UNIT II

Business Income

Net income is the total amount your business earns over a period of time minus all of its costs, taxes, and interest. It measures the profitability of your company. Next to revenue, it's the most important number in accounting.

Net profit, sometimes referred to as "net profit," "net profit," or simply "profit," is the opposite of net loss when a business loses money.

Have you ever heard someone say that your business is in the red or in the black? This is because accountants literally recorded net losses with red ink and net profits with black ink.

Why is it important?

Many small businesses don't start calculating profitability until they are forced by lenders and investors, but tracking net revenue is one of the best ways to monitor the health of your business. If your net income is increasing, you're probably heading in the right direction. If not, it may be time to cut costs.

It's also important for lenders who want to make sure they have enough money to pay off all their debts, and investors who want to know how much money is left in their business to pay dividends or set aside for rainy days.

How can I calculate it?

If you know your total income and total costs, you can calculate your net income very easily. Just subtract the second number from the first number.

However, like most companies, you need to prepare an income statement, which is one of the three major financial statements. The point of a company's income statement, also known as the "income statement," is to show how it reached its net profit.

The income statement does this by taking the total income for the period (which is usually the first line of the statement) and subtracting each expense and loss one line at a time until it spits out net income on the last line. Increase. This is also why we sometimes hear people call net profit "earnings".

The following is an example of the income statement of Coffee Roaster Enterprises Inc. Net income is shown at the bottom.

- Coffee Roaster Enterprises Inc.

- Profit and loss statement

- Year ended December 31, 2020

Category | Amount |

Sales Revenue | $57,050.68 |

Cost of Goods Sold (COGS) | $24,984.79 |

Gross Profit | $32,065.89 |

|

|

General Expenses | $11,049.55 |

*Rent | $9,000.00 |

*Bank & ATM Fee Expenses | $9.43 |

*Equipment Expenses | $742.40 |

*Marketing Expenses | $503.53 |

*Merchant Fees Expenses | $794.19 |

|

|

Operating Earnings | $21,016.34 |

Interest Expense | $5,000.00 |

Earnings Before Income Tax | $16,016.34 |

Income Tax Expense | $10,000.00 |

Net Profit | $6,016.34 |

What is total income?

It is important not to confuse total income with net income. Gross income, also known as gross income or gross profit, is revenue minus cost of sales (COGS) and is the direct cost associated with the production of a product or service.

This can be expressed in the form of an equation as follows.

Gross income – Operating Expenses = Operating Income

The cost of goods sold for a business is typically displayed at the top of the income statement, just below revenue.

Here are some common examples of COGS:

- Raw materials

- Labor

- Packing, freight, delivery

- Production facility energy and utility costs

- Depreciation of production equipment and machinery

COGS do not include indirect costs such as lawyers, accountants, management, utilities, insurance, interest and other salaries (sometimes called "overheads", "operating costs" or "operating costs"). Be careful.

How is your operating income?

Operating profit is another more conservative measure of profitability that goes one step further than gross profit. This includes operating costs (also known as selling, general and administrative expenses [SG & A]), which are costs that a company incurs independently of production. Operating expenses do not include non-operating expenses such as interest, taxes, depreciation and depreciation.

The operating income equation is:

Gross revenue, operating revenue, and net revenue are the three most common ways to measure a company's profitability, all of which are related.

By writing out all three formulas, you can see how gross profit, operating profit, and net profit differ, and profitability measurements are becoming more and more conservative.

Revenues - COGS = Gross profit

Revenues - COGS - Operating expenses = Operating income

Revenues - COGS - Operating expenses - non-operating expenses = Net income

Notice that the net profit equation includes all three major expense types: cost of goods sold, operating expenses, and non-operating expenses. This is because it is the most conservative and reliable indicator of profitability we have obtained.

The Accounting Period

What is the concept of accounting period?

The concept of accounting periods is based on the theory that all accounting transactions in a business must be divided into equal periods called accounting periods.

The purpose of these periods is to help you prepare financial statements and present them to investors to compare business performance to each period.

By preparing financial statements within a specific time period, a company can determine the profit or loss incurred during the period of its business.

Without the proper accounting period, the results will vary and it will be difficult to determine the financial position of the company at that time.

The accounting period is usually 12 months (1 year). The period is fixed, but the month may vary from company to company.

Types of accounting periods in accounting

In accounting, you can see the following types of accounting periods:

1. Calendar year

2. Fiscal year

Calendar Year: The accounting period for a company following a calendar year is from January 1st to December 31st of the same year.

Fiscal Year: For companies that follow a fiscal year, the accounting period begins on the first day of any other month except January.

Benefits of the accounting period concept

Below are some of the benefits of the accounting period concept

1. Helps you prepare financial statements that show the financial position of your business over a period of time.

2. You can compare financial data related to two accounting periods.

3. Investors can see the progress or decline of a company by looking at trends in financial data over a period of time.

Disadvantages of the concept of accounting period

The following are some of the drawbacks of the accounting period concept

1. You need to maintain two separate accounts for different tax periods.

2. The comparison between the two accounting periods does not take into account the de facto reasons behind the differences observed between the periods.

The continuity doctrine and matching concept

What is the doctrine of corporate continuity?

The Going Concern Principle is the taxation principle that the acquirer must continue the business of the acquirer before the acquisition is considered a tax deferral restructuring. If the acquired company is unable to continue its business, a significant percentage of the company's assets must be used for the new business so that the acquisition is considered a tax deferral transaction. The Going Concern Principle is a taxation principle that governs the tax treatment of a reorganizing company.

A little more about what is the continuity of corporate doctrine

Under the Going Concern Principle, before treating an acquisition as a tax deferral restructuring or transaction, it is necessary to retain the actual business of the acquired company or use most of the company's assets for a combined (new) business. There is. This doctrine is used by the Internal Revenue Service (IRS) for tax processing as companies reorganize. Tax incentives are usually the motivation for most mergers and acquisitions. This doctrine helps the IRS control or limit the number of transactions that can be considered tax deductions. Acquisitions that do not meet these criteria are not automatically subject to tax incentives after restructuring.

An entity is considered to be in business unless there is evidence of opposition. Because companies are relatively permanent, financial accounting is designed with the assumption that the business will survive indefinitely in the future.

The Going Concern concept justifies the valuation of assets on a non-clearing basis and requires the use of acquisition costs for many valuations. In addition, fixed and intangible assets are amortized over their useful lives, rather than in shorter periods, in the hope of early liquidation.

This further means that the data transmitted is tentative and that the current statement should disclose adjustments to the statement over the past year revealed by more recent developments

Matching Concept

The concept of matching in financial accounting is the process of matching (associating) performance or revenue (measured at the selling price of goods and services offered) with labour or expense (measured at the cost of goods and services used) over a specific period of time. Is. Targets for which income has been determined.

This concept emphasizes which item of expense in a particular accounting period is expense. That is, expenses are reported as expenses for the accounting period in which revenue related to those expenses is reported. For example, if the sales of some products are reported as revenue for one year, the costs for those products are reported as expenses for the same year.

The concept of matching only needs to be met after the accountant has completed the concept of realization. First measure the revenue according to the concept of realization, then associate the costs with these revenues. Cost matches revenue, but not the other way around.

Therefore, the reconciliation process requires significant cost allocation in acquisition cost accounting. Past (history) costs are investigated and steps are taken to assign a cost element that is considered to have expired service potential or to match it with the associated revenue.

The remaining component of the cost, which is considered to have continued potential for future services, is carried over to the past balance sheet and is called an asset. Therefore, the balance sheet is just a report of unallocated past costs waiting for the estimated future service potential to expire before it matches the appropriate revenue.

Key takeaways:

- The matching principle states that costs should be reported in the accounting period in which the costs were incurred, and all revenues resulting from the costs should be reported in the same accounting period.

- Revenue recognition may be a generally accepted accounting standard (GAAP) that defines when and the way revenue is recognized.

- The principle of revenue recognition using accrual accounting requires that revenue be recognized when cash is realized and earned, not when cash is received.

- The revenue recognition standard, ASC606, provides a unified framework for recognizing revenue from contracts with customers.

- A going concern principle is a taxation principle that applies to mergers and acquisitions of a company.

- The principle is that in order to qualify for tax deferral restructuring, the acquiring company must either continue the historic business of the target company or use a significant portion of the target business assets in doing business.

What is Revenue Recognition?

Revenue recognition is an accounting standard that outlines the precise conditions under which revenue is recognized. Theoretically, there are many points where you can recognize revenue. This guide describes the recognition principles of both IFRS and U.S. GAAP.

Revenue recognition conditions

- According to IFRS Standards, the following conditions must be met in order for revenue to be recognized:

- Ownership risks and rewards have been transferred from the seller to the buyer.

- The seller loses control of the items sold.

- The collection of payments from goods or services is reasonably guaranteed.

- Revenue can be reasonably measured.

- The cost of revenue can be reasonably measured.

Conditions (1) and (2) are called performance. When it comes to performance, it happens when the seller does what he or she expects to be entitled to pay.

Condition (3) is called collectability. The seller must have an inexpensive expectation that he or she is going to be purchased the performance.

Conditions (4) and (5) are called measurable. Accounting guidelines for matching principles require sellers to be able to match revenue and expense. Therefore, you need to be able to reasonably measure both revenue and expense.

Revenue recognition from contract

IFRS 15 is revenue from contracts with customers and establishes specific steps for revenue recognition. It is important to note that IFRS 15 has some exclusions, including:

- Lease agreement (IAS 17)

- Insurance contract (IFRS 4)

- Financial Instruments (IFRS 9)

Revenue recognition steps from contracts

The five steps of revenue recognition in a contract are:

1. Contract identification

- All conditions must be met in order to enter into a contract.

- Both parties must approve the contract (whether written, verbal, or implied).

- You can identify the transfer point of goods and services.

- Payment terms are identified.

- The contract has a commercial entity.

- There is a possibility of collecting money.

2. Identifying performance obligations

Some contracts may include multiple performance obligations. For example, selling a car with a complementary driving school is considered two performance obligations. The first is the car itself and the second is the driving school.

Performance obligations must be distinguished from each other. To distinguish between goods or services, the following conditions must be met:

Buyers (customers) can benefit from goods and services on their own.

Goods or services are individually identified in the contract.

3. Determining transaction price

Transaction prices are usually easy to determine. Most contracts include a fixed amount. For example, the price of a car with complementary driving lessons is $ 20,000. The transaction price in this case will be $ 20,000.

4. Assign transaction prices to performance obligations

The allocation of transaction prices to multiple performance obligations should be based on the independent selling prices of the performance obligations.

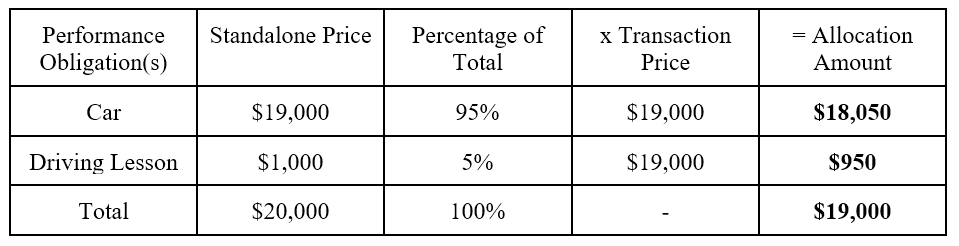

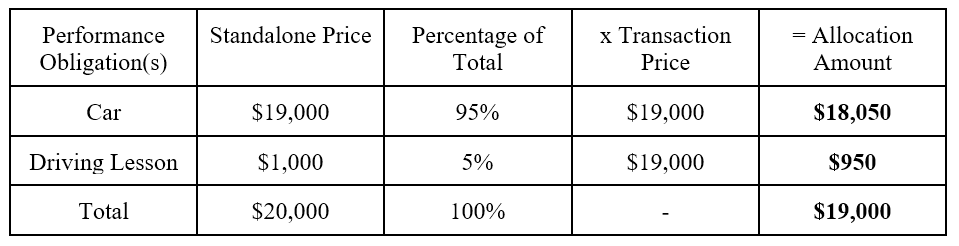

For example, the contract includes the sale of a car with complementary driving lessons. The total transaction price is $ 20,000. The stand-alone price for a car is $ 19,000 and the stand-alone price for a driving school is $ 1,000. The distribution of transaction prices is as follows.

Note: The total percentage is the stand-alone price divided by the stand-alone total price. For example, the total percentage of cars is calculated as $ 19,000 / $ 20,000 = 95%.

5. Revenue recognition according to business performance

Recall the terms of revenue recognition. Conditions (1) and (2) indicate that revenue is recognized when the seller does what is expected to be entitled to payment. Therefore, revenue is recognized in one of the following:

At some point; with time

In the example above, the revenue associated with the car is recognized when the buyer owns the car. Complementary driving lessons, on the other hand, are recognized when the service is provided.

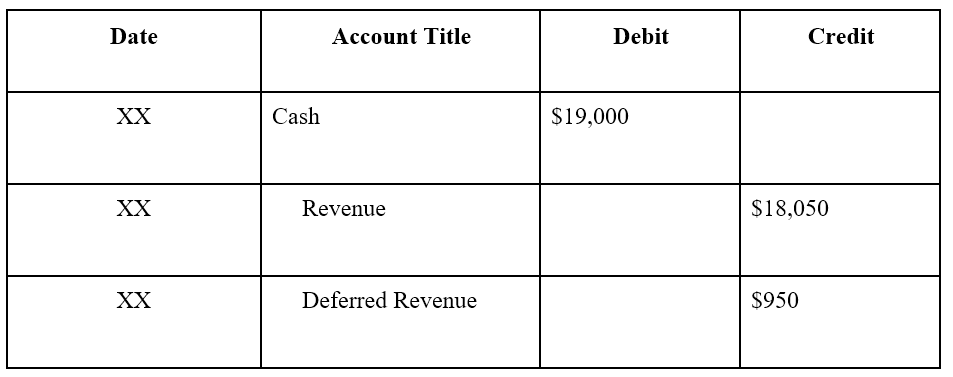

The revenue recognition journals for the two performance obligations (car and driving lessons) are as follows:

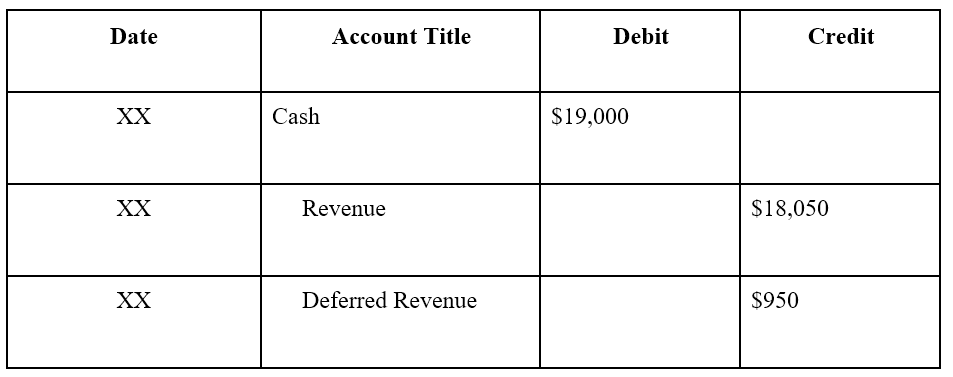

For car sales and free driving lessons:

Note: Revenue is recognized for car sales ($ 18,050), but not for complementary driving lessons because it has not yet been offered.

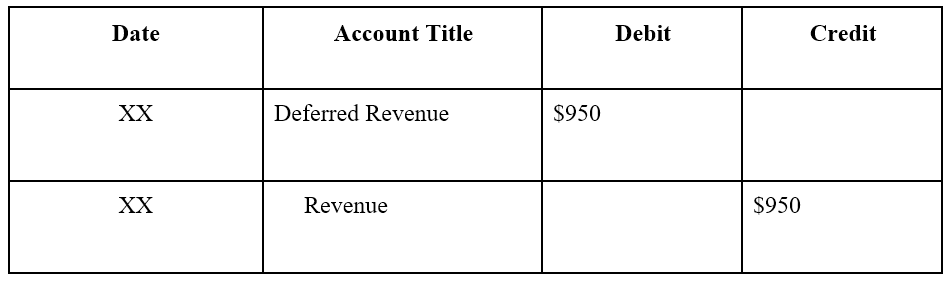

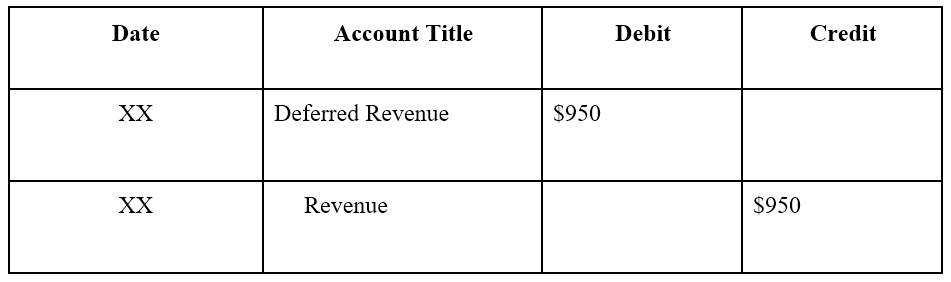

If complementary driving lessons are offered:

Note: Revenue will be deferred until driving lessons are offered.

GAAP Revenue Recognition Principles

The Financial Accounting Standards Foundation (FASB), which sets the standards for US GAAP, has five principles for recognizing revenue:

- Identify customer contracts

- Identify customer contract obligations

- Determine the transaction price

- Assign Corresponding price according to the performance obligation of the contract

- Recognize revenue when performance obligations are met.

Principles of Revenue Recognition

Regardless of the type of accounting you use in your business, the principle of revenue recognition remains the same.

The principle of revenue recognition states that revenue should be recorded when it is earned, not received. The concept of revenue recognition is part of accrual accounting. That is, when you create an invoice for a customer of a product or service, the amount of that invoice is recorded as revenue at that time, not when you receive the money from the customer.

This is one of the major differences between accrual accounting and cash accounting. This is because in cash accounting, revenue is recognized when it is received, not when it is paid.

Revenue recognition requirements

The principle of revenue recognition should use double-entry bookkeeping. Here are some additional guidelines that you need to follow regarding revenue recognition principles:

There is an agreement or agreement between your business and your customers. This means that you have provided your customers with credit terms and have agreed to pay the invoice over time to fulfill those terms. For example, we provide client A with a consulting service with a net 30 credit requirement. If Client A agrees to these terms, Client A agrees to pay the invoice within 30 days from the date of the invoice.

The product or service you are selling has been delivered or completed. This is one of the most important elements of the revenue recognition principle, which means that revenue is recognized and recorded when a service is provided or a product is provided. In essence, this means that your part of the contract is complete.

The cost has been decided. If you want to provide services or sell products to clients, you must provide the clients with the costs of those services or products. The cost is fixed before the revenue is recognized.

Billed amounts can be collected. This is fairly straightforward and demonstrates the importance of accurately screening clients to determine their creditworthiness. Before you can offer your credit terms to your clients, you need to reasonably ensure that you will be able to collect your balance from them in the future. Of course, this is not absolutely certain. This is an exception, not a rule, because even properly scrutinized companies can delay payment of invoices.

If you have any doubts about the collectability of your invoice, it should not be recognized as revenue. This is a difficult problem. This is because it is unlikely that you will extend your credit terms to customers who may not be able to pay your invoice. However, if you encounter this issue, you should delay revenue recognition until the invoice is paid.

If payment is received prior to the product or service, revenue should only be recognized after the service is provided. For example, if your business offers an office cleaning service for $ 500 per month and your customers pay $ 1,500 in the next three months, your revenue will be $ 500 in the next three accounting cycles instead of the current total. It will be recognized. Accounting cycle.

What does the revenue recognition principle mean for a company?

Revenue recognition principles allow you to accurately view your profit and loss by recording your revenue when you earn it, not when you receive it.

Revenue recognition principles are also useful for financial forecasting. Allows your business to more accurately predict future revenue. Recognizing revenue correctly is also important for companies that receive prepayment for services, such as those that offer service contracts that require prepayment.

In order to properly recognize revenue, a company that receives a prepayment for a service provided must only recognize that revenue after the service has been performed. For example, if you offer your customers an annual support contract of $ 12,000 a year, they will recognize a monthly revenue of $ 1,000 for the next 12 months.

Example 1

DATE | ACCOUNT NAME & DESCRIPTION | DEBIT | CREDIT |

1/1/2020 | Cash - To record prepayment | $12,000 |

|

1/1/2020 | Client Prepayment - To record prepayment |

| $12,000 |

Example 2

DATE | ACCOUNT NAME & DESCRIPTION | DEBIT | CREDIT |

1/31/2020 | Client Prepayment - Record January payment | $1,000 |

|

1/31/2020 | Account Services Income - Payment for January |

| $1,000 |

In Example 1, the money will be credited, so debit it from your cash account. However, instead of applying to the income account, place it in the client prepaid account. This will be gradually reduced until you earn the full $ 12,000.

Example 2 debits the January income account and debits it from the client prepaid account to continue monthly journal entries until December for proper accounting, while reducing the balance by $ 1,000. For the income earned.

Example of Revenue Recognition Principles

The following are two simple revenue recognition examples.

- Your business provides tax services to clients. After the tax return is complete, forward a copy of the invoice to the client. The client agrees to pay the invoice within 30 days (net 30 days). The service is already available, so you can immediately recognize your revenue.

- You provide your clients with monthly accounting services. The client pays in advance throughout the year and receives payment on January 2nd throughout the year. You can recognize January revenue because you can only recognize revenue as revenue, but you have to wait until February to recognize February revenue. Revenue is recognized until December of each month when the service is provided.

Recognition of Expenses

What is the principle of expense recognition?

The principle of cost recognition states that costs should be recognized in the same period as the associated revenue. Otherwise, the expense is likely to be perceived as incurred and may be incurred before or after the period in which the associated revenue amount is recognized.

This principle also affects the timing of income tax. In this example, the cost is too high, so the income tax is underpaid this month, and if the cost is too low, the income tax is overpaid the following month.

Some costs, such as managed salaries, rent, and utilities, are difficult to relate to revenue. These costs are designated as term costs and are billed as costs for the relevant period. This usually means that you will be charged when it occurs.

When to use the expense recognition principle

The principle of cost recognition is a core element of accrual accounting, where revenue is recognized at the time of acquisition and costs are recognized at the time of consumption. Instead, if a company recognizes costs when paying a supplier, this is known as accounting cash basis.

If a company wants to be audited in financial statements, it should use the principle of expense recognition when recording commercial transactions. Otherwise, the auditor will refuse to comment on the financial statements.

Example of Expense Recognition Principle

The company pays $ 100,000 for the item and sells it for $ 150,000 the following month. Under the principle of expense recognition, an expense of $ 100,000 should not be recognized as an expense until the following month when the associated revenue is also recognized. Otherwise, the expense will be overvalued by $ 100,000 this month and undervalued by $ 100,000 the following month.

Key takeaways:

- If the sale of goods involves high uncertainties in recoverability, the entity must defer recognition of revenue until after delivery.

- The installment sales method recognizes revenue after the sale or delivery has taken place. Revenue recognized is the product of revenue and the percentage of cash collected.

- Use the cost recovery method when the likelihood of non-collectible payments is very high. With this method, no revenue is recognized until the cash collection exceeds the cost of the seller of the item sold.

- The deposit method is used when the company receives cash before the transfer of ownership occurs.

- Revenue is not recognized upon receipt of cash because the risks and rewards of ownership have not been transferred to the purchaser.

- Revenue is only recognized if a value transfer has taken place.

- According to the principle of revenue recognition, revenue is recognized, feasible or feasible (whether cash payments have been received) during the period of acquisition (buyer and seller have a contract to transfer the asset).

- Recognized if payment collection is reasonably guaranteed).

- Matching principles, which are part of accrual accounting, recognize costs when obligations arise (usually when transferring goods or providing services) and (2) offset recognized revenues incurred from those costs. Need to do it.

- As long as the timing of recognition of revenue and expense is within the same accounting period, revenue and expense will match and will be reported in the income statement.

- In accrual accounting, revenue is realized (collection of payment) or feasible (seller reasonably guarantees that payment of goods will be collected) and earned (usually generated at the time of transfer of goods or provision of services). It will be recognized once you do.

- For companies that do not follow accrual accounting and use cash basis instead, revenue is only recognized when they receive cash.

- Revenue recognition is part of the accrual accounting concept that determines when revenue is recognized during an accounting period.

- The matching principle aims to match revenues and expenses for the right accounting period, also as revenue recognition. This allows you to better evaluate your income statement, which shows the income and expenses for the accounting period, or the amount of money spent to earn the income for that period.

- Accrual journals for recording sales include debits to accounts receivable and credits to revenue. For cash sales, debit cash instead.

- The revenue earned is reported as part of the revenue on the income statement for the current accounting period.

- If the transfer of ownership of the sold item is not immediate and the item requires delivery, the shipping terms of the sale determine when revenue is recognized. The shipping terms are usually "FOB shipping address" and "FOB shipping point".

- If a company is unable to reasonably estimate future revenues and / or has a very high rate of return, then revenue should only be recognized when the return right expires.

Meaning, Characteristics and Accounting of non-profits

A non-profit organization is an organization established for the purpose of social welfare and the promotion of social arts and culture. These are usually founded as charities with a motive for service. The trustee manages these organizations. Members of the organization elect a trustee. Non-profits raise funds from their members and the general public to achieve their goals.

The main motivation for these organizations is to provide services. But they may eventually benefit. In general, these organizations do not manufacture, buy, sell, or provide services for goods. Therefore, they do not need to prepare trading and P & L A / c. They credit the funds they receive to the Capital Fund or the General Fund A / c.

Accounting for Non-Profit Organizations

As we know, non-profits do not trade goods or provide profitable services. However, they also need to keep good records of income, expenses, assets, and liabilities. Their main sources of income are donations, subscriptions and grants. Therefore, most of their transactions are done through cash or bank accounts.

Appropriate books, firstly because members and contributors are accountable, and secondly because the law requires the government to maintain adequate books so that they can manage grants appropriately. Must be maintained. Proper accounting also reduces the risk of fraud and embezzlement. In addition to your ledger and cash book, you also need to maintain an inventory ledger. The stock ledger also maintains a complete record of all fixed assets and consumables.

In non-profit accounting, instead of maintaining Capital A / c, these organizations maintain Capital Fund or General Fund A / c. They deposit surpluses, lifetime membership fees, donations, heritage, etc. into this account.

Non-profits are also required to prepare final accounts or financial statements at the end of the fiscal year in accordance with accounting principles. The final account for these organizations consists of:

Receipts and payments A / c: An overview of cash and bank transactions. This will help you create a balance sheet A / c and a balance sheet. You must also submit it to the Social Registration Bureau along with your balance sheet A / c and balance sheet.

Balance A / c: Similar to P & L A / c, check for any surplus or deficiency.

Balance Sheet: Create in the same way as the balance sheet for profit motivation concerns.

Q

Ashraya is an organization working to improve and improve the welfare of street children. It sponsors their food and clothing. We also provide basic education to children. Its sources of income are donations, subscriptions and government grants. Identify the type of organization that states the reason. Also mention the accounting procedures you should follow.

A:

Ashraya is a non-profit organization. It works for the well-being of children and society. The sources of income are donations, grants and subscriptions from members. Therefore, it is clear that it works for service purposes, not for commercial purposes.

However, non-profits also need to maintain proper accounting books. Financial statements help to win donations from current and future contributors. Financial statements also help you receive grants from various authorities.

Below are the financial statements they prepare at the end of the year.

- Receipts and payments A / c

- Balance A / c

- Balance sheet

Characteristics or characteristics of non-profit organizations

Entity: There is a separate legal entity promoted by an individual.

Purpose: To promote cultural, educational, religious and professional purposes and to serve the general public.

Ownership: Established as a charity or trust. Therefore, it is owned by an individual or a group of individuals.

Financial Statements: Every year, we prepare financial statements that include balance sheets, balance sheets, and balance sheets.

Funds: The members and donors will provide the necessary items for operation as admission fees, membership fees, subscription fees, and donations. It is supplemented by surplus from the business.

Receipts and payment accounts: An overview of cash and bank transactions over a specific period. Created from a cashbook at the end of the fiscal year. All cash receipts are entered on the debit side and all cash payments are entered on the credit side.

Feature:

- An overview of cash and bank transactions

- You can infer that receipt and payment accounts are similar to cash accounts

- No distinction is made between capital and revenue items, and all non-cash items are excluded.

- Records all cash and banking transactions, whether related to the current period, the previous period, or the next period.

Format of Receipts and payment Account

Receipt Dr.

| Rs. | Payment Cr.

| Rs. |

To the opening balance (bal b / d.) Cash on hand Cash at the bank To capital receipt (subscription) In the case of the previous year This year For next year To Grant for a specific purpose To general grants To general donations To Rent received To dividend To receive with interest For a lifetime membership fee To sell fixed assets Balance c / d (overdraft) Balance b / d (opening bal.)

Total

|

_____ _____ | By salary By rent By repair By investment By audit fee By Due to miscellaneous expenses By insurance By drawings By Bank overdraft By building By book By loan By balance c / d (settlement balance) Cash on hand Cash at the bank

Total |

______ ______ |

Features:

- This is a revenue account created to determine a surplus or deficit at the end of the accounting period.

- Period costs and revenues are collated to determine a deficit or surplus.

- Both cash and non-cash items are considered.

- The surplus of this account will not be distributed to the members, but will be added to the capital stock.

- Excess income for spending is in the black and excess expenditure for income is in the red.

Format of Income and Expenditure

Expenditure Rs. | Income Rs. |

To salary: Added: Finally, unresolved Less: Conspicuous at first To Rent To insurance premiums To printing and stationery To sports expenses To the electricity bill To the loss due to the sale of furniture To miscellaneous expenses To newspapers and periodicals To depreciation: Furniture Sports material To the surplus on the balance sheet

Total

| By subscription By Admission fee By sports fee By Sale in old newspapers By Due to interest in investment By Deficit (taken on the balance sheet)

Total |

Q7:

Create a balance account for the same period from the following balance accounts for the year ending March 31, 2017 at People's Club.

Receipt and Payment Account

Dr. Cr.

Expenditure | Rs. | Income

| Rs. |

Balance c / d bank Subscription: 2015 6,750.00 2016 45,000.00 2017 2,250.00 Donations Hall rent Interest on bank deposits Admission fee

Total

| 1,12,500.00

54,000.00 9,000.00 1,350.00 2,025.00 4,500.00

1,83,375.00

| Purchasing Furniture Salary Telephone Bill Electric Bill Shipping and Stationery Book Purchase Expense Entertainment 5% Government Purchase Paper Miscellaneous Expenses Balance C / D Cash Bank

Total | 22,500.00 9,000.00 1,350.00 2,700.00 675.00 11,250.00 4,050.00 36,000.00 2,700.00

1,350.00 91,800.00

1,83,375.00 |

The following information is available:

- Unpaid salary

- Unpaid entertainment expenses

- Bank interest income

- Incurred subscription

- Capitalize 50% of admission

- Furniture is depreciated at an annual rate of 10%

Expenditure | Rs. | Income

| Rs. |

Salary 9,000 Add: Unprocessed 6,750 Telephone bill Electric bill Shipping and stationery Entertainment fee 4,052.00 Add: Unprocessed2,250.00 Miscellaneous expenses Furniture Miscellaneous expenses on Depreciation expenses Surplus

Total

|

15,750.00 1,350.00 2,700.00 675.00

6,302.00 6,300.00 2,700.00

1,687.50 31,837.50

63,000.00 | Subscription Donations Admission fee (50% of 4500) Bank interest 2,025 Added: Unpaid interest 675 Interest in investment Hall rent

Total | 46,800.00 9,000 2,250.00

2,700.00 900 1,350

63,000.00 |

A7:

Income and Expenditure A/C

Balance sheet overview

Balance preparation for non-trade or non-profit concerns is the same as balance sheet preparation for trading companies. You have all the liabilities and assets as of the date the organization created the balance sheet. Excess assets that exceed liabilities are called capital funds or general funds. Creating a balance sheet for non-profits.

Non-profit Balance Sheet: General Financial Resources

For non-profits, capital is accumulated during the year along with receipts and receipts of capital capitalized by further increasing the surplus or reducing the deficit. At the beginning of non-trading concerns, there is no formal capital fund. In such cases, the surplus earned that year constitutes a year-end capital fund.

Non-profit balance sheets are created in the same way as companies do. Organizational assets are recorded on the right and liabilities are recorded on the left. Non-profits do not use the term capital. Instead, general or cumulative funds are displayed on the balance sheet.

NPOs may also create special funds such as prizes and match funds. Its purpose is to meet the costs associated with the purpose for which it was created. The amount of income invested from these funds is generated only in the funds, not in the balance account.

Accounting for general financial resources and preparation of balance sheet

- Creating a balance sheet begins with general financial resources. You need to add each surplus or deficit to the amount.

- In addition, add a lifetime membership fee or heritage at this stage.

- Place all fixed assets on the asset side of the balance sheet.

- Introducing the amount paid in advance and the unpaid amount on the asset and liability side.

- Post the closing balances of assets and liabilities to each side of the balance sheet.

- To calculate the amount of a fund, subtract the value of total liabilities from the value of assets.

Let's understand the format of the non-profit balance sheet from the following figure, which we will consider in the below question.

Q8. How do you view your subscription amount on your non-profit balance sheet from the following Receipt and Payment accounts and additional information?

Receipt | Rs. | Payment

| Rs. |

To subscription

| 25,000 |

|

|

Additional Information:

- Unpaid subscriptions from the previous year Rs.2000

- Unpaid subscriptions for this year Rs.1500

- Subscriptions are Rs received in advance at the end of the previous year. 1000

- Subscription is Rs received in advance at the end of this year. 1200

A8:

Start of Balance Sheet

Liabilities | Rs. | Assets

| Rs. |

Pre-subscription (previous year) out. | 1,000

1,000 ________ 2,000 | Subscription (previous year)

| 2,000

________ 2,000 |

Closing the Balance Sheet

Liabilities | Rs. | Assets

| Rs. |

Advanced Subscription (Next Year)

|

1,200

1,200 | Unprocessed Subscription (This Year) Unpaid subscription (previous year)

|

1,500 2,000

3,500 |

Q9. Calculate sports material debited to Income & Expenditure a / c. Yearly. It ended on March 31, 2007, based on the following information. The amount paid for sports material during the year. It was Rs.19,000

Details Inventory of sports materials Creditors of sports materials

| 1 = 4 = 2006 (Rs.) 7,500 200 | 31.3.2007 (Rs.) 6,400 2,600 |

- Rs.20300

- Rs.20700

- Rs.20000

- Rs.20500

A9:

Option 2. Rs.20700

Description: Amount debited to income and expenditure as consumption of sports materials = payment amount + starting inventory-ending inventory-starting creditor + ending creditor. Amount debited to income and expenses = 19000 + 7500-6400-2000 + 2600 = Rs. 20,700

Q10.The non-profit has received Rs.10,000 as an admission fee for new members. If 20% of the fee needs to be capitalized, what is the amount of the fee that needs to be displayed in the balance account?

- Rs.9000

- Rs.8000

- Rs.2000

- Rs.5000

A10:

Option 2 Rs.8000

Description: These are the fees collected from all members upon enrolment in membership. Once you become a member of society or a club, you will only be paid once by new entrants. It is treated in two ways: -when capitalized, it appears on the debt side's balance sheet. -If it is considered a receipt for income, it will be displayed in the income and expenditure account on the income side. Therefore, Rs. 20% means Rs. 2000 (10,000 * 20%) appears on the balance sheet on the debt side and the balance of Rs. 8000 is displayed in the income and expenditure account on the income side.

Q11: Prize Rs.10000, Prize Investment Interest Rs.1000, Prize Payment Rs.2000, Prize Investment Rs.8000. What will happen to that treatment?

- Rs.20000, Rs on the debt side. 8000 on the asset side

- Rs.1000, Rs on the responsible side. 8000 on the asset side

- Responsible side Rs.1700, Rs. 8000 on the asset side

- Rs.9000, Rs on the debt side. 8000 on the asset side

A11:

Option 4. Rs.9000, Rs on the debt side. 8000 on the asset side

Description: The balance sheet calculation looks like this: -Prize-9000 Addition: -Interest 1000 deduction for prize investment: -Prize payment 2000 Debt side amount = Rupee. 9000 prize investment Rs. 8000 is displayed on the asset side.

Q12. Bell, a non-governmental non-profit organization, received special pledged funding from a donor to another non-governmental non-profit medical organization during its annual campaign. How does Bell need to record these funds?

- Increased assets and increased profits

- Increased assets and increased liabilities

- Increased assets and increased deferred income.

- Decrease in assets and decrease in funds balance.

A12:

Option 2. Increased assets and increased liabilities

Description: Bell, a non-governmental NPO, is responsible for the funds for the annual campaign and is recorded on the balance sheet. And if the organization pledges this fund to another non-governmental NPO, it becomes a property of the Bernon government. Organisation recorded on the asset side of the balance sheet.

Q13. From the information below, we will calculate the amount of stationery that will be posted to the Income and Expenditure account of the Cultural Association of India for the year ending March 31, 2018.

Details Stationery inventory Stationery creditors | 1.4.2017 (Rs.) 21,000 11,000 | 31.3.2018 (Rs.) 18,000 23,000 |

Stationery purchased in the year ended March 31, 2018 was Rs 75,000. Also, please present relevant items on the social balance sheet as of March 31, 2018.

A13 :

Stationery Account

Dr. |

|

| Cr.

|

Details | Rs. | Details | Rs. |

To Balance b / d | 21,000 | By income and expenditure in balance A / c | 78,000 |

To Bank balance | 75,000 | Balancing figure |

|

|

| By balance c / d

| 18,000

|

| 96,000 |

| 96,000 |

Balance sheet as of March 31, 2018

Liabilities | Amount | Assets | Amount |

Stationery Creditors | 23,000 | Stationery Inventory | 18,000 |

Q14. From the information below, we will calculate the amount of the subscription that will be credited to the 2007-2008 balance account.

Particulars | Amount |

Subscriptions received for year | 50,000 |

Outstanding subscriptions on March 31, 2007 | 20,000 |

Unprocessed subscriptions on March 31, 2008 | 6,000 |

Subscriptions pre-received on March 31, 2007 | 8,000 |

Subscriptions received in advance on March 31, 2008. The 2006-07 delinquency is still 1,500. | 9,000

|

A14:

Particulars | Amount |

Subscriptions received for year | 50,000 |

(+) March 31, 2008 Unprocessed Subscriptions (6,000 – 1,500) | 4,500 |

(+) Subscriptions received in advance on March 31, 2007 | 8,000 |

(-) Subscription received in advance on March 31, 2008 | (9,000) |

(-) Unprocessed subscriptions on March 31, 2007 (20,000 – 1,500) | (18,500)

|

Revenue from 2007-08 subscription | 35,000 |

Q15. Find out the cost of drugs consumed in 2015-16 from the following information:

Particulars | Amount (Rs) |

Purchase price of medicine | 3,70,000 |

Creditors of purchased medicines April 1, 2015 March 31, 2016 | 25,000 17,000 |

Drug inventory April 1, 2015 March 31, 2016 |

62,000 54,000 |

Pre-pharmaceutical supplier April 1, 2015 March 31, 2016 |

11,500 18,200 |

A15 :

Particulars | Amount |

Payment for drug purchase | 3,70,000 |

(-) Decrease in drug creditors in 2016 (25,000 – 17,000) | (8,000) |

(-) Increase in drug advance payments in 2016 (18,200 – 11,500) | (6,700) |

2016 drug purchase | 3,55,300 |

(+) Starting inventory of pharmaceutical products on April 1, 2015 (-) End of stock of pharmaceutical products on March 31, 2016 | 62,000 (54,000) |

= Medicines consumed in 2016 | 3,63,000 |

Q16. From the following receipt and payment accounts for the Cricket Club and the additional information provided, prepare the balance sheet for the year ending December 31, 2018 and the balance sheet for that date.

Receipt and Payment Accounts

Year ending December 31, 2018

To bal b/d | Rs. |

| Rs. |

- Cash | 3,520 | By Maintenance | 6,820 |

-Bank | 27,380 | By tableware | 2,650 |

-Time deposit @ 6% | 30,000 | By Match cost | 13,240

|

To subscription (2017 including Rs 6000) | 40,000 | By salary

| 11,000 |

To admission | 2,750 | By Transportation | 820 |

To Donation | 5,010 | By maintaining the lawn | 4,240 |

To Interested in time deposit | 900 | By Stamps | 1,050 |

To Tournament Fund | 20,000 | By purchasing cricket products | 9,720 |

To Sale of tableware (book value Rs. 1200) | 2,000 | By Miscellaneous expenses

| 2,000 |

|

| By Investment | 5,700 |

|

| By Tournament costs | 18,800 |

|

| By Balance c / d: -Cash -Bank |

2,200 23,320 |

|

| Time deposit | 30,000 |

| 1,31,560 |

| 1,31,560

|

Additional Information:

- Unpaid salary is rupees. 1000.

- The initial balance of the stock of stamps, stationery and cricket gods is Rs. 3210 each for 750 rupees. The same closing price is Rs. 900 and rupees. 2800 each.

- Unpaid subscriptions for 2017 and 2018 are Rs. 6600 and Rs. 8000 each.

A17:

Cricket Club Income and Expenditure Account

Year ended December 31, 2018

Expenditure | Rs. | Income | Rs. |

| ||

To Maintenance | 6,820 | By Subscription | 40,000 |

| ||

To transport | 820 | Less: Rec. Last year | 6,000 |

| ||

To Lawn Maintenance | 4,240 | Add: untreated this year | 8,000 | 42,000 | ||

To match cost | 13,240 | By Admission fee | 2,750 | |||

To Salary | 11,000 |

| By Donations | 5,010 | ||

Add: Outstanding |

1,000 |

12,000 | By Interest on time deposits |

900 |

| |

To Postage stamps: |

| Added: Unpaid due | 900 | 1,800 | ||

Balance at the beginning |

750 |

| By Gain on sale of tableware (2000-1200) |

800 | ||

Add: Purchase | 1,050 |

|

|

|

| |

Less: Closing Inventory |

(900) |

900 |

|

|

| |

To cricket goods: |

|

|

|

|

| |

Beginning balance Added: Buy Less: Closing price

|

3210 9720 (2800) |

10,130 |

|

|

| |

To miscellaneous expenses | 2,000 |

|

|

| ||

To income that exceeds expenditure (Bal Fig) |

2,210

|

|

|

| ||

| 52,360 |

| 52,360 | |||

Balance sheet

As of December 31, 2018

Liabilities | Amount | Assets | Amount | ||

Tournament Fund Less: Tournament costs | 20,000

18,800 |

1,200 | Cash Bank Time deposit Investment

| 2,200 23,320 30,000 5,700 | |

Unpaid salary |

| 1,000 | Crockery

| 2,650 | |

Capital (balance Fig) Added: Surplus | 72,660

2,210 |

74,870 | Interest accrued on time deposit | 900 | |

|

|

| Subscription expiration date 2017 (6600-6000) 2018 |

600 8000 |

8,600 |

|

|

| Stamps and stationery |

900 | |

|

|

| Cricket product inventory |

2,800 | |

| 77,070 |

| 77,070 | ||

Key takeaways:

- According to accounting matching principles, depreciation links the value of employing a tangible asset with the profits gained over its useful life.

- There are differing types of depreciation, including the straight-line method of depreciation and various sorts of accelerated depreciation.

- Accumulated depreciation is that the sum of all depreciation recorded on an asset up to a specific date.

- The value of an asset on the record is that the acquisition cost minus all accumulated depreciation.

- The carrying amount of an asset in any case depreciation has been made is named its salvage value.

- The straight-line method of depreciation may be a method of calculating depreciation and is that the process of paying an asset for a extended period of your time than when it had been purchased.

- Straight-line bases are popular because they're easy to calculate and understand, but they even have some drawbacks.

References:

- Lal Jawahar and Seema Sriwastava, Financial Accounting, Himalaya Publishing House

- Monga, J.R, Financial Accounting: Concepts and Application Mayoor Paper Backs, New Delhi.

- Shukla M.C, T.S. Grewal and S.C. Gupta. Advanced Accounts. Vol-1, S. Chand & Co.

- Maheshwari S.N, Financial Accounting Vikas Publishing House, New Delhi

- Jain S.P. And K.L. Narang Financial Accounting Kalyani Publishers New Delhi

- Bhushan Kumar Goyal and, HN Tiwari, Financial Accounting, Vikas Publishing House, New Delhi

- P.C. Tulsian, Financial Accounting, Tata McGraw Hill, New Delhi

- Compendium of Statements and Standards of Accounting, ICAI, New Delhi

UNIT II

Business Income

Net income is the total amount your business earns over a period of time minus all of its costs, taxes, and interest. It measures the profitability of your company. Next to revenue, it's the most important number in accounting.

Net profit, sometimes referred to as "net profit," "net profit," or simply "profit," is the opposite of net loss when a business loses money.

Have you ever heard someone say that your business is in the red or in the black? This is because accountants literally recorded net losses with red ink and net profits with black ink.

Why is it important?

Many small businesses don't start calculating profitability until they are forced by lenders and investors, but tracking net revenue is one of the best ways to monitor the health of your business. If your net income is increasing, you're probably heading in the right direction. If not, it may be time to cut costs.

It's also important for lenders who want to make sure they have enough money to pay off all their debts, and investors who want to know how much money is left in their business to pay dividends or set aside for rainy days.

How can I calculate it?

If you know your total income and total costs, you can calculate your net income very easily. Just subtract the second number from the first number.

However, like most companies, you need to prepare an income statement, which is one of the three major financial statements. The point of a company's income statement, also known as the "income statement," is to show how it reached its net profit.

The income statement does this by taking the total income for the period (which is usually the first line of the statement) and subtracting each expense and loss one line at a time until it spits out net income on the last line. Increase. This is also why we sometimes hear people call net profit "earnings".

The following is an example of the income statement of Coffee Roaster Enterprises Inc. Net income is shown at the bottom.

- Coffee Roaster Enterprises Inc.

- Profit and loss statement

- Year ended December 31, 2020

Category | Amount |

Sales Revenue | $57,050.68 |

Cost of Goods Sold (COGS) | $24,984.79 |

Gross Profit | $32,065.89 |

|

|

General Expenses | $11,049.55 |

*Rent | $9,000.00 |

*Bank & ATM Fee Expenses | $9.43 |

*Equipment Expenses | $742.40 |

*Marketing Expenses | $503.53 |

*Merchant Fees Expenses | $794.19 |

|

|

Operating Earnings | $21,016.34 |

Interest Expense | $5,000.00 |

Earnings Before Income Tax | $16,016.34 |

Income Tax Expense | $10,000.00 |

Net Profit | $6,016.34 |

What is total income?

It is important not to confuse total income with net income. Gross income, also known as gross income or gross profit, is revenue minus cost of sales (COGS) and is the direct cost associated with the production of a product or service.

This can be expressed in the form of an equation as follows.

Gross income – Operating Expenses = Operating Income

The cost of goods sold for a business is typically displayed at the top of the income statement, just below revenue.

Here are some common examples of COGS:

- Raw materials

- Labor

- Packing, freight, delivery

- Production facility energy and utility costs

- Depreciation of production equipment and machinery

COGS do not include indirect costs such as lawyers, accountants, management, utilities, insurance, interest and other salaries (sometimes called "overheads", "operating costs" or "operating costs"). Be careful.

How is your operating income?

Operating profit is another more conservative measure of profitability that goes one step further than gross profit. This includes operating costs (also known as selling, general and administrative expenses [SG & A]), which are costs that a company incurs independently of production. Operating expenses do not include non-operating expenses such as interest, taxes, depreciation and depreciation.

The operating income equation is:

Gross revenue, operating revenue, and net revenue are the three most common ways to measure a company's profitability, all of which are related.

By writing out all three formulas, you can see how gross profit, operating profit, and net profit differ, and profitability measurements are becoming more and more conservative.

Revenues - COGS = Gross profit

Revenues - COGS - Operating expenses = Operating income

Revenues - COGS - Operating expenses - non-operating expenses = Net income

Notice that the net profit equation includes all three major expense types: cost of goods sold, operating expenses, and non-operating expenses. This is because it is the most conservative and reliable indicator of profitability we have obtained.

The Accounting Period

What is the concept of accounting period?

The concept of accounting periods is based on the theory that all accounting transactions in a business must be divided into equal periods called accounting periods.

The purpose of these periods is to help you prepare financial statements and present them to investors to compare business performance to each period.

By preparing financial statements within a specific time period, a company can determine the profit or loss incurred during the period of its business.

Without the proper accounting period, the results will vary and it will be difficult to determine the financial position of the company at that time.

The accounting period is usually 12 months (1 year). The period is fixed, but the month may vary from company to company.

Types of accounting periods in accounting

In accounting, you can see the following types of accounting periods:

1. Calendar year

2. Fiscal year

Calendar Year: The accounting period for a company following a calendar year is from January 1st to December 31st of the same year.

Fiscal Year: For companies that follow a fiscal year, the accounting period begins on the first day of any other month except January.

Benefits of the accounting period concept

Below are some of the benefits of the accounting period concept

1. Helps you prepare financial statements that show the financial position of your business over a period of time.

2. You can compare financial data related to two accounting periods.

3. Investors can see the progress or decline of a company by looking at trends in financial data over a period of time.

Disadvantages of the concept of accounting period

The following are some of the drawbacks of the accounting period concept

1. You need to maintain two separate accounts for different tax periods.

2. The comparison between the two accounting periods does not take into account the de facto reasons behind the differences observed between the periods.

The continuity doctrine and matching concept

What is the doctrine of corporate continuity?

The Going Concern Principle is the taxation principle that the acquirer must continue the business of the acquirer before the acquisition is considered a tax deferral restructuring. If the acquired company is unable to continue its business, a significant percentage of the company's assets must be used for the new business so that the acquisition is considered a tax deferral transaction. The Going Concern Principle is a taxation principle that governs the tax treatment of a reorganizing company.

A little more about what is the continuity of corporate doctrine

Under the Going Concern Principle, before treating an acquisition as a tax deferral restructuring or transaction, it is necessary to retain the actual business of the acquired company or use most of the company's assets for a combined (new) business. There is. This doctrine is used by the Internal Revenue Service (IRS) for tax processing as companies reorganize. Tax incentives are usually the motivation for most mergers and acquisitions. This doctrine helps the IRS control or limit the number of transactions that can be considered tax deductions. Acquisitions that do not meet these criteria are not automatically subject to tax incentives after restructuring.

An entity is considered to be in business unless there is evidence of opposition. Because companies are relatively permanent, financial accounting is designed with the assumption that the business will survive indefinitely in the future.

The Going Concern concept justifies the valuation of assets on a non-clearing basis and requires the use of acquisition costs for many valuations. In addition, fixed and intangible assets are amortized over their useful lives, rather than in shorter periods, in the hope of early liquidation.

This further means that the data transmitted is tentative and that the current statement should disclose adjustments to the statement over the past year revealed by more recent developments

Matching Concept

The concept of matching in financial accounting is the process of matching (associating) performance or revenue (measured at the selling price of goods and services offered) with labour or expense (measured at the cost of goods and services used) over a specific period of time. Is. Targets for which income has been determined.

This concept emphasizes which item of expense in a particular accounting period is expense. That is, expenses are reported as expenses for the accounting period in which revenue related to those expenses is reported. For example, if the sales of some products are reported as revenue for one year, the costs for those products are reported as expenses for the same year.

The concept of matching only needs to be met after the accountant has completed the concept of realization. First measure the revenue according to the concept of realization, then associate the costs with these revenues. Cost matches revenue, but not the other way around.

Therefore, the reconciliation process requires significant cost allocation in acquisition cost accounting. Past (history) costs are investigated and steps are taken to assign a cost element that is considered to have expired service potential or to match it with the associated revenue.

The remaining component of the cost, which is considered to have continued potential for future services, is carried over to the past balance sheet and is called an asset. Therefore, the balance sheet is just a report of unallocated past costs waiting for the estimated future service potential to expire before it matches the appropriate revenue.

Key takeaways:

- The matching principle states that costs should be reported in the accounting period in which the costs were incurred, and all revenues resulting from the costs should be reported in the same accounting period.

- Revenue recognition may be a generally accepted accounting standard (GAAP) that defines when and the way revenue is recognized.

- The principle of revenue recognition using accrual accounting requires that revenue be recognized when cash is realized and earned, not when cash is received.

- The revenue recognition standard, ASC606, provides a unified framework for recognizing revenue from contracts with customers.

- A going concern principle is a taxation principle that applies to mergers and acquisitions of a company.

- The principle is that in order to qualify for tax deferral restructuring, the acquiring company must either continue the historic business of the target company or use a significant portion of the target business assets in doing business.

What is Revenue Recognition?

Revenue recognition is an accounting standard that outlines the precise conditions under which revenue is recognized. Theoretically, there are many points where you can recognize revenue. This guide describes the recognition principles of both IFRS and U.S. GAAP.

Revenue recognition conditions

- According to IFRS Standards, the following conditions must be met in order for revenue to be recognized:

- Ownership risks and rewards have been transferred from the seller to the buyer.

- The seller loses control of the items sold.

- The collection of payments from goods or services is reasonably guaranteed.

- Revenue can be reasonably measured.

- The cost of revenue can be reasonably measured.

Conditions (1) and (2) are called performance. When it comes to performance, it happens when the seller does what he or she expects to be entitled to pay.

Condition (3) is called collectability. The seller must have an inexpensive expectation that he or she is going to be purchased the performance.

Conditions (4) and (5) are called measurable. Accounting guidelines for matching principles require sellers to be able to match revenue and expense. Therefore, you need to be able to reasonably measure both revenue and expense.

Revenue recognition from contract

IFRS 15 is revenue from contracts with customers and establishes specific steps for revenue recognition. It is important to note that IFRS 15 has some exclusions, including:

- Lease agreement (IAS 17)

- Insurance contract (IFRS 4)

- Financial Instruments (IFRS 9)

Revenue recognition steps from contracts

The five steps of revenue recognition in a contract are:

1. Contract identification

- All conditions must be met in order to enter into a contract.

- Both parties must approve the contract (whether written, verbal, or implied).

- You can identify the transfer point of goods and services.

- Payment terms are identified.

- The contract has a commercial entity.

- There is a possibility of collecting money.

2. Identifying performance obligations

Some contracts may include multiple performance obligations. For example, selling a car with a complementary driving school is considered two performance obligations. The first is the car itself and the second is the driving school.

Performance obligations must be distinguished from each other. To distinguish between goods or services, the following conditions must be met:

Buyers (customers) can benefit from goods and services on their own.

Goods or services are individually identified in the contract.

3. Determining transaction price

Transaction prices are usually easy to determine. Most contracts include a fixed amount. For example, the price of a car with complementary driving lessons is $ 20,000. The transaction price in this case will be $ 20,000.

4. Assign transaction prices to performance obligations

The allocation of transaction prices to multiple performance obligations should be based on the independent selling prices of the performance obligations.

For example, the contract includes the sale of a car with complementary driving lessons. The total transaction price is $ 20,000. The stand-alone price for a car is $ 19,000 and the stand-alone price for a driving school is $ 1,000. The distribution of transaction prices is as follows.

Note: The total percentage is the stand-alone price divided by the stand-alone total price. For example, the total percentage of cars is calculated as $ 19,000 / $ 20,000 = 95%.

5. Revenue recognition according to business performance

Recall the terms of revenue recognition. Conditions (1) and (2) indicate that revenue is recognized when the seller does what is expected to be entitled to payment. Therefore, revenue is recognized in one of the following:

At some point; with time

In the example above, the revenue associated with the car is recognized when the buyer owns the car. Complementary driving lessons, on the other hand, are recognized when the service is provided.

The revenue recognition journals for the two performance obligations (car and driving lessons) are as follows:

For car sales and free driving lessons:

Note: Revenue is recognized for car sales ($ 18,050), but not for complementary driving lessons because it has not yet been offered.

If complementary driving lessons are offered:

Note: Revenue will be deferred until driving lessons are offered.

GAAP Revenue Recognition Principles

The Financial Accounting Standards Foundation (FASB), which sets the standards for US GAAP, has five principles for recognizing revenue:

- Identify customer contracts

- Identify customer contract obligations

- Determine the transaction price

- Assign Corresponding price according to the performance obligation of the contract

- Recognize revenue when performance obligations are met.

Principles of Revenue Recognition

Regardless of the type of accounting you use in your business, the principle of revenue recognition remains the same.

The principle of revenue recognition states that revenue should be recorded when it is earned, not received. The concept of revenue recognition is part of accrual accounting. That is, when you create an invoice for a customer of a product or service, the amount of that invoice is recorded as revenue at that time, not when you receive the money from the customer.

This is one of the major differences between accrual accounting and cash accounting. This is because in cash accounting, revenue is recognized when it is received, not when it is paid.

Revenue recognition requirements

The principle of revenue recognition should use double-entry bookkeeping. Here are some additional guidelines that you need to follow regarding revenue recognition principles:

There is an agreement or agreement between your business and your customers. This means that you have provided your customers with credit terms and have agreed to pay the invoice over time to fulfill those terms. For example, we provide client A with a consulting service with a net 30 credit requirement. If Client A agrees to these terms, Client A agrees to pay the invoice within 30 days from the date of the invoice.

The product or service you are selling has been delivered or completed. This is one of the most important elements of the revenue recognition principle, which means that revenue is recognized and recorded when a service is provided or a product is provided. In essence, this means that your part of the contract is complete.

The cost has been decided. If you want to provide services or sell products to clients, you must provide the clients with the costs of those services or products. The cost is fixed before the revenue is recognized.

Billed amounts can be collected. This is fairly straightforward and demonstrates the importance of accurately screening clients to determine their creditworthiness. Before you can offer your credit terms to your clients, you need to reasonably ensure that you will be able to collect your balance from them in the future. Of course, this is not absolutely certain. This is an exception, not a rule, because even properly scrutinized companies can delay payment of invoices.

If you have any doubts about the collectability of your invoice, it should not be recognized as revenue. This is a difficult problem. This is because it is unlikely that you will extend your credit terms to customers who may not be able to pay your invoice. However, if you encounter this issue, you should delay revenue recognition until the invoice is paid.

If payment is received prior to the product or service, revenue should only be recognized after the service is provided. For example, if your business offers an office cleaning service for $ 500 per month and your customers pay $ 1,500 in the next three months, your revenue will be $ 500 in the next three accounting cycles instead of the current total. It will be recognized. Accounting cycle.

What does the revenue recognition principle mean for a company?

Revenue recognition principles allow you to accurately view your profit and loss by recording your revenue when you earn it, not when you receive it.

Revenue recognition principles are also useful for financial forecasting. Allows your business to more accurately predict future revenue. Recognizing revenue correctly is also important for companies that receive prepayment for services, such as those that offer service contracts that require prepayment.

In order to properly recognize revenue, a company that receives a prepayment for a service provided must only recognize that revenue after the service has been performed. For example, if you offer your customers an annual support contract of $ 12,000 a year, they will recognize a monthly revenue of $ 1,000 for the next 12 months.

Example 1

DATE | ACCOUNT NAME & DESCRIPTION | DEBIT | CREDIT |

1/1/2020 | Cash - To record prepayment | $12,000 |

|

1/1/2020 | Client Prepayment - To record prepayment |

| $12,000 |

Example 2

DATE | ACCOUNT NAME & DESCRIPTION | DEBIT | CREDIT |

1/31/2020 | Client Prepayment - Record January payment | $1,000 |

|

1/31/2020 | Account Services Income - Payment for January |

| $1,000 |

In Example 1, the money will be credited, so debit it from your cash account. However, instead of applying to the income account, place it in the client prepaid account. This will be gradually reduced until you earn the full $ 12,000.

Example 2 debits the January income account and debits it from the client prepaid account to continue monthly journal entries until December for proper accounting, while reducing the balance by $ 1,000. For the income earned.

Example of Revenue Recognition Principles

The following are two simple revenue recognition examples.

- Your business provides tax services to clients. After the tax return is complete, forward a copy of the invoice to the client. The client agrees to pay the invoice within 30 days (net 30 days). The service is already available, so you can immediately recognize your revenue.

- You provide your clients with monthly accounting services. The client pays in advance throughout the year and receives payment on January 2nd throughout the year. You can recognize January revenue because you can only recognize revenue as revenue, but you have to wait until February to recognize February revenue. Revenue is recognized until December of each month when the service is provided.

Recognition of Expenses

What is the principle of expense recognition?

The principle of cost recognition states that costs should be recognized in the same period as the associated revenue. Otherwise, the expense is likely to be perceived as incurred and may be incurred before or after the period in which the associated revenue amount is recognized.

This principle also affects the timing of income tax. In this example, the cost is too high, so the income tax is underpaid this month, and if the cost is too low, the income tax is overpaid the following month.

Some costs, such as managed salaries, rent, and utilities, are difficult to relate to revenue. These costs are designated as term costs and are billed as costs for the relevant period. This usually means that you will be charged when it occurs.

When to use the expense recognition principle

The principle of cost recognition is a core element of accrual accounting, where revenue is recognized at the time of acquisition and costs are recognized at the time of consumption. Instead, if a company recognizes costs when paying a supplier, this is known as accounting cash basis.

If a company wants to be audited in financial statements, it should use the principle of expense recognition when recording commercial transactions. Otherwise, the auditor will refuse to comment on the financial statements.

Example of Expense Recognition Principle

The company pays $ 100,000 for the item and sells it for $ 150,000 the following month. Under the principle of expense recognition, an expense of $ 100,000 should not be recognized as an expense until the following month when the associated revenue is also recognized. Otherwise, the expense will be overvalued by $ 100,000 this month and undervalued by $ 100,000 the following month.

Key takeaways:

- If the sale of goods involves high uncertainties in recoverability, the entity must defer recognition of revenue until after delivery.

- The installment sales method recognizes revenue after the sale or delivery has taken place. Revenue recognized is the product of revenue and the percentage of cash collected.

- Use the cost recovery method when the likelihood of non-collectible payments is very high. With this method, no revenue is recognized until the cash collection exceeds the cost of the seller of the item sold.

- The deposit method is used when the company receives cash before the transfer of ownership occurs.

- Revenue is not recognized upon receipt of cash because the risks and rewards of ownership have not been transferred to the purchaser.

- Revenue is only recognized if a value transfer has taken place.

- According to the principle of revenue recognition, revenue is recognized, feasible or feasible (whether cash payments have been received) during the period of acquisition (buyer and seller have a contract to transfer the asset).

- Recognized if payment collection is reasonably guaranteed).

- Matching principles, which are part of accrual accounting, recognize costs when obligations arise (usually when transferring goods or providing services) and (2) offset recognized revenues incurred from those costs. Need to do it.

- As long as the timing of recognition of revenue and expense is within the same accounting period, revenue and expense will match and will be reported in the income statement.

- In accrual accounting, revenue is realized (collection of payment) or feasible (seller reasonably guarantees that payment of goods will be collected) and earned (usually generated at the time of transfer of goods or provision of services). It will be recognized once you do.

- For companies that do not follow accrual accounting and use cash basis instead, revenue is only recognized when they receive cash.

- Revenue recognition is part of the accrual accounting concept that determines when revenue is recognized during an accounting period.

- The matching principle aims to match revenues and expenses for the right accounting period, also as revenue recognition. This allows you to better evaluate your income statement, which shows the income and expenses for the accounting period, or the amount of money spent to earn the income for that period.

- Accrual journals for recording sales include debits to accounts receivable and credits to revenue. For cash sales, debit cash instead.

- The revenue earned is reported as part of the revenue on the income statement for the current accounting period.

- If the transfer of ownership of the sold item is not immediate and the item requires delivery, the shipping terms of the sale determine when revenue is recognized. The shipping terms are usually "FOB shipping address" and "FOB shipping point".

- If a company is unable to reasonably estimate future revenues and / or has a very high rate of return, then revenue should only be recognized when the return right expires.

Meaning, Characteristics and Accounting of non-profits

A non-profit organization is an organization established for the purpose of social welfare and the promotion of social arts and culture. These are usually founded as charities with a motive for service. The trustee manages these organizations. Members of the organization elect a trustee. Non-profits raise funds from their members and the general public to achieve their goals.

The main motivation for these organizations is to provide services. But they may eventually benefit. In general, these organizations do not manufacture, buy, sell, or provide services for goods. Therefore, they do not need to prepare trading and P & L A / c. They credit the funds they receive to the Capital Fund or the General Fund A / c.

Accounting for Non-Profit Organizations

As we know, non-profits do not trade goods or provide profitable services. However, they also need to keep good records of income, expenses, assets, and liabilities. Their main sources of income are donations, subscriptions and grants. Therefore, most of their transactions are done through cash or bank accounts.