Unit 1

Negotiable Instruments

Negotiable instrument is written contact between the parties which are freely transferable in nature.

According to Section 13 (a) of the Act, “Negotiable instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer, whether the word “order” or “bearer” appear on the instrument or not.”

There are two conditions of negotiability:

1. The instrument should be freely transferable (by delivery or by endorsement. And delivery) by the custom of the trade; and

2. The person who obtains it in good faith and for value should get it free from all defects, and be entitled to recover the money of the instrument in his own name.

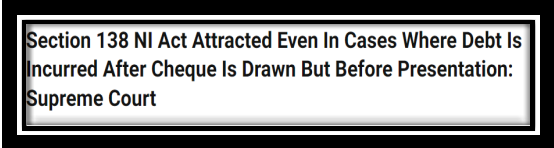

Features of negotiable instrument

The features of negotiable instrument are stated below-

Figure: Features of NI

- Property:

The prossessor of the negotiable instrument is presumed to be the owner of the property contained therein. A negotiable instrument does not merely give possession of the instrument but right to property also. The property in a negotiable instrument can be transferred without any formality. In the case of bearer instrument, the property passes by mere delivery to the transferee. In the case of an order instrument, endorsement and delivery are required for the transfer of property.

2. Title:

The transferee of a negotiable instrument is known as ‘holder in due course.’ A bona fide transferee for value is not affected by any defect of title on the part of the transferor or of any of the previous holders of the instrument.

3. Rights:

The transferee of the negotiable instrument can sue in his own name, in case of dishonour. A negotiable instrument can be transferred any number of times till it is at maturity. The holder of the instrument need not give notice of transfer to the party liable on the instrument to pay.

4. Presumptions:

Certain presumptions apply to all negotiable instruments e.g., a presumption that consideration has been paid under it. It is not necessary to write in a promissory note the words ‘for value received’ or similar expressions because the payment of consideration is presumed. The words are usually included to create additional evidence of consideration.

5. Prompt payment:

A negotiable instrument enables the holder to expect prompt payment because a dishonour means the ruin of the credit of all persons who are parties to the instrument.

Key Takeaways

- Negotiable instrument is written contact between the parties which are freely transferable in nature.

Promissory Notes- Definitions and features

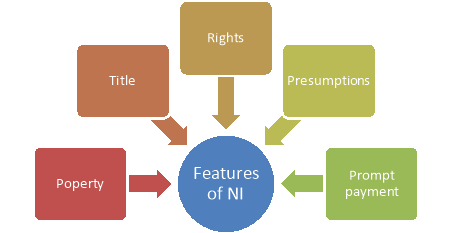

Section 4 of the Act defines, “A promissory note is an instrument in writing (note being a bank-note or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.”

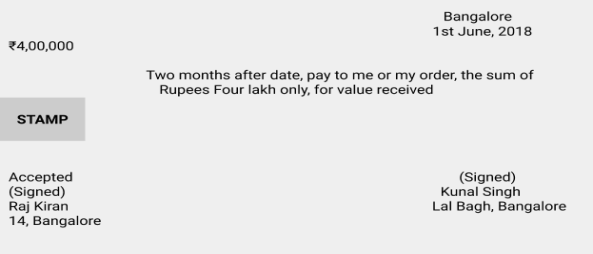

Image: Specimen of promissory note

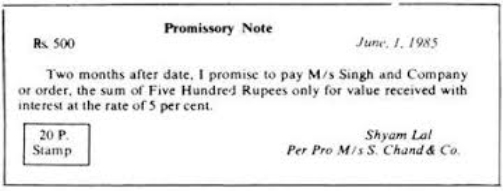

A promissory note possesses the following features:

Figure: Features of promissory note

(1) It must be in writing:

A mere verbal promise to pay is not a promissory note. The method of writing (either in ink or pencil or printing, etc.) is unimportant, but it must be in any form that cannot be altered easily.

(2) It must certainly an express promise or clear understanding to pay:

There must be an express undertaking to pay. A mere acknowledgment is not enough. The following are not promissory notes as there is no promise to pay.

(3) Promise to pay must be unconditional:

A conditional undertaking destroys the negotiable character of an otherwise negotiable instrument. Therefore, the promise to pay must not depend upon the happening of some outside contingency or event. It must be payable absolutely.

(4) It should be signed by the maker:

The person who promises to pay must sign the instrument even though it might have been written by the promisor himself. It may be in pencil or ink, a thumb mark or initials.

(5) The maker must be certain:

The note self must show clearly who is the person agreeing to undertake the liability to pay the amount. In case a person signs in an assumed name, he is liable as a maker because a maker is taken as certain if from his description sufficient indication follows about his identity. In case two or more persons promise to pay, they may bind themselves jointly or jointly and severally, but their liability cannot be in the alternative.

(6) The payee must be certain:

The instrument must point out with certainty the person to whom the promise has been made. The payee may be ascertained by name or by designation. A note payable to the maker himself is not pronate unless it is indorsed by him. In case, there is a mistake in the name of the payee or his designation; the note is valid, if the payee can be ascertained by evidence. Even where the name of a dead person is entered as payee in ignorance of his death, his legal representative can enforce payment.

(7) The promise should be to pay money and money only:

Money means legal tender money and not old and rare coins. A promise to deliver paddy either in the alternative or in addition to money does not constitute a promissory note.

(8) The amount should be certain:

One of the important characteristics of a promissory note is certainty—not only regarding the person to whom or by whom payment is to be made but also regarding the amount.

Parties to a Promissory Note

1. Maker: He is the person who promises to pay the amount stated in the note. He is the debtor.

2. Payee: He is the person to whom the amount is payable i.e. the creditor.

3. Holder: He is the payee or the person to whom the note might have been indorsed.

4. The indorser and indorsee (the same as in the case of a bill).

Bills of Exchange- Definition and features

Section 5 of the Act defines, “A bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument”.

Image: Specimen of bills of exchange

Essential features of a bill of exchange are-

(1) It must be in writing.

(2) It must be signed by the drawer.

(3) The drawer, drawee and payee must be certain.

(4) The sum payable must also be certain.

(5) It should be properly stamped.

(6) It must contain an express order to pay money and money alone.

Parties to Bills of Exchange

1. Drawer: The maker of a bill of exchange is called the ‘drawer’.

2. Drawee: The person directed to pay the money by the drawer is called the ‘drawee’,

3. Acceptor: After a drawee of a bill has signed his assent upon the bill, or if there are more parts than one, upon one of such pares and delivered the same, or given notice of such signing to the holder or to some person on his behalf, he is called the ‘acceptor’.

Types of bills of exchange

Figure: Types of bills of exchange

(1) Inland and Foreign Bills Inland bill:

A bill is, named as an inland bill if:

(a) it is drawn in India on a person residing in India, whether payable in or outside India, or

(b) it is drawn in India on a person residing outside India but payable in India. The following are the Inland bills

(i) A bill is drawn by a merchant in Delhi on a merchant in Madras. It is payable in Bombay. The bill is an inland bill.

(ii) A bill is drawn by a Delhi merchant on a person in London, but is made payable in India. This is an inland bill.

(iii) A bill is drawn by a merchant in Delhi on a merchant in Madras. It is accepted for payment in Japan. The bill is an inland bill.

A bill which is not an inland bill is a foreign bill. The following are the foreign bills:

i) A bill drawn outside India and made payable in India.

Ii) A bill drawn outside India on any person residing outside India.

Iii) A bill drawn in India on a person residing outside India and made payable outside India.

Iv) A bill drawn outside India on a person residing in India.

v) A bill drawn outside India and made payable outside India.

(2) Time and Demand Bill Time bill:

A bill payable after a fixed time is termed as a time bill. In other words, bill payable “after date” is a time bill.

A bill payable at sight or on demand is termed as a demand bill.

(3) Trade and Accommodation Bill:

A bill drawn and accepted for a genuine trade transaction is termed as a “trade bill”.

A bill drawn and accepted not for a genuine trade transaction but only to provide financial help to some party is termed as an “accommodation bill”.

Cheques - Crossing of Cheques – Types of Crossing

Section 6 of the Act defines “A cheque is a bill of exchange drawn on a specified banker, and not expressed to be payable otherwise than on demand”.

A cheque is bill of exchange with two more qualifications, namely,

(i) it is always drawn on a specified banker, and

(ii) it is always payable on demand. Consequently, all cheque are bill of exchange, but all bills are not cheque.

Parties to a Cheque

1. Drawer: He is the person who draws the cheque, i.e., the depositor of money in the bank.

2. Drawee: It is the drawer’s banker on whom the cheque has been drawn.

3. Payee: He is the person who is entitled to receive the payment of the cheque.

4. The holder, indorser and indorsee (the same as in the case of a bill or note).

Crossing of Cheques

A crossing is an instruction to the paying banker to pay the amount of cheque to a particular banker and not over the counter. The crossing of the cheque secures the payment to a banker.

It also traces the person so receiving the amount of cheque. Addition of words ‘Not negotiable’ or ‘Account Payee only’ is necessary to restrain the negotiability of the cheque. The crossing of a cheque ensures security and protection to the holder.

Types of Crossing

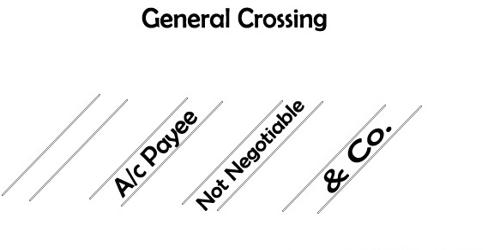

- General Cheque Crossing

In general crossing, the cheque bears across its face an addition of two parallel transverse lines and/or the addition of words ‘and Co.’ or ‘not negotiable’ between them. In the case of general crossing on the cheque, the paying banker will pay money to any banker. For the purpose of general crossing two transverse parallel lines at the corner of the cheque are necessary. Thus, in this case, the holder of the cheque or the payee will receive the payment only through a bank account and not over the counter. The words ‘and Co.’ have no significance as such.

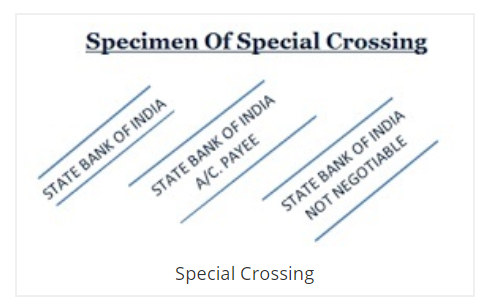

2. Special Cheque Crossing

In special crossing, the cheque bears across its face an addition of the banker’s name, with or without the words ‘not negotiable’. In this case, the paying banker will pay the amount of cheque only to the banker whose name appears in the crossing or to his collecting agent.

3. Restrictive Cheque Crossing or Account Payee’s Crossing

This type of crossing restricts the negotiability of the cheque. It directs the collecting banker that he needs to credit the amount of cheque only to the account of the payee, or the party named or his agent. Where the collecting banker credits the proceeds of a cheque bearing such crossing to any other account, he shall be guilty of negligence.

Key Takeaways

- A promissory note is an instrument in writing (note being a bank-note or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.

The word ‘endorsement’ in its literal sense means, writing on the back of an instrument. But under the Negotiable Instruments Act it means, the writing of one’s name on the back of the instrument or any paper attached to it with the intention of transferring the rights therein. Thus, endorsement is signing a negotiable instrument for the purpose of negotiation. The person who effects an endorsement is called an ‘endorser’, and the person to whom negotiable instrument is transferred by endorsement is called the ‘endorsee’.

Who may endorse?

The payee of an instrument is the rightful person to make the first endorsement. Thereafter the instrument may be endorsed by any person who has become the holder of the instrument. The maker or the drawer cannot endorse the instrument but if any of them has become the holder thereof he may endorse the instrument (Sec. 51). The maker or drawer cannot endorse or negotiate an instrument unless he is in lawful possession of instrument or is the holder there of. A payee or indorsee cannot endorse or negotiate unless he is the holder there of.

Essentials of a valid endorsement

The following are the essentials of a valid endorsement:

1. It must be on the instrument:

The endorsement may be on the back or face of the instrument and if no space is left on the instrument, it may be made on a separate paper attached to it. It should usually be in ink.

2. It must be made by the maker or holder of the instrument. A stranger cannot endorse it.

3. It must be signed by the endorser. Full name is not essential. Initials may suffice. Thumb-impression should be attested. Signature may be made on any part of the instrument. A rubber stamp is not accepted but the designation of the holder can be done by a rubber stamp.

4. It may be made either by the endorser merely signing his name on the instrument (it is a blank endorsement) or by any words showing an intention to endorse or transfer the instrument to a specified person (it is an endorsement in full). No specific form of words is prescribed for an endorsement. But intention to transfer must be present. When in a bill or note payable to order the endorsee’s name is wrongly spelt, he should when he endorses it, sign the name as spelt in the instrument and write the correct spelling within brackets after his endorsement.

5. It must be completed by delivery of the instrument. The delivery must be made by the endorser himself or by somebody on his behalf with the intention of passing property therein. Thus, where a person endorses an instrument to another and keeps it in his papers where it is found after his death and then delivered to the endorsee, the latter gets no right on the instrument.

6. It must be an endorsement of the entire bill. A partial endorsement i.e. which purports to transfer to the endorsee a part only of the amount payable does not operate as a valid endorsement. If delivery is conditional, endorsement is not complete until the condition is fulfilled.

Types of endorsement

The types of endorsement are discussed below-

(a) Blank or general endorsement (Sections 16 and 54):

It is an endorsement when the endorser merely signs on the instrument without mentioning the name of the person in whose favour the endorsement is made. Endorsement in blank specifies no endorsee. It simply consists of the signature of the endorser on the endorsement. A negotiable instrument even though payable to order becomes a bearer instrument if endorsed in blank. Then it is transferable by mere delivery. An endorsement in blank may be followed by an endorsement in full.

Example: A bill is payable to X. X endorses the bill by simply affixing his signature. This is an endorsement in blank by X. In this case the bill becomes payable to bearer.

(b) Special or full endorsement (Section 16):

When the endorsement contains not only the signature of the endorser but also the name of the person in whose favour the endorsement is made, then it is an endorsement in full. Thus, when endorsement is made by writing the words “Pay to A or A’s order,” followed by the signature of the endorser, it is an endorsement in full. In such an endorsement, it is only the endorsee who can transfer the instrument.

(c) Partial endorsement (Section 56)

A partial endorsement is one which purports to transfer to the endorsee a part only of the amount payable on the instrument. Such an endorsement does not operate as a negotiation of the instrument.

Example: A is the holder of a bill for Rs.1000. He endorses it “pay to B or order Rs.500.” This is a partial endorsement and invalid for the purpose of negotiation.

(d) Restrictive endorsement (Section 50)

The endorsement of an instrument may contain terms making it restrictive. Restrictive endorsement is one which either by express words restricts or prohibits the further negotiation of a bill or which expresses that it is not a complete and unconditional transfer of the instrument but is a mere authority to the endorsee to deal with bill as directed by such endorsement. “Pay C,” “Pay C for my use,” “Pay C for the account of B” are instances of restrictive endorsement. The endorsee under a restrictive endorsement acquires all the rights of the endoser except the right of negotiation

(e) Conditional or qualified endorsement

An endorsement may be made conditional or qualified in any of the following forms:

(i) ‘Sans recourse’ endorsement:

An endorser may be express word exclude his own liability thereon to the endorser or any subsequent holder in case of dishonour of the instrument. Such an endorsement is called an endorsement sans recourse (without recourse). Thus ‘Pay to A or order sans recourse, ‘pay to A or order without recourse to me,’ are instances of this type of endorsement. Here if the instrument is dishonoured, the subsequent holder or the indorsee cannot look to the indorser for payment of the same. An agent signing a negotiable instrument may exclude his personal liability by using words to indicate that he is signing as agent only. The same rule applies to directors of a company signing instruments on behalf of a company. The intention to exclude personal liability must be clear. Where an endorser so excludes his liability and afterwards becomes the holder of the instrument, all intermediate endorsers are liable to him. Example: A is the holder of a negotiable instrument. Excluding personal liability by an endorsement without recourse, he transfers the instrument to B, and B endorses it to C, who endorses it to A. A can recover the amount of the bill from B and C.

(ii) Facultative endorsement:

An endorsement where the endorser extends his liability or abandons some right under a negotiable instrument, is called a facultative endorsement. “Pay A or order, Notice of dishonour waived” is an example of facultative endorsement.

(iii) ‘Sans frais’ endorsement:

Where the endorser does not want the endorsee or any subsequent holder, to incur any expense on his account on the instrument, the endorsement is ‘sans frais’.

(iv) Liability dependent upon a contingency:

Where an endorser makes his liability depend upon the happening of a contingent event, or makes the rights of the endorsee to receive the amount depend upon any contingent event, in such a case the liability of the endorser will arise only on the happening of that contingent event. Thus, an endorser may write ‘Pay A or order on his marriage with B’. In such a case, the endorser will not be liable until the marriage takes place and if the marriage becomes impossible, the liability of the endorser comes to an end.

Case study

Allowing courts to make summary convictions and discouraging the use of cheques can help reduce the huge pile-up of cases The Supreme Court recently came out with a slew of directions to ensure speedy disposal of cheque-bounce cases. The court referred to a recent study that revealed more than 35 lakh cheque-bounce cases are pending, constituting more than 15 per cent of the total criminal cases pending in district courts. The issue of prolonged litigation with respect to dishonoured cheques came to the court’s notice when it was hearing a case dating back to 2005 recently. The apex court has said that the evidence in cheque dishonour cases can now be tendered by filing affidavits and there would be no need to examine witnesses physically. The court has asked the Centre to make “suitable amendments” in the Negotiable Instruments Act to ensure that trials in cheque-bounce cases lodged in 12 months against a person can be clubbed together into one consolidated case. Until 1989, failure to discharge the liability of a payment through cheque was only a civil liability. By amending Section 138 of Negotiable Instruments Act 1881, the civil liability was converted as a criminal liability. The objective of introducing Section 138 was to encourage the culture of using cheques and enhance the credibility of the instrument. It was also to inculcate faith in the efficacy of banking operations by making the issuer of the cheque liable for penalties in case it is dishonoured. Due care has also been taken to prevent harassment of honest drawers of cheque. Prior to this, the drawer of a dishonoured cheque could only be criminally prosecuted under Section 420 of the Indian Penal Code (for offence of cheating). To convict persons under Section 420, the prosecution had to establish dishonest intention on the part of the issuer of the cheque from the inception of the cheque and just because the cheque is dishonoured the crime of cheating is not established.

However, under Section138 of the NI Act if a cheque is dishonoured for insufficient funds, the offence under the Act is constituted, notwithstanding the intention of the person issuing the cheque. But as observed by the Supreme Court, Indian courts are riddled with the colossal problem of pending cases. This defeats the very purpose of making cheque return a criminal offence, and the credibility of the cheque system is seriously affected. The existing legal provisions contain sufficient safeguards like issuing of notice of dishonour by the beneficiary within 30 days, 15 days’ time for the issuer to make the payment and one-month time to file complaint for the beneficiary. The introduction of Section 138 initially enhanced the credibility of the usage of cheques. Casual way of issuing cheques has been arrested to a large extent. Hence measures are required to speed up the settlement of cheque-bounce cases; faster conviction will be a deterrent to offenders. As suggested by the Supreme Court, additional courts can be established. But this will involve huge costs and logistic issues too. There are other measures that can also be considered.

The beneficiary of the returned cheque always files a criminal case with sufficient documentary proof like returned cheque and return memo from the drawee bank. Hence just on scrutinising the documents, the court can decide about the conviction of the issuer of the cheque, without providing any scope for prolonging the case. In a way, there can be automatic (summary) conviction. This can be done by making suitable amendments to the legal provisions. It is also possible to create a database for cheques returned by banks with facility of verification by government agency or court for confirmation before conviction. Issue of bailable or non-bailable warrant, based on the documentary evidence, can also discourage people issuing cheques without funds. It is possible to restrict the usage of cheques itself. When there are digital payments like NEFT, IMPS, RTGS, etc., that are available 24x7x365, the system of issuing cheques can be restricted for smaller payments. By suitable amendment to Negotiable Instruments Act, the amount that can be transacted through cheque can be restricted. It is also possible to make cheque transactions costly by levying appropriate charges for any transaction through cheque. This will automatically migrate people to the digital payment system. Banks are incurring huge cost for providing cheque facility to the customers and also for clearing huge volume of cheques through the Cheque Truncation System. When 20 of the 27 EU member-states have effectively eliminated cheques, with usage down to two cheques per capita per annum, India, with strong mobile phone and internet penetration, should be able to move to paperless bank transaction smoothly.

Key Takeaways

- The word ‘endorsement’ in its literal sense means, writing on the back of an instrument.

References:

1. Gordon & Natarajan: Banking Theory Law and Practice, HPH

2. S. P Srivastava; Banking Theory & Practice, Anmol Publications

4. M. Prakash, Bhargavi VR: Banking law & Operation, Vision Book House.

5. Tannan M.L: Banking Law and Practice in India, Indian Law House