UNIT III

Accounting for Hire Purchase and Consignment

Meaning & Introduction

If you buy your TV in cash, you pay, for example, Rs. 15,000. But if you want to pay in instalments of Rs, for example. You may need to pay 3,000 or Rs in 4 instalments each year. A total of 20,000. Extra amount of Rs. 3,000 are interested. If you choose the latter payment method, you will need to debit Rs. 5,000 to treat with interest in television as rated by Rs. 15,000 (not Rs. 20,000). For installment payments, there are two types of arrangements. Each installment may be treated as an "employment" in which the purchaser becomes the owner only if the purchaser has paid all the instalments. In other words, no property is passed to him, even if one installment remains unpaid. The seller reserves the right to take away the goods in case of default with respect to any installation. This is known as the "Hire Purchase" System.

Another arrangement may be that the property passes at the same time as the contract is signed. If the installment payment is not paid, the seller does not have the right to retrieve the item. His right is to sue the buyer for the amount to be paid. This is known as an Installment Payment System.

Definition: The Hire Purchase System is a system in which an employer (employee purchaser) purchases goods from a seller (employment vendor) but does not pay the full amount at one time. However, the down payment will be made in one lump sum and the balance will be paid in instalments by the employer. It's kind of like an installment plan, but the big difference between the installment plan and the hiring purchase plan is when the ownership is transferred.

Rental purchase systems are generally imposed on products with high resale value in the market. Therefore, if the job purchaser does not pay in instalments, the job vendor has the option of re-owning and reselling the asset in the market to recover costs and rates of return.

Parties involved in the employment purchase system

1. Hirer: In general terms, "Hirer" means the purchaser of an item, or the owner or person who acquires an item from a seller under an employment purchase system.

2. Rental Vendor: A "rental vendor" is the owner or seller of a product that delivers the product to the rental company based on the rental purchase system.

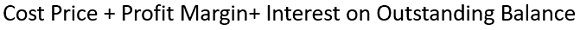

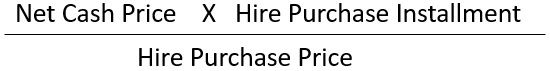

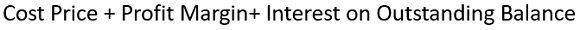

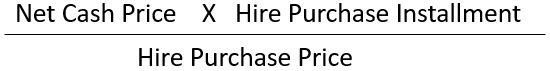

Formula

1. To calculate the Rental Purchase Price

2. How to calculate Cash Price Instalments

Hire Purchase Contract

The Employment Purchase Agreement contains conditions under which the Buyer and Seller mutually agree to hire the goods. This agreement contains the following terms:

The vendor or seller grants ownership of the goods to the employer or employment purchaser, provided that ownership is transferred only when the employer pays the final installment payment.

Hirer has the option to terminate the contract at any time if the asset is not needed or if additional instalments cannot be paid. Instalments paid by that date are considered rent to use the asset and the employer must return the asset to the vendor upon termination of the contract.

Contents of Employment Purchase Contract

According to the Employment Purchase Act of 1972 (Section 4), the Employment Purchase Agreement must include the following:

- Product description.

- The selling price of the sold product.

- The actual cash price of the item sold.

- Date and time of contract start.

- The amount and number of instalments paid by the employer along with the interest rate.

- The last day until all instalments are paid off.

- The name of the person eligible for the installment payment.

Benefits of Employment Purchasing System

Here are some of the benefits of a hiring purchase system:

- Buying an asset is much easier for your employer by paying in simple instalments.

- After paying all instalments, the employer can enjoy ownership of the asset.

- Hirer can claim depreciation of employment assets.

- Hirer enjoys tax incentives over the interest you pay when hiring a purchased item.

- The rental purchase system is also beneficial to vendors as it increases sales volume.

Features of Hire Purchase System

Some of the related features of the Employment Purchasing System are:

Law: Regulated by the Employment Purchase Act of 1972.

Parties: This is an agreement between the employer and the hiring vendor to hire the asset.

Claims: If the employer fails to pay, the hiring vendor can only sue or claim the return of the property and not the remaining instalments.

Selling Rights: Hiler may not sell or mortgage the assets employed until the ownership is transferred.

Loss Bearer: The hiring vendor remains liable for the loss of the goods until ownership is transferred to the employer.

Key takeaways:

- Hire Purchase Contract are not considered an extension of credit.

- Hire Purchase Contract do not transfer ownership to the purchaser until all payments have been made.

- Hire Purchase Contract have usually proven to cost more in the long run than purchasing the item in full.

- Each installment may be treated as an "employment" in which the purchaser becomes the owner only if the purchaser has paid all the instalments.

- The Hire Purchase System is a system in which an employer (employee purchaser) purchases goods from a seller (employment vendor) but does not pay the full amount at one time.

- Hirer has the option to terminate the contract at any time if the asset is not needed or if additional instalments cannot be paid.

- Instalments paid by that date are considered rent to use the asset and the employer must return the asset to the vendor upon termination of the contract.

Calculation of Interest on Hire Purchase

Interest: In either case (employment purchase or installment payment), interest must be separated from the principal. Payments will continue for more than two fiscal years, so you will need to calculate the interest for each year separately. Information about cash prices and interest rates is usually available. This will make it easier to calculate interest. Simply set up one party's account on a regular line and charge interest on your unpaid balance. Suppose A purchases from machine B with a cash price of Rs on January 1, 2000. 15,000; Rs. 5,000 rupees will be paid at the time of signing the contract, and 4,000 rupees will be paid at the end of each year for three years. The interest rate is 10% per annum. If you create B's account (memo-based) in A's book, you'll see the annual interest.

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs. 10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs. 7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

Since this is the final year of instalments, the interest amount will be the difference between the outstanding balance and the actual instalments. [Students note that if they calculate last year's interest at a given percentage of the O / S amount (3700 x 10% = 370), the total payment will be (3700 + 370 = 4070), which is more than the installment payment. Please give me. Paid. So, there is Rs again. 70 will be paid even after the last installment has been paid.

If no interest rate is specified, the interest for each year is proportional to the amount unpaid for each year. In the above example, the total amount paid is Rs. 17,000 rupees 5,000 will be paid immediately. This leaves Rs. 12,000 unpaid in the first year and Rs at the end. 4,000 will be paid. In the second year Rs. 8,000 is outstanding and in the third year it is Rs. There is a deadline of 4,000. The total interest is rupees. 2,000. That is, Rs. 17,000. Minus Rs. 15,000. Interest must be allocated to the unpaid ratio, or Rs, over a three-year period. 12,000; Rs. 8,000 rupees 4,000 or 3: 2: 1 ratio. The interest in the first year is Rs.1,000, in the second year he is Rs.670, and in the third year he is Rs.333. Please note that the interest rate cannot be the same as the specified amount.

To check cash prices, interest rates and instalments. Cash prices may not be listed. Assets cannot be debited beyond the cash price and must be confirmed. The process is to first take last year and separate interest from principal from the total amount to be paid. In the above example, Rs. 4,000 will be paid at the end of 2002. The interest rate is 10%. If Rs.100 is paid at the beginning of 2001, Rs.10 will be added and Rs.110 will be paid at the end of 2002. Therefore, one eleventh of the total paid at the end of the year is interest. The rest are principals. In this way, we can proceed year by year.

Thus: —

| Rs. |

Amount due on 31-12-2001 | 4,000 |

Interest @ 1/11 | 364 |

Amount due on 1-1-2002 or 31-12-2001 | 3,636 |

Paid on 31-12-2001 | 4,000 |

Total amount due on 31-12-2001 | 7,636 |

Interest @ 1/11 | 694 |

Amount due on 1-1-96 or 31-12-2000 | 6,942 |

Paid on 31-12-2000 | 4,000 |

Total amount due on 31-12-2000 | 10,942 |

Interest @ 1/11 | 995 |

Amount due on 1-1-2000 | 9,947 |

Paid Cash down on 1-1-2000 | 5,000 |

Cash Price | 14,947 |

The interest for three years is Rs.995, Rs.694 and Rs.364 respectively. | |

Key takeaways:

- In either case (employment purchase or installment payment), interest must be separated from the principal.

- Payments will continue for more than two fiscal years, so you will need to calculate the interest for each year separately.

- If no interest rate is specified, the interest for each year is proportional to the amount unpaid for each year.

- Information about cash prices and interest rates is usually available.

Accounting for hire purchase transactions by asset purchase method based on full cash price

Journal Entries in the books - Actual Cash Price Method

This method follows a technical approach and does not treat the employer as the owner until the final installment payment is paid. In this way, the asset is recorded at the actual cash price paid.

* Last year's interest is the same as the difference between the payment amount and the beginning balance. It is not calculated in the usual way.

Journal entry with Actual Cash Price Payment Method

Below are the various accounting entries in the books of hiring buyers and hiring vendors.

| Case | In the Books of Hire Purchaser |

| In the Books of Hire Vendor |

| Amount with which debited or credited |

| ||||||

A. | On making down payment due | Asset A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Hire Purchase Sales A/c | Dr. | (With the amount of down payment) |

B. | On making Down Payment | Hire Vendor’s A/c To Bank A/c | Dr. | Bank A/c To Hire Purchaser’s A/c | Dr. | (With the amount of down payment) |

C. | On making principal part of the instalment due | Asset A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Hire Purchase Sales A/c | Dr. | (With the amount of principal part of the instalment) |

D. | On making Interest due on Unpaid balance | Interest A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Interest A/c | Dr. | (With the interest Due on unpaid Balance) |

E. | On making payment of instalment | To Hire Vendor’s A/c To Bank A/c | Dr. | Bank A/c To Hire Purchaser’s A/c | Dr. | (With the amount of instalment) |

F. | On providing Depreciation | Depreciation A/c To Asset A/c | Dr. | No Entry |

| (With the amount of (depreciation) |

G. | On closure of Depreciation A/c | Profit & Loss A/c To Depreciation A/c | Dr. | No entry |

| (With the amount Of depreciation) |

H. | On closure of Interest A/c | Profit & Loss A/c To Interest A/c | Dr. | Interest A/c To Profit & Loss A/c | Dr. | (With the amount Of interests) |

Note: Depreciation is charged on full cash price of the asset and Interest is calculated on total outstanding balance.

Key takeaways:

- The actual amount that is exchanged when a product is purchased or sold in the real world is called as Actual Price method.

- At the end of each accounting period, the associated account appears on the balance sheet.

- Cash prices may include other costs, such as shipping or storage charges for goods.

- Investors often trade commodity futures to profit from expected changes in commodity prices, rather than buying or selling actual commodities.

- However, the cash price of the commodity is actually different from the futures price. Futures contracts reflect expected cash prices later.

- Cash prices are the amount that large manufacturers usually pay for goods in the spot market where they buy the goods, they need for factory production.

- A product is a physical product that is generally indistinguishable no matter which company puts it on the market.

- When paying cash prices, manufacturers do not speculate on the price of the goods they need.

- Speculation is more common in futures than in the cash market. Instead, manufacturers physically purchase the raw materials needed for their manufacturing activities.

Journal entries, ledger accounts and disclosure in balance sheet for hirer and vendor

At the end of each accounting period, the associated account appears on the balance sheet as follows:

Disclosure on the balance sheet based on the Actual Cash Price Payment Method

Balance Sheet of Hire Purchaser |

| Balance Sheet of Hire Vendor | |||

Liabilities | Rs. Assets | Rs. | Liabilities | Rs. Assets | Rs. |

| Fixed Assets: |

|

|

| |

| Asset (at actual cash) |

|

| No disclosure is | |

| Price paid) | Xxx |

| Required |

|

| Less: Depreciation till date | Xxx |

|

|

|

|

| Xxx |

|

|

|

Key takeaways:

- At the end of each accounting period, the associated account appears on the balance sheet.

Hire Purchase in the Books of Vendor

Vendor Books: Vendors do not follow any special method for recording sales of rental purchases, especially when selling large items. He debits the buyer with the cash price and credits the amount received. Interest expense is debited each year. This is explained below.

Illustration-1

Calculate interest under the Employment Purchasing System based on the following details

(a) X & Co.-Buyer Y & Co. -Seller purchase date-January. January 1999

Cash price-Rs. 74,500.

Instalment payment Rs. 20,000 yen at the time of contract conclusion. Rest with 3 instalments of Rs. 20,000 each. Interest rate-5%. Depreciation of 10% of the decreasing balance.

(b) All details above, except that interest rates are not shown.

(c) All details similar to (a) above, except that the cash price is not shown.

Solution:

(a) Calculation of Interest | ||

|

| Rs. |

Jan.1, 1999 | Cash Price | 74,500 |

| Less-Cash down | 20,000 |

| Balance Due | 54,500 |

| Interest @ 5% for 1999 | 2,725 |

Dec.31, 1999 | Total | 57,225 |

| Amount paid | 20,000 |

Jan.1, 2000 | Balance Due | 37,225 |

| Interest for 2000 @ 5% | 1,861 |

Dec.31, 2000 | Total | 39,086 |

| Amount paid | 20,000 |

Jan.1,2001 | Balance due 2001 | 19,086 |

| Interest for (balancing figure) 2001 | 914 |

Jan.1,2002 | Amount paid | 20,000 |

(b) Calculation of interest when the rate of interest is not given :

Hire Purchase Price | 80,000 | ||||

Cash Price | 74,500 | ||||

Total interest | 5,500 | ||||

|

|

|

|

|

|

Year | Amount Outstanding | Ratio | Interest | Rs. | |

1 | 60,000 |

| 3 | 3/6 x 5,500 | 2,750 |

2 | 40,000 |

| 2 | 2/6 x 5,500 | 1,833 |

3 | 20,000 |

| 1 | 1/6 x 5,500 | 917 |

(c) Calculation of cash price, rate of interest being given:

Instalment | Amount due at the end of the year (After payment of Installment) | Instalment Paid | Total amount due at the end of the Year (before payment of instalment) | Interest @ 1/21 | Principal due in the beginning | |

| Rs. | Rs. |

| Rs. | Rs. | Rs. |

3 | Nil | 20,000 |

| 20,000 | 952 | 19,408 |

2 | 19,048 | 20,000 |

| 39,048 | 1,859 | 37,189 |

1 | 37,189 | 20,000 |

| 57,189 | 2,723 | 54,466 |

|

|

|

|

| 5,534 |

|

Cash Price: 54,466 + cash down, Rs. 20,000 or Rs. 74,466.

Illustration-2

Y & Co. Sold a machine with a cash price of Rs. 74,500. X and Co. On a rental purchase basis on January 1, 2000. To. Payment was to be made as Rs. 20,000 down and rupees. 20,000 people every year for 3 years. The interest rate is 5%, Co. Charged depreciation at an annual rate of 10%. About the decrease in balance. Give a ledger account in a Y & Co book.

Ledger of Y & Co. | |||||

Dr. |

|

| X & Co. |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Sales | 74,500 | Jan.1 | By Cash | 20,000 |

Dec.31 | To Interest A/c |

| Dec.31 | By Cash | 20,000 |

| (5% on Rs. 54,500) | 2,725 |

| By Balance c/d | 37,225 |

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 37,225 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 1,861 |

| By Balance c/d | 19,086 |

|

| 39,086 |

|

| 39,086 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 19,086 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 914 |

|

|

|

|

| 20,000 |

|

| 20,000 |

Dr. | Sales Account | Cr. | ||

|

| 2000 |

|

|

|

| Jan. 1 | By X & Co. | Rs. 15,000. |

Interest Account | ||||

Dr. |

|

|

| Cr. |

2000 |

| 2000 |

|

|

Dec.31 to P & L A/c | 2,725 | Dec.31 | By X & Co. | 2,725 |

2001 |

| 2001 |

|

|

Dec.31 to P & L A/c | 1,861 | Dec.31 | By X & Co. | 1,861 |

2002 |

| 2002 |

|

|

Dec.31 to P & L A/c | 914 | Dec.31 | By X & Co. | 914 |

Key takeaways:

- Vendors do not follow any special method for recording sales of rental purchases, especially when selling large items.

- Vendor debits the buyer with the cash price and credits the amount received. Interest expense is debited each year.

Hire Purchase in the Books of Purchaser

Buyer's Book — First Way. Buyers can also enter as if they were a regular asset purchase, according to the system adopted by the vendor. However, he should credit the seller with interest to be paid each year and debit him in cash when paid. The above example can be performed in the following way (ledger account): —

Dr. |

| Machinery account |

| Cr. | |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Y & Co. | 74,500 | Dec.31 | By Depreciation A/c | 7,450 |

|

|

|

| By Balance c/d | 67,050 |

|

| 74,500 |

|

| 74,500 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 67,050 | Dec.31 | By Depreciation A/c | 6,705 |

|

|

|

| By Balance c/d | 60,345 |

|

| 67,050 |

|

| 67,050 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 60,345 | Dec.31 | By Depreciation A/c | 6,035 |

|

|

|

| By Balance c/d | 54,310 |

|

| 60,345 |

|

| 60,345 |

2003 |

|

|

|

|

|

Jan.1 | To Balance b/d | 54,310 |

|

|

|

Y & Co. A/c | |||||

2000 |

| Rs. |

2000 |

| Rs. |

Jan.31 | To bank A/c | 20,000 | Jan.1 | By Machinery A/c | 74,500 |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Interest A/c | 2,725 |

’’ | To Balance c/d | 37,225 |

|

|

|

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Bank A/c | 20,000 | Jan.1 | By Balance b/d | 37,225 |

’’ | To balance c/d | 19,086 | Dec.31 | By Interest A/c | 1,861 |

|

| 39,086 |

|

| 39,086 |

2002 Dec.31 |

To Bank A/c |

20,000 | 2002 Jan.1 |

By Balance b/d |

19,086 |

|

|

| Dec.31 | By Interest A/c | 914 |

|

| 20,000 |

|

| 20,000 |

Students need to set up an account related to interest and depreciation.

The second method. In the second method, the entry is only passed when the payment is due or made. At this point, the vendor will be credited with the unpaid amount. Interest for a term is debited to the interest account and balance (principal) is debited to the asset account. Of course, at the time of payment, the vendor is debited and credited to cash (or bank). The two entries are:

1. Debit asset account, debit interest account, credit (employment) vendor

2. Debit (rental) vendor, credit cash, or (bank)

You need to charge depreciation according to the cash price of the asset

In the above example, the purchaser, X & Co. The journal entries and ledger accounts for the books are shown below.

|

|

| Debit (Rs) | Credit (Rs) |

2000 |

|

|

|

|

Jan.1 | Machinery Account | Dr. | 20,000 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. As down payment for purchase of machinery on hire purchase basis.) |

|

| |

|

|

|

| |

Jan.1 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co. Down) |

|

| |

|

|

|

| |

Dec.31 | Machinery Account | Dr. | 17,275 | |

| Interest Account | Dr. | 2,725 | |

| To Y & Co. |

| 20,000 | |

| (The amount due to Y & Co. Under the hire purchase Contract for interest (and debited as such) and the balance treated as payment for machinery) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank A/c |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec.31 | Depreciation Account | Dr. | 7,450 | |

| To Machinery Account |

| 7,450 | |

| (Depreciation for 1st year-10% on Rs.74,500) |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 10,175 | |

| To Interest Account |

| 2,725 | |

| To Depreciation Account |

| 7,450 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

2001 | ||||

Dec.31 | Machinery Account | Dr. | 18,139 | |

| Interest Account | Dr. | 1,861 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. For interest the balance charged to Machinery A/c.) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec. 31 | Depreciation | Dr. | 6,705 | |

| To Machinery Account |

| 6,705 | |

| (Depreciation for the second year 10% on Rs. 67,050; i.e. Rs. 74,500 - Rs. 7,450). |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 8,566 | |

| To Interest Account |

| 1,861 | |

| To Depreciation Account |

| 6,705 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

2002 | ||||

Dec.31 | Machinery Account | Dr. | 19,086 | |

| Interest Account | Dr. | 914 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. In respect of interest and the principal sum.) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec.31 | Depreciation Account | Dr. | 6,035 | |

| To Machinery Account |

| 6,035 | |

| (Depreciation @ 10% of the diminishing balance charged for the third years). |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 6,949 | |

| To Interest Account |

| 914 | |

| To Depreciation Account |

| 6,035 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

Ledger Accounts | |||||

Dr. |

| Machinery Account |

| Cr. | |

2000 |

| Rs. | 2000 |

| Rs. |

Jan.1 | To Y & Co. | 20,000 | Dec.31 | By Depreciation | 7,450 |

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 29,825 |

| (20,000—2,725) | 17,275 |

|

|

|

|

| 37,275 |

|

| 37,275 |

2001 |

|

| 2001 |

|

|

Jan.1 | To balance b/d | 29,825 | Dec.31 | By Depreciation A/c | 6,705 |

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 41,259 |

| (20,000—1,861) | 18,139 |

|

|

|

|

| 47,964 |

|

| 47,964 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 41,259 | Dec.31 | By Depreciation A/c | 6,035 |

Dec.31 | To Y & Co. | 19,086 | Dec.31 | By Balance c/d | 54,310 |

|

| 60,345 |

|

| 60,345 |

2003 |

|

|

|

|

|

Jan.1 | To Balance b/d | 54,310 |

|

|

|

Dr. |

| Interest Account | Cr. | ||

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Y & Co. | 2,725 | Dec.31 | By P & L A/c | 2,725 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Y & Co. | 1,861 | Dec.31 | By P & L A/c | 1,861 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Y & Co. | 914 | Dec.31 | By P & L A/c | 914 |

Dr. |

|

| Y & Co. |

|

| Cr. |

2000 |

| Rs. |

| 2000 |

| Rs. |

Jan.1 | To Bank A/c | 20,000 | Jan.1 | By Machinery A/c | 20,000 | |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Sundries— |

|

|

|

|

|

| Machinery | 17,275 |

|

|

|

|

| Interest | 2,725 | 20,000 |

|

| 40,000 |

|

| 40,000 | |

2001 |

|

| 2001 |

|

|

|

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 18,139 | |

|

|

|

| By Interest A/c | 1,861 | |

|

| 20,000 |

|

| 20,000 | |

2002 |

|

| 2002 |

|

| |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 19,086 | |

|

|

|

| By Interest A/c | 914 | |

|

| 20,000 |

|

| 20,000 | |

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Machinery A/c | 7,450 | Dec.31 | By P & L A/c | 7,450 |

2001 |

| 2001 |

|

| |

Dec.31 | To machinery A/c | 6,705 | Dec.31 | By P & L A/c | 6,705 |

2002 |

| 2002 |

|

| |

Dec.31 | To Machinery A/c | 6,035 | Dec.31 | By P & L A/c | 6,035 |

Key takeaways:

- Buyers can also enter as if they were a regular asset purchase, according to the system adopted by the vendor.

- However, buyer should credit the seller with interest to be paid each year and debit him in cash when paid.

- In the second method, the entry is only passed when the payment is due or made. At this point, the vendor will be credited with the unpaid amount.

- Interest for a term is debited to the interest account and balance (principal) is debited to the asset account.

Summary

Hire Purchase: No property is passed to him, even if one installment remains unpaid. The seller reserves the right to pick up the goods in the event of default on installment payments. This is known as the "Hire Purchase" system. Another arrangement may be that the property passes at the same time as the contract is signed. If the installment payment is not paid, the seller does not have the right to retrieve the item. His right is to sue the buyer for the amount to be paid. This is known as an installment payment system.

To check cash prices, interest rates and instalments. Cash prices may not be listed. Assets cannot be debited beyond the cash price and must be confirmed. The process is to first take last year and separate interest from principal from the total amount to be paid.

Bookkeeping: Actual Cash Price Payment Method: This method follows a technical approach and does not treat the employer as the owner until the final installment payment is paid. In this way, the asset is recorded at the actual cash price paid.

Vendor Book. Vendors do not follow any special method for recording sales of rental purchases, especially when selling large items. He debits the buyer with the cash price and credits the amount received. Interest expense is debited each year.

Buyer's Book

First Method

Buyers can also enter as if they were a regular asset purchase, according to the system adopted by the vendor. However, he should credit the seller with interest to be paid each year and debit him in cash when paid. The above example can be performed in the following way (ledger account): —

Second Method

In the second method, the entry is passed only when the payment is due or made. At this point, the vendor will be credited with the unpaid amount. Interest for a term is debited to the interest account and balance (principal) is debited to the asset account. Of course, at the time of payment, the vendor is debited and credited to cash (or bank).

Key takeaways:

- No property is passed to him, even if one installment remains unpaid.

- The seller reserves the right to pick up the goods in the event of default on installment payments.

- The process is to first take last year and separate interest from principal from the total amount to be paid.

- Buyers can also enter as if they were a regular asset purchase, according to the system adopted by the vendor.

- Interest for a term is debited to the interest account and balance (principal) is debited to the asset account.

MEANING:

- To consign means TO SEND

- Consignment is an AGREEMENT between two parties i.e., Consignor and Consignee, whereby Consignor agrees to send goods to consignee on regular basis for the purpose of sale in exchange of commission and reimbursement of expenses to be paid by consignor to consignee.

- The party who sends the goods is called CONSIGNOR (Principal).

- The party to whom the goods are sent is called CONSIGNEE (Agent).

- The ownership of the goods i.e., Property in goods remain with consignor. Agent does not become the owner. It means the POSSESSION of the goods is transferred but not OWNERSHIP. On sale, the buyer will become the owner.

- Principal does not send invoice to agent he only sends PROFORMA INVOICE which looks like invoice. The object of proforma invoice is to convey information to agent regarding particulars of goods sent.

- Goods are sold by consignee on behalf of consignor AT THE RISK OF CONSIGNOR. Consignee gets commission for the goods sold and he is not responsible for any Bad Debts that may arise.

- If the agent has to be made responsible for any BAD DEBTS that may arise, he is to be paid additional commission called DEL-CREDERE COMMISSION. Such commission is calculated on total sales, not only on credit sales until and unless agreed.

- Agent sends periodical statement to principal called ACCOUNT SALES. It includes information about sales made by agent, expenses incurred on behalf of principal, commission charged by agent and balance due to principal.

ACCOUNT SALES:

An Account sale is the periodical summary sent by consignee to consignor.

It contains:

a) Sales made.

b) Expenses by consignee on behalf of consignor.

c) Commission earned.

d) Unsold inventory left with consignee.

e) Advance payments if any.

f) Balance payment due or remitted

ADVANCE TO CONSIGNEE | SECURITY AGAINST CONSIGNMENT |

Advance is paid by consignee at the time of delivery of goods which is adjusted in full against amount due. | Deposit is in the form of security against goods. In case if unsold inventories are left with consignee, only proportionate security on respect of sold goods is adjusted against amount due and balance security in respect of goods unsold is carried forward. Full amount of security is not adjusted against amount due |

DIFFERENCE BETWEEN CONSIGNMENT & SALE:

CONSIGNMENT | SALE |

Ownership of the goods remains with the consignor. | Ownership of the goods transfer to buyer. |

Consignee can return unsold goods. | Goods sold can be returned only if seller agrees. |

Consignor bears the loss of goods held with consignee. | Buyer have to bear the loss if any after delivery of goods. |

Relationship between CONSIGNOR and CONSIGNEE is that of PRINCIPAL and AGENT. | Relationship between buyer and seller is that of Creditor and Debtor |

Expenses incurred by consignee to keep goods safely are borne by consignor. | Expenses by buyer to keep goods safely is borne by buyer. |

CALCULATION OF STOCK ON CONSIGNMENT

VALUE OF STOCK ON CONSIGNMENT

= Proportionate Cost of Goods + Proportionate Consignor’s Exp + Proportionate Consignee’s Non-Selling Exp.

CONSIGNEE’S EXPENSE

NON-SELLING EXPENSES (Incurred by consignee before goods reaches at consignee’s place)

Packing, Freight, Carriage inward, Cartage, Octroi, Transit insurance.

SELLING EXPENSES (Incurred by consignee after goods reaches at consignee’s place)

Godown rent, Godown insurance, Delivery charges, Advertisement & Other selling exp.

VALUE OF GOODS IN TRANSIT

= Proportionate Cost + Proportionate consignors Exp.

COMMISSION

NORMAL COMMISSION | OVER-RIDING COMMISSION | DEL-CREDERE COMMISSION |

Given to agent as a reward for his services. | Given to agent for selling goods over and above a targeted price. This type of commission includes agent to sell at higher selling price. | Given to agent for shifting responsibility of collection and risk too. In case if Del-Credere Commission is given, agent bears the loss of Bad Debts (if any) |

NORMAL & ABNORMAL LOSS

NORMAL LOSS

A loss which is unavoidable and essential.

A loss which can be anticipated well in advance

Such loss would be spread over entire consignment. It means good units will bear the normal loss.

ABNORMAL LOSS

A loss which is incurred over and above the normal loss.

A loss which is avoidable.

Such loss would not be spread over entire consignment. It means good units will not bear the abnormal loss.

ABNORMAL LOSS IN TRANSIT does not include consignee’s non-recurring exp.

ABNORMAL LOSS AT CONSIGNEES GODOWN include consignee’s non-recurring expenses.

GOODS RETURNED BT CONSIGNEE does not include consignee’s expenses.To return the goods.

JOURNAL ENTRIES IN THE BOOKS OF CONSIGNOR

GOODS SENT ON CONSIGNMENT. Consignment A/c. Dr To GSOC A/C. EXPENSES PAID BY CONSIGNOR Consignment A/c. Dr To Cash/Bank A/c. EXPENSES PAID BY CONSIGNEE Consignment A/c. Dr To Consignee A/c SALES BY CONSIGNEE Consignee A/c. Dr To Consignment A/c EXPENSES & COMMISSION BY CONSIGNEE. Consignment A/c. Dr To Consignee A/c FINAL REMITANCE RECEIVED Cash/Bank A/c. Dr To Consignee A/c

| TRANSFER OF GSOC GSOC A/c. Dr To Trading A/c. GOODS RETURNED BY CONSIGNEE GSOC A/c. Dr To Consignment A/c

ADV. RECEIVED FROM CONSIGNEE Cash/Bank/BR A/c. Dr To Consignee A/c. BR DISCOUNTED Bank A/c. Dr Discount A/c. Dr To BR A/c.

DISCOUNT CHARGED/TRF.TO CONSIGNMENT A/c. Consignment A/c. Dr To Discount A/c.

| NORMAL LOSS NO ENTRY Cost of normal units will be shifted to other Good units and finally borne by customer. ABNORMAL LOSS P&L A/c. Dr. To Consignment A/c

This loss is not shifted to good units but shifted to P&L A/c. It means it is borne by businessman In case if insurance Claim is admitted, entry for abnormal loss will appear as follows Insurance claim. Dr P&L A/c. Dr. To Consignment A/c |

GOODS SENT ON CONSIGNMENT AT INVOICE PRICE

Dr. CONSIGNMENT A/c Cr.

Particulars | Amount | Particulars | Amount |

To Opening stock | Invoice Price | By Opening Stock Reserve | LOADING |

To GSOC(Goods sent) | Invoice Price | By GSOC(Goods sent) | LOADING |

TO GSOC(Goods returned) | LOADING | BY GSOC(Goods returned) | Invoice Price |

To Closing Stock Reserve | LOADING | By Closing Stock | Invoice Price |

GOODS SENT ON CONSIGNMENT AT INVOICE PRICE Consignment A/c. Dr To GSOC A/c. | GOODS RETURNED FROM CONSIGNMENT AT INVOICE PRICE GSOC A/c. Dr To Consignment A/c. |

LOADING ON GOODS SENT ON CONSIGNMENT AT INVOICE PRICE GSOC A/c. Dr To Consignment A/c. | LOADING ON GOODS RETURNED FROM CONSIGNMENT AT INVOICE PRICE Consignment A/c. Dr To GSOC A/c. |

JOURNAL OF CONSIGNEE

GOODS RECEIVED ON CONSIGNMENT.

NO ENTRY

EXPENSE PAID BY CONSIGNOR

NO ENTRY

EXPENSES PAID BY CONSIGNEE.

Consignor A/c. Dr

To Cash/Bank A/c.

CASH SALES MADE BY CONSIGNEE.

Cash/Bank A/c. Dr

To Consignor A/c.

CREDIT SALES MADE BY CONSIGNEE.

Consignment Debtor A/c. Dr

To Consignor A/c.

COLLECTION FROM CONSIGNMENT DEBTOR.

Cash/Bank A/c. Dr

To Consignment Debtors A/c.

COMMISSION CHARGED.

Consignor A/c. Dr

To Commission / Del-credere commission A/c

AMOUNT PAID TO CONSIGNOR.

(advance or final remittance)

Consignor A/c. Dr

To Cash / Bank / BP A/c

BAD DEBTS

(a) If Del-Credere Commission is charged

Del-Credere A/c. Dr.

To Consignment Debtors A/c

(b) If Del-Credere Commission is NOT charged

Consignor A/c. Dr.

To Consignment Debtors A/c.

Q.1. RAWAL RATAN SINGH of Chittorgarh consigned 1000 units of 100 each to RANI PADMAVATI of SINGHAL. Expense made by RAWAL RATAN SINGH in such consignment are Rs. 20,000.

RANI PADMAVATI paid unloading charges Rs. 5,000 and Rs.2 P.U. Selling expenses.

She sold all the goods at Rs.140 each and deducted 5% as commission and remitted draft for the balance. Prepare Ledger accounts in the books of Consignor.

SOLUTION: -

Ledger of Rawal Ratan Singh(Consignor)

Dr. CONSIGNMENT A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Goods sent on Consignment (1000 X 100) | 1,00,000 | By Padmavati (Sales-1000 X 140) | 1,40,000 |

T0 Cash (1000 X 20) | 20,000 |

|

|

To Padmavati Non selling exp (1,000 X 5) Selling exp (1,000 X 2) |

5,000 2,000 |

|

|

To Padmavati (Comm-1,40,000 X 5%) | 7,000 |

|

|

To P&L (Bal.Fig) | 6,000 |

|

|

|

|

|

|

TOTAL | 1,40,000 | TOTAL | 1,40,000 |

Dr. PADMAVATI A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Consignment | 1,40,000 | By Consignment | 6,600 |

|

| By Consignment | 5,600 |

|

| By Bank (Bal.Fig) | 1,27,800 |

|

|

|

|

TOTAL | 1,40,000 | TOTAL | 1,40,000 |

Dr. Goods Sent On Consignment A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

|

| By Consignment | 1,00,000 |

To Trading (transfer) | 1,00,000 |

|

|

TOTAL | 1,00,000 | TOTAL | 1,00,000 |

Q.2. On 15 Jan, 2013 J&K Co. Of Mumbai sent to Muku & Co. Of Kolkata 400 bicycle at an invoice price of Rs.100 per bicycle to be sold on commission. Freight and insurance were Rs.600.

Accounts sale was received from consignee as follow: -

15 March - 100 per bicycle were sold @ Rs.145 on which 5%. Commission and Rs.375 for expenses were deducted.

10 April - 150 per bicycle were sold @ Rs.140 on which 5%. Commission and Rs.290 for expenses were deducted.

From the above information prepare Consignment A/c in the books of J&K Co. And close it on 30 April, 2013 keeping in mind that no salves were made afterwards. Also show accounts in the books of Muku & Co.

Solution: -

Ledger of J&K CO. (Consignor)

Dr. CONSIGNMENT A/c Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

2013 |

|

| 2013 |

|

|

Jan 15 | To GSOC | 40,000 | Mar. 15 | By Muku (sales) | 14,500 |

Jan 15 | To Cash/Bank (J&K exp.) | 600 | Apr. 10 | By Muku (sales) | 21,000 |

Mar. 15 | To Muku (exp.) | 375 | Apr. 30 | By Stock on Consignment | 15,225 |

Mar. 15 | To Muku (commission) | 725 |

|

|

|

Apr. 10 | To Muku (exp.) | 290 |

|

|

|

Apr. 10 | To Muku (commission) | 1,050 |

|

|

|

Apr. 30 | To P&L (Bal. Fig.) | 7,685 |

|

|

|

|

|

|

|

|

|

| TOTAL | 50,725 |

| TOTAL | 50,725 |

Dr. MUKU’s A/c (Consignee) Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

2013 |

|

| 2013 |

|

|

Mar. 15 | To Consignment (Sales) | 14,500 | Mar. 15 | By Consignment (expense) | 375 |

Apr. 10 | To Consignment (Sales) | 21,000 | Mar. 15 | By Consignment (Commission) | 725 |

|

|

| Apr. 10 | By Consignment (expense) | 290 |

|

|

| Apr. 10 | By Consignment (Commission) | 1,050 |

|

|

| Apr. 30 | By Balance c/d | 33,060 |

| TOTAL | 35,500 |

| TOTAL | 35,500 |

Dr. Goods sent on Consignment A/c Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

2013 |

|

|

| 2013 |

|

Apr. 30 | To Trading A/c (transfer) | 40,000 | Jan. 15 | By Consignment | 40,000 |

|

|

|

|

|

|

| TOTAL | 40,000 |

| TOTAL | 40,000 |

LEDGER OF MUKU & CO. (Consignee)

Dr. J&K Co. A/c Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

2013 |

|

| 2013 |

|

|

Mar. 15 | To Cash/Bank (expense) | 375 | Mar. 15 | By Cash/Bank (Sales) | 14,500 |

Mar.15 | To Commission | 725 | Apr. 10 | By Cash/Bank (Sales) | 21,000 |

Apr. 10 | To Cash /Bank (expense) | 290 |

|

|

|

Apr. 10 | To Commission | 1,050 |

|

|

|

Apr. 30 | To Balance c/d | 33,060 |

|

|

|

|

|

|

|

|

|

| TOTAL | 34,500 |

| TOTAL | 34,500 |

Dr. COMMISSION A /c Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

2013 |

|

| 2013 |

|

|

Apr. 30 | To P&L (Bal.Tfd.) | 1,775 | Mar.15 | By J&K (14,500 X 5%) | 725 |

|

|

| Apr. 10 | By J&K (21,000 X 5%) | 1,050 |

|

|

|

|

|

|

| TOTAL | 34,500 |

| TOTAL | 34,500 |

Working note: -

Closing Stock

Cost of Goods Sent.

Quantity sent 400

Cost of Goods (400 X 100) 40,000

Add: - J&K Co. Expense 600

b) Total Cost 40,600

c) Quantity Sold 250

d) Quantity in stock 150

e) Closing Stock - Cost

= Total Cost X Quantity in Stock / Quantity Sent

= 40,600 X 150/400

= 15,225

Note: - It is assumed that the consignee's expenses are incurred after the goods have reached their godown and hence not included in valuation of stock.

Q.3. On 1st November,2015, A of Calcutta sends goods costing Rs.1,00,000 to B of Delhi on Consignment basis. A paid Rs. 5,000 as freight and Rs. 2,000 as insurance.

On 31st December,2015, an Account Sales was received from B disclosing that the entire quantity of goods were sold for Rs.1,50,000 out of which Rs. 30,000 was sold on credit A customer who purchased goods for Rs. 5,000 failed to pay and the debt proved bad. All other debts were collected by B in full. As per the agreement, B is allowed a commission @ 10% on sales. B sends the amount due to A by cheque.

Prepare necessary Ledger accounts in the books of A & B.

Solution: -

LEDGER OF A

Dr. CONSIGNMENT A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Goods sent on Consignment | 1,00,000 | By B’s (Cash sales) | 1,20,000 |

To Cash/Bank Freight. 5,000 Insurance. 2000 | 7,000 | By B’s (Cr. Sales) | 30,000 |

To B's (commission) (10% of 1,50,000) | 15,000 |

|

|

To B's A/c (Bad debt) | 5,000 |

|

|

To P&L A/c (bal.fig.) | 23,000 |

|

|

|

|

|

|

TOTAL | 1,50,000 | TOTAL | 1,50,000 |

Dr. B's A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Consignment (Cash sales) | 1,20,000 | By Consignment (commission) | 15,000 |

To Consignment (Cr. Sales) | 30,000 | By Consignment (bad debts) | 5,000 |

|

| By Bank A/c (Remittance) | 1,30,000 |

|

|

|

|

TOTAL | 1,50,000 | TOTAL | 1,50,000 |

Dr. Goods sent on Consignment A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Trading A/c (transfer) | 1,00,000 | By Consignment A/c | 1,00,000 |

TOTAL | 1,00,000 | TOTAL | 1,00,000 |

LEDGER OF B

Dr. A's A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Commission | 15,000 | By Cash/ Bank (Sales) | 1,20,000 |

To Consignment Debtors (Bad debts- no del credere comm) | 5,000 | By Consignment Debtors (Cr. Sales) | 30,000 |

To Cash/Bank (Remittance) | 1,30,000 |

|

|

TOTAL | 1,50,000 | TOTAL | 1,50,000 |

Dr. CONSIGNMENT DEBTORS A/c Cr.

PARTICULAR | AMOUNT | PARTICULAR | AMOUNT |

To A's | 30,000 | By Cash/Bank (collection) | 25,000 |

|

| By A's (Bad debts no del cr. Commission) | 5,000 |

TOTAL | 30,000 | TOTAL | 30,000 |

Q.4 Refer to question 3. Prepare the necessary ledger account, if in the above question the consignee is given a del credere commission of 5% on sales (In addition to ordinary commission)—other things remaining the same.

SOLUTION: -

LEDGER OF A

Dr. CONSIGNMENT A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To GSOC | 1,00,000 | By B’s (Cash sales) | 1,20,000 |

To Cash/Bank Freight. 5,000 Insurance 2000 | 7,000 | By B's (Cr. Sales) | 30,000 |

To B's (commission) (10% of 1,50,000) | 15,000 |

|

|

To B's (Del-Credere Commission) | 7,500 |

|

|

To P&L (bal.fig.) | 23,000 |

|

|

TOTAL | 1,50,000 | TOTAL | 1,50,000 |

Dr. B's A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Consignment (Cash sales) | 1,20,000 | By Consignment (commission) | 15,000 |

To Consignment (Cr. Sales) | 30,000 | By Consignment (Del-cr. Commission) | 7,500 |

|

| By Cash/Bank(Remittance) | 1,27,500 |

TOTAL | 1,50,000 | TOTAL | 1,50,000 |

Dr. Goods sent on Consignment A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Trading A/c (transfer) | 1,00,000 | By Consignment A/c | 1,00,000 |

TOTAL | 1,00,000 | TOTAL | 1,00,000 |

LEDGER OF B

Dr. A's A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To commission | 15,000 | By Cash/ Bank (Sales) | 1,20,000 |

To Del credere commission | 7,500 | By Consignment Debtors (Cr. Sales) | 30,000 |

To Cash/Bank (Remittance) | 1,27,500 |

|

|

TOTAL | 1,50,000 | TOTAL | 1,50,000 |

Dr. CONSIGNMENT DEBTORS A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To A's | 30,000 | By Cash/Bank (collection) | 25,000 |

|

| By A's (Bad debts Adjusted) | 5,000 |

TOTAL | 30,000 | TOTAL | 30,000 |

Dr. Del Credere Commission A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Consignment Debtors (Bad Debts) | 5,000 | By A's | 7,500 |

To P&L (Bal. Fig) | 2,500 |

|

|

TOTAL | 7,500 | TOTAL | 7,500 |

Dr. COMMISSION A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To P&L (Bal. Fig) | 15,000 | By A's | 15,000 |

TOTAL | 15,000 | TOTAL | 15,000 |

Dr. PROFIT & LOSS ACCOUNT Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Profit c/d to B/S | 17,500 | By Commission | 15,000 |

|

| By Del Credere Commission (Net trfd.) | 2,500 |

TOTAL | 17,500 | TOTAL | 17,500 |

Q.5. Amit of Mumbai consigned 100 sewing machines to Sanjay of Surat to be sold on his risk. The cost of one machine was Rs.150, but the invoice price was Rs.200. Amit paid freight Rs. 600 and insurance in transit Rs.200

Sanjay sent a draft to Amit for Rs. 10,000 as advance and later sent an account sales showing that 80 machine were sold at Rs.220 each. Expenses incurred by Sanjay were carriage inward Rs. 25, Octroi Rs.75, godown rent Rs.500 and advertisement Rs.300. Sanjay is entitled to a commission of 5% on sales.

Journalise the above transaction in the books of Amit and Sanjay.

SOLUTION: -

LEDGER OF AMIT

Dr. CONSIGNMENT A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To GSOC | 20,000 | By Sanjay (Sales) | 17,600 |

To Cash/Bank (Amit expenses) | 800 | By Stock on Consignment | 4,180 |

To Sanjay (Expenses) | 900 | By GSOC (Load) | 5,000 |

To Sanjay (Commission) | 880 |

|

|

To Stock Reserve c/d | 1,000 |

|

|

To P&L(bal.fig.) | 3,200 |

|

|

TOTAL | 26,780 | TOTAL | 26,780 |

Dr. SANJAY A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Consignment (Cash Sales) | 17,600 | By Cash/ Bank (Advance) | 10,000 |

|

| By Consignment (Expenses) | 900 |

|

| By Consignment (Commission) | 880 |

|

| By Balance c/d | 5,820 |

TOTAL | 17,600 | TOTAL | 17,600 |

Dr. Goods sent on Consignment A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Consignment | 5,000 | By Consignment A/c | 20,000 |

To Trading A/c (transfer) | 15,000 |

|

|

TOTAL | 20,000 | TOTAL | 20,000 |

LEDGER OF SANJAY

Dr. AMIT A/c Cr.

PARTICULAR | AMOUNT | PARTICULAR | AMOUNT |

To Cash/ Bank (Advance) | 10,000 | By Cash/ Bank | 17,600 |

To Cash/ Bank (Expenses) | 900 |

|

|

To Commission | 880 |

|

|

To Balance c/d | 5,820 |

|

|

TOTAL | 17,600 | TOTAL | 17,600 |

Q.6. On 1st July,2016, Rustom House of Ahmedabad consigned 100 keyboards to TCS of Mumbai. The cost of each keyboard was Rs.450 but the pro forma invoice price was Rs.600. Rustom House paid Rs.3000 for freight and insurance. On 7th July,2016, TCS accepted a 3 months’ bill drawn upon them by Rustom House for Rs. 30,000. TCS paid Rs. 1,200 as rent and Rs.750 for advertisement and up to 31st December,2016(On which Rustom House closes their books) they sold 80 keyboards @ 615 each. TCS were entitled to a commission of 5% on sales.

Show the ledger accounts recording the above transaction in the books of Rustom House and TCS

SOLUTION: -

LEDGER OF Rustom House

Dr. CONSIGNMENT A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To GSOC | 60,000 | By TCS (Sales) | 49,200 |

To Cash/Bank (Rustom House expenses) | 3,000 | By Stock on Consignment | 12,600 |

To TCS (Expenses) | 1,950 | By GSOC (Load) | 15,000 |

To TCS (Commission) (49,200 X 5%) | 2,460 |

|

|

To Stock Reserve (Load) | 3,000 |

|

|

To P&L(bal.fig.) | 6,390 |

|

|

TOTAL | 17,600 | TOTAL | 17,600 |

Dr. TCS A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Consignment (Cash Sales) | 49,200 | By Bills Receivable (Advance) | 30,000 |

|

| By Consignment (Expenses) | 1,950 |

|

| By Consignment (Commission) | 2,460 |

|

| By Balance c/d | 14,790 |

TOTAL | 49,200 | TOTAL | 49,200 |

Dr. Goods sent on Consignment A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Trading A/c (transfer) | 45,000 | By Consignment A/c | 60,000 |

To Consignment | 15,000 |

|

|

TOTAL | 60,000 | TOTAL | 60,000 |

LEDGER OF TCS

Dr. Rustom House A/c Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Bills Payable (Advance) | 30,000 | By Cash/ Bank(Sales) | 49,200 |

To Cash/ Bank (Expenses) | 1,950 |

|

|

To Commission | 2,460 |

|

|

To Balance c/d | 14,790 |

|

|

TOTAL | 49,200 | TOTAL | 49,200 |

Q.7. D. Dogra of Delhi sent to his agent, M. Monga of Madras, 500 articles costing Rs.15/- per article at an invoice price of Rs.20 per article. The following payments were made by D. Dogra in this connection: freight and carriage Rs. 450, miscellaneous exp. Rs. 50. M. Monga sent a bank draft for Rs. 3,000 as an advance against the Consignment M. Monga sold 300 articles at a flat rate of Rs.28 per article and sent an Account Sales showing deduction for storage charges Rs.550 insurance Rs.550 and his Commission of 3% plus 2% Del Credere on gross sale proceeds, and remitted the amount due on consignment. M. Monga also informed D. Dogra that 50 articles were damaged in transit and thus they were valued at Rs.550. Journalize the above transactions in the books of the consignor and consignee.

SOLUTION: -

Books of Dogra (Consignor)

Journal

|

|

|

| Dr. | Cr. |

|

| Rs. | Rs. | ||

(1) | Consignment to madras A/c Dr | 7,500 |

| ||

| To Goods sent on Consignment A/c |

| 7,500 | ||

(500 articles sent to M. Monga, Agent, Cost being Rs.15 per article). | |||||

(2) | Consignment to Madras A/c Dr | 500 |

| ||

| To Bank Account |

| 500 | ||

(Expenses incurred on the Consignment) | |||||

| Freight & Carriage | Rs. | 450 |

|

|

| Miscellaneous Exp. | Rs. | 50 |

|

|

|

|

| 500 |

|

|

(3) | Bank Account Dr | 3,000 |

| ||

| To M. Monga |

| 3,000 | ||

(Advance received from the Agent in the form of Bank Draft.) | |||||

(4) | M. Monga Dr | 8,400 |

| ||

| To Consignment to Madras A/c |

| 8,400 | ||

(Sales affected by M. Monga as per Account Sales.) | |||||

(5) | Consignment to Madras A/c Dr | 570 |

| ||

| To M. Monga |

| 570 | ||

(Expenses incurred by M. Monga Rs.150 and Commission due to him, Rs.550 (5% of Rs. 8,400). | |||||

(6) | Bank Account Dr | 4,830 |

| ||

| To M. Monga |

| 4,830 | ||

(Amount due from the consignee received.) | |||||

(7) | P & Loss A/c Dr | 350 |

| ||

| To Consignment to Madras A/c |

| 350 | ||

(Abnormal Loss on 50 damaged Articles) | |||||

(8) | Stock on Consignment A/c Dr | 2,850 |

| ||

| To Consignment to Madras A/c |

| 2,850 | ||

| (Value of stock unsold at Madras) |

| Rs. |

|

|

| 150, goods articles, @ Rs.20 |

| 2,250 |

|

|

| Add: Expenses Rs.150 |

| 150 |

|

|

| 50 damaged articles |

| 450 |

|

|

|

|

| 2,850 |

|

|

(9) | Consignment to Madras A/c Dr | 3,030 |

| ||

| To Profit & Loss Account |

| 3,030 | ||

(Profit on consignment transferred to Profit & Loss Account) | |||||

(10) | Goods sent on Consignment A/c | 7,500 |

| ||

| To Trading A/c |

| 7,500 | ||

(Goods sent on consignment A/c closed by transfer to trading Account) | |||||

Books of M. Monga (Consignee)

Journal

|

|

|

| Dr. | Cr. |

|

| Rs. | Rs. | ||

(1) | D.Dogra A/c Dr | 3,000 |

| ||

| To Bank A/c |

| 3,000 | ||

(Advance sent to the Consignor against consignment) | |||||

(2) | D. Dogra A/c Dr | 150 |

| ||

| To Bank A/c |

| 150 | ||

(Expenses incurred on the Consignment on behalf of D. Dogra | |||||

| Storage |

| 50 |

|

|

| Insurance |

| 100 |

|

|

|

|

| 150 |

|

|

(3) | Bank A/c Dr | 8,400 |

| ||

| To D. Dogra A/c |

| 8,400 | ||

(Sale of 300 articles @ Rs.28 each out of the Consignment.) | |||||

(4) | D. Dogra A/c Dr | 420 |

| ||

| To Commission A/c |

| 420 | ||

(5% Commission on Sales made on half of D. Dogra; 3% Commission + 2% Del Credere) | |||||

(5) | D. Dogra A/c Dr | 4,830 |

| ||

| To Bank A/c |

| 4,830 | ||

(Amount due to D. Dogra remitted). | |||||

Q.8. Philips Radio of Calcutta dispatched 1,000 transistors at Rs.700 each to Mohan Bros. Of Delhi, the consignors paid freight Rs.7,500, cartage Rs.500 and insurance Rs.2,500 Mohan Bros. Received only 900 sets and incurred he following expenses.

Rs.

Octroi and other Expenses 1,00,000

Cartage 5,000

Sales expenses 6,000

The consignee sold 600 sets only. You are required to calculate the value of closing stock.

SOLUTION: -

Calculation of value of unsold stock

Particulars | Units |

Sets Received | 900 |

Sets Sold | 300 |

Unsold Stock | 600 |

Particulars | Rs. |

Cost of Unsold Stock (300 x 700) | 2,10,000 |

Add: Proportionate expenses of Consignor (7500 + 500 + 2500) x 300/1000 | 3,150 |

Add: Proportionate expenses of Consignee (Octroi & Cartage) (1,00,000 + 5000) x 300/900 | 35,000 |

| 2,48,150 |

Q.9. Deepak sold goods on behalf of Geep Sales Corporation on consignment basis. On 1 January 2002 he had with him a stock of Rs.20,000 on consignment. During the year he received goods worth Rs.2,00,000.

Deepak had instructions to sell goods at cost plus 25% and was entitled to a commission of 4% on sales in addition to 1% del credere commission.

During the year ended 31 December 2002 cash sales were Rs.1,20,000; credit sales Rs.1,05,000; Deepak’s expenses relating to consignment Rs.3,000 being salaries and insurance bad debts amounted to Rs.3,000.

Prepare necessary accounts in the books of Geep Sales Corporation.

SOLUTION: -

Solution : |

|

|

|

In the books of Geep Sales Corporation | |||

Consignment Account | |||

Dr. |

|

| Cr. |

| Rs. |

| Rs. |

To Consignment Stock b/d | 20,000 | By Deepak |

|

To Goods sent on Consignment Account | 2,00,000 | Cash Sales 1,20,000 |

|

To Deepak (Commission) | 9,000 | Credit Sales 1,05,000 | 2,25,000 |

To Deepak (Commission) | 2,250 | By Consignment Stock c/d | 40,000 |

To Deepak (expenses) | 3,000 |

|

|

To Profit & Loss Account |

|

|

|

(Profit) | 30,750 |

|

|

| 2,65,000 |

| 2,65,000 |

Deepak’s Account | |||

Dr. |

|

| Cr. |

| Rs. |

| Rs. |

To Consignment account (Sales) | 2,25,000 | By Consignment account |

|

|

| (Commission) | 9,000 |

|

| By Consignment Account |

|

|

| (Commission) | 2,250 |

|

| By Consignment Account |

|

|

| (Exp.) | 3,000 |

|

| By Balance c/d | 2,10,750 |

| 2,25,000 |

| 2,25,000 |

Working Notes:

(1) Calculation of Consignment Stock Sale Price = 100 + 25 = 125

Cost of Sales = Sales × 100/125

= 2,25,000 × 100/125

= Rs.1,80,000

Cost of the goods available for sale = Rs. 20,000 + Rs. 2,00,000 = Rs.2,20,000. Hence stock at the end = Rs. 2,20,000 - Rs. 1,80,000 = Rs. 40,000

(2) Since Deepak is paid del-credere commission, bad debts of Rs. 3,000 would be borne by him.

Q.10. S of Bombay consigned 10,000 kg. Of oil to D of Calcutta. The cost of oil was Rs.2 per kg. S paid Rs. 5,000 as freight and insurance. During transit 250 kg were accidentally destroyed for which the insurers paid directly to the consignors Rs.450 if full settlement of the claim.

D reported that 7,500 kg were sold @ Rs.3 per kg. The expenses being on godown rent Rs. 200 on advertisement Rs. 1,000 and on salesman salary Rs. 2,000 D. Is entitled to a commission of 3% plus 1.5% del credere. D reported a loss of 100 kg. Due to leakage. D. Settled the accounts by bank draft. Prepare the accounts is the books of S.

SOLUTION: -

Consignment to Calcutta A/c | |||||

Dr. |

|

|

|

| Cr. |

|

| Rs. |

|

| Rs. |

To Goods on Consignment A/c |

| 20,000 | By Bank (Ins. Co.) |

| 450 |

To Bank—Freight & Insurance |

| 5,000 | By P & L A/c (abnormal loss |

| 175 |

To D—Expenses |

| 3,200 | By D— (Sale proceeds) |

| 22,500 |

To D—Commission |

|

|

|

|

|

Ordinary 3% | 675 |

| By Consignment Stock A/c |

| 5,431 |

Del Credere 1.5% | 338 | 1,013 | By P & L A/c—Loss |

| 657 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 29,213 |

|

| 29,213 |

Goods Sent on Consignment A/c | |||||

Dr. |

|

|

|

| Cr. |

|

| Rs. |

|

| Rs. |

To Trading A/c |

| 20,000 | By Consignment to Calcutta A/c |

| 20,000 |

Consignment Stock A/c | |||||

Dr. |

|

|

|

| Cr. |

|

| Rs. |

|

| Rs. |

To Consignment Calcutta A/c |

| 5,431 | By Balance c/d |

| 5,431 |

D’s A/c | |||||

Dr. |

|

|

|

| Cr. |

|

| Rs. |

|

| Rs. |

To Consignment to Calcutta A/c |

|

| By Consignment to Calcutta A/c |

|

|

—(sale proceeds) |

| 22,500 | (Exp.) |

| 3,200 |

|

|

| By Consignment to Calcutta A/c |

|

|

|

|

| (commission) |

| 1,013 |

|

|

| By Bank |

| 18,287 |

|

| 22,500 |

|

| 22,500 |

Working Notes: |

|

|

|

|

|

(A) Cost of Goods destroyed |

|

| Rs. |

|

|

Cost of 10,000 kg.@Rs.2 |

|

| 20,000 |

|

|

Freight |

|

| 5,000 |

|

|

Total cost of 10,000 kg. |

|

| 25,000 |

|

|

|

|

|

|

|

|

(B) Value of Stock still unsold |

|

|

|

|

|

Quantity received by D (Excluding accidental loss) | 9,750 |

|

| ||

Less: Normal Leakage |

|

| (100) |

|

|

|

|

| 9,650 |

|

|

Cost of 9,650 kgs (25,000-625) | Rs. 24,375 |

|

| ||

Cost of 2,150 kgs (24,375 / 9650 x 2150) |

|

| Rs. 5,431 |

|

|

|

|

|

|

|

|

Key takeaways:

- Consignment is an AGREEMENT between two parties i.e., Consignor and Consignee, whereby Consignor agrees to send goods to consignee on regular basis for the purpose of sale in exchange of commission and reimbursement of expenses to be paid by consignor to consignee.

- The party who sends the goods is called CONSIGNOR (Principal).

- The party to whom the goods are sent is called CONSIGNEE (Agent).

- The ownership of the goods i.e., Property in goods remain with consignor. Agent does not become the owner. It means the POSSESSION of the goods is transferred but not OWNERSHIP. On sale, the buyer will become the owner.

- Principal does not send invoice to agent he only sends PROFORMA INVOICE which looks like invoice. The object of proforma invoice is to convey information to agent regarding particulars of goods sent.

- Goods are sold by consignee on behalf of consignor AT THE RISK OF CONSIGNOR. Consignee gets commission for the goods sold and he is not responsible for any Bad Debts that may arise.

References:

- Lal Jawahar and Seema Sriwastava, Financial Accounting, Himalaya Publishing House

- Monga, J.R, Financial Accounting: Concepts and Application Mayoor Paper Backs, New Delhi.

- Shukla M.C, T.S. Grewal and S.C. Gupta. Advanced Accounts. Vol-1, S. Chand & Co.

- Maheshwari S.N, Financial Accounting Vikas Publishing House, New Delhi

- Jain S.P. And K.L. Narang Financial Accounting Kalyani Publishers New Delhi

- Bhushan Kumar Goyal and, HN Tiwari, Financial Accounting, Vikas Publishing House, New Delhi

- P.C. Tulsian, Financial Accounting, Tata McGraw Hill, New Delhi

- Compendium of Statements and Standards of Accounting, ICAI, New Delhi

UNIT III

Accounting for Hire Purchase and Consignment

Meaning & Introduction

If you buy your TV in cash, you pay, for example, Rs. 15,000. But if you want to pay in instalments of Rs, for example. You may need to pay 3,000 or Rs in 4 instalments each year. A total of 20,000. Extra amount of Rs. 3,000 are interested. If you choose the latter payment method, you will need to debit Rs. 5,000 to treat with interest in television as rated by Rs. 15,000 (not Rs. 20,000). For installment payments, there are two types of arrangements. Each installment may be treated as an "employment" in which the purchaser becomes the owner only if the purchaser has paid all the instalments. In other words, no property is passed to him, even if one installment remains unpaid. The seller reserves the right to take away the goods in case of default with respect to any installation. This is known as the "Hire Purchase" System.

Another arrangement may be that the property passes at the same time as the contract is signed. If the installment payment is not paid, the seller does not have the right to retrieve the item. His right is to sue the buyer for the amount to be paid. This is known as an Installment Payment System.

Definition: The Hire Purchase System is a system in which an employer (employee purchaser) purchases goods from a seller (employment vendor) but does not pay the full amount at one time. However, the down payment will be made in one lump sum and the balance will be paid in instalments by the employer. It's kind of like an installment plan, but the big difference between the installment plan and the hiring purchase plan is when the ownership is transferred.

Rental purchase systems are generally imposed on products with high resale value in the market. Therefore, if the job purchaser does not pay in instalments, the job vendor has the option of re-owning and reselling the asset in the market to recover costs and rates of return.

Parties involved in the employment purchase system

1. Hirer: In general terms, "Hirer" means the purchaser of an item, or the owner or person who acquires an item from a seller under an employment purchase system.

2. Rental Vendor: A "rental vendor" is the owner or seller of a product that delivers the product to the rental company based on the rental purchase system.

Formula

1. To calculate the Rental Purchase Price

2. How to calculate Cash Price Instalments

Hire Purchase Contract

The Employment Purchase Agreement contains conditions under which the Buyer and Seller mutually agree to hire the goods. This agreement contains the following terms:

The vendor or seller grants ownership of the goods to the employer or employment purchaser, provided that ownership is transferred only when the employer pays the final installment payment.

Hirer has the option to terminate the contract at any time if the asset is not needed or if additional instalments cannot be paid. Instalments paid by that date are considered rent to use the asset and the employer must return the asset to the vendor upon termination of the contract.

Contents of Employment Purchase Contract

According to the Employment Purchase Act of 1972 (Section 4), the Employment Purchase Agreement must include the following:

- Product description.

- The selling price of the sold product.

- The actual cash price of the item sold.

- Date and time of contract start.

- The amount and number of instalments paid by the employer along with the interest rate.

- The last day until all instalments are paid off.

- The name of the person eligible for the installment payment.

Benefits of Employment Purchasing System

Here are some of the benefits of a hiring purchase system:

- Buying an asset is much easier for your employer by paying in simple instalments.

- After paying all instalments, the employer can enjoy ownership of the asset.

- Hirer can claim depreciation of employment assets.

- Hirer enjoys tax incentives over the interest you pay when hiring a purchased item.

- The rental purchase system is also beneficial to vendors as it increases sales volume.

Features of Hire Purchase System

Some of the related features of the Employment Purchasing System are:

Law: Regulated by the Employment Purchase Act of 1972.

Parties: This is an agreement between the employer and the hiring vendor to hire the asset.

Claims: If the employer fails to pay, the hiring vendor can only sue or claim the return of the property and not the remaining instalments.

Selling Rights: Hiler may not sell or mortgage the assets employed until the ownership is transferred.

Loss Bearer: The hiring vendor remains liable for the loss of the goods until ownership is transferred to the employer.

Key takeaways:

- Hire Purchase Contract are not considered an extension of credit.

- Hire Purchase Contract do not transfer ownership to the purchaser until all payments have been made.

- Hire Purchase Contract have usually proven to cost more in the long run than purchasing the item in full.

- Each installment may be treated as an "employment" in which the purchaser becomes the owner only if the purchaser has paid all the instalments.

- The Hire Purchase System is a system in which an employer (employee purchaser) purchases goods from a seller (employment vendor) but does not pay the full amount at one time.

- Hirer has the option to terminate the contract at any time if the asset is not needed or if additional instalments cannot be paid.

- Instalments paid by that date are considered rent to use the asset and the employer must return the asset to the vendor upon termination of the contract.

Calculation of Interest on Hire Purchase

Interest: In either case (employment purchase or installment payment), interest must be separated from the principal. Payments will continue for more than two fiscal years, so you will need to calculate the interest for each year separately. Information about cash prices and interest rates is usually available. This will make it easier to calculate interest. Simply set up one party's account on a regular line and charge interest on your unpaid balance. Suppose A purchases from machine B with a cash price of Rs on January 1, 2000. 15,000; Rs. 5,000 rupees will be paid at the time of signing the contract, and 4,000 rupees will be paid at the end of each year for three years. The interest rate is 10% per annum. If you create B's account (memo-based) in A's book, you'll see the annual interest.

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs. 10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs. 7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

Since this is the final year of instalments, the interest amount will be the difference between the outstanding balance and the actual instalments. [Students note that if they calculate last year's interest at a given percentage of the O / S amount (3700 x 10% = 370), the total payment will be (3700 + 370 = 4070), which is more than the installment payment. Please give me. Paid. So, there is Rs again. 70 will be paid even after the last installment has been paid.

If no interest rate is specified, the interest for each year is proportional to the amount unpaid for each year. In the above example, the total amount paid is Rs. 17,000 rupees 5,000 will be paid immediately. This leaves Rs. 12,000 unpaid in the first year and Rs at the end. 4,000 will be paid. In the second year Rs. 8,000 is outstanding and in the third year it is Rs. There is a deadline of 4,000. The total interest is rupees. 2,000. That is, Rs. 17,000. Minus Rs. 15,000. Interest must be allocated to the unpaid ratio, or Rs, over a three-year period. 12,000; Rs. 8,000 rupees 4,000 or 3: 2: 1 ratio. The interest in the first year is Rs.1,000, in the second year he is Rs.670, and in the third year he is Rs.333. Please note that the interest rate cannot be the same as the specified amount.

To check cash prices, interest rates and instalments. Cash prices may not be listed. Assets cannot be debited beyond the cash price and must be confirmed. The process is to first take last year and separate interest from principal from the total amount to be paid. In the above example, Rs. 4,000 will be paid at the end of 2002. The interest rate is 10%. If Rs.100 is paid at the beginning of 2001, Rs.10 will be added and Rs.110 will be paid at the end of 2002. Therefore, one eleventh of the total paid at the end of the year is interest. The rest are principals. In this way, we can proceed year by year.

Thus: —

| Rs. |

Amount due on 31-12-2001 | 4,000 |

Interest @ 1/11 | 364 |

Amount due on 1-1-2002 or 31-12-2001 | 3,636 |

Paid on 31-12-2001 | 4,000 |

Total amount due on 31-12-2001 | 7,636 |

Interest @ 1/11 | 694 |

Amount due on 1-1-96 or 31-12-2000 | 6,942 |

Paid on 31-12-2000 | 4,000 |

Total amount due on 31-12-2000 | 10,942 |

Interest @ 1/11 | 995 |

Amount due on 1-1-2000 | 9,947 |

Paid Cash down on 1-1-2000 | 5,000 |

Cash Price | 14,947 |

The interest for three years is Rs.995, Rs.694 and Rs.364 respectively. | |

Key takeaways:

- In either case (employment purchase or installment payment), interest must be separated from the principal.

- Payments will continue for more than two fiscal years, so you will need to calculate the interest for each year separately.

- If no interest rate is specified, the interest for each year is proportional to the amount unpaid for each year.

- Information about cash prices and interest rates is usually available.

Accounting for hire purchase transactions by asset purchase method based on full cash price

Journal Entries in the books - Actual Cash Price Method

This method follows a technical approach and does not treat the employer as the owner until the final installment payment is paid. In this way, the asset is recorded at the actual cash price paid.

* Last year's interest is the same as the difference between the payment amount and the beginning balance. It is not calculated in the usual way.

Journal entry with Actual Cash Price Payment Method

Below are the various accounting entries in the books of hiring buyers and hiring vendors.

| Case | In the Books of Hire Purchaser |

| In the Books of Hire Vendor |

| Amount with which debited or credited |

| ||||||

A. | On making down payment due | Asset A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Hire Purchase Sales A/c | Dr. | (With the amount of down payment) |

B. | On making Down Payment | Hire Vendor’s A/c To Bank A/c | Dr. | Bank A/c To Hire Purchaser’s A/c | Dr. | (With the amount of down payment) |

C. | On making principal part of the instalment due | Asset A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Hire Purchase Sales A/c | Dr. | (With the amount of principal part of the instalment) |

D. | On making Interest due on Unpaid balance | Interest A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Interest A/c | Dr. | (With the interest Due on unpaid Balance) |

E. | On making payment of instalment | To Hire Vendor’s A/c To Bank A/c | Dr. | Bank A/c To Hire Purchaser’s A/c | Dr. | (With the amount of instalment) |

F. | On providing Depreciation | Depreciation A/c To Asset A/c | Dr. | No Entry |

| (With the amount of (depreciation) |

G. | On closure of Depreciation A/c | Profit & Loss A/c To Depreciation A/c | Dr. | No entry |