UNIT 4

Market structure

Perfect competition refers to ‘A market structure in which there are large number of buyers and sellers with a single uniforms price for the product which is determined by the forces of demand & supply.’ The price prevailing in perfect competition market is equilibrium price.

Definition:

It is identified by the existence of the many firm; they all sell an identical products an equivalent way. The supplier is the one who accepts the price."- Vilas

Such market gains when the request for product of every producer is totally elastic. Mrs Joan Robinson.

It is a market condition with an outsized number of sellers and buyers, similar products, free entry of enterprises into the industry is ideal knowledge between buyers and sellers of existing market conditions and free mobility of production factors between alternative uses. Lim Chong-ya

Characteristic of perfect competition:-

1) Large number of seller / seller are price takers: There are many potential sellers selling their commodity in the market. Their number is so large that a single seller cannot influence the market price because each seller sells a small fraction of total market supply. The price of the product is determined on the basis of market demand and market supply of the commodity which is accepted by the firms, thus seller is a price taker and not a price maker.

2) Large number of buyers: There are many buyers in the market. A single buyer cannot influence the price of the commodity because individual demand is a small fraction of total market demand.

3) Homogeneous product: The product sold in the market is homogeneous, i.e. identical in quality and size. There is no difference between the products. The products are perfect substitutes for each other.

4) Free entry and exit: There is freedom for new firms or sellers to enter into the market or industry. There is no legal, economic or any type of restrictions. Similarly, the seller is free to leave the market on industry.

5) Perfect knowledge: The seller and buyers have perfect knowledge about the market such as price, demand and supply. This will prevent the buyer from paying higher price than the market price. Similarly, sellers cannot change a different price than the prevailing market price.

6) Perfect mobility of factors of production: Factors of production are freely mobile from one firm to another or from one place to another. This ensures freedom of entry and exit firms. This also ensure that the factors cost are the same for all firms.

7) No transport cost: It is assumed that there are no transport costs. As a result, there is no possibility of changing a higher price on the behalf of transport costs.

8) Non intervention by the government: It is assumed that government does not interfere in the working of the market economy. Price is determined freely according to demand and supply conditions of the market.

9) Single Price: In Perfect Competition all units of a commodity have uniforms or a single price. It is determined by the forces of demand and supply.

Key takeaways - A perfectly competitive market is characterized by many buyers and sellers, undifferentiated products, no transaction costs, no barriers to entry and exit, and perfect information about the price of a good.

Theory of the firm under perfect competition, Demand and revenue

A commodity with profit-earning potential is not produced by one firm. Instead, numerous firms are competing with each other to attract customers towards their brand. As there are a wide variety of commodities which differ in characteristics, the market for these also differs. Perfect competition is one such classification. Though hypothetical to a large extent, it is the simplest type of a market form. The major types of market formation include monopoly, monopolistic competition, oligopoly, and perfect competition. Perfect competition is an industry structure in which many firms are producing homogeneous products. None of the firms is large enough to control the industry. The characteristics of a perfectly competitive market incorporate insignificant contributions from the producers, perfect information about products, zero transaction fee, equivalent products, and no long-term economic profits.

Perfect Competition

A perfectly competitive market has the following features:

The market includes a large number of buyers and sellers.

Each firm produces and sells a comparable product. i.e., the work of one firm cannot be differentiated from the effect of any other firm.

Entry into the market as well as exit from the market is free for firms.

Information is perfect.

The existence of a large number of buyers and sellers means that each buyer and seller is very small compared to the size of the market. It means that no particular buyer or seller can influence the market by their size. Homogenous products further indicate that the creation of each firm is identical. So, a buyer can choose to buy from any firm in the market, and she gets the same product. Free entry and exit mean that it is easy for firms to enter the market, as well as to leave it. This condition is essential for the large numbers of firms to exist. If the entry was difficult, or restricted, then the number of firms in the market could be small. Perfect information implies that all buyers and all sellers are completely informed about the price, quality and other relevant details about the product, as well as the market.

Total Revenue in a Perfect Competition

A perfectly competitive firm has only one major decision to make, i.e. what quantity to produce.

Profit = Total revenue − Total cost

= (Price) (Quantity produced) − (Average cost) (Quantity produced)

A perfectly competitive firm must receive the price for its output as determined by the product’s market order and supply, it cannot choose the fee it charges. Rather, the perfectly competitive firm can decide to sell any quantity of output at the same price. It suggests that the firm faces a perfectly elastic demand curve for its product and buyers are willing to buy any number of units of output from the firm at the market price. When the perfectly competitive firm chooses what amount to produce, then the quantity along with the prices prevailing in the market for output and inputs will determine the firm’s total revenue, total costs, and level of profits.

Equilibrium of firm and industry

Equilibrium refers to when the firm has no inclination to expand or to contract its output. The producer can attain equilibrium under two situations.

- Perfect competition – the price remains constant and fixed by the industry which is accepted by the entire firm within the industry. Any quantity of commodity is sold at this price.

- Imperfect competition – under this condition, the firm has the freedom to set prices for their output. Price is not constant here, as the firm adopt independent pricing policy.

The Marginal Revenue-Marginal Cost Approach

Profit depends on revenue and cost. Thus equilibrium revolves around revenue and cost. According to the MR-MC approach, a producer is said to be in equilibrium when:

- MR = MC

- A Firm can maximise the profit when marginal revenue is equal to marginal cost

- MR is the addition to TR from the sale of one more unit

- MC is the addition to TC when an additional unit is produced.

- Thus when MR = MC, TR-TC result in maximum profit.

- If MR exceeds MC, then producer will produce more as it adds to the profit

- MC is greater than MR after the MC=MR Output Level

- MC= MR is a necessary condition, but its is not enough to ensure equilibrium. This condition happens more than one output level.

- To ensure equilibrium, it has to be supplemented by the condition that MR should be less than MC after this level

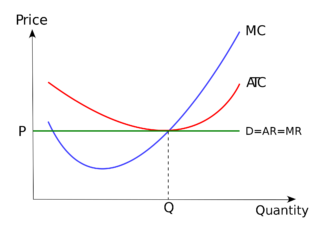

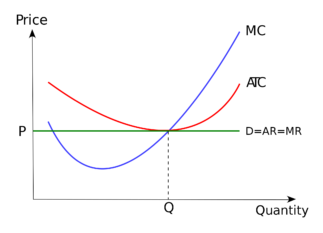

Producer’s Equilibrium when Price remains Constant

Price remains constant under conditions of perfect competition. Here price is equal to AR. When price is constant, revenue from each additional unit is equal to AR. It means AR curve is same as MR curve. The firm attains equilibrium when two condition are fulfilled , that is firm aims at producing that level of output at which MC is equal to MR and MC is greater than MR after MC = MR output level.

Producer’s Equilibrium when Price is not Constant

When there is no fixed price, price falls with an increase in output. The producer sells more units at a lower price. In this case MR slopes downwards. The firm aims at producing that level of output at which MC is equal to MR and MC is greater than MR.

Short run and long run supply curves

Supply curve shows the relationship between price and quantity supplied. According to Dorfman, “Supply curve is that curve which indicates various quantities supplied by the firm at different prices”.

Supply curve can be divided into two parts as:

- Short Run Supply Curve

- Long Run Supply Curve

Short run supply curve of a firm

Under Short run , fixed cost remains constant, supply can be changed by changing the only the variable factors. Thus the firm has to bear fixed cost id it is shut down. Thus in short run, goods are supplied at price is either greater or equal to average variable cost. Average revenue is equal to marginal revenue under perfect competition. Hence the firm will produce at the point where marginal revenue and marginal cost are equal.

Prof. Bilas has defined it in simple words, “The Firm’s short period supply curve is that portion of its marginal cost curve that lies-above the minimum point of the average variable cost curve.”

From the above figure we can see that, the firm will not be covering its average variable cost, at price less than OP. At price OP, OM is the supply. MC and MR cut at point A, OM is equilibrium output. If price rise to OP1, the firm will produce OM1 output. This short run supply curve of a firm starts from A upwards i.e., thick line AB.

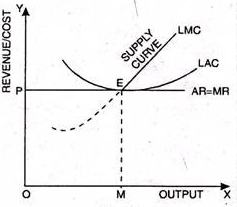

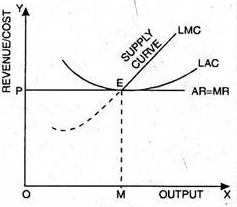

Long run supply curve

Under long run, the supply curve changes by changing all the factors of production. The firm produces only at minimum average cost in long run. In this case, long run marginal cost, marginal revenue, average revenue and long run average cost are equal. The firm enjoys normal profit.

Optimum production is the point where minimum average cost is equal to marginal cost. Long run supply curve is a portion where marginal cost curve that lies above the minimum point of the average cost curve.

Optimum point is the Point E, as at this point MR=LMCAR minimum LAC. The portion of LMC above point E is called long run supply curve

The word monopoly has been derived from the combination of two words i.e., ‘Mono’ and ‘Poly’. Mono refers to a single and poly to control.

Thus, monopoly refers to a market situation in which there is only one seller of a commodity.

In monopoly market, single firm or one seller controls the entire market. The firm has all the market power, so he can set the prices to earn more profit as the consumers do not have any alternative.

Definition

“Pure monopoly is represented by a market situation in which there is a single seller of a product for which there are no substitutes; this single seller is unaffected by and does not affect the prices and outputs of other products sold in the economy.” Bilas

“Monopoly is a market situation in which there is a single seller. There are no close substitutes of the commodity it produces, there are barriers to entry”. –Koutsoyiannis

“A pure monopoly exists when there is only one producer in the market. There are no dire competitions.” –Ferguson

Features

- One seller and large number of buyers -in a monopoly one seller produces all of the output for a good or service. The entire market is served by a single firm. For practical purposes the firm is the same as the industry. But the number of buyers is assumed to be large.

2. No Close Substitutes - There is no close substitutes for the product sold by the monopolist. The cross elasticity of demand between the product of the monopolist and others must be negligible or zero.

3. Difficulty of Entry of New Firms - There are restrictions on the entry of firms into the industry, even when the firm is making abnormal profits. Other sellers are unable to enter the market of the monopoly

4. Profit maximizer: a monopoly maximizes profits. Due to the lack of competition a firm can charge a set price above what would be charged in a competitive market, thereby maximizing its revenue.

5. Price Maker - Under monopoly, monopolist has full control over the supply of the commodity. The price is set by determining the quantity in order to demand the price desired by the firm. Therefore, buyers have to pay the price fixed by the monopolist.

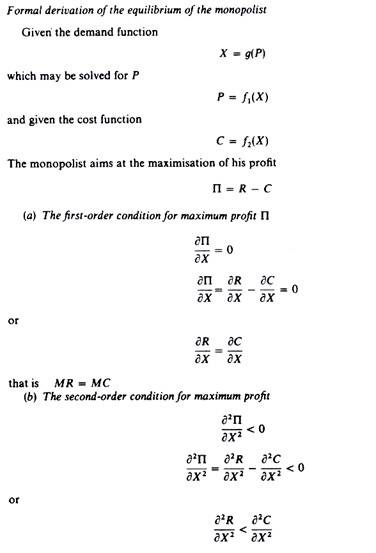

Equilibrium

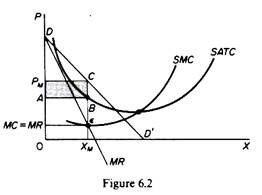

A. Short run

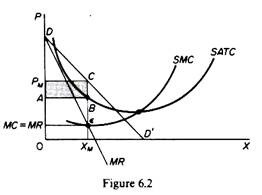

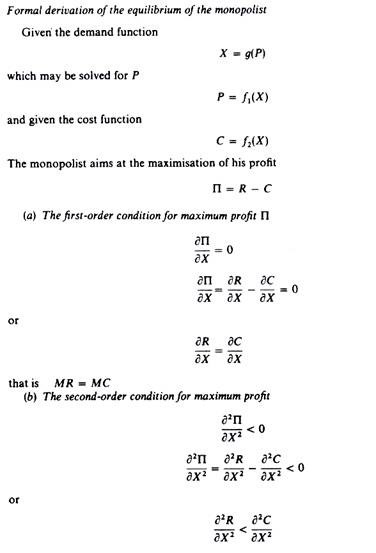

A monopolist maximizes his short-term profits if the following two conditions are met first, MC equals Mr. Secondly; the slope of MC is larger than that of Mr at the intersection.

In Figure 6.2, the equilibrium of the monopoly is defined by the point θ at which MC intersects the MR curve from below. Thus, both conditions of equilibrium are met. The price is PM and the quantity is XM. Monopolies realize excess profits equal to shaded areas APM CB. Please note that the price is higher than Mr

In pure competition, the company is the one who receives the price, so it’s only decision is the output decision. The monopolist is faced with two decisions: to set his price and his output. But given the downward trend demand curve, the two decisions are interdependent.

Monopolies set their own prices and sell the amount the market takes on it, or produce an output defined by the intersection of MC and MR and are sold at the corresponding price. An important condition for maximizing the profits of monopolies is the equality of the MC and the MR, provided that the MC cuts the MR from below.

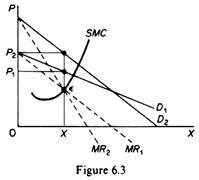

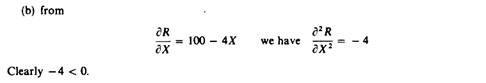

We can now revisit the statement that there is no unique supply curve for the monopolist derived from his MC. Given his MC, the same amount could be offered at different prices depending on the price elasticity of demand. This is graphically shown in Figure 6.3. Quantity X is sold at price P1 if demand is D1, and the same quantity X is sold at price P2 if demand is D2.

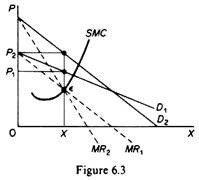

So there is no inherent relationship between price and quantity. Similarly, given the monopolist MC, we can supply various quantities at any one price, depending on the market demand and the corresponding MR curve. Figure 6.4 illustrates this situation. The cost condition is represented by the MC curve. Given the cost of a monopolist, he would supply 0X1 if the market demand is D1, then p at the same price, and only 0X2 if the market demand is D2 B.Long-term equilibrium:

In the long run the monopolist will have time to expand his plants or use his existing plants at every level to maximize his profits. However, if the entry is blocked, the monopolist does not need to reach the optimal scale (that is, the need to build the plant until the minimum point of LAC is reached), neither does the guarantee that he will use his existing plant at the optimum capacity. What is certain is that if he makes a loss in the long run, the monopolist will not stay in business.

He will probably continue to earn paranormal benefits even in the long run, given that entry is banned. But the size of his plant and the degree of utilization of any plant size depends entirely on the market demand. He may reach the optimal scale (the minimum point of Lac), stay on the less optimal scale (the falling part of his LAC), or exceed the optimal scale (expand beyond the minimum LAC), depending on market conditions.

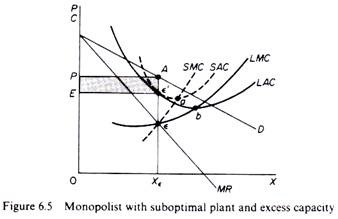

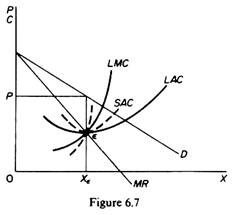

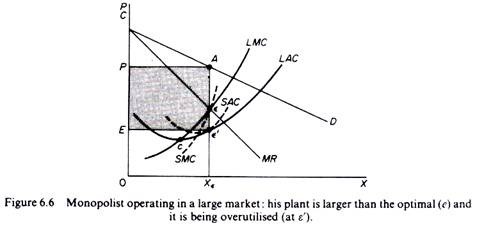

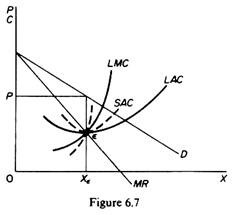

Figure 6.5 shows when the market size does not allow the monopolist to expand to the minimum point of Lac. In this case, not only is his plant not optimal (in the sense that the economy of full size is not depleted), but also the existing plant is not fully utilized. This is because on the left of the minimum point of the LAC, the SRAC touches the LAC at its falling part, and the short-term MC must be equal to the LRMC. This happens in e, but the minimum LAC is b,and the optimal use of the existing plant is a. Since it is utilized at Level E', there is excess capacity. Finally, figure 6.7 shows a case where the market size is large enough for a monopolist to build an optimal plant and be able to use it at full capacity.

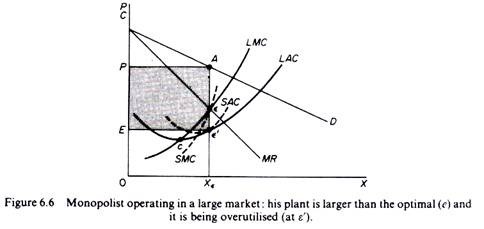

In Figure 6.6, the scale of the market is so large that monopolists have to build plants larger than the optimal ones to maximize output and over-exploit them. This is because to the right of the minimum point of LAC, SRAC and LAC is tangent at the point of positive slope, and SRMC must be equal to LAC. Thus, plants that maximize the profits of monopolies are, firstly, larger than the optimal size, and secondly, they are over-utilized, which leads to higher costs. This is often the case with utility companies operating at the state level.

It should be clear that which of the above situations will appear in a particular case will depend on the size of the market (given the technology of monopolists). There is no certainty that monopolies will reach their optimal size in the long run, as is the case with purely competitive markets. In Monopoly, there is no market force similar to those of pure competition that will lead companies to operate at optimal plant size in the long run (and utilize it at its full capacity).

Price determination

A monopolistic firm is a price-maker, not a price-taker. Therefore, a monopolist can increase or decrease the price. Also, when the price changes, the average revenue, and marginal revenue changes too. Take a look at the table below:

Quantity sold | Price per unit | Total revenue | Average revenue | Marginal revenue |

1 | 6 | 6 | 6 | 6 |

2 | 5 | 10 | 5 | 4 |

3 | 4 | 12 | 4 | 2 |

4 | 3 | 12 | 3 | 0 |

5 | 2 | 10 | 2 | -2 |

6 | 1 | 6 | 1 | -4 |

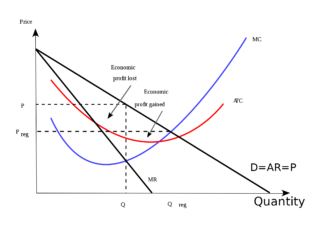

Let’s look at the revenue curves now:

As you can see in the figure above, both the revenue curves (Average Revenue and Marginal Revenue) are sloping downwards. This is because of the decrease in price. If a monopolist wants to increase his sales, then he must reduce the price of his product to induce:

• The existing buyers to purchase more

• New buyers to enter the market

Hence, the demand conditions for his product are different than those in a competitive market. In fact, the monopolist faces demand conditions similar to the industry as a whole.

Therefore, he faces a negatively sloped demand curve for his product. In the long-run, the demand curve can shift in its slope as well as location. Unfortunately, there is no theoretical basis for determining the direction and extent of this shift.

Talking about the cost of production, a monopolist faces similar conditions that a single firm faces in a competitive market. He is not the sole buyer of the inputs but only one of the many in the market. Therefore, he has no control over the prices of the inputs that he uses.

Role of time element in determination of price are given below:

Time plays an important role in the theory of volume, i.e., price determination because supply and demand conditions are affected by time.

Price during the short-period can be higher or lower than the cost of production, but in the long-period price will have a tendency to be equal to the cost of production.

The relative importance of supply on demand in the determination of price depends upon the time given to supply to adjust itself to demand.

To study the relative importance of supply or demand in price determination, Prof. Marshall has divided time element-into three categories:

(a) Very short period or market period.

(b) Short period.

(c) Long period.

.

(a) Very short period (determination of market price):

Market period is a time period which is too short to increase production of the commodity in response to an increase in demand. In this period the supply cannot be more than existing stock of the commodity.

The supply of perishable goods is perfectly inelastic during market period. But non-perishable goods (durable goods) can be stored.:

Therefore, the supply curve of non-perishable goods above reserve price has a positive scope at first but becomes perfectly inelastic after some price level.

The reserve price y depends upon-(i) cost of storing, (ii) future expected price, (iii) future cost of production, and (iv) seller’s need for cash we will discuss the determination of market price by taking a perishable commodity and determination of market price is illustrated.

DD is the original demand curve and SS the market period supply curve. The demand curve DD (perfectly inelastic) cuts the supply curve SS at point E. Point E, is the equilibrium point and equilibrium price is determined at OP, level.

Increase in demand shifts the demand curve to D,D and the price also increased to OP,. Decrease in demand shifts the demand curve downward to D2D2 and the price too falls to OP It is, thus, clear that in market period price fluctuates with change in demand conditions.

(b) Price determination is short period:

In the short period fixed factors of production remain unchanged, i.e., productive capacity remains unchanged.

However, in the short period supply can be affected by changing the quantity of variable factors.

In other words, during the short period supply can be increased to some extent only by an intensive use of the existing productive capacity.

Therefore, the supply curve in the short-run slopes positively, but the supply curve is less elastic. Determination of price in the short-run is illustrated.

SS is the market period supply curve and SRS is short-run supply curve. The original demand curve DD cuts both the supply curves at E, point and thus OP, price is determined.

Increase in demand shifts the demand curve upward to the right to D,D,. Now with the increase in demand the market price (in market period) rises at once to OP3 because supply remains fixed. But in the short-run supply increases. Therefore, in the short-run price will cuts the SRS curve. If demand decreases opposite will happen.

(c) Price determination in long period (Normal Price):

In the long period there is enough time for the supply to adjust fully to the changes in demand.

In the long period all factors are variable. Present firms can increase on decrease the size of their plants (productive capacity).

The new firms can enter the industry and old firms can leave the market. Therefore, long-period supply curve has a positive slope and is more elastic than short period supply curve.

The shape of supply curve of the industry depends upon the nature of the laws of returns applicable to the industry. Price determination in the long period is illustrated.

DD is the original demand curve and LS is the long period supply curve of the industry. Demand curve DD and supply curve LS both intersect each other at E point and OP price is determined.

This price will be equal to minimum average cost (AC) of production because in the long period firms under perfect competition can only earn normal profits. Suppose these are permanent increase in demand.

With the increase in demand, the demand curve shifts to D1,D1. As a result of increase in demand the price in the market period and short period will rise.

Due to increase in price present firms will earn above normal profit. Therefore, new firms will enter into market in the long period.

As a result of it supply will increase in the long period. In the long period price will be determined at OP1, level because at this price demand curve D1 D2 cuts the LS curve at E2 point.

Price OP1, is greater than previous price OP1, because the industry is an increasing cost industry. This new higher price will also be equal to minimum average cost of production

Key takeaways –

- Monopoly refers to a market situation in which there is only one seller of a commodity

- A monopolist maximizes his short-term profits if the following two conditions are met first, MC equals Mr.

- Secondly; the slope of MC is larger than that of Mr at the intersection.

- In the long run the monopolist will have time to expand his plants or use his existing plants at every level to maximize his profits

- Monopoly market is characterized by the profit maximize, price maker, high barriers to entry, single seller, and price discrimination.

Difference between Perfect Competition ,Monopoly and Imperfect competition

Basis of comparison | Perfect competition | Imperfect competition |

Meaning | Perfect Competition is a type of competitive market where there are numerous sellers selling homogeneous products or services to numerous buyers. | Imperfect Competition is an economic structure, which does not fulfill the conditions of the perfect competition. |

Nature of concept | Perfect competition is a hypothetical situation, which does not apply in the real world. | Imperfect Competition is a situation that is found in the present day world. |

Product differentiation | In perfect competition, the sellers produce or supply identical products. | In imperfect competition the products offered by the sellers can either be homogeneous or differentiated |

Players | When it comes to perfect competition, there are many players in the market | In imperfect competition, there can be few to many players, depending upon the type of market structure. |

Restricted entry | No | Yes |

Firms are | Firms are price takers, it is assumed that the firms do not influence the price of a product. | The firms are price makers |

STRUCTURE | NO.OF PRODUCERS AND DEGREE OF PRODUCT DIFFERENTIATION | PART OF ECONOMY WHERE IT’S PREVALENT | FIRM’S DEGREE OF CONTROL | METHODS PF MARKETING |

Perfect Competition | Many products; identical products. | Financial markets and agricultural products | None | Market exchange or auction. |

Imperfect Competition |

|

|

|

|

Monopolistic Competition | Many producers; many real differences in products. | Retail trade like pizzas, beer. | Some | Advertising and quality rivalry administered prices. |

Oligopoly | Few producers; little or no difference in product. | Steel, chemicals | Some | Advertising and quality rivalry administered prices. |

Monopoly | Single producer; product without close substitutes. | Franchise monopolies like electricity, water,drugs | Considerable | Advertising |

Key takeaways - Perfect competition is an imaginary situation which does not exist in reality, but imperfect competition is factual i.e. which genuinely exist.

Monopolistic competition

In Monopolistic competition there are large numbers of buyers and sellers which do not sell homogenous product unlike perfect competition. This is more realistic in the real world. Monopolistic competition occurs when an industry in which many firms selling products that are similar but not identical.

Monopolistic competitions try to differentiate its product. Thus it is closely related to business strategy of brand differentiation. In monopolistic competition heavy advertising and marketing is common among firms.

Monopolistic competition combines element of both monopoly and perfect competition. All firms in monopolistic competition relatively have low market power and they are all market makers.

Monopolistic competitive market

- The firm offer highly differentiated product

- Free entry and exit in the market ie no barriers

- Firm can make decision independently

- Customers have the preference of choosing products

- Seller becomes price setter

- Seller can charge marginally high price to enjoy some degree of market power

Assumption

- Product differentiation – monopolistic competition includes firms that offer similar product but are not identical. The products are differentiated not on the basis of price but the difference includes physical aspects of the product, location from where it sells and intangible aspects of the product. The product and services performs the basic function but have difference ion quality such as type, colour, appearance, reputation, location that distinguish the product from each other. For ex, motor vehicles are same to move people from one point to another. But there are many types of motor vehicles such as car, bike, scootor.

2. Many firms – there are many firms in each product group. A product group is a "collection of similar products". Under monopolistic market, each firms has a small market share. This gives each firm a freedom to set price and each firm action have negligible impact on the market. A firm can cut the price to increase sale without any fear. As its action will not prompt retaliatory responses from competitors.

3. Freedom of entry and exit - Like perfect competition, under monopolistic competition the firms can freely enter or exit. When the existing firms makes super-normal profits, then new firms will enter. The entry of new firms leads to increase the supply of goods and services and this would reduce the price and thus the existing firms will be left only with normal profits. Similarly, if the existing firms are incurring losses, some of the firms will exit. This will reduce the supply which result decrease in price and the existing firms will be left only with normal profit.

4. Independent decision making – under monopolistic market, each firm can independently sets the terms and conditions of exchange for its product. The firm does not consider how their decision will have impact on competitors. In other words, each firm feels free to set prices and prompting heightened competition.

5. Market power – under monopolistic competition, the firms have low degree of market power. Market power means that the firm has control over the terms and conditions of exchange for its product. All firms under monopolistic competition are price makers. A firm can raise the prices of products and services without losing all its customers base. The firm can also lower prices without any effect on the competitors. Since the firm have relatively low market power, there is no barrier to entry.

Short run equilibrium, Long run equilibrium

Under monopolistic competition a firm can some extent independently control the supply and price of the product. The demand curve is stable and slightly downward slope

A monopolistic competitor creates output at which the marginal cost is equal to marginal revenue. The price is greater than marginal cost.

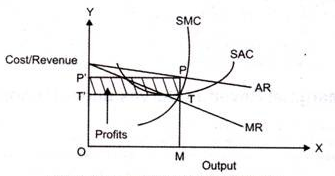

Short run

In short run, the firm attains its equilibrium where marginal revenue equals marginal cost and the price is set according to its demand curve. Thus when MR=MC, profits are maximized

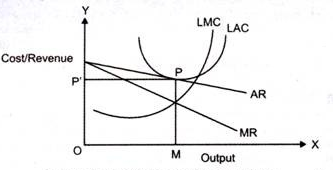

In the above fig,

AR is the average revenue curve,

MR represents the marginal revenue curve,

SAC curve represents the short run average cost curve,

SMC signifies the short run marginal cost.

In the above figure we can see that at output OM, MR intersects SMC. Here price is OP’ (which is equal to MP). Thus P is the point on AR curve, which is price. PT is the supper normal profit per unit output, is the difference between the average revenue and average cost.

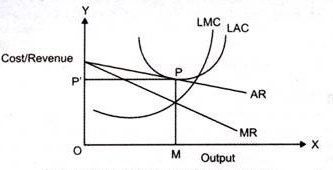

Long run

In the long run due to the possibility of new firms entering the industry the price under monopolistic competition becomes equal to long-run average cost giving only normal profits. So, no firm under monopolistic competition can make excess profit or loss in the long run.

When the new firm start supplying , the price would fall. Thus the AR curve shifts from right to left and supernormal profits are replaced with normal profits. The long run equilibrium is achieved when average revenue is equal to average cost.

In the above fig we can see that, at pointP, AR curve touches the average cost curve (LAC) as a tangent. P is the equilibrium at price MP and output OM.

At MP average cost is equal to average revenue. Therefore, in long run, the profit is normal. The conditions (MR=MC and AR=AC) result in attaining equilibrium in long run.

Key takeaways –

- Monopolistic competition combines element of both monopoly and perfect competition

- A monopolistic competitor creates output at which the marginal cost is equal to marginal revenue. The price is greater than marginal cost.

The term oligopoly has been derived from Greek words, ‘oligoi’ means few and ‘poly’ means control. Oligopoly refers to a market structure in which few sellers control the market. These sellers deal with either homogenous or differentiated products.

Oligopoly is also called ‘competition among the few’. Under oligopoly, the industry are dominated by few sellers in the market, every seller influence the behavior of other firm.

In oligopoly there are small numbers of firms in the market. As per the norms, oligopoly consist of 3 -5 dominant firms. The firms can compete with each other or collaborate to earn more profits. Here the buyers are more than the sellers. Some of the examples are automobiles, cement, steel, aluminum, etc.

Characteristics

- Few firms – under oligopoly, there are few firms and the exact number of firms is not defined. Each firm produces a significant portion of the total output, so there is severe competition.

- Barriers to entry – under oligopoly there are barrier to entry and thus the firm can earn super normal profits in the long run. Barriers to entry are patents, licenses, control over crucial raw materials, etc. The entry of new firms is prevented by these barriers.

- Non price competition - due to the fear of price wars in Oligopoly, firms try to avoid price competition. They are dependent on non price methods such as advertising, after sales services, warranties, etc.

- Interdependence - each firm is affected by the price and output decisions of rival firms since each firms hold a significant share in the total output of the industry. While determining the price and output levels, the firm takes into consideration the action and reaction of its rival firms.

- Nature of product – the firm products are homogeneous or differentiated under oligopoly.

- Selling cost – for large market share selling costs are highly important for competing against rival firms

- No unique pattern of pricing behaviour - The firms can cooperate with each other in setting the pricing policy or they may act as competitors. The pricing behaviour depends on the firm motives. The firms can compete or cooperate with other firm which leads to different pricing situations.

- Indeterminateness of the Demand Curve - Unlike other market structures, it is not possible to determine the demand curve of a firm, under Oligopoly. Under oligopoly, the demand curve is not stable and changes as per the action of rivals

Cause for the existence of oligopolistic firms in the market rather than perfect competition

There are certain reasons which have led to the emergence of oligopoly. These are:

1. Large Investment of Capital:

The number of firms in an industry may be small due to the large requirements of capital. No entrepreneur will like to venture to invest large sums in an industry in which addition to output to the existing one may likely to depress prices. Further, the new entrant may also fear of provoking a price-war by the established firms in the industry. This is always true that in the midst of differentiated product, it is difficult to make a new product.

2. Control of Indispensable Resources:

A few firms may control some indispensable resources which may enable them to secure several advantages in costs over all others. This enables them to operate profitably at a price at which others cannot survive.

3. Legal Restriction and Patents:

In public utility sector, the entry of new firms is closely regulated through the grant of certificate by the state. This policy of exclusion of rivals may be due to diseconomies of small scale or of duplication of services. Another factor for the emergence of oligopoly is the patent right which a few firms acquire in matter of some goods. Patents have led to many of the most important industrial monopolies in America and elsewhere.

4. Economies of Scale:

Another factor responsible for emergence of oligopoly is the large scale firm. In some industries, a few firms can meet the entire demand for the product. It is possible that the demand may be satisfied by a large number of firms, while small firms cannot secure the economies of large scale production. In those industries where there is a lot of mechanization and where economies of large scale are considerable a few firms will survive.

5. Superior Entrepreneurs:

In some industries there may be some superior entrepreneurs whose costs are lower than inferior rivals. These entrepreneurs under sell and eliminate most of their rivals.

6. Mergers:

Many oligopolies have been created by combining two or more independent firms. The combination of two or more firms into one firm is known a merger. The main motives of mergers include increasing market powers, more resources, economies of scale and market extensions etc.

7. Difficulties of Entry into the Industry:

Lastly, oligopoly may come to exist because of difficulties of entry into the industry. One big difficulty in some industries is the large requirements of capital. Businessmen do not like to venture into those industries entry to which, even of one firm, is likely to depress prices to such an extent as to make it unprofitable for all. They may also be afraid of the price war that their entry may provoke from the established firms in the industry. Prospective entrants to an industry are also deterred by the difficulty of marketing new products or new brands in the presence of already well- established, well entrenched brands.

Co-operative vs. Non co-operative behaviour and dilemma of oligopolistic firms

Co-operative Behaviour and Prisoner’s Dilemma

Co-operative behaviour in oligopoly is a situation when firms jointly decide the prices and output and maximise their joint profit. This situation is called collusion. In this situation it becomes profitable for one firm if it defects and undercuts the prices and raises output, as long as others do not do so. Noncooperative behaviour is a situation when they do not co-operate and decides their prices and output separately and compete with each other. When firms in oligopoly do not co-operate it is called non-cooperative equilibrium or Nash equilibrium (Named after US mathematician John Nash)

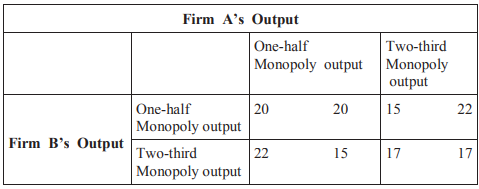

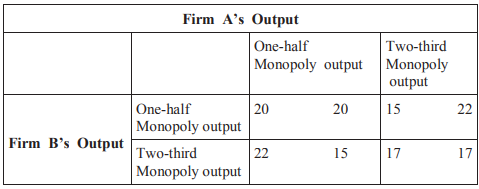

In oligopoly, the basic dilemma the firms face is whether to co-operate or to compete. If they co-operate, profit will be maximum and if they do not, profit for all will decrease. Now we will see the behaviour of an oligopolistc firm through an example of game theory. Game theory is the study of decision making in situations where strategic interaction (moves and countermoves) between rival firms occurs. We will assume a case of only two firms in the market, called Duopoly. The case is as follow:

The Oligopolist’s dilemma: to co-operate or to compete.

The figure above explains the dilemma faced by oligopolists of whether to cooperate or to compete. It is called Payoff Matrix for a two Firm duopoly game. The right side figures on each cell shows the profits of Firm A and left side figures on each cell show the profits of Firm B (in Rs. Crores). It can be explained that if the two firms co-operate and produce one half of market share each will earn Rs. 20 crores of profit. In case of co-operation they can maximise their profits. If Firm A defects and produces two thirds of output and Firm B produces half of monopoly output then Firm A will earn Rs. 22 crores and Firm B Rs. 15 crores. Similarly if Firm B defects and produces two-third and Firm A produces one-half then Firm B will earn Rs. 22 crores and Firm A will earn only Rs. 15 crores. If both decide to compete and produce two-third of monopoly output each then profits for both will fall to Rs. 17 crores. This type of game, where they reach a non-cooperative solution when they could cooperate, is called Prisoner’s Dilemma. Prisoner’s Dilemma is shown below:

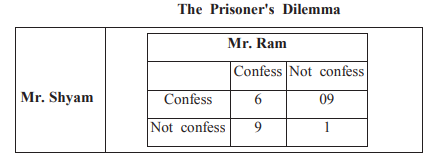

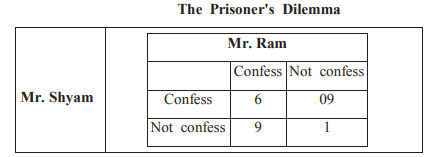

Two prisoners Mr. Ram and Mr. Shyam are arrested for committing a crime and interrogated separately. They are told the following:

a) If both are claimed to be innocent, they will get a light sentence that is 1 year in jail.

b) If one confesses and the other does not, then who confesses will be released free and the other will be punished for 9 year in jail, and

c) If both confess, then both of them will get a punishment of 6 years in jail.

The payoff matrix presented in second table shows the dilemma of the prisoners about whether to confess or not to confess. If none of them confess then both will get 1 year of jail, but if Ram confesses and Shyam does not then Ram will be left free and Shyam will get 9 year of imprisonment and the vise-versa. And if both of them confess then both will get 6 years of imprisonment. Not confessing is the best solution in this game (Pareto efficient solution) but this leaves one always in uncertainty. This solution is not a stable solution as one gets an imprisonment of 9 years if he/she does not confess and the other does. Therefore, confession dominates in the mind of both the prisoners. If both of them confess then they end up with 6 years jail for both. This kind of equilibrium is called Nash equilibrium. From both the figures above it is clear that it they co-operate then they will earn the maximum profit than if they compete

Types of cooperative behavior

In order to avoid uncertainty arising out of interdependence and to avoid price war and cut throat competition, firms under oligopoly often enter into some agreement about determining uniform price and output. The agreement can be of the following two types.

- Explicit Collusion: It is situation when firms under oligopoly do formal (explicit) agreement to determine uniform price and output and maximise their joint profit. Such an agreement at international level is called Cartel, Many such agreements have taken place in the past. The best example of cartel is that of OPEC – Organisation of Petroleum Exporting Countries. Saudi Arabia and other countries after 1973 formed this cartel. An individual firm always has incentive to cheat. Possibility of cheating is larger if number of firms is large. Cheating by a small firm has negligible effect on the market price.

- Tacit Co-operation: When firms co-operate without any explicit agreement it is called tacit co-operation. For example in first table, if Firm A produces one-half of monopoly output hoping that Firm B will do the same and Firm B does so then they achieve the co-operative equilibrium without any formal agreement.

Types of non cooperative behavior

In the absence of formal or informal agreements about co-operation, firms under oligopoly compete with each other. Non-Cooperative or Competitive behaviour under oligopoly can be of following types.

Competition for Market Share: Firms under oligopoly always compete with each other for market share. They use various forms of non-price competition such as advertising, quality products etc. to increase their market share. For example in Delhi major mobile service providers like Airtel, Hutch and Idea compete for increase their mobile connections.

Covert Cheating: In oligopoly, because of huge market share, firms sell their products through contract. Large scale production and distribution is done through contracts. When firms provide secret discounts and rebates to their buyers to increase sales it is called covert cheating.

Contestable Markets and Potential Entry: Theory of contestable markets explains that in the long-run, abnormal profits earned by oligopolists can be eliminated without actual entry. Potential entry can also affect the market as much as an actual entry does. It is possible only when the following two conditions are fulfilled:

1) Entry must be easy to accomplish: There should not exist any barriers to entry, either natural or firm created.

2) The existing firms must consider potential entry while making price and output decisions: The existing firms must react when new firms try to enter into the market. They must cut their prices and sacrifice profits (short run) to restrict the new entrants.

Contestable markets always expect potential entry because of huge profits earned by the existing firms in the market. But entry to such markets is too costly. Fixed costs are very high. To develop, design, and sale a new product in such a market involve huge sunk cost. Sunk costs are those costs which cannot be recovered if a firm leaves the market soon. Firms which produce multiple and differentiated products can easily distribute these costs among those many products. For new firms, producing huge number of differentiated products is not easy. Therefore, these costs are very high for a firm which produces single product in the market.

If a new firm can enter and leave the market without any sunk costs of entry, such markets are called perfectly contestable markets. A market can be perfectly contestable, even if, firms have to pay some costs of entry if these costs are recovered when firms leave the market. If the sunk costs are lower, the market will be more contestable and vise-versa.

Sunk costs of entry constitute entry barriers. Higher the sunk costs, larger will be profits earned by the existing firms. If the firms operate in the market without large sunk costs of entry, then they will not earn large profits. As part of strategy, existing firms keep their prices as low as that can only cover the total costs. If they charge high prices and earn abnormal profits, the new firms will enter and may capture the profits. Contestability forces the existing firms to keep the prices low. The threat of entry into a market is as effective as actual entry to limit profiteering by existing firms

Key takeaways-

- In oligopoly there are small numbers of firms in the market. As per the norms, oligopoly consist of 3 -5 dominant firms

- Co-operative behaviour in oligopoly is a situation when firms jointly decide the prices and output and maximise their joint profit

Sources

- Pindyck, R.S. , D.L. Rubinfield and P.L. Mehta; Microeconomics, Pearson Education.

- N. Gregory mankiw, Principles of Micro Economics, Cengage Learning

- Browining E.K. And J.M. Browining: Microeconomics Theory and Applications, Kalyani Publishers, New Delhi.

- Gould, J.P and E.P. Lazear: Microeconomics Theory, All India Traveller Bookseller New Delhi

UNIT 4

Market structure

Perfect competition refers to ‘A market structure in which there are large number of buyers and sellers with a single uniforms price for the product which is determined by the forces of demand & supply.’ The price prevailing in perfect competition market is equilibrium price.

Definition:

It is identified by the existence of the many firm; they all sell an identical products an equivalent way. The supplier is the one who accepts the price."- Vilas

Such market gains when the request for product of every producer is totally elastic. Mrs Joan Robinson.

It is a market condition with an outsized number of sellers and buyers, similar products, free entry of enterprises into the industry is ideal knowledge between buyers and sellers of existing market conditions and free mobility of production factors between alternative uses. Lim Chong-ya

Characteristic of perfect competition:-

1) Large number of seller / seller are price takers: There are many potential sellers selling their commodity in the market. Their number is so large that a single seller cannot influence the market price because each seller sells a small fraction of total market supply. The price of the product is determined on the basis of market demand and market supply of the commodity which is accepted by the firms, thus seller is a price taker and not a price maker.

2) Large number of buyers: There are many buyers in the market. A single buyer cannot influence the price of the commodity because individual demand is a small fraction of total market demand.

3) Homogeneous product: The product sold in the market is homogeneous, i.e. identical in quality and size. There is no difference between the products. The products are perfect substitutes for each other.

4) Free entry and exit: There is freedom for new firms or sellers to enter into the market or industry. There is no legal, economic or any type of restrictions. Similarly, the seller is free to leave the market on industry.

5) Perfect knowledge: The seller and buyers have perfect knowledge about the market such as price, demand and supply. This will prevent the buyer from paying higher price than the market price. Similarly, sellers cannot change a different price than the prevailing market price.

6) Perfect mobility of factors of production: Factors of production are freely mobile from one firm to another or from one place to another. This ensures freedom of entry and exit firms. This also ensure that the factors cost are the same for all firms.

7) No transport cost: It is assumed that there are no transport costs. As a result, there is no possibility of changing a higher price on the behalf of transport costs.

8) Non intervention by the government: It is assumed that government does not interfere in the working of the market economy. Price is determined freely according to demand and supply conditions of the market.

9) Single Price: In Perfect Competition all units of a commodity have uniforms or a single price. It is determined by the forces of demand and supply.

Key takeaways - A perfectly competitive market is characterized by many buyers and sellers, undifferentiated products, no transaction costs, no barriers to entry and exit, and perfect information about the price of a good.

Theory of the firm under perfect competition, Demand and revenue

A commodity with profit-earning potential is not produced by one firm. Instead, numerous firms are competing with each other to attract customers towards their brand. As there are a wide variety of commodities which differ in characteristics, the market for these also differs. Perfect competition is one such classification. Though hypothetical to a large extent, it is the simplest type of a market form. The major types of market formation include monopoly, monopolistic competition, oligopoly, and perfect competition. Perfect competition is an industry structure in which many firms are producing homogeneous products. None of the firms is large enough to control the industry. The characteristics of a perfectly competitive market incorporate insignificant contributions from the producers, perfect information about products, zero transaction fee, equivalent products, and no long-term economic profits.

Perfect Competition

A perfectly competitive market has the following features:

The market includes a large number of buyers and sellers.

Each firm produces and sells a comparable product. i.e., the work of one firm cannot be differentiated from the effect of any other firm.

Entry into the market as well as exit from the market is free for firms.

Information is perfect.

The existence of a large number of buyers and sellers means that each buyer and seller is very small compared to the size of the market. It means that no particular buyer or seller can influence the market by their size. Homogenous products further indicate that the creation of each firm is identical. So, a buyer can choose to buy from any firm in the market, and she gets the same product. Free entry and exit mean that it is easy for firms to enter the market, as well as to leave it. This condition is essential for the large numbers of firms to exist. If the entry was difficult, or restricted, then the number of firms in the market could be small. Perfect information implies that all buyers and all sellers are completely informed about the price, quality and other relevant details about the product, as well as the market.

Total Revenue in a Perfect Competition

A perfectly competitive firm has only one major decision to make, i.e. what quantity to produce.

Profit = Total revenue − Total cost

= (Price) (Quantity produced) − (Average cost) (Quantity produced)

A perfectly competitive firm must receive the price for its output as determined by the product’s market order and supply, it cannot choose the fee it charges. Rather, the perfectly competitive firm can decide to sell any quantity of output at the same price. It suggests that the firm faces a perfectly elastic demand curve for its product and buyers are willing to buy any number of units of output from the firm at the market price. When the perfectly competitive firm chooses what amount to produce, then the quantity along with the prices prevailing in the market for output and inputs will determine the firm’s total revenue, total costs, and level of profits.

Equilibrium of firm and industry

Equilibrium refers to when the firm has no inclination to expand or to contract its output. The producer can attain equilibrium under two situations.

- Perfect competition – the price remains constant and fixed by the industry which is accepted by the entire firm within the industry. Any quantity of commodity is sold at this price.

- Imperfect competition – under this condition, the firm has the freedom to set prices for their output. Price is not constant here, as the firm adopt independent pricing policy.

The Marginal Revenue-Marginal Cost Approach

Profit depends on revenue and cost. Thus equilibrium revolves around revenue and cost. According to the MR-MC approach, a producer is said to be in equilibrium when:

- MR = MC

- A Firm can maximise the profit when marginal revenue is equal to marginal cost

- MR is the addition to TR from the sale of one more unit

- MC is the addition to TC when an additional unit is produced.

- Thus when MR = MC, TR-TC result in maximum profit.

- If MR exceeds MC, then producer will produce more as it adds to the profit

- MC is greater than MR after the MC=MR Output Level

- MC= MR is a necessary condition, but its is not enough to ensure equilibrium. This condition happens more than one output level.

- To ensure equilibrium, it has to be supplemented by the condition that MR should be less than MC after this level

Producer’s Equilibrium when Price remains Constant

Price remains constant under conditions of perfect competition. Here price is equal to AR. When price is constant, revenue from each additional unit is equal to AR. It means AR curve is same as MR curve. The firm attains equilibrium when two condition are fulfilled , that is firm aims at producing that level of output at which MC is equal to MR and MC is greater than MR after MC = MR output level.

Producer’s Equilibrium when Price is not Constant

When there is no fixed price, price falls with an increase in output. The producer sells more units at a lower price. In this case MR slopes downwards. The firm aims at producing that level of output at which MC is equal to MR and MC is greater than MR.

Short run and long run supply curves

Supply curve shows the relationship between price and quantity supplied. According to Dorfman, “Supply curve is that curve which indicates various quantities supplied by the firm at different prices”.

Supply curve can be divided into two parts as:

- Short Run Supply Curve

- Long Run Supply Curve

Short run supply curve of a firm

Under Short run , fixed cost remains constant, supply can be changed by changing the only the variable factors. Thus the firm has to bear fixed cost id it is shut down. Thus in short run, goods are supplied at price is either greater or equal to average variable cost. Average revenue is equal to marginal revenue under perfect competition. Hence the firm will produce at the point where marginal revenue and marginal cost are equal.

Prof. Bilas has defined it in simple words, “The Firm’s short period supply curve is that portion of its marginal cost curve that lies-above the minimum point of the average variable cost curve.”

From the above figure we can see that, the firm will not be covering its average variable cost, at price less than OP. At price OP, OM is the supply. MC and MR cut at point A, OM is equilibrium output. If price rise to OP1, the firm will produce OM1 output. This short run supply curve of a firm starts from A upwards i.e., thick line AB.

Long run supply curve

Under long run, the supply curve changes by changing all the factors of production. The firm produces only at minimum average cost in long run. In this case, long run marginal cost, marginal revenue, average revenue and long run average cost are equal. The firm enjoys normal profit.

Optimum production is the point where minimum average cost is equal to marginal cost. Long run supply curve is a portion where marginal cost curve that lies above the minimum point of the average cost curve.

Optimum point is the Point E, as at this point MR=LMCAR minimum LAC. The portion of LMC above point E is called long run supply curve

The word monopoly has been derived from the combination of two words i.e., ‘Mono’ and ‘Poly’. Mono refers to a single and poly to control.

Thus, monopoly refers to a market situation in which there is only one seller of a commodity.

In monopoly market, single firm or one seller controls the entire market. The firm has all the market power, so he can set the prices to earn more profit as the consumers do not have any alternative.

Definition

“Pure monopoly is represented by a market situation in which there is a single seller of a product for which there are no substitutes; this single seller is unaffected by and does not affect the prices and outputs of other products sold in the economy.” Bilas

“Monopoly is a market situation in which there is a single seller. There are no close substitutes of the commodity it produces, there are barriers to entry”. –Koutsoyiannis

“A pure monopoly exists when there is only one producer in the market. There are no dire competitions.” –Ferguson

Features

- One seller and large number of buyers -in a monopoly one seller produces all of the output for a good or service. The entire market is served by a single firm. For practical purposes the firm is the same as the industry. But the number of buyers is assumed to be large.

2. No Close Substitutes - There is no close substitutes for the product sold by the monopolist. The cross elasticity of demand between the product of the monopolist and others must be negligible or zero.

3. Difficulty of Entry of New Firms - There are restrictions on the entry of firms into the industry, even when the firm is making abnormal profits. Other sellers are unable to enter the market of the monopoly

4. Profit maximizer: a monopoly maximizes profits. Due to the lack of competition a firm can charge a set price above what would be charged in a competitive market, thereby maximizing its revenue.

5. Price Maker - Under monopoly, monopolist has full control over the supply of the commodity. The price is set by determining the quantity in order to demand the price desired by the firm. Therefore, buyers have to pay the price fixed by the monopolist.

Equilibrium

A. Short run

A monopolist maximizes his short-term profits if the following two conditions are met first, MC equals Mr. Secondly; the slope of MC is larger than that of Mr at the intersection.

In Figure 6.2, the equilibrium of the monopoly is defined by the point θ at which MC intersects the MR curve from below. Thus, both conditions of equilibrium are met. The price is PM and the quantity is XM. Monopolies realize excess profits equal to shaded areas APM CB. Please note that the price is higher than Mr

In pure competition, the company is the one who receives the price, so it’s only decision is the output decision. The monopolist is faced with two decisions: to set his price and his output. But given the downward trend demand curve, the two decisions are interdependent.

Monopolies set their own prices and sell the amount the market takes on it, or produce an output defined by the intersection of MC and MR and are sold at the corresponding price. An important condition for maximizing the profits of monopolies is the equality of the MC and the MR, provided that the MC cuts the MR from below.

We can now revisit the statement that there is no unique supply curve for the monopolist derived from his MC. Given his MC, the same amount could be offered at different prices depending on the price elasticity of demand. This is graphically shown in Figure 6.3. Quantity X is sold at price P1 if demand is D1, and the same quantity X is sold at price P2 if demand is D2.

So there is no inherent relationship between price and quantity. Similarly, given the monopolist MC, we can supply various quantities at any one price, depending on the market demand and the corresponding MR curve. Figure 6.4 illustrates this situation. The cost condition is represented by the MC curve. Given the cost of a monopolist, he would supply 0X1 if the market demand is D1, then p at the same price, and only 0X2 if the market demand is D2 B.Long-term equilibrium:

In the long run the monopolist will have time to expand his plants or use his existing plants at every level to maximize his profits. However, if the entry is blocked, the monopolist does not need to reach the optimal scale (that is, the need to build the plant until the minimum point of LAC is reached), neither does the guarantee that he will use his existing plant at the optimum capacity. What is certain is that if he makes a loss in the long run, the monopolist will not stay in business.

He will probably continue to earn paranormal benefits even in the long run, given that entry is banned. But the size of his plant and the degree of utilization of any plant size depends entirely on the market demand. He may reach the optimal scale (the minimum point of Lac), stay on the less optimal scale (the falling part of his LAC), or exceed the optimal scale (expand beyond the minimum LAC), depending on market conditions.

Figure 6.5 shows when the market size does not allow the monopolist to expand to the minimum point of Lac. In this case, not only is his plant not optimal (in the sense that the economy of full size is not depleted), but also the existing plant is not fully utilized. This is because on the left of the minimum point of the LAC, the SRAC touches the LAC at its falling part, and the short-term MC must be equal to the LRMC. This happens in e, but the minimum LAC is b,and the optimal use of the existing plant is a. Since it is utilized at Level E', there is excess capacity. Finally, figure 6.7 shows a case where the market size is large enough for a monopolist to build an optimal plant and be able to use it at full capacity.

In Figure 6.6, the scale of the market is so large that monopolists have to build plants larger than the optimal ones to maximize output and over-exploit them. This is because to the right of the minimum point of LAC, SRAC and LAC is tangent at the point of positive slope, and SRMC must be equal to LAC. Thus, plants that maximize the profits of monopolies are, firstly, larger than the optimal size, and secondly, they are over-utilized, which leads to higher costs. This is often the case with utility companies operating at the state level.

It should be clear that which of the above situations will appear in a particular case will depend on the size of the market (given the technology of monopolists). There is no certainty that monopolies will reach their optimal size in the long run, as is the case with purely competitive markets. In Monopoly, there is no market force similar to those of pure competition that will lead companies to operate at optimal plant size in the long run (and utilize it at its full capacity).

Price determination

A monopolistic firm is a price-maker, not a price-taker. Therefore, a monopolist can increase or decrease the price. Also, when the price changes, the average revenue, and marginal revenue changes too. Take a look at the table below:

Quantity sold | Price per unit | Total revenue | Average revenue | Marginal revenue |

1 | 6 | 6 | 6 | 6 |

2 | 5 | 10 | 5 | 4 |

3 | 4 | 12 | 4 | 2 |

4 | 3 | 12 | 3 | 0 |

5 | 2 | 10 | 2 | -2 |

6 | 1 | 6 | 1 | -4 |

Let’s look at the revenue curves now:

As you can see in the figure above, both the revenue curves (Average Revenue and Marginal Revenue) are sloping downwards. This is because of the decrease in price. If a monopolist wants to increase his sales, then he must reduce the price of his product to induce:

• The existing buyers to purchase more

• New buyers to enter the market

Hence, the demand conditions for his product are different than those in a competitive market. In fact, the monopolist faces demand conditions similar to the industry as a whole.

Therefore, he faces a negatively sloped demand curve for his product. In the long-run, the demand curve can shift in its slope as well as location. Unfortunately, there is no theoretical basis for determining the direction and extent of this shift.

Talking about the cost of production, a monopolist faces similar conditions that a single firm faces in a competitive market. He is not the sole buyer of the inputs but only one of the many in the market. Therefore, he has no control over the prices of the inputs that he uses.

Role of time element in determination of price are given below:

Time plays an important role in the theory of volume, i.e., price determination because supply and demand conditions are affected by time.

Price during the short-period can be higher or lower than the cost of production, but in the long-period price will have a tendency to be equal to the cost of production.

The relative importance of supply on demand in the determination of price depends upon the time given to supply to adjust itself to demand.

To study the relative importance of supply or demand in price determination, Prof. Marshall has divided time element-into three categories:

(a) Very short period or market period.

(b) Short period.

(c) Long period.

.

(a) Very short period (determination of market price):

Market period is a time period which is too short to increase production of the commodity in response to an increase in demand. In this period the supply cannot be more than existing stock of the commodity.

The supply of perishable goods is perfectly inelastic during market period. But non-perishable goods (durable goods) can be stored.:

Therefore, the supply curve of non-perishable goods above reserve price has a positive scope at first but becomes perfectly inelastic after some price level.

The reserve price y depends upon-(i) cost of storing, (ii) future expected price, (iii) future cost of production, and (iv) seller’s need for cash we will discuss the determination of market price by taking a perishable commodity and determination of market price is illustrated.

DD is the original demand curve and SS the market period supply curve. The demand curve DD (perfectly inelastic) cuts the supply curve SS at point E. Point E, is the equilibrium point and equilibrium price is determined at OP, level.

Increase in demand shifts the demand curve to D,D and the price also increased to OP,. Decrease in demand shifts the demand curve downward to D2D2 and the price too falls to OP It is, thus, clear that in market period price fluctuates with change in demand conditions.

(b) Price determination is short period:

In the short period fixed factors of production remain unchanged, i.e., productive capacity remains unchanged.

However, in the short period supply can be affected by changing the quantity of variable factors.

In other words, during the short period supply can be increased to some extent only by an intensive use of the existing productive capacity.

Therefore, the supply curve in the short-run slopes positively, but the supply curve is less elastic. Determination of price in the short-run is illustrated.

SS is the market period supply curve and SRS is short-run supply curve. The original demand curve DD cuts both the supply curves at E, point and thus OP, price is determined.

Increase in demand shifts the demand curve upward to the right to D,D,. Now with the increase in demand the market price (in market period) rises at once to OP3 because supply remains fixed. But in the short-run supply increases. Therefore, in the short-run price will cuts the SRS curve. If demand decreases opposite will happen.

(c) Price determination in long period (Normal Price):

In the long period there is enough time for the supply to adjust fully to the changes in demand.

In the long period all factors are variable. Present firms can increase on decrease the size of their plants (productive capacity).

The new firms can enter the industry and old firms can leave the market. Therefore, long-period supply curve has a positive slope and is more elastic than short period supply curve.

The shape of supply curve of the industry depends upon the nature of the laws of returns applicable to the industry. Price determination in the long period is illustrated.

DD is the original demand curve and LS is the long period supply curve of the industry. Demand curve DD and supply curve LS both intersect each other at E point and OP price is determined.

This price will be equal to minimum average cost (AC) of production because in the long period firms under perfect competition can only earn normal profits. Suppose these are permanent increase in demand.

With the increase in demand, the demand curve shifts to D1,D1. As a result of increase in demand the price in the market period and short period will rise.

Due to increase in price present firms will earn above normal profit. Therefore, new firms will enter into market in the long period.

As a result of it supply will increase in the long period. In the long period price will be determined at OP1, level because at this price demand curve D1 D2 cuts the LS curve at E2 point.

Price OP1, is greater than previous price OP1, because the industry is an increasing cost industry. This new higher price will also be equal to minimum average cost of production

Key takeaways –

- Monopoly refers to a market situation in which there is only one seller of a commodity

- A monopolist maximizes his short-term profits if the following two conditions are met first, MC equals Mr.

- Secondly; the slope of MC is larger than that of Mr at the intersection.

- In the long run the monopolist will have time to expand his plants or use his existing plants at every level to maximize his profits

- Monopoly market is characterized by the profit maximize, price maker, high barriers to entry, single seller, and price discrimination.

Difference between Perfect Competition ,Monopoly and Imperfect competition

Basis of comparison | Perfect competition | Imperfect competition |

Meaning | Perfect Competition is a type of competitive market where there are numerous sellers selling homogeneous products or services to numerous buyers. | Imperfect Competition is an economic structure, which does not fulfill the conditions of the perfect competition. |

Nature of concept | Perfect competition is a hypothetical situation, which does not apply in the real world. | Imperfect Competition is a situation that is found in the present day world. |

Product differentiation | In perfect competition, the sellers produce or supply identical products. | In imperfect competition the products offered by the sellers can either be homogeneous or differentiated |

Players | When it comes to perfect competition, there are many players in the market | In imperfect competition, there can be few to many players, depending upon the type of market structure. |

Restricted entry | No | Yes |

Firms are | Firms are price takers, it is assumed that the firms do not influence the price of a product. | The firms are price makers |

STRUCTURE | NO.OF PRODUCERS AND DEGREE OF PRODUCT DIFFERENTIATION | PART OF ECONOMY WHERE IT’S PREVALENT | FIRM’S DEGREE OF CONTROL | METHODS PF MARKETING |

Perfect Competition | Many products; identical products. | Financial markets and agricultural products | None | Market exchange or auction. |

Imperfect Competition |

|

|

|

|

Monopolistic Competition | Many producers; many real differences in products. | Retail trade like pizzas, beer. | Some | Advertising and quality rivalry administered prices. |

Oligopoly | Few producers; little or no difference in product. | Steel, chemicals | Some | Advertising and quality rivalry administered prices. |

Monopoly | Single producer; product without close substitutes. | Franchise monopolies like electricity, water,drugs | Considerable | Advertising |

Key takeaways - Perfect competition is an imaginary situation which does not exist in reality, but imperfect competition is factual i.e. which genuinely exist.

Monopolistic competition

In Monopolistic competition there are large numbers of buyers and sellers which do not sell homogenous product unlike perfect competition. This is more realistic in the real world. Monopolistic competition occurs when an industry in which many firms selling products that are similar but not identical.

Monopolistic competitions try to differentiate its product. Thus it is closely related to business strategy of brand differentiation. In monopolistic competition heavy advertising and marketing is common among firms.

Monopolistic competition combines element of both monopoly and perfect competition. All firms in monopolistic competition relatively have low market power and they are all market makers.

Monopolistic competitive market

- The firm offer highly differentiated product

- Free entry and exit in the market ie no barriers

- Firm can make decision independently

- Customers have the preference of choosing products

- Seller becomes price setter

- Seller can charge marginally high price to enjoy some degree of market power

Assumption

- Product differentiation – monopolistic competition includes firms that offer similar product but are not identical. The products are differentiated not on the basis of price but the difference includes physical aspects of the product, location from where it sells and intangible aspects of the product. The product and services performs the basic function but have difference ion quality such as type, colour, appearance, reputation, location that distinguish the product from each other. For ex, motor vehicles are same to move people from one point to another. But there are many types of motor vehicles such as car, bike, scootor.

2. Many firms – there are many firms in each product group. A product group is a "collection of similar products". Under monopolistic market, each firms has a small market share. This gives each firm a freedom to set price and each firm action have negligible impact on the market. A firm can cut the price to increase sale without any fear. As its action will not prompt retaliatory responses from competitors.

3. Freedom of entry and exit - Like perfect competition, under monopolistic competition the firms can freely enter or exit. When the existing firms makes super-normal profits, then new firms will enter. The entry of new firms leads to increase the supply of goods and services and this would reduce the price and thus the existing firms will be left only with normal profits. Similarly, if the existing firms are incurring losses, some of the firms will exit. This will reduce the supply which result decrease in price and the existing firms will be left only with normal profit.

4. Independent decision making – under monopolistic market, each firm can independently sets the terms and conditions of exchange for its product. The firm does not consider how their decision will have impact on competitors. In other words, each firm feels free to set prices and prompting heightened competition.

5. Market power – under monopolistic competition, the firms have low degree of market power. Market power means that the firm has control over the terms and conditions of exchange for its product. All firms under monopolistic competition are price makers. A firm can raise the prices of products and services without losing all its customers base. The firm can also lower prices without any effect on the competitors. Since the firm have relatively low market power, there is no barrier to entry.

Short run equilibrium, Long run equilibrium

Under monopolistic competition a firm can some extent independently control the supply and price of the product. The demand curve is stable and slightly downward slope

A monopolistic competitor creates output at which the marginal cost is equal to marginal revenue. The price is greater than marginal cost.

Short run

In short run, the firm attains its equilibrium where marginal revenue equals marginal cost and the price is set according to its demand curve. Thus when MR=MC, profits are maximized

In the above fig,

AR is the average revenue curve,

MR represents the marginal revenue curve,

SAC curve represents the short run average cost curve,

SMC signifies the short run marginal cost.

In the above figure we can see that at output OM, MR intersects SMC. Here price is OP’ (which is equal to MP). Thus P is the point on AR curve, which is price. PT is the supper normal profit per unit output, is the difference between the average revenue and average cost.

Long run

In the long run due to the possibility of new firms entering the industry the price under monopolistic competition becomes equal to long-run average cost giving only normal profits. So, no firm under monopolistic competition can make excess profit or loss in the long run.