Unit 2

Banker and Customer Relationship

Banker and Bank

Banker refers to the institution that provides banking services to its customers.

According to section 5(b) of Banking Regulation Act, 1949, “banking” means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by cheque, draft, order or otherwise.

According to section 5 (c) of Banking Regulation Act, 1949, “banking company” means any company which transacts the business of banking [in India]. Explanation— Any company which is engaged in the manufacture of goods or carries on any trade and which accepts deposits of money from the public merely for the purpose of financing its business as such manufacturer or trader shall not be deemed to transact the business of banking within the meaning of this clause.

In other words, the term bank refers to a financial institution that accepts deposits, makes various loans, and offers basic financial products like certificates of deposit (CDs) and savings accounts to individuals and small businesses. For example, SBI, UBI, Yes bank, Union bank etc.

Importance of bank

Some of the importance of bank is mentioned below-

- Commercial bank provides an institutional framework for savings and investment of money and it promotes capital formation in the economy.

- It provides loans and advances to the borrowers of different sectors of the economy like agriculture, business, education, housing etc.

- It focuses on rural development of the economy by focussing on priority sector lending.

- It provides digital banking services to customers to provide convenient banking services to the customers.

- It reduces the grip of money lenders form the rural economy by establishing more bank branches in the rural and unbanked areas.

Functions of bank

The bank provides variety of service to satisfy the customer needs. The functions of commercial bank are-

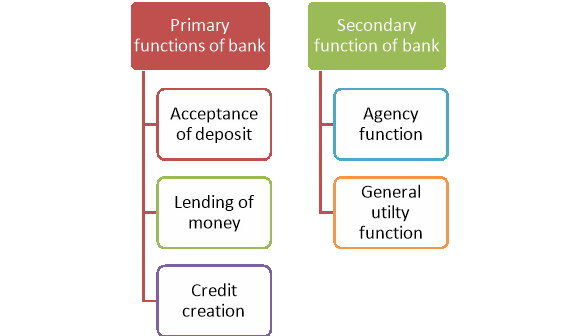

Figure: Functions of bank

A) Primary functions: These are the traditional functions of commercial banks.

i) Acceptance of deposit: Banks accept deposit from the public under savings account, current account, recurring deposit account and fixed deposit account. Deposits of savings and current account are repayable on demand and deposit of recurring and fixed account is repayable on maturity.

Ii) Lending of money: Banks lend money to the general public to satisfy their borrowing needs. Different types of lending facilities provided to the customers by banks are bank overdraft, discounting of bills, cash credit and term loans.

Iii) Creation of credit: Banks create credit while lending money to the borrowers. When bank approve any loan of a customer, it opens a secondary/loan account in the name of the borrower and deposit (credit) the sanctioned loan amount. Thus banks create credit through its lending activities.

B) Secondary functions: Secondary functions of bank are grouped under two heads-

i) Agency functions: Bank acts as an agent for its customers. Some of the agency functions performed by banks are-

- Collection and payment of cheque on behalf of customers.

- Purchase and sale of securities through Demat account on behalf of customers.

- Collection of interest and dividend from respective company and credit the same in respective account of customers.

- Payment of premium, bills, standing orders etc. on scheduled date on behalf of the customers.

- Remittance of money from one place to another place etc.

Ii) General utility functions: Banker perform general utility functions to provide the customers retail and more convenient banking services. Some of the general utility functions performed by banks are-

- Gift cheque and travellers cheque facility.

- Tax consultancy service for efficient tax planning of beneficiaries.

- Locker facility service to keep valuable documents and ornaments.

- Plastic money (Debit card, credit card) facility for easy handling of cash.

- Internet banking and mobile banking facility for fast and convenient transfer and payment of money.

- Green channel facility for promotion of cashless transactions etc.

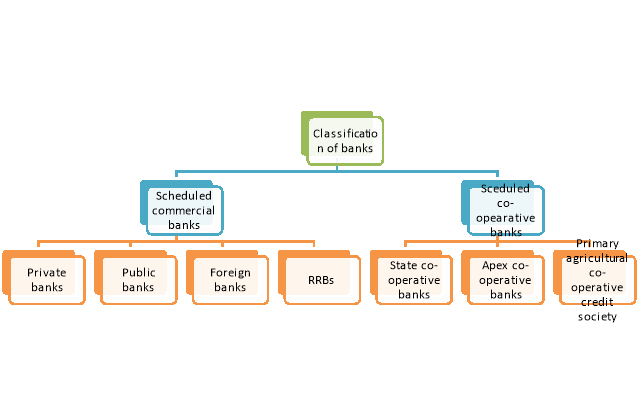

Structure/Classification of banking system in India

Depending on the nature of activities performed and ownership, the classification of banks are discussed below-

Figure: Classification of banks

A) Scheduled Commercial banks: It refers to the banks established to facilitate trade and industry. It is again sub-divided as follow-

i) Public sector bank: It refers to the commercial banks where more than 50 per cent shares are held by the government. At present there are 12 public sector banks in India. It is again grouped as-

- SBI and its associates

- Other nationalised banks.

Some examples of public sector banks are State Bank of India, Punjab National bank, Union Bank of India etc.

Ii) Private sector bank: It refers to the commercial banks where more than 50 per cent shares are owned by the private individuals. Some examples of private sector bans are Yes bank, ICICI, City bank, Federal bank etc.

Iii) Foreign bank: It refers to the commercial bank which is operating in India but their head office is situated outside India. For example HSBC ban Ltd. Standard Chartered etc.

Iv) Regional Rural Bank: RRBs are commercial banks established to operate at regional level of different states and to focus on the banking needs of rural masses. For example, Maharashtra Garmin bank, Assam Gramin Vikash bank etc.

B) Scheduled Co-operative bank: It refers to the bank established according to the co-operative principle and consumers are the owners of the bank. It provides normal banking services to its customers but it mainly focus on the agriculture and allied activities. It operates under three tier structure-

- State Co-operative banks operate at the State level

- Apex Co-operative banks operate at the District level

- Primary Agricultural Co-operative Credit Society operates at the village level.

Key Takeaways

- Commercial bank refers to a financial institution that accepts deposits, makes various loans, and offers basic financial products like certificates of deposit (cds) and savings accounts to individuals and small businesses.

The term Customer has not been defined by any act. In simple words a customer is such a person to whom you extend your services in return of consideration. A customer is a person who maintains an account with the bank without taking into consideration the duration and frequency of operation of his account. To be a customer for any bank the individual should have an account with the bank. The individual should deal with the bank in its nature of regular banking business.

As per ‘Know Your Customer’ guidelines issued by Reserve Bank of India, customer has been defined as:

- A person or entity that maintains an account and/or has a business relationship with the bank;

- One on whose behalf the account is maintained (i.e. the beneficial owner);

- Beneficiaries of transactions conducted by professional intermediaries, such as Stock Brokers, Chartered Accountants, Solicitors etc. as permitted under the law, and

- Any person or entity connected with a financial transaction, which can pose significant reputation or other risks to the bank, say, a wire transfer or issue of a high value demand draft as a single transaction.

The relationship between a banker and a customer depends on the type of transaction. These relationships confer certain rights and obligations both on the part of the banker and on the customer. However, the personal relationship between the bank and its customers is the long lasting relationship. Some banks even say that they have generation-to-generation banking relationship with their customers.

Figure: Banker-customer relationship

A. General Relationship: If we look at Sec 5(b) of Banking Regulation Act, we would notice that bank’s business is accepting of deposits for the purposes of lending. Thus, the relationship arising out of these two main activities are known as General Relationship.

- Debtor and Creditor:

When a ‘customer’ opens an account with a bank, he fills in and signs the account opening form. By signing the form he enters into an agreement/contract with the bank. When customer deposits money in his account the bank becomes a debtor of the customer and customer a creditor. The money so deposited by customer becomes bank’s property and bank has a right to use the money as it likes. The bank is not bound to inform the depositor the manner of utilization of funds deposited by him. Bank does not give any security to the depositor i.e. debtor. The bank has borrowed money and it is only when the depositor demands, banker pays. Bank’s position is quite different from normal debtors. While issuing Demand Draft, Mail / Telegraphic Transfer, bank becomes a debtor as it owns money to the payee/ beneficiary.

2. Creditor and Debtor:

Lending money is the most important activities of a bank. The resources mobilized by banks are utilized for lending operations. Customer who borrows money from bank owns money to the bank. In the case of any loan/advances account, the banker is the creditor and the customer is the debtor. The relationship in the first case when a person deposits money with the bank reverses when he borrows money from the bank. Borrower executes documents and offer security to the bank before utilizing the credit facility.

In addition to these two activities banks also undertake other activities mentioned in Sec.6 of Banking Regulation Act. In addition to opening of a deposit/loan account banks provide variety of services, which makes the relationship more wide and complex. Depending upon the type of services rendered and the nature of transaction, the banker acts as a bailee, trustee, principal, agent, lessor, custodian etc.

3. Trustee and Beneficiary (Bank as a Trustee and Customer as a Beneficiary):

As per Sec. 3of Indian Trust Act 1882, a “trust” is an obligation annexed to the ownership of property, and arising out of a confidence reposed in and accepted by the owner, or declared and accepted by him, for the benefit of another, or of another and the owner. Thus, trustee is the holder of property on behalf of a beneficiary.

In case of trust, banker customer relationship is a special contract. When a person entrusts valuable items with another person with an intention that such items would be returned on demand to the keeper the relationship becomes of a trustee and trustier. Customers keep certain valuables or securities with the bank for safekeeping or deposits certain money for a specific purpose (Escrow accounts) the banker in such cases acts as a trustee. Banks charge fee for safekeeping valuables.

4. Bailee and Bailor (Bank-Bailee and Customer- Bailor):

Sec.148 of Indian Contract Act, 1872, defines “Bailment” “bailor” and “bailee”. A “bailment” is the delivery of goods by one person to another for some purpose, upon a contract that they shall, when the purpose is accomplished, be returned or otherwise disposed of according to the directions of the person delivering them. The person delivering the goods is called the “bailor”. The person to whom they are delivered is called, the “bailee”.

5. Lessor and Lessee (Bank- Lessor and Customer- Lessee):

Sec.105 of ‘Transfer of property Act 1882’ defines lease, Lessor, lessee, premium and rent. As per the section “A lease of immovable property is a transfer of a right to enjoy such property, made for a certain time, express or implied, or in perpetuity, in consideration of a price paid or promised, or of money, a share of crops, service or any other thing of value, to be rendered periodically or on specified occasions to the transferor by the transferee, who accepts the transfer on such terms.”

6. Agent and Principal (Bank- Agent and Customer- Principal):

Sec. 182 of ‘The Indian Contract Act, 1872’ defines “an agent” as a person employed to do any act for another or to represent another in dealings with third persons. The person for whom such act is done or who is so represented is called “the Principal”.

Thus an agent is a person, who acts for and on behalf of the principal and under the latter’s express or implied authority and the acts done within such authority are binding on his principal and, the principal is liable to the party for the acts of the agent. Banks collect cheques, bills, and makes payment to various authorities’ viz., rent, telephone bills, insurance premium etc., on behalf of customers. . Banks also abides by the standing instructions given by its customers. In all such cases bank acts as an agent of its customer, and charges for these services. As per Indian contract Act agent is entitled to charges. No charges are levied in collection of local cheques through clearing house. Charges are levied in only when the cheque is returned in the clearinghouse.

7. Indemnity holder and Indemnifier (Bank-Indemnity holder and Customer-Indemnifier):

The dictionary meaning of the word Indemnity means ‘security or protection against a loss or other financial burden’. As per Section 124 of the Indian Contract Act 1872 the definition of the Indemnity is as follows. ‘A contract by which one party promises to save the other from loss caused to him by the contract of the promisor himself, or by the conduct of any other person, is called a “contract of indemnity”. Right of indemnity-holder is defined in Section 124 of the Indian Contract Act 1872. Anindemnityis an obligation by a person to provide compensation for a particular loss suffered by another person. In case of banking, the relationship happens in transactions of issue duplicate demand draft, TDR, deceased account payment etc. In that case indemnifier will compensate any loss arising from the wrong or excess payment. In these case banks is Indemnity Holder (Promisee) and customer is Indemnifier (Promisor).

8. Hypothecator and Hypothecatee (Bank- Hypothecatee and Customer- Hypothecator):

The relationship between customer and banker can be that of Hypothecator and Hypothecatee. This happens when the customer hypothecates certain movable or non-movable property or assets with the banker in order to get a loan. In this case, the customer became the Hypothecator, and the Banker became the Hypothecatee.

9. Pledger and Pledgee (Bank- Pledgee or Pawnee and Customer- Pledger or Pawnor):

The relationship between customer and banker can be that of Pledger and Pledgee. This happens when customer pledges (promises) certain assets or security with the bank in order to get a loan. In this case, the customer becomes the Pledger or Pawnor, and the bank becomes the Pledgee or Pawnee. Under this agreement, the assets or security will remain with the bank until a customer repays the loan.

10. Mortgagor and Mortgagee (Bank- Mortgagee and Customer- Mortgagor):

As per section 58 of Transfer of Property Act 1882, mortgage is transfer of interest in specific immovable property for the purpose of securing the payment of money advanced or to be advanced by way of loan, an existing or future debt or the performance of an engagement which may give rise to pecuniary liability. The mortgagor only pats with the interest in the property and not the ownership. The transferor of interest in property, is called a mortgagor and the transferee is called a mortgagee. In this case, the customer became the Mortgagor, and the Banker became the Mortgagee.

11. Advisor and Client (Bank- Advisor and Customer- client):

When a customer invests in securities, the banker acts as an advisor. The advice can be given officially or unofficially. While giving advice the banker has to take maximum care and caution. Here, the banker is an Advisor, and the customer is a Client.

B. Special relationship

The rights and responsibilities are also known as "Special Features of Relationship between a Banker and Customer". The following are the special relationships between banker and customer:

1. Obligation to honor cheques: According to Sec. 31 of the Negotiable Instruments Act, 1881, every banker must honor the cheques drawn on it by a customer, provided :

- The customer has sufficient amount of balance to his account with the banker;

- The funds are properly applicable to the payment of such cheque;

- The banker has been duly required to pay;

- The cheque has been presented to the banker within a reasonable time (i.e., within six months) after the apparent date and of its issue;

- No prohibition order of the court or any other competent authority (e.g., income tax) is standing against the account of the customer.

2. Banker's Lien: A lien may be defined as the right to retain property belonging to a debtor until he is discharged of his debt due to the retainer (creator) of the property. The banker's lien refers to the right of banker over such of his customer's securities as may come into his possession in the ordinary course of business. According to Sec.171 of the Contract Act, a banker has a general lien on cash, cheques, bills of exchange and securities deposited with him.

Conditions required for the banker to exercise general lien

- The securities and goods must come to his hands in his capacity as a banker.

- The banker should have obtained the possession of the securities and goods lawfully.

- The goods or securities should not have been entrusted to the bank for a specific or special purpose.

- The goods and securities, held by the bank shall stand in the name of borrower only and not jointly with others.

- There must be no arrangement either express or implied that is inconsistent with the banker's right to lien.

3. Secrecy of Customer's Accounts: It is an obligation on the part of a banker to maintain secrecy about the customer's accounts. The banker must not disclose any information pertaining to the customer to any one. But there are certain exceptions. They are,

- Where such disclosure is required by law

- Where such disclosure is in public interest to disclose

- Where the interest of the bank require such disclosure

- Where disclosure is made by the express or implied consent of the customer; and

- Where such disclosure is permissible on account of banking practices.

4. Banker's Right to Combine Accounts: The banker has a right to combine several accounts kept by the customer at the same branch or different branches of the bank (Garnet V. Mc Kervan). The banker however, cannot combine the personal account of a customer with a joint account of a customer and some other person. Customer has no right to treat two accounts as one.

5. Banker's Right to Set-Off: The banker can adjust a debit balance to a customer's account with any balance standing to the customer's credit. While doing so, the banker gives due notice to the customer. To exercise the right of set-off the following conditions should be fulfilled;

- The debts are certain and are due. The right cannot be exercised against future debt / or contingent debts.

- The debit and credit balances are of the same person in the same capacity.

- There should not be any express or implied agreement to the contrary.

6. Banker's Right of Appropriation: As a part of ordinary banking business, the banker receives deposits of money from his customer. The customer has the right to dictate as to which account a particular amount is to be credited where he has more than one account and / or loan account. In case the customer has not appropriated, i.e., not indicated his account to which the said amount is to be credited, the creditor is at liberty to apply the payment to any debt owed by the debtor including to a debt barred by limitation.

7. Banker has a right to claim incidental charges: Every banker has a right to claim incidental charges on non-remunerative accounts of a customer, e.g., collection charges, remittance charges for drafts, etc.

Termination of relationship between a banker and a customer: It would thus be observed that banker customer relationship is transaction relationship. The relationship between a bank and a customer ceases on:

(a) The death, insolvency, lunacy of the customer;

(b) The customer closing the account i.e. Voluntary termination;

(c) Liquidation of the company;

(d) The closing of the account by the bank after giving due notice;

(e) The completion of the contract or the specific transaction.

(f) Lends to the borrower or

(g) Invests the money so collected by way of deposits.

Key takeaways

- The relationship between a banker and a customer depends on the type of transaction. These relationships confer certain rights and obligations both on the part of the banker and on the customer. However, the personal relationship between the bank and its customers is the long lasting relationship. Some banks even say that they have generation-to-generation banking relationship with their customers.

Case study

Focus on ICICI Bank’s Initiatives

The use of Customer Relationship Management (CRM) in banking has gained importance with the aggressive strategies for customer acquisition and retention being employed by banks in today’s competitive milieu. This has resulted in the adoption of various CRM initiatives by these banks to enable them achieve their objectives.

The steps that banks follow in implementing Customer Relationship Management (CRM) are:

- Identifying CRM initiatives with reference to the objectives to be attained (such as increased number of customers, enhanced per-customer profitability, etc.),

- Setting measurable targets for each initiative in terms of growth in profits, number of customers, etc. and

- Evaluating and choosing the appropriate Customer Relationship Management (CRM) package that will help the company achieve its CRM goals (a comparison of pay-offs against investments could be carried out during the evaluation exercise).

Customer Relationship Management (CRM) has been deployed in retail banking.

The challenges in managing customer relations in retail banking are due to the multiple products being offered and the diverse channels being used for the distribution of the products.

References:

1. Gordon & Natarajan: Banking Theory Law and Practice, HPH

2. S. P Srivastava; Banking Theory & Practice, Anmol Publications

4. M. Prakash, Bhargavi VR: Banking law & Operation, Vision Book House.

5. Tannan M.L: Banking Law and Practice in India, Indian Law House