supply not eligible for ITC

Eligibility and conditions for taking input tax credit (Section 16) are-

Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

However, ITC is not for the supply of following goods or services or both:

- Food and beverages

- Outdoor catering

- Beauty treatment

- Health services

- Cosmetic and plastic surgery

However, ITC will be available if the category of inward and outward supply is same or the component belongs to a mixed or composite supply under GST.

Example- XY Enterprises arranges for an office party for its employees. XY Enterprises will not be able to claim ITC on the food & beverages served.

Matching, reversal & Reclaim of ITC

Matching, reversal, and reclaim of Input Tax Credit (ITC) are important for taxpayers because it helps in claiming the accurate amount of ITC without any discrepancy. One can be considered as completely compliant to GST if their ITC claims are in place.

Matching of ICT

Issues related to unavailability of Input Tax Credit (ITC) are some of the major concerns for several taxpayers in India. The basic meaning of mismatched ITC can be understood as:

- Difference between the credit amounts disclosed in forms GSTR 3B and GSTR 2A

- Discrepancies between forms GSTR 1 and GSTR 3B

- Mismatch in the amount of claimed provisional credit and claimable actual credit (usually arises during transition stages)

Any of these mismatches which are noticed in returns will lead to issuance of scrutiny notices by officers to taxpayers.

The discrepancies noticed by an authorized officer in the filed returns will be communicated to the respective taxpayer through Form GST ASMT-10. This form will include:

- The officer’s observations

- Available time in which the taxpayer has to explain his/her position in response to the said notice

- The mismatched amount of tax and the reason for the discrepancy (optional)

Upon receiving the notice, taxpayers can accept the notice or reject the notice:

- Accepting the Notice: The taxpayer will have to respond to the notice in Form GST AMT-11 within 30 days or in the time period mentioned in the notice (whichever is earlier). Acceptance of this response may be communicated by the government in Form GST AMT-12.

- Rejecting the Notice: If the taxpayer does not reply to the notice, it will be considered as absence of explanation or justification on the part of the taxpayer. The taxpayer will be proceeded against by the government according to the law so as to recover the mismatched amount of ITC. The taxpayer may also be charged with an interest of 18% for wrongly claiming ITC.

Reversal of ICT

Any discrepancy which arises in returns may be rectified in the following manner:

- Excess claim of ITC with respect to supplier’s declaration OR Supplier has not declared outward supply:

- If there is a discrepancy in the ITC claimed with respect to the supplier’s declaration in returns, it will be communicated to the recipient and the supplier. On receiving the communication, the supplier will have to rectify the said discrepancy in valid returns.

- In case, the supplier fails to rectify the discrepancy, the excess amount of ITC claimed will be added to the recipient’s output tax liability in the following month.

Duplication of ITC claim by recipient:

- For any duplication of ITC claim, the recipient will have to face intimation about it. If the issue is not rectified then the previously claimed ITC will be added to the recipient’s output tax liability for the month when duplication was communicated.

- In case of additions, the recipient will have to pay interest for a maximum of 18% on the amount which was added to the output tax liability from the date when ITC was availed to the date when additions in returns were made.

Re-claim of ITC

- It means re-claiming the amount of ITC which was earlier reversed due to discrepancy in amount declared by supplier in his valid return or duplication of the ITC claim. Such re-claims can be made by the supplier only in case the supplier declares the details of invoice and/or debit notes in his valid return pertaining to the period in which the omission or incorrect particulars were noticed by the supplier, or the communication about the same was received.

- Any interest paid earlier on excess claim of ITC will be refunded by crediting the amount to the recipient’s Electronic Cash Ledger.

- In case of duplication of ITC claim, no refund will be allowed as it is a contravention of the GST provisions.

KEY TAKEAWAYS

- INPUT TAX CREDIT (ICT) MEANS CLAIMING THE CREDIT OF THE GST PAID ON PURCHASE OF GOODS AND SERVICES WHICH ARE USED FOR THE FURTHERANCE OF BUSINESS. THE MECHANISM OF INPUT TAX CREDIT IS THE BACKBONE OF GST AND IS ONE OF THE MOST IMPORTANT REASONS FOR THE INTRODUCTION OF GST.

Manner of Payment of GST liability

Section 49 of the Central Goods and Services Tax Act, along with rules published by the Central Board of Excise and Customs (CBEC), govern the new payment procedures.

a) Electronic ledgers

In the GST portal, a taxable person can track his tax liabilities across three ledgers, each maintained in real-time:

- Electronic liability ledger (also known as electronic tax liability register): Accounts for a taxpayer’s gross tax liability — form GST PMT-01 on the GST portal

- Electronic credit ledger (also known as electronic input tax credit ledger): Records the tax payments already made during the supply chain e. Every claim of ITC is recorded here — form GST PMT-02

- Electronic cash ledger: All amounts paid by the taxpayer are reflected here — form GST PMT-05

b) Electronic liability ledger

This ledger records all liabilities of a taxable person including:

- The tax, interest, late fees, or any other amount payable per the return furnished by the taxpayer or per any proceedings

- The tax and interest payable arising out of any mismatch of ITC or output tax liability

- Any interest that may accrue from time to time

- The reversal of ITC or interest

Taxpayers should settle their liabilities in the following order:

- Self-assessed tax and other dues, such as interest, penalty, fees, or any other amount relating to previous tax period returns

- Self-assessed tax and other dues relating to the current tax period return

- Any other amount payable under the act/rules (liability arising out of demand notice, proceedings, etc.)

c) Electronic credit ledger

Every claim of ITC self-assessed by the taxpayer shall be credited to this ledger. The amount available in this ledger may be used for payment towards output tax only. Under no circumstance can an entry be made directly in the electronic credit ledger.

This ledger may include the following:

- ITC on inward supplies from registered taxpayers

- ITC available based on distribution from input services distributor (ISD)

- ITC on input of stock held/semi-finished goods or finished goods held in stock on the day immediately preceding the date on which the taxpayer became liable to pay tax, provided he applies for registration within 30 days of becoming liable

- Permissible ITC on inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day of conversion from composition scheme to regular tax scheme

- ITC eligible on a payment made on a reverse charge basis

d) Electronic cash ledger

Any amount paid by the taxpayer will be reflected in the electronic cash ledger. The amount available in this ledger may be used for making any payment towards tax, interest, penalty, fees, or any other amount due under the act/rules in the time and manner prescribed. (It is reiterated that any credit in the electronic credit ledger can be utilized only for payment of output tax.) To initiate a payment, taxpayers generate a challan online using form GST PMT-06, which will be valid for a period of 15 days. Payment can then be remitted through any of the following modes:

- Internet banking (authorized banks only)

- Credit or debit card (authorized banks only)

- National Electronic Fund Transfer (NEFT) or real-time gross settlement (RTGS) (any bank, authorized or unauthorized)

- Over-the-counter (OTC) payment (authorized banks only) for deposits up to ten thousand rupees per challan and per tax period

The taxpayer is responsible for any commission due on the payment.

The payment date shall be recorded as the date the payment is credited to the appropriate government account. The date, the payment is debited from the taxpayer's account is not relevant.

Unregistered taxpayers needing to make a tax payment will still use the online GST portal but with a temporary identification number generated through the portal.

GST payment forms

Sl no | Form no | Short description | Purpose |

1. | GST PMT-01 | Electronic tax liability register | Any tax, interest, penalty, late fee, or any other amount will be debited to this register |

2 | GST PMT-02 | Electronic credit ledger | Every claim of ITC shall be credited to this ledger |

3 | GST PMT-03 | Refund to be recredited | Refund if rejected the amount debited from the electronic credit ledger or electronic cash ledger, as the case may be, will be recredited by order of a proper officer |

4 | GST PMT-04 | Discrepancy in electronic credit ledger | Discrepancy in electronic credit ledger, communicated to an officer through this form |

5 | GST PMT-05 | Electronic cash ledger | Any tax, interest, penalty, late fee, or any other amount to be deposited in cash are credited to this ledger |

6 | GST PMT-06 | Challan for deposit of tax | Generate and pay a challan |

7 | GST PMT-07 | Application for intimating discrepancy relating to payment | The application is meant for the tax payer where the amount intended to be paid is debited from his account but CIN has not been conveyed by bank to Common Portal or CIN has been generated but not reported by concerned bank (within 24 hours of debit)” |

Refund of excess GST

The GST refund process requires the taxpayer to follow elaborate steps, submit documents and declaration if required, to the GST authorities for claiming a GST refund. The refunds under GST can be the cash balance in the electronic cash ledger deposited in excess or tax paid by mistake or the accumulated Input Tax Credit (ITC) unable to be utilised for tax payments due to zero-rated sales or inverted tax structure.

The two steps involved in filing the GST refund pre-application form are as follows:

- Log in to the GST portal, go to the ‘Services’ tab, click on ‘Refunds’ and select the ‘Refund pre-application form’ option.

2. On the page displayed called ‘Refund pre-application form’, fill in the details asked, and click on ‘Submit’. A confirmation of submission will be displayed on the screen.

The following details must be reported:

- Nature of business – Manufacturer, merchant exporter, trader, and service provider

- Date of issue of IEC (only for exporters) – Those applying for a refund on account of exports (without payment of tax) must furnish the date of issue of the Import Export Certificate.

- Aadhaar number of the primary authorised signatory is mandatory.

- Value of exports made in the FY 2019-2020 (only for exporters) – This must be computed at the GSTIN level and not PAN level.

KEY TAKEAWAYS

- SECTION 49 OF THE CENTRAL GOODS AND SERVICES TAX ACT, ALONG WITH RULES PUBLISHED BY THE CENTRAL BOARD OF EXCISE AND CUSTOMS (CBEC), GOVERN THE NEW PAYMENT PROCEDURES.

Meaning

A GST return is a document containing details of all income/sales and/or expense/purchase which a taxpayer (every GSTIN) is required to file with the tax administrative authorities. This is used by tax authorities to calculate net tax liability.

Under GST, a registered dealer has to file GST returns that broadly include:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

Purpose & Importance of GST return

The purpose of GST return are-

- It is a Mode for transfer of information to tax administration under GST tax system.

- It Compliance verification program of tax administration.

- It declares tax liability for a given period.

- It provides necessary inputs for taking policy decision under GST system.

- It provides management of audit and anti-evasion programs of tax administration.

The importance of GST return are-

- GST return is a document that will contain all the details of sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax).

- It helps to pay the resulting tax liability to the government.

- It ensures all business owners and dealers who have registered under the GST system must file GST returns according to the nature of their business or transactions.

Different type of return and due date of filing return

Different types of return under GST are stated below-

1. GSTR-1

GSTR-1 is the return to be furnished for reporting details of all outward supplies of goods and services made. In other words, it contains the invoices and debit-credit notes raised on the sales transactions for a tax period. GSTR-1 is to be filed by all normal taxpayers who are registered under GST, including casual taxable persons. Any amendments to sales invoices made, even pertaining to previous tax periods, should be reported in the GSTR-1 return by all the suppliers or sellers.

The filing frequency of GSTR-1 is currently as follows:

(a) Monthly, by 11th* of every month- If the business either has an annual aggregate turnover of more than Rs.5 crore or has not opted into the QRMP scheme.

(b) Quarterly, by 13th** of the month following every quarter- If the business has opted into the QRMP scheme.

2. GSTR-2A

GSTR-2A is a view-only dynamic GST return relevant for the recipient or buyer of goods and services. It contains the details of all inward supplies of goods and services i.e., purchases made from GST registered suppliers during a tax period.

The data is auto-populated based on data filed by the corresponding suppliers in their GSTR-1 returns. Further, data filed in the Invoice Furnishing Facility (IFF) by the QRMP taxpayer, also get auto-filled. Since GSTR-2A is a read-only return, no action can be taken in it. However, it is referred by the buyers to claim an accurate Input Tax Credit (ITC) for every financial year, across multiple tax periods. In case any invoice is missing, the buyer can communicate with the seller to upload it in their GSTR-1 on a timely basis. It was used frequently for claiming ITC for every tax period until August 2020. Thereafter, the buyers must mostly refer to GSTR-2B, static return, to claim the input tax credit for every tax period.

3.GSTR-2B

GSTR-2B is again a view-only static GST return important for the recipient or buyer of goods and services. It is available every month, starting in August 2020 and contains constant ITC data for a period whenever checked back. TC details will be covered from the date of filing GSTR-1 for the preceding month (M-1) up to the date of filing GSTR-1 for the current month (M). The return is made available on the 12th of every month, giving sufficient time before filing GSTR-3B, where the ITC is declared. GSTR-2B provides action to be taken against every invoice reported, such as to be reversed, ineligible, subject to reverse charge, references to the table numbers in GSTR-3B.

4.GSTR-2

GSTR-2 is currently a suspended GST return, that applied to registered buyers to report the inward supplies of goods and services, i.e. the purchases made during a tax period. The details in the GSTR-2 return had to be auto-populated from the GSTR-2A. Unlike GSTR-2A, the GSTR-2 return can be edited. GSTR-2 is to be filed by all normal taxpayers registered under GST. However, the filing of the same has been suspended ever since September 2017.

5. GSTR-3

GSTR-3 is again currently a suspended GST return. It was a monthly summary return for furnishing summarized details of all outward supplies made, inward supplies received and input tax credit claimed, along with details of the tax liability and taxes paid. This return would have got auto-generated on the basis of the GSTR-1 and GSTR-2 returns filed. GSTR-3 is to be filed by all normal taxpayers registered under GST, however, the filing of the same has been suspended ever since September 2017.

6. GSTR-3B

GSTR-3B is a monthly self-declaration to be filed, for furnishing summarised details of all outward supplies made, input tax credit claimed, tax liability ascertained and taxes paid. GSTR-3B is to be filed by all normal taxpayers registered under GST. The sales and input tax credit details must be reconciled with GSTR-1 and GSTR-2B every tax period before filing GSTR-3B. GST reconciliation is crucial to identify mismatches in data, that may lead to GST notices in future or suspension of GST registration as well.

The filing frequency of GSTR-3B is currently as follows:

(a) Monthly, 20th* of every month- For taxpayers with an aggregate turnover in the previous financial year of more than Rs.5 crore or have been otherwise eligible but still opted out of the QRMP scheme.

(b) Quarterly, 22nd of the month following the quarter for ‘X’** category of States and 24th of the month following the quarter for ‘Y’** category of States.

7. GSTR-4

GSTR-4 is the annual return that was to be filed by the composition taxable persons under GST, by 30th April of the year following the relevant financial year. It has replaced the erstwhile GSTR-9A (annual return) from FY 2019-20 onwards. Prior to FY 2019-20, this return had to be filed on a quarterly basis. Thereafter, a simple challan in form CMP-08 filed by 18th of the month succeeding every quarter replaced it.

8.GSTR-5

GSTR-5 is the return to be filed by non-resident foreign taxpayers, who are registered under GST and carry out business transactions in India. The return contains details of all outward supplies made, inward supplies received, credit/debit notes, tax liability and taxes paid. The GSTR-5 return is to be filed monthly by the 20th of each month under GSTIN that the taxpayer is registered in India.

9. GSTR-5A

GSTR-5A refers to a summary return for reporting the outward taxable supplies and tax payable by Online Information and Database Access or Retrieval Services (OIDAR) provider under GST. The due date to file GSTR-5A is the 20th of every month.

10. GSTR-6

GSTR-6 is a monthly return to be filed by an Input Service Distributor (ISD). It will contain details of input tax credit received and distributed by the ISD. It will further contain details of all documents issued for the distribution of input credit and the manner of distribution. The due date to file GSTR-6 is the 13th of every month.

11. GSTR-7

GSTR-7 is a monthly return to be filed by persons required to deduct TDS (Tax deducted at source) under GST. This return will contain details of TDS deducted, the TDS liability payable and paid and TDS refund claimed if any.

The due date to file GSTR-7 is the 10th of every month.

12. GSTR-9

GSTR-9 is the annual return to be filed by taxpayers registered under GST. It is due by 31st December of the year following the relevant financial year, as per the GST law. It contains the details of all outward supplies made, inward supplies received during the relevant financial year under different tax heads i.e. CGST, SGST & IGST and a summary value of supplies reported under every HSN code, along with details of taxes payable and paid. It is a consolidation of all the monthly or quarterly returns (GSTR-1, GSTR-2A, GSTR-3B) filed during that financial year. GSTR-9 is required to be filed by all taxpayers registered under GST.

13. GSTR-9A

GSTR-9A is currently a suspended annual return earlier required to be filed by composition taxpayers. It had a consolidation of all the quarterly returns filed during that financial year. Ever since GSTR-4 (annual return) was introduced from FY 2019-20, this return stands scrapped. Prior to that, GSTR-9A filing for composition taxpayers had been waived off for FY 2017-18 and FY 2018-19.

14. GSTR-9C

GSTR-9C is the reconciliation statement to be filed by all taxpayers registered under GST whose turnover exceeds Rs.2 crore in a financial year, as per the GST law. It must be certified by a Chartered Accountant/Cost & Management Accountant after conducting a thorough GST audit of the books of accounts and comparing the figures with the GSTR-9. The deadline to file this statement is the same as the due date prescribed for GSTR-9, i.e., 31st December of the year following the relevant financial year.

15. GSTR-10

GSTR-10 is to be filed by a taxable person whose registration has been cancelled or surrendered. This return is also called a final return and has to be filed within three months from the date of cancellation or cancellation order, whichever is earlier.

16. GSTR-11

GSTR-11 is the return to be filed by persons who have been issued a Unique Identity Number (UIN) in order to get a refund under GST for the goods and services purchased by them in India. UIN is a classification made for foreign diplomatic missions and embassies not liable to tax in India, for the purpose of getting a refund of taxes. GSTR-11 will contain details of inward supplies received and refund claimed.

KEY TAKEAWAYS

- A GST RETURN IS A DOCUMENT CONTAINING DETAILS OF ALL INCOME/SALES AND/OR EXPENSE/PURCHASE WHICH A TAXPAYER (EVERY GSTIN) IS REQUIRED TO FILE WITH THE TAX ADMINISTRATIVE AUTHORITIES. THIS IS USED BY TAX AUTHORITIES TO CALCULATE NET TAX LIABILITY.

Meaning

Under GST, the term “assessment” means a determination of tax liability under this Act and includes self-assessment, re-assessment, provisional assessment, summary assessment, and best judgment assessment. Normally, persons having GST registration file GST returns and pay GST every month based on self-assessment of GST liability.

Types-self assessment

The different types of assessment under GST are as under:

- Section 59 – Self-assessment of taxes payable

- Section 60 – Provisional assessment

- Section 61 – Scrutiny of tax returns filed by registered taxable persons

- Section 62 – Assessment of registered taxable person who has failed to file the tax returns

- Section 63 – Assessment of unregistered persons

- Section 64 – Summary assessment in certain special cases

Such types are discussed below-

- Self-Assessment (Section 59)

The taxable person is required to pay tax on the basis of self-assessment done by himself. Hence, all GST return filings are based on self-assessment by the taxpayer.

2. Provisional Assessment

Provisional assessment can be conducted for a taxable person when the taxpayer is unable to determine the value of goods or services or both or determine the rate of tax applicable thereto. Procedure for Provisional Assessment are-

Step 1: The taxable person has to give, the concerned GST officer, a request for provisional assessment in writing.

Step 2: The GST officer on reviewing the application will pass an order within a period not later than ninety days from the date of receipt of the request, allowing payment of tax on a provisional basis or at a GST rate or on such value as specified by him.

Step 3: The taxable person, who is making payment on a provisional basis, has to issue a bond with security promising to pay the difference between a provisionally assessed tax and final assessed tax.

Step 4: The GST officer will pass a final assessment, with a period not exceeding six months from the date of communication of the order of provisional payment.

3. Scrutiny Assessment (Section 61)

GST Officers can scrutinize a GST return and related particulars furnished by the registered person to verify the correctness of the return. This is called a scrutiny assessment. In case of any discrepancies noticed by the officer, he/she would inform the same to the registered person and seek his explanation on the same. On the basis of the explanation received from the registered person, the officer can take the following action:

- If the explanation provided by the individual seems satisfactory, the officer shall inform about the same to the registered person, and no the officer shall take no further action in this regard.

- However, upon unsatisfactory explanation or the registered person failed to take corrective measures after accepting the discrepancies, the proper officer shall initiate appropriate action like conducting an audit of the registered person, conducting a special audit, inspect and search the place of business of the registered person, or initiate demand and recovery provisions.

4. Failure to File GST Return – Best Judgement Assessment (Section 62)

When a registered person fails to furnish the required returns, even after service of notice under Section 46, an assessment would be conducted by the GST Officer. In such cases, the GST officer would proceed to assess the tax liability of the taxpayer to the best of his judgment taking into account all the relevant material which is available or which he has gathered and issue an assessment order within a period of five years from the date for furnishing of the annual return for the financial year to which the tax not paid relates. On receipt of the said assessment order, if the registered person furnishes a valid return within a period of 30 days from the date of issuance of the assessment order, then in such case, the assessment order would be deemed to have withdrawn. However, the registered person will be liable to pay interest under Section 50 (1) and/or liable to pay a late fee under Section 47.

5. Assessment of Unregistered Person- best judgement(Section 63)

When a taxable person fails to obtain GST registration even though liable to do so or whose registration has been cancelled under section 29 (2) but who was liable to pay tax, the GST officer can proceed to assess the tax liability of such taxable person to the best of his judgment for the relevant tax periods and issue an assessment order within a period of five years from the date specified under section 44 for furnishing of the annual return for the financial year to which the tax not paid relates.

6. Summary Assessment (Section 64)

A GST Officer can on any evidence showing a tax liability of a person coming to his notice, proceed to assess the tax liability of such person to protect the interest of revenue and issue an assessment order if he has sufficient grounds to believe that any delay in doing so may adversely affect the interest of revenue. In order to undertake assessment under section 64, the proper officer should obtain previous permission of additional commissioner or joint commissioner. Such an assessment is called a summary assessment.

KEY TAKEAWAYS

- UNDER GST, THE TERM “ASSESSMENT” MEANS A DETERMINATION OF TAX LIABILITY UNDER THIS ACT AND INCLUDES SELF-ASSESSMENT, RE-ASSESSMENT, PROVISIONAL ASSESSMENT, SUMMARY ASSESSMENT, AND BEST JUDGMENT ASSESSMENT.

Case study

The officers of Central Goods and Services Tax (CGST) Commissionerate, Delhi East, carried out the detailed analysis and unearthed a network of fictitious exporters who were availing and utilizing fake Input Tax Credit (ITC) of Rs 134 crore under the Goods and Services Tax (GST) with an intent to claim IGST refund fraudulently. On the basis of Risk Analysis, a risky exporter M/s Vibe Tradex was identified for scrutiny. M/s Vibe Tradex is engaged in export of Pan Masala, chewing tobacco, FMCG goods, etc. The network of fictitious exporters was being operated by a person named Mr. Chirag Goel, who is an MBA from the University of Sunderland, UK. On an extensive analysis of the e-Way Bills generated by two supplier firms/ companies owned by his associate, who is at large, it was found that the vehicles for which the e-way Bill were generated for the purported supply of goods were being used in distant cities namely Gujrat, Maharashtra, Madhya Pradesh and had never entered Delhi during the said period. The fake Input Tax Credit availed and utilized is Rs. 134 crore. Mr Chirag Goel masterminded a deep-rooted conspiracy to defraud the Government and committed offenses specified under Section 132(1)(c) of the CGST Act, 2017 which are cognizable and non-bailable. He has been remanded to judicial custody by the Metropolitan Magistrate Patiala House Courts, New Delhi, for a period of 14 days till 26.10.2021. Further investigation in the case is under progress.

References:

1. Agrawal, Raj. K; Advanced Handbook on GST.

2. Background Material on Model GST Law, Sahitya Bhawan Publications.

3. Bansal,K.M; GST a Customer’s Law, TAXMANN Publication(P)Ltd, University Edition.

4. Chaudhary, Vashishtha; Dalmia, Ashu; Girdharwal, “GST- A Practical Approach”, Taxman Publication.