Unit -IV

The Negotiable Instruments Act 1881

Table of content:

INTRODUCTION

The Negotiable Instruments Act was enacted, in India, in 1881. Prior to its enactment, the supply of the English negotiable instrument Act were applicable in India, and therefore the present Act is additionally based on English Act with certain modifications.

It extends to the entire of India except the State of Jammu and Kashmir. The Act operates subject to the provisions of Sections 31 and 32 of the reserve banks of India Act, 1934.

NEGOTIABLE INSTRUMENTS

What is negotiable?

• Negotiable means transferable.

• The negotiation that goes on refers to the transfer of the instrument between two people, or from one bank to a different, or maybe from one country to a different.

What is an instrument?

• In the broadest sense, almost any agreed-upon medium of exchange could be considered a negotiable instrument.

• In day-to-day banking, a negotiable instrument usually refers to checks, drafts, bills of exchange, and a few sorts of promissory notes.

According to Section 13 (1) of the Negotiable Instruments Act, 1881

“A negotiable instrument means a promissory note, bill of exchange, or cheque payable either to order or to bearer”. “A negotiable instrument may be made payable to two or more payees jointly, or it may be made payable within the alternative to one of two, or one or some of several payees” [Section 13(2)].

FORMS OF NEGOTIABLE INSTRUMENTS

• A negotiable instrument may be a written, order promising to pay a sum of money.

• A document becomes negotiable when it contains an unconditional promise to pay money and is payable to a bearer or payable on demand.

FEATURES OF A NEGOTIABLE INSTRUMENT

• It may be a written document by which certain rights are created and or/ transferred to a particular person.

• It must be signed by the maker or the drawer as the case may be.

• There must exist the unconditional order or promise to pay.

• There must be a time mentioned for such payment.

• In particular cases, the drawer’s name should be specifically mentioned.

Sorts of negotiable instrument

1. Promissory note

2. Cheque

3. Bills of exchange

DEFINITION

PROMISSORY NOTES

Section 4 of the Act defines, “A promissory note is an instrument in writing (promissory note being a bank-promissory note or a currency promissory note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.”

The one that makes the promissory note and promises to pay is named the maker. The person to whom the payment is to be made is named the payee.

Examples:

A Signs instruments within the following terms

A) I promise to pay B or order Rs.500."

b) I promise to pay B Rs.500 which shall flow from to him.

CHARACTERISTICS OF A PROMISSORY NOTE

• It is an Instrument in Writing

• It may be a Promise to Pay

• Signed by the Maker

• Other Formalities

• Definite and Unconditional Promise

• Promise to Pay Money Only

• Maker must be a particular Person

• Payee must be sure

• Sum Payable must be sure

• It could also be Payable on Demand or after a particular Period of time

• It can't be Made Payable to Bearer on Demand

PARTIES TO A PROMISSORY NOTE

• Maker:

Maker is that the one that promises to pay the quantity stated within the promissory note.

• Payee:

Payee is that the person to whom the quantity of the promissory note is payable.

• Holder:

He is either the payee or the person to whom the promissory note may are endorsed.

ESSENTIALS OF PROMISSORY NOTE

Promissory notes must contain the following essentials elements;

- It should be in written shape.

- It must contain a guarantee to give money.

- The promise to give money must be unconditional.

- It must be signed by the maker.

- The maker should be a certain person.

- The payee must also be a certain person.

- The amount must be certain.

- Payment should be of money only.

- Time or period of payment should be fixed.

BILL OF EXCHANGE

According to Section 5 of the act, A bill of exchange is “an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a particular person or to the bearer of the instrument”. It’s also called a Draft.

SPECIAL BENEFITS OF BILL OF EXCHANGE:

• A bill of exchange may be a double secured instrument.

• In case of immediate requirement, a Bill could also be discounted with a bank.

ESSENTIAL ELEMENTS OF BILL OF EXCHANGE

• It must be in Writing

• Order to pay

• Drawee

• Signature of the Drawer

• Unconditional Order

• Parties

• Certainty of Amount

• Payment in a similar way isn't Valid

• Stamping

• Cannot be made Payable to Bearer on Demand

PARTIES TO A BILL OF EXCHANGE

• Drawer:

The maker of a bill of exchange is named the drawer.

• Drawee:

The person directed to pay the money by the drawer is named the drawee.

• Payee:

The person named within the instrument, to whom or to whose order the money are directed to be paid by the instruments are called the payee.

KINDS OF BILLS OF EXCHANGE

1. Inland

2. Foreign bills

1. Inland bill:

• It is drawn in India on an individual residing in India, whether payable in or outside India, or

• It is drawn in India on person residing outside India but payable in India

.The following are the inland bills:

a) A bill is drawn by a merchant in Delhi on a merchant in Chennai. It’s payable in Mumbai the bill is a draft.

b) A bill is drawn by a Delhi merchant on an individual in London but is formed payable in

2. Foreign draft

• A bill drawn outside India & made payable in India.

• A bill drawn outside India on a person residing outside India.

• A bill drawn in India on an individual residing outside India and made payable outside India.

CLASSIFICATION OF BILL OF EXCHANGE

Inland and Foreign Bills

Inland Bill:

• It is drawn in India on an individual residing in India whether payable in or outside India; or

• It is drawn in India on an individual residing outside India but payable in India. ◦

Foreign Bill:

• A bill drawn in India on an individual residing outside India and made payable outside India.

• Drawn upon an individual who is that the resident of a far-off country.

Time and Demand Bills:

Time Bill:

A bill payable after a hard and fast time is termed as a time draft. A bill payable “after date” may be a time draft. ◦

Demand Bill:

A bill payable at sight or on demand is termed as a requirement bill.

Trade and Accommodation Bills:

Trade Bill:

A bill drawn and accepted for a real trade transaction is termed as “trade bill”.

Accommodation Bill:

A bill drawn and accepted not for a real trade transaction but only to supply financial help to some party is termed as an “accommodation bill”.

Basis of difference | Bills of exchange | Cheque |

Person/firm | A bill of exchange usually drawn on some person or firm | A cheque is always drawn on bank |

Acceptance | It is essential that a bill of exchange must be accepted before its payment can be claimed | A cheque does not require any such acceptance |

Payable on demand | The B.O.E. May be drawn payable on demand | A cheque can only be drawer payable on demand |

Grace of days | Three days are allowed in case of B.O.E. | In case cheque no grace of days are allowed |

Notice of dishonor | It is necessary in B.O.E. | No. Such notice is required |

Crossing | No crossing of bills of exchange | A cheque may be crossed |

Stamp | It must be properly stamped | No stamp is required |

CHEQUE

Consistent with Section 6 of the act, A cheque is “a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand”. A cheque is additionally, therefore, a bill of exchange with two additional qualifications:

• It is usually drawn on a specified banker.

• It is usually payable on demand.

Special Benefits of bill of exchange:

• A bill of exchange may be a double secured instrument.

• In case of immediate requirement, a Bill could also be discounted with a bank.

ESSENTIAL ELEMENTS OF A CHEQUE

• In writing

• Express Order to Pay

• Definite and Unconditional Order

• Signed by the Drawer

• Order to Pay Certain Sum

• Order to Pay Money Only

• Certain Three Parties

• Drawn upon a Specified Banker

• Payable on Demand

PARTIES TO A CHEQUE

• Drawer:

Drawer is that the one that draws the cheque.

• Drawee/Banker:

Drawee is that the drawer’s banker on whom the cheque has been drawn.

• Payee:

Payee is that the one that is entitled to receive the payment of a cheque.

CROSSING OF CHEQUES

• It may be a direction given by the customer to the banker that payment shouldn't be made across the counter.

• Crossing is suffering from drawing two parallel transverse lines with or without particular abbreviations.

• A cheque that's not crossed is an open cheque.

• It is a measure of safety against theft or loss of cheques in transit.

TYPES OF CROSSING

• Special

• General

According to section 14 of the Act, ‘when a promissory note, bill of exchange or cheque is transferred to a person so on constitute that person the holder thereof, the instrument is claimed to be negotiated.’ the most purpose and essence of negotiation is to form the transferee of a promissory note, a bill of exchange or a cheque the holder there of.

Negotiation thus requires two conditions to be fulfilled, namely:

• There must be a transfer of the instrument to a different person.

• The transfer must be made in such a fashion on constitute the transferee the holder of the instrument.

MODES OF NEGOTIATION

1. Negotiation by delivery (Sec. 47):

Where a promissory note or a bill of exchange or a cheque is payable to a bearer, it's going to be negotiated by delivery thereof. Example: A the holder of a negotiable instrument payable to bearer, delivers it to B’s agent to stay it for B. The instrument has been negotiated.

2. Negotiation by endorsement and delivery (Sec. 48):

A promissory note, a cheque or a bill of exchange payable to order are often negotiated only be endorsement and delivery. Unless the holder signs his endorsement on the instrument and delivers it, the transferee doesn't become a holder. If there are more payees than one, all must endorse it.

ENDORSEMENT [SECTION 15]

The word ‘endorsement’ in its literal sense means, writing on the back of an instrument. But under the Negotiable Instruments Act it means, the writing of one’s name on the rear of the instrument or any paper attached thereto with the intention of transferring the rights therein. Thus, endorsement is signing a negotiable instrument for the aim of negotiation. The one that effects an endorsement is named an ‘endorser’, and therefore the person to whom negotiable instrument is transferred by endorsement is named the ‘endorsee’.

WHO MAY ENDORSE / NEGOTIATE [SECTION 51]:

Every Sole maker, drawer, payee or endorsee, or all of several joint makers, drawers, payees or endorsees of a negotiable instrument may endorse and negotiate an equivalent if the negotiability of such instrument has not been restricted or excluded as mentioned in Section 50.

ENDORSEMENT

Essentials of a legitimate Endorsement:

• It must get on the rear or face of instrument or on an error of paper annexed thereto.

• It must be signed by the endorser.

• It must be completed by the delivery of the instrument

• It must be made by the holder of the instrument.

Kinds of Endorsement:

• Blank or General Endorsement

• Full or Special Endorsement

• Partial Endorsement

• Restrictive Endorsement

• Conditional Endorsement

KINDS OF ENDORSEMENT

1. Blank endorsement: If the endorser signs his name only, the endorsement is claimed to be in blank and it becomes payable to bearer e.g. Mahbubul Haq.

2. Special or Full endorsement: An endorsement “in full” or a special endorsement is one where the endorser not only puts his signature on the instrument but also writes the name of an individual to whom or to whose order the payment is to be made.

3. Conditional endorsement: In conditional endorsement the endorser puts his signature under such an article which makes the transfer of title subject to fulfillment of some conditions of the happening of some events.

Example: Pay to Mr.Sarwar Jahan or order after his marriage- Sd/Badrul Kamal

4. Restrictive endorsement: An endorsement is named restrictive when the endorser restricts or prohibits further negotiation. Example: “Pay to Miss. / A. Pereira only” Sd/HosneAra.

5. Partial endorsement: In Partial endorsement only a part of the quantity of the bill is transferred or the quantity of the bill is transferred to 2 or more endorsees severally. This doesn't separate as a negotiation of the instrument. The law lies down that an endorsement must relate to the entire instrument.

INSTRUMENTS OBTAIN BY UNLAWFUL

• Lost instruments:

• The holder of a lost instrument should give notice of the loss to all or any the parties through public advertisement.

• The finder of the lost instrument isn't entitled to sue thereon in his own name.

• The true owner can recover the instrument from the finder if it's with him but he has parted with the instrument and has received payment thereon and can't return the instrument to the owner, he must compensate the owner.

• An acceptor, maker or drawee that makes payment in due course of a lost instrument gets a legitimate discharge for it.

STOLEN INSTRUMENT

• The thief doesn't get any title to the instrument, but if the instrument is payable to the bearer and it's negotiated to a holder in due course; he will get an honest title thereto not only against the thief but also against any party before him.

• Good title: ownership of real estate which is completely freed from claims against it and thus are often sold, transferred, or put up as security (placing a mortgage or deed of trust on the property).

INSTRUMENTS OBTAIN BY FRAUD

• Valid contracts must be caused by the free consent of the parties competent to contract. Therefore, the person guilty of fraud not only gets no valid title to the thing obtained but also susceptible to damages.

• Forged instruments: Forged instruments within the eyes of law haven't any existence whatsoever. There’s an entire absence of title from the very beginning and a forged signature is altogether inoperative.

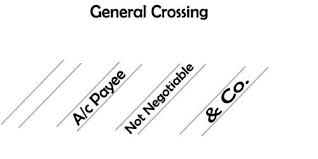

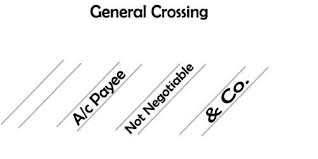

Cheque crossing is recognized in the Negotiable Instruments Act of 1881.Crossing a cheque means drawing two parallel transverse lines between the lines on the cheque with or without additional words such as “& CO.” or “Account Payee” or “Not Negotiable.”

Types of Crossing

The way a cheque is crossed specified the banker on how the funds are to be handled, to protect it from fraud and forgery. Primarily, it ensures that the funds must be transferred to the bank account only and not to encash it right away upon the receipt of the cheque. There are several types of crossing

- General Crossing: When across the face of a cheque two transverse parallel lines are drawn at the top left corner, along with the words & Co., between the two lines, with or without using the words “not negotiable”. When a cheque is crossed in this way, it is called a general crossing.

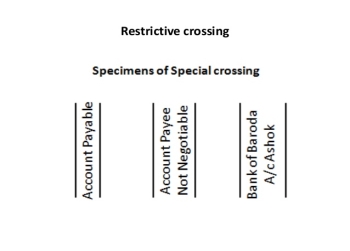

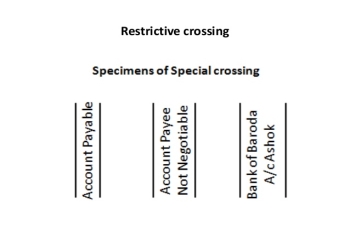

- Restrictive Crossing: When in between the two transverse parallel lines, the words ‘A/c payee’ is written across the face of the cheque, then such a crossing is called restrictive crossing or account payee crossing. In this case, the cheque can be credited to the account of the stated person only, making it a non-negotiable instrument.

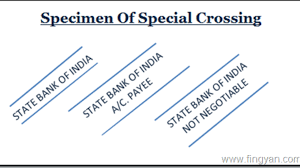

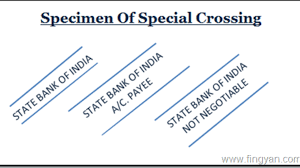

3. Special Crossing: A cheque in which the name of the banker is written, across the face of the cheque in between the two transverse parallel lines, with or without using the word ‘not negotiable’. This type of crossing is called a special crossing. In a special crossing, the paying banker will pay the sum only to the banker whose name is stated in the cheque or to his agent. Hence, the cheque will be honored only when the bank mentioned in the crossing orders the same.

4. Not Negotiable Crossing: When the words not negotiable is mentioned in between the two transverse parallel lines, indicating that the cheque can be transferred but the transferee will not be able to have a better title to the cheque.

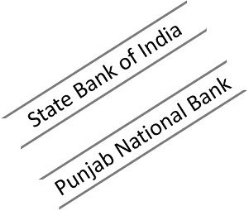

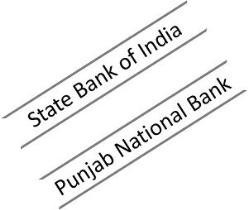

5. Double Crossing: Double crossing is when a bank to whom the cheque crossed specially, further submits the same to another bank, for the purpose of collection as its agent, in this situation the second crossing should indicate that it is serving as an agent of the prior banker, to whom the cheque was specially crossed.

The crossing of a cheque is done to ensure the safety of payment. It is a well-known mechanism used to protect the parties to the cheque, by making sure that the payment is made to the right payee. Hence, it reduces fraud and wrong payments, as well as it protects the instrument from getting stolen or encashed by any unscrupulous individual.

FFA situation of cheque bounce is basically a term used to define the unsuccessful processing of a dispensed cheque due to several reasons. Non-sufficient funds (NSF) in the issuer’s account are one of the primary reasons for a bounced cheque. The banks return or dishonour the cheques, also known as rubber checks, in addition to imposing a particular charge. Further, the passing of bad cheques can be illegal, and this crime can be aggravated depending on the amount and whether this action involves crossing state boundaries.

There are various reasons for bouncing of cheques:

- Insufficient funds

- Date not mentioned properly or scribbled figures

- Signature mismatch

- Difference in numbers and words

- Damaged Cheque

- Overwriting on Cheque

References

- Business Law for Management by Balchandani

- Business Law by Henry R. Cheeseman

- Business Law by B. B. Dam

Unit -IV

The Negotiable Instruments Act 1881

Table of content:

INTRODUCTION

The Negotiable Instruments Act was enacted, in India, in 1881. Prior to its enactment, the supply of the English negotiable instrument Act were applicable in India, and therefore the present Act is additionally based on English Act with certain modifications.

It extends to the entire of India except the State of Jammu and Kashmir. The Act operates subject to the provisions of Sections 31 and 32 of the reserve banks of India Act, 1934.

NEGOTIABLE INSTRUMENTS

What is negotiable?

• Negotiable means transferable.

• The negotiation that goes on refers to the transfer of the instrument between two people, or from one bank to a different, or maybe from one country to a different.

What is an instrument?

• In the broadest sense, almost any agreed-upon medium of exchange could be considered a negotiable instrument.

• In day-to-day banking, a negotiable instrument usually refers to checks, drafts, bills of exchange, and a few sorts of promissory notes.

According to Section 13 (1) of the Negotiable Instruments Act, 1881

“A negotiable instrument means a promissory note, bill of exchange, or cheque payable either to order or to bearer”. “A negotiable instrument may be made payable to two or more payees jointly, or it may be made payable within the alternative to one of two, or one or some of several payees” [Section 13(2)].

FORMS OF NEGOTIABLE INSTRUMENTS

• A negotiable instrument may be a written, order promising to pay a sum of money.

• A document becomes negotiable when it contains an unconditional promise to pay money and is payable to a bearer or payable on demand.

FEATURES OF A NEGOTIABLE INSTRUMENT

• It may be a written document by which certain rights are created and or/ transferred to a particular person.

• It must be signed by the maker or the drawer as the case may be.

• There must exist the unconditional order or promise to pay.

• There must be a time mentioned for such payment.

• In particular cases, the drawer’s name should be specifically mentioned.

Sorts of negotiable instrument

1. Promissory note

2. Cheque

3. Bills of exchange

DEFINITION

PROMISSORY NOTES

Section 4 of the Act defines, “A promissory note is an instrument in writing (promissory note being a bank-promissory note or a currency promissory note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.”

The one that makes the promissory note and promises to pay is named the maker. The person to whom the payment is to be made is named the payee.

Examples:

A Signs instruments within the following terms

A) I promise to pay B or order Rs.500."

b) I promise to pay B Rs.500 which shall flow from to him.

CHARACTERISTICS OF A PROMISSORY NOTE

• It is an Instrument in Writing

• It may be a Promise to Pay

• Signed by the Maker

• Other Formalities

• Definite and Unconditional Promise

• Promise to Pay Money Only

• Maker must be a particular Person

• Payee must be sure

• Sum Payable must be sure

• It could also be Payable on Demand or after a particular Period of time

• It can't be Made Payable to Bearer on Demand

PARTIES TO A PROMISSORY NOTE

• Maker:

Maker is that the one that promises to pay the quantity stated within the promissory note.

• Payee:

Payee is that the person to whom the quantity of the promissory note is payable.

• Holder:

He is either the payee or the person to whom the promissory note may are endorsed.

ESSENTIALS OF PROMISSORY NOTE

Promissory notes must contain the following essentials elements;

- It should be in written shape.

- It must contain a guarantee to give money.

- The promise to give money must be unconditional.

- It must be signed by the maker.

- The maker should be a certain person.

- The payee must also be a certain person.

- The amount must be certain.

- Payment should be of money only.

- Time or period of payment should be fixed.

BILL OF EXCHANGE

According to Section 5 of the act, A bill of exchange is “an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a particular person or to the bearer of the instrument”. It’s also called a Draft.

SPECIAL BENEFITS OF BILL OF EXCHANGE:

• A bill of exchange may be a double secured instrument.

• In case of immediate requirement, a Bill could also be discounted with a bank.

ESSENTIAL ELEMENTS OF BILL OF EXCHANGE

• It must be in Writing

• Order to pay

• Drawee

• Signature of the Drawer

• Unconditional Order

• Parties

• Certainty of Amount

• Payment in a similar way isn't Valid

• Stamping

• Cannot be made Payable to Bearer on Demand

PARTIES TO A BILL OF EXCHANGE

• Drawer:

The maker of a bill of exchange is named the drawer.

• Drawee:

The person directed to pay the money by the drawer is named the drawee.

• Payee:

The person named within the instrument, to whom or to whose order the money are directed to be paid by the instruments are called the payee.

KINDS OF BILLS OF EXCHANGE

1. Inland

2. Foreign bills

1. Inland bill:

• It is drawn in India on an individual residing in India, whether payable in or outside India, or

• It is drawn in India on person residing outside India but payable in India

.The following are the inland bills:

a) A bill is drawn by a merchant in Delhi on a merchant in Chennai. It’s payable in Mumbai the bill is a draft.

b) A bill is drawn by a Delhi merchant on an individual in London but is formed payable in

2. Foreign draft

• A bill drawn outside India & made payable in India.

• A bill drawn outside India on a person residing outside India.

• A bill drawn in India on an individual residing outside India and made payable outside India.

CLASSIFICATION OF BILL OF EXCHANGE

Inland and Foreign Bills

Inland Bill:

• It is drawn in India on an individual residing in India whether payable in or outside India; or

• It is drawn in India on an individual residing outside India but payable in India. ◦

Foreign Bill:

• A bill drawn in India on an individual residing outside India and made payable outside India.

• Drawn upon an individual who is that the resident of a far-off country.

Time and Demand Bills:

Time Bill:

A bill payable after a hard and fast time is termed as a time draft. A bill payable “after date” may be a time draft. ◦

Demand Bill:

A bill payable at sight or on demand is termed as a requirement bill.

Trade and Accommodation Bills:

Trade Bill:

A bill drawn and accepted for a real trade transaction is termed as “trade bill”.

Accommodation Bill:

A bill drawn and accepted not for a real trade transaction but only to supply financial help to some party is termed as an “accommodation bill”.

Basis of difference | Bills of exchange | Cheque |

Person/firm | A bill of exchange usually drawn on some person or firm | A cheque is always drawn on bank |

Acceptance | It is essential that a bill of exchange must be accepted before its payment can be claimed | A cheque does not require any such acceptance |

Payable on demand | The B.O.E. May be drawn payable on demand | A cheque can only be drawer payable on demand |

Grace of days | Three days are allowed in case of B.O.E. | In case cheque no grace of days are allowed |

Notice of dishonor | It is necessary in B.O.E. | No. Such notice is required |

Crossing | No crossing of bills of exchange | A cheque may be crossed |

Stamp | It must be properly stamped | No stamp is required |

CHEQUE

Consistent with Section 6 of the act, A cheque is “a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand”. A cheque is additionally, therefore, a bill of exchange with two additional qualifications:

• It is usually drawn on a specified banker.

• It is usually payable on demand.

Special Benefits of bill of exchange:

• A bill of exchange may be a double secured instrument.

• In case of immediate requirement, a Bill could also be discounted with a bank.

ESSENTIAL ELEMENTS OF A CHEQUE

• In writing

• Express Order to Pay

• Definite and Unconditional Order

• Signed by the Drawer

• Order to Pay Certain Sum

• Order to Pay Money Only

• Certain Three Parties

• Drawn upon a Specified Banker

• Payable on Demand

PARTIES TO A CHEQUE

• Drawer:

Drawer is that the one that draws the cheque.

• Drawee/Banker:

Drawee is that the drawer’s banker on whom the cheque has been drawn.

• Payee:

Payee is that the one that is entitled to receive the payment of a cheque.

CROSSING OF CHEQUES

• It may be a direction given by the customer to the banker that payment shouldn't be made across the counter.

• Crossing is suffering from drawing two parallel transverse lines with or without particular abbreviations.

• A cheque that's not crossed is an open cheque.

• It is a measure of safety against theft or loss of cheques in transit.

TYPES OF CROSSING

• Special

• General

According to section 14 of the Act, ‘when a promissory note, bill of exchange or cheque is transferred to a person so on constitute that person the holder thereof, the instrument is claimed to be negotiated.’ the most purpose and essence of negotiation is to form the transferee of a promissory note, a bill of exchange or a cheque the holder there of.

Negotiation thus requires two conditions to be fulfilled, namely:

• There must be a transfer of the instrument to a different person.

• The transfer must be made in such a fashion on constitute the transferee the holder of the instrument.

MODES OF NEGOTIATION

1. Negotiation by delivery (Sec. 47):

Where a promissory note or a bill of exchange or a cheque is payable to a bearer, it's going to be negotiated by delivery thereof. Example: A the holder of a negotiable instrument payable to bearer, delivers it to B’s agent to stay it for B. The instrument has been negotiated.

2. Negotiation by endorsement and delivery (Sec. 48):

A promissory note, a cheque or a bill of exchange payable to order are often negotiated only be endorsement and delivery. Unless the holder signs his endorsement on the instrument and delivers it, the transferee doesn't become a holder. If there are more payees than one, all must endorse it.

ENDORSEMENT [SECTION 15]

The word ‘endorsement’ in its literal sense means, writing on the back of an instrument. But under the Negotiable Instruments Act it means, the writing of one’s name on the rear of the instrument or any paper attached thereto with the intention of transferring the rights therein. Thus, endorsement is signing a negotiable instrument for the aim of negotiation. The one that effects an endorsement is named an ‘endorser’, and therefore the person to whom negotiable instrument is transferred by endorsement is named the ‘endorsee’.

WHO MAY ENDORSE / NEGOTIATE [SECTION 51]:

Every Sole maker, drawer, payee or endorsee, or all of several joint makers, drawers, payees or endorsees of a negotiable instrument may endorse and negotiate an equivalent if the negotiability of such instrument has not been restricted or excluded as mentioned in Section 50.

ENDORSEMENT

Essentials of a legitimate Endorsement:

• It must get on the rear or face of instrument or on an error of paper annexed thereto.

• It must be signed by the endorser.

• It must be completed by the delivery of the instrument

• It must be made by the holder of the instrument.

Kinds of Endorsement:

• Blank or General Endorsement

• Full or Special Endorsement

• Partial Endorsement

• Restrictive Endorsement

• Conditional Endorsement

KINDS OF ENDORSEMENT

1. Blank endorsement: If the endorser signs his name only, the endorsement is claimed to be in blank and it becomes payable to bearer e.g. Mahbubul Haq.

2. Special or Full endorsement: An endorsement “in full” or a special endorsement is one where the endorser not only puts his signature on the instrument but also writes the name of an individual to whom or to whose order the payment is to be made.

3. Conditional endorsement: In conditional endorsement the endorser puts his signature under such an article which makes the transfer of title subject to fulfillment of some conditions of the happening of some events.

Example: Pay to Mr.Sarwar Jahan or order after his marriage- Sd/Badrul Kamal

4. Restrictive endorsement: An endorsement is named restrictive when the endorser restricts or prohibits further negotiation. Example: “Pay to Miss. / A. Pereira only” Sd/HosneAra.

5. Partial endorsement: In Partial endorsement only a part of the quantity of the bill is transferred or the quantity of the bill is transferred to 2 or more endorsees severally. This doesn't separate as a negotiation of the instrument. The law lies down that an endorsement must relate to the entire instrument.

INSTRUMENTS OBTAIN BY UNLAWFUL

• Lost instruments:

• The holder of a lost instrument should give notice of the loss to all or any the parties through public advertisement.

• The finder of the lost instrument isn't entitled to sue thereon in his own name.

• The true owner can recover the instrument from the finder if it's with him but he has parted with the instrument and has received payment thereon and can't return the instrument to the owner, he must compensate the owner.

• An acceptor, maker or drawee that makes payment in due course of a lost instrument gets a legitimate discharge for it.

STOLEN INSTRUMENT

• The thief doesn't get any title to the instrument, but if the instrument is payable to the bearer and it's negotiated to a holder in due course; he will get an honest title thereto not only against the thief but also against any party before him.

• Good title: ownership of real estate which is completely freed from claims against it and thus are often sold, transferred, or put up as security (placing a mortgage or deed of trust on the property).

INSTRUMENTS OBTAIN BY FRAUD

• Valid contracts must be caused by the free consent of the parties competent to contract. Therefore, the person guilty of fraud not only gets no valid title to the thing obtained but also susceptible to damages.

• Forged instruments: Forged instruments within the eyes of law haven't any existence whatsoever. There’s an entire absence of title from the very beginning and a forged signature is altogether inoperative.

Cheque crossing is recognized in the Negotiable Instruments Act of 1881.Crossing a cheque means drawing two parallel transverse lines between the lines on the cheque with or without additional words such as “& CO.” or “Account Payee” or “Not Negotiable.”

Types of Crossing

The way a cheque is crossed specified the banker on how the funds are to be handled, to protect it from fraud and forgery. Primarily, it ensures that the funds must be transferred to the bank account only and not to encash it right away upon the receipt of the cheque. There are several types of crossing

- General Crossing: When across the face of a cheque two transverse parallel lines are drawn at the top left corner, along with the words & Co., between the two lines, with or without using the words “not negotiable”. When a cheque is crossed in this way, it is called a general crossing.

- Restrictive Crossing: When in between the two transverse parallel lines, the words ‘A/c payee’ is written across the face of the cheque, then such a crossing is called restrictive crossing or account payee crossing. In this case, the cheque can be credited to the account of the stated person only, making it a non-negotiable instrument.

3. Special Crossing: A cheque in which the name of the banker is written, across the face of the cheque in between the two transverse parallel lines, with or without using the word ‘not negotiable’. This type of crossing is called a special crossing. In a special crossing, the paying banker will pay the sum only to the banker whose name is stated in the cheque or to his agent. Hence, the cheque will be honored only when the bank mentioned in the crossing orders the same.

4. Not Negotiable Crossing: When the words not negotiable is mentioned in between the two transverse parallel lines, indicating that the cheque can be transferred but the transferee will not be able to have a better title to the cheque.

5. Double Crossing: Double crossing is when a bank to whom the cheque crossed specially, further submits the same to another bank, for the purpose of collection as its agent, in this situation the second crossing should indicate that it is serving as an agent of the prior banker, to whom the cheque was specially crossed.

The crossing of a cheque is done to ensure the safety of payment. It is a well-known mechanism used to protect the parties to the cheque, by making sure that the payment is made to the right payee. Hence, it reduces fraud and wrong payments, as well as it protects the instrument from getting stolen or encashed by any unscrupulous individual.

FFA situation of cheque bounce is basically a term used to define the unsuccessful processing of a dispensed cheque due to several reasons. Non-sufficient funds (NSF) in the issuer’s account are one of the primary reasons for a bounced cheque. The banks return or dishonour the cheques, also known as rubber checks, in addition to imposing a particular charge. Further, the passing of bad cheques can be illegal, and this crime can be aggravated depending on the amount and whether this action involves crossing state boundaries.

There are various reasons for bouncing of cheques:

- Insufficient funds

- Date not mentioned properly or scribbled figures

- Signature mismatch

- Difference in numbers and words

- Damaged Cheque

- Overwriting on Cheque

References

- Business Law for Management by Balchandani

- Business Law by Henry R. Cheeseman

- Business Law by B. B. Dam